The 59% Discount That Made Me Pull the Trigger

I stared at Adobe’s price tag this morning and did something I’ve been hesitant to do for months: I bought shares. Not because the chart looked pretty (it doesn’t) or because Wall Street suddenly turned bullish (they haven’t). I bought because the math finally screamed louder than the fear.

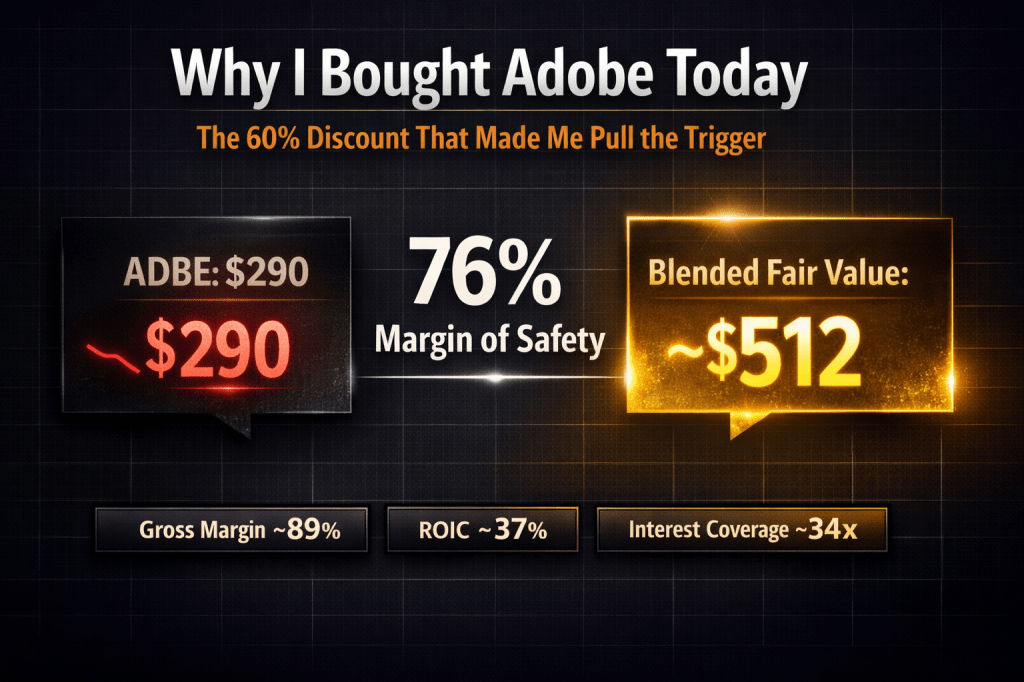

At $290, Adobe trades at roughly 11x forward earnings, versus the S&P 500 in the low-20s. We’re talking about a company with 89% gross margins, 37% ROIC, and a balance sheet so clean you could eat off it. This is one of the cheapest setups I’ve seen in more than a decade for a company with Adobe’s quality profile.

The Setup: Maximum Fear, Maximum Opportunity

Adobe’s stock has been massacred. Down 32% over the past year while the market partied. Down about 59% from its 2021 highs. The narrative? “AI is going to destroy creative software.” Midjourney, DALL-E, Canva, the flavor of the month tool that lets anyone become a designer. The story writes itself, and Wall Street has priced it in with brutal efficiency.

But here’s what the fear merchants miss: Adobe isn’t some legacy dinosaur waiting to be disrupted. Firefly has generated 24 billion+ assets since launch. Adobe says 99% of Fortune 100 companies have used AI in an Adobe app, and adoption across its largest enterprise accounts is broad. Generative credit consumption was up 3x last quarter, which is an early signal that the monetization plumbing is working. The incumbents aren’t sleeping while the barbarians storm the gates. They’re building moats in real-time.

Why the Numbers Changed My Mind

The Vulcan-MK5 framework runs 170+ metrics per stock, but let me share what moved the needle for Adobe.

Valuation gap is historic. Stock Rover’s fair value sits at $468. Morningstar marks it at $560. My blended fair value calculation lands around $512. Current price? $290. That’s a 76% margin of safety against the blended estimate. In a decade of running systematic screens, I’ve rarely seen spreads this wide on companies with Adobe’s quality characteristics.

Balance sheet is fortress-grade. Interest coverage at 34x. Altman Z-score above 8 (anything over 3 indicates safety). Net debt to EBITDA at essentially zero. If the AI transition takes longer than expected, Adobe has the financial runway to experiment for years without distress.

Profitability remains elite. Operating margins at 36.6%. ROIC at 37%. These aren’t “maybe someday” profits. Adobe throws off $6+ billion in annual free cash flow. They can fund AI development, buy back stock, and still have capital to spare.

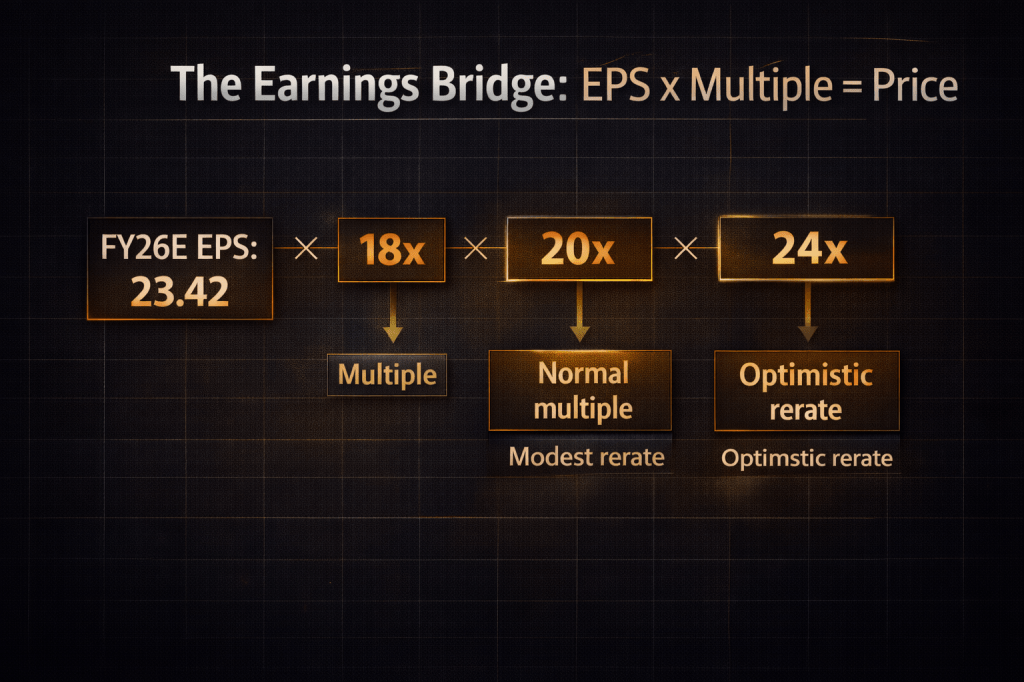

The earnings bridge works. Consensus estimates show EPS growing from $20.94 (FY25) to $23.42 (FY26) to $26.43 (FY27). At a still-modest 18x multiple on FY26 earnings, you get to $420. At 20x, which is below Adobe’s historical norm, you hit $468. The math doesn’t require heroics.

What Could Go Wrong (Because Something Always Can)

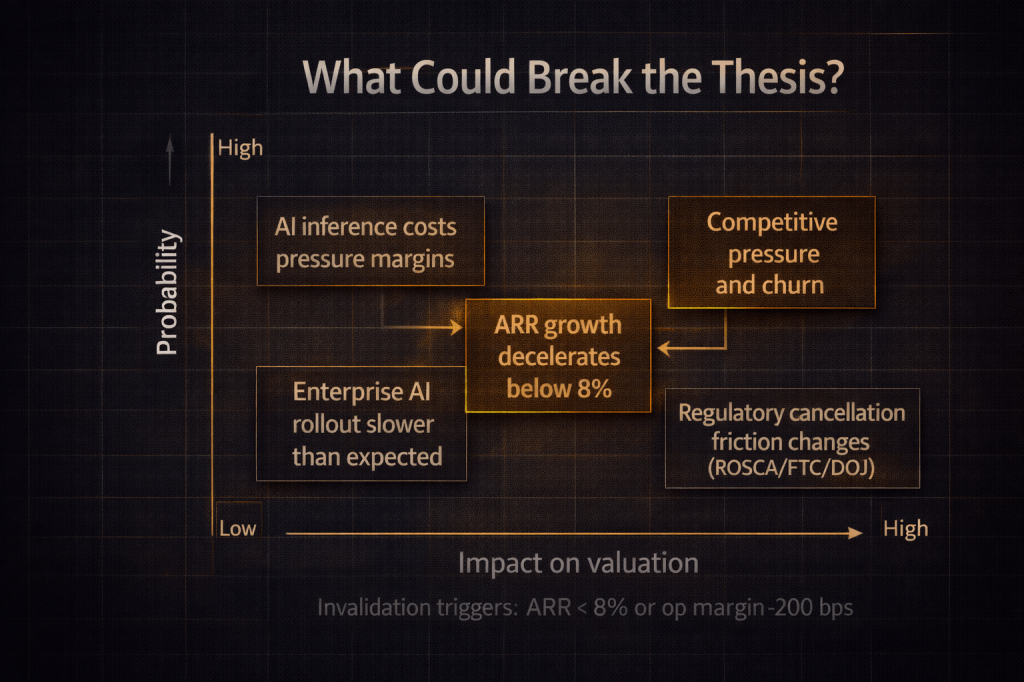

I’m not naive. Five specific risks keep me from going all-in:

1. AI Inference Costs Are Rising. Some analysts have warned that AI inferencing costs and AI investment could pressure operating margins in FY26. Running millions of Firefly generations isn’t free, and NVIDIA isn’t cutting prices. If AI costs grow faster than AI revenue, margins get squeezed.

2. ARR Growth Is Decelerating. Digital Media segment growth has slowed from the high teens to low double digits. Market saturation is real. The question is whether AI features accelerate new customer acquisition or just maintain existing relationships.

3. Competition Has Teeth. Private-market comps in creative tooling have historically commanded premium growth multiples, while public markets are currently pricing Adobe like a value stock. That perception gap matters. The market rewards Adobe’s competitors with growth multiples while punishing Adobe with value multiples.

4. Enterprise AI Rollout Is Slow. Most enterprises are still in pilot or experimentation with agentic AI, and only a small minority have production deployments at scale. Adobe’s pivot from “tool company” to “workflow automation platform” requires enterprise adoption that may not materialize until 2027 or 2028.

5. Legal Wildcards Exist. Regulatory pressure could force a materially simpler cancellation flow, which could increase churn among casual subscribers. And ongoing AI copyright litigation could create licensing headaches across the industry.

How I’m Playing It

Position sizing matters when you’re buying into weakness. Here’s my action plan:

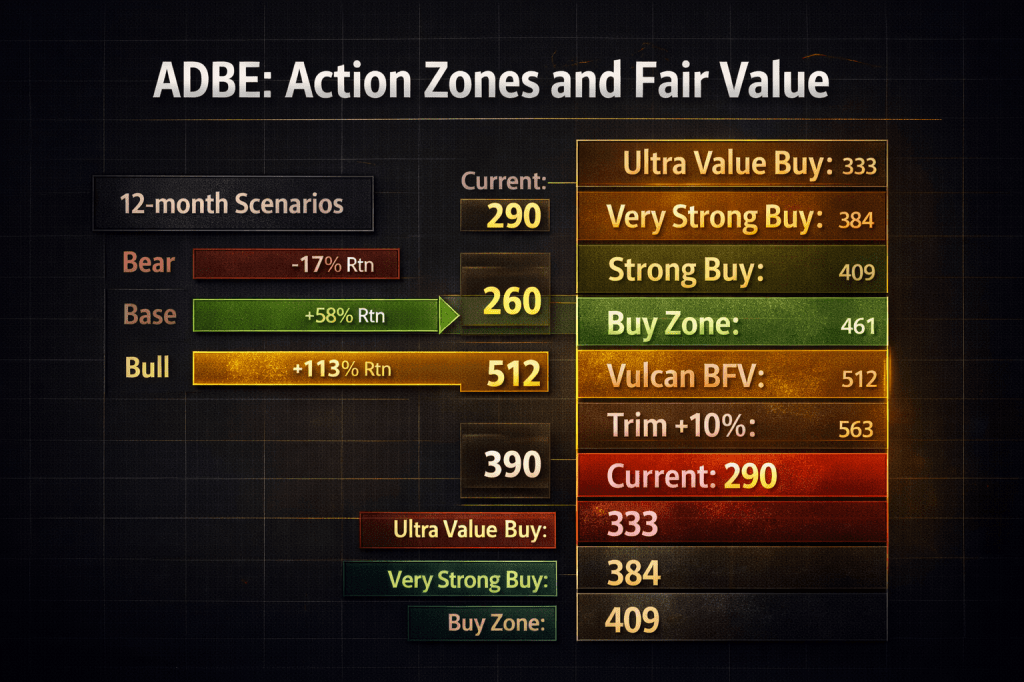

Entry: 50% of intended position at current levels ($290). This is Ultra Value territory against my buy zones.

Add Trigger #1: Another 25% if Adobe reclaims and holds above its 50-day moving average. Price needs to show some relative strength before I commit more.

Add Trigger #2: Final 25% on a post-earnings volatility dip in March, assuming the fundamental story remains intact. Never add on headline noise alone.

Invalidation: I’ll reassess if FY26 ARR growth comes in below 8% or if operating margins contract more than 200 basis points. The thesis requires execution, not hope.

Trim Zones: I start taking profits around $460 (roughly 10% above fair value) and more aggressively above $500.

The Catalyst Calendar

March 12, 2026: Q1 FY26 earnings call. First real data point on AI monetization trajectory for the new fiscal year.

April 20-22, 2026: Adobe Summit. This is where they’ll demo the next wave of AI integration. Watch for enterprise adoption metrics and new pricing announcements.

If management delivers on the $25.9-26.1 billion revenue guidance and shows improving ARR trends, the multiple expansion story activates.

Bottom Line

Adobe at $290 is a calculated bet that the market has overpriced AI disruption risk while underpricing AI monetization opportunity. The company generates obscene free cash flow, maintains structural competitive advantages in enterprise workflows, and trades at valuations not seen in over a decade.

Is it comfortable buying into a falling knife? Absolutely not. But the systematic framework exists precisely to override emotional discomfort when data and price diverge this significantly.

I’m not predicting a bottom. I’m sizing a position for asymmetric risk/reward. If Adobe executes FY26, the path to $460 is arithmetic, not magic. If they stumble, the balance sheet buys time and buybacks can help dampen downside over time, even if they’re not a hard floor.

Sometimes the best investments feel the worst at purchase. Today felt terrible. The math said buy anyway.

Master Metrics Table

| Metric | Value | Source |

|---|---|---|

| Current Price | $290.37 | Live (Jan 20, 2026) |

| Stock Rover Fair Value | $467.89 | SR PDF |

| Morningstar Fair Value | $560.00 | Schwab/User |

| Vulcan BFV (Blended) | ~$512 | Vulcan Calculation |

| Forward P/E | 11.3x | Vulcan DB |

| FY26E EPS | $23.42 | FAST Graphs/Consensus |

| Gross Margin | 89.3% | Vulcan DB |

| Operating Margin | 36.6% | Vulcan DB |

| Net Margin | 30.0% | Vulcan DB |

| ROIC | 37.1% | Vulcan DB |

| Interest Coverage | 34.2x | FAST Graphs |

| Altman Z-Score | 8.0 | Vulcan DB |

| Piotroski F-Score | 7 | Vulcan DB |

| Beta (3Y) | 1.13 | Vulcan DB |

| YTD Return | -17% | Derived |

| 12-Month Return | -32% | Momentum Data |

| Margin of Safety vs BFV | ~76% | Calculated |

| 12-Month Price Target | $460 | Vulcan Probability-Weighted |

| Ultra Value Buy Zone | <$333 | Vulcan Action Ladder |

| Implied Upside to PT | +58% | Price vs Target |

Rating: Strong Buy | Action: Buy (Staged) | 12-Month Target: $460

Disclosure: Author initiated a position in ADBE at time of publication.

Leave a comment