Rating: Buy (China-Risk-Adjusted) | Price: ~$147 | Fair Value: $180 | Upside: +22%

Three years ago, Alibaba was worth more than Facebook. Then Beijing showed up with a regulatory sledgehammer, and $500 billion in market cap evaporated in eighteen months. Investors fled. The stock became untouchable. Jack Ma disappeared from public view. The empire, it seemed, had fallen.

Here’s what everyone missed while they were running for the exits: the business never broke. Revenue kept growing. Cloud computing exploded. Free cash flow stayed positive. And now, with the stock still trading at half its intrinsic value by some measures, Alibaba is staging one of the most contrarian comebacks in global markets.

I’m not going to tell you this is safe. It isn’t. Owning Chinese ADRs means accepting political risk you can’t model. But for investors willing to size appropriately and stomach volatility, BABA offers something rare: a wide-moat business with accelerating growth, trading at a 17% discount to fair value, with management aggressively buying back shares at these levels.

Let me walk you through why I’m a buyer here, and exactly where the thesis breaks.

The Business Behind the Ticker

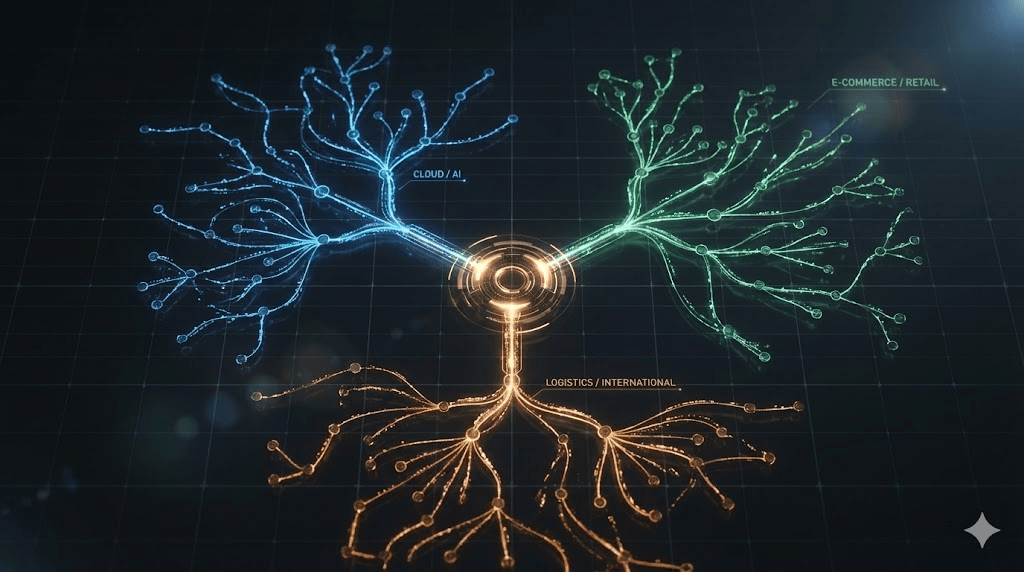

Think of Alibaba as China’s Amazon, Google Cloud, and PayPal rolled into one, but with a fundamentally different model. While Amazon owns warehouses and trucks, Alibaba operates marketplaces. They connect 1.3 billion consumers with millions of merchants and take a cut of everything that moves through the pipes.

The core business is Taobao and Tmall, two e-commerce platforms that handle more transaction volume than Amazon and eBay combined. When a Chinese consumer searches for a product, browses reviews, and clicks buy, Alibaba captures advertising revenue, transaction fees, and increasingly, logistics fees through their Cainiao network.

But the growth story has shifted. Cloud Intelligence, Alibaba’s answer to AWS, grew 34% last quarter, driven by AI workloads that tripled year-over-year. They’re not just riding China’s cloud adoption curve: they’re building the infrastructure that Chinese companies need to deploy AI at scale. Their Qwen large language model, now open-sourced, is creating an ecosystem that makes switching costs sticky.

International commerce adds another leg. AliExpress and Lazada delivered 29% revenue growth last quarter, expanding Alibaba’s footprint beyond the China macro story that makes investors nervous.

The Numbers That Matter

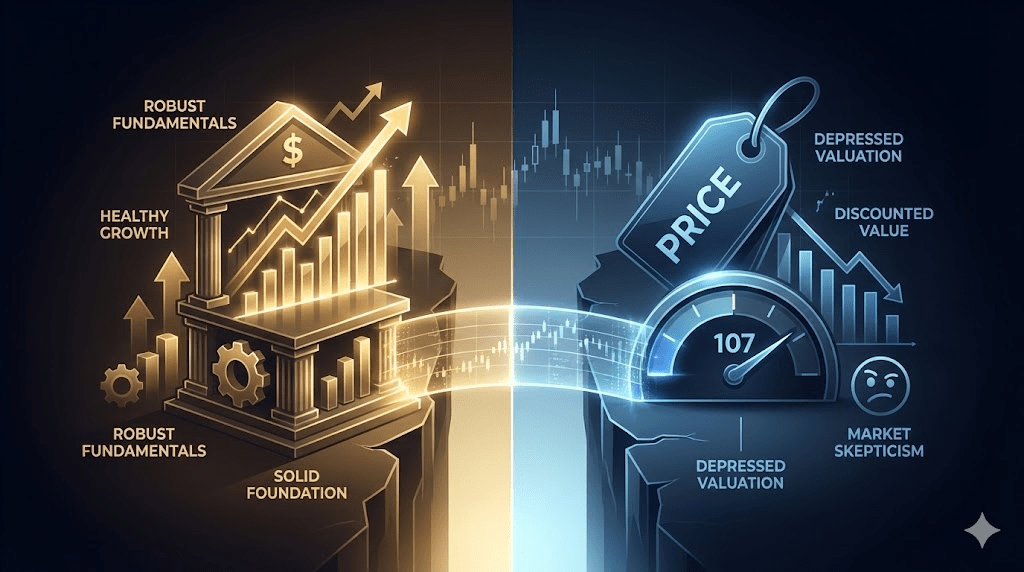

Here’s where Alibaba separates from the narrative. Strip away the China headlines, and you find a quality business hiding in plain sight.

ROIC stands at 10.3%, comfortably above their 8.4% cost of capital. That positive spread means every dollar Alibaba invests creates value. Not every company can say that, and it’s the foundation of compounding.

The Piotroski F-Score of 7 out of 9 signals strong financial health, not distress. Altman Z-Score of 3.4 puts bankruptcy risk firmly in the “safe” zone. These aren’t the metrics of a broken business. They’re the metrics of a company the market has simply decided to ignore.

Margins tell a similar story. Gross margins of 41% indicate pricing power. Net margins of 12% show operational efficiency. FCF conversion of 4.3% of sales, while modest, reflects heavy reinvestment in cloud and logistics infrastructure that should pay off as capital intensity normalizes.

The balance sheet is fortress-like. Debt-to-equity of 0.3 and interest coverage of 15.7x mean Alibaba could survive significant stress without financial distress. Net cash per share of $4.88 provides additional cushion.

The Valuation Disconnect

At $147 per share, Alibaba trades at roughly 16x forward earnings. Let that sink in. A wide-moat platform business with double-digit earnings growth, accelerating cloud revenue, and aggressive buybacks, priced like a no-growth utility.

The Vulcan fair value model puts intrinsic value at $182.61, implying 17% upside before accounting for growth. Morningstar’s estimate is even higher at $258. Analyst consensus target sits at $198. Three different frameworks, three different methodologies, all pointing in the same direction: the market is mispricing this business.

The Earnings Power Value of $68 per share shows this isn’t an asset-floor value play. You’re not buying Alibaba because it’s cheap on a liquidation basis. You’re buying because the market is pricing in perpetual decline that the operating results don’t support.

Management clearly agrees. They repurchased $12.5 billion in stock last fiscal year and another $1.3 billion last quarter alone. When insiders are buying at these prices, and they have better information than you do, that’s a signal worth noting.

The Risk Matrix (Read This Carefully)

I need to be direct about what could go wrong. This isn’t a “set it and forget it” position.

China Macro Deterioration: Consumer spending in China remains fragile. Retail sales disappointed in recent months, and property sector stress continues rippling through the economy. If Chinese consumers pull back further, Taobao and Tmall take the hit directly. A prolonged recession in China could push the stock to $120 or lower.

Regulatory Intervention, Round Two: Beijing’s 2020-2021 crackdown cost shareholders hundreds of billions. The regulatory environment has stabilized, but another campaign targeting platform companies remains possible. This risk is unquantifiable, which is precisely why the stock trades cheap.

VIE Structure Vulnerability: American investors don’t own Alibaba directly. They own shares in a Cayman Islands shell company with contractual rights to Alibaba’s economics. If US-China relations deteriorate further, or if Beijing decides to challenge these structures, ADR holders could face significant losses. This isn’t theoretical: legislation threatening delisting has passed both houses of Congress.

Competition Intensifying: PDD’s aggressive pricing strategy and Douyin’s expansion into e-commerce are forcing Alibaba to spend on subsidies and quick commerce. Market share defense costs money and compresses margins. If the competitive dynamic worsens, the high-margin marketplace business faces structural pressure.

AI Capex Risk: Alibaba has committed hundreds of billions of RMB to AI infrastructure over coming years. If AI demand disappoints or competitors catch up, these investments may not generate adequate returns. Heavy capex also limits near-term free cash flow.

These risks justify a structural discount. They don’t justify a 50% discount to peers with comparable growth profiles.

The Technical Setup

Price currently sits around $147, below the 50-day moving average of $163 but above the 200-day around $137. This is correction-within-uptrend territory, not a fresh breakdown.

The charts show a descending wedge from the $190 high, with price probing the lower wedge boundary. Volume profile reveals a high-volume node between $145 and $165, meaning support is real in this range. Below $145, however, there’s an air pocket down to the 200-day in the high-$130s.

RSI around 35 suggests oversold but not yet washed-out conditions. The DeMark setup indicates we’re late in the current downswing, not early.

The Action Plan

Buy Zone (Current): $145-160. Acceptable to initiate a starter position here. The risk-reward skews positive, but assume you may see lower prices.

Strong Add Zone: $138-142. If price breaks $145 and tags the 200-day while fundamentals remain intact, add more aggressively. This is where the chart support and Vulcan value case converge.

Deep Value Zone: $122-128. Only if the fundamental thesis remains intact. At this level, you’d be buying near the prior breakout base with a big volume shelf as support.

Hold Zone: $160-185. Let the position work. Don’t chase strength here, but don’t sell either.

Trim Zone: Above $190. Start taking profits into strength, especially if China macro and regulatory headlines haven’t materially improved.

Position Sizing: Cap single-name exposure at 1-2% of total capital. This isn’t a “back up the truck” situation because of the unquantifiable tail risks. Size for volatility, not conviction.

Invalidation: A decisive close below $135 with expanding volume signals the correction may be morphing into something worse. At that point, reassess rather than average down blindly.

The 12-Month Return Framework

Based on Vulcan’s Monte Carlo simulation and Bayesian probability overlay:

Bear Case (15-30% probability): -20% to flat. China macro shock, regulatory resurgence, or competitive deterioration. Stock trades to $115-147.

Base Case (40-60% probability): +5% to +15%. Mid-single-digit revenue growth, high-teens EPS growth, continued buybacks, multiple roughly flat. Stock trades to $155-170.

Bull Case (20-35% probability): +25% to +45%. Cloud AI growth accelerates to mid-20s%, Chinese macro stabilizes, sentiment re-rates. Stock trades to $185-215.

The asymmetry favors longs. Downside is real but bounded by the balance sheet and ongoing buybacks. Upside is substantial if any of the multiple compression drivers reverse.

The Bottom Line

Alibaba is not a comfortable investment. It requires accepting uncertainty you can’t fully quantify and trusting that a business you can’t visit will continue executing in an environment you can’t control.

But investing is about expected value, not comfort. At $147, you’re paying a stressed multiple for an unstressed business. You’re getting China’s dominant e-commerce platform, fastest-growing cloud franchise, and expanding international presence, all while management buys back shares at the same price you can.

The empire isn’t dead. It’s on sale.

Buy BABA in the $145-160 range with appropriate position sizing. Add aggressively near $140 if it gets there. Take profits above $190. And accept that you’re getting paid to hold uncertainty that most investors refuse to touch.

Master Metrics Table

| Metric | Value | Context |

|---|---|---|

| Price (as of 12/18/2025) | ~$147 | Below 50-day MA, above 200-day |

| Vulcan Fair Value | $182.61 | 17% margin of safety |

| Morningstar FVE | $258 | Wide moat, high uncertainty |

| Analyst Consensus | $198.58 | ~35% upside to target |

| Forward P/E | ~16x | Significant discount to growth |

| Trailing P/E | ~20x | Depressed vs. 5-year average |

| P/S | ~2.4x | Below mega-cap peers |

| ROIC | 10.3% | Positive spread vs. 8.4% WACC |

| Net Margin | 12.2% | Stable profitability |

| Gross Margin | 41.2% | Pricing power intact |

| FCF Margin | 4.3% | Reinvestment phase |

| Debt/Equity | 0.3 | Conservative leverage |

| Interest Coverage | 15.7x | No refinancing risk |

| Current Ratio | 1.5 | Adequate liquidity |

| Altman Z-Score | 3.4 | Safe zone |

| Piotroski F-Score | 7/9 | Strong financial health |

| Earnings Power Value | $68.40 | Growth required for thesis |

| 1-Year Return | ~+70% | Strong recovery, still below highs |

| Max Drawdown (5Y) | -76.7% | High volatility historical |

| Beta (3Y) | 0.84 | Moderate market sensitivity |

| Dividend Yield | ~1.3% | Growing, modest income |

| Buyback Yield | ~5%+ | Significant capital return |

Data sources: Vulcan Research Database, Stock Rover, Morningstar, Yahoo Finance. Analysis as of December 18, 2025. Price validation: $147 consistent across multiple sources.

Leave a comment