When markets sell fear, systematic traders buy the recalibration

When the S&P 500 drops 4% in two weeks after an 18-month run with zero meaningful pullbacks, everyone calls it a correction. When Nvidia crushes earnings and the stock barely moves, something’s recalibrating. When the 10-year yield hits 4.15% and the forward P/E sits at 23x, the machine is resetting itself.

I’m watching this recalibration with positions in GOOGL, NVDA, and PYPL, about 65% invested with 20% cash and 15% in defensive positions. My base case says we’re looking at a 10-15% peak-to-trough reset over the next few months, not the start of something catastrophic. But I learned in 2018 that corrections feel different when you’ve got real money on the line, so here’s exactly how I’m thinking about the next phase.

As of November 21st, the S&P closed at 6,526, down 5.5% from the early November high near 6,900 but still up 12% year-to-date. The Nasdaq’s off 6% from its peak but up 16% for the year. This isn’t a crash. It’s the market’s internal pressure gauge finally releasing after running too hot for too long.

Summary

- This is a normal recalibration, not a crash – The S&P is down 5.5% from November highs but still up 12% year-to-date. Earnings are growing 10%, credit spreads are calm at 3.2%, and Nvidia confirmed the AI engine.

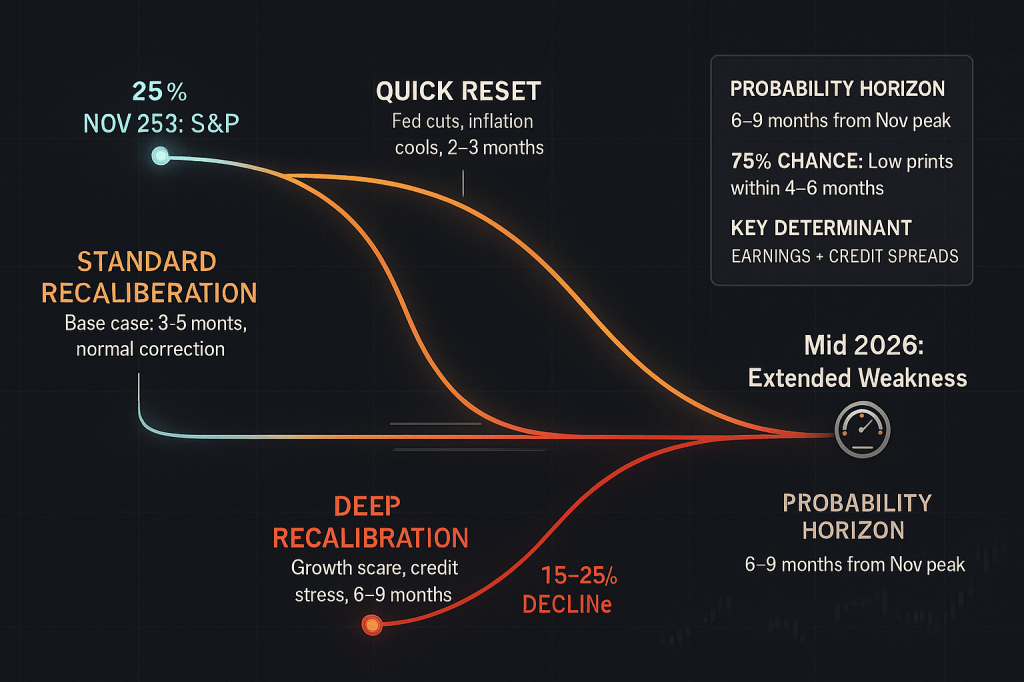

- Base case: 10-15% correction over 3-5 months — Three scenarios with clear probabilities: 25% chance of quick 5-10% reset, 50% chance of standard 10-15% correction (my base case), and 25% chance of deeper 15-25% drawdown.

- Critical support levels to watch — S&P 6,395-6,450 zone is major support where the broken 18-month channel may provide bounce. NVDA’s $189 support is make-or-break given its 8% S&P weighting. Break below S&P 5,850 watch.

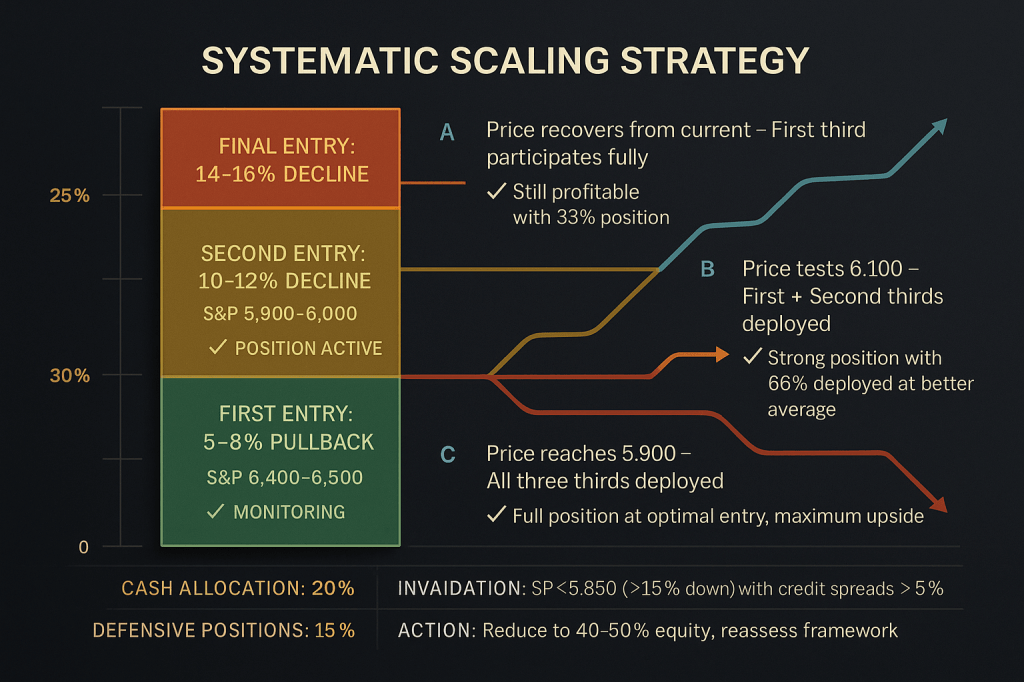

- Scale in, don’t try to nail the bottom — Deploy capital in thirds: first third in the 5-8% pullback zone (now), second third if we reach 10-12% down (S&P 6,100), final third if we hit 15% decline (S&P 5,900). Keep 15-20%

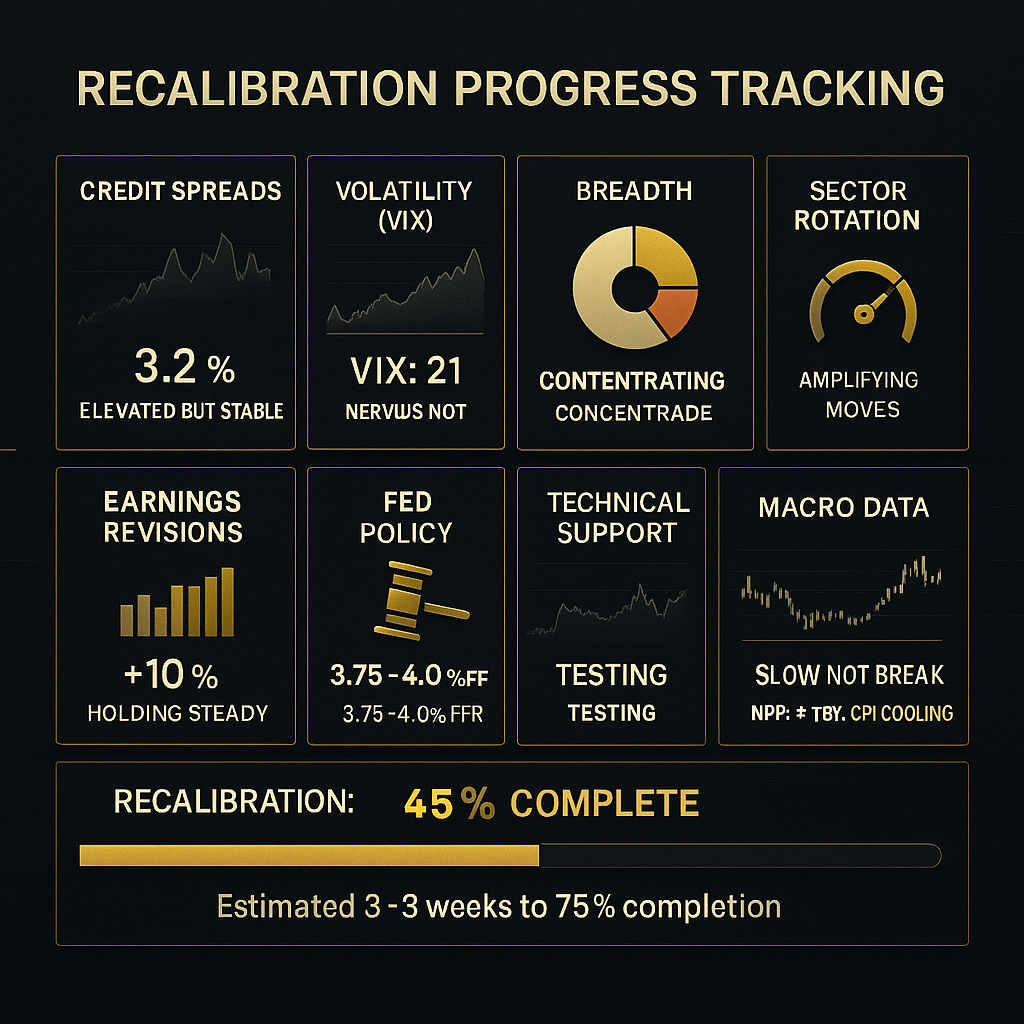

- Technical analysis shows we’re 40-50% through the cooldown — QQQ confirmed weekly DeMark sell signal, VIX at 21 (nervous not panicked), credit functioning normally at 3.2% spreads. Looking for Technology sector low.

The Recalibration Thesis: What’s Actually Broken

Think of the market like a high-performance engine. For 18 months, it ran at redline RPMs with the temperature gauge climbing steadily higher. Earnings grew 10-11% annually—good, sustainable growth—but valuations expanded 35% in the same period. That’s the classic setup for an overheating episode that requires a cooldown, not a breakdown.

The recalibration dial moved in three distinct ways:

First: The concentration gauge maxed out. Seven stocks drove nearly all returns since October 2022. When Nvidia reported $57 billion in revenue (up 62% year-over-year) and data center sales of $51 billion (up 66%), the stock jumped 5% premarket, then the broader market barely budged. That divergence tells you the recalibration isn’t questioning whether AI works—it’s questioning whether anything else matters.

Second: The valuation pressure relief valve opened. FactSet shows the S&P 500’s forward P/E at 23x versus a 10-year average of 18.6x. With the 10-year Treasury at 4.15%, the equity risk premium compressed to barely 0.25%—the thinnest margin in years. The machine needed to release that pressure, and it’s doing it now through multiple compression rather than earnings collapse.

Third: The Fed’s cooling mechanism stopped working. After cutting rates to 3.75-4.0% in October, officials immediately pumped the brakes on further cuts. The delayed September NFP showed 119,000 jobs added (double the 50,000 consensus) and unemployment at 4.4%—high enough to worry about but not high enough for the Fed to panic. Translation: the recalibration has to happen through fundamentals, not via Fed rescue.

That’s what’s driving this selloff: not broken fundamentals, but an overheated valuation engine that finally started its cooldown cycle.

What the new jobs report means for the recalibration timeline

The September employment report (delayed by the government shutdown and just released) gives us critical data on how fast this cooldown happens.

Key calibration points:

- Nonfarm payrolls rose by 119,000 jobs—more than double consensus expectations

- Unemployment ticked up to 4.4%, the highest since 2021 but still historically low

- Average hourly earnings rose 0.2% monthly and 3.8% annually—moderating but still above the Fed’s comfort zone

Job gains concentrated in health care, food services, and social assistance, while transportation, warehousing, and parts of government shed jobs. This is “growth slowing” data, not “growth breaking” data.

For the recalibration process, this NFP report does two critical things:

- It reduces the probability of an imminent deep recession (which would require a 15-25% drawdown)

- It also reduces the probability of an aggressive Fed pivot that would abort the recalibration mid-cycle

The machine has to finish cooling down on its own. That means we’re looking at the middle scenario—a standard 10-15% correction over 3-5 months—rather than either extreme.

Nvidia proved the engine still works. The question is: at what speed?

Nvidia’s Q3 earnings answered the fundamental question clearly: the AI growth engine is real and running strong.

They delivered $57 billion in quarterly revenue (up roughly 62% year-over-year), with data center revenue hitting $51 billion (up 66%). CEO Jensen Huang addressed bubble concerns directly, saying demand is “off the charts” with $500 billion in orders visible through 2026.

The initial reaction was revealing:

- Nvidia itself ripped on the report

- Other top AI names bounced selectively—Broadcom up 4%, Alphabet up 3%

- But AMD fell 3%, Meta ticked down 1.2%

The narrative shifted from “everyone wins in AI” to “there will be a few big winners and many also-rans.” That’s not bearish for the AI theme—it’s the recalibration sorting winners from pretenders.

The machine isn’t broken. But at 23x forward earnings with rates at 4%, the RPM gauge needed resetting before the next acceleration phase.

What volatility and credit markets tell us about recalibration progress

Two critical cross-checks on whether this is a normal cooldown or something worse:

Volatility: Nervous, not panicked

The VIX moved from mid-teens into the high teens and low 20s, with occasional spikes to mid-20s. True panic shows VIX above 30 for sustained periods. We’re seeing hedging activity, not capitulation.

Put/call ratios spiked to 0.90 on the 10-day average, with S&P put/call hitting above 1.2 on several recent days. That’s elevated demand for downside protection, which paradoxically creates a cushion if a real shock hits—all that insurance is already purchased.

Dealers flipped to negative gamma, meaning their hedging activity now amplifies moves rather than dampening them. That explains the choppier price action, but it’s not apocalyptic—it’s just a bumpier ride while the recalibration completes.

Credit: Functioning, not freezing

High yield option-adjusted spreads sit around 3.1-3.2 percentage points over Treasuries. In real stress events (2008, March 2020), that number blows out to 6-8 percentage points or higher.

Investment-grade spreads moved modestly from 75 to 85 basis points—noticeable but not alarming. If credit were truly dislocating, we’d see much wider spreads, forced selling, and contagion across asset classes.

Translation: The market’s internal cooling system is working as designed. The recalibration gauge shows we’re maybe 40-50% through the process, not near the beginning or the end.

Three recalibration scenarios: How deep and how long

Here’s how I’m thinking about the path from here, with probabilities that describe the total peak-to-trough outcome over roughly the next 6-9 months. History says there’s a 75% chance the ultimate low prints within 4-6 months, with only about a 25% tail that this drags beyond that timeline.

Scenario 1: Quick Reset (25% probability)

Recalibration depth: 5-10% total drawdown from November highs Timeline: 2-3 months to new highs Conditions required:

- Inflation continues trending lower toward 2%

- Labor data stays “slow but steady” like this NFP

- Fed signals at least one more cut in H1 2026 without sounding alarmed

What it looks like: The cooling cycle completes faster than expected. The S&P finds support around current levels (6,400-6,500), tests it once or twice, then gradually works higher as the valuation reset proves sufficient. AI leadership narrows but doesn’t break.

The recent NFP actually nudges this scenario slightly higher than a truly weak report would have—it suggests the economy is slowing toward optimal speed rather than stalling out.

Scenario 2: Standard Recalibration (50% probability—my base case)

Recalibration depth: 10-15% peak-to-trough drawdown Timeline: 3-5 months from first meaningful pullback to eventual bottom Conditions required:

- Earnings growth slows but stays positive (FactSet currently projecting this)

- Labor market continues cooling gradually (similar to September’s pattern)

- Credit spreads stay in the “uneasy but functioning” zone (under 4.5%)

What it looks like: The S&P drops to the 5,900-6,100 range, spends a few weeks testing and retesting support while volatility stays elevated (VIX 20-28 range), then stabilizes as Q1 2026 earnings guidance provides clarity. This matches historical correction averages—mid-teens decline over roughly 4 months for corrections that stay corrections.

The recalibration completes its full cycle: valuations compress from “obviously stretched” to “expensive but defendable,” leadership rotates away from the most crowded trades, and the foundation gets set for a more sustainable next leg higher.

This is where I’m positioned: I’m holding my GOOGL and NVDA core positions (both down about 8-10% from my cost basis but still fundamentally sound), adding to PYPL in the high $80s as it approached fair value, and keeping that 20% cash specifically for deploying if we get the flush down toward 5,900-6,000 on the S&P.

Scenario 3: Deep Recalibration (25% probability)

Recalibration depth: 15-25% drawdown Timeline: 6-9 months with multiple failed rallies Conditions required:

- Labor data deteriorates quickly—unemployment rising sharply above 5%, payrolls turning negative

- Earnings estimates for 2026 get cut meaningfully (especially cyclicals and Financials)

- High yield spreads blow out toward 6% over Treasuries

- Fed forced to respond to genuine growth scare, not just valuation reset

What it looks like: The cooling cycle overshoots. Small caps (already down 15% from highs) lead the market into deeper territory. The mega-caps that held up early finally crack under sustained selling pressure. Credit spreads widen aggressively, VIX sustains above 30, and sentiment swings to true despair.

The September NFP actually makes this scenario slightly less likely in the near term because it shows a still-growing jobs market with moderating wages. But it doesn’t remove the risk entirely—if the next couple of employment and inflation prints come in materially weaker, probabilities shift toward this deeper recalibration.

My invalidation trigger: If the S&P breaks decisively below 5,850 (roughly 15% down) on increasing volume with credit spreads above 5%, I’d shift from “normal recalibration” to “something’s breaking” mode and reduce equity exposure to 40-50% until the picture clarifies.

What the technical picture reveals about recalibration progress

Beyond fundamentals and sentiment, the technical setup provides critical clues about where this cooldown finds support and how long it lasts.

The channel break tells the story

The chart shows what recalibration looks like in real-time: an 18-month uptrend channel that powered the move from 550 to 690 finally broke down. Thursday’s sharp reversal caught most traders off guard—the S&P broke below October lows around 6,500, and the Nasdaq followed suit.

The selling pressure expanded throughout the afternoon with breadth deteriorating steadily. Despite this technical damage, I’m not betting on an extended collapse. My technical work suggests we’re likely seeing a reversal attempt by next week, right ahead of Thanksgiving.

Key support zones in the recalibration:

- S&P 500: The 6,395-6,450 zone represents major support. A test and hold here sets up the December rally attempt in my standard scenario. Breaking this level opens the door to deeper cooling toward 6,100 or even the 5,900 level I mentioned in Scenario 2.

- Nasdaq (QQQ): Support sits near 568. A bounce from here would be constructive for the broader tape and suggest the tech recalibration is finding its natural resting point.

The DeMark signals and what they mean

For those tracking DeMark indicators (I use them as one input among many), QQQ officially confirmed its first weekly Sell signal on Friday’s close below 617.14. That’s a completed TD 13-Countdown exhaustion signal on the weekly timeframe.

The recalibration context: Weekly timeframe exhaust signals typically precede 2-4 weeks of consolidation or further weakness. But monthly signals are NOT confirmed, and daily charts show the possibility of a Buy Setup forming within the next few days if selling continues.

Translation: The short-term cooling cycle has further to run (another week or two), but the longer-term monthly timeframes haven’t rolled over, which supports my base case of a 3-5 month recalibration rather than a multi-quarter bear market.

Nvidia’s critical juncture in the recalibration

NVDA sits at a make-or-break technical level that matters for the entire market. The stock’s been consolidating in a tight range for weeks, repeatedly testing support near $189.

Why this level matters: If NVDA breaks $189 on a weekly close, technical analysis suggests a move down to $164. Given Nvidia’s 8% weighting in the S&P and larger weight in the Nasdaq, this stock holding or breaking support directly impacts whether the recalibration stays orderly or accelerates.

The repeated failure to rally despite strong earnings is concerning. A breakdown here would signal the cooling cycle needs to go deeper before stabilizing—shifting probabilities from Scenario 2 toward Scenario 3.

Cross-asset recalibration signals

Precious metals: Both Silver and Gold show patterns suggesting weakness into early December before rallying. Silver futures could decline to $47 before the cooldown cycle completes and metals resume their uptrend.

The Dollar and rates: The dollar index around 100 (up from 96 in July) reflects capital flowing toward safety and higher U.S. yields. Until long-term rates make a meaningful downturn back toward monthly lows, the equity recalibration probably needs more time to complete.

My actual playbook: How I’m trading the recalibration

This is how I’m positioning as someone who has to sleep at night while managing real capital through this cooldown.

The three-dashboard system

I’m watching these dashboards to gauge recalibration progress:

- Price vs moving averages: S&P and Nasdaq relationship to 50-day and 200-day MAs

- Credit spreads: Especially high yield OAS—is it staying under 4% or blowing out?

- Earnings revisions: Are analysts holding or slashing 2026 estimates?

As long as earnings stay positive, credit functions normally, and indexes hold above levels consistent with a mid-teens drawdown, I treat this as buy-the-cooldown environment, not sell-everything mode.

Quality over momentum in the recalibration

The stocks that went up 50%+ in 2025 on pure multiple expansion are most vulnerable to further pressure during this cooling cycle. My focus:

- Strong balance sheets (net cash or manageable debt)

- Consistent free cash flow (not just accounting earnings)

- Reasonable forward multiples relative to history (15-20x for quality growth)

- Trading at 10-15% discounts from recent highs

I still want exposure to AI infrastructure and quality growth, but this is the phase where entry price finally matters again. The recalibration is creating opportunities in names that got sold indiscriminately with the broader market.

Scaling in, not trying to nail the exact low

My actual position sizing through the recalibration:

For stocks I want to own:

- First third: Already deployed in the initial 5-8% pullback (this is where we are now for many names)

- Second third: Add if we see a 10-12% total drawdown and credit remains orderly (S&P around 6,100-6,200)

- Final third: Save for if we approach a 15% decline with a classic washout day (S&P around 5,900-6,000)

This approach keeps me participating if Scenario 1 (quick reset) plays out, while leaving firepower if we drift toward Scenario 2 or even Scenario 3.

Current positions and next moves:

- GOOGL: Holding full position, not adding (already well-sized)

- NVDA: Watching the $189 support—if it holds and bounces, I add 25% more to position

- PYPL: Added aggressively in high $80s as it approached fair value during the pullback

- Cash (20%): Deploying in thirds as outlined above

- Defensives (15%): Utilities and quality dividend stocks providing ballast

The 15% defensive allocation isn’t market timing

Keeping 15% in lower-beta positions (utilities, staples, quality dividend stocks) isn’t about calling the top. It’s portfolio engineering—having positions that zig when growth zags lets me sleep better and provides funds to redeploy when the recalibration creates genuine bargains.

It’s the difference between watching a 12% correction with 100% growth exposure (psychologically brutal, often leads to panic selling) versus watching it with 65% growth, 15% defense, 20% cash (annoying but manageable, allows rational redeployment).

Recalibration progress triggers: What I’m watching

The cooldown cycle is likely closer to completion than continuation when we see several of these flip:

Macro data stabilization:

- Labor reports showing modest but stable job growth

- Wage growth drifting closer to 3% year-over-year

- Core inflation continuing to trend toward 2%

- Fed messaging shifting to “ready to cut if needed”

Market internals improving:

- High yield spreads stabilizing then tightening back under 3.5%

- VIX spike to 25-30 followed by strong reversal day (80%+ of stocks advancing)

- Breadth improvement—advance-decline line making new highs while index lags

- Sector rotation back into beaten-down areas (small caps, cyclicals)

Technical confirmation:

- S&P holding the 6,395-6,450 support zone on volume

- NVDA defending the $189 support level

- Weekly DeMark buy signals forming on major indexes

- Positive gamma returning to dealer positioning

Earnings resilience:

- Q4 2025 and Q1 2026 guidance not getting slashed

- Analysts holding or raising estimates for 2026

- Management commentary staying cautiously optimistic rather than defensive

Right now we’re maybe 4-5 out of 10 on this checklist. Not close enough to call a bottom, but not in dire territory either. The recalibration gauge shows we’re progressing but need more time to complete the full cycle.

Bottom line: This is the cooldown, not the breakdown

With Nvidia’s earnings confirming the AI engine still runs strong, the delayed NFP showing labor markets cooling without collapsing, and credit functioning normally, the picture is clearer:

- The AI growth engine is intact—the question is valuation, not viability

- The labor market is slowing to sustainable speed, not stalling out

- The Fed is constrained but watching—they’ll cut if the data truly rolls over

- Valuations needed resetting, and that’s happening now through multiple compression

- Technical support zones are being tested but haven’t catastrophically failed

This lines up with a standard mid-cycle recalibration inside a bull market, not a new secular bear. The machine ran too hot for too long, built excessive concentration in seven stocks, and pushed valuations to 23x forward earnings while rates hit 4%. The internal cooling system activated, and we’re watching it work.

My base case remains Scenario 2: a 10-15% recalibration over the next 3-5 months, with the S&P likely testing but ultimately holding the 6,000-6,100 zone. The next 3-5 trading days will be critical—I’m looking for signs of a Technology sector low by next Wednesday that sets up a year-end rally attempt.

But I’m watching those triggers closely. The next couple of employment and inflation prints, combined with how NVDA’s $189 support holds up, will determine whether we stay in this orderly cooldown or shift toward the deeper recalibration scenario.

What I’m doing right now: Using the volatility to upgrade quality at better prices, scaling into positions in thirds rather than trying to nail the exact bottom, and maintaining discipline around position sizing and risk management. I’m keeping that 20% cash and 15% defensive allocation specifically so I can act rationally when the recalibration creates opportunity—like it already has in PYPL and potentially will in GOOGL and NVDA if we get another 5% down.

The recalibration isn’t fun when you’ve got real capital deployed, but it’s necessary. The market needed to release pressure, reset valuations, and shake out weak hands. That process is underway. When it completes—likely sometime in Q1 2026—the foundation will be set for the next leg of this bull market.

Until then, the temptation is always to sell your process along with the decline. This is exactly when sticking to systematic frameworks, keeping emotional discipline, and focusing on the data matters most. The recalibration will complete. The question is whether you positioned to benefit from it or panicked your way through it.

I’m choosing the former. The machine is cooling down, not breaking down. Let’s see how the next month plays out.

Leave a comment