Copper and COPX ETF Vulcan analysis as part of the GNG Research team. February 3, 2026.

While everyone chases semiconductor stocks, the real AI infrastructure bottleneck is piling up in warehouses from Shanghai to Chicago.

The $50 Million Problem Nobody’s Talking About

In a keynote explanation of the GB200 NVL72 design, Jensen Huang said the NVLink spine uses roughly 5,000 cables totaling about 2 miles, and that going optical would have added roughly 20 kW of transceiver and retimer power draw. Not fiber optics. Copper. The same metal that still does the heavy lifting in power and cooling hardware worldwide.

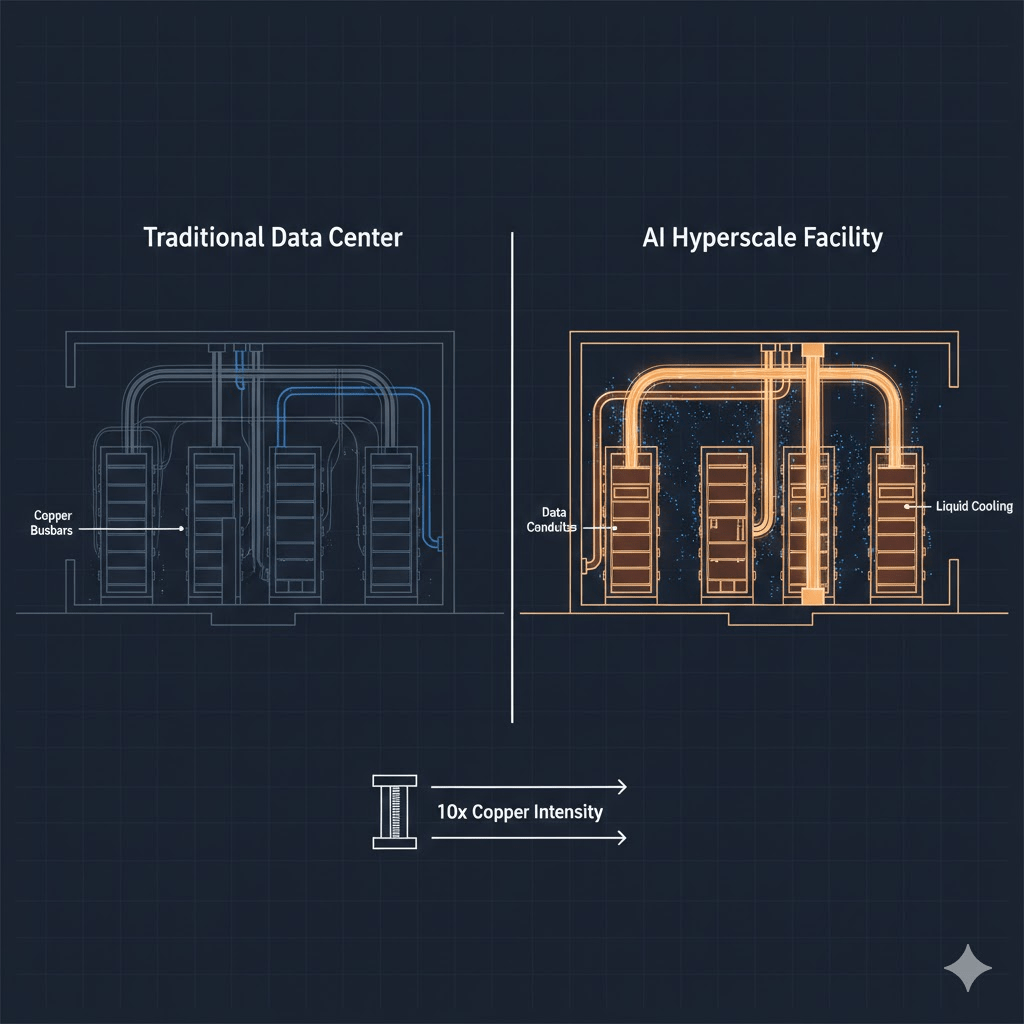

I’ve spent 15 years watching investors chase shiny objects while ignoring the obvious plays. And right now, the AI trade has become so obsessed with chips that it’s completely missing the infrastructure bottleneck forming underneath. A conventional data center might use 5,000 to 15,000 tons of copper (CSIS estimate). A hyperscale AI facility running NVIDIA’s latest hardware? Try 50,000 tons per site (CSIS estimate). That’s not a typo. That’s a 10x jump in copper intensity, and it’s happening across every major tech campus being built.

My read: the copper miners aren’t just a derivative play on AI. They might be the trade with the clearest risk/reward in the entire sector.

Why NVIDIA Couldn’t Use Fiber (And What That Means for Your Portfolio)

Here’s the part that surprised me. When NVIDIA engineers designed the GB200 system, they faced a brutal tradeoff. They could use fiber optic connections between GPUs and keep the heat down. Or they could use copper and deal with the thermal nightmare. They chose copper. Why? Because switching to fiber would have added another 20 kilowatts of power draw just from the transceivers and retimers.

Think about that for a second. NVIDIA, the company building the most sophisticated AI hardware on the planet, looked at every material science option available and concluded that copper was irreplaceable for their highest performance systems. The metal that humans have been mining for 10,000 years is still the optimal solution for connecting AI processors in 2026.

This isn’t just an NVIDIA story either. Every AI accelerator generates intense heat in a tiny space, and copper remains one of the best practical conductors for power delivery and heat transfer at scale. The power delivery systems require thick copper busbars to carry hundreds of megawatts across campus. Even the grounding systems protecting billions in AI hardware rely on copper.

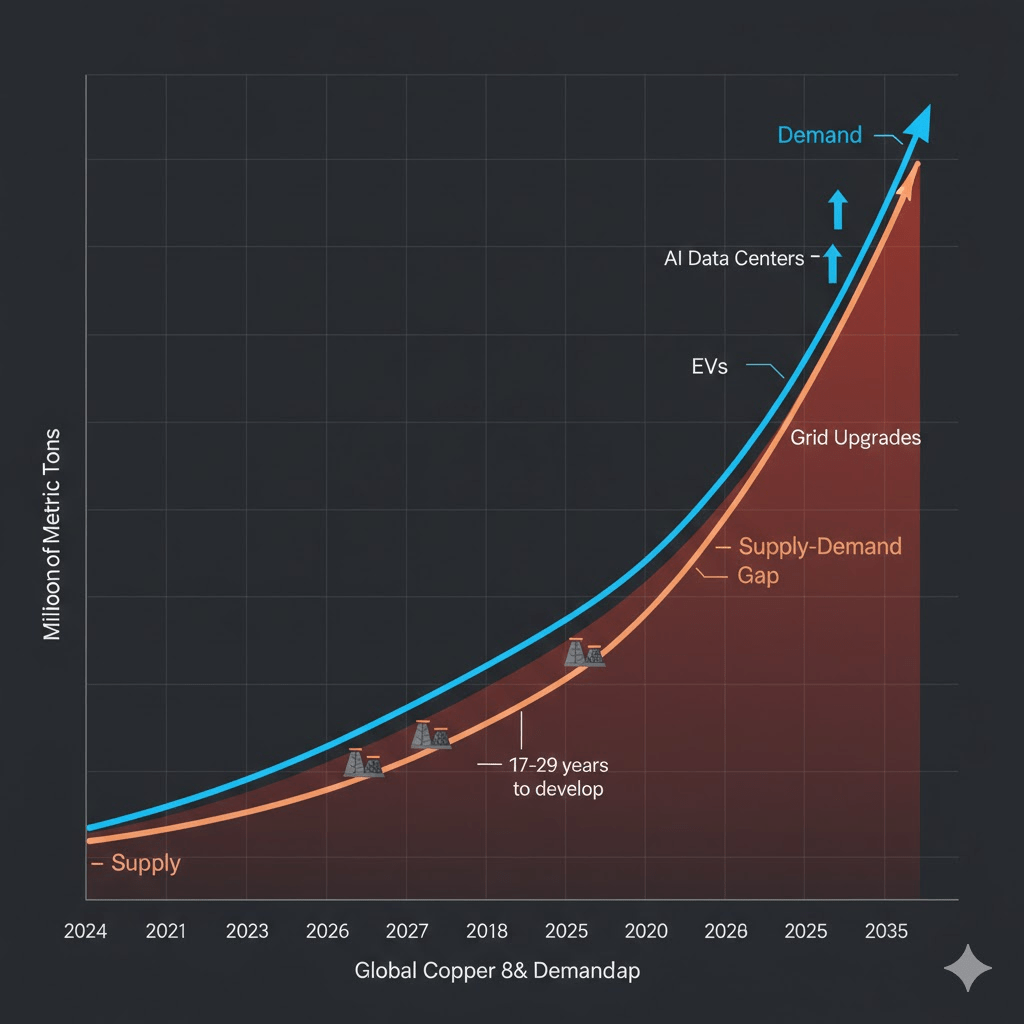

When I pull up the supply data, the math gets uncomfortable. AI data center construction in North America hit 6.3 gigawatts of capacity under development in 2024. Industry estimates suggest AI facilities alone could push data center copper demand to more than half a million metric tons annually by 2030 (Forbes). And that’s before you count EVs, grid upgrades, and everything else fighting for the same constrained supply.

The 29-Year Problem That Nobody Can Fix

Here’s where the thesis gets interesting. Unlike semiconductors, where capacity can scale relatively quickly, copper has a fundamental timing problem. It takes 17 to 29 years to permit and develop a new copper mine in Western countries. You read that right. The copper that will supply AI data centers in 2035 needed to start permitting before smartphones existed.

The industry spent the 2010s underinvesting after commodity prices collapsed. Now ore grades are declining at existing mines, and the giant Chilean operations that supply much of the world are aging. S&P Global projects that even with mines under construction, global supply will peak by 2030 and fall behind demand, potentially creating a 10 million ton annual shortfall by 2040.

BHP, the world’s largest mining company, has been screaming about this for months. Their CFO publicly stated that while data centers represent only 1% of copper demand today, they could reach 6 to 7% by 2050. They projected AI applications alone will add 3.4 million tonnes of annual copper demand over the next two decades. BHP’s response? A $49 billion takeover attempt for Anglo American and aggressive stakes in South American copper projects. When the biggest miner on the planet starts paying premium prices for reserves, the signal is pretty clear.

My Playbook: COPX as the Core Position

I’ve looked at the individual miners, and they each have their own story. Southern Copper runs some of the lowest cost operations globally, but they’re trading at 40x trailing earnings after a 69% run in 2025. Freeport-McMoRan gives you Grasberg and diversified geography, but they just had an operational setback that reminded everyone about execution risk. First Quantum offers higher beta and growth, but their Panama exposure adds political risk.

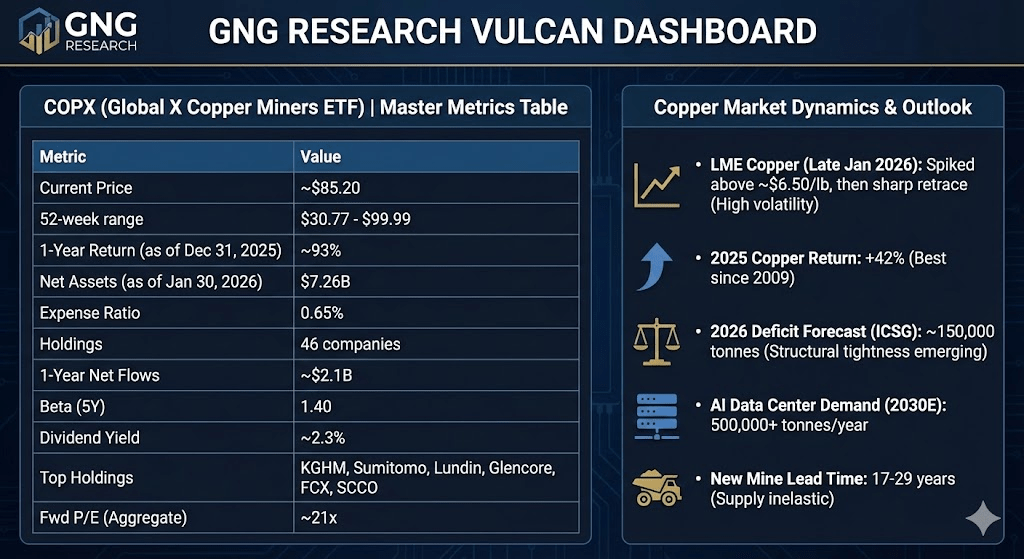

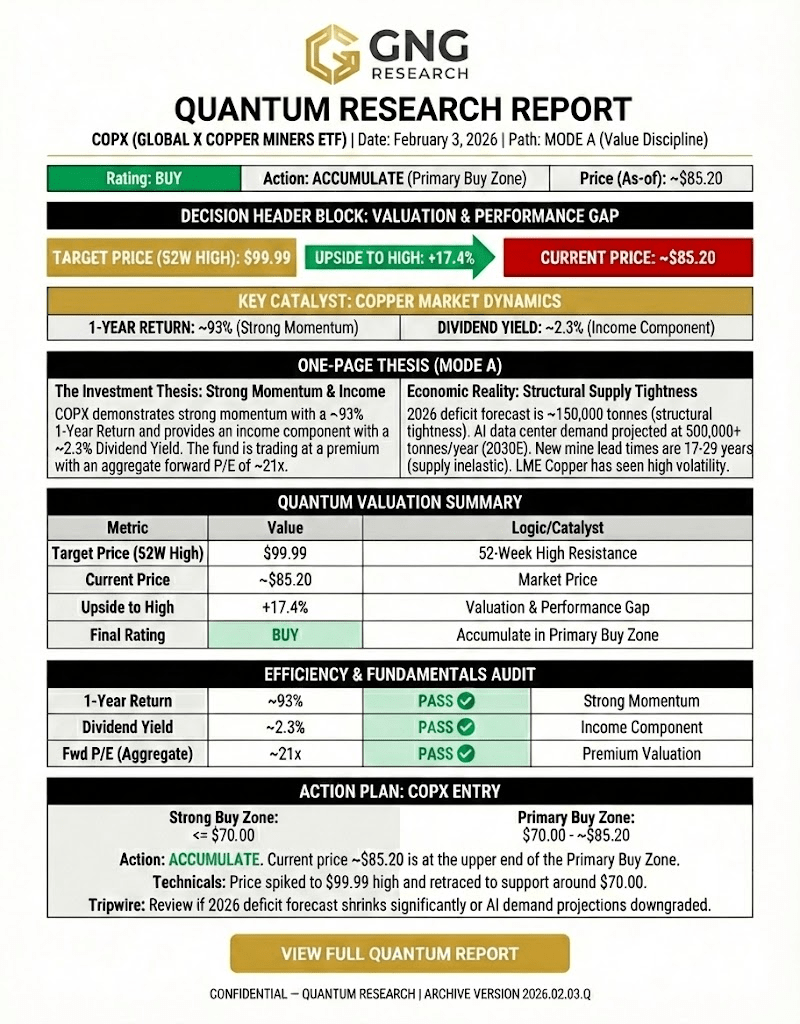

For my money, the Global X Copper Miners ETF (COPX) offers the cleanest exposure to this thesis. At roughly $85 with a 52-week range from $31 to $100, the ETF captures the entire sector without making me pick winners among individual operators. The fund holds about 46 companies across every major mining geography, from stable jurisdictions like Canada and Australia to higher-risk, higher-reward plays in Peru and Congo.

COPX returned over 93% in 2025 and has seen massive inflows. Fund flows have accelerated; ETFDB shows about $2.1 billion of net inflows over the past year. That tells me institutional investors are waking up to the same thesis. The expense ratio at 0.65% is reasonable for thematic exposure, and the diversification means no single mine disaster can blow up your position.

The valuation case isn’t as clean as I’d like. Aggregate P/E for the holdings runs around 21x forward earnings, which isn’t cheap by historical standards. But if copper prices sustain above $5 per pound, those earnings estimates probably look conservative. The miners have tremendous operating leverage. Freeport’s own numbers show each $0.10 change in copper price moves their annual operating cash flow by $335 million.

What Could Go Wrong (And Where I’d Cut Bait)

Let me be honest about the risks because this is not a low-volatility trade:

China demand softening. China consumes 58% of global copper. Their property sector has been a mess, and if infrastructure spending disappoints, copper could pull back 15 to 20% in a hurry. I’d start trimming if copper breaks below $4.50 per pound for more than two consecutive weeks.

US tariff policy. The 2025 Section 232 action imposed 50% tariffs on certain semi-finished copper and derivative imports, while stopping short of tariffs on refined copper. The next formal update is due by June 30, 2026, with refined copper duties discussed as a future possibility. Watch the Commerce Department for signals.

Speculative positioning. LME net long positions are in the 80th percentile. When positioning gets this stretched, corrections come fast and hard. Copper whipsawed in late January 2026, briefly spiking above $6.50 per pound before retracing sharply. More volatility is certain.

Mine supply surprises. If Indonesian export bans lift or major African projects come online faster than expected, the deficit narrative weakens. I track ICSG monthly data for early warning signs.

Recession risk. Copper is ultimately cyclical. If the US enters recession in 2026, industrial demand could crater regardless of AI buildouts. The AI demand story is real, but it doesn’t immunize copper from broader economic weakness.

Position Sizing and Entry Strategy

Given the volatility profile, I’m sizing this at 3 to 4% of portfolio maximum. The beta on COPX runs around 1.4, so this will move. My approach: accumulate on pullbacks rather than chasing strength.

Entry zones for COPX look attractive in the $75 to $82 range, which represents a pullback to the rising 50-day moving average. I’d add aggressively at $68 to $72 if we see a broader market correction. Above $95, I’m not adding and would consider taking partial profits.

For those wanting individual equity exposure alongside the ETF, Freeport-McMoRan (FCX) at $55 to $58 offers a more liquid large-cap alternative with direct US listing. Southern Copper (SCCO) works for income-oriented investors, though the valuation is stretched.

My invalidation triggers: COPX closes below $65 for five consecutive sessions, or copper breaks below $4.25 per pound on weakening demand data (not just speculative deleveraging). Either of those and I’d reassess the entire position.

The Bottom Line

The AI infrastructure buildout requires physical materials in quantities the market hasn’t fully appreciated. While GPU makers trade at nosebleed valuations and every portfolio manager on earth owns NVIDIA, the copper miners offer a different angle on the same mega-trend. You’re essentially betting that all those AI data centers getting announced actually get built, and that building them requires exactly what the engineering says it requires: massive quantities of copper.

I’ve been wrong before, and commodity trades can go sideways for longer than you expect. But when NVIDIA’s own engineers conclude that copper is irreplaceable for their highest-end systems, and when the world’s largest miner is paying premium prices to acquire more copper reserves, the signal is worth heeding. The metal hiding in plain sight might be the best way to play the AI theme without paying 50 times earnings for the privilege.

Long COPX. This reflects my personal analysis and is not financial advice.

Master Metrics Table: COPX (Global X Copper Miners ETF)

| Metric | Value | Context |

|---|---|---|

| Current Price | ~$85.20 | 52-week range: $30.77 – $99.99 |

| 1-Year Return (as of Dec 31, 2025) | ~93% | Outperformed S&P 500 significantly |

| Net Assets | $7.26B (as of Jan 30, 2026) | Significant institutional interest |

| Expense Ratio | 0.65% | Reasonable for thematic ETF |

| Holdings | 46 companies | Globally diversified |

| 1-Year Net Flows | ~$2.1B (ETFDB) | Strong institutional accumulation |

| Beta (5Y) | 1.40 | Higher volatility than market |

| Dividend Yield | ~2.3% | Income component |

| Top Holdings | KGHM, Sumitomo, Lundin, Glencore, FCX, SCCO | Diversified by geography |

| Fwd P/E (Aggregate) | ~21x | Premium to historical average |

Copper Market Reference

| Metric | Value | Implication |

|---|---|---|

| LME Copper (Late Jan 2026) | Spiked above ~$6.50/lb, then sharp retrace | High volatility, near record highs |

| 2025 Copper Return | +42% | Best since 2009 |

| 2026 Deficit Forecast (ICSG) | ~150,000 tonnes | Structural tightness emerging |

| AI Data Center Demand (2030E) | 500,000+ tonnes/year (Forbes) | New demand vector |

| New Mine Lead Time | 17-29 years | Supply inelastic |

Sources & Citations

- NVIDIA GB200 NVL72 copper/cabling details: Jensen Huang keynote remarks

- Data center copper intensity (5k-15k vs 50k tons): Center for Strategic and International Studies (CSIS)

- 500,000+ tonnes AI/data center demand by 2030: Forbes

- COPX AUM and holdings: Global X official site (as of Jan 30, 2026)

- COPX fund flows: ETFDB

- 2026 copper deficit forecast: International Copper Study Group (ICSG)

- Section 232 tariff scope: US Commerce Department

- BHP demand projections and M&A activity: Company filings and financial press

Leave a comment