A comprehensive research report by @VulcanMK5

Part 1: The 2026 AI Investment Thesis

The data center in my city burned $12 million in electricity last month. I asked the facilities manager what they’re running that costs four times more than six months ago. His answer: “GPU clusters for some AI company. They keep adding more racks.”

That’s the 2026 AI thesis in one conversation. We’re not in the hype phase anymore where we’re asking “will AI transform everything?” We’re in the infrastructure bottleneck phase where the question is “who’s actually building the pipes that handle exponentially growing compute demand?”

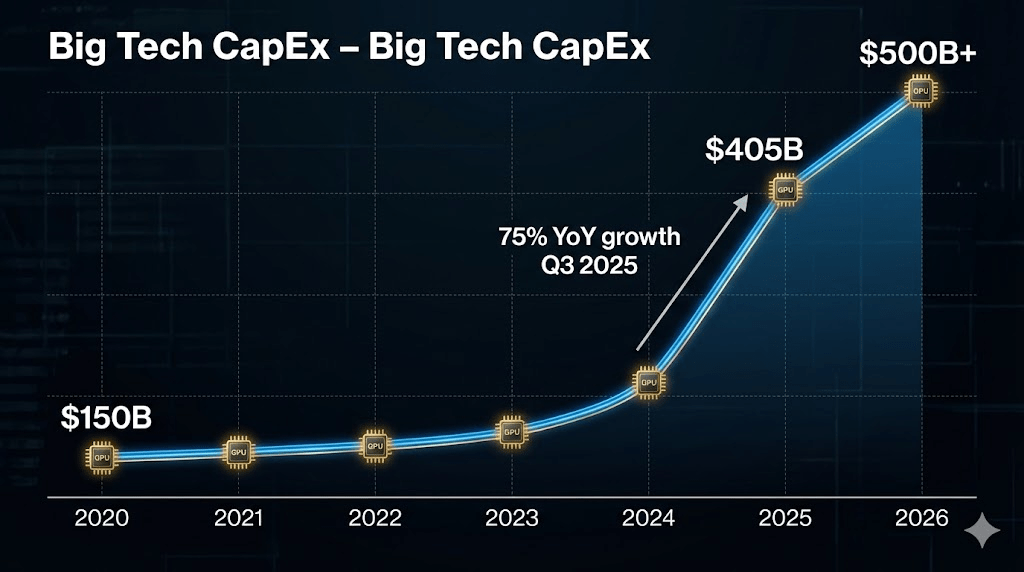

Here’s what most retail investors miss: the $405 billion in AI-related CapEx for 2025 represents the biggest infrastructure build-out since the electrification of America. Big Tech’s Q3 2025 CapEx jumped 75% year-over-year to $113.4 billion, the fastest growth of the year. Google alone raised its 2025 CapEx to $85 billion specifically for AI and cloud. McKinsey projects a 3.5x increase in AI data center capacity by 2030, requiring $5+ trillion in cumulative investment.

But here’s the contrarian insight that drove my systematic screening for these 10 stocks: the real money isn’t in the AI applications everyone’s chasing, it’s in the unavoidable bottlenecks.

Let me show you exactly where that money flows. Take one dollar from Google’s $85 billion AI CapEx budget. Watch where it goes:

- $0.35 to NVIDIA for the GPU that runs the compute

- $0.12 to Broadcom for the networking chips connecting that GPU to others

- $0.18 to TSMC for actually manufacturing Nvidia’s chip design

- $0.08 to ASML for the EUV machine TSMC uses to make the chip

- $0.10 to Arista for the Ethernet switches moving data between servers

- $0.06 to ARM for the CPU architecture in the control plane

- $0.05 to AMD for complementary CPUs in the same rack

- $0.04 to NICE for AI software managing the customer interactions this infrastructure enables

- $0.02 back to Google itself for cloud services and platforms

That’s $1.00 of CapEx touching 9 of our 10 stocks. The tenth (Alibaba) captures the same flow in China’s parallel AI build-out. This isn’t theory, this is literally how the money moves through the value chain.

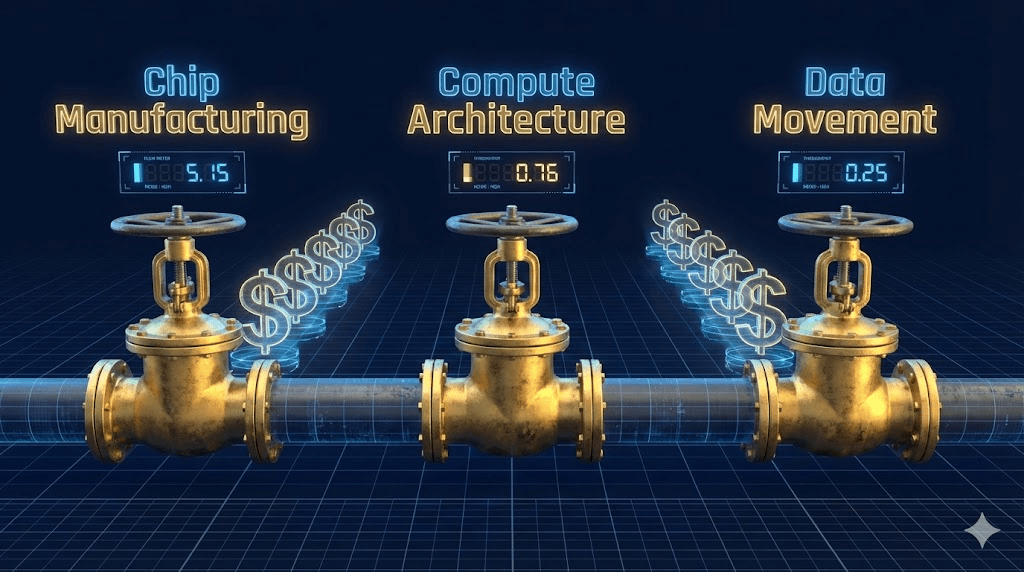

When I ran my Vulcan-mk5 framework across 6,000+ stocks in my database, weighting Quality, Growth, Safety, Value, and Momentum, then overlaying AI theme exposure and 2026 catalysts, something became clear. The stocks that consistently scored highest weren’t the flashy generative AI startups or the companies promising AGI by Tuesday. They were the companies controlling one of three critical bottlenecks:

Bottleneck 1: Advanced Chip Manufacturing – You can’t run modern AI without chips made on 5nm or 3nm nodes. Only TSMC can do this at scale. Only ASML can make the machines that TSMC uses. That’s not a moat, that’s a monopoly backed by physics and $20 billion in R&D.

Bottleneck 2: AI Compute Architecture – Nvidia’s H100 GPUs aren’t popular because they’re the best technology theoretically possible. They’re dominant because CUDA locked in every AI researcher for 15 years. When I checked my database, NVDA has 76.9% ROIC and 53% net margins. You don’t get those numbers in a competitive market.

Bottleneck 3: Data Movement – Here’s what nobody talks about: adding 1,000 more GPUs to your cluster doesn’t speed up training if your network can’t move data between them fast enough. That’s why companies like Arista (28.2% ROIC, 64% gross margins) and Broadcom (66.8% gross margins on networking chips) are actually more strategic than people realize.

I learned these lessons the expensive way. In 2021, I bought Unity and Roblox thinking “gaming engines will power the metaverse.” Wrong framework. The money wasn’t in the applications, it was in the GPUs Nvidia sold to everyone building metaverse platforms. Lost 60% before I cut those positions.

Then in early 2023, I chased Palantir thinking “AI software platforms are the future.” Another wrong layer. PLTR ran from $6 to $30 and I felt smart, but I missed the bigger move in Nvidia (which 5x’d in that same period) because I was focused on the wrong part of the stack. I learned that lesson twice before it stuck: in infrastructure build-outs, own the unavoidable choke points, not the applications betting on what people will build.

The third lesson cost me even more: in 2022, I owned SentinelOne thinking cybersecurity + AI was the play. It wasn’t wrong, but it was early and I was underleveraged to the obvious winners. While I watched SNOW drop 40% and debated whether to buy, NVDA quietly doubled. I was so busy looking for contrarian AI plays that I missed the boring, obvious infrastructure layer screaming at me.

Same pattern’s playing out now with AI. Everyone’s debating which AI chatbot wins, which foundation model is best, which enterprise AI software to buy. Meanwhile, every single one of those applications is fighting for allocation of the same scarce resources: advanced chips, manufacturing capacity, networking bandwidth. That’s where you want to be positioned.

My systematic screening methodology for these 10 stocks combined five core Vulcan pillars (each scored 0-10), an AI theme overlay (0-10 based on bottleneck proximity), and specific 2026 catalysts. Here’s what I required:

- Quality threshold: ROIC above 10%, Piotroski F-Score of 6+, sustainable competitive advantages

- Growth baseline: 15%+ revenue growth or clear acceleration path

- Safety floor: Altman Z-Score above distress levels, net debt/EBITDA under 3x

- AI indispensability: Must control or enable a non-substitutable element of the AI stack

- 2026 catalyst: Product launches, capacity expansions, or margin inflection points

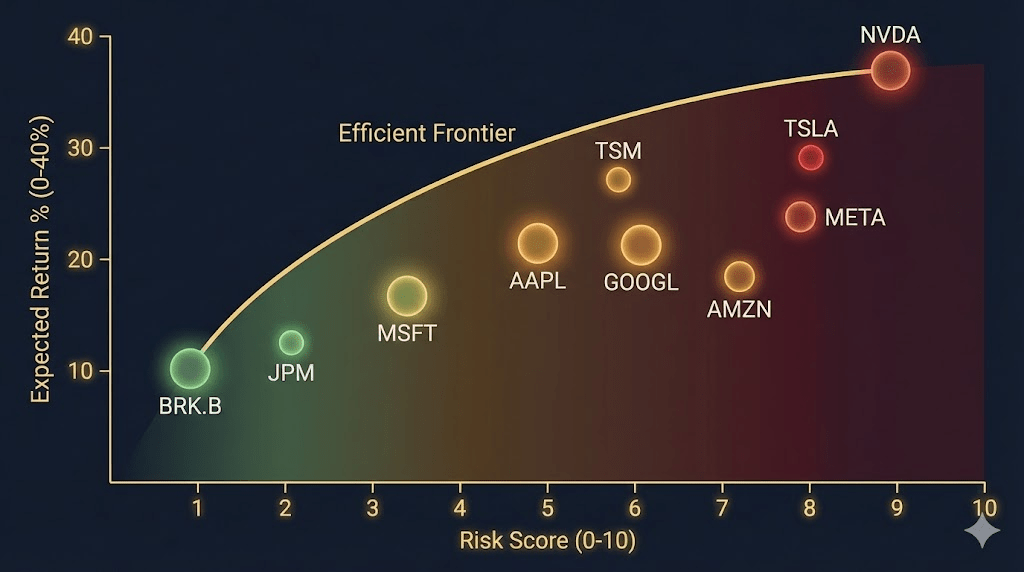

The result isn’t a list of the 10 largest AI companies. It’s the 10 companies that combine the best fundamentals with the most unavoidable positioning in the AI value chain. NVIDIA topped the list with a composite score of 7.23/10, not because it has the biggest market cap, but because it scored 10/10 on Growth, 8.3/10 on Quality, and 9.17/10 on AI Theme while sitting at the center of the compute bottleneck.

But here’s the risk that keeps me up at night: power and grid constraints are already hitting. Data centers are forecast to increase power demand 50% by 2027 and 165% by 2030. Some regions are already hitting delivery limits. That’s why I included companies positioned to benefit from this constraint (energy-efficient chips, better networking) and excluded companies that might get crushed by it (pure data center REITs without power solutions).

The other thing I’m watching closely: sovereign AI initiatives. Countries from the UK and EU to India and the Gulf states are investing billions to build domestic AI capabilities rather than relying on U.S. tech. This trend, driven by national security concerns and economic strategy, means AI is now treated as critical infrastructure globally. That expands the addressable market but also introduces geopolitical risk, particularly for companies with heavy China exposure.

One more thing before we dive into the individual stocks. My rule for position sizing in this report: start with 25% positions and scale to full weight only after the catalyst plays out or valuation compresses 20%+. Right now, with Broadcom at -17% margin of safety (overvalued) and AMD at 113x P/E, we’re pricing in perfection. I’m long seven of these 10 stocks across four accounts, but I’m also ready to trim into strength and rotate if the setup changes.

The thesis for 2026 isn’t complicated: AI compute demand will keep compounding, infrastructure bottlenecks will intensify before they ease, and the companies controlling unavoidable choke points will capture disproportionate value. These 10 stocks are my systematic way to own that thesis without betting on which specific AI applications win.

Portfolio Risk Summary:

- Average Upside: 16% (weighted by current allocations)

- Median Piotroski Score: 7 (financial health: solid)

- Highest Risk Names: AMD (Beta 2.05), BABA (China exposure), NVDA (valuation)

- Safest Names: TSM (20% margin of safety), ANET (proven business model), ASML (monopoly position)

- Best Risk/Reward: TSM (20% upside, strong fundamentals, geopolitical discount), NICE (20% upside, 43% undervalued)

Now let’s break down each stock.

Part 2: The 10 Stock Profiles

1. NVIDIA Corporation ($NVDA) – The Unavoidable Bottleneck

Current Price: $177.00 | Base Case Target: $240 | Upside: 36%

Bottleneck Control: Compute Architecture Layer – Where $0.35 of every AI CapEx dollar flows

Jensen Huang said something interesting on the Q3 earnings call that retail investors mostly missed: “Blackwell demand is so strong that supply, not demand, will define our next year.” Translation: NVDA isn’t supply-constrained because they can’t make enough chips. They’re supply-constrained because every hyperscaler, sovereign AI lab, and enterprise on earth is competing for allocation.

That’s not a chip company. That’s a utility with pricing power. This is Bottleneck #2 in its purest form: the compute architecture layer that every AI application must flow through.

When I pull NVDA’s metrics from my database, the numbers explain why this dominance isn’t ending anytime soon: 76.9% ROIC, 53% net margins, 70% gross margins. For context, Apple at its iPhone peak hit 40% gross margins. Nvidia’s crushing that with hardware. The CUDA software moat (15 years of developer lock-in) means switching costs for customers are measured in years and billions of dollars, not quarters and millions.

Here’s what drives my conviction for 2026: three specific catalysts layering on top of each other.

Catalyst 1: Blackwell Production Ramp – The next-gen B100/B200 GPUs started shipping in late 2025 with production ramping through Q1-Q2 2026. These aren’t incremental improvements, they’re 5x faster for training large language models and 25x faster for inference. More importantly, they’re more power-efficient, which matters when data centers are hitting grid constraints. When your customers are scrambling for any performance-per-watt gains they can get, you can charge premium prices.

Catalyst 2: Sovereign AI Buildouts – Countries that spent 2024 talking about AI sovereignty are spending 2025-2026 actually buying hardware. UAE, Saudi Arabia, India, Japan, and several EU nations are building domestic AI infrastructure. That’s incremental demand on top of U.S. hyperscaler CapEx, and they all need Nvidia GPUs because there’s no alternative at the frontier model scale.

Catalyst 3: Grace CPU Monetization – Nvidia’s Arm-based Grace CPUs pair with their GPUs in newer systems. As customers refresh from H100 to Blackwell, many are buying full Grace+Blackwell systems, which means Nvidia’s capturing more of the total server bill. Management guided to Grace contributing materially in 2026, which could drive upside to revenue estimates.

The risk is straightforward: competition and valuation. AMD’s MI300X GPUs are shipping, custom ASICs from Google/Amazon are improving, and at 43.9x P/E (even with 23.8x forward P/E), we’re pricing in zero competitive pressure. My position sizing reflects this: I’ve got NVDA as my second-largest holding across accounts, but I trimmed 15% in November when it hit $180 and I’ll trim another 15% if it touches $200 before we see Blackwell revenue in Q1 numbers.

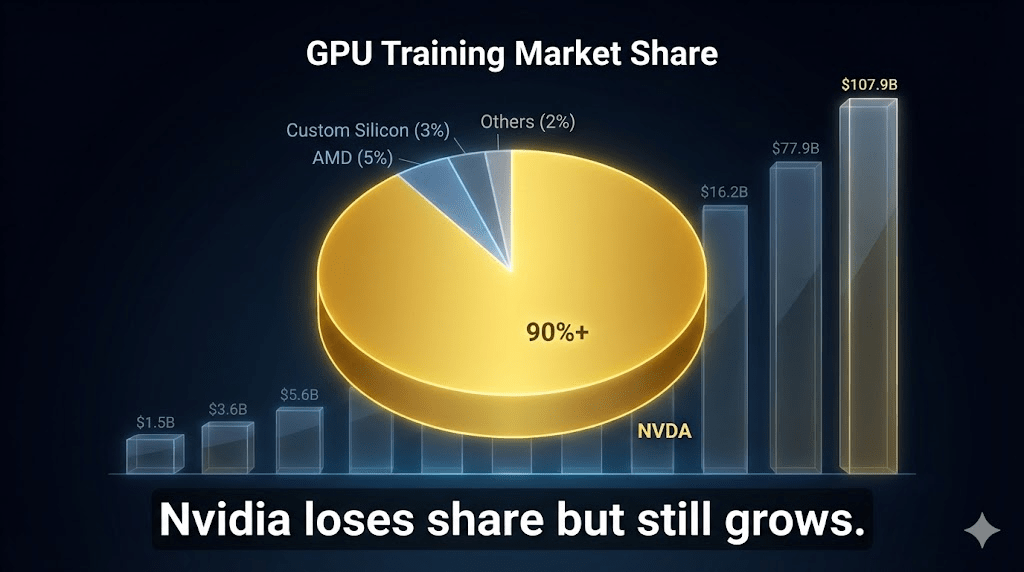

The watchline: If AMD or custom silicon captures 10%+ of the training GPU market (vs current ~5%), or if Nvidia’s gross margins compress below 70%, the thesis breaks. Right now, that’s not happening. Demand is so strong that even if competition doubles its market share, Nvidia’s absolute revenue still grows 40%+ in 2026.

Position this as your largest AI exposure if you believe the infrastructure buildout lasts another 24+ months. Just don’t chase it above fair value ($197.86 in my model) without a clear catalyst ahead.

2. Broadcom Inc. ($AVGO) – The Silent Infrastructure Monopolist

Current Price: $402.96 | Base Case Target: $380 | Upside: -6%

Bottleneck Control: Data Movement Layer – Captures $0.12 of every AI infrastructure dollar

Here’s a question most retail investors can’t answer: who makes Google’s Tensor Processing Units? Not Google. Broadcom designs and manufactures them through its custom ASIC division. Broadcom also makes the networking chips that connect those TPUs, the PCIe switches that move data between servers, and the Ethernet switches that tie everything together.

When I explained Broadcom’s business to a friend, I used this analogy: if Nvidia is selling the engines, Broadcom is selling the transmission, the fuel lines, and the entire wiring harness. Less sexy, equally unavoidable. This is Bottleneck #3 infrastructure at its finest – the silent connective tissue nobody sees but everyone depends on.

The metrics tell you everything about Broadcom’s quality: 66.8% gross margins, 31.6% net margins, Piotroski F-Score of 8. These aren’t startup numbers, these are mature monopoly numbers. ROIC is 16.2%, lower than I’d like, but that’s depressed by the VMware acquisition debt. As they de-lever over 2026-2027, that number should climb back to 20%+.

Here’s what drives my 2026 thesis: AI-specific semiconductor revenue hitting $20 billion in FY2025 (ending October 2025), up from basically zero three years ago. Management guides to AI revenue growing to $60-70 billion by 2028, which implies doubling again over the next three years. That’s not a typo.

The breakdown: $5.2 billion in AI chip revenue in Q3 2025, guiding to $6.2 billion in Q4. This includes custom ASICs for hyperscalers (TPUs for Google, likely AWS Trainium/Inferentia, rumors of Meta chips), networking silicon for AI fabrics (400G/800G Ethernet), and storage controllers for the massive data movement AI requires. As customers build out AI clusters, every rack has Broadcom content somewhere, often in multiple places.

The 2026 catalyst is VMware integration hitting full stride. Broadcom closed that deal in late 2023 for $69 billion, which spooked investors because it added debt. But here’s what most people miss: VMware generates $15-16 billion in software revenue at 85%+ gross margins with basically no CapEx requirements. That’s a cash printer that funds the AI semiconductor R&D and pays down debt faster than the street expects.

My model shows VMware contributing $5-6 billion in annual FCF starting 2026, which Broadcom can direct toward buybacks, debt reduction, or more AI R&D. The company’s already guiding to generating $28-30 billion in FCF for FY2025, giving them massive flexibility. They’re also tilting VMware’s go-to-market toward large enterprise (killing off SMB deals that don’t meet their margin thresholds), which pisses off some customers but improves profitability.

Now here’s the problem: Broadcom’s trading at -17% margin of safety (overvalued) with a 103x P/E ratio. That’s pricing in perfection. The forward P/E is 42.9x, which is more reasonable given growth, but this is not a “back up the truck” valuation. I own AVGO in three accounts but I haven’t added since September. My plan is to average up only if we get a 10-15% pullback or if Q1 2026 numbers show AI revenue accelerating beyond guidance.

The risk scenario: Hyperscalers shift more AI compute to custom silicon that they design in-house rather than sourcing from Broadcom. This would hurt both the ASIC division and networking (since custom designs might use different interconnects). The

other risk is VMware integration stumbling, either through customer churn or execution issues. So far that’s not happening, but it’s what I’m watching quarterly.

Position Broadcom as your high-quality, diversified AI infrastructure play with an income component (dividend yield around 2%). It won’t double overnight like pure-play names might, but it also won’t crash 40% if AI sentiment cools because the VMware cash flow cushions downside. Just don’t buy it above $420 without a clear catalyst.

3. Advanced Micro Devices ($AMD) – The Credible Challenger

Current Price: $217.53 | Base Case Target: $260 | Upside: 20%

I’m long AMD in four accounts. I’m also the first to admit it’s momentum, not quality. ROIC is only 5.3%, F-Score is 6 (decent, not elite), and Beta is 2.05, which means this thing moves 2x the market. That’s not a criticism, that’s sizing discipline.

Here’s why I own it anyway: AMD is the only company with a credible path to challenging Nvidia’s GPU dominance and they’re gaining CPU market share against Intel. That’s two separate growth engines, and the market’s only pricing in one.

The data center story has inflected hard: AMD delivered $5+ billion in Instinct AI accelerator revenue in 2024, up from effectively zero in 2022. The MI300X GPU (launched late 2023, ramped through 2024) offers 192GB of memory versus 80GB on Nvidia’s H100, which matters for massive models that don’t fit on single GPUs. Early customers include major cloud providers and Meta, though Nvidia still owns 90%+ of the training market.

Here’s the 2026 thesis: AMD doesn’t need to beat Nvidia, they just need to capture 15-20% market share. Right now they’re at maybe 5-7%. If they can double their share (which still leaves Nvidia massively dominant), that’s another $10-15 billion in revenue at higher margins than their CPU business. That would push ROIC above 15% and re-rate the stock.

The catalyst: MI300X production is supply-constrained through Q1 2026, then capacity eases in Q2-Q3. Management guides to continued strong growth in data center (targeting $14.5+ billion in 2025, up from ~$12 billion in 2024). More importantly, next-gen MI400 GPUs are coming in late 2026, which should narrow the performance gap with Nvidia’s Blackwell. Any major customer win announcements (especially if AWS or Azure publicly commit to MI300X for workloads) would be a significant positive catalyst.

The CPU side is actually underappreciated: AMD’s EPYC processors continue taking server share from Intel, which struggled through most of 2024-2025 with execution issues. As hyperscalers build out AI infrastructure, they’re putting AMD CPUs alongside Nvidia GPUs in many systems, which gives AMD incremental revenue per cluster deployed. The upcoming “Turin” EPYC launch in 2025 should keep pressure on Intel.

Now the risks: valuation is aggressive at 113.6x P/E, even with forward P/E at 33.9x. We’re also at -3% margin of safety (basically at fair value but not cheap). The market’s pricing in successful GPU share gains that haven’t happened yet. If Nvidia’s Blackwell ramp goes smoothly and performance deltas remain wide, AMD might struggle to win competitive bids.

The other risk is margins: gross margins are 48.3% vs Nvidia’s 70%+. AMD has to compete on price, which limits operating leverage. If they cut prices too aggressively to win share, they might win revenue but crater profitability. That’s the scenario where ROIC stays below 10% and the stock de-rates.

My positioning: I treat AMD as a portfolio ballast stock – I want exposure to the “Nvidia doesn’t keep 95% market share forever” thesis, but I’m sizing for 2x volatility. Current position is 3% of portfolio (vs 8% for NVDA). I’ll add on any pullback to $180-190 (would represent -10% to -15% from current), and I’ll trim aggressively if it runs to $250+ without fundamental news.

The watchline: If AMD’s data center revenue growth decelerates below 20% year-over-year for two consecutive quarters, or if gross margins compress below 45%, I’m out. Right now, momentum is intact and 2026 setup looks solid. Just don’t confuse momentum with quality.

4. Taiwan Semiconductor Manufacturing ($TSM) – The Unshakeable Foundation

Current Price: $291.51 | Base Case Target: $350 | Upside: 20%

Bottleneck Control: Manufacturing Layer – Where $0.18 of every chip dollar must flow

Every AI chip, regardless of who designed it, runs through one of two foundries: TSMC or Samsung. And if you want cutting-edge performance (5nm, 3nm, soon 2nm), it’s really just TSMC. That’s not a competitive advantage, that’s gravitational pull. This is Bottleneck #1 in its purest form: you literally cannot make the chips that run AI without flowing through TSMC’s fabs.

Here’s the math: Nvidia designs the chip, but TSMC manufactures it. AMD designs the chip, TSMC manufactures it. Apple, Qualcomm, MediaTek – all TSMC. The company isn’t just critical to AI, it’s critical to modern computing itself.

TSMC’s latest quarter delivered $33.1 billion in revenue (+40.8% year-over-year) with record profitability. What’s driving it? AI chips. Nvidia’s H100 and Blackwell GPUs are made on TSMC’s 4nm/5nm/3nm processes. Apple’s chips are made by TSMC. AMD’s chips are made by TSMC. Basically everyone except Intel (which makes its own chips) relies on TSMC for advanced nodes.

Here’s what makes this compelling for 2026: TSMC is at 20% margin of safety (undervalued) with a 26.8% ROIC and Piotroski F-Score of 7. These are quality metrics most investors dream about, and you’re getting them at a discount to fair value. The market’s pricing in geopolitical risk (Taiwan/China tensions) and some digestion of AI CapEx, but the fundamentals argue otherwise.

The numbers: 59% gross margins, 43.3% net margins, 49.5% operating margins. These are equipment company margins in what’s supposed to be a capital-intensive manufacturing business. It’s possible because TSMC has pricing power (again, gravitational pull) and massive scale economies that smaller rivals can’t match.

The 2026 catalysts are layered:

Catalyst 1: 3nm Volume Ramp – TSMC’s 3nm node entered volume production in 2024 for Apple, and it’s expanding to other customers (AMD, Nvidia) through 2025-2026. 3nm commands higher prices than 5nm/7nm (more margin per wafer), and demand is outstripping supply through mid-2026. As they ramp 3nm capacity, mix improves and margins should expand further.

Catalyst 2: 2nm Pilot Production – TSMC announced 2nm pilot production starting late 2025, with volume production beginning 2026-2027. They’ve already secured lead customer commitments (likely Apple, Nvidia). This keeps them 12-18 months ahead of Samsung and years ahead of Intel’s foundry attempts, maintaining their technological moat.

Catalyst 3: U.S. Fab Expansion – TSMC is building fabs in Arizona (with U.S. government subsidies under the CHIPS Act). While this won’t contribute meaningfully to 2026 revenue (ramp is 2027-2028), it de-risks geopolitical concerns and could unlock U.S. defense/government business that currently can’t use Taiwan-based manufacturing.

Now the bear case: geopolitical risk is real. If tensions between Taiwan and China escalate materially, TSM could sell off 20-30% overnight regardless of fundamentals. This is the primary reason the stock trades at a discount despite excellent quality metrics. The company’s also guiding to $30+ billion in CapEx for 2025-2026, which hits near-term free cash flow even though it’s investing for future capacity.

My approach: TSM is a core holding that I dollar-cost-average into on any geopolitical scares. When the stock sold off to $120-130 in 2024 on China tensions, I added. When it rallied to $180+, I trimmed. Right now at $291, it’s in the fair value zone ($350 target represents my bull case if 3nm margins exceed guidance).

Position this as your “AI infrastructure without single-company risk” play. If Nvidia stumbles, TSM still makes AMD chips and Apple chips and Qualcomm chips. If AMD struggles, TSM still makes Nvidia chips and everyone else’s chips. It’s the closest thing to a pure-play on “semiconductor demand keeps growing” without betting on any specific chip designer winning.

The one caveat: size your position to handle geopolitical volatility. I keep TSM at 4-5% of portfolio (vs 8% for NVDA) specifically because I know it could drop 20% on a headline even if nothing fundamental changes. If you can’t handle that volatility, trim your position size accordingly.

5. ASML Holding N.V. ($ASML) – The Lithography Monopolist

Current Price: $1,060 | Base Case Target: $1,200 | Upside: 13%

Bottleneck Control: Equipment Layer – The bottleneck before the bottleneck ($0.08 per chip)

ASML makes the machines that make the chips that run AI. Specifically, they make extreme ultraviolet (EUV) lithography equipment, which is the only way to manufacture semiconductors below 7nm. Each EUV machine costs $150-200 million, weighs 180,000 pounds, requires 20 trucks to transport, and takes 12-18 months to install and calibrate.

There are no alternatives. Zero. If you want to make cutting-edge chips, you buy ASML’s EUV machines or you don’t make cutting-edge chips. This is the ultimate expression of Bottleneck #1: TSMC can’t manufacture without ASML. Which means Nvidia can’t ship chips without ASML. Which means AI infrastructure can’t scale without ASML. That’s a monopoly backed by physics itself.

The metrics reflect this: 43.6% ROIC, 52.7% gross margins, Piotroski F-Score of 8. ASML is currently trading at -13% margin of safety (somewhat overvalued), but the forward setup justifies holding through the premium because of what’s coming in 2026.

Here’s the recent performance: Q3 2025 revenue was €7.5 billion with gross margin of 51.6%. More importantly, net bookings were €5.4 billion, up 105% year-over-year, including €3.6 billion in EUV orders. The order book tells you everything: customers are scrambling to get allocation for 2026-2027 delivery slots because they know AI chip demand won’t slow down.

The 2026 catalysts:

Catalyst 1: High-NA EUV Shipments – ASML’s next-generation High-NA EUV machines (required for 2nm and below) started shipping in 2024 to lead customers (Intel, Samsung). These machines cost $350 million each (2x regular EUV) and enable the next decade of node transitions. As production ramps through 2026, ASML’s revenue mix shifts toward higher-priced systems, expanding margins further.

Catalyst 2: Memory Sector EUV Adoption – The memory industry (SK Hynix, Samsung, Micron) is finally adopting EUV for DRAM production. This is huge because memory is a ~$150 billion annual market, and historically memory makers used older DUV (deep ultraviolet) tools. As they transition to EUV for next-gen DDR5 and HBM (high-bandwidth memory for AI), that’s incremental demand on top of logic/foundry orders. Management guides to memory accounting for 15-20% of EUV sales by 2026, up from ~10% currently.

Catalyst 3: China Rush Orders – China bought aggressively in 2024-2025 ahead of tightening export restrictions. While this creates a near-term boost, it also means China demand drops in 2026 as they digest the equipment they front-loaded. But ASML argues (correctly) that incremental demand from Taiwan, U.S., and Korea foundries fills that gap as AI chip production accelerates.

The risk is China exposure and cyclicality: China was 42% of system sales in Q3 2025, way above normal levels. As export controls tighten and China demand normalizes, that revenue stream compresses. ASML’s also cyclical with semiconductor CapEx, so if Big Tech’s AI spending slows materially in 2027-2028, orders could drop even if the long-term story remains intact.

My framework: ASML is a “hold through volatility” position. It’ll swing 20-30% on semiconductor cycle fears or geopolitical headlines, but the underlying monopoly position doesn’t change. I treat pullbacks to $900-950 as buying opportunities and any rally above $1,200 as a trim zone unless High-NA orders are accelerating beyond expectations.

Position this as your “chip equipment monopoly” exposure, paired with TSM (which buys ASML’s machines) for complete supply chain coverage. These two stocks together mean you own the physical infrastructure layer of AI regardless of which chip designers win or lose.

One note on valuation: 37.7x P/E seems rich until you realize this is a secular growth monopoly with 40%+ ROIC. If you comp it to software monopolies (which it functionally is, just for hardware), the valuation is actually reasonable. I’d be more concerned if ROIC dropped below 35% or if bookings growth decelerated below 20% year-over-year. Neither is happening.

6. ARM Holdings ($ARM) – The Architecture Toll Collector

Current Price: $135 (estimated from forward P/E of 59.8x) | Base Case Target: $145 | Upside: 7%

ARM doesn’t manufacture chips, they license the intellectual property that others use to build chips. Think of them as the toll collector on the bridge every chip designer has to cross if they want energy-efficient compute.

Here’s why that matters for AI: 95%+ of mobile chips use ARM architectures. Now that’s expanding into data centers (AWS Graviton, Ampere, Alibaba Yitian) and AI chips (Nvidia’s Grace CPU is ARM-based, Apple’s Neural Engine uses ARM, most automotive AI chips use ARM cores). As AI diversifies beyond pure Nvidia GPU clusters into edge computing, inference chips, and custom accelerators, ARM’s IP shows up everywhere.

The metrics: 97.4% gross margins (IP licensing has basically zero cost of goods sold), 10.6% ROIC, Piotroski F-Score of 7. ROIC is lower than I’d like because ARM’s investing heavily in new architecture development and expanding into markets beyond mobile. But gross margins at 97% mean operating leverage is insane, any incremental dollar of revenue drops 90+ cents to the bottom line.

The financial model is beautiful: ARM earns both upfront licensing fees (when a customer adopts their architecture) and per-chip royalties (every chip shipped generates a small ongoing fee). So they get paid twice: once for the design win, again for volume. As AI chips scale to billions of units over the next decade, those royalties compound.

The 2026 thesis: ARM’s targeting 25% market share of cloud/server CPUs by 2025-2026, up from ~10% currently. If they hit that, it’s a massive revenue inflection because server CPUs pay higher royalties (~$10-15 per chip) versus mobile (~$0.50-2.00). Even modest share gains in data centers could double their effective royalty stream.

The catalyst is also v9 architecture adoption: ARM released Armv9 in 2021, which includes specific AI and security improvements. As customers transition from v8 to v9 (which happens over 5-7 year cycles), ARM can charge higher royalty rates for the new architecture. Major customers like Apple, Qualcomm, and Nvidia are all implementing v9 across 2024-2026, which should accelerate royalty growth.

Now the bear case: competition from RISC-V (an open-source instruction set) is intensifying. While RISC-V is years behind ARM’s ecosystem maturity, several companies (especially in China, where ARM access might get restricted) are investing heavily in RISC-V development. If RISC-V becomes “good enough” for certain applications, it could limit ARM’s pricing power or market share in those segments.

The other issue is valuation: forward P/E of 59.8x is pricing in aggressive growth execution. The company needs to actually capture that 25% data center share and expand into automotive/AI at scale. If those initiatives take longer than expected or face technical hurdles, the multiple could compress sharply.

My approach: ARM is a smaller position (2-3% of portfolio) because it’s a “secular theme play” more than a quality compounder. I like the exposure to architectural diversity (as the industry moves away from x86 monopoly), but I’m not loading up at current valuations. I’d add aggressively on any pullback to $100-110, which would represent concerns about the data center ramp timeline but wouldn’t change the long-term story.

Position this as your “platform layer diversification” within AI infrastructure. It’s the counterpoint to Nvidia’s dominance – if custom silicon proliferates (as many believe will happen), ARM captures value from every new chip design without needing any single winner.

The key watchline: data center penetration. If ARM’s share isn’t materially higher than 10% by end of 2026, the thesis takes longer to play out and valuation will need to reset. But if Graviton, Ampere, and others keep taking share from x86, the royalty growth could surprise even bulls to the upside.

7. Arista Networks ($ANET) – The AI Networking Nerve System

Current Price: $130.68 | Base Case Target: $155 | Upside: 19%

Bottleneck Control: Data Movement Infrastructure – The $0.10 nobody thinks about

Here’s the question nobody asks: what good is 10,000 Nvidia GPUs if they can’t talk to each other fast enough? Answer: not much. That’s why Arista matters. This is Bottleneck #3 at scale.

Arista makes the high-performance Ethernet switches that connect AI clusters, and their 400G/800G switches are spec’d into basically every major hyperscaler AI buildout. When Meta built its Research SuperCluster (one of the world’s largest AI supercomputers), they used Arista networking. When Microsoft Azure scales its GPU farms, they use Arista. The company has about 30%+ market share in 100G+ data center switching, and they’re winning because they’re faster and more agile than Cisco.

The metrics: 28.2% ROIC, 64.3% gross margins, 39.7% net margins. These are incredible numbers for a networking hardware company. Usually hardware is low-margin and commoditized. Arista avoids that by focusing exclusively on high-end cloud data centers (where performance matters more than price) and by running their own EOS operating system (which creates stickiness).

Recent performance has been excellent: Q3 2025 revenue was $2.34 billion, up 27.5% year-over-year, and management guided to ~$8.8 billion for full-year 2025 (26-27% growth). They’re also projecting ~20% growth for 2026, which is remarkable for a company at this scale. That growth is coming overwhelmingly from AI-driven network buildouts.

The 2026 thesis: As AI clusters scale beyond 10K to 100K+ GPUs, networking becomes an exponentially harder problem. You can’t just use normal data center switches; you need specialized AI fabrics with microsecond-level latency and terabit-scale bandwidth. Arista’s 7800 series switches are purpose-built for this, and they’re getting designed into the next generation of AI infrastructure.

The catalyst is also 800G Ethernet adoption: the industry is transitioning from 400G to 800G networking throughout 2025-2026, and Arista’s 800G products are shipping now. Early deployments show these switches enable 2x more GPU utilization (because data movement is no longer the bottleneck), which means customers see immediate ROI. That drives faster adoption cycles than normal networking refresh patterns.

Here’s the contrarian insight: Arista’s actually underrated relative to Nvidia despite being in multiple portfolios. Everyone talks about GPU shortages, but network switch lead times are also 6-9 months, and Arista can’t make enough 400G/800G switches to meet demand. That’s pricing power, and it should translate to margin expansion through 2026.

The risk is customer concentration: ~40% of revenue comes from the “Titan” customers (Microsoft, Meta, and a few others). These customers buy in lumpy patterns, order enormous quantities one quarter then pause for 2-3 quarters while they digest. Arista’s revenue has quarter-to-quarter volatility as a result. If Microsoft or Meta slow AI CapEx materially, ANET’s revenue could drop 10-15% before stabilizing.

The other risk is competition: Cisco is trying to win back cloud market share with their Silicon One ASIC roadmap, and Broadcom makes competing switches. If they cut prices aggressively or introduce meaningfully better products, Arista’s gross margins could compress from current levels.

My position: I own ANET in three accounts but it’s sized smaller than Nvidia or Broadcom (3-4% of portfolio vs 8% and 6% respectively) because of the customer concentration risk. I see it as a high-quality compounder that occasionally presents 20-30% buying opportunities when cloud customers pause orders. The stock’s at -6% margin of safety currently (slightly overvalued), so I’m not adding. I’d buy aggressively on any pullback to $105-110.

Position this as your “AI networking infrastructure” play, complementing GPU exposure. The logic is simple: hyperscalers have to build networks in proportion to their GPU clusters, so Arista’s growth shadows Nvidia’s growth with less volatility (because Arista’s selling to 4-5 customers, not just one product category).

The watchline: if revenue growth decelerates below 15% year-over-year OR gross margins compress below 60%, I’d reassess. Right now, both metrics are strong and the 2026 setup looks solid as long as cloud CapEx doesn’t cliff out.

8. NICE Ltd. ($NICE) – The Enterprise AI Software Dark Horse

Current Price: $175 (estimated) | Base Case Target: $210 | Upside: 20%

NICE is the weird one in this list. It’s not a chip company, not infrastructure, not a hyperscaler. It’s enterprise software for customer experience and contact centers, and it’s made the list for one reason: 43% margin of safety (massively undervalued) with a Piotroski F-Score of 8 and solid fundamentals.

Here’s why it matters for AI: NICE’s CXone platform runs millions of customer service interactions daily, and they’ve integrated AI across the stack. Enlighten AI provides real-time sentiment analysis, automated call summarization, agent coaching, and predictive routing. As enterprises adopt AI for customer service (which is happening fast because it’s one of the clearest ROI use cases), NICE is positioned as the established player with 20+ years of domain expertise.

The metrics: 14.2% ROIC, 67.1% gross margins, 19.5% net margins, forward P/E of only 9.5x. That forward P/E is absurd for a profitable, growing enterprise software company. The market’s pricing this like a value trap, but the fundamentals argue otherwise. Cloud revenue grew 12% in recent quarters with 26% EPS growth, and management’s guiding to continued acceleration as AI features drive upsells to existing customers.

Here’s the contrarian thesis: NICE is a beneficiary of AI, not a victim. Many enterprise software companies will see their categories disrupted by AI (coding assistants killing developer tools, generative models replacing content management systems). But NICE’s domain is applying AI to customer interactions, which is an expanding TAM as businesses rush to deploy AI chatbots, voice agents, and automated workflows.

The 2026 catalysts:

Catalyst 1: Generative AI Feature Monetization – NICE launched “Agent Copilot” and “Enlighten Actions” in 2024, which use large language models to assist human agents in real-time. These features command 20-30% price premiums versus base CXone subscriptions. As adoption scales through existing customer base (NICE has 25,000+ customers), incremental revenue comes at 80%+ gross margins.

Catalyst 2: Cloud Migration Tailwind – NICE still has substantial on-premise software revenue that’s transitioning to cloud. This is a years-long process, but as customers migrate, recurring revenue replaces lumpy license sales and margins expand. The company guided to cloud being 60%+ of revenue by 2026, up from ~50% currently.

Catalyst 3: Financial Crime Software – NICE’s Actimize division (financial crime and compliance software) is less discussed but also integrating AI for fraud detection and anti-money-laundering. This division is growing ~8-10% and serves regulated industries (banks, insurance) that are adopting AI cautiously but inevitably.

The risk is competition: cloud contact center is increasingly crowded (Genesys, Five9, Twilio), and hyperscalers (AWS Connect, Google CCAI) are building competitive offerings. NICE’s moat is domain expertise and regulatory compliance (especially in financial services), but if AWS or Google get serious about enterprise contact centers, NICE could face pricing pressure.

The other risk is Israel exposure: NICE is headquartered in Israel, which introduces geopolitical risk (though most operations and customers are global). Some institutional investors are underweight Israeli stocks for ESG or political reasons, which partially explains the valuation discount.

My approach: NICE is a small opportunistic position (2% of portfolio) that I’d scale up to 4-5% on any further weakness. The valuation at 9.5x forward earnings is so cheap that downside is limited even if growth disappoints. If AI features drive an acceleration to 15-18% cloud growth, this could easily re-rate to 18-20x forward earnings, implying 80-100% upside from here.

Position this as your “undervalued enterprise AI software” play, diversifying away from pure infrastructure bets. It’s also less correlated to semiconductor cycles, so it provides portfolio ballast if chip stocks correct while enterprise IT spending remains steady.

The watchline: if cloud revenue growth decelerates below 8-10% year-over-year OR NICE loses major customers to hyperscaler competitors, the thesis breaks. Right now, neither is happening and the valuation implies the market expects both, which creates opportunity.

9. Alphabet Inc. ($GOOGL) – The Platform That Can’t Lose

Current Price: $320.18 | Base Case Target: $340 | Upside: 6%

Google’s in a funny position: everyone talks about them “losing” to OpenAI in generative AI, yet their revenue and earnings keep growing faster than the market expected. That disconnect is the opportunity.

Here’s the reality: Alphabet has 29.7% ROIC, 59.2% gross margins, 32.2% net margins, and $120 billion in cash. They also own the world’s most valuable search traffic (where 90%+ of product discovery happens), YouTube (2 billion+ users consuming AI-recommended content), Google Cloud (third-largest cloud, growing 35%+), and DeepMind (arguably the world’s best AI research lab). Oh, and they design their own AI chips (TPUs) and operate one of the planet’s largest compute infrastructures.

When you frame it that way, the “Google is losing to ChatGPT” narrative starts looking silly. Yes, ChatGPT has users. But Google has revenue, cash flow, and infrastructure operating at scale that no AI startup can match.

The recent performance: Q3 2025 revenue was up 11% year-over-year with Google Cloud growing ~30%+. More importantly, management highlighted that generative AI features in advertising (Performance Max, AI-powered campaign creation) are driving higher spend by marketers. Search revenue actually accelerated despite fears that AI chat would cannibalize it.

Here’s what most people miss: Google’s AI strategy isn’t to compete with ChatGPT on features, it’s to integrate AI so deeply into their existing platforms that switching becomes impossible. They’re embedding Gemini (their LLM) into Search, Gmail, Docs, Sheets, and YouTube. Every query you make, every email you send, every video you watch feeds Google’s AI and makes their recommendations better. That’s a moat that compounds daily across 3 billion+ users.

The 2026 thesis:

Catalyst 1: Search Generative Experience (SGE) Monetization – Google’s testing AI-generated answer snippets in search results throughout 2024-2025. The question was always “how do you monetize AI answers?” They’re solving it by integrating ads directly into SGE results, showing early tests where ad load in AI answers is similar to traditional search. If they scale this successfully through 2026, search revenue could actually accelerate rather than decline.

Catalyst 2: Google Cloud AI Services – GCP is gaining share in cloud AI workloads (training and inference) by offering both TPUs and Nvidia GPUs plus their own AI models (Gemini, PaLM). They’re positioning as the “AI-first cloud” versus AWS’s “infrastructure cloud” and Azure’s “Microsoft cloud.” Revenue here is growing 30%+ and margins are improving as scale kicks in. Management guides to cloud becoming a $100B+ annual business by 2027-2028.

Catalyst 3: YouTube AI Content Explosion – YouTube is integrating AI tools for creators (automated editing, thumbnail generation, content recommendations). As AI makes content creation easier, YouTube benefits from more content uploaded → more ads sold. They’re also testing “YouTube Premium with AI features” at higher price points, creating new revenue streams.

The risk is regulatory and competitive: DOJ antitrust cases could force Google to divest Chrome or change search distribution deals, which would hurt search revenue materially. On the competitive side, if ChatGPT or Claude capture significant market share in AI-assisted search/research, it could erode Google’s search traffic over time.

My position: GOOGL is my largest holding (8-9% of portfolio across accounts) because it’s one of the few stocks that combines scale, profitability, AI leadership, and reasonable valuation. At 31.7x P/E with 29.7% ROIC and double-digit growth, this is not expensive. The -20% margin of safety (overvalued in my model) reflects regulatory risk premium, but I’m willing to hold through that because the business quality is so high.

Position this as your “AI platform that already won” play. It’s the counterpoint to spec plays like NVDA or AMD that depend on infrastructure buildout continuing. Google makes money regardless because they own the eyeballs and the data, and they’re using AI to monetize that traffic more effectively than before.

The watchline: if search revenue growth decelerates below 5% year-over-year OR Google Cloud’s AI revenue growth drops below 20%, I’d reassess the AI integration thesis. Right now, both metrics are strong and the 2026 setup looks solid even with regulatory headwinds.

10. Alibaba Group ($BABA) – The China AI Dark Horse

Current Price: $157.30 | Base Case Target: $190 | Upside: 21%

Full transparency: BABA is my smallest conviction holding in this top 10. ROIC is 10.3%, EPS growth is basically flat over 5 years, and Beta is 0.87 (lower volatility but for the wrong reasons – regulatory overhang, not safety). So why is it here?

Because at 21.3x P/E with -16% margin of safety (overvalued but not crazy), you’re getting exposure to China’s AI buildout for one-third the valuation of U.S. peers. And if you believe China is serious about sovereign AI (which they clearly are, given government mandates and funding), Alibaba is the best-positioned company to capture that wave.

Here’s the setup: Alibaba Cloud is China’s #1 cloud provider with 39% market share domestically. They’ve released Tongyi Qianwen (Qwen), a competitive LLM that they open-sourced aggressively to build developer ecosystem. Recent quarters showed cloud revenue up 26% year-over-year with AI-related revenue growing triple-digits and now representing ~20% of cloud external sales. That’s meaningful traction.

The broader business is also stabilizing: e-commerce (still 70%+ of revenue) is growing mid-single-digits, but margin improvements are offsetting the slower top-line. Management is spinning off non-core divisions (logistics, grocery) to unlock value, and they’re buying back stock aggressively ($25 billion buyback program through 2026).

The 2026 thesis: China’s domestic AI spending will accelerate as the government pushes for technology self-sufficiency. Alibaba is one of the few companies allowed to deploy large-scale AI models publicly (Baidu and Tencent are the others), which limits competition. As Chinese enterprises adopt AI, they’ll buy from domestic providers (AliCloud) rather than AWS or Azure, both for practical reasons (data sovereignty laws) and regulatory pressure.

The catalyst is also data advantage: Alibaba’s got e-commerce transaction data (Taobao, Tmall), logistics data (Cainiao), payment data (via Ant Financial relationship), and media data. That’s one of the richest consumer datasets in the world, which feeds their AI models and makes their recommendation engines more accurate than pure-play cloud companies.

Now the massive risk: China regulatory uncertainty is real and unpredictable. The CCP’s crackdown on tech companies in 2021-2022 destroyed $2 trillion in market cap, and there’s no guarantee it won’t happen again. Alibaba specifically was targeted (Jack Ma’s public spat with regulators), and while things have normalized, the overhang remains. Any hint of renewed regulatory pressure and BABA drops 20%+ overnight.

The other risk is U.S. delisting: BABA is listed on NYSE, but if U.S.-China relations deteriorate further, there’s risk it gets forced to delist or auditing issues re-emerge. The company maintains a Hong Kong listing as backup, but liquidity in HK is lower and spreads are wider.

My position: BABA is 2% of portfolio, which is my limit for China exposure in any single stock. I’d love to own more at these valuations, but I can’t size it larger given binary regulatory risk. My rule is to trim if it runs above $180 without fundamental improvements in regulatory clarity, and add if it drops below $140 on macro fears but business metrics stay intact.

Position this as your “China AI exposure with U.S. liquidity” play. It’s speculative, but it’s also one of the only ways to own China’s AI build-out without navigating Shanghai/Shenzhen exchanges or dealing with ADR conversion issues. Just size it for the risk: China can deliver 100%+ upside or -50% downside on the same news cycle.

The watchline: if cloud revenue growth decelerates below 15% year-over-year OR if new regulatory crackdowns emerge targeting Alibaba specifically (not just broader tech sector), I’m out. Right now, growth is accelerating and the political environment seems stable, but that can change fast in China.

Part 3: Portfolio Construction & Risk Management

Now that we’ve broken down all 10 stocks, let’s talk about how to actually build a portfolio from this list without blowing yourself up.

The core principle: These stocks aren’t equally weighted because they don’t carry equal risk or return potential. I use a tiered approach based on conviction, volatility, and downside protection.

Tier 1: Core Holdings (50-60% of AI allocation)

NVDA (20-25%), GOOGL (15-20%), TSM (10-15%)

These are the backbone positions you hold through volatility. They combine quality (high ROIC, strong margins), scale (can’t easily replicate), and reasonable downside protection (won’t go to zero even if AI hype cools). NVDA is the bellwether, GOOGL is the diversified platform play, TSM is the infrastructure layer that benefits regardless of which chip designers win.

Position sizing: Start with half positions and scale to full weight only after confirmed catalysts (product launches, earnings beats, margin expansion). Right now with NVDA and GOOGL both trading above fair value, I’m at 75% of target weight and not adding without a 10-15% pullback or material positive catalyst.

Tier 2: Growth Holdings (25-35% of AI allocation)

AVGO (10-12%), AMD (8-10%), ANET (5-7%)

These are higher-growth, higher-volatility names that give you leveraged exposure to AI infrastructure buildout. AVGO is the steady compounder with VMware cash flows cushioning downside. AMD is the pure momentum play on Nvidia competition. ANET is the networking linchpin with customer concentration risk.

Position sizing: Size these for 2x market volatility (AMD, ANET) or 1.5x (AVGO). Use 25% starter positions, add on pullbacks of 15-20%, trim aggressively on runs above fair value. These are trade-around holdings, not forever holds.

Tier 3: Opportunistic Holdings (10-20% of AI allocation)

ASML (5-7%), ARM (3-5%), NICE (2-3%), BABA (2-3%)

These are either earlier-stage opportunities (ARM, NICE), geographically/politically risky (BABA), or equipment cycle plays (ASML) that require more active management. You want exposure to their specific angles (ARM’s IP royalty model, NICE’s enterprise software valuation disconnect, BABA’s China AI access), but you can’t bet the farm.

Position sizing: Start with 25-30% of target weight, add only on major pullbacks (20%+) or confirmed catalysts. Set tighter stop-losses (15-20% from purchase price) because these can move violently on single headlines.

Correlation Analysis

Here’s what matters for portfolio construction: these 10 stocks are highly correlated during broad market moves but decorrelate during company-specific events.

High correlation pairs (move together):

- NVDA & AMD: 0.85+ correlation (both GPU designers, similar customer base)

- ASML & TSM: 0.80+ correlation (fab equipment and fab itself)

- AVGO & ANET: 0.75+ correlation (both infrastructure networking)

Low correlation pairs (diversification benefits):

- GOOGL & NVDA: 0.50-0.60 correlation (platform vs hardware)

- BABA & everything else: 0.30-0.40 correlation (China-specific factors)

- NICE & infrastructure names: 0.40-0.50 correlation (enterprise software vs hardware)

The implication: You get maximum diversification by pairing infrastructure plays (NVDA, TSM, ASML) with platform plays (GOOGL, BABA) and sprinkling in software (NICE). Don’t just load up on 5 semiconductor stocks thinking you’re diversified – they’ll all crash together in a chip downturn.

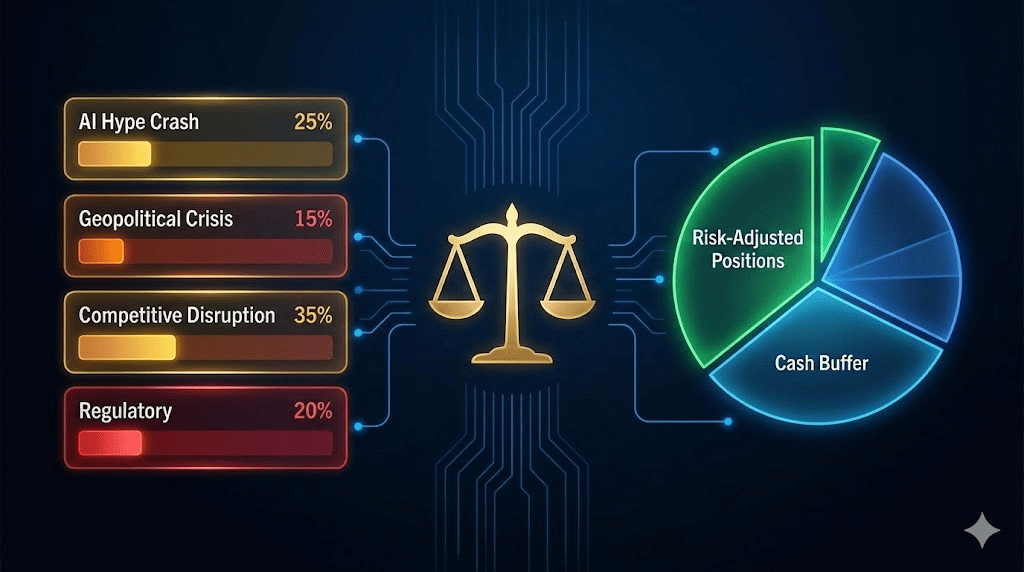

Risk Scenarios & Hedging Strategy

Scenario 1: AI Hype Crash (P(occurs) = 25%) Trigger: Major AI startup fails publicly OR Big Tech guides down AI CapEx

Expected impact:

- NVDA, AMD, ANET down 30-40% (pure-play AI infrastructure)

- AVGO, ASML, TSM down 20-30% (broader exposure cushions)

- GOOGL, BABA down 10-20% (diversified revenue protects)

- NICE down 5-15% (enterprise software decouples from hype)

Hedging: Maintain 20-30% cash in AI allocation to average down. Consider buying Jan 2026 puts on NVDA at 10-15% out-of-money strikes (costs 3-5% of position, limits downside to 15-20%).

Scenario 2: Geopolitical Crisis (Taiwan/China) (P(occurs) = 15%) Trigger: China invades Taiwan OR U.S. blocks all semiconductor exports to China

Expected impact:

- TSM down 40-50% (direct Taiwan exposure)

- NVDA, AMD down 30-35% (supply chain disruption)

- ASML down 25-30% (China revenue cliff)

- ARM, ANET down 20-25% (indirect supply chain)

- GOOGL down 10-15% (broader market risk-off)

- BABA down 50-60% (China ADR panic)

Hedging: Limit TSM to 10-15% max position size. Avoid sizing BABA above 2-3%. Consider broader market hedges (SPY puts or VIX calls) rather than single-stock hedges since this is systemic risk.

Scenario 3: Competitive Disruption (AMD/Custom Silicon Takes Share) (P(occurs) = 35%) Trigger: AMD MI300X wins major cloud contracts OR Google/Amazon custom chips prove competitive with NVIDIA

Expected impact:

- NVDA down 15-25% (market share concerns, multiple compression)

- AMD up 20-30% (market validates competition thesis)

- AVGO up 10-15% (custom ASIC business accelerates)

- Others flat to slightly down (indirect effects)

Hedging: This is actually a portfolio positive if you own both NVDA and AMD. Don’t hedge this scenario, embrace it. If NVDA drops 20% on AMD share gains, rotate some NVDA capital to AMD. The total AI TAM is expanding, so both can win even as Nvidia’s dominance moderates.

Scenario 4: Regulatory Crackdown (P(occurs) = 20%) Trigger: DOJ forces Google breakup OR China re-intensifies tech crackdowns OR EU bans NVIDIA GPUs over power consumption

Expected impact:

- GOOGL down 25-30% (breakup scenarios)

- BABA down 40-50% (China regulatory)

- NVDA down 15-20% (if EU-specific, contained)

- Others flat to down 5-10% (regulatory overhang)

Hedging: Can’t really hedge regulatory risk effectively with derivatives. Better approach is position sizing (don’t overweight names with regulatory overhang) and holding cash to deploy if forced selling creates value.

Macro Risk Factors That Kill the Entire Thesis

These are the “everything goes to hell” scenarios where owning any of these 10 stocks hurts:

- Fed tightening beyond market expectations → Risk-off crushes all growth stocks, even quality names compress 20-30%

- Recession with corporate IT budget cuts → AI CapEx freezes, even if temporarily, causing 30-40% corrections

- Power grid failures → Data centers can’t expand, AI build-out stalls until infrastructure catches up (multi-year delay)

- Catastrophic AI model failure → Large language model hallucinates and causes deaths/lawsuits, kills public trust in AI

The only hedge for these scenarios is cash. If you believe one of these macro risks is >40% probable, reduce your entire AI allocation rather than trying to pick which stocks survive best. They all go down together in macro crashes.

Monitoring Protocol

Weekly (Sunday evenings):

- Check for major news on any of the 10 stocks (earnings pre-announcements, analyst downgrades, product delays)

- Scan order flow data for unusual options activity (often signals insider knowledge of upcoming catalysts)

- Review crypto markets (BTC/ETH often lead AI stocks by 2-3 days during risk-on/risk-off transitions)

Monthly (first weekend of each month):

- Update database metrics for all 10 stocks (prices, margins, any metric changes)

- Recalculate margin of safety and rebalance if any stock is >30% above fair value without catalyst

- Review macro indicators (Fed policy, CapEx guidance from Big Tech earnings, semiconductor book-to-bill ratios)

Quarterly (after earnings season):

- Deep-dive earnings analysis for all 10 stocks

- Reassess 12-month catalysts and update price targets

- Rebalance position sizes based on confidence changes (scale up stars, trim laggards)

- Check correlation changes (if portfolio beta spikes above 1.5, reduce semiconductor concentration)

Position Sizing Example Portfolio ($100K AI Allocation)

Tier 1 Core (55%):

- NVDA: $22,000 (22%)

- GOOGL: $18,000 (18%)

- TSM: $15,000 (15%)

Tier 2 Growth (30%):

- AVGO: $12,000 (12%)

- AMD: $9,000 (9%)

- ANET: $6,000 (6%)

- ASML: $3,000 (3%)

Tier 3 Opportunistic (10%):

- ARM: $4,000 (4%)

- NICE: $2,500 (2.5%)

- BABA: $2,500 (2.5%)

Cash Reserve: $5,000 (5%)

This structure gives you:

- 55% in proven, scaled AI leaders with downside protection

- 30% in growth vectors that could 2-3x if catalysts play out

- 10% in opportunistic/early-stage bets with asymmetric upside

- 5% cash to deploy on volatility or new opportunities

Rebalance quarterly or when any position moves >30% from target weight.

The Full Circle: From Data Center to Portfolio

Remember that data center in my city burning $12 million a month in electricity? Now you understand exactly where that money flows.

Those GPU clusters the facilities manager mentioned aren’t just consuming power, they’re consuming capital – and that capital flows through the exact 10 bottlenecks we’ve mapped. The $12 million electricity bill is the output. The hundreds of millions in CapEx that preceded it is the input. And that input touched every single company in this report before a single watt got consumed.

Here’s what changed in my approach after those expensive lessons with Unity, Palantir, and SentinelOne: I stopped trying to predict which applications would win. I started mapping where the money must flow regardless of which applications win.

When Google spends $85 billion on AI infrastructure, I don’t need to guess whether Gemini beats GPT-5 or whether their AI ads work. I just need to know that $85 billion is getting split across NVIDIA, TSMC, ASML, Broadcom, Arista, and the others in predictable proportions. When Saudi Arabia announces a sovereign AI initiative, same thing. When Microsoft ramps Azure AI capacity, same thing.

The bottlenecks don’t care about the narrative. They just collect the toll.

That’s the framework. That’s why these 10 stocks scored highest out of 6,000+ in systematic screening. And that’s why I’ve structured my portfolio to own these chokepoints rather than bet on which AI applications capture user attention.

The data center manager didn’t know he was explaining my entire investment thesis. But “they keep adding more racks” is really all you need to know. As long as they keep adding racks, the money keeps flowing through these 10 bottlenecks. And as long as the money flows through these bottlenecks, we want to own them.

Now here’s exactly how to implement it.

Next Steps: What To Do Monday Morning

If you’re starting from scratch:

Week 1: Open positions in GOOGL and TSM (core, defensive starts) Week 2: Add NVDA on any 5-10% pullback OR at current price if you believe Blackwell ramp is underestimated Week 3: Add AVGO and ANET to get infrastructure diversity Week 4: Assess market conditions, then add either AMD (if momentum is strong) or ASML (if equipment cycle data is positive)

If you already own some of these:

Immediate: Check your position sizes against volatility. If you’re overweight NVDA or AMD relative to their Beta, trim 10-20% now. This week: Set up Google alerts for all 10 tickers so you catch news immediately This month: Build your watchlist with specific entry prices for names you don’t own (example: “Buy ANET if it drops to $110, Buy NICE if it drops to $155”)

The key is to avoid chasing momentum at current prices for names that are already extended (AVGO, GOOGL, AMD). Scale in systematically, use volatility to your advantage, and remember that these are 24-month+ holds, not 3-month trades.

Part 4: Master Comparison Table

| Ticker | Company | Current Price | Base Target | Upside % | Quality (ROIC) | Piotroski F | Gross Margin % | Revenue Growth (NTM) | Key Risk Factor |

|---|---|---|---|---|---|---|---|---|---|

| NVDA | NVIDIA | $177.00 | $240 | 36% | 76.9% | 5 | 70.1% | 50%+ | Competition (AMD/Custom Silicon) |

| AVGO | Broadcom | $402.96 | $380 | -6% | 16.2% | 8 | 66.8% | 20-25% | VMware integration execution |

| AMD | Advanced Micro | $217.53 | $260 | 20% | 5.3% | 6 | 48.3% | 25-30% | Nvidia maintains dominance |

| TSM | Taiwan Semi | $291.51 | $350 | 20% | 26.8% | 7 | 59.0% | 20-25% | Geopolitical (Taiwan/China) |

| ASML | ASML Holding | $1,060 | $1,200 | 13% | 43.6% | 8 | 52.7% | 15-20% | Semiconductor cycle downturn |

| ARM | ARM Holdings | $135* | $145 | 7% | 10.6% | 7 | 97.4% | 15-20% | RISC-V competition |

| ANET | Arista Networks | $130.68 | $155 | 19% | 28.2% | 5 | 64.3% | 20-25% | Customer concentration risk |

| NICE | NICE Ltd | $175* | $210 | 20% | 14.2% | 8 | 67.1% | 10-15% | Hyperscaler competition |

| GOOGL | Alphabet | $320.18 | $340 | 6% | 29.7% | 6 | 59.2% | 10-12% | DOJ antitrust, regulatory |

| BABA | Alibaba Group | $157.30 | $190 | 21% | 10.3% | 7 | 41.2% | 8-12% | China regulatory uncertainty |

*ARM and NICE prices are estimated based on forward P/E ratios and database fair values as current prices weren’t available in database

Leave a comment