Wall Street loves a good growth story. But what if I told you that one of America’s fastest-declining industries is simultaneously generating some of its highest profit margins in history?

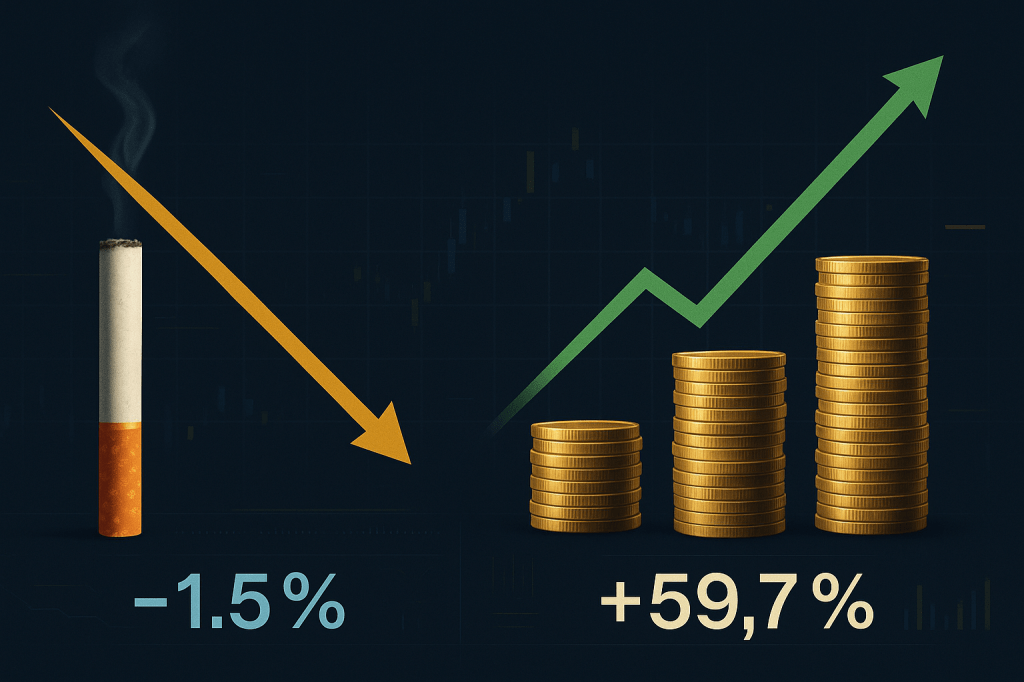

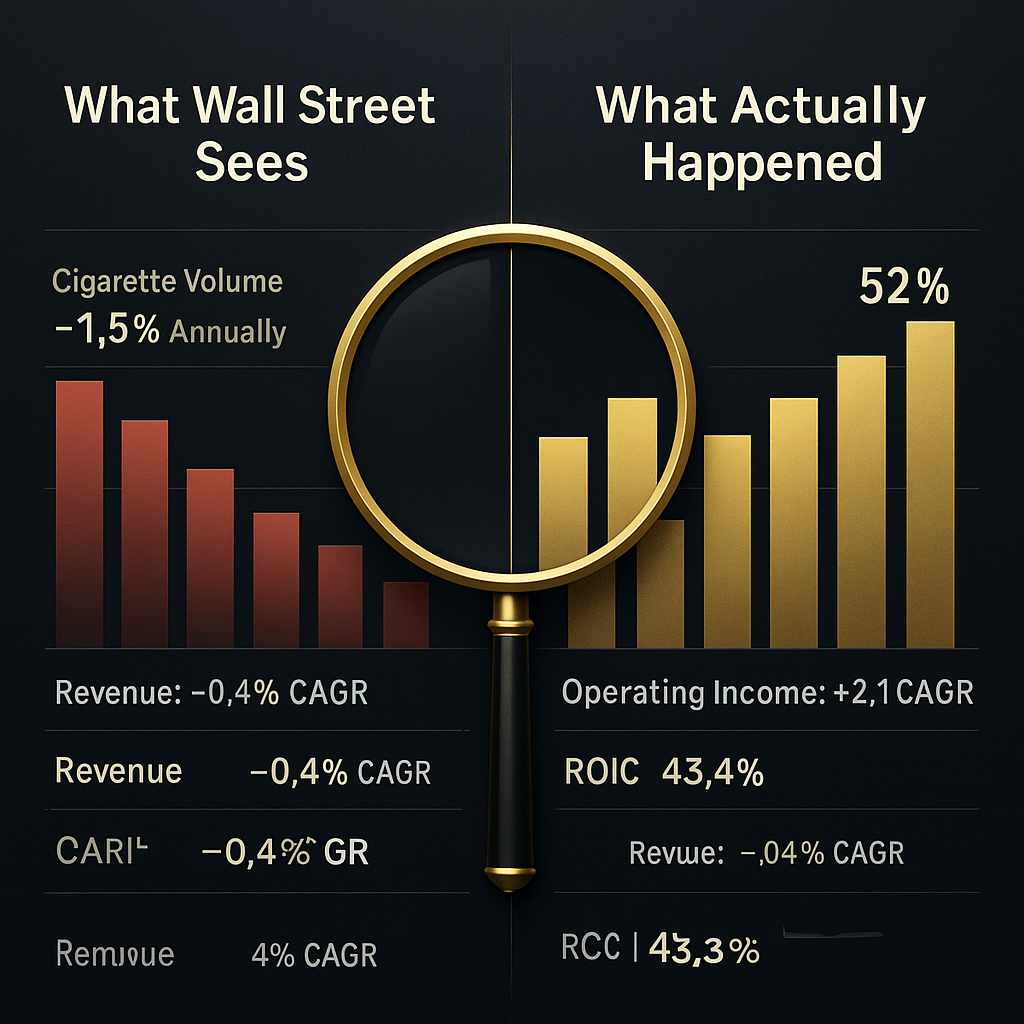

Altria (MO) sold 1.5% fewer cigarettes last quarter. Revenue dropped 1.0% year-over-year. The smoking rate among U.S. adults has plummeted from 42% in 1965 to just 11.3% today.

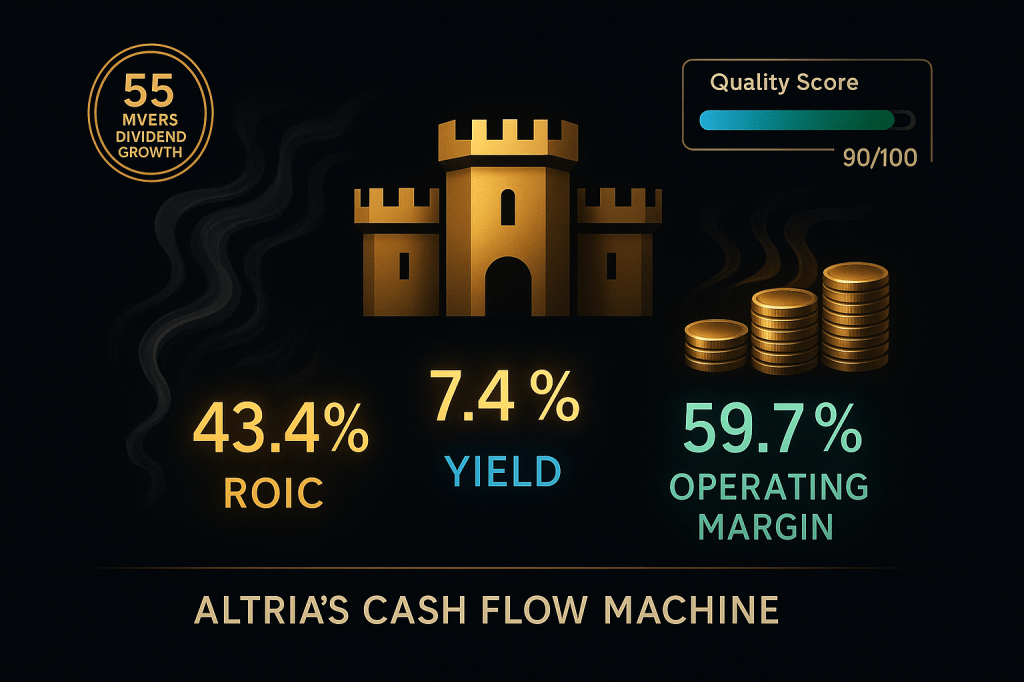

Yet here’s what actually happened: operating margins expanded to 59.7%—the highest in company history. Free cash flow surged to 45.6% of sales. Return on invested capital hit 43.4%. And shareholders collected a 7.4% dividend yield backed by 55 consecutive years of increases.

This isn’t a turnaround story. It’s a masterclass in harvesting a declining franchise so efficiently that profits grow even as volumes shrink. The question isn’t whether Altria will decline. The question is whether management can keep extracting more profit per cigarette faster than smokers quit.

Right now, the data says yes.

The Math That Breaks Conventional Wisdom

Altria generated $20.2 billion in trailing revenue—down from $20.4 billion five years ago (-0.4% CAGR). Volume dropped 1.5% last quarter. But despite shrinking volumes, gross margin expanded to 72.0% from 65.6%. Operating margin jumped to 59.7% from 52.2%. Net margin reached 44.0%, nearly double the 22.7% posted three years ago.

This defies how declining businesses typically work. The secret lies in three compounding dynamics:

Pricing power that defies elasticity: Altria raised prices 8-9% annually over five years. Smoking is one of the most inelastic products in consumer markets—habitual users accept price increases rather than quit.

Mix shift toward premium: Marlboro’s market share expanded to 42.1% from 40.8%. As discount smokers quit first, Altria’s mix tilts toward higher-margin premium brands.

Operating leverage from cost discipline: Marketing dropped to just $33 million quarterly. Altria cut costs faster than volumes declined.

Result? While revenue fell 0.4% annually, operating income grew 2.1% annually. EPS expanded at 17.5% annually. This is alchemy—turning volume decline into earnings growth.

Quality That Hides Behind a Sin-Stock Discount

Vulcan’s Quality Score of 90/100 places Altria in the top decile of all U.S. stocks. ROIC of 43.4% ranks among the highest in consumer staples—Apple’s is 32%, Google’s is 27%, Coca-Cola’s is 18%.

The business model’s simplicity breeds extraordinary efficiency: capex runs just 0.9% of sales (near-zero reinvestment), FDA regulation creates a fortress moat (no new competitors), and tobacco demand is remarkably stable quarter-to-quarter.

Safety Score of 98/100 reflects this stability. Volatility runs just 19.6% annually versus 27.6% for the S&P 500. Beta of 0.14 means when the S&P drops 10%, Altria typically falls just 1.4%. This is a bond with a 7.4% coupon that occasionally appreciates.

The Dividend Engine: 55 Years and Counting

Current yield: 7.4%—that’s 4.9 percentage points above the 10-year Treasury. Payout ratio: 78.6%. Free cash flow coverage: 1.27x. Dividend growth: 4.3% annually over five years.

The dividend’s safety rests on three pillars:

The FCF machine: $9.2 billion in free cash flow supports a $7.1 billion dividend bill (77% of FCF), leaving $2.1 billion for buybacks and deleveraging.

The pricing treadmill: As long as Altria can raise prices 6-8% annually while volumes decline only 2-3%, operating income grows.

The balance sheet: Debt-to-capital runs 111% (reflecting buybacks, not distress). Interest coverage of 10.2x. Credit rating: BBB with positive outlook. Bankruptcy risk: 7.5% over 30 years.

Valuation: What the Market Actually Pays

Stock Rover fair value: $67.66. Zen Research blended: $52.75. Midpoint: ~$62. Current price: $57.26.

At $57.26, Altria trades at 10.2x forward P/E (S&P 500: 25.8x), 6.5% FCF yield (S&P 500: 2.7%), and 9.8x EV/EBITDA (S&P 500: 25.8x).

Scenario analysis:

If volumes decline 2% annually and pricing holds at 7% (base case), revenue stays flat, margins hold at 58-60%, and FCF per share grows 2-3% annually to $6.00+ by Year 5. Fair value: $62-70.

If regulatory pressure intensifies and pricing fades to 5% (bear case), margins compress to 55% and FCF per share drops to $4.80. Fair value: $48-52. Even here, the 7.4% yield generates $20+ in income over five years.

Probability-weighted fair value: $62-68. At $57.26, Altria offers 8-19% upside plus 7.4% yield—not enormous margin of safety, but attractive risk/reward for income portfolios.

The Risks They Don’t Advertise

Risk #1: Regulatory Shock (20% probability, severe impact) – FDA could mandate reduced nicotine levels, collapsing smoking rates and pricing power. FCF could drop 40-50%. Mitigation: FDA has studied this for decades without action; implementation would take 3-5 years.

Risk #2: Accelerating Social Stigma (40% probability, moderate impact) – Gen Z smoking rates are materially lower. If decline accelerates to 4-5% annually, pricing power can’t compensate. Mitigation: Smoking decline has been linear for 50+ years with no acceleration yet.

Risk #3: Price Ceiling Breaches (30% probability, moderate impact) – Packs now cost $8-10 in most states, $12-15 in high-tax states. Smokers may hit pain threshold. Mitigation: Elasticity studies suggest ceiling is higher than intuition suggests; addicted consumers tolerate extraordinary increases.

Risk #4: Litigation Wildcard (15% probability, severe) – New lawsuits could wipe out billions despite Master Settlement Agreement protections. Courts are unpredictable.

Risk #5: ESG Exclusion Deepens (60% probability, moderate) – Institutional ESG exclusions shrink buyer pool, suppressing valuations. The sin-stock discount could widen from 30% to 50%. Mitigation: Already reflected in 10.9x P/E; discount can’t widen forever.

Bottom line: Most risks are slow-moving. Altria won’t collapse overnight. Monitoring quarterly allows exits if trends deteriorate.

The Technical Picture

Current: $57.26, down 16.5% from $68.60 high

Support: $54-56 (primary), $50-52 (secondary)

Resistance: $62-64 (200-day MA), $68-70 (fair value)

Technicals: Below all major moving averages, RSI at 42 (neutral), MACD bearish but flattening

The setup suggests consolidation after sharp decline. Not oversold enough for bounce, but testing two-year support. For value buyers, current level offers price below moving averages, proximity to support, and 7.4% yield cushion.

The Actionable Strategy

Position sizing: 2-5% for income portfolios, 0-2% for growth portfolios, 0% for ESG portfolios.

Entry strategy – layered buying:

- Zone 1 ($55-58): Start with 33% of position – below moving averages, near support

- Zone 2 ($50-54): Add 33% if drops – multi-year support, improved risk/reward

- Zone 3 ($46-50): Complete with final 33% – 8-9% yield, extreme oversold

Dividend reinvestment: Automatic. At 7.4% yield, position doubles from dividends alone in 10 years.

Invalidation triggers – exit if:

- Dividend cut or freeze

- Operating margin falls below 50%

- Volume declines accelerate above 4% for two consecutive quarters

- Credit rating downgraded below BBB

- Break below $50 on volume

- FDA announces nicotine reduction mandate

Trim strategy:

- At $68-70: Trim 25%

- At $75-78: Trim another 25%

- At $85+: Exit to minimum position

The Verdict: Boring Is Beautiful (Sometimes)

Altria won’t make you rich quick. There’s no AI pivot, no disruptive technology, no visionary founder. It’s a 175-year-old company selling an addictive product that’s slowly going out of fashion.

But here’s what it offers: a 7.4% yield in a world where 10-year Treasuries pay 2.5%, 55 years of dividend growth through wars and recessions, 43.4% ROIC rivaling top tech companies, and Quality Score of 90/100 hidden behind a sin-stock discount.

For retirees needing income, this is compelling. For ESG investors, it’s untouchable. For value investors willing to hold a controversial name, it’s a grind-it-out winner delivering 10-12% annual returns if trends continue.

The market hates tobacco. But the market also pays you 7.4% annually to wait. And sometimes, getting paid to wait is the best strategy of all.

Current price: $57.26 | Fair value: $62-68 | Yield: 7.4% | Quality Score: 90/100

The math says buy carefully and collect checks. Sometimes, that’s enough.

Master Metrics Table

| Metric Category | Metric | Value | Interpretation |

|---|---|---|---|

| Valuation | Forward P/E | 10.2x | Deeply discounted vs 25.8x S&P 500 |

| FCF Yield | 6.5% | Elite vs 2.7% S&P 500 | |

| EV/EBITDA | 9.8x | Cheapest decile | |

| Quality | Quality Score | 90/100 | Top-decile quality |

| ROIC | 43.4% | Beats Apple (32%), Google (27%) | |

| Operating Margin | 59.7% | Best-in-class | |

| Piotroski F-Score | 7/9 | Solid financial health | |

| Safety | Safety Score | 98/100 | Elite stability |

| Volatility (1Y) | 19.6% | Low-volatility haven | |

| Beta (1Y) | 0.14 | Minimal market correlation | |

| Interest Coverage | 10.2x | Debt easily serviceable | |

| Dividend | Yield | 7.4% | Top-tier income |

| Dividend Safety | 5/5 | Maximum safety rating | |

| Consecutive Years | 55 years | Dividend aristocrat | |

| 5Y Dividend CAGR | 4.3% | Solid growth | |

| Growth | Sales 5Y CAGR | -0.4% | Volume decline headwind |

| Forward EPS Growth | 3.0% | Modest growth ahead |

Disclaimer: This analysis is for informational purposes only. Altria operates in the tobacco industry with unique regulatory, health, and social risks. Investors should consider their risk tolerance and values before investing. Past performance does not guarantee future results.

Analysis Date: November 8, 2025 | Vulcan-mk5 Framework | Quality Score: 90/100

Leave a comment