I bought Google in 2007 for less than $10 a share (post split price). I’ve watched it split, soar, stumble, and now sit at roughly $276—a position that’s become to my portfolio’s cornerstone and your biggest concentration risk. The question that keeps sophisticated investors up at night isn’t whether Alphabet is a great business. It’s whether greatness at this price still makes sense.

The answer requires uncomfortable honesty: at current levels, GOOGL sits in that awkward zone where quality meets valuation reality. This isn’t a screaming buy. It’s a systematic trim-and-reload opportunity that demands precision timing over emotional attachment.

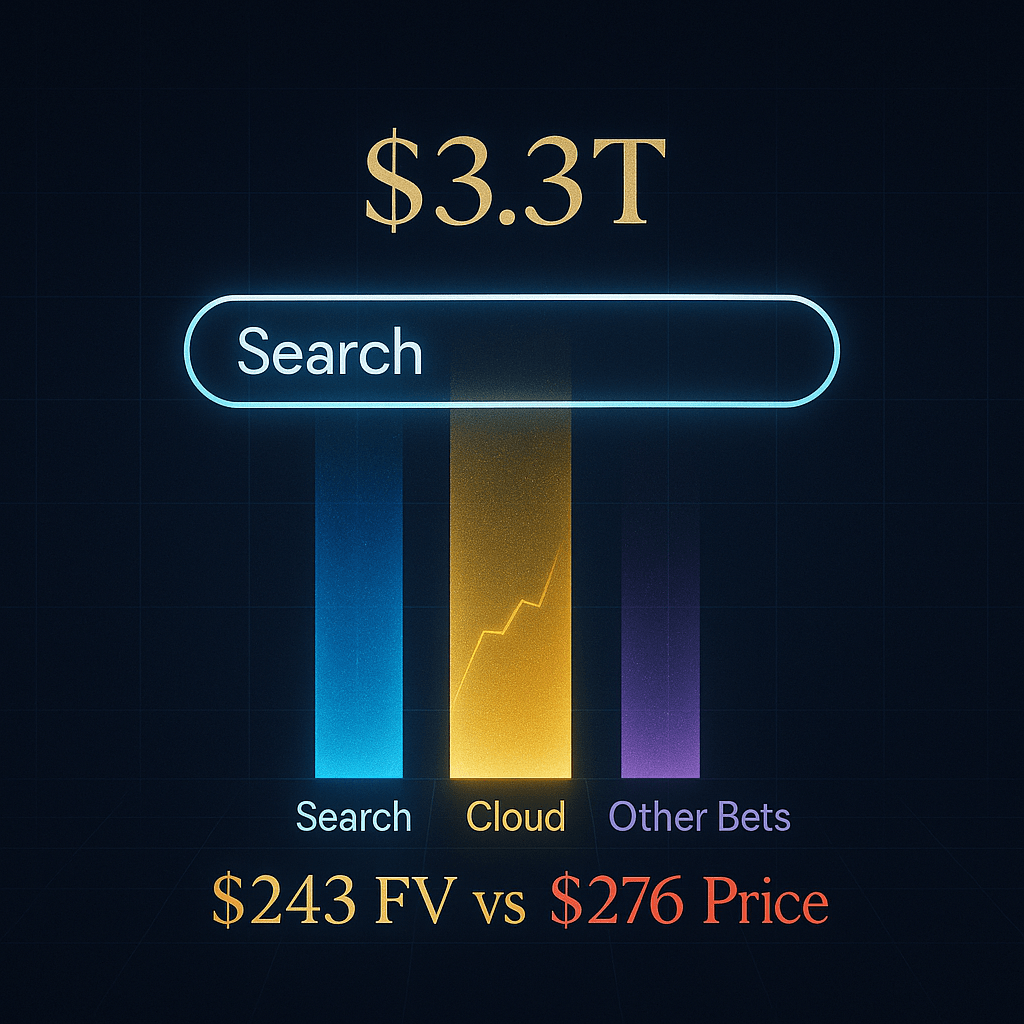

Here’s the framework that matters: Alphabet’s Bayesian fair value—blending conservative DCF analysis, historical multiples, and institutional research—lands near $243 per share. Today’s $276 price puts you roughly 13-16% above intrinsic value. Not catastrophically overvalued. Not attractively cheap. Just priced for perfection in a world where perfection rarely arrives on schedule.

The business model that built an empire

Alphabet operates three distinct economic engines that together generate over $400 billion in annual revenue. Think of it as owning three separate Fortune 100 companies under one ticker.

The first engine—Google Services—is the original search monopoly that prints money with 90% market share globally. Every query you’ve ever typed, every YouTube video you’ve watched, every Android phone in your pocket feeds this machine. Q3 2025 revenue: $102.3 billion, up 16% year-over-year. Operating margin: 30%, or 33.9% when you exclude a $3.5 billion European Commission fine.

The second engine—Google Cloud—represents the future Alphabet is buying with today’s profits. Annual run rate now exceeds $60 billion with 34% growth, though it still trails Amazon and Microsoft in market share. The backlog sits near $155 billion, up mid-double digits, driven by enterprise AI infrastructure demand that’s just beginning to scale.

The third engine—Other Bets—bleeds about $1-2 billion quarterly while funding moonshots like Waymo autonomous vehicles. This is Alphabet using Search profits to buy lottery tickets on the next computing platform. Some will fail. One or two might redefine transportation or healthcare. That asymmetry matters when you’re sitting on $100 billion in cash.

The numbers that actually matter

Four metrics tell you everything about Alphabet’s operational reality:

Return on Invested Capital: 30%. This isn’t efficiency theater—it’s what happens when you own infrastructure nobody can replicate. Every incremental dollar Alphabet deploys into data centers, AI models, or network effects compounds at rates that make traditional businesses look quaint.

Free cash flow: $74 billion annually. Real money, after all capital expenditures, flowing into corporate coffers at a rate that funds both a growing dividend ($0.84/share, 0.30% yield) and aggressive buybacks (2% buyback yield). Total shareholder yield around 2.3% before you count any price appreciation.

Operating margin: 30-34%. Despite ramping AI infrastructure spend to $91-93 billion for 2025, Alphabet maintains profitability that reflects genuine pricing power. When you can invest tens of billions in future infrastructure while keeping margins in this range, you’re not managing decline—you’re building the next platform.

Debt-to-equity: 0.1. Effectively zero net leverage on a $3.3 trillion market cap. This matters because it gives Alphabet unlimited optionality. Acquisition opportunities, AI arms races, regulatory fights, economic downturns—none of these existential threats apply when you’re sitting on fortress-level balance sheet strength.

Why now matters (and why it doesn’t)

The bull case rests on AI infrastructure leverage that’s just beginning to show results. Gemini models are rolling out across Search, YouTube, Workspace, and Android. Cloud is finally profitable and growing faster than the overall market. Management is guiding toward “tens of billions” in additional AI capex through 2026, betting that whoever owns the infrastructure layer wins the next computing cycle.

The timing catalyst everyone’s watching: Berkshire Hathaway’s new 17.8 million share position worth roughly $4.3 billion. Warren Buffett doesn’t typically buy $3 trillion market cap growth stocks. When he does, it signals that even legendary value investors see durable competitive advantage at reasonable—if not cheap—prices.

But here’s what the optimists are missing: AI compute is more expensive than search infrastructure, and monetization hasn’t proven scalable yet. Generative AI answers consume significantly more compute per query than traditional blue-link results. If Alphabet can’t charge proportionally more for AI-enhanced search, margin compression becomes inevitable as adoption scales.

The company is also navigating meaningful regulatory headwinds. A U.S. court found Google maintained an illegal search monopoly in 2024, ordering behavioral remedies that could loosen default search contracts and mandate data sharing with competitors. The European Commission continues to watch Android, Search, and ads with multi-billion-dollar fine authority. These aren’t break-up threats yet, but they’re definitely “cap the terminal growth rate” factors.

The risks that invalidate the thesis

Let’s talk about what breaks this investment in specific, measurable terms:

Risk #1: AI margin compression below 25% operating margin. If generative AI inference costs don’t decline fast enough relative to monetization gains, Alphabet faces a world where growth comes at the expense of profitability. Watch quarterly operating margins. If they trend sustainably below 25%, the premium multiple evaporates fast.

Risk #2: Cloud growth decelerating below 20% annually. Google Cloud’s 34% growth rate is what justifies the “second leg” narrative. If that drops below 20% before Cloud achieves AWS-level scale, the rerating story dies. This becomes clear by Q2 2026.

Risk #3: Search market share erosion past 85%. Current 90% share has room for regulatory-mandated degradation. Below 85% suggests ChatGPT or other AI-native interfaces are genuinely substituting core search volume. That scenario requires immediate re-underwriting.

Risk #4: Capex escalation above $100 billion without corresponding revenue acceleration. Management is guiding $91-93 billion for 2025. If that number climbs above $100 billion in 2026-2027 while revenue growth stays in the mid-teens, free cash flow generation stalls. The market will punish that mismatch.

Risk #5: Regulatory structural remedies instead of behavioral fixes. A forced break-up—separating Search, YouTube, Android, and Cloud—would destroy bundling synergies and vertical integration advantages that underpin the current valuation. Low probability, but terminal if it happens.

Where to buy, hold, and trim

Using Bayesian blended fair value near $243 and volatility-adjusted bands, here’s the systematic framework:

Strong Buy: $180 and below

This is 0.75x posterior fair value—a level that implies either broad market panic or company-specific crisis. For long-term capital deployment, this represents exceptional entry into one of the world’s highest-quality businesses at a generational discount. Expect to see these levels perhaps once per decade during genuine market dislocations.

Primary Buy: $180-219

The opportunistic add zone. Price sits 0.75-0.90x fair value with manageable multiple compression risk and positive expected returns over 3-5 year horizons. These levels typically appear during sector rotations, macro scares, or temporary earnings disappointments that don’t impair long-term fundamentals.

Hold / Neutral: $219-267

Fair value zone. Expected 12-month returns in the mid-single digits, mostly from earnings growth plus dividend. This is “maintain your core position” territory, not “back up the truck” territory. If GOOGL represents appropriate portfolio weight, do nothing. If overconcentrated, begin systematic trimming.

Trim: $267-316

Current price of $276 sits squarely here. At 1.10-1.30x posterior fair value, the market is pricing in best-case AI scenarios. For holders with massive embedded gains like yours, this is the zone to opportunistically reduce concentration. Take 10-25% off when prices spike toward $300+ on news events or earnings beats.

Too Expensive: $316 and above

Requires sustained multiple expansion to 28-30x earnings or aggressive analyst upgrade cycles to justify. At these levels, downside risk dominates upside potential over 12-24 month horizons. Avoid new purchases entirely and actively de-risk oversized positions.

The 12-month outlook

Base case scenario (55% probability): Price drifts toward $295 over the next year. AI and Cloud narratives remain supportive without reaching euphoria. P/E multiple holds in the mid-20s. Earnings estimates nudge modestly higher. Total return roughly +7% including dividend.

Bull case (25% probability): Price reaches $330. AI infrastructure leverage becomes evident in margins. Cloud accelerates past 40% growth. Berkshire’s endorsement pulls in more institutional capital. Multiple expands toward 28x. Total return approximately +20%.

Bear case (20% probability): Price corrects toward $220. Macro weakness or tech rotation drives multiple compression back to 20-22x earnings. AI capex concerns escalate. Regulatory headlines intensify. Fundamentals remain solid but market demands cheaper entry. Total return roughly -20%.

Scenario-weighted expected return from current levels: approximately 4-5% over 12 months. That’s acceptable but not compelling, especially given concentration risk and opportunity cost of capital deployment elsewhere.

What this means for your specific situation

You’ve owned Google since the mid-2000s at prices below $10 per share. It’s still your largest position. You have deep fundamental edge in search, SEM, and the Google ecosystem. The Berkshire endorsement confirms your long-term conviction was correct.

Given that context, the strategy is straightforward:

Maintain GOOGL as a core multi-decade holding. The business quality and competitive moat justify permanent portfolio presence. Don’t sell out of tax optimization or momentum chasing. This is a compounder worth holding through cycles.

Use $270-320 as a systematic rebalancing band. If the position creeps above target allocation, trim 10-25% opportunistically. The goal isn’t market timing—it’s managing concentration risk at favorable prices. Treat strength as a gift for risk management, not a reason to hold everything forever.

Treat moves under $220 as serious add opportunities. These represent 5-10% portfolio moves, not token 1% position adds. Build shopping lists now for capital deployment if market volatility creates entry points. Any panic toward the high $190s is the kind of “reload” moment you likely only see a few times per decade.

Watch the quarterly operating margin and Cloud growth rate religiously. If operating margins trend below 25% or Cloud growth decelerates below 20%, reassess immediately. These are the leading indicators that would invalidate the premium multiple hypothesis.

The uncomfortable truth: at $276, Alphabet is priced for quality you’re getting, not for explosive upside you’re hoping for. That doesn’t make it a sell—it makes it a trim-and-wait opportunity where discipline matters more than conviction.

Master Metrics Table

| Metric | Value | Notes |

|---|---|---|

| Ticker | GOOGL (Class A) | |

| Sector | Technology | Communication Services |

| Current Price | ~$276 | As of recent trading |

| Market Cap | ~$3.36 trillion | Among largest globally |

| Vulcan Posterior FV | ~$243 | Bayesian blended fair value |

| Margin of Safety | -13 to -16% | Currently overvalued |

| Trailing P/E | ~27x | Above 3Y/5Y averages |

| Forward P/E | ~25x | Moderate premium |

| 3Y Average P/E | ~22.5x | Historical context |

| 5Y Average P/E | ~23.3x | Historical context |

| Quality Score | 96/100 | Elite tier |

| ROIC | ~30% | Exceptional capital efficiency |

| Operating Margin | 30-34% | Industry-leading |

| FCF Margin | ~19% | Strong cash conversion |

| FCF (TTM) | $73.6 billion | Real cash generation |

| Debt/Equity | ~0.1 | Fortress balance sheet |

| Revenue (Q3 2025) | $102.3 billion | First $100B+ quarter |

| Revenue Growth (YoY) | 16% (15% cc) | Accelerating |

| Cloud Revenue | $15.2B quarterly | ~$60B+ annual run rate |

| Cloud Growth | 34% YoY | Faster than AWS/Azure |

| Dividend Yield | ~0.30% | Growing from new base |

| Annual Dividend | $0.84 | Initiated 2024 |

| Buyback Yield | ~2% | Consistent repurchases |

| Total Shareholder Yield | ~2.3% | Combined return stream |

| 2025 Capex Guidance | $91-93 billion | AI infrastructure build |

| Strong Buy Zone | ≤$180 | 0.75x FV_post |

| Primary Buy Zone | $180-219 | 0.75-0.90x FV_post |

| Hold Zone | $219-267 | 0.90-1.10x FV_post |

| Trim Zone | $267-316 | 1.10-1.30x FV_post |

| Too Expensive | ≥$316 | >1.30x FV_post |

| Berkshire Position | 17.8M shares (~$4.3B) | Notable endorsement |

| Key Catalyst #1 | AI infrastructure monetization | H1 2026 clarity |

| Key Catalyst #2 | Cloud profitability acceleration | Ongoing quarterly |

| Key Catalyst #3 | Regulatory remedy finalization | 2025-2026 timeline |

Leave a comment