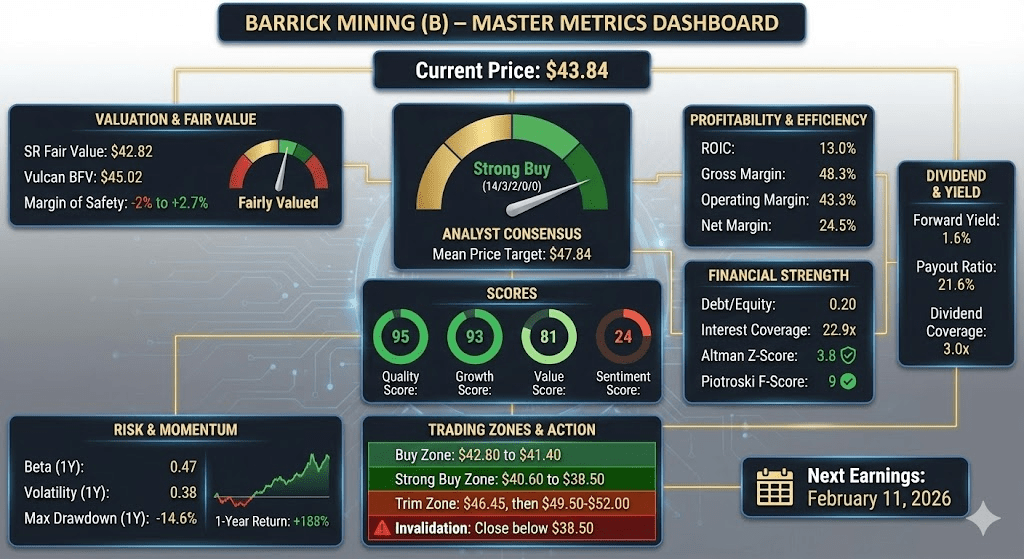

Vulcan-mk5 Analysis | January 3, 2026

Recommendation: HOLD (Buy-on-Pullback)

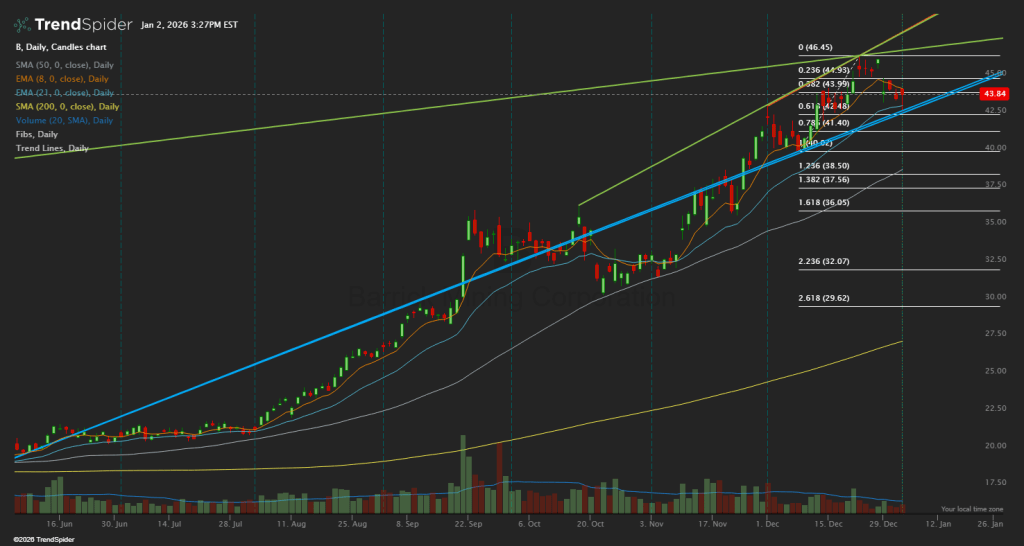

Price at time of Analysis: $43.84

Buy Zone: $42.80 to $41.40

Strong Buy Zone: $40.60 to $38.50

12-Month Expected Return: Base case +8% to +15% (commodity-dependent)

The Setup That Most Investors Get Wrong

Last January, headlines screamed about helicopters lifting three tonnes of gold off Barrick’s Mali operations. Investors panicked. The stock cratered. Then something remarkable happened: management did what management does at world-class operators. They negotiated. They settled for $430 million. And by November 2025, operations resumed at one of Africa’s largest gold complexes.

Here’s what the headlines missed: while retail traders sold on fear, the underlying machine kept printing cash. Barrick ended the year with 13% ROIC, 95 Quality Score, and a Piotroski F-Score of 9, which is about as clean as a balance sheet gets. The stock ran from the mid-teens to nearly $47, a 188% twelve-month return that put the S&P 500’s 18% to shame.

Now comes the tricky part. That run left the shares slightly above fair value, with momentum cooling and MACD turning negative. This isn’t a “sell everything” signal. It’s a “don’t chase” signal, and there’s a critical difference between the two.

Understanding What You Actually Own

Barrick is not a gold stock. It’s a cash-flow machine that happens to produce roughly 3.9 million ounces of gold annually, plus 195,000 metric tons of copper for diversification. Think of it like a factory with two product lines: the legacy business (gold) provides stability and dividends, while the growth engine (copper) positions the company for the electrification megatrend.

The Toronto-based miner operates across four continents with 67 million ounces in gold reserves, roughly two decades of runway at current extraction rates. That scale buys three things smaller competitors cannot match: operational redundancy when one site faces trouble, capital flexibility to fund the best projects while starving the worst, and political leverage that eventually resolved the Mali standoff.

CEO Mark Bristow departed during the Mali crisis, but his strategic vision remains intact. The Lumwana copper expansion in Zambia and Reko Diq development in Pakistan represent optionality that most gold investors overlook entirely.

The Vulcan Score Breakdown

The numbers tell a cleaner story than any headline:

Quality Score: 95/100

Gross margins at 48.3%, operating margins at 43.3%, and net margins at 24.5% put Barrick in elite company. Interest coverage of 22.9x means debt service costs barely register. The 0.2 Debt/Equity ratio and Altman Z-Score of 3.8 signal fortress-level balance sheet strength.

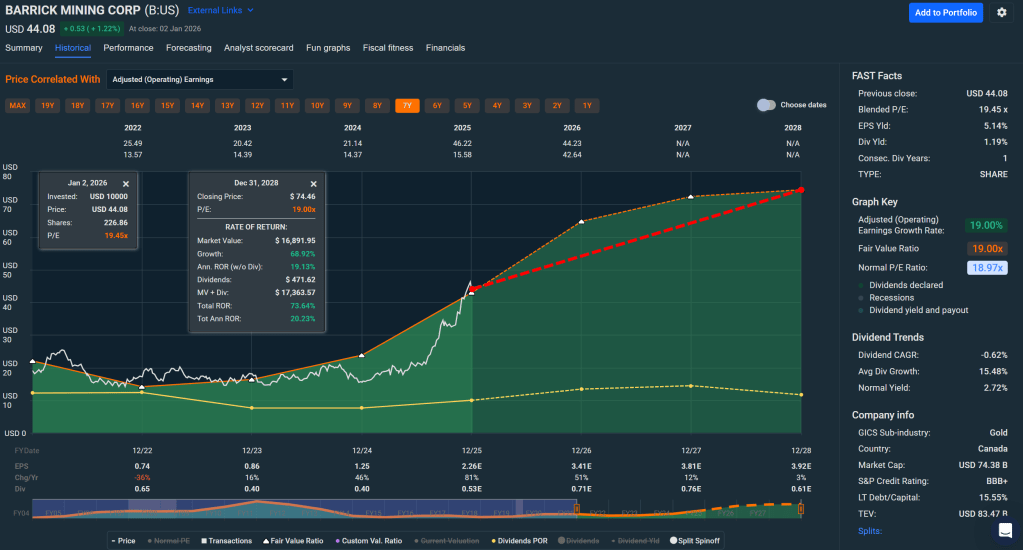

Growth Score: 93/100

Sales grew 14.6% year-over-year with EPS expansion of 70.5%. The copper thesis provides duration here, as BloombergNEF projects copper deficits starting in 2026 as electrification demand outpaces supply.

Value Score: 81/100

At 21x trailing earnings versus the industry’s 26.5x and S&P’s 30x, the valuation looks reasonable but not cheap. EV/EBITDA of 8.2x compares favorably to sector median of 11.3x. The stock trades at 5.2x sales against industry’s 5.1x, essentially fair.

Sentiment Score: 24/100

This is the warning flag. Short-term momentum has cooled significantly after the massive run. The 5-day return of negative 5.5% and MACD crossover signal near-term distribution. When sentiment diverges this sharply from quality, the systematic response is to wait for better entries.

Why the Entry Point Matters More Than the Thesis

The common mistake with quality cyclicals is assuming “good company” equals “good buy.” Barrick proves otherwise right now. At $43.84, you’re paying roughly fair value, perhaps 2-3% above the Stock Rover fair value estimate of $42.82 and within spitting distance of my blended fair value of $45.02.

The math doesn’t work for new money here. You need margin of safety with commodity exposure because gold and copper prices can move against you even when the company executes perfectly. The 1.6% forward yield provides some cushion but not enough to compensate for entry risk at current levels.

The systematic approach demands patience. Wait for the stock to pull back into the $42.80 to $41.40 buy zone where the fundamental value proposition and technical support converge. If broader markets crack and Barrick trades into $40.60 to $38.50, that becomes a strong buy opportunity assuming the trend structure remains intact.

Five Risks That Actually Keep Me Up at Night

1. Commodity Regime Dominance

Gold and copper prices drive everything. Your DCF can be perfect, and the stock can still lag for years in the wrong commodity environment. The base case assumes gold stays above $2,000 and copper finds support. A deflationary shock or sustained dollar strength could invalidate both assumptions.

2. Geopolitical Resurgence

Mali is resolved, but the playbook exists now. West African governments watched the junta extract $430 million from one of the world’s largest miners. The February 2026 license renewal for Loulo’s processing plant bears watching. Sovereign risk doesn’t disappear, it migrates.

3. Momentum Decay After 188% Run

Mean reversion affects even the best stocks. The Sentiment Score of 24 reflects market awareness that the easy money has been made. Expect consolidation or pullback before the next leg higher.

4. Copper Execution Risk

The Lumwana expansion and Reko Diq development represent significant capital deployment. Project delays, cost overruns, or permitting challenges could impair the growth narrative that justifies premium multiples versus pure-play gold miners.

5. Management Transition

Mark Bristow’s departure during the Mali crisis creates continuity risk. The strategic direction appears intact, but execution through leadership transitions requires monitoring.

The Technical Picture: Patience Rewarded

The TrendSpider daily chart shows a stock that ran hard and now consolidates. Price pulled back from the $46.45 high into the low-$44s, testing the rising trend channel support. The Fibonacci cluster between $42.48 and $41.40 represents the sweet spot where buyers historically emerge.

Key levels to monitor:

- Resistance: $44.93 (0.236 Fib), then $46.45 (prior high)

- Support: $42.80 (starter buy zone), $41.40 (core buy zone), $40.62 (0.786 Fib extension)

- Invalidation: Sustained close below $38.50 signals the pullback has become something worse

The negative MACD crossover confirms what price action suggests: near-term momentum favors sellers. This isn’t bearish for the company. It’s simply the market digesting a nearly 190% move.

The Tactical Playbook

If You Own It:

Hold existing positions. The fundamental story remains intact. Consider trimming 10-15% near $46.45 if it re-tests the high, with heavier trims in the $49.50 to $52.00 range should gold prices spike.

If You Want to Own It:

Wait. Set alerts at $42.80 for a starter position, $41.40 for core accumulation. Only get aggressive in the $40.60 to $38.50 zone if broader market conditions support risk assets and Barrick’s trend structure holds.

Position Sizing:

Given commodity volatility (0.38 annualized), cap initial positions at 1-1.5% of portfolio. Scale to 2% maximum only if buying in strong buy zones with confirmed support.

Invalidation Trigger:

Close below $38.50 on sustained volume requires reassessment. That level represents the 1.236 Fibonacci extension and loss of trend structure. Below there, the pullback becomes a breakdown.

What I’m Actually Watching

The February 11, 2026 earnings report will provide the first clean look at post-Mali operations. Investors should focus on three things: cash flow recovery trajectory, updated copper expansion timelines, and any commentary on successor leadership. The consensus strong buy rating (14 strong buys, 3 buys, 2 holds) provides institutional support but also creates expectations risk.

Gold price action matters more than company specifics in the near term. If bullion finds support above $2,100 and the dollar weakens on Fed rate expectations, Barrick’s path of least resistance points higher regardless of technical hesitation.

The Bottom Line

Barrick Mining represents exactly the kind of opportunity systematic investors wait for: a high-quality compounder temporarily trading at fair value with cooling momentum. The thesis is intact. The execution has been validated through crisis. The dividend provides income while you wait.

But “high quality” doesn’t mean “buy at any price.” The edge in commodity cyclicals comes from entry discipline. At $43.84, you’re paying fair value for a company worth owning but not worth chasing. At $42 and change, the risk/reward shifts materially in your favor. At $40 or below, assuming the structure holds, you’re buying a dollar for 85 cents.

I’ve learned the hard way that patience with quality names beats impatience with timing. Barrick will likely provide better entries in the weeks ahead. The only question is whether you’ll have the discipline to act when fear, not headlines, sets the price.

Master Metrics Table

| Metric | Value |

|---|---|

| Current Price | $43.84 |

| SR Fair Value | $42.82 |

| Vulcan BFV | $45.02 |

| Margin of Safety | -2% to +2.7% |

| Quality Score | 95 |

| Growth Score | 93 |

| Value Score | 81 |

| Sentiment Score | 24 |

| ROIC | 13.0% |

| Gross Margin | 48.3% |

| Operating Margin | 43.3% |

| Net Margin | 24.5% |

| Debt/Equity | 0.20 |

| Interest Coverage | 22.9x |

| Altman Z-Score | 3.8 |

| Piotroski F-Score | 9 |

| Forward P/E | N/A |

| Trailing P/E | 21.0 |

| EV/EBITDA | 8.2 |

| Forward Yield | 1.6% |

| Payout Ratio | 21.6% |

| Dividend Coverage | 3.0x |

| Beta (1Y) | 0.47 |

| Volatility (1Y) | 0.38 |

| Max Drawdown (1Y) | -14.6% |

| 1-Year Return | +188% |

| Analyst Consensus | Strong Buy (14/3/2/0/0) |

| Mean Price Target | $47.84 |

| Next Earnings | February 11, 2026 |

| Buy Zone | $42.80 to $41.40 |

| Strong Buy Zone | $40.60 to $38.50 |

| Trim Zone | $46.45, then $49.50-$52.00 |

| Invalidation | Close below $38.50 |

Disclosure: Analysis based on Vulcan-mk5 systematic framework. Positions may be established in buy zones as described. This is not investment advice. Do your own due diligence.

Leave a comment