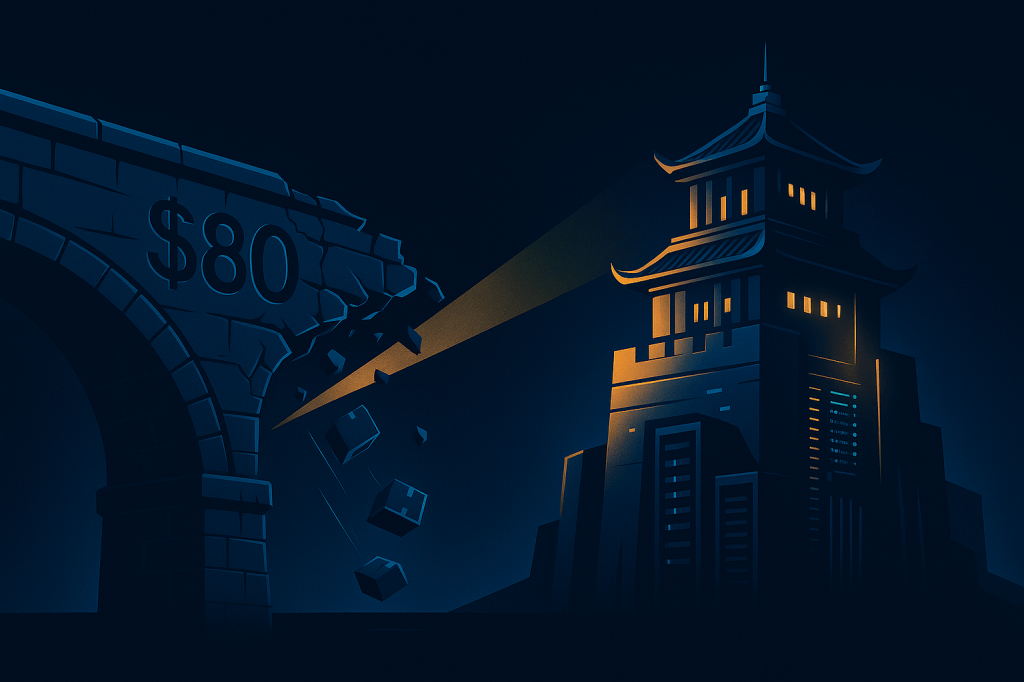

The $800 loophole is dead. And with it died Temu’s easy-money model that made American shoppers addicted to $5 sneakers shipped directly from Shenzhen.

PDD Holdings, the company behind both China’s Pinduoduo marketplace and the global Temu phenomenon, just watched its fastest growth engine get kneecapped by policy. Trump’s de minimis crackdown, which began in May 2025, effectively slapped 130-150% import charges on the ultra-cheap parcels that blanketed American porches for three years. Daily active users cratered 52% within weeks. Advertising spend evaporated. The stock price followed, carving through six months of uptrend support like a hot knife through butter.

Yet here’s the counter-intuitive reality that Wall Street is slowly waking up to: PDD might be more interesting now than it was during the rocket ship years.

The Company Behind The Chaos

PDD operates two distinct engines. Pinduoduo is the original; a Chinese marketplace that pioneered “team purchase” social commerce, letting friends band together to unlock bulk discounts on everything from produce to electronics. It captured hundreds of millions of value-conscious consumers, particularly in China’s lower-tier cities where price sensitivity runs deep.

Then came Temu in 2022. The global app exploited America’s generous $800 de minimis threshold to ship factory-direct goods tariff-free. A garlic press for $1.50. Sneakers for $5. The unit economics were absurd, and Americans couldn’t resist. Downloads exploded. Revenue nearly doubled in 2023, then grew another 59% in 2024.

The twin engines created something rare: a company generating massive cash while burning through conventional growth metrics at hyper-speed. Operating margins stayed fat because PDD ran asset-light marketplaces, not warehouses full of inventory. The balance sheet accumulated cash like a vacuum. Zero debt. Altman Z-score screaming “no distress.” Free cash flow flowing like a firehose.

What Actually Changed (And What Didn’t)

The tariff shock is real. Let’s not sugarcoat it. Temu’s original model, millions of tiny parcels slipping through customs duty-free is functionally dead. The platform has already stopped shipping directly from China to U.S. customers. Prices now include “import charges” that sometimes double the cost of items. Sensor Tower data shows U.S. daily active users plummeted 52% between March and May 2025.

But here’s what didn’t change: the fortress underneath.

PDD still holds approximately $40 in net cash per share. There’s no debt problem because there’s no debt. The Piotroski F-Score sits at 5, indicating reasonable financial strength. Return on invested capital runs above 25%, meaning every dollar PDD deploys generates substantially more than its cost of capital. Free cash flow as a percentage of sales remains in the mid-20s.

This is not a house of cards waiting for the wind to blow. This is a well-capitalized platform with real profits and real optionality, trying to adapt to a harder environment.

The Temu 2.0 Pivot

Management isn’t sitting still. Temu has already begun recruiting U.S.-based sellers and building domestic inventory networks. The model is shifting from “ship $5 gadgets from Guangzhou” to “fulfill from American warehouses using diversified sourcing.”

Will it work? Unknown. The transition inherently requires more working capital, more logistics complexity, and either higher prices or compressed margins. Management explicitly warned that “current profit levels are not sustainable” as they reinvest in adaptation.

But the company has resources to make mistakes and learn. The cash pile buys time. And Temu’s non-U.S. business keeps growing, the platform now claims 405 million global monthly active users, with 90% outside America. Europe, Latin America, Southeast Asia all represent less hostile regulatory terrain.

The Valuation Gift Wrapped In Geopolitical Risk

At roughly $113 per ADS, PDD trades at approximately 11-12x trailing earnings. The Vulcan database shows fair value estimates clustering around $137-155, suggesting 20-35% upside just to reach consensus fair value, before accounting for any growth normalization or multiple expansion.

Compare that to Amazon at 40x+ or even JD.com at higher multiples with worse margins, and the disconnect becomes stark. PDD is priced like a struggling retailer, not a profitable platform business with 24% net margins and 57% gross margins.

The discount exists because the risks are real: policy escalation could get worse; VIE structures remain legally ambiguous; competition from Alibaba, JD, and Shein intensifies daily; China’s domestic consumption wobbles periodically. But at current prices, you’re getting paid to take those risks.

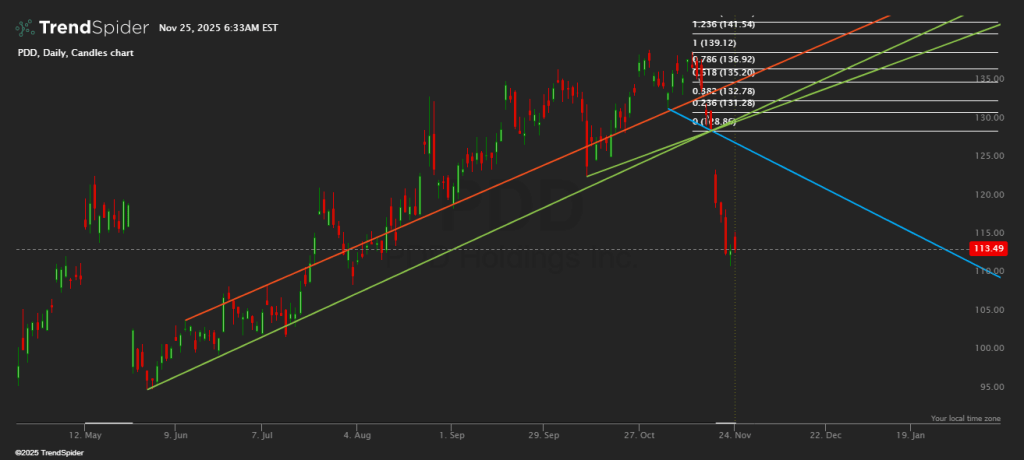

What The Chart Says

The technical picture confirms the fundamental story; broken uptrend, new regime, but approaching meaningful support.

The stock broke both its six-month rising channel and a steeper secondary trendline following Q3 earnings. Price now trades below key moving averages, under a descending trendline pointing toward the high-90s if nothing changes.

Key levels to watch:

Support zones:

- First support: $108-110 (recent low, likely to be tested)

- Primary support: $98-100 (old congestion area, where descending trendline meets horizontal support)

- Emergency support: $88-90 (52-week low, “something’s seriously wrong” territory)

Resistance zones:

- First resistance: $128-137 (broken trendlines plus Fibonacci cluster, heavy supply)

- Second resistance: $140-145 (recent peak; if price reaches here quickly without fundamental improvement, likely overbought)

Five Specific Risks With Numbers

- Tariff escalation: Current effective rates around 54-145% on former de minimis goods. If rates rise further or loopholes close entirely, Temu U.S. revenue could decline another 30-40% from current depressed levels.

- Margin compression: Management guides for profit volatility. Operating margins could contract 500-800 basis points as logistics costs rise and subsidies continue to defend market share.

- Regulatory whiplash: VIE structure remains untested in U.S. courts. SEC delisting threats or Chinese regulatory action could trigger 20-30% overnight gaps regardless of fundamentals.

- Competitive squeeze: Shein, Amazon Haul, Alibaba all competing for the same value-conscious consumer. Sustained subsidy wars could burn through $3-5B annually.

- Domestic China deceleration: Pinduoduo’s home market growth slowing to single digits. If Chinese consumer confidence deteriorates further, the “safe” engine sputters too.

The Action Plan

Position sizing: Cap at 3% of portfolio. This is satellite allocation territory, not core holdings. If you already have significant China exposure, go lower.

Entry strategy:

- Starter position (0.5-1%): Current levels around $110-115

- Primary add (to 2%): $98-105 zone if fundamentals remain intact

- Full position (to 3%): Low-90s if selloff is macro-driven rather than PDD-specific deterioration

Trim zones:

- First trim: $128-137 (take 25-30% off if entry was sub-$110)

- Second trim: $140-145 (reduce to core position; reassess thesis)

Invalidation triggers:

- Price below $88 combined with evidence of Temu rebuild failing (market share loss, margin collapse beyond guidance)

- Revenue growth staying negative for two consecutive quarters

- Material adverse regulatory action (delisting notice, VIE challenge)

The Bottom Line

PDD is no longer the simple growth rocket it was in 2023. The Temu 1.0 model is dead. Growth has decelerated from 90% to single digits. Management openly warns that profits will bounce around.

But at 11x earnings with a net-cash balance sheet, 25%+ ROIC, and optionality on a Temu 2.0 pivot, the risk-reward math has gotten interesting for investors who can stomach volatility. You’re not buying certainty. You’re buying a well-funded, cleverly-run platform at a discount price, with the chance to profit if adaptation succeeds and the discipline to exit if it doesn’t.

The smart play isn’t to run away or go all-in. It’s to show up with a plan, buy in defined zones, keep your size humble, and let PDD prove, or fail to prove, that the $800 loophole was a shortcut, not the only road.

Master Metrics Table

| Metric | Value | Context |

|---|---|---|

| Current Price | ~$113 | As of November 2025 |

| Market Cap | ~$161B | Mid-cap territory for Chinese tech |

| Trailing P/E | 11.7x | Significant discount to peers |

| Forward P/E | 9.2x | Implies 27% earnings growth |

| ROIC | 25.4% | Exceptional capital efficiency |

| Net Margin | 24.4% | Top-tier profitability |

| Gross Margin | 56.7% | Platform economics intact |

| Net Cash/Share | ~$39 | No debt, significant cushion |

| Piotroski F-Score | 5/9 | Adequate financial health |

| 5Y EPS Growth Est | 43.9% | Consensus may be optimistic |

| Fair Value Range | $137-155 | 20-35% upside to fair value |

| 52-Week Range | $87-139 | Currently mid-range |

| Beta (3Y) | 0.88 | Less volatile than market |

| Sector | Consumer Cyclical | Internet Retail subsector |

Vulcan Stock Research | @VulcanMK5 | vulcan-stock.com

Leave a comment