Summary

- Current Price: ~$12/share (as of June 25, 2025)

- 12-month Price Target: ~$20/share

- Long-Term (3–5 Year) Potential: $30–$40+/share

- Rating: Strong Buy

- Catalysts: Elevated gold prices, strong margins, recent acquisition integration, and potential mine restarts.

SSR Mining Inc. (NASDAQ: SSRM), a mid-tier gold and silver producer operating mines in North America and Turkey, offers investors attractive upside potential driven by historically elevated gold prices (~$3,334/oz), strong operating margins, and solid growth from recent acquisitions.

Master Metrics Table

| Metric | Value |

|---|---|

| Current Price (June 2025) | ~$12 |

| 12-Month Target Price | ~$20 |

| Long-Term Upside Potential | ~$30–$40+ |

| Price/Earnings (Forward) | ~6.4x |

| Price/Book | ~0.8x |

| Debt/Equity | 0.09 (low leverage) |

| Dividend Yield | 0% |

| All-In Sustaining Costs | ~$1,900/oz |

| Current Gold Price | ~$3,334/oz |

| Scenario Gold Prices | Bear: $2,800; Bull: $3,700+ |

| Volatility | ~20% annualized |

| Buy Zone Guidance | Strong Buy: $12–14, Ultra Value <$11 |

Investment Outlook

12-Month Outlook (Primary)

SSR Mining is well-positioned to capitalize on historically high gold prices. With current spot prices around $3,334/oz, SSRM’s ~$1,900/oz cost basis generates exceptionally strong margins. The integration of the newly acquired Cripple Creek & Victor (CC&V) mine significantly boosts annual production, pushing 2025 guidance toward 410k–480k ounces. Even conservatively estimating average gold prices slightly below current levels, we project SSRM will deliver earnings growth and robust free cash flows, warranting a price target of approximately $20/share within 12 months.

Mid-Term (2–3 Years)

Looking further out, SSR Mining should fully benefit from its recent acquisitions and the potential restart of its key Turkish asset, the Çöpler mine. If Çöpler resumes operations, SSRM could see significant incremental production growth. Additionally, sustained gold prices above historical averages (~$3,000/oz) position the stock for potential appreciation to the mid-to-high $20s per share within this horizon.

Long-Term Outlook (5+ Years)

In the long term, SSRM’s trajectory largely hinges on gold prices, reserve replacement, and exploration successes. Persistent structural demand for gold, driven by inflation hedging, geopolitical uncertainties, and central bank buying, could push long-term gold prices significantly higher ($3,500–$4,000/oz). Under these favorable conditions, SSRM could reach a valuation exceeding $40/share, particularly given its low-cost structure and growth optionality.

Investment Thesis

SSR Mining provides attractive exposure to gold with a blend of value and growth. Current high gold prices materially improve SSRM’s earnings power, highlighting the disconnect between market price and intrinsic value. Recent operational setbacks at Çöpler are largely priced in, providing limited downside. SSRM’s well-capitalized balance sheet and operational diversification further strengthen its investment case, making it compelling for investors seeking risk-adjusted exposure to precious metals.

Risk Profile

| Key Risk Factors | Mitigants |

|---|---|

| Commodity Price Volatility | High margin cushion at current gold prices. |

| Operational Risks (e.g., Çöpler mine) | Diversified asset base reduces single-mine dependency. |

| Geopolitical (Turkey, Argentina) | Majority North America-based production. |

| Cost Inflation | Strong liquidity and cost-control measures. |

| Reserve Depletion | Active exploration and acquisition strategy. |

| ESG and Regulatory Risks | Enhanced oversight post-Çöpler incident. |

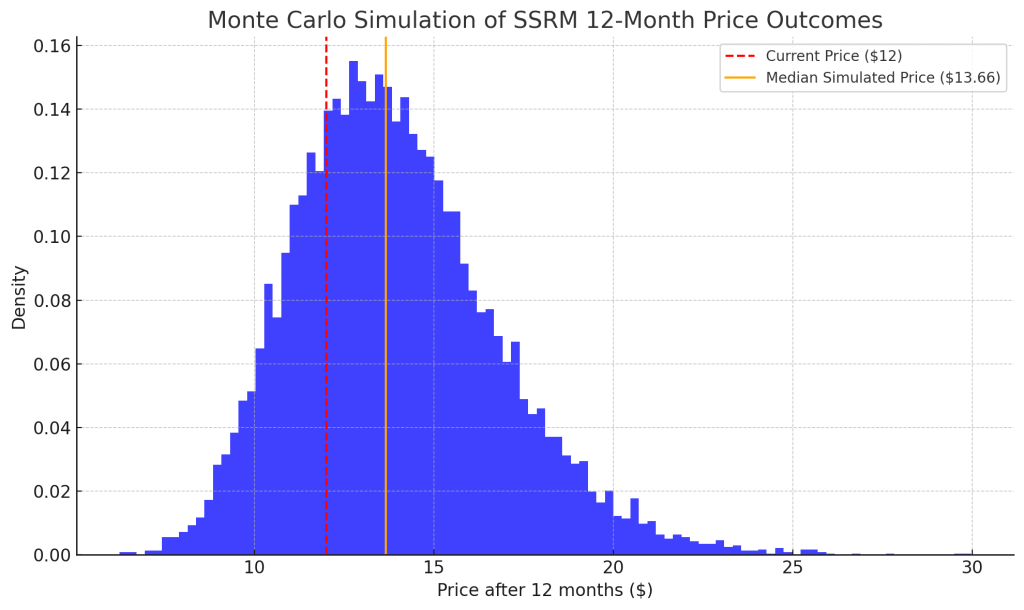

Monte Carlo Simulation

A Monte Carlo analysis underscores SSRM’s asymmetric risk-reward profile. At current gold price volatility (~20%), simulations indicate an approximately 80% likelihood that gold remains favorable, supporting SSRM’s share price appreciation. The simulation suggests a significant upside skew with limited downside, given the robust margins and strong balance sheet even under bear scenarios.

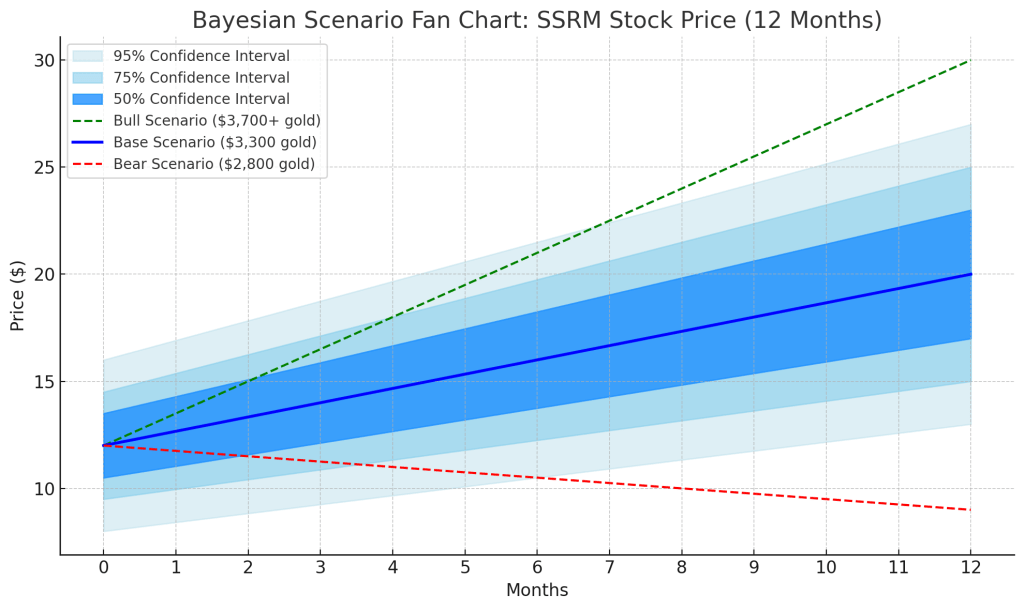

Bayesian Scenario Modeling

- Bull Scenario (20% probability): Gold sustained at ~$3,700+, implying SSRM’s share price potential above $40.

- Base Scenario (60% probability): Gold averaging ~$3,300 short-term; target price ~$20/share.

- Bear Scenario (20% probability): Gold declines to

$2,800; intrinsic value around current market price ($14/share).

Weighted scenario valuation suggests an intrinsic price of approximately $22/share, emphasizing the current valuation disconnect.

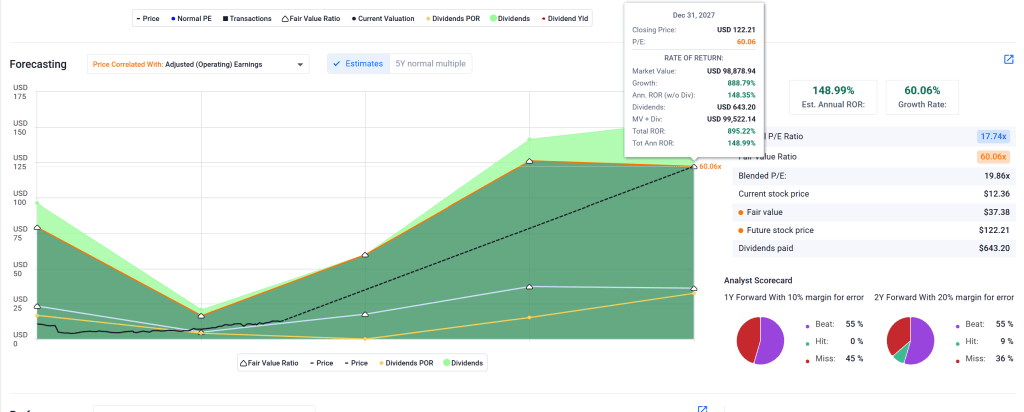

Discounted Cash Flow Valuation

Using updated gold assumptions:

- Bear Case (~$2,800 gold): Valuation ~$14/share, aligning with the current market price.

- Base Case (~$3,300 gold): Valuation ~$20/share, indicating ~60% upside.

- Bull Case (~$3,700 gold): Valuation ~$42/share, highlighting significant upside leverage.

This analysis confirms SSRM’s undervaluation, given the current macro backdrop of elevated gold prices.

Final Recommendation

SSR Mining is rated a Strong Buy at current prices ($12–14/share), presenting a compelling entry point with considerable upside and limited downside risk. Investors should accumulate shares, especially on any temporary price weakness.

References

Data sourced from FactSet, SSR Mining Investor Relations, Reuters gold price consensus, Citi Research, Goldman Sachs, and Bloomberg analyst reports (June 2025).

Leave a reply to Kinross Gold (KGC): Mining Gold While Others Panic – Vulcan Stock Research Cancel reply