When a business generates more free cash flow than most banks while trading at a P/E under 8x, something’s broken. Either the business model is dying, or the market has momentarily lost its mind. With H&R Block (HRB), I’m betting it’s the latter.

The tape tells a brutal story: down 27% over the past year, trading near 52-week lows around $42, with short interest at 16% of the float. Analysts are revising estimates downward. The momentum crowd has moved on. This is the definition of an unloved stock.

But here’s what the tape doesn’t show: a business still generating 40%+ returns on invested capital, operating margins in the low-20s, and $600 million returned to shareholders last year against a market cap barely above $5 billion. The dividend has grown at 10% annually for nine consecutive years. Management just bought back 6% of shares outstanding in a single quarter.

This is either value investing’s dream scenario, or I’m about to learn an expensive lesson about why cheap stocks stay cheap.

The Seasonal Cash Engine Nobody Wants

H&R Block does one thing exceptionally well: it helps roughly 20 million Americans navigate the annual ritual of tax filing. About 60% through traditional assisted preparation at company-owned or franchise offices. About 40% through digital DIY software. And increasingly, through hybrid models where AI handles the grunt work while human experts stand ready for complex questions.

The business model is beautifully simple: massive customer traffic compressed into a 14-week tax season generates the bulk of annual revenue. Fixed costs stay relatively flat. Variable costs scale with volume. The result is operating leverage that most SaaS companies would envy, despite being in a business many investors dismiss as “mature” or “dying.”

Revenue grew 4% last fiscal year. EPS grew 7%. Free cash flow conversion ran north of 100%. Management returned that entire FCF pile, plus some, to shareholders through dividends and aggressive buybacks at prices I believe will look cheap three years from now.

The market’s concern isn’t subtle: TurboTax and new fintech players are eating share, IRS “direct file” programs threaten the entire tax prep industry, and AI might commoditize the last remaining moat of expertise. These are legitimate risks. But they’re also the exact same fears investors have harbored for a decade while HRB compounded returns at double the S&P 500 rate.

The Quality Dilemma: High Returns, Ugly Balance Sheet

Here’s where HRB gets interesting and confusing in equal measure. By almost every operational metric, this is a high-quality compounder. ROIC above 40% puts it in rarefied air alongside software and payments companies. Gross margins around 45% and operating margins in the low-20s are stable and ahead of both its sector and the broader market.

But the reported balance sheet looks like a disaster. Negative book equity. Negative reported ROE. Net debt of roughly $750 million against that $5.3 billion market cap. Solvency ratios in the mid-20s range.

Here’s the key: this isn’t distress. It’s financial engineering on top of a cash-gushing engine. Years of aggressive buybacks have reduced the equity base to negative territory while the underlying business generates consistent cash. Interest coverage sits comfortably at 11x. The Altman Z-score is above 3, signaling no near-term distress risk.

Think of it this way: if you own a rental property generating $40,000 annual cash flow and you mortgage it to buy another property, your “book equity” drops but your wealth-generating capacity increases. That’s HRB in a nutshell, assuming you believe the cash flows are sustainable.

I do, with caveats. The negative equity structure means less margin for error if something goes wrong. Vulcan rates HRB’s Safety pillar at 7.0/10, solid but not bulletproof. This isn’t a sleep-like-a-utility bond proxy. It’s a leveraged bet on a stable franchise with cyclical consumer exposure.

The Digital Evolution Nobody’s Pricing In

The bearish narrative on HRB boils down to: “TurboTax is winning, AI is coming, assisted prep is dying.” There’s truth in each clause. But the conclusion might be wrong.

Management has spent the past three years rebuilding the digital stack with a critical insight: most tax filers don’t want pure DIY or pure assisted. They want something in between. Enter AI Tax Assist, which lets customers handle simple sections themselves, get AI-powered suggestions, and seamlessly escalate to a human expert when things get complex.

The early data is promising. Digital revenue is growing faster than assisted. Hybrid offerings are converting customers who previously churned to TurboTax. Average revenue per customer is holding or improving as the mix shifts toward higher-value services.

Beyond tax prep, HRB is building a year-round small business ecosystem through Block Advisors (bookkeeping and payroll) and Wave (small business financial software). These initiatives smooth out seasonal volatility and create stickier customer relationships. Spruce, the banking/financial products arm, adds another revenue stream with better unit economics than traditional tax prep.

None of this is showing up in the multiple yet. The market is pricing HRB like it’s Blockbuster Video in 2005, not a cash machine investing systematically in digital transformation while returning excess capital to shareholders.

Why the Market Hates HRB (and Why I Don’t)

Let’s be honest about what’s driving the 27% drawdown. First, the macro picture: consumer spending is slowing, tax refund timing creates volatility, and anything labeled “consumer cyclical” is out of favor. Second, competitive fears: Intuit reported strong results, making HRB look like the loser by comparison. Third, technical positioning: short interest at 16% means a meaningful cohort is actively betting against the name.

None of these are fundamental breaks in the thesis. They’re sentiment issues.

The business isn’t shrinking. Revenue growth is low-single-digits to mid-single-digits, which isn’t exciting but also isn’t declining. EPS growth is running high-single-digits to low-double-digits, boosted by buybacks that reduce share count by 3-4% annually. The dividend continues growing at 10%+, covered at 2.6x by earnings.

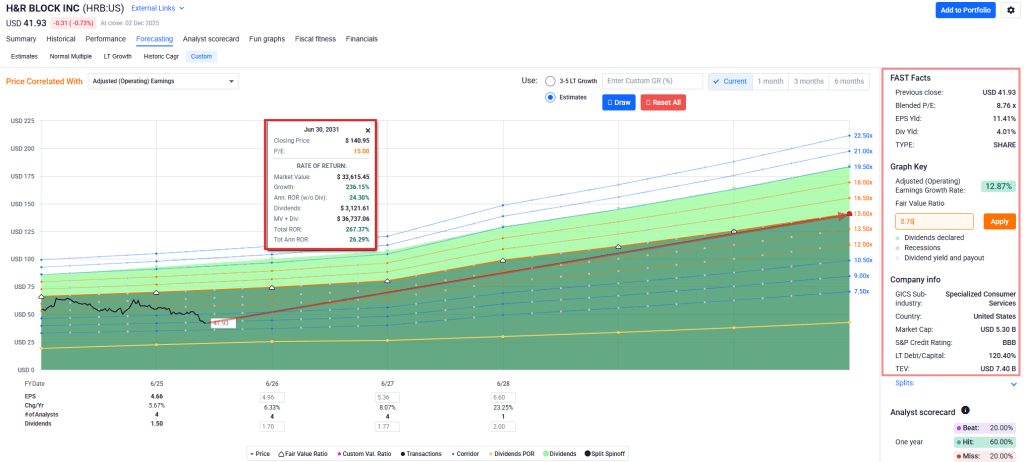

Management’s fiscal 2026 guidance calls for 3-4% revenue growth and high-single-digit to low-double-digit EPS growth. If they hit those numbers, the current 7.7x forward P/E is absurd. Even a move to 10-11x earnings (still cheap by almost any standard) would deliver 30-40% upside before accounting for the 4% dividend yield.

The Greenwald Valuation Framework

Vulcan’s Greenwald Mode triangulates three value anchors: asset floor, earnings power value (EPV), and growth value. For HRB, the asset floor is effectively zero given the negative equity structure and intangible-heavy balance sheet. This isn’t a liquidation play.

EPV, normalizing free cash flow per share around $4.20-4.40 and discounting at a high-single-digit cost of equity, yields a value in the low-40s. Essentially, the market is pricing HRB like a no-growth perpetuity with modest reinvestment.

Layer in 3-4% revenue growth, continued buybacks reducing share count, and modest margin expansion from digital mix shift, and a DCF approach yields fair value in the low-60s. Stock Rover’s own DCF model pegs fair value at $59, implying roughly 40% upside from current levels.

Blending EPV and growth value with a discount for leverage and competitive risk, Vulcan’s fair value band sits at $55-62. The midpoint at $58 suggests the current tape around $42 is pricing in permanent multiple compression or fundamentals materially worse than management’s guidance.

I’m not willing to bet on either. Base case: HRB trades to $47-53 over the next 12 months as earnings come through and sentiment normalizes. Upside case: a strong tax season and continued AI/digital traction push the stock toward $55-62. Downside case: guidance disappointments or competitive pressure keep the stock range-bound in the high-30s to low-40s.

The Risks That Keep Me Honest

Five specific concerns temper my conviction:

Structural disruption risk: If digital DIY and AI tools compress pricing and erode assisted demand faster than HRB can pivot, both margins and revenue could fall. The “death by a thousand cuts” scenario where each tax season loses 2-3% share adds up over time.

Intuit’s ecosystem advantage: TurboTax isn’t just tax software anymore. It’s part of a broader QuickBooks/Credit Karma/Mailchimp ecosystem that creates switching costs HRB can’t match. If Intuit leverages that platform advantage aggressively, HRB becomes a subscale player fighting for scraps.

IRS Direct File expansion: Current direct file pilots are limited, but if the IRS decides to scale free government-run filing, it caps the entire industry’s profit pool. This is a binary policy risk that’s hard to handicap but potentially devastating.

Leverage leaves no margin for error: With negative equity and moderate debt, HRB has less cushion than it appears. A severe recession that hammers consumer spending or a strategic misstep that requires capital infusion would be problematic.

Execution risk on digital bets: AI Tax Assist, Wave, Spruce, and Block Advisors are all promising initiatives. But if they fail to gain traction or require more investment than budgeted, HRB remains a low-growth, highly seasonal core business without the valuation multiple to support it.

Position Strategy and Entry Points

Vulcan’s buy zone for HRB sits at $38-44. At the current price around $42, this is a reasonable entry for patient investors comfortable with 3-4% position sizing in a diversified portfolio.

Strong buy / opportunistic add: Below $40, where the implied FCF yield exceeds 10% and upside to fair value tops 40%. I’d scale to a 4% position size if the stock breaks into the high-30s without fundamental deterioration.

Normal buy range: $40-44, where risk/reward still favors longs but without the extreme margin of safety. Appropriate for 2-3% starter positions.

Hold / neutral: $44-55, where valuation remains reasonable but the margin of safety compresses. I’d take no new action unless fundamentals improved materially.

Trim zone: Above $60, where the stock trades near or above Vulcan’s fair value band. Depending on what else looks attractive, I’d consider rotating capital.

Invalidation triggers: Three things would make me exit regardless of price. First, repeated guidance misses or negative revisions for two consecutive quarters. Second, dividend cut or payout ratio climbing above 60% without offsetting FCF growth. Third, sustained share loss to competitors evidenced by declining market share for two consecutive tax seasons.

The Variant Perception

Most investors see H&R Block as a melting ice cube: declining relevance, secular headwinds, low growth, uninspiring. The stock is priced accordingly.

I see a cash machine trading at 10x free cash flow, returning 100%+ of that cash to shareholders, investing methodically in digital transformation, and managed by a team that has delivered for shareholders over long time horizons despite persistent skepticism.

The bet isn’t that HRB becomes a growth story. It’s that normalized earnings plus capital allocation plus eventual sentiment repair deliver mid-teens to low-20s percentage annualized returns over 18-24 months. That’s more than enough when you’re buying at 7.7x forward earnings with a 4% yield.

I’m not betting the ranch. This isn’t a 10% portfolio position. But at current prices, HRB deserves serious consideration for anyone building an income + total return portfolio with patience and discipline.

The market might keep hating this stock for quarters. But at some point, compounding cash flows and aggressive capital allocation win. I’m willing to wait.

Master Metrics Table: H&R Block (HRB)

| Metric | Value |

|---|---|

| Ticker | HRB |

| Current Price | $41.93 |

| Market Cap | $5.3B |

| Sector | Consumer Cyclical / Personal Services |

| Trailing P/E | 9.6x |

| Forward P/E | 7.7x |

| EV/EBITDA | 7.2x |

| Price/FCF | 9.9x (FCF Yield ≈10%) |

| Forward Div Yield | 4.0% |

| TTM Yield | 3.7% |

| Payout Ratio | 35% |

| Div Growth (5Y) | 10% |

| Consecutive Div Growth | 9 years |

| ROIC | 41% |

| Gross / Operating / Net Margin | 45% / 23% / 16% |

| Altman Z-Score | 3.1 |

| Interest Coverage | 11x |

| 1Y Beta | 0.19 |

| 1Y Volatility | 26% |

| 1Y Total Return | -27% |

| 5Y Total Return | +163% |

| Margin of Safety vs FV | ~40% (FV ≈$59) |

| Vulcan Quality | 8.8/10 |

| Vulcan Growth | 6.5/10 |

| Vulcan Valuation | 9.0/10 |

| Vulcan Safety | 7.0/10 |

| Vulcan Income | 7.8/10 |

| Vulcan Momentum | 2.5/10 |

| Vulcan Composite | 7.4/10 |

| 12M Base Case Return | +12% to +25% |

| 12M Upside Scenario | +30% to +45% |

| Buy Zone | $38-44 |

| Strong Buy | <$40 |

| Trim Zone | $60+ |

Leave a comment