Vulcan-mk5 Stock Analysis | January 27, 2026

The Challenge That Creates Opportunity

A company announces a strategic collaboration with OpenAI at CES 2026, gets early access to frontier AI models, sees its stock jump nearly 9% on the news… and then trades right back to where it started. That gap between narrative excitement and price action is exactly where systematic investors find edge.

Zeta Global sits at that uncomfortable intersection where most investors cannot hold: too expensive on traditional value metrics to attract the bargain hunters, and not yet profitable enough on GAAP to satisfy the quality screens. The result is a stock that screens poorly everywhere except in the one place that matters: the actual trajectory of the business.

The Business in Plain English

Imagine you run marketing for a Fortune 500 retailer. You have customer data scattered across seventeen different systems, built up over twenty years of acquisitions. You know your customers bought something last year. You have no idea what they want next week.

Zeta’s platform is the translation layer that turns that chaos into action. The company ingests billions of consumer signals daily, from email engagement patterns to purchase intent signals, and converts them into marketing campaigns that actually work. Think of it as a marketing operating system: one platform where teams can identify audiences, create campaigns, deploy across channels, and measure results, all without switching between five different software vendors.

The twist that makes 2026 interesting is Athena. Unveiled at CES with OpenAI’s backing, Athena transforms the Zeta platform from a tool you use into an agent that works for you. Instead of running a report to find your best customers, you ask Athena a question and get an answer. Instead of building a campaign manually, Athena recommends one based on what worked before. The marketing department becomes a conversation.

TKO Group Holdings, the parent company of UFC and WWE, has been testing Athena in early access. Their data intelligence team reported that tasks requiring hours of manual work now happen instantly. If that experience scales, Zeta’s value proposition shifts from “better software” to “fewer headcount needed,” and enterprise buyers pay significantly more for the latter.

The Profitability Crossover Thesis

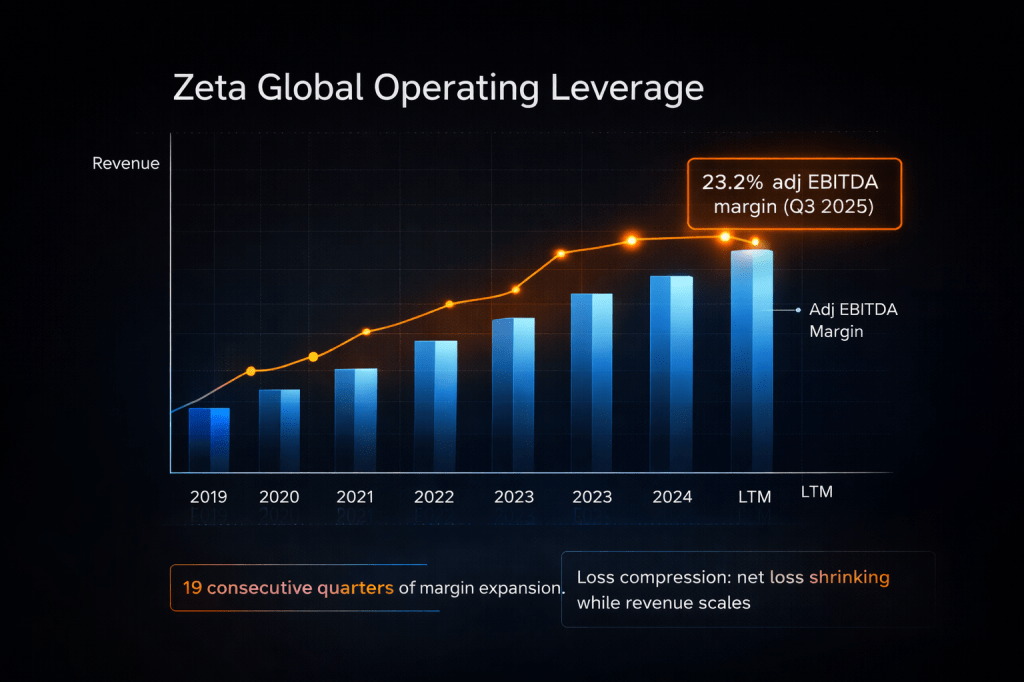

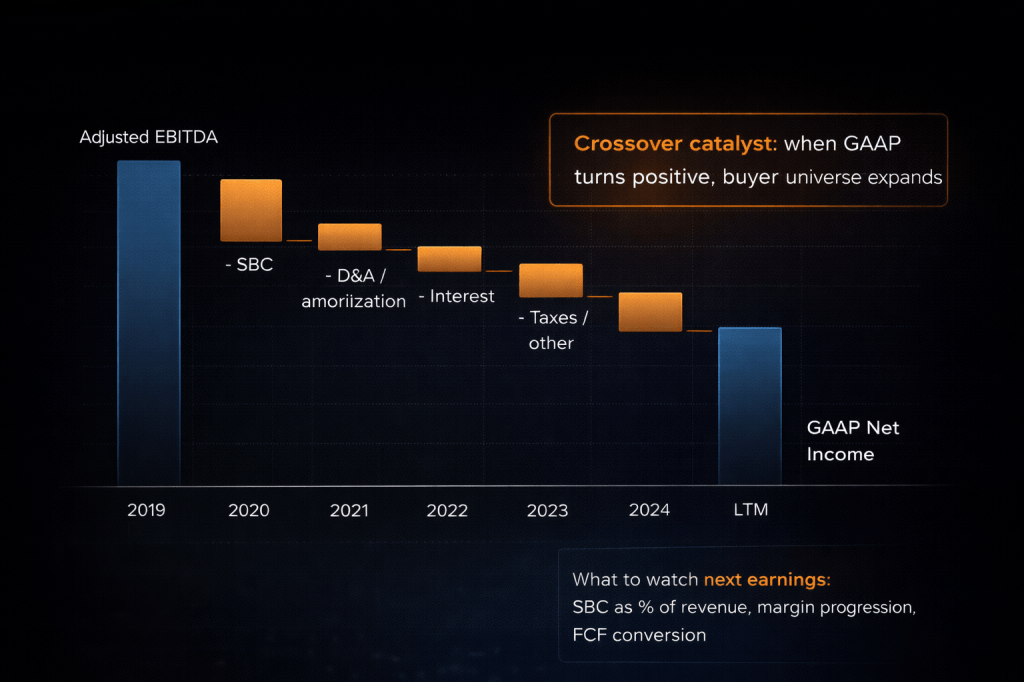

Here is the number that matters more than any partnership announcement: Zeta’s adjusted EBITDA margin hit 23.2% in Q3 2025. That extends a 19-quarter streak of margin expansion. The company is still not GAAP profitable, reporting a small net loss last quarter, but the gap between operating profits and accounting profits is closing fast.

This is what operating leverage looks like in action. Revenue grew 26% year-over-year. Costs grew slower. The result is not just bigger revenue, but better revenue. Each incremental dollar of sales drops more to the bottom line than the dollar before it.

Why does this matter for your portfolio? Because the market prices unprofitable growth companies one way and profitable growth companies another way entirely. The moment Zeta crosses into consistent GAAP profitability, the stock will not just move on fundamentals. The investor base itself will change. Funds that cannot own unprofitable companies will suddenly be buyers. Short sellers using profitability screens will cover. The stock gets repriced for what it is becoming, not what it has been.

Management is guiding for $1.54 billion in 2026 revenue, up 21% from 2025, with a path toward $2.1 billion by 2028. If margins continue expanding at the current trajectory, GAAP profitability arrives somewhere in the next six to twelve months. That is the catalyst that makes the valuation math work.

The Valuation Conflict You Need to Understand

GNG Research screens ZETA as an “Ultra Value Buy” at $20.19, showing a fair value of $42.99 and a 53% discount to intrinsic worth. Stock Rover’s model is more conservative, pegging fair value closer to $26. Which one is right?

Both are, depending on what you underwrite. GNG is pricing in the profitability crossover and the multiple expansion that follows. Stock Rover is anchoring to current earnings power without a heroic assumption about future margin trajectory. The disagreement is not noise. It reveals exactly what you are betting on if you buy the stock.

The Altman Z-Score at 6.47 puts ZETA firmly in the “safe” zone, meaning no near-term bankruptcy risk. Piotroski F-Score at 4/9 is middling, reflecting the fact that the company is still in transition mode rather than showing clean improving financials across every metric. But the direction of travel matters more than the snapshot. FCF margin hit 12.7% TTM, gross margin holds at 61%, and debt-to-equity sits at just 0.29 with a net cash position by some measures.

This is not a distressed turnaround. It is a company in the final stages of proving its business model works at scale.

The Risk Stack: Five Specific Concerns

Profitability timing slip. If GAAP profitability arrives in Q4 2026 instead of Q2 2026, the stock could give back 20-30% while investors wait. The thesis is not invalidated, but patience would be tested.

Valuation compression in risk-off environments. ZETA trades at roughly 22x forward earnings and 75x EV/EBITDA. In a market selloff, high-multiple growth names get hit first. Your entry price matters more here than it would for a low-beta dividend stock.

Competitive intensity in martech. Salesforce, Adobe, and Oracle all play in adjacent markets. If a larger competitor decides to invest heavily in AI marketing capabilities, Zeta’s differentiation could narrow. Watch for major platform announcements at Dreamforce and Adobe Summit.

OpenAI dependency risk. The partnership validates Zeta’s AI strategy, but it also creates reliance on a third party’s roadmap. If OpenAI shifts focus or changes pricing dramatically, Zeta’s cost structure could be affected.

Post-acquisition integration. The Marigold acquisition closed in late 2025, adding roughly $190 million in revenue for 2026. Integrations are execution risk. If synergy targets slip, revenue guidance could come under pressure.

The Systematic Entry Strategy

Based on GNG’s valuation stack and technical price action, here is how I am staging entry:

Primary accumulation zone: $21.82 to $24.90. This range spans from GNG’s Ultra Value threshold up through the Very Strong Buy level. At current prices around $20.19, the stock is trading below the Ultra Value threshold, making this an even more attractive entry point. A starter position here makes sense for anyone building a GARP-style growth allocation.

Secondary add zone: $24.90 to $28.10. Only add in this range if the technical trend is clearly improving and the stock is not extended above key moving averages. Risk-reward compresses as you move higher.

Invalidation line: sustained breakdown below $18.50 without quick recovery. If the stock loses the high $18s and cannot reclaim that level within two to three weeks, the near-term thesis timing is in question. I would stop adding and demand new evidence before resuming.

Trim trigger: stretch above $28 without fundamental confirmation. If the stock squeezes into the high $20s before the next earnings report, consider taking partial profits. Let the remaining position ride into the profitability crossover catalyst.

Position sizing: 1-2% starter, max 3-4% after adds. This is a mid-cap growth name with elevated volatility. Size accordingly.

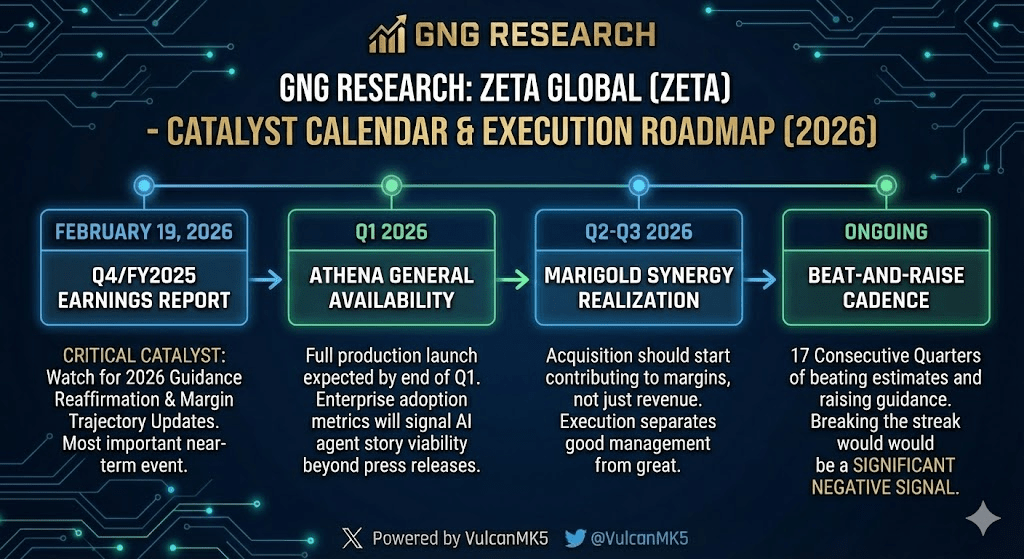

Catalyst Calendar

February 19, 2026: Q4/FY2025 earnings report. Watch for 2026 guidance reaffirmation and margin trajectory updates. This is the most important near-term catalyst.

Q1 2026: Athena general availability. Management expects full production launch by end of Q1. Enterprise adoption metrics will signal whether the AI agent story has legs beyond press releases.

Q2-Q3 2026: Marigold synergy realization. The acquisition should start contributing to margins, not just revenue. Execution here separates good management from great management.

Ongoing: Beat-and-raise cadence. Zeta has delivered 17 consecutive quarters of beating estimates and raising guidance. Breaking that streak would be a significant negative signal.

The Bottom Line

ZETA is not a value stock. It is not a low-risk compounder. It is a GARP play at an inflection point, where the business model is proven but the market has not yet paid up for it.

If you believe enterprise marketing software is becoming more AI-native, if you believe operating leverage can convert growth into profits, and if you can tolerate volatility while you wait for the thesis to play out, ZETA offers asymmetric upside from current levels. GNG’s fair value implies 100% upside to $43. More conservative models suggest 25-40% upside to $27-30. Either outcome rewards patient capital.

But the risk is real. This is a name that could easily drop 25% in a growth stock correction before recovering. Size your position assuming that drawdown will happen. Only add when price action confirms the thesis.

I am initiating a position on January 27, 2026, below the Ultra Value threshold at $20.19. My plan is to build toward a 2% allocation over time, adding if the stock continues to weaken into the high $18s and holding steady if it moves higher without me. The profitability crossover is the prize. Everything else is noise.

Master Metrics Table

| Metric | Value | Source |

|---|---|---|

| Current Price | $20.19 | Intraday (Jan 27, 2026) |

| GNG Fair Value | $42.99 | GNG Research |

| GNG Discount to FV | 53.0% | Calculated |

| Ultra Value Buy Threshold | $21.82 | GNG Research |

| Analyst Mean Target | $26-30 | Multiple sources |

| Forward P/E | ~22x | Investing.com |

| EV/EBITDA | ~75x | ChatGPT analysis |

| TTM Revenue | $1.22B | Company filings |

| Revenue Growth (YoY) | 26% | Q3 2025 |

| Adjusted EBITDA Margin | 23.2% | Q3 2025 |

| TTM FCF Margin | 12.7% | GNG data |

| Gross Margin | 61% | Company filings |

| Debt/Equity | 0.29 | GNG data |

| Altman Z-Score | 6.47 (Safe) | GNG Research |

| Piotroski F-Score | 4/9 (Medium) | GNG Research |

| Quality Score | 55.91% | GNG Research |

| Safety Score | 67.00% | GNG Research |

| 52-Week Range | $10.69 – $26.60 | Multiple sources |

| Market Cap | ~$5.0B | Multiple sources |

| Next Earnings | February 19, 2026 | Company IR |

Disclosure: Initiating position in ZETA on January 27, 2026. This analysis reflects my systematic framework, not personalized advice. Verify all data independently before making investment decisions.

Leave a comment