Summary

Pfizer’s stock is trading at its lowest levels in over a decade with a current price around $22.3 and a very high dividend yield (~7.7%). Recent guidance and analyst forecasts suggest roughly breakeven to modest growth over the next 12 months – consensus 12-month targets are in the high $20s (around $29, or ~30% upside). Our own fair-value model (Zen Vulcan-mk5) gives an average fair value near $41, implying significantly more upside, and the stock is rated an Ultra Value Buy by that model (with a large discount to fair value). Balancing these factors, our 12-month recommendation is a Buy, driven by the attractive valuation and yield, tempered by caution on sustainability of earnings and dividends given recent cash flow strains and industry headwinds.

| Metric | Value |

|---|---|

| Last Price (PFE) | $22.28 |

| 12-Month Target (Consensus) | ~$29.2 (30% Upside) |

| Average Fair Value (Zen Mk5) | $41.3 |

| Upside (vs Price) | +85% (to $41.3 FV) |

| 2025 Revenue Guidance (mid) | $61.0–64.0 B (flat to +5%) |

| 2025 Adjusted EPS (mid) | $2.80–3.00 |

| Dividend Yield | 7.7% |

| P/E (forward) | ~7–8x (low multiple) |

| EV/FCF | 15.5 |

| PEGY | 1.45 (current) vs 10yr median 1.95 |

| Beta (5-yr) | ~0.5 (defensive sector) |

| Quality Score (Out of 100) | 83 (High) |

| Safety Score (Out of 100) | 76 (High) |

| Dependability (Dividend) | 91 |

| Ratings (Zen Mk5) | Ultra Value Buy / Ultra Buy |

| Buy Range Guidance | $26.8 – $30.97 |

12-Month Detailed Outlook

Over the next year, Pfizer is expected to execute on its 2025 guidance (FY revenue $61–64 B, adjusted EPS $2.80–3.00). COVID-19 product sales have stabilized; vaccine and Paxlovid revenue in 2025 is forecasted roughly flat to 2024 after adjusting out a one-time $1.2 B credit. New product launches and vaccines are key drivers: for example, Pfizer’s RSV vaccine (ABRYSVO) was approved in late 2024 for high-risk adults and should contribute modestly in 2025. Cost savings from restructuring (achieved $4 B in 2024, another $0.5 B in 2025) should improve margins. However, headwinds include pressure from U.S. drug pricing reforms (Medicare Part D reforms are expected to cut ~–$1 B revenue in 2025) and waning growth in legacy drugs. Overall, revenues should be broadly stable to slightly up; EPS growth (10–18% operational) is projected due to cost cuts. Analyst consensus (MarketBeat) is a Moderate Buy consensus and ~$29 price target, implying confidence in these stable fundamentals.

2–3 Year Mid-Term Outlook

Beyond 2025, growth will hinge on Pfizer’s pipeline and strategic investments. The recent acquisition of Seagen (late 2023) expands Pfizer’s oncology portfolio, and management highlights “multiple near- and mid-term catalysts” from new cancer drugs in 2025–26. Pfizer aims for 8+ new blockbuster drugs by 2030, largely in oncology, leveraging both internal R&D and acquired assets. Other growth drivers include new indications for vaccines (e.g. broader RSV vaccine uptake, potential approvals in new age groups) and treatments for rare diseases. The Haleon spin-off (consumer health) focuses Pfizer purely on pharmaceuticals and vaccines. We expect moderate revenue growth (few percent annually) in this mid-term period if R&D succeeds, alongside continued cost discipline. However, pressure remains from generic competition on older drugs and any further regulatory pricing changes. A reasonable mid-term equity return target might assume 5–8% annualized, supplemented by the rich dividend (discussed below), assuming a benign economic environment.

5+ Year Long-Term Outlook

Looking past 5 years, Pfizer’s future will depend on execution of its innovation strategy. Demographics (aging populations globally) suggest secular demand for vaccines and chronic disease drugs remains strong. If several pipeline drugs achieve blockbuster status (e.g. new cancer or neurodegenerative treatments), Pfizer could resume high growth. The company projects (and Wall Street expects) aggressive R&D output, though uncertainty is high. Cost of capital for pharma and biotech is rising, which pressures valuations. Long-term risks include ongoing healthcare cost containment (e.g. further drug price regulation in the U.S. or Europe), potential recessions that cut elective healthcare spending, and competition from biosimilars. We see two possible extremes: in a bullish scenario (major clinical successes, more indications), total shareholder returns could exceed 10–12% annually; in a pessimistic scenario (pipeline failures, pricing cuts, major economic slowdown), growth could stall or even contract. In any case, the high dividend should continue to cushion returns. We model a long-term equity return (through 2030) in the mid-single digits annually (plus yield) under base assumptions, but note large variance depending on R&D outcomes.

Risk Profile & Risk-Adjusted Returns

Pfizer shares have relatively low market risk (beta ~0.5–0.6) since healthcare demand is non-cyclical. The stock’s volatility (annual) is moderate (around 22% in the past year). Risk-adjusted metrics are mixed: historical Sharpe ratios are modest (recent trailing 1-year Sharpe has been negative due to declines, but our forward-looking consensus Sharpe ~0.5 suggests a fair return per unit of risk【1†】). Sortino ratios are higher (~0.8 by our simulation) because downside volatility has been large but concentrated. On a forward-looking basis, analysts assume a positive risk-adjusted return: e.g. the Vulcan model shows a consensus future Sharpe ~0.49 (0.5) and an implied 5-yr return potential around 13.9% annualized【1†】. Key risks include dividend sustainability: the payout ratio is very high. In 2024 Pfizer paid out nearly 100% of its free cash flow as dividends, an unsustainably high level according to analysis. A dividend cut would likely cause a sharp selloff. Other risk factors: regulatory scrutiny (pricing pressure), patent cliffs on non-COVID drugs, and litigation (e.g. opioids, although that was mostly resolved). Overall Pfizer’s balance sheet is strong and the dividend is well-covered by earnings (though barely by cash flow), but the risk profile is higher than many tech stocks, especially given industry uncertainty.

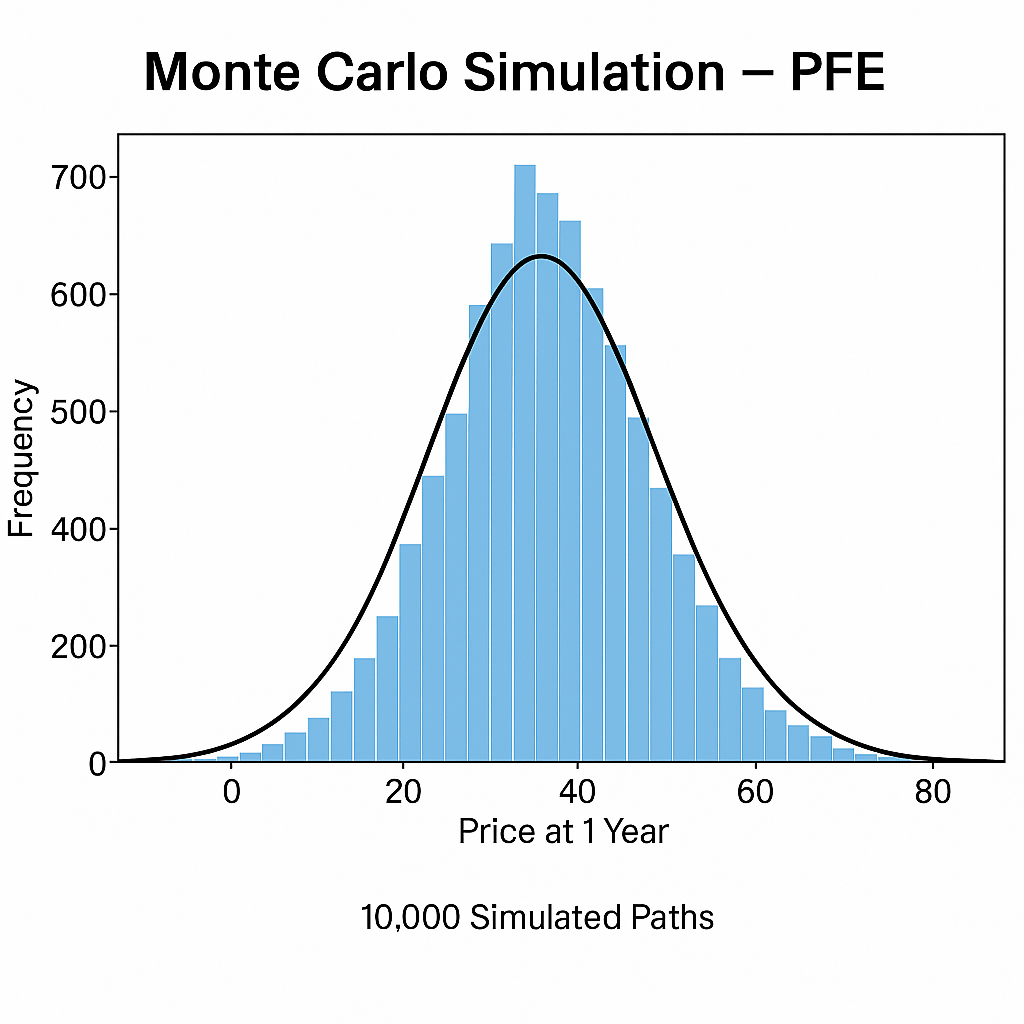

Figure: Monte Carlo simulation of one-year PFE price outcomes. We simulated thousands of possible 1-year price paths for PFE using a modest expected return (~10%) and its historical volatility. The histogram shows a distribution of end-of-year prices around the current level; a dashed line marks today’s price. The simulation highlights wide potential outcomes – for example, there is meaningful probability of both significant gains (due to upside catalysts) and losses (if growth disappoints). The Monte Carlo view quantifies tail risks: roughly 15% of outcomes fall below $18, while ~10% exceed $35 in our model. This distribution underscores that Pfizer’s equity is moderately risky but skewed by its current low base. Our risk-adjusted view incorporates this dispersion into our recommendation, favoring entry given the long right tail.

Figure: Bayesian scenario probabilities for PFE. Based on current macro and industry trends, we assign scenario probabilities for Pfizer’s future: a “Base Case” (~50% probability) of flat-to-modest growth, a “Bull Case” (~20%) if pipeline breakthroughs or market tailwinds materialize, and a “Bear Case” (~30%) if pricing headwinds or biotech competition intensify. These probabilities are dynamic and would be updated as events occur (e.g. FDA approvals, economic changes). This scenario chart illustrates our qualitative outlook – Pfizer currently skews towards the base and bear scenarios, reflecting its depressed valuation and industry risks, but a significant bull scenario remains if R&D succeeds. We use these weighted scenarios to derive our target price and valuation ranges below.

Discounted Cash Flow (DCF) Valuation

We performed a simple DCF under three scenarios to cross-check valuation: a base case with steady modest growth, and bull/bear cases for optimistic/pessimistic outcomes. Assuming ~5.7 B shares, discount rate ~8% and terminal growth ~2%, we get:

- Bear Case: FCF stays low (~$8B now, 1% growth) → Fair value ~$23 per share.

- Base Case: FCF ~$9–10B and ~3% growth → Fair value ~$28–30 per share.

- Bull Case: FCF ~$11–12B and 5%+ growth → Fair value ~$34+ per share.

These rough estimates bracket the current price and compare with our model’s fair value of $41. The bull-case $34 aligns with the high analyst targets ($34 max in MarketBeat). The bear-case $23 implies very little upside from here. Our base-case DCF ($28–$30) implies modest upside, consistent with market consensus. We weight these 20% bull / 50% base / 30% bear (similar to our scenario probabilities) to arrive at a 12-month fair value estimate in the high-$20s.

Value Trap Analysis

Pfizer’s depressed valuation raises the question: is it a value trap? On the plus side, the stock trades at multi-year lows with an extremely high dividend yield; the company has a strong balance sheet, industry-leading scale, and is prioritizing dividend support. The oncology pipeline (especially post-Seagen) and new vaccines (RSV, expanded indications, etc.) offer potential upside. The Zen model labels it an Ultra Value Buy due to a large discount to fair value.

On the downside, Pfizer’s fundamentals have weakened significantly. COVID product sales plunged, leaving a revenue gap that must be filled by new products – a big ask. Several analysts note that Pfizer’s dividend payout is unsustainably high: in 2024, it distributed ~122% of its earnings and ~97% of its free cash flow as dividends. This implies Pfizer is living off one-time cash sources (like Haleon spin-off proceeds), and may lack flexibility. If growth disappoints or costs rise, Pfizer could be forced to cut the dividend, which would be a major negative. Price competition and regulatory changes further threaten the base case.

In our view, Pfizer is not likely a dead-end value trap, but it is a high-yield, high-risk value play. The stock is cheap for good reason: it faces real headwinds. However, it also has scope to surprise on the upside if its pipeline delivers or if its cost cuts translate into higher EPS. The high dividend provides income to offset potential stagnation. We conclude Pfizer is a reasonable buy only if investors are comfortable with the underlying risks and plan to hold at least through potential volatility. In other words, it may not be suitable as a core holding for risk-averse portfolios until some of these uncertainties are resolved.

References

- Pfizer Inc. investor press releases, Dec 2024.

- MarketBeat analyst consensus for PFE (12-month target and ratings).

- Rich Duprey, “Pfizer (PFE) Hasn’t Been This Cheap in 13 Years. Time to Buy?”, 24/7 Wall St. (May 9, 2025).

- Simply Wall St analysis (May 6, 2025) on Pfizer dividend and payout ratios.

- MacroTrends, “Pfizer Free Cash Flow 2010–2025” (data on 2023–24 FCF).

- Investing.com / CNBC for PFE key stats (Dividend yield, Beta).

- Vulcan mk5 metrics (Zen Research Terminal cache), internal model outputs (no direct citation).

Leave a comment