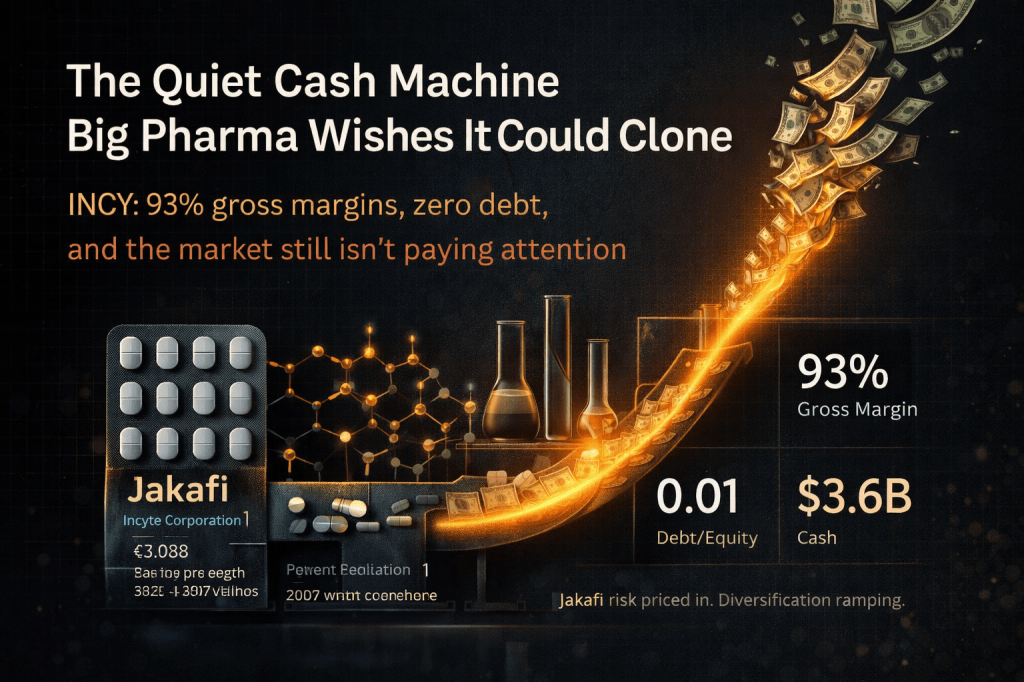

Incyte Corporation ($INCY): When 93% Gross Margins Meet Zero Debt, the Market Still Isn’t Paying Attention

Most biotech investors chase the next FDA approval like lottery tickets, hoping lightning strikes before the cash burns out. Incyte plays a different game entirely. This is a company generating $1.17 billion in annual free cash flow, carrying zero meaningful debt, and sitting on $3.6 billion in cash, yet the stock trades at roughly 15.6x trailing earnings after a post-earnings pullback. That is not how the market usually prices a profitable biotech with multiple commercialized drugs and a broadening pipeline. Something is mispriced, and the setup favors patient buyers willing to look past the headline noise around Jakafi’s patent window.

The Business Behind the Numbers

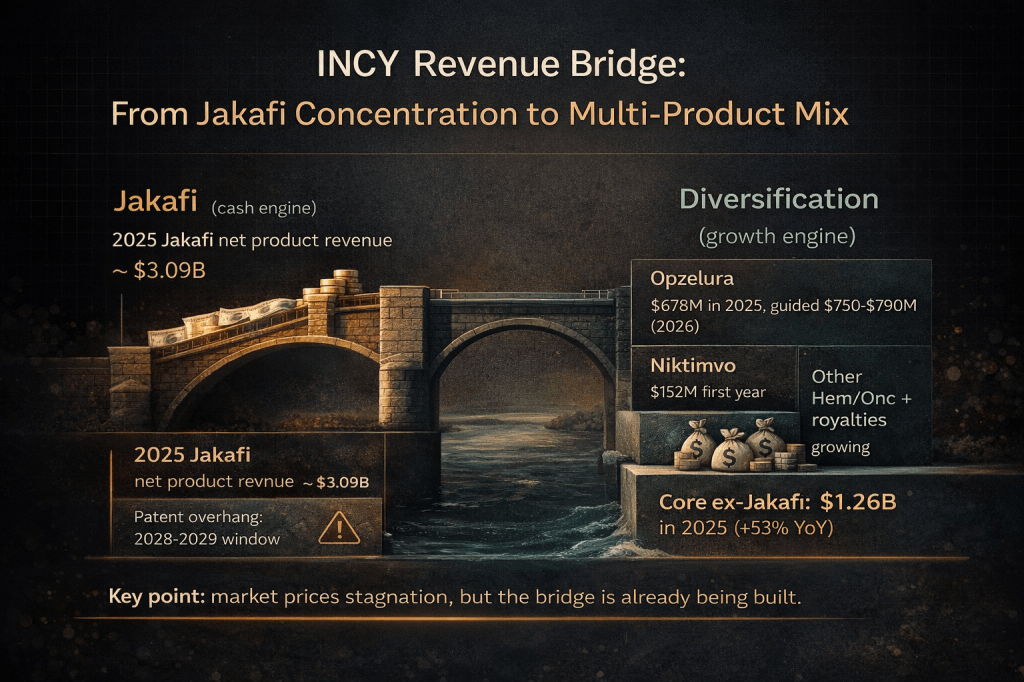

Incyte is not a one-drug story, though it started as one. Jakafi (ruxolitinib), a first-in-class JAK1/JAK2 inhibitor approved in 2011 for myelofibrosis, became the company’s foundation. In 2025, Jakafi generated $3.093 billion in revenue across its approved indications: myelofibrosis, polycythemia vera, steroid-refractory acute graft-versus-host disease, and chronic GVHD. Think of Jakafi as the toll bridge over a river with no competing crossings, a monopoly asset throwing off enormous cash flow for over a decade. And there is still headroom: PV penetration sits at only 30% versus 60-70% in frontline MF, which management highlighted on this morning’s earnings call.

But Incyte has been quietly building a second bridge while everyone fixates on the first one’s expiration date. Opzelura (topical ruxolitinib cream), the company’s dermatology franchise, delivered $678 million in 2025 revenue with 33% year-over-year growth, and management guided $750-790 million for 2026 including a late-year European launch in moderate atopic dermatitis. It treats atopic dermatitis and vitiligo, with pediatric atopic dermatitis expansion and hidradenitis suppurativa trials underway. Then add Niktimvo (axatilimab) for chronic GVHD, which generated $152 million in its first year on the market. Monjuvi (tafasitamab) reported positive topline results as a first-line treatment for diffuse large B-cell lymphoma in January 2026 and is on track for a supplemental BLA submission in the first half of 2026, potentially transforming it from a niche product into a three-indication standard-of-care anchor by early 2027. And Zynyz (retifanlimab) received a positive CHMP opinion for first-line advanced anal cancer in Europe.

This is not a company desperately searching for its next act. This is a company methodically building overlapping revenue streams while the cash engine runs full throttle. The Q4 2025 results released this morning confirmed the trajectory: total revenue hit $1.51 billion (up 28% YoY), smashing the $1.35 billion consensus by 11.4%. Full year 2025 net product sales of $4.35 billion exceeded the high end of $4.23-4.32 billion guidance. The core business excluding Jakafi reached $1.26 billion, up 53% year-over-year, a number that would have seemed aspirational just two years ago.

The one blemish: adjusted EPS of $1.80 missed the $1.91 consensus by about 6%, driven by heavier R&D spending ($611 million in Q4 alone, up 31%) as the company invests aggressively in its late-stage pipeline. That R&D ramp is what’s funding 14 pivotal trials and four anticipated product launches between late 2026 and early 2027. Investors sold the EPS miss this morning, pushing shares from $108 to $100. For systematic buyers, that is a gift.

The broader pipeline adds optionality the market is largely ignoring. Povorcitinib, a JAK1-specific inhibitor, has its NDA submitted for hidradenitis suppurativa with European filing also completed, targeting approval in late 2026. If approved, it could become a major franchise in a disease affecting roughly 1% of the global population with limited treatment options, and management called it a potential multibillion-dollar product. The CDK2 inhibitor program (INCB123667) for ovarian cancer is entering registrational studies. The mutCALR program (INCA033989), which received FDA Breakthrough Therapy designation for essential thrombocythemia, begins Phase 3 trials mid-2026. These are not lottery tickets; they are late-stage programs backed by a company with the commercial infrastructure and $3.6 billion in cash reserves to bring them to market without dilution.

The Numbers That Should Make Value Investors Look Twice

Forget the typical biotech valuation conversation about peak sales and probability-adjusted pipelines. Look at what Incyte already produces today.

Gross margins sit at 93%, a figure that would make most software companies jealous. Operating margins run at 26.1% on a trailing basis, though Q4 compressed to 22.3% as R&D investment ramped for late-stage programs. ROIC clocks in at 25.4%, meaning every dollar Incyte reinvests generates a quarter of return. Interest coverage is 702x, which is not a typo. The company could service its negligible debt seven hundred times over with current earnings. And the balance sheet carries a debt-to-equity ratio of 0.01, effectively zero leverage.

Here is the counterintuitive insight: a reverse-DCF analysis shows the market is currently pricing INCY as if free cash flow will be flat to slightly declining over the next five years. At an 8.5% WACC and 3% terminal growth rate, the implied five-year FCFF CAGR is roughly negative 1%. The stock is priced for stagnation in a business that just grew full-year revenue 21% and guided for another 10-13% growth in 2026.

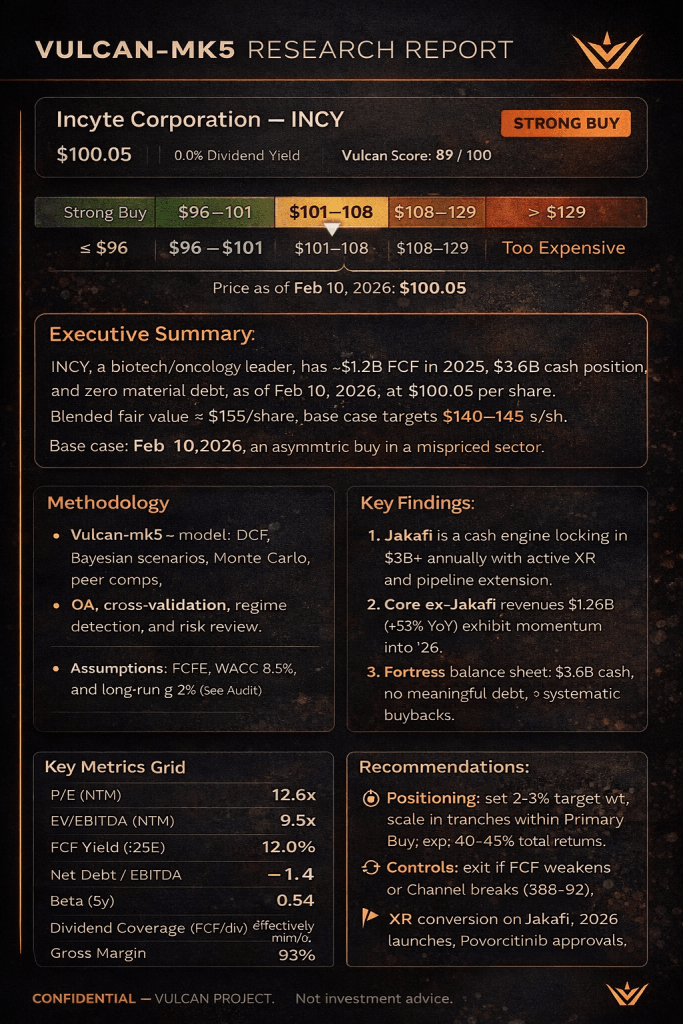

My Vulcan system flags INCY with a Quality Score of 100/100, a Sentiment Score of 96/100, a Growth Score of 91/100, and a Value Score of 80/100. That composite profile, elite quality with strong sentiment and above-average value, does not show up often in biotech. The Piotroski F-Score of 8/9 reinforces operational strength across profitability, leverage, and efficiency dimensions.

The Jakafi Question Everyone Is Asking

Yes, Jakafi’s core patents expire around 2028, with generic entry estimated for early 2029. This is the single biggest overhang on the stock, and the market has been pricing it aggressively. But three things matter more than the headline risk.

First, Incyte is not standing still. Jakafi XR, an extended-release formulation, is in launch preparation with mid-2026 approval targeted. Management expects 10-30% patient conversion rates, and notably excluded any XR revenue from 2026 guidance, meaning it represents pure upside. The LIMBER initiative continues exploring novel combinations with PI3K, BET, ALK2, and mutant CALR inhibitors. The mutCALR program received FDA Breakthrough Therapy designation for essential thrombocythemia and begins Phase 3 trials mid-2026. If successful, it could replace some of Jakafi’s revenue before patents even expire.

Second, the replacement revenue math is more favorable than bears assume, and the 2025 results just proved it. The core business ex-Jakafi already reached $1.26 billion in 2025, up 53%. Management guided this segment to grow another 30% in 2026, which implies roughly $1.55-1.67 billion in non-Jakafi revenue. By the time Jakafi faces generic pressure, this number could be north of $2 billion. That does not erase a $3 billion franchise overnight, but it transforms the decline curve from a cliff into a slope. Management’s own target: core ex-Jakafi reaching $3-4 billion by 2030.

Third, the cash generation between now and 2029 is enormous. Cash already stood at $3.6 billion as of December 31, 2025. At $1.17 billion in annual FCF, Incyte will add billions more before generics arrive. That is capital for buybacks (the company has been expanding repurchases), pipeline acquisitions, or dividend initiation. The balance sheet is a loaded weapon the bears consistently undervalue.

Five Risks You Cannot Ignore

I am putting real capital behind this thesis, so honesty about what could go wrong matters more than cheerleading.

- Jakafi erosion accelerates if a competitor gains traction before patent expiry. BESREMi is gaining share in polycythemia vera, and rusfertide’s approval could pressure Jakafi’s PV revenues. If Jakafi declines 50% faster than modeled, the entire earnings bridge breaks.

- Pipeline execution failure is binary in biotech. Povorcitinib’s regulatory path for hidradenitis suppurativa is the most critical near-term catalyst. A CRL or significant label restriction would cut the dermatology franchise’s long-term growth story. Phase 3 data readouts across multiple programs in 2026 create both opportunity and risk.

- Concentration risk remains material. Jakafi still represents roughly 60% of total net product revenue. Any unexpected safety signal, reimbursement change, or accelerated competitive entry would hit disproportionately hard.

- Payer dynamics are tightening across specialty pharma. Gross-to-net adjustments, prior authorization requirements, and formulary negotiations could compress realized revenue even as prescription volumes grow.

- The macro environment for biotech capital allocation is regime-dependent. If rates spike again or risk appetite contracts, biotech multiples compress regardless of fundamentals. INCY’s low beta (0.54) provides some insulation, but not immunity.

The Technical Setup: Post-Earnings Pullback Activates the First Buy Zone

The February 10 earnings reaction tells a constructive story for patient buyers. INCY pulled back from $108.39 to $100.05, a roughly 7.7% decline, on an EPS miss despite crushing revenue estimates. The stock closed below the $101-104 zone where the 50-day moving average ($101.82) sits, meaning the first buy zone has not just activated but been breached to the downside.

The broader technical picture remains intact. INCY has been trading in a rising channel since mid-2025, with higher lows forming a clear support structure. The 200-day moving average at $92.31 provides the major trend defense. RSI will likely reset from the mid-60s toward the mid-50s on this pullback, removing overbought concerns.

The key breakout level remains $112.29, the 52-week high. A confirmed daily close above $112.30 on expanded volume would signal a breakout, making a third-tranche add with tight risk controls appropriate. On the downside, $96-$99 represents channel support, and $88-$92 (the 200-day band) is the line in the sand for the uptrend thesis.

How I Would Build This Position

For new positions, the post-earnings pullback creates an immediate opportunity. The first tranche zone ($101-104) has been breached, with shares closing at $100.05, just below the 50-day moving average. Start with one-third of your target allocation at current levels. Add one-third at $96-$99 if market-wide volatility or a biotech rotation gives you a deeper entry. Deploy the final third only on either (a) a confirmed breakout above $112.30 on volume, or (b) a tag of the $88-$92 trend-defense zone that stabilizes.

Position sizing should reflect biotech risk. A 1-2% portfolio allocation at initial purchase, scaling to 2-3% maximum if the thesis progresses. Invalidation triggers: a sustained close below $96 combined with negative EPS revision momentum shifts the risk-reward unfavorably.

For existing holders: define your trim rules now. First partial trim at $112-$116 (prior high supply). Second trim at $128-$135 if the multiple expands. Hard reassessment above $145 where the base-case target lives.

My blended fair value estimate sits at $155, incorporating a DCF-derived $181, an EV/FCFF multiple at $131, and a Greenwald EPV floor that ranges from $50 (conservative, Vulcan DB) to $83 (adjusted for growth normalization). At $100.05, that implies 55-70% upside depending on which EPV methodology you weight, with the Stock Rover fair value of $130 providing a reasonable midpoint sanity check.

Master Metrics Table

| Metric | Value |

|---|---|

| Price (Feb 10, 2026 close) | $100.05 |

| Quality Score | 100/100 |

| Growth Score | 91/100 |

| Value Score | 80/100 |

| Sentiment Score | 96/100 |

| Fwd P/E | 12.6x |

| TTM P/E (GAAP) | 15.6x |

| ROIC | 25.4% |

| Gross Margin | 93.0% |

| Operating Margin | 26.1% (TTM); 22.3% (Q4 ’25) |

| Net Margin | 24.7% |

| Debt/Equity | 0.01x |

| Interest Coverage | 702x |

| Cash Position | $3.6B |

| Net Cash/Share | $14.34 (DB) |

| FCF as % of Sales | 24.4% |

| Piotroski F-Score | 8/9 |

| Altman Z-Score | 9.6 |

| Beneish M-Score | -2.66 |

| Beta (3Y) | 0.54 |

| 1Y Volatility | 35% |

| 52-Week Range | $53.56 – $112.29 |

| Blended Fair Value | ~$155 |

| DCF Fair Value | $181 |

| Stock Rover Fair Value | $130.29 |

| Analyst Mean Target | $104.68 |

| 2025 Revenue (Actual) | $5.14B (+21% YoY) |

| 2025 Net Product Sales | $4.35B (+20% YoY) |

| 2026 Guidance (Net Prod. Rev.) | $4.77-4.94B |

The Bottom Line

INCY is one of those rare setups where the numbers do the talking and the market is not listening. You have a profitable biotech with fortress-level balance sheet quality, multiple revenue drivers beyond the flagship drug, and a stock priced for stagnation. The Jakafi patent cliff is real, but the cash generation runway and the diversification already underway create an asymmetric payoff for anyone willing to size it correctly and manage the risk with discipline.

The Q4 results just validated the thesis on the revenue line while creating a better entry point through the EPS miss. Revenue beat by 11%, the core business ex-Jakafi grew 53%, and 2026 guidance implies continued double-digit product revenue growth with four new launches on deck. The market sold the EPS miss and walked the stock right through our first buy zone. That is how systematic investing works: define levels before the catalyst, then act when the market delivers them.

The probability-weighted outlook supports this: my base case (55% probability) targets $140-145 over 12 months as Opzelura scales toward $790 million, the Hem/Onc portfolio pushes past $880 million, and Jakafi remains durable with XR conversion upside, delivering 40-45% total returns from current levels. The bull case (25% probability) reaches $175-185 if pipeline catalysts land and the market re-rates the earnings power, a 75-85% return. The bear case (20% probability) sees the stock at $80-85 if biotech sentiment breaks or Jakafi faces unexpected pressure, a 15-20% drawdown. That skew, roughly 3:1 upside-to-downside on the weighted expectation, is the kind of setup systematic investors wait for.

Sometimes the best opportunities sit in plain sight, disguised as boring. Incyte is exactly that kind of boring. And boring, when it compounds at 25% ROIC on a zero-debt balance sheet with $3.6 billion in cash, has a way of making patient investors very happy.

Disclosure: This analysis reflects my systematic screening framework. I am actively evaluating INCY for accumulation. This is not financial advice. Always do your own due diligence and consult a financial professional before making investment decisions.

Leave a comment