Vulcan Stock Research | December 14, 2025

Ticker: $AVGO | Price: $357.15 | Rating: Buy (accumulate in tranches)

Broadcom just did something that spooked Wall Street: the company reported blowout demand and then warned that making too much money from AI would temporarily hurt its margins.

Read that again. The stock dropped 11% on Friday because AI is growing too fast within the business mix. If that sounds backwards, you’re starting to understand why this might be one of those rare moments where the market’s panic becomes your opportunity.

Two Engines, One Aircraft

Picture Broadcom as a twin-engine aircraft. The first engine is semiconductors: custom AI accelerators, networking chips, and the silicon plumbing that makes hyperscale data centers actually function. When you hear about Meta or Google building custom AI chips, Broadcom is often the company building them. This engine is screaming right now, with AI semiconductor revenue guided to roughly $8.2 billion for Q1 FY2026, essentially doubling year over year.

The second engine is infrastructure software, headlined by VMware. This engine isn’t exciting at cocktail parties, but it’s the margin ballast: sticky subscriptions, high gross margins, and the kind of repeatable revenue that lets CFOs sleep at night.

The earnings call revealed a simple truth: when AI hardware grows faster than software, consolidated margins temporarily compress. Management explicitly guided to a 100 basis point sequential gross margin decline. Not because anything is broken, but because AI hardware, while profitable, runs at lower margins than Broadcom’s legacy franchises.

What Actually Happened Thursday Night

The Q4 FY2025 numbers were strong. Revenue hit approximately $18 billion, with management guiding Q1 to $19.1 billion. That’s not a company whispering “maybe AI.” That’s a company shipping at scale to hyperscalers who are racing to deploy AI infrastructure.

But here’s where institutional investors got nervous: Broadcom explicitly connected margin pressure to mix shift. As AI becomes a larger slice of semiconductor revenue, the consolidated margin profile wobbles. Even if operations are flawless.

This matters because AVGO trades at roughly 38x forward earnings. At that multiple, you don’t get to mumble about “transitional margin pressure.” The market immediately asked: is this one quarter, or all of 2026?

The honest answer is probably somewhere in the middle. First half mix headwinds, with potential for software growth and scale to offset later. But uncertainty creates opportunity for disciplined buyers.

The Numbers That Actually Matter

Let me pull from the Vulcan database and show you why this business remains exceptional despite the margin narrative.

Free cash flow margin sits at 41.6%. That’s not a typo. For every dollar of revenue, Broadcom converts nearly 42 cents to free cash flow. This kind of conversion power is the financial equivalent of a moat with alligators.

ROIC clocks in at 16.2% against a WACC of 14.5%. The spread is positive, meaning every dollar reinvested creates value. Piotroski F-Score hits 8 out of 9, signaling rock-solid financial health. Altman Z-Score of 13.4 suggests bankruptcy is about as likely as snow in Phoenix.

Cash flow predictability percentile? 99th. This is a business where you can model future cash generation with unusual confidence.

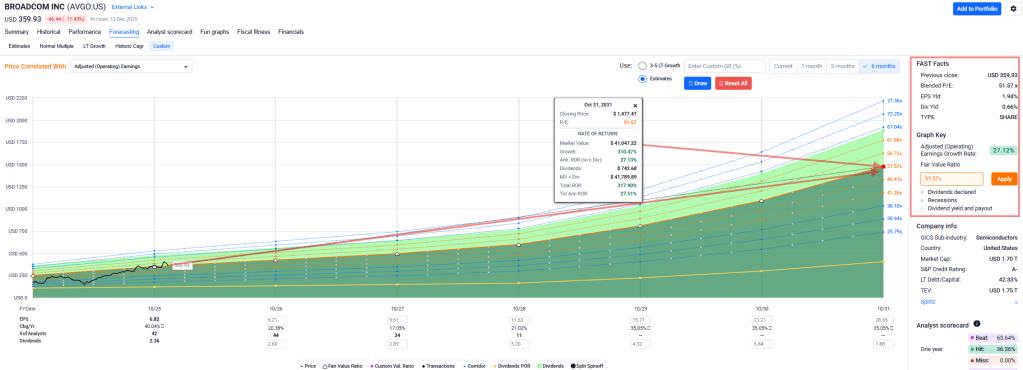

The Vulcan database shows fair value at $345.92, which puts the current price at roughly a 4% premium. Not screaming cheap, but not demanding perfection either.

Why the Street Stayed Bullish Anyway

After the selloff, analyst price targets actually rose. Morgan Stanley bumped to $462. Citi went to $480. Oppenheimer raised to $450. The median among top analysts landed around $467.

This seems contradictory until you understand what these analysts are underwriting: a multi-year AI infrastructure buildout where Broadcom captures custom silicon and networking dollars from the biggest spenders on earth. The margin story is a speed bump. The AI story is a highway.

Our Vulcan 12-month target is more conservative at $410. We’re not paid to be exciting. We’re paid to identify prices where the risk-reward tilts meaningfully in your favor.

The Buy Zone Discipline

Vulcan doesn’t let a single valuation method dictate decisions. We blend internal DCF analysis with external fair value anchors and then stress-test against uncertainty.

The blended fair value lands around $365. From there, we derive zones:

Primary Buy Zone: $301 to $358. At $357.15, we’re sitting just above the upper edge of this band. That argues for smaller initial tranches rather than aggressive deployment.

Strong Buy Zone: Below $237. If the market panics this deeply without fundamental deterioration, that’s gift territory.

Trim Zone: $376 to $391. If the stock races back into this range without margin clarity improving, reduce exposure.

Too Expensive: Above $391. At that point, you’re paying for perfection in a world that rarely delivers it.

What Could Go Right

Three green lights would make this thesis feel obvious in hindsight.

First, AI revenue stays on trajectory. If the $8.2 billion Q1 guide converts and management confirms sustained demand from hyperscalers, the market stops obsessing over 100 basis points and starts celebrating “share of wallet.”

Second, VMware behaves like an annuity. Software gross margins are beautiful. If software grows faster than expected, it absorbs the AI mix headwind and stabilizes consolidated profitability.

Third, capital returns turn opportunistic. Broadcom generates tens of billions in free cash flow. A company with that firepower can buy dips, accelerate dividends, or make accretive acquisitions. The buyback yield is modest today at 0.4%, but that lever exists.

What Could Go Wrong

Every investment has a bear case. Ignoring it is how you become exit liquidity for someone smarter.

Customer concentration is the biggest structural risk. AI visibility is strong, but a meaningful portion of that backlog sits with a handful of hyperscalers. When those customers pause, rescope, or decide to internalize a function, Broadcom’s stock can reprice violently. This isn’t theoretical risk. It’s the nature of doing business with buyers who have infinite optionality.

Margin compression might not be temporary. If AI hardware economics are structurally lower margin and AI keeps growing faster than software, the consolidated margin profile could stair-step down, not stabilize. That would compress the multiple.

VMware integration isn’t bulletproof. Any escalation in customer disputes or regulatory scrutiny could make investors less willing to pay “software annuity” multiples for that portion of the business.

Valuation leaves little room for stumbles. At 38x forward earnings with a 1.86 beta, this is not a stock where you can afford to be wrong about the next two quarters.

The Actionable Plan

Here’s how to approach this without needing perfect timing.

If you don’t own AVGO and want exposure, start a quarter position here. The stock is slightly above the primary buy zone but within reasonable striking distance. Use weakness toward $340 to add another quarter.

If you already own AVGO, this is not a sell signal. The fundamental story remains intact. Consider adding on any pullback into the $320-340 range.

Set your invalidation trigger clearly: if gross margins decline more than 200 basis points over two consecutive quarters without a path to recovery, the “temporary mix pressure” thesis is broken.

Position sizing guidance: 3-4% of portfolio for new positions. This is a quality compounder, but the beta and concentration risk argue against hero-sizing.

The Bottom Line

Broadcom remains one of the highest-quality AI infrastructure franchises in public markets. The earnings print confirmed demand but handed the market a margin narrative to obsess over. That obsession created a price that is not cheap but is reasonable for accumulation.

You’re buying the plumbing for AI data centers and a sticky software annuity. The question isn’t whether these businesses are valuable. The question is whether you’re disciplined enough to buy when others are spooked by short-term mix dynamics.

At $357.15, start small. Keep powder dry for better prices. Watch Q1 for margin stabilization signals. And remember: the best entries rarely feel comfortable.

Master Metrics Table

| Metric | Value | Source |

|---|---|---|

| Price (current) | $357.15 | Market data |

| Fair Value | $345.92 | Vulcan DB |

| Blended Fair Value | $365 | Vulcan model |

| 12-month Target (Vulcan) | $410 | Vulcan model |

| Primary Buy Zone | $301 – $358 | Vulcan model |

| Trim Zone | $376 – $391 | Vulcan model |

| Mean Consensus Target | $416.34 | Vulcan DB |

| Top Analyst Median | $467 | Analyst data |

| Revenue (TTM) | $59.9B | Vulcan DB |

| FCF (TTM) | $24.9B | Vulcan DB |

| FCF Margin | 41.6% | Vulcan DB |

| Gross Margin | 66.8% | Vulcan DB |

| Operating Margin | 39.0% | Vulcan DB |

| Net Margin | 31.6% | Vulcan DB |

| ROIC | 16.2% | Vulcan DB |

| WACC | 14.5% | Vulcan DB |

| Debt/Equity | 0.9x | Vulcan DB |

| Interest Coverage | 6.8x | Vulcan DB |

| Altman Z-Score | 13.4 | Vulcan DB |

| Piotroski F-Score | 8 | Vulcan DB |

| Cash Flow Predict. Pctl | 99th | Vulcan DB |

| Forward P/E | 38.4x | Vulcan DB |

| Dividend Yield (TTM) | 0.7% | Vulcan DB |

| Buyback Yield | 0.4% | Vulcan DB |

| Max Drawdown (1Y) | -41.1% | Vulcan DB |

| Beta (3Y) | 1.86 | Vulcan DB |

| 5Y EPS Growth Est. | 7.6% | Vulcan DB |

Disclosure: This analysis is for informational purposes only and does not constitute investment advice. Always conduct your own due diligence before making investment decisions.

Leave a comment