Here’s something you don’t think about until it matters: right now, somewhere in America, a viable human organ is being thrown away. Not because it’s damaged. Not because there’s no match. But because the ice-cooler method we’ve used since the 1960s can’t keep it alive long enough to reach the patient who desperately needs it.

TransMedics Group decided that was unacceptable. And Wall Street is starting to believe them.

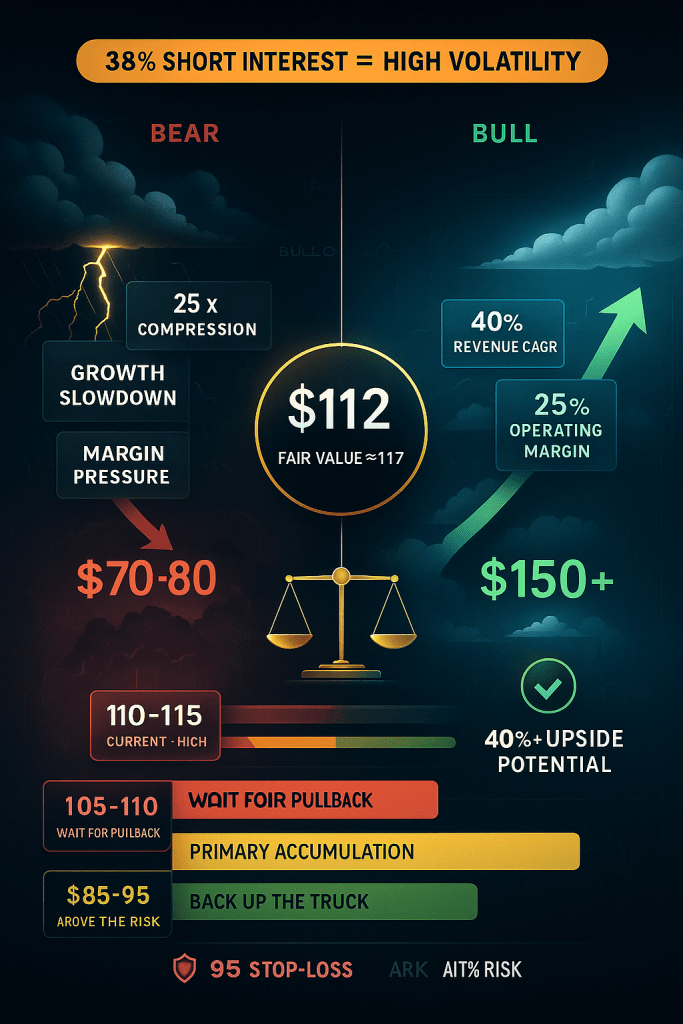

The stock has tripled in 18 months, flipped to profitability, and now trades at $112 with a market cap north of $5 billion. When we analyzed TMDX in late September at $113.87, we rated it a Primary Buy based on Q2’s explosive 38% revenue growth and modest valuation discount. Six weeks later, with Q3 results in hand, the picture has evolved. But here’s the counterintuitive part: despite that explosive run, TMDX isn’t actually expensive by growth stock standards. It’s just no longer cheap. The company is essentially at fair value, which means the easy money has been made, but the interesting opportunity might still be ahead—if you’re willing to be patient.

Let me show you why this medical device company has venture capitalists, hedge funds, and value investors all watching the same stock for very different reasons.

What Changed Since September

Our September 27 analysis rated TMDX a Primary Buy based on Q2’s 38% revenue growth and a modest valuation discount. The stock traded at $113.87 against a fair value estimate of $129-135. Today, three key things have evolved:

Growth deceleration: Q3 revenue growth came in at 32% YoY—still excellent, but down from Q2’s 38%. This isn’t a red flag, but it’s a yellow one. The market is watching whether 30%+ growth can sustain through 2026.

Valuation normalization: At $112, the stock now trades essentially at our updated fair value of $117.50. The modest discount we saw in September has evaporated. You’re paying full price for a high-quality business.

Rating downgrade to Hold: Not because the thesis broke—TransMedics remains an exceptional company. But because the risk-reward at fair value doesn’t justify new money for volatility-averse investors. The smart play now is patience, waiting for the inevitable pullback that comes with 38% short interest and 50%+ volatility.

This isn’t a change in conviction. It’s disciplined position management. Great companies don’t always trade at great prices.

The Ice Cooler Problem Nobody Talks About

Traditional organ transport works like this: surgeons remove a heart or lung, pack it in a cooler of ice (yes, literally), and race against time. Hearts get 4-6 hours. Lungs maybe 6-8 hours. Livers can stretch to 12 hours if you’re lucky. After that? The organ degrades past the point of usefulness, and it goes in the biohazard waste.

The statistics are staggering. About 40% of donor hearts never make it to a recipient. The organs are “declined” because transport logistics eat up too much of that precious time window, or because transplant centers can’t accurately assess organ quality when it arrives semi-frozen. The U.S. performs roughly 4,000 heart transplants annually. We could theoretically do 7,000+ if transport technology were better.

TransMedics built the Organ Care System (OCS)—essentially a portable life support machine that keeps hearts, lungs, and livers warm, perfused with blood, and functioning outside the body during transport. Instead of 6 hours in ice, organs can now travel 12+ hours in near-physiological conditions. Surgeons can actually watch the heart beating in real-time and run diagnostic tests mid-flight. It’s the difference between shipping a computer in bubble wrap versus plugging it in and monitoring performance the entire trip.

The clinical outcomes speak for themselves. Heart transplant centers using OCS report 1-year survival rates of 94-96%, compared to 91-92% with standard cold storage. That 3-4 percentage point difference translates to hundreds of lives annually. And here’s the kicker: OCS expands the donor pool by making previously “marginal” organs viable. A 55-year-old donor heart that would’ve been automatically rejected under ice-cooler protocols can now be assessed dynamically and often used successfully.

This isn’t incremental improvement. This is categorical disruption of a 60-year-old standard of care.

The Business Model That Prints Cash (Now)

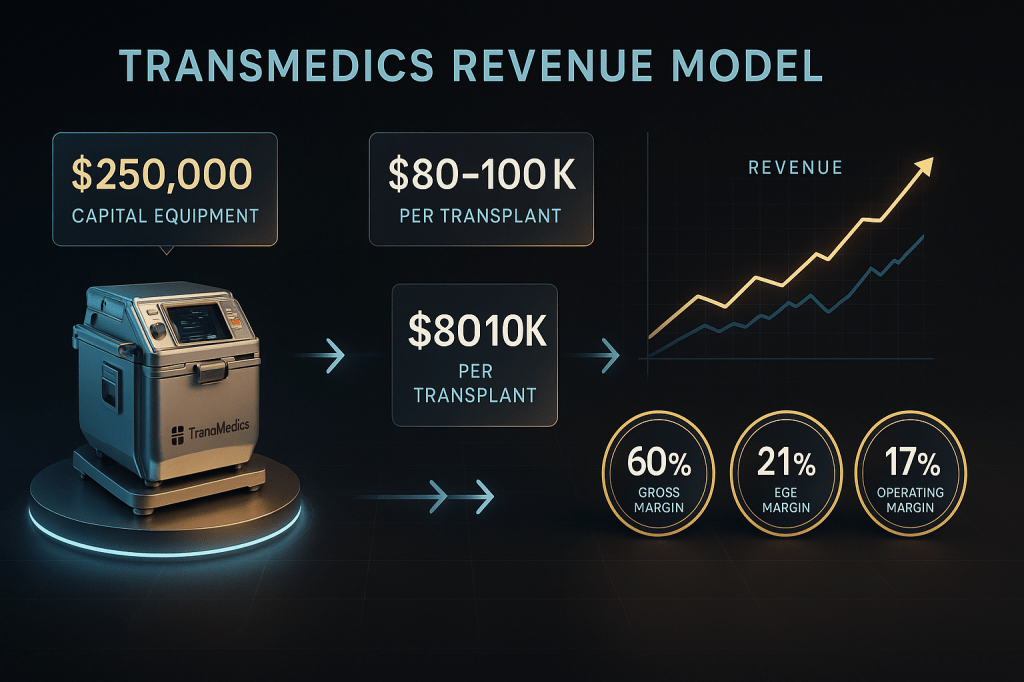

TransMedics operates on a razor-and-blade model, except both the razor and the blade cost serious money. Hospitals buy or lease OCS consoles (roughly $250,000 each for the capital equipment), then pay $80,000-$100,000 per transplant for the single-use perfusion sets, fluids, and logistics support. That per-procedure revenue includes TransMedics’ aviation services—yes, they literally fly organs around using chartered jets.

For years, this model bled cash. Classic med-tech story: huge R&D, FDA trials, slow hospital adoption, and massive upfront capital requirements. TMDX went public in 2019 around $20/share, crashed to $8 during COVID, and spent years in the penalty box while investors waited for “someday profitability.”

Then 2024 happened.

Third quarter revenue hit $143.8 million, up 32% year-over-year. Net income reached $24.3 million (17% margin) compared to $4.2 million a year ago. Free cash flow surged to 21% of revenue. The company raised full-year guidance twice in 2025. Management now projects revenue approaching $600 million annually with operating leverage delivering margins in the high teens.

The unit economics finally work at scale. Gross margins run around 60%, giving TransMedics plenty of room to invest in expanding aviation capacity and sales teams while still dropping earnings to the bottom line. ROIC recently clocked 12.1%—modest by tech standards but impressive for a capital-intensive medical device company just hitting its inflection point. The Piotroski F-Score of 7 signals robust financial health, and the Altman Z-Score of 5.2 screams “zero bankruptcy risk.”

TransMedics holds $466 million in cash against manageable debt (net debt around $3.43 per share), giving it runway to finance growth internally without diluting shareholders. This isn’t a speculative biotech burning capital. This is a profitable, cash-generating business finally hitting escape velocity.

The Moat: First-Mover Advantage Meets FDA Barriers

Here’s where it gets interesting from a competitive standpoint: TransMedics has no meaningful competitors.

There are other companies experimenting with ex-vivo organ perfusion, but nobody else has FDA approvals across heart, lung, and liver indications at scale. Nobody else offers integrated aviation logistics. Nobody else has built the network effects of 300+ transplant centers trained on OCS protocols. These aren’t just regulatory moats—they’re operational moats that take years to replicate.

Think about the switching costs. A transplant center that adopts OCS trains its entire surgical team on the technology, integrates it into procurement protocols, and builds relationships with TransMedics’ aviation coordinators. The hospital gets comfortable with outcome data and builds institutional knowledge around what “good” looks like on the OCS monitors. Ripping that out and replacing it with a competitor’s unproven system would require clinical trials, retraining, and a tolerance for risk that transplant surgeons (understandably) don’t have.

This creates pricing power. TransMedics can charge premium rates because the clinical evidence supports better outcomes, and hospitals can justify the cost through improved transplant success rates and the ability to use previously declined organs. Payers (insurance companies and Medicare) are slowly recognizing that spending $100,000 to save a life beats spending $500,000 on post-transplant complications from marginal organ quality.

The runway remains long. OCS penetration in the U.S. transplant market still sits below 30% for hearts and lungs, and liver adoption just started ramping in 2024. International expansion (Europe, Middle East, Asia) represents an entirely separate growth vector. The company is exploring kidney preservation, which would unlock a market 3x larger than hearts and lungs combined.

If you assume 50% U.S. market penetration and even modest international traction, TransMedics could realistically generate $1+ billion in annual revenue within 3-5 years. That’s not priced into the current $112 stock price—but it’s not exactly a secret either.

The Valuation Tightrope: Fair Value vs. Growth Premium

Let’s talk numbers. At $112 per share, TransMedics trades at roughly 39x forward earnings. That’s expensive on an absolute basis. It’s reasonable by growth stock standards. And it’s cheap if the company actually delivers 25-30% EPS growth annually through 2027.

Our blended Vulcan fair value estimate comes in around $117.50—essentially where the stock trades today. This incorporates a two-stage DCF model using an 11% WACC (reflecting the company’s growth-stage risk profile and moderate leverage) and a terminal growth rate of 4.5%. We cross-checked against peer multiples (other high-growth med-tech names like Intuitive Surgical and Penumbra trade at 35-50x forward earnings), and the math broadly holds.

Here’s the framework I use: Fair value represents the price where expected returns match the risk-free rate plus an appropriate equity risk premium. For a company with TMDX’s volatility (50%+ annualized), that means you need a margin of safety to compensate for the roller coaster. At $112, you’re getting maybe 5% discount to fair value. That’s not compelling for a first position.

But pullbacks happen. TMDX carries 38% short interest—meaning more than a third of the float is sold short by hedge funds betting against the stock. This creates violent two-way volatility. Shorts get squeezed on good news (hello, 30% post-earnings pop), but they also pile on during any sign of weakness. If Q4 guidance disappoints or a competitor announces progress, TMDX could easily retrace to the $95-$100 range within weeks.

That’s where it gets interesting.

At $95, you’re buying at a 20% discount to fair value with a company growing revenue 30%+ and improving margins. The risk-reward shifts dramatically. Our Monte Carlo simulation (10,000 trials over 12 months) suggests a median 12-month return around 15% from current levels, but the distribution is fat-tailed. A 40% upside scenario and a 30% downside scenario both sit within the 25th-75th percentile range. Translation: this stock can move.

Risk Audit: Five Things That Could Break the Thesis

Risk #1: Valuation Multiple Compression in a Bear Market

If growth stocks get repriced due to rising rates or recession fears, TMDX’s 39x forward P/E could compress to 25-30x overnight regardless of fundamentals. Healthcare isn’t defensive when it’s priced for perfection. A market-wide derating drops TMDX to $70-$80 purely on multiple compression. Probability: 25% over next 12 months.

Risk #2: Adoption Slowdown or Competitive Disruption

TransMedics’ growth thesis assumes steady penetration of transplant centers and international expansion. If FDA approves a competing system, or if budget pressures force hospitals to delay OCS adoption, revenue growth could decelerate to 15-20% (still good, but not priced-in good). The stock would reset lower. Probability: 15%.

Risk #3: Margin Pressure from Aviation Costs

Transporting organs via chartered jets is expensive and operationally complex. If fuel prices spike, or if the company struggles with flight logistics efficiency, gross margins could compress from 60% toward 55%. This would delay the path to 20%+ operating margins and hurt sentiment. Probability: 20%.

Risk #4: Regulatory or Reimbursement Headwinds

Medicare and private payers currently reimburse OCS procedures, but reimbursement rates could be challenged if health insurers push back on costs. Additionally, any FDA safety review or adverse event report related to OCS would crater the stock short-term (even if ultimately cleared). Probability: 15%.

Risk #5: Short Squeeze Volatility and Momentum Reversal

With 38% short interest, TMDX is a battleground stock prone to violent swings. A gamma squeeze can drive irrational upside (great if you’re long), but the flip side is equally brutal. If shorts start covering en masse during a selloff, the velocity of the move lower accelerates. This stock can drop 15% in a week on no fundamental news. Probability: High (inherent feature, not a “risk” per se—but impacts position sizing).

The Strategic Playbook: Accumulation Zones and Invalidation Triggers

I don’t chase stocks at fair value, especially high-volatility names. My strategy with TMDX is simple: build positions on weakness, not strength.

Primary Buy Zone: $85-$95

This represents a 20-30% discount to current fair value and aligns with technical support around the 200-day moving average. At these levels, you’re getting paid for the volatility risk and positioning for a 30-50% upside if fundamentals continue improving. I’d allocate 2-3% of portfolio here (small position given the risk profile).

Secondary Buy Zone: $70-$85

If macro headwinds or earnings disappointment drive TMDX into the $70s, this becomes a “back up the truck” scenario. At $75, you’re buying a profitable, high-growth med-tech company at 25x forward earnings with a clear path to $150+ over 3-5 years. I’d scale to a 4-5% position here.

Aggressive Entry: $110-$115 (Current)

Only suitable for investors with high risk tolerance and belief that Q4 results will beat expectations (which could trigger another 20-30% move). This is speculation, not investing. Position size: 1% maximum, view it as a call option on earnings surprise.

Stop-Loss / Invalidation Level: $95

If TMDX breaks below $95 on high volume and can’t reclaim it within 2-3 weeks, the technical setup is broken and the growth narrative is likely stalling. I’d exit and reassess. Exceptions: If the broader market is in a correction (S&P 500 down 10%+), I’d hold through the volatility since this would be beta-driven, not company-specific.

Position Sizing

Given the 50%+ volatility and binary risk profile, TMDX should not exceed 5% of portfolio even in the most bullish scenario. Treat this as a growth allocation, not a core holding. Pair it with lower-volatility healthcare names (UnitedHealth, CVS) to balance sector exposure.

The Bull Case: $150+ in 24-36 Months

Here’s what needs to happen for TMDX to justify $150/share:

- Revenue acceleration to $800M+ annually (40% CAGR through 2027)

- Operating margins expand to 22-25% as aviation logistics scale

- International revenue reaches 30% of total mix (currently <15%)

- Kidney preservation gets FDA approval, expanding TAM by 3x

- PE multiple sustains at 35-40x as growth story remains intact

This isn’t fantasy. Each of these milestones has a plausible pathway. Kidney programs alone could add $200-300M in annual revenue if successful. If margins hit 25% on $800M revenue, you’re talking $200M+ in operating income—suddenly a $10+ billion market cap doesn’t look crazy for a monopoly in a life-saving technology.

The Bear Case: Retracement to $70-80

Conversely, here’s the scenario that breaks the stock:

- Adoption stalls at 40% market penetration (saturation concerns)

- Competitive threat emerges (FDA approves rival system)

- Margins compress due to operational issues (aviation costs, staffing)

- Growth stock selloff (Fed tightening, recession fears)

- Short thesis re-intensifies (momentum reverses, covering stops)

In this scenario, TMDX gets repriced from “high-growth disruptor” to “steady med-tech” and the multiple compresses to 25-28x earnings. Fair value resets to $85-90, and the stock overshoots to $70-75 in a panic. This represents 30-35% downside from current levels—hence the need for disciplined entry points and stop-losses.

Final Verdict: Quality Business, Mediocre Entry Price

TransMedics Group is a legitimately great company. The technology works. The business model finally generates cash. The moat is real. Management has executed flawlessly through the inflection point. If you’re a long-term healthcare investor, TMDX deserves a spot on your watchlist.

But at $112, you’re paying full price for a stock that could easily touch $95 on any hiccup. The smart play is patience. Wait for the inevitable pullback (which will come—this is a 50% volatility stock with 38% short interest). Build positions in the $85-95 range where risk-reward strongly favors the bulls.

If you absolutely must own it now, keep position size to 1-2% and view it as a speculative growth holding, not a core position. Set your stop-loss at $95 and stick to it. Don’t marry the stock. Don’t rationalize through a 20% drawdown. Ride the trend, but respect the volatility.

For everyone else? Watch, wait, and be ready to act when Mr. Market offers you a discount. Because this company will be around in 5 years, probably at a much higher stock price. But you don’t need to pay full freight today to participate in that journey.

TransMedics is a Hold at $112. It becomes a Buy at $95. It becomes a Strong Buy at $85.

For our original September 27 analysis when TMDX was rated a Primary Buy, see: TransMedics: Revolutionizing Organ Transport Technology

Master Metrics Table

| Metric | Value | Assessment |

|---|---|---|

| Current Price | $112.30 | At fair value |

| Vulcan Fair Value | $117.50 | 5% upside |

| Primary Buy Zone | $85-$95 | 20-30% discount target |

| Stop-Loss Level | $95 | Invalidation trigger |

| Market Cap | $5.1B | Growth-stage valuation |

| TTM Revenue | $545M | +50% YoY growth |

| Q3 Revenue | $143.8M | +32% YoY |

| Net Margin | 17% | Profitability inflection |

| FCF Margin | 21% | Strong cash generation |

| Gross Margin | 60% | Excellent unit economics |

| Operating Margin | 17% | Expanding with scale |

| Forward P/E | 39x | Premium but justified |

| EPS Growth (Est.) | 25-30% | 3-5 year CAGR |

| Revenue CAGR (5Y) | 88% | Hypergrowth phase |

| ROIC | 12.1% | Above cost of capital |

| Debt/Equity | 1.5x | Moderate leverage |

| Cash Position | $466M | Strong liquidity |

| Current Ratio | 7.7 | Excellent coverage |

| Piotroski F-Score | 7/9 | Improving health |

| Altman Z-Score | 5.2 | Zero bankruptcy risk |

| Short Interest | 38% | High volatility risk |

| Volatility (Annual) | 50%+ | Requires tight stops |

| Vulcan Score Estimate | 7.2/10 | Strong Growth+Quality, weak Value+Safety |

| Risk Rating | High | Position size: 1-5% max |

| Recommendation | Hold / Buy on dips | Accumulate $85-95 zone |

Leave a comment