While investors obsess over Fed rate cuts and earnings season, a far more critical drama unfolded Friday that could reshape global supply chains for decades. President Trump just threatened 100% tariffs on all Chinese goods—on top of existing tariffs—in response to China’s expansion of rare earth export controls. The S&P 500 plunged 2.7%, and suddenly everyone remembers that the elements powering our phones, electric vehicles, and weapons systems come from one place: China.

Our take: This isn’t just another trade tantrum. China controls 90% of global rare earth processing and just weaponized 12 of the 17 rare earth elements critical for everything from EV motors to F-35 fighter jets. But here’s what most investors miss—this crisis creates a once-in-a-generation opportunity for the tiny handful of non-Chinese producers who can actually deliver these materials. MP Materials surged 12.9% Friday to $81.60, and that might just be the opening act.

The Elements That Run Everything (And Why You Never Heard Of Them)

Think of rare earth elements as the vitamins of the industrial world. You need tiny amounts, but without them, nothing works. That neodymium magnet in your iPhone’s speaker? It’s what makes your music crystal clear in something the size of your fingernail. The dysprosium in your Tesla’s motor? It’s what prevents those powerful magnets from demagnetizing at high temperatures, giving you range and performance.

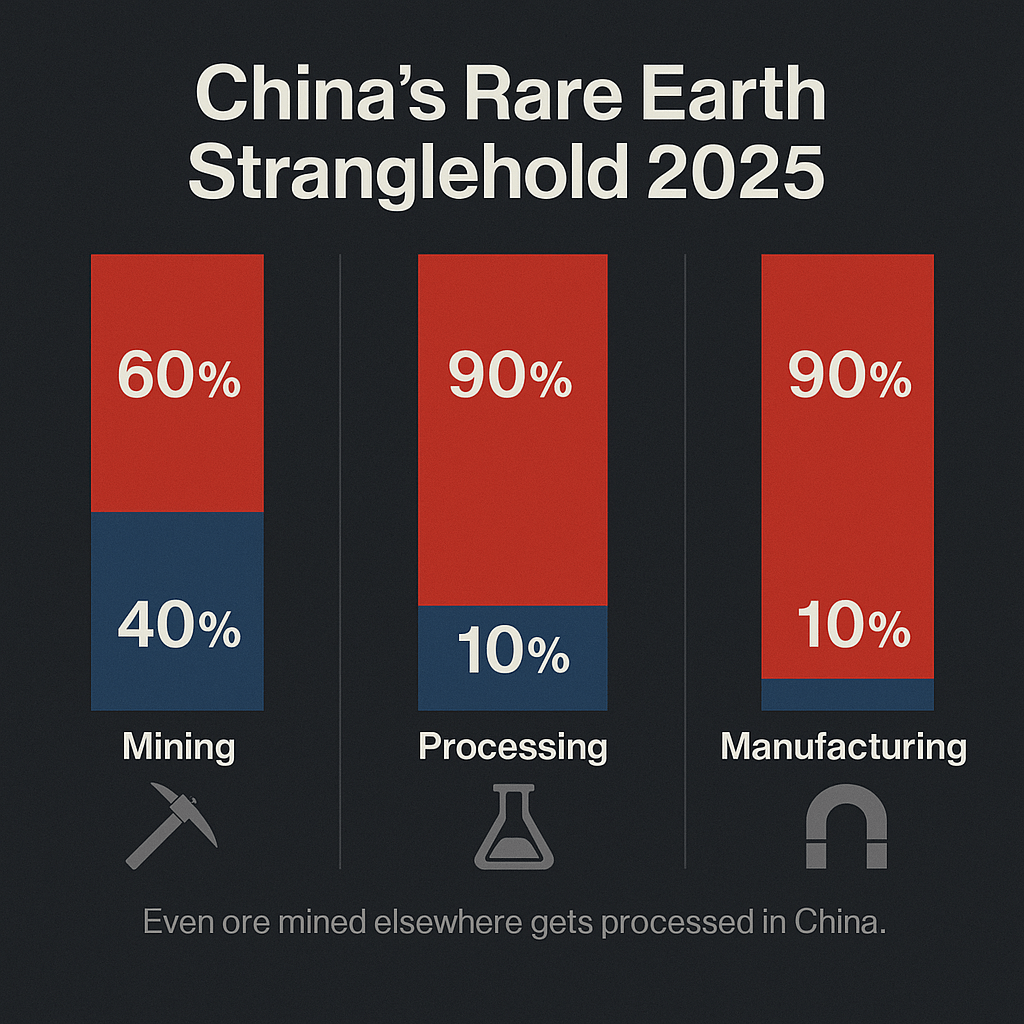

Here’s the uncomfortable reality: China doesn’t just mine most rare earths (that’s actually the easy part). They’ve spent 30 years building the only industrial-scale processing infrastructure that can turn rare earth ore into the pure oxides, metals, and magnets that manufacturers actually need. When Trump talks about China “holding the world captive,” he’s not exaggerating—it’s just stating the obvious strategic reality that everyone ignored for decades.

The crisis escalated fast. In April 2025, China slapped export controls on seven rare earth elements. Then, on October 9, 2025, Beijing expanded restrictions to five more: holmium, erbium, thulium, europium, and ytterbium. Now 12 of 17 rare earths face Chinese export licensing requirements. Even worse, China’s new rules control items containing as little as 0.1% Chinese rare earths—meaning products manufactured with Chinese processing technology can’t be exported without Beijing’s permission.

Trump’s response Friday afternoon was characteristically blunt: 100% additional tariffs on all Chinese goods, effective November 1, 2025 (or sooner), plus export controls on critical U.S. software. He also canceled a planned meeting with Xi Jinping, signaling this isn’t diplomatic theater—it’s a fundamental restructuring of global supply chains playing out in real-time.

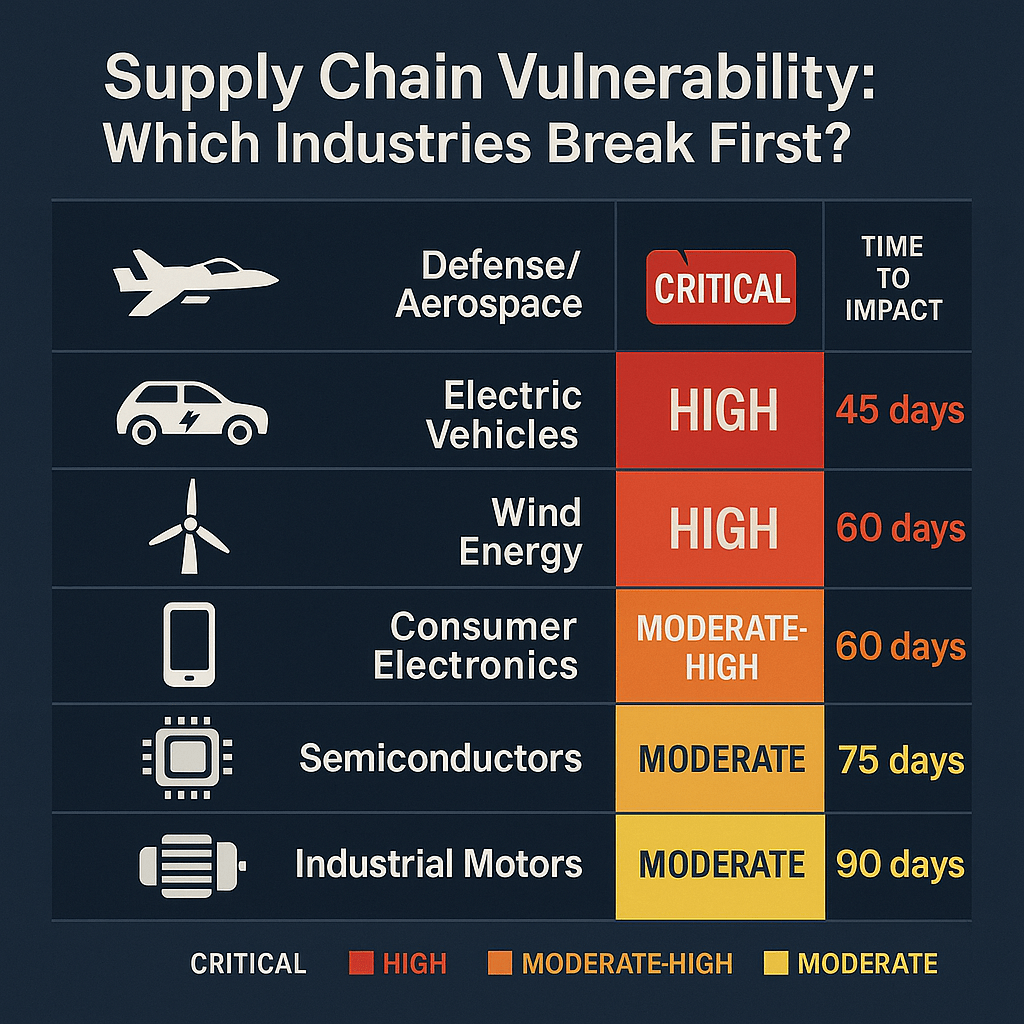

The Industries Caught in the Crossfire

Electric Vehicles: When Your Motor Depends on Chinese Magnets

Every modern EV contains 2-4 kilograms of neodymium-iron-boron magnets in its traction motor. There’s no meaningful substitute—switching to induction motors means sacrificing range and efficiency, switching to ferrite magnets means accepting a performance vehicle that drives like your grandfather’s Buick.

When China tightened exports in April 2025, automakers panicked. Some assembly lines actually halted due to missing motor components. Ford and GM executives admitted China’s magnet squeeze disrupted their production schedules. Desperate manufacturers paid 15-30% premiums for non-Chinese magnets just to keep building cars.

The exposure is brutal: automakers typically keep only weeks of motor inventory, meaning a sustained cutoff would force production cuts within 30-60 days. GM saw this coming and inked a deal with Texas-based Noveon Magnetics (the only U.S. producer) for domestic magnet supply. Ford is scrambling to catch up. Tesla, meanwhile, promises a rare-earth-free motor “soon”—but that technology isn’t production-ready, making today’s Tesla as dependent on Chinese rare earths as everyone else.

Defense: When National Security Meets Supply Chain Reality

This is where the rare earth crisis gets truly uncomfortable for Pentagon planners. One Lockheed Martin F-35 Lightning II contains 920 pounds of rare earth materials embedded throughout its avionics, engines, and weapons systems. A single Virginia-class submarine uses over 9,000 pounds. U.S. defense contractors are nearly 100% dependent on China for heavy rare earths like dysprosium and terbium—the exact elements that make military-grade magnets work in extreme conditions.

The U.S. National Defense Stockpile holds only “vanishingly small” reserves of critical rare earths—enough for weeks to a few months of priority programs, not sustained production. If China flipped the switch tomorrow on neodymium or dysprosium exports, the Pentagon would face existential choices: divert stockpiles to prioritize F-35s over missiles? Halt production of less-critical systems entirely?

A 2025 Atlantic Council war-game scenario concluded that U.S. private stockpiles would deplete “within weeks to months” if China banned exports, with defense production trade-offs starting in 60-90 days. This isn’t theoretical risk—it’s a strategic vulnerability that keeps defense secretaries awake at night.

Wind Energy and Consumer Electronics: The Hidden Dependency

Large offshore wind turbines use hundreds of kilograms of rare earth magnets in their direct-drive generators—a single 5MW turbine might contain 150-200 kg of neodymium-praseodymium. When China’s April export controls hit, some wind projects reported difficulty securing magnet components, threatening the entire renewable energy transition timeline.

Consumer electronics face subtler but pervasive exposure. Your smartphone’s vibration motor, laptop’s speakers, hard drive magnets—all neodymium. Your LED display’s red and green pixels—europium and yttrium phosphors. Apple has started using recycled rare earths to reduce dependency, but most manufacturers still source fresh supply from China’s processing facilities.

The Supply Chain Math Nobody Wants to Face

Here’s what makes this crisis so acute: the bottleneck isn’t mining, it’s processing. Global rare earth mine output in 2024 was roughly 390,000 tons, with China producing 60-70% (about 240,000 tons). The U.S. produced 45,000 tons from MP Materials’ Mountain Pass mine—about 14% of global supply.

But mining is the easy part. China handles approximately 90% of rare earth refining and separation—turning raw ore into pure oxides that manufacturers can use. Even ore mined in Australia or the U.S. historically got shipped to China for processing because nobody else built the infrastructure.

Current Non-China Processing Capacity (2025):

| Facility | Location | Annual Capacity | Status |

|---|---|---|---|

| Lynas Malaysia | Kuantan, Malaysia | 22,000 tons REO | Operating at ~17,500 tons |

| MP Materials Stage 2 | California, USA | 5,000 tons NdPr | Late commissioning phase |

| Neo Performance | Sillamäe, Estonia | 3,000 tons | Operating |

| Lynas Texas (Heavy RE) | Hondo, Texas | TBD (Heavy RE focus) | Under construction, 2026 target |

| Iluka Eneabba | Western Australia | 4,000 tons (Heavy RE) | Due 2025-2026 |

| Energy Fuels | Utah, USA | Few hundred tons | Pilot/scaling phase |

Total estimated non-China processing capacity by 2026: 30,000-50,000 tons REO/year versus China’s 290,000+ tons. That’s still only 15-17% of global capacity outside Chinese control.

Magnet manufacturing is even more concentrated. China produces roughly 90% of sintered neodymium-iron-boron magnets globally. Non-Chinese capacity consists of:

Global Magnet Manufacturing Capacity (Non-China):

| Producer | Location | Est. Annual Capacity |

|---|---|---|

| Japanese Producers (Hitachi Metals/TDK) | Japan | 5,000-8,000 tons |

| VAC/European Producers | Germany/EU | ~2,000 tons |

| Noveon Magnetics | Texas, USA | Hundreds to low thousands |

| MP Materials Fort Worth | Texas, USA | 1,000 tons (2025), targeting 10,000 by 2030s |

| E-VAC JV | South Carolina, USA | 500-1,000 tons (planned) |

By 2025-2026, non-China magnet capacity might reach 5-8% of world demand. That’s why automakers panicked in April—they literally cannot source enough non-Chinese magnets to keep their EV production lines running at full capacity.

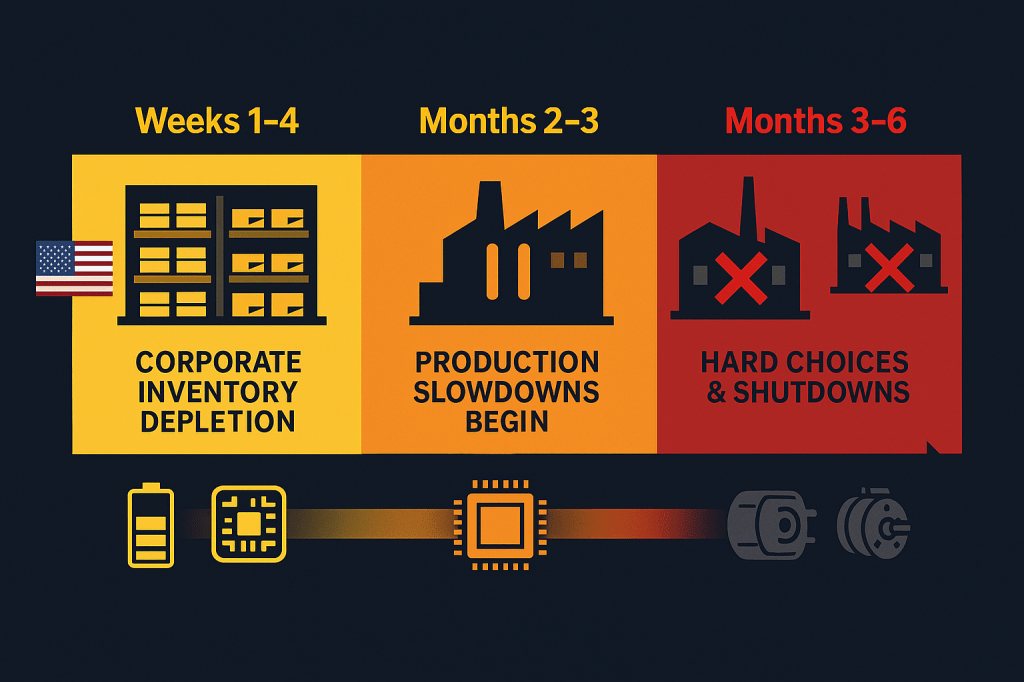

The Resilience Timeline: How Long Before Everything Breaks?

Most companies and countries are far more vulnerable than they realize:

Weeks 1-4: Companies use existing inventory. Smaller Tier-2 suppliers with thin stock start rationing by week 4. Spot prices skyrocket as buyers scramble.

Months 2-3: Many firms exhaust safety stock. Production slowdowns begin in automotive and electronics. Pentagon taps National Defense Stockpile for highest priorities (F-35s, missile programs). Japan and South Korea release some strategic reserves.

Months 3-6: Hard choices multiply. Some consumer product lines pause due to component shortages. Defense contractors enter force majeure on less-critical deliveries. Countries without stockpiles (U.S., most of EU) plead with those who have them (Japan might share reluctantly).

Beyond 6 months: Emergency reconfiguration. Desperate sourcing from any non-China source (including gray markets and smuggling channels). Recycling operations ramp frantically. Industries begin serious consideration of lower-performance substitutes or design changes that previously seemed unacceptable.

Japan maintains roughly 60 days of rare earth reserves nationally, plus corporate stockpiles aiming for 6 months total. South Korea targets 100+ days for critical materials. The U.S.? The National Defense Stockpile was designed for short emergencies, not sustained supply interruptions.

An official Japanese estimate concluded that without Chinese supply, Japan’s reserves would run dry in under a year even with rationing. For the U.S., with minimal strategic stockpiles and just-in-time corporate inventories, the timeline is shorter—industry impacts within weeks, severe disruptions within 2-3 months.

The Investment Opportunity Hidden in the Crisis

While markets panicked Friday, three types of companies suddenly became strategically invaluable:

The Crown Jewels: Non-Chinese Producers

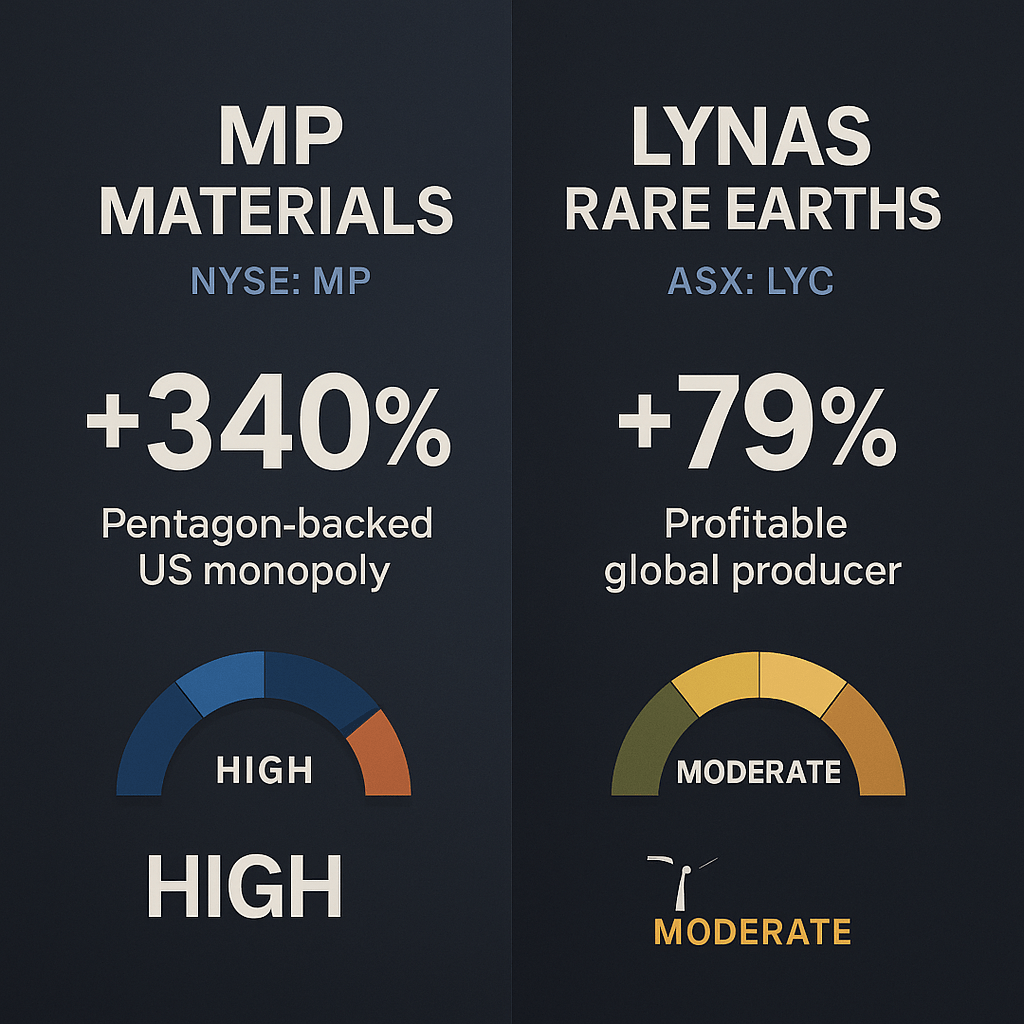

MP Materials (NYSE: MP) – The U.S. Strategic Asset

Friday’s 12.9% surge to $81.60 reflects dawning realization that MP Materials isn’t just a mining company—it’s a strategic national asset the U.S. government will protect at almost any cost.

The numbers tell the transformation story. MP stock has exploded 311-340% year-to-date. The company now sports a $14.5 billion market cap, up from $3-4 billion at the start of 2025. This isn’t speculative froth—it’s the market recognizing that being the only significant U.S. rare earth producer in the middle of a supply chain war has extraordinary value.

The Pentagon’s move in July 2025 was unprecedented: a $400 million equity investment making the Department of Defense MP’s largest shareholder, plus a price floor guarantee of $110/kg for neodymium-praseodymium oxide—nearly double the Chinese market price of $60/kg. That price floor alone effectively subsidizes MP’s entire business model.

MP’s Mountain Pass mine in California produces about 45,000 tons of rare earth concentrate annually—15% of global consumption. The company’s Stage 2 separation facility (late commissioning phase) will eliminate its historical dependence on shipping concentrate to China for processing. The Fort Worth, Texas magnet factory, targeting 1,000 tons of finished magnets in 2025 and 10,000 tons later, creates an end-to-end U.S. supply chain for the first time in decades.

Current valuation assessment: At $81.60, MP trades at roughly 24-25x forward sales—a premium multiple reflecting both strategic value and execution risk. Analyst consensus of $64.40 suggests the stock ran ahead of fundamentals. But here’s the counter-argument: if China’s export controls tighten further (and they probably will), MP’s strategic premium expands, not contracts.

The risk: MP is currently unprofitable (expected loss of $0.43/share in fiscal 2025) and burning cash on expansion. If rare earth prices collapse or demand disappoints, the valuation could compress violently. The stock’s 17% volatility and 340% year-to-date gain make it susceptible to sharp profit-taking.

The opportunity: If the U.S.-China decoupling accelerates, MP becomes essentially a government-backed monopoly on domestic supply. The $110/kg price floor protects downside, while any further Chinese restrictions would drive spot prices higher, giving MP exposure to upside. Long-term contracts with Apple ($500M starting 2027) and GM provide demand visibility.

Lynas Rare Earths (OTC: LYSDY) – The Australian Alternative

Lynas is the largest rare earth producer outside China and the more mature, profitable operation compared to MP. The Perth-based company operates the Mt. Weld mine in Australia and processes ore at facilities in Malaysia, with a new heavy rare earth separation plant under construction in Texas.

Fourth quarter fiscal 2025 results showcased the business momentum: Record NdPr production of 2,080 tons, total REO production of 3,212 tons, and sales revenue of A$170.2 million (up 38% year-over-year). Average selling price climbed to A$60.20/kg—the highest since July 2022—as China’s export curbs created urgency among buyers.

Lynas CEO Amanda Lacaze told Reuters in July that rare earth prices “can go above $110” given the U.S. government’s willingness to pay premium prices to secure non-Chinese supply. She noted Japanese magnet makers “significantly increased” output during China’s April squeeze, and Lynas is working with them to develop automotive customers outside Japan.

The company recently struck a partnership with U.S.-based Noveon Magnetics to supply both light and heavy rare earths for American magnet manufacturing, creating what Lacaze called a “secure and traceable” supply chain for U.S. end-users.

Current valuation: Lynas has gained 79% year-to-date (less explosive than MP but still strong), trades at roughly 11.6x forward sales (half MP’s multiple), and unlike MP, is actually profitable. Market cap of $6.64 billion reflects a more mature, de-risked operation.

The case: Lynas offers less speculative upside than MP but also less downside risk. The company’s established operations, profitability, and expanding capacity (targeting 10,500 tons/year by 2026) make it a “boring winner” in a rare earth crisis. Its Texas heavy rare earth separation facility (funded by DoD, due 2026) addresses the most critical supply gap—heavy rare earths like dysprosium and terbium, where China’s monopoly is most complete.

Strategic positioning comparison:

| Metric | MP Materials | Lynas Rare Earths |

|---|---|---|

| 2025 YTD Return | +311-340% | +79% |

| Market Cap | $14.5B | $6.64B |

| Profitability | Loss (~$0.43/share) | Profitable |

| Valuation (P/S) | ~24-25x | ~11.6x |

| Government Support | DoD $400M equity, $110/kg floor | DoD funding for Texas plant |

| Production Focus | Light RE (Nd, Pr, Ce, La) | Both light & heavy RE |

| Geographic Advantage | U.S. mine, U.S. processing | Australia mine, Malaysia processing, Texas expansion |

| Risk Profile | Higher risk/higher reward | Lower risk/steady execution |

The Emerging Players: Magnets and Processing

Noveon Magnetics (private, but worth watching): The Texas-based startup became the first U.S. manufacturer of sintered NdFeB magnets at scale in decades. Its deals with GM (supplying EV magnets) and Lynas (securing feedstock) position it as a critical missing link in reshoring supply chains. Noveon’s CEO noted that customers are willing to pay premiums for U.S.-made magnets—the “resilience premium” is real.

VAC/E-VAC Magnetics: The German magnet manufacturer Vacuumschmelze is establishing a South Carolina magnet factory (E-VAC) that received $112 million in IRA tax credits. This JV could produce 500-1,000 tons annually, serving U.S. auto and defense customers desperate for non-Chinese magnets.

Energy Fuels (NYSE: UUUU): Better known as a uranium miner, Energy Fuels diversified into rare earth processing at its Utah facility. Currently small-scale (few hundred tons), but strategically important as one of the few U.S. facilities processing monazite (which contains heavy rare earths). Any expansion here fills critical gaps.

The Industries at Risk: Who Gets Hit Hardest?

The Immediate Losers

U.S. Tech Giants: Apple (NASDAQ: AAPL), already down in Friday’s 2.7% S&P rout, faces dual exposure. Its iPhones contain rare earth magnets and phosphors throughout (speakers, cameras, haptic engines, displays). More critically, 100% tariffs on Chinese imports would hit Apple’s China-assembled products brutally—either forcing rapid price increases or devastating margins. Apple’s recycling initiative covers only a fraction of its rare earth needs.

Tesla (NASDAQ: TSLA): As one of the largest Western consumers of rare earth magnets (2kg+ per vehicle), Tesla’s EV production could face direct constraints if magnet supplies tighten. The company’s promised rare-earth-free motor isn’t production-ready, leaving current Model 3/Y production vulnerable. Tesla’s vertical integration helps somewhat, but it can’t integrate what it can’t source.

Nvidia (NASDAQ: NVDA): Friday’s near-5% plunge reflected investor fear that the AI darling faces supply chain and demand risks. While Nvidia’s GPUs don’t directly contain rare earths in the silicon, manufacturing equipment (lasers, polishers) and packaging components do. More importantly, China represents a massive end-market for Nvidia—100% tariffs and Chinese retaliation could hammer both supply and demand sides.

Automakers Without Supply Deals: Ford (NYSE: F) acknowledged that China’s magnet shortage disrupted production. Without GM’s foresight in securing Noveon supply, Ford and other automakers dependent on traditional supply chains face acute risk. European manufacturers (BMW, Mercedes, Volkswagen) face similar exposure unless they’ve quietly locked up alternative suppliers.

The Complex Exposure

Defense Contractors (LMT, RTX, NOC, BA): Lockheed Martin, Raytheon, Northrop Grumman, and Boeing all use rare earths in weapons systems, avionics, and advanced electronics. The Pentagon’s stockpile prioritization means they’ll get materials for critical programs (F-35s, missiles), but less-critical systems could face delays. Long-term, defense contractors could actually benefit from increased defense spending on supply chain security and domestic sourcing mandates—but near-term production risks create uncertainty.

Wind Turbine Manufacturers (GE Vernova, Siemens Gamesa, Vestas): The renewable energy transition depends on rare earth magnets for efficient offshore wind turbines. GE Vernova’s Haliade-X turbines use direct-drive generators full of neodymium magnets. A sustained rare earth shortage would force wind projects to pivot to less-efficient geared designs or face delayed installations—slowing the entire clean energy transition.

The Policy Response: Industrial Strategy Returns

What makes this crisis different from past trade disputes is the coordinated policy response already underway:

U.S. Industrial Policy on Steroids:

The Inflation Reduction Act’s 10% production tax credit for U.S.-made NdFeB magnets has already catalyzed over $600 million in announced investments (MP Materials’ $58.5M credit, E-VAC’s $112M, others pending). These credits improve project economics by 15-20%, making previously marginal domestic projects viable.

Department of Defense funding exceeds $439 million since 2020 for rare earth projects—MP Materials, Lynas USA, Noveon Magnetics, and others. The July 2025 MP Materials deal (equity stake, price floor, guaranteed offtake) represents a new model: government as strategic investor and anchor customer, not just grant provider.

Allied Coordination:

The Minerals Security Partnership (U.S., EU, Japan, Australia, Canada) is coordinating investments in rare earth projects across allied nations. Recent developments include:

- U.S.-Saudi Arabia partnership: MP Materials and Saudi Arabia’s Ma’aden signed an MoU to develop a rare earth “mine-to-magnet” supply chain in Saudi Arabia by 2028

- U.S.-Australia agreements supporting Lynas expansion and Iluka’s rare earth refinery

- U.S. Ex-Im Bank financing for Greenland rare earth projects

- Japan’s decades-long support for Lynas ensuring non-Chinese supply for Japanese electronics

Technology and Substitution R&D:

The Department of Energy and DARPA are funding research on rare-earth-free motors, magnetic materials using more abundant elements, and improved recycling technologies. Toyota developed magnets using 50% less neodymium by substituting lanthanum/cerium. Tesla’s rare-earth-free motor, if commercialized, could disrupt demand long-term.

But here’s the reality: these alternatives are years away from commercial scale. For 2025-2027, demand for conventional rare earth magnets will exceed non-Chinese supply by a wide margin.

Market Scenarios: Escalation vs. Détente

Scenario 1: Full-Blown Trade War (40% probability)

Trump follows through with 100% tariffs November 1. China retaliates by actually enforcing strict export licensing, reducing rare earth exports to the U.S. by 50-75%. Negotiations collapse.

Market Impacts:

- S&P 500: Additional 10-15% correction as investors price in recession risk and margin compression

- MP Materials/Lynas: Surge another 50-100% as rare earth prices spike to $150-200/kg (2011 bubble levels) and strategic premium expands

- Tech/Auto exposed to China: Apple, Tesla, NVDA face 20-35% declines as tariff impacts hit margins and Chinese consumers retaliate

- Defense contractors: Initial 10-15% decline on production concerns, followed by recovery as DoD accelerates supply chain spending

- Rare earth prices: NdPr oxide climbs to $150-200/kg (current: ~$60/kg), dysprosium to $500-700/kg

- Consumer price inflation: Modest uptick (0.3-0.5%) from rare earth passthrough in electronics and vehicles

Timeline: 3-6 months of severe market volatility, then stabilization as emergency supply chains and government interventions take effect. Long-term winners: MP, Lynas, domestic manufacturers. Long-term losers: China-dependent global manufacturers who fail to adapt.

Scenario 2: Managed Détente (45% probability)

Cooler heads prevail. China and U.S. strike a compromise—China grants more export licenses and potentially removes some restrictions, while U.S. postpones or moderates the 100% tariff. Similar to the June 2025 mini-deal that temporarily calmed tensions.

Market Impacts:

- S&P 500: Relief rally recovers 4-6% as immediate crisis abates

- MP Materials/Lynas: Pull back 20-30% from recent highs as urgency premium dissipates, but stabilize at levels 2-3x higher than start of 2025

- Tech/Auto exposed to China: Rebound 10-20% on relief that supply chains can continue functioning

- Rare earth prices: Stabilize at $70-90/kg (modest premium to pre-crisis levels but below panic pricing)

What doesn’t change: Even in détente, the strategic push to build non-Chinese supply chains continues—just less frantically. The U.S. and allies won’t roll back IRA incentives or DoD contracts. Think of it as breathing room to complete the 3-5 year buildout of alternative infrastructure rather than panic emergency measures.

Scenario 3: Partial Decoupling / Ongoing Skirmishes (15% probability)

Neither full war nor peace, but continued targeted measures and counter-measures. China keeps export licensing system but administers it flexibly to avoid crippling Western industries completely. Trump uses tariff threats as leverage but settles for sector-specific deals.

Market Impacts:

- Volatility: Recurring spikes around each new development (tariff threats, export control adjustments, deal rumors)

- Rare earth producers: Trade in wide range ($60-120/kg prices, MP stock $60-90), benefiting from premium pricing but facing uncertainty

- Exposed sectors: Persistent risk premium (higher cost of capital, lower multiples) for companies without supply chain resilience

This “muddle-through” scenario creates the most trading opportunities for nimble investors but frustrates long-term strategic planning.

Investment Strategy: How to Position Portfolios

For Aggressive Growth Investors

Core Thesis Trade: MP Materials + Lynas Rare Earths represents a leveraged bet on permanent supply chain restructuring.

Position Sizing:

- MP Materials: 2-4% of portfolio (high conviction, high volatility)

- Lynas Rare Earths: 2-3% of portfolio (lower volatility, profitable)

- Combined exposure: 4-7% max to rare earth theme

Entry Strategy:

- MP Materials: Current price $81.60 is extended. Wait for pullback to $65-72 for initial position, then add on further weakness to $55-60 if it occurs. Use dollar-cost averaging over 2-3 months rather than lump sum.

- Lynas: More stable, can build position at current levels (~A$10.50) with bias toward accumulation under A$9.50

Exit Triggers:

- MP: Trim 25-50% above $95-100 (speculative excess territory)

- Sell signals: Loss of DoD support, failure to hit Stage 2 production targets, rare earth prices back below $50/kg sustainably

- Timeline: 12-24 month holding period with active management

For Conservative Value Investors

Defensive Positioning: Avoid companies with high China dependence until supply chain clarity emerges.

Near-term Caution:

- Reduce exposure to AAPL, TSLA, NVDA if not already positioned—all face meaningful China risk

- Consider hedging with puts on tech-heavy indices (QQQ) if markets rally sharply on détente hopes

- Favor domestic-focused industrials and defense contractors who benefit from reshoring spending

Patient Accumulation:

- If MP Materials corrects to $50-60 (post-profit-taking or détente announcement), scale in gradually

- Lynas under A$8.50 would represent excellent long-term value given production growth trajectory

- Wait for panic selling, don’t chase momentum

For Index Investors

Reality Check: The S&P 500’s 2.7% Friday decline might be just the beginning if escalation continues. Rare earth tensions threaten margins across multiple sectors (tech, auto, industrials).

Hedge Considerations:

- Increase cash allocation from 5% to 10-15% to deploy on further weakness

- Consider adding defensive sectors (utilities, consumer staples) that have lower China supply chain exposure

- Quality over growth: Favor companies with strong balance sheets and diversified supplier bases

Don’t Panic, But Don’t Ignore:

- This isn’t 2008 financial crisis or COVID crash requiring extreme positioning

- It is structural supply chain reconfiguration that will create winners and losers for years

- Rebalance opportunistically as volatility creates mispricings

For Long-Term Thematic Investors

The Decade-Long Opportunity: Reshoring critical supply chains is a multi-year, bipartisan policy priority that will persist regardless of who wins the 2028 election. Companies enabling this transition deserve “infrastructure premium” valuations similar to renewable energy stocks during the 2010s buildout.

Beyond Rare Earths:

- This same playbook applies to semiconductors (CHIPS Act beneficiaries), batteries (IRA beneficiaries), and critical minerals broadly

- Look for companies with: (1) government contracts/support, (2) technical moats, (3) capacity expansion funded by policy incentives

- Examples: Defense tech suppliers, battery manufacturers, critical mineral processors, advanced manufacturing equipment makers

The Bottom Line: Crisis as Catalyst

Friday’s rare earth escalation isn’t just another trade war headline—it’s the moment when America’s supply chain vulnerability became undeniable to markets, policymakers, and voters alike. The fact that a handful of obscure elements can threaten everything from electric vehicles to F-35 fighters exposes decades of strategic complacency.

But crisis breeds opportunity. The companies positioned to solve this problem—MP Materials, Lynas, Noveon, and others—suddenly became invaluable strategic assets rather than speculative mining stocks. The U.S. government’s willingness to provide $400 million equity stakes, guaranteed price floors, and tax credits signals this isn’t normal market capitalism—it’s strategic industrial policy with effectively unlimited support.

The calculus for investors:

Buy the solution, not the problem. MP Materials and Lynas are volatile, richly valued, and could pull back sharply if détente emerges. But the long-term trend is clear: Western governments will pay premiums to secure non-Chinese supply, and these are the only scaled options. Over 3-5 years, their production will expand 3-5x while enjoying government-supported pricing and guaranteed demand.

Avoid the exposed. Companies dependent on Chinese rare earth supply without mitigation plans (most consumer electronics, many automakers, smaller defense contractors) face years of margin pressure, supply uncertainty, and potential production disruptions. Even if détente arrives, the “China discount” for supply chain risk isn’t going away.

Watch for the second-order winners. Magnet manufacturers, recycling technology companies, and alternative materials developers will emerge as enablers of the transition. Many are private today but will IPO or get acquired at premium valuations as their technology proves out.

The rare earth crisis of 2025 will be remembered as the moment supply chain resilience became a national security imperative with a multi-hundred-billion-dollar price tag. For investors willing to embrace volatility and think in years rather than quarters, this creates one of the clearest asymmetric opportunities of the decade.

Position accordingly. The elements that power everything just became the trade of everything.

Key Statistics Summary

| Metric | Value |

|---|---|

| Market Impact (Oct 10, 2025) | |

| S&P 500 Decline | -2.7% (largest since April) |

| MP Materials Gain | +12.9% to $81.60 |

| Nvidia Decline | ~-5% |

| China’s Rare Earth Dominance | |

| Global Mining Share | 60-70% |

| Global Processing Share | ~90% |

| Global Magnet Manufacturing | ~90% |

| Rare Earths Under Export Control | 12 of 17 elements |

| U.S. Policy Response | |

| DoD Investment in MP Materials | $400M equity stake (July 2025) |

| Price Floor for NdPr Oxide | $110/kg (vs ~$60/kg market price) |

| Total DoD Rare Earth Funding Since 2020 | $439M+ |

| IRA Magnet Production Tax Credit | 10% |

| MP Materials (NYSE: MP) | |

| Current Price (Oct 11, 2025) | $81.60 |

| YTD Performance | +311-340% |

| Market Cap | $14.5B |

| 52-Week Range | $15.56 – $84.88 |

| Annual Mine Production | 45,000 tons REO (~15% global) |

| Target Magnet Production 2025 | 1,000 tons |

| Target Magnet Production 2030s | 10,000 tons |

| Analyst Price Target | $64.40 |

| Lynas Rare Earths (OTC: LYSDY) | |

| YTD Performance | +79% |

| Market Cap | $6.64B |

| Q4 FY2025 NdPr Production | 2,080 tons (record) |

| Average Selling Price Q4 | A$60.20/kg (+42% YoY) |

| Target Annual Capacity 2026 | 10,500 tons/year |

| Non-China Supply Capacity | |

| Global Rare Earth Mining (ex-China) | ~100,000 tons (25-30% of global) |

| Global Rare Earth Processing (ex-China) | 30,000-50,000 tons by 2026 (15-17% of global) |

| Global Magnet Manufacturing (ex-China) | 5-8% of global demand |

| Supply Chain Vulnerability Timeline | |

| Corporate Inventory Depth | 1-3 months typical |

| U.S. National Defense Stockpile | Weeks to few months for priority programs |

| Japan Strategic Reserves | ~60 days national, 6 months with corporate |

| South Korea Strategic Reserves | 100+ days target |

| Time to Production Impact | 30-60 days for automakers |

| Time to Severe Disruption | 2-3 months for most industries |

Data compiled from company reports, government sources, and market data as of October 11, 2025.

Leave a reply to How China’s Battery Export Ban Reshapes AI Infrastructure – Vulcan Stock Research Cancel reply