It’s not every day a REIT with a fortress-like balance sheet, mission-critical tenants, and a dividend yield over 7% trades at an 8x FFO multiple. But after a bruising 5.5% drop on August 6th, that’s exactly where Alexandria Real Estate Equities (ARE) finds itself—near decade-low valuations with investor sentiment decoupled from fundamentals.

The selloff looks more emotional than rational. And for patient investors, this could be a generational entry point into the only pure-play, blue-chip life science REIT.

Anatomy of the Pullback: Sentiment vs Substance

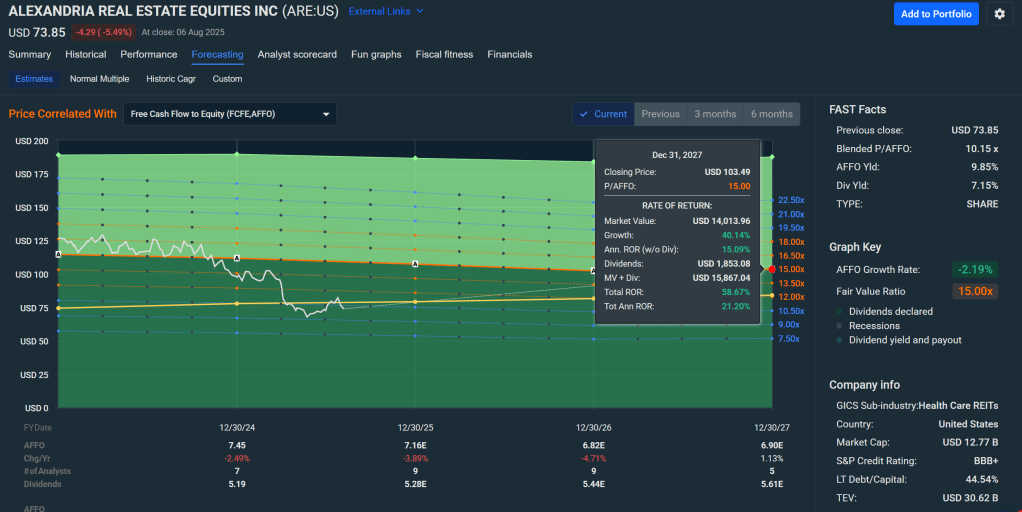

ARE’s shares are now down over 40% from their 52-week high, despite reaffirmed full-year 2025 FFO guidance of $9.16–$9.36 per share. That midpoint implies a P/FFO multiple of just 7.97x, a level rarely seen outside of crisis periods like 2009 or 2020.

The August 6th drop came with no earnings miss, no downgrade, and no fundamental deterioration. Instead, it followed broader weakness in rate-sensitive REITs and growing fears around commercial real estate. But ARE isn’t office—and lumping it in with the sector misses its structural advantages.

This is not a landlord hoping WeWork pays rent. ARE builds and manages wet-lab campuses for biotech giants like Bristol-Myers Squibb, Eli Lilly, and Moderna. Lab space is mission-critical, highly customized, and difficult to replace or relocate. Remote work? Irrelevant here.

Why We’re Bullish: 5 Key Drivers

1. Real Assets with Real Demand

ARE’s portfolio spans over 75 million square feet across core U.S. life science markets—Boston, San Francisco, San Diego. Occupancy remains healthy at ~91–92%, with retention rates near 80%. As biotech funding recovers, demand should outpace generic office assets for years to come.

2. Irreplaceable Locations, Long-Duration Leases

Roughly 45% of ARE’s leases extend past 2030, most with creditworthy tenants. Rent escalators average 3% annually, helping to offset inflation. With 12-year weighted average debt maturity and 97% fixed-rate debt, rising rates aren’t the threat they are for many peers.

3. Asset Sales Are Working

Management has already lined up $1.1 billion in asset sales this year to fund development and reduce leverage. This mitigates refinancing risk, with only 9% of debt maturing before 2027. Despite macro stress, the firm maintains its BBB+/Baa1 credit ratings.

4. Dividend Strength and Safety

The dividend yield now sits at 7.1%, with a payout ratio under 60% of FFO. ARE has grown its dividend for 13 consecutive years. Management reiterated its commitment to further increases tied to stable FFO growth (~4% CAGR mid-term).

5. Valuation is a Gift

Based on internal Vulcan-mk5 DCF modeling, fair value sits near $110, implying ~49% upside from current levels. Peer comps (BXP, WELL, KRC) trade at far higher multiples with lower quality real estate. The Bayesian fan chart suggests a base-case 12-month target of $105, and even under bearish scenarios, the downside is limited to the mid-$60s.

Risk Flags to Monitor

No position is without risk. ARE’s Altman Z-score of 0.61 puts it technically in “distress” territory—though this is not unusual for real estate-intensive firms with heavy depreciation and non-cash charges. The more pressing watchpoints are:

- Leverage: Net Debt/EBITDA remains above 6.5×. Asset sales help, but a funding gap could emerge if cap rates climb faster than expected.

- Tenant Mix: A slowdown in early-stage biotech could pressure renewals, though ARE’s tenant base is diversified and tilted toward large-cap pharma.

- Technical Momentum: Shares remain below their 200-day moving average, and RSI dipped near 34. This could invite quant-driven selling if $70 fails to hold.

Still, for long-horizon investors focused on income and capital appreciation, these risks appear priced in.

Conclusion: Time to Be Greedy?

Warren Buffett’s famous quote about being greedy when others are fearful applies here. ARE’s 5.5% one-day plunge feels more like a misfire of market psychology than a justified repricing.

The long-term case remains intact: a rare, monopolistic footprint in lab real estate, high-quality tenants, stable cash flow, and a 7% yield growing annually.

The Vulcan-mk5 model assigns ARE a Strong Buy rating with a 12-month return potential of over 40%.

Long-term investors should consider accumulating shares below $75 with confidence—and view any additional volatility as an opportunity to build exposure to one of the highest-quality REITs in the public markets.

Related Reads on Vulcan-Stock.com

- Pfizer: Strong Buy with 7.2% Yield & Growth Catalysts – another dividend compounder trading at fire-sale valuations.

- Optimizing Your Portfolio with Dividend ETFs – a complementary income sleeve for ARE investors.

Leave a reply to REITs for the Rate-Cut Cycle: 8 Picks That Actually Make Sense – Vulcan Stock Analysis Engine Cancel reply