January 14, 2026

On October 1, 2025, Halozyme announced a deal to acquire Elektrofi: $750 million upfront plus up to $150 million in milestones, totaling potential consideration of $900 million. Elektrofi’s Hypercon technology enables ultra-concentrated biologics at 400-500 mg/ml, five times the industry standard. In the first week of January 2026, Halozyme added two more ENHANZE partnerships: Skye Bioscience (January 5) for obesity treatment delivery, followed by Takeda (January 8) for vedolizumab. Three major deals in roughly 100 days, each one extending a delivery-technology IP runway that now stretches into the 2040s through Hypercon.

This isn’t a biotech gamble. It’s a toll collection business masquerading as one.

The Business Model: Getting Paid Every Time Someone Crosses

Imagine owning the only bridge between two cities. You don’t build cars. You don’t pave roads. You just collect a fee every time someone crosses. That’s Halozyme’s ENHANZE platform for injectable biologics.

ENHANZE uses a proprietary enzyme called rHuPH20 that enables subcutaneous delivery of drugs that previously required IV infusions. Patients spend less time in treatment chairs. Healthcare systems save money. Halozyme gets paid royalties on every dose, often for a decade or more per drug.

The math is elegant. Halozyme licenses ENHANZE to pharmaceutical giants like Roche, Takeda, Janssen, and Eli Lilly. Partners develop and sell the drugs. Halozyme collects royalties ranging from low-single digits to mid-single digits on billions in annual sales. Ten commercialized products across 100+ global markets have touched over one million patient lives.

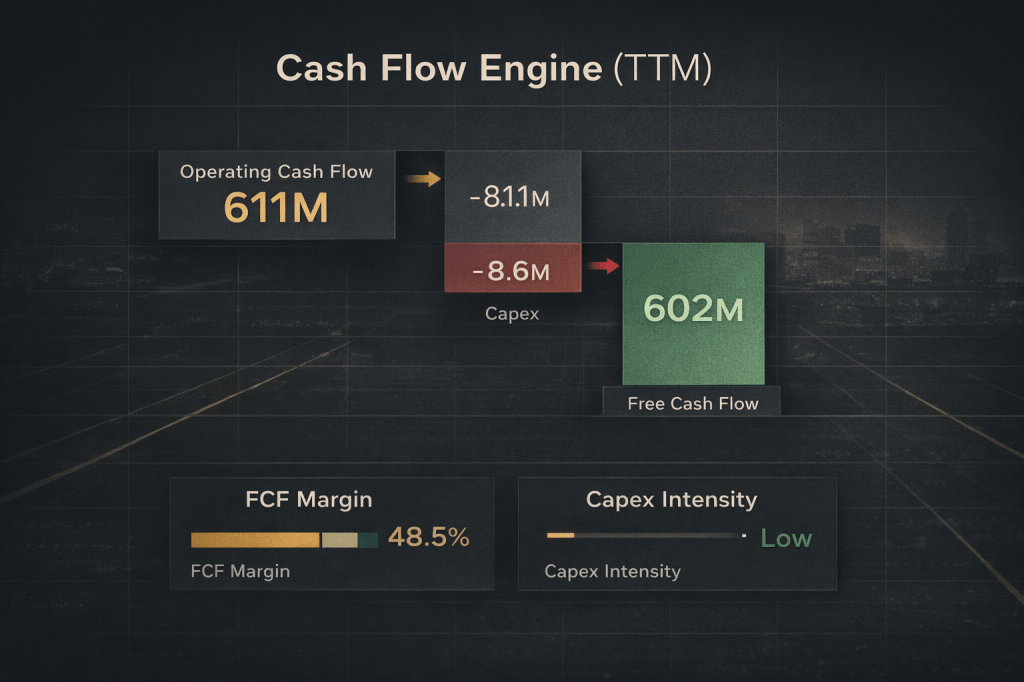

Current financials reflect this leverage. Stock Rover metrics show gross margins of 84.6% and operating margins of 59.3%. Free cash flow runs at 48.5% of sales. TTM operating cash flow reached $611 million against capex of just $8.6 million, yielding $602 million in free cash flow. ROIC stands at 30.4%, more than triple the company’s 6.3% WACC. This isn’t growth-at-any-cost biotech. It’s a capital-light compounding machine.

What the Market Is Missing

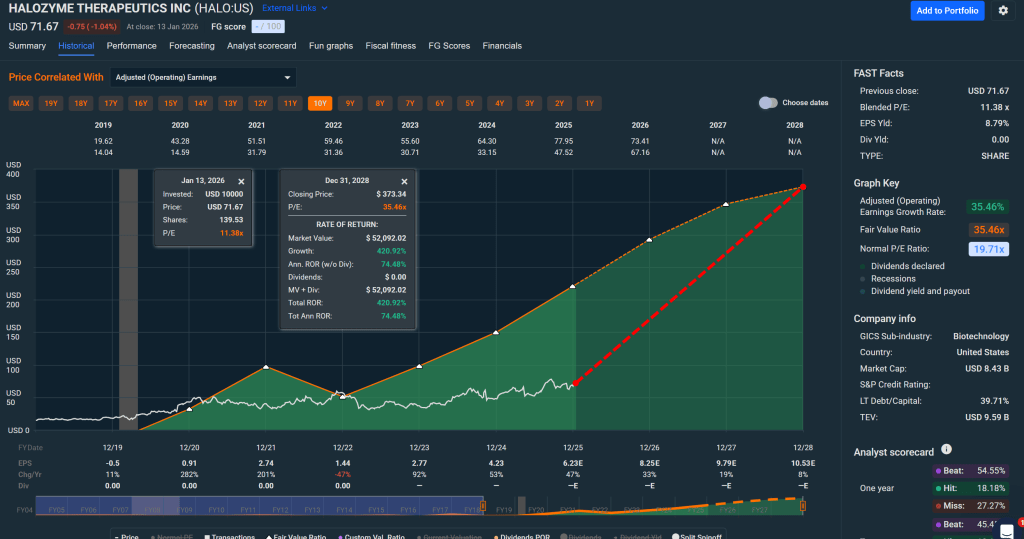

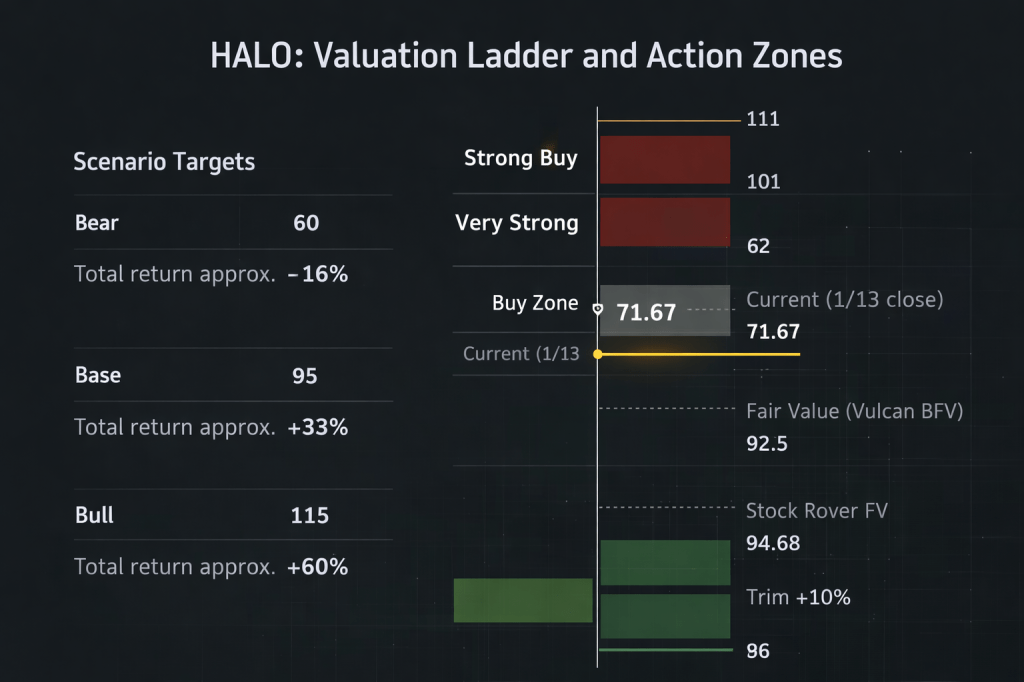

At $71.67 (January 13 close), Halozyme trades at roughly 15x price-to-FCF. Stock Rover’s January 11 report showed fair value of $94.68 with a 31% margin of safety at the then-price of $72.47. At the current $71.67 price, the implied margin of safety expands to approximately 24%.

Analyst targets range from $58 to $92, with multiple recent upgrades: TD Cowen raised to $90, Benchmark to $90, and HC Wainwright maintained at $90.

The disconnect stems from two concerns: duration risk on existing royalties and uncertainty about new platform adoption. Both deserve scrutiny, but January’s deal announcements suggest the market is underweighting platform durability.

The Takeda collaboration (announced January 8) adds vedolizumab, a blockbuster IBD treatment marketed as ENTYVIO, to the ENHANZE ecosystem. Inflammatory bowel disease affects millions globally with projections exceeding 10 million patients by 2032. Takeda’s upfront payment plus milestone potential and royalties extends Halozyme’s addressable market into gastroenterology.

The Skye Bioscience deal (announced January 5) represents something more speculative but potentially larger: ENHANZE’s entry into obesity therapeutics. Nimacimab, a CB1-inhibiting antibody being developed as a potential GLP-1 complement, could leverage ENHANZE for higher-dose subcutaneous delivery. Skye is targeting a Phase 2b start in Q3 2026. The obesity market’s explosive growth creates optionality most analysts haven’t priced.

The Elektrofi acquisition adds duration insurance through the Hypercon microparticle platform, extending delivery-technology IP protection into the 2040s. Note that ENHANZE cash flows still depend on product-by-product life cycles and contract terms. Two Hypercon partner products enter clinical development by year-end 2026 with royalty contributions projected from 2030.

The Margin Structure That Changes Everything

Halozyme’s profitability metrics deserve emphasis because they’re unusual for biotech and critical for understanding downside protection.

Net margin reaches 47.9%. Interest coverage stands at 43x despite elevated debt-to-equity of 3.0x. The Piotroski F-Score of 8 indicates strong fundamental health. Altman Z-Score of 5.2 signals financial fortress territory. These aren’t growth-stage biotech numbers. They’re mature software company numbers.

This margin structure means Halozyme can absorb partnership disappointments, regulatory setbacks, or delayed commercialization without existential risk. The company generated $354 million in Q3 2025 revenue, beating estimates by $15 million. Full-year 2025 guidance was raised to $1.3-1.375 billion in total revenue with royalty revenue of $850-880 million.

Stock Rover shows trailing P/E of 15.3x and Price/FCF of 15.1x. From the Vulcan database, forward P/E sits at 8.8x against estimated 39.8% five-year EPS growth, yielding a forward PEG ratio of 0.3x. Growth stocks trading below 1.0x PEG typically signal value, not speculation.

Five Risks That Could Break This Thesis

No investment thesis survives contact with reality unchanged. These risks require monitoring:

1. Partner Concentration Risk. DARZALEX (multiple myeloma), Herceptin (breast cancer), and Ocrevus (multiple sclerosis) drive substantial royalty revenue. If any single drug faces biosimilar competition, patent challenges, or safety issues, royalty streams compress quickly.

2. Duration Uncertainty. The core ENHANZE patent portfolio begins expiring in the late 2020s. While Elektrofi’s Hypercon extends the delivery-tech runway and ongoing partnerships add new protected products, each contract carries renegotiation risk at renewal points.

3. Regulatory Platform Risk. Any safety signal attributed to rHuPH20 across multiple products could trigger regulatory scrutiny of the entire ENHANZE platform. Immunogenicity concerns, injection site reactions, or unexpected interactions would affect all partnerships simultaneously.

4. Competitive Technology. Alternative delivery technologies could reduce ENHANZE’s value proposition. If competitors achieve similar subcutaneous conversion without royalty obligations, partner economics shift unfavorably.

5. Short Interest Pressure. Current short interest runs at 14.8% of float. Elevated short positions suggest institutional skepticism about growth durability or valuation. While this creates squeeze potential on positive surprises, it also reflects “smart money” concern.

The Technical Setup

Current price of $71.67 sits above the 50-day EMA (approximately $69.4) and 150-day EMA (approximately $67.1). The 52-week range of $47.50 to $79.50 suggests support in the mid-$60s and resistance near $80.

1-year volatility of 42% creates position sizing constraints for conservative portfolios. Beta of 0.54 (1-year, per Stock Rover) against the broader market provides modest defensive characteristics despite healthcare sector classification. Maximum 1-year drawdown reached 31.7%, within tolerance for quality-focused investors willing to weather volatility.

Momentum metrics show strength: 1-month return of 17.1%, YTD return of 7.7%, and 1-year return of 34.8% compared to S&P 500’s 19.1%. The stock outperformed its industry by approximately 15 percentage points over the trailing month (17.1% vs 1.8%).

How to Play This: Buy Zones, Position Sizing, and Exit Triggers

The valuation framework suggests structured accumulation rather than aggressive concentration.

Buy Zone (Current): $71-74. Current price sits within the primary accumulation range. A starter position of 40% of intended allocation captures exposure while preserving dry powder.

Strong Add Zone: $62-69. A pullback to the EMA support cluster (high $60s) warrants adding 30% of intended allocation. This zone aligns with the 150-day moving average and recent support.

Very Strong Zone: $56-62. Deep value territory requires adding the final 30% aggressively. This level approximates earnings power value and represents significant margin of safety.

Trim Zones: Begin reducing exposure at $96-101 (BFV +10%) and trim more aggressively above $101 (BFV +20%). If price reaches $110+ without fundamental improvement, consider taking profits.

Position Sizing: Given 42% volatility and biotech sector risk, limit individual position size to 1-2% of portfolio value. Scale to 3% only at Very Strong zone prices.

Invalidation Triggers: Exit or reduce if TTM FCF declines for two consecutive quarters without timing explanation. Downgrade to HOLD if guidance implies royalty plateau materially earlier than DCF assumptions. Reassess entirely if any ENHANZE safety signal emerges across multiple products.

The Catalyst Calendar

Mid-to-Late February 2026: Next earnings report (many calendars estimate Feb 17; TipRanks shows Feb 24 as confirmed. Verify with company IR). Watch royalty growth trajectory and guidance commentary. Management tone on Takeda/Skye integration and Hypercon development timeline provides forward visibility.

Q3 2026: Skye Bioscience targeting Phase 2b initiation for nimacimab with ENHANZE. Positive trial design and enrollment pace would validate obesity market optionality.

Year-End 2026: Two Elektrofi partner programs expected to enter clinical development. Milestone payments and development progress provide acquisition thesis validation.

The Bottom Line

Halozyme isn’t a biotech bet. It’s an infrastructure investment in how biologics get delivered. At $71.67, the stock trades at a meaningful discount to DCF-blended fair value in the low $90s, offering 28-34% upside to base case targets.

The January 2026 partnership announcements confirm platform durability and market extension rather than maturation. The Elektrofi acquisition provides duration insurance with Hypercon IP extending into the 2040s. Profitability metrics offer downside protection most biotech investors never experience.

Rating: BUY (Value + Quality hybrid, Path A discipline)

For investors seeking compounding exposure to healthcare innovation without binary clinical trial risk, Halozyme represents systematic entry into biotech’s picks-and-shovels trade.

Master Metrics Table

| Metric | Value | Source |

|---|---|---|

| Price (1/13 close) | $71.67 | Yahoo Finance |

| Market Cap | $8.52B | Public filings |

| Enterprise Value | $9.36B | StockAnalysis |

| 52-Week Range | $47.50 – $79.50 | Yahoo Finance |

| Gross Margin (TTM) | 84.6% | Stock Rover |

| Operating Margin (TTM) | 59.3% | Stock Rover |

| Net Margin (TTM) | 47.9% | Stock Rover |

| ROIC | 30.4% | Stock Rover |

| TTM Operating Cash Flow | $611.0M | StockAnalysis |

| TTM Capex | -$8.6M | StockAnalysis |

| TTM Free Cash Flow | $602.4M | StockAnalysis |

| FCF as % of Sales | 48.5% | Stock Rover |

| P/E (Trailing) | 15.3x | Stock Rover |

| Price/FCF | 15.1x | Stock Rover |

| Forward P/E | 8.8x | Vulcan DB |

| PEG (Forward) | 0.3x | Vulcan DB |

| Piotroski F-Score | 8 | Stock Rover |

| Altman Z-Score | 5.2 | Stock Rover |

| Interest Coverage | 43.0x | Stock Rover |

| Debt/Equity | 3.0x | Stock Rover |

| Beta (1Y) | 0.54 | Stock Rover |

| Volatility (1Y) | 42% | Stock Rover |

| Max Drawdown (1Y) | -31.7% | Stock Rover |

| Short % Float | 14.8% | Stock Rover |

| Stock Rover Fair Value | $94.68 | Stock Rover (Jan 11) |

| Vulcan BFV (Blended) | ~$92.5 | DCF Analysis |

| Margin of Safety (vs BFV at $71.67) | ~24% | Calculated |

| 1M Return | 17.1% | Stock Rover |

| YTD Return | 7.7% | Stock Rover |

| 1Y Return | 34.8% | Stock Rover |

| WACC | 6.3% | Vulcan DB |

| Cost of Equity | 7.2% | Vulcan DB |

| 5Y EPS Growth Est. | 39.8% | Vulcan DB |

| Next Earnings | Est. mid-late Feb 2026 | Multiple sources |

Vulcan-MK5 Full Deep Analysis | Data as of January 14, 2026

Leave a comment