Picture this: A 67-year-old grandmother stands in her bathroom, holding yet another prescription cream that promises to clear her stubborn plaque psoriasis. She’s been down this road before—decades of messy ointments, skin-thinning steroids, and treatments that work for a few weeks before her symptoms roar back. But this time is different. This cream, ZORYVE, doesn’t contain a single molecule of steroid. And it’s working.

This grandmother’s experience isn’t just a feel-good anecdote—it’s the opening chapter of what could become one of biotechnology’s most dramatic turnaround stories. Arcutis Biotherapeutics (NASDAQ: ARQT) has engineered something rare in modern medicine: a genuinely novel approach to treating the most common inflammatory skin conditions. The company’s steroid-free roflumilast cream is rewriting the dermatology playbook, and the market is starting to notice. Shares have rocketed 79% year-to-date and nearly 200% over the past year, vastly outpacing broader market returns.

But here’s what most investors miss: This isn’t a story about a lucky drug approval or a one-hit wonder. This is a story about systematic market capture, expanding therapeutic territories, and a management team that’s actually delivering on its promises. Third-quarter 2025 ZORYVE sales hit $99.2 million—a staggering 122% surge versus the prior year. The company now guides toward $455-$470 million in ZORYVE revenue for 2026, which would represent another near-doubling in just twelve months.

The Steroid-Free Revolution Nobody Saw Coming

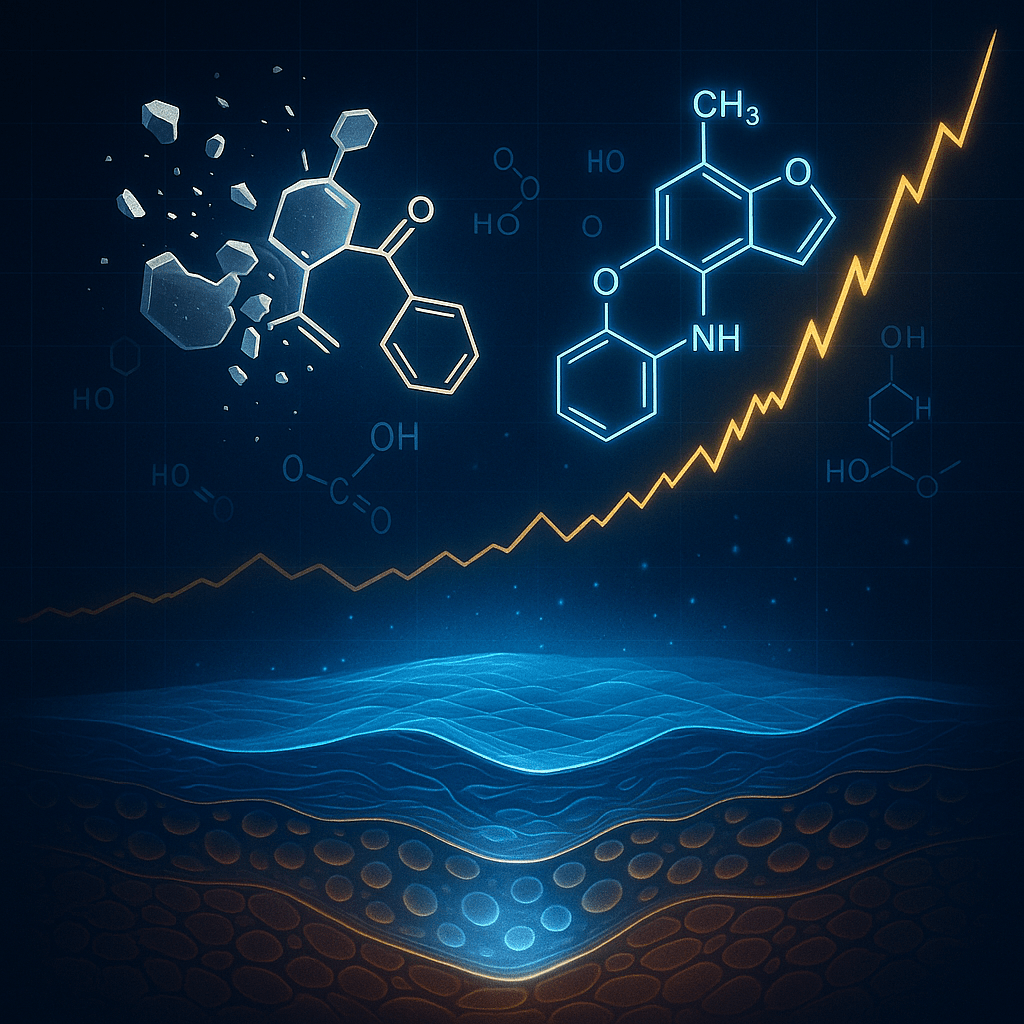

For decades, topical corticosteroids have dominated dermatology the way aspirin once ruled pain management—ubiquitous, effective for many, but carrying baggage that patients and physicians have learned to tolerate rather than embrace. Prolonged steroid use thins the skin, causes stretch marks, can lead to systemic absorption issues, and often triggers rebound inflammation when discontinued. It’s a Faustian bargain: temporary relief at the cost of long-term skin integrity.

Arcutis saw this vulnerability and built an entire franchise around it. ZORYVE harnesses roflumilast, a phosphodiesterase-4 (PDE-4) inhibitor that short-circuits the inflammatory cascade without touching the glucocorticoid pathway. Translation for the non-biochemist: It shuts down inflammation at its source while leaving your skin’s structural integrity completely intact. No thinning. No stretch marks. No rebounds.

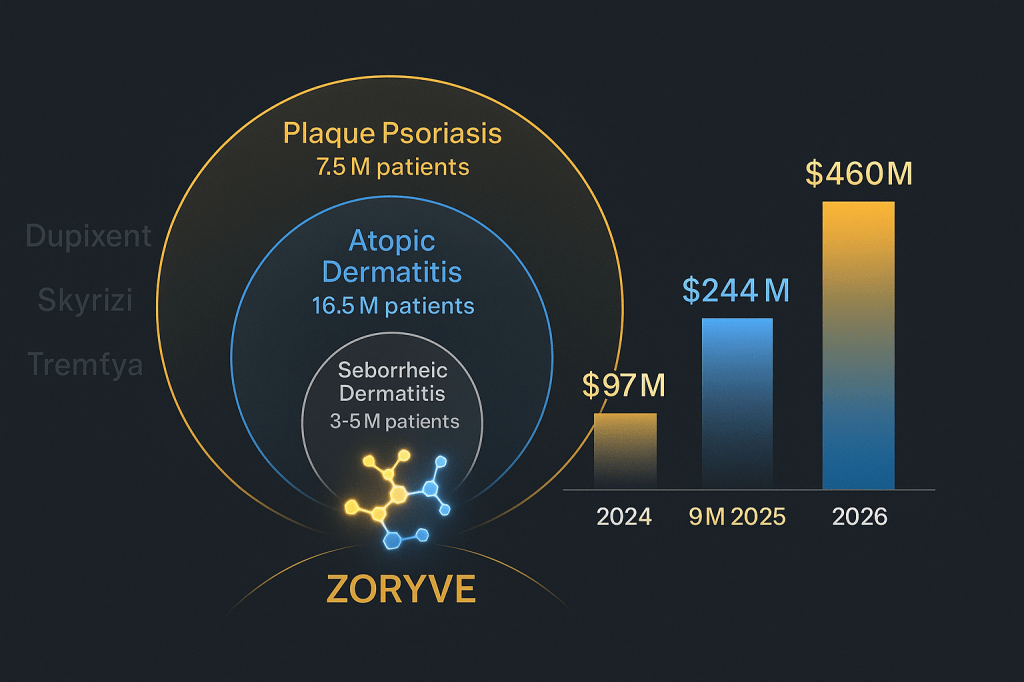

The addressable market is breathtaking in scope. Consider the numbers: Plaque psoriasis affects roughly 7.5 million Americans. Seborrheic dermatitis (think persistent dandruff and facial redness) touches 3-5% of the population. Atopic dermatitis—the condition that torments children and drives parents to desperation—afflicts 16.5 million Americans. Cumulatively, tens of millions of prescriptions flow annually toward traditional topicals and steroids. If ZORYVE captures even 15-20% of that sprawling market, peak sales could reach $2.6-3.5 billion. That’s not pie-in-the-sky projection; that’s the company’s own carefully modeled target based on current penetration trajectories.

Growth That Actually Shows Up in the Numbers

Here’s where Arcutis separates itself from the typical biotech hype cycle: The revenue growth isn’t just impressive on a percentage basis—it’s accelerating in absolute dollar terms. Nine-month 2025 product revenue reached $244.6 million versus $97.2 million in the same period of 2024. That’s a 152% surge, and it’s being driven by legitimate commercial fundamentals: expanded insurance coverage, foam and cream formulation launches that address different patient preferences, pricing power that reflects genuine clinical differentiation, and a sales force that’s actually converting physician interest into prescription volume.

The margin profile tells an equally compelling story. ZORYVE enjoys approximately 90% gross margins—third-quarter cost of goods sold ran just $8.7 million against $99.2 million in product sales. This isn’t a low-margin commodity business. Once Arcutis scales past its current investment phase in marketing and patient support (the company covers 90% of patient co-pays to drive adoption), the operating leverage will be dramatic. Every incremental dollar of ZORYVE revenue drops nearly straight to the bottom line.

And here’s the kicker: Arcutis is already approaching profitability faster than anyone expected. Third-quarter 2025 delivered GAAP net income of $7.4 million (earnings per share of $0.06) versus a $41.5 million loss in the year-ago period. That’s not a rounding error or an accounting gimmick—that’s real black ink on a path toward sustainable profitability by 2026-2027.

The Pipeline Optionality Nobody’s Pricing In

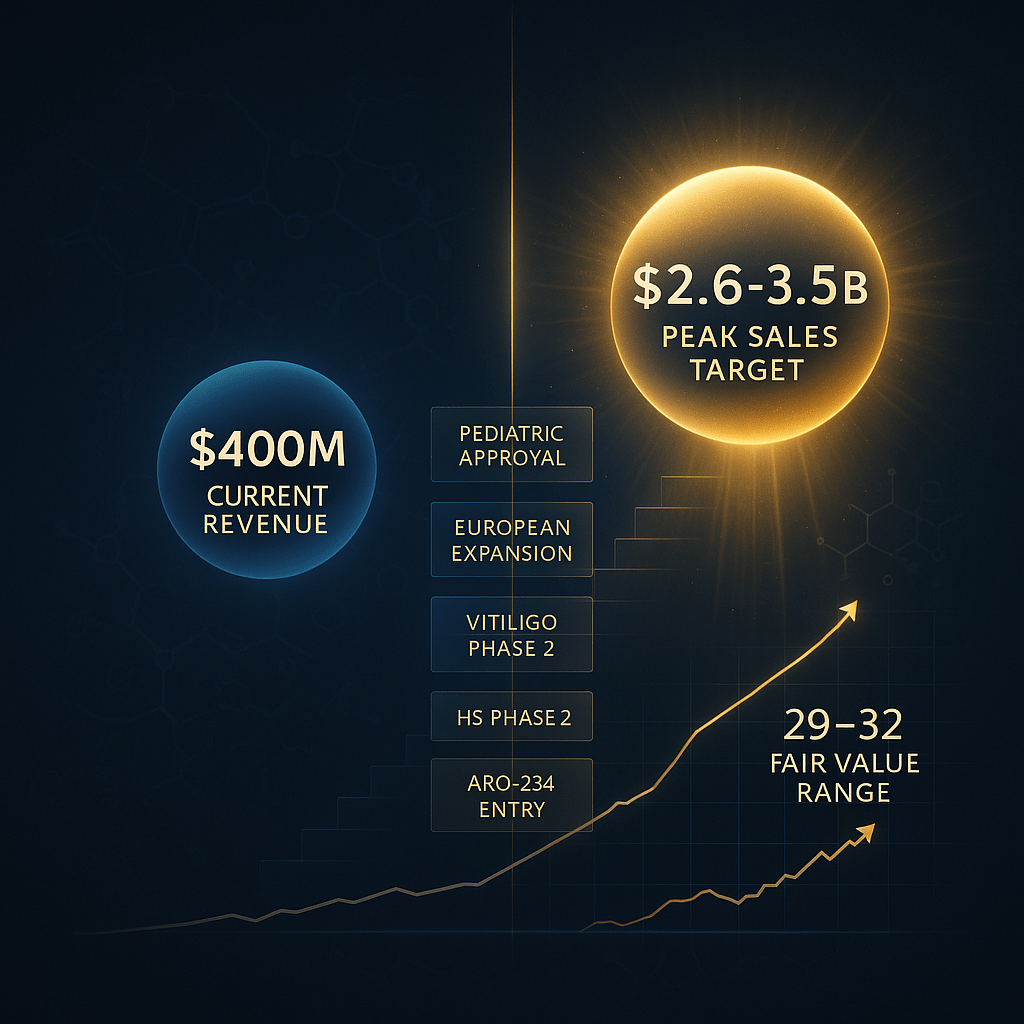

Most Wall Street analysts are modeling Arcutis as a one-product company, which means they’re systematically undervaluing the embedded optionality in the pipeline. The FDA just granted approval for ZORYVE in pediatric atopic dermatitis for children ages 2-5, immediately expanding the addressable patient population by roughly 30%. That approval alone could add $100+ million in annual peak sales—and it happened in October 2025, meaning the revenue contribution starts flowing in Q4.

But the real upside lurks further out. Arcutis is running Phase 2 trials for vitiligo (a visible depigmentation disorder with massive unmet need) and hidradenitis suppurativa (a painful inflammatory skin condition with almost no effective treatments). Positive data from either indication would be transformative—vitiligo alone affects 1-2% of the global population, and patients are desperate for treatments that actually work. Then there’s ARQ-234, a novel biologic targeting the CD200 pathway, entering Phase 1 trials. Each of these programs represents a separate shot on goal, and each one could materially expand Arcutis’s commercial footprint.

Think of it this way: The market is valuing Arcutis primarily on ZORYVE’s base business in plaque psoriasis and seborrheic dermatitis. Everything else—pediatric atopic dermatitis, vitiligo, hidradenitis suppurativa, ARQ-234, potential European approvals, foam formulations for scalp applications—is essentially free. That asymmetry creates a compelling risk-reward setup for investors who can tolerate near-term volatility.

The Five Risks You Must Understand Before You Buy

Let me be crystal clear: Arcutis is not a sleep-well-at-night blue-chip investment. This is a high-octane growth stock in one of the most competitive sectors in healthcare. The risks are real, specific, and potentially portfolio-damaging if you don’t manage position size and entry points carefully.

Clinical Execution Risk: Those pipeline programs sound exciting, but biotech trials fail more often than they succeed. If the vitiligo or hidradenitis suppurativa programs stumble, or if ARQ-234 shows safety concerns in Phase 1, the upside story gets capped at ZORYVE alone. That’s still a good business, but at today’s valuation, it’s more fully priced in.

Competitive Pressure: Dermatology is a battleground dominated by pharmaceutical giants wielding blockbuster biologics. Dupixent (Sanofi/Regeneron) generates over $11 billion annually treating atopic dermatitis. Skyrizi and Tremfya (AbbVie and Johnson & Johnson) command premium pricing for psoriasis. These drugs work via different mechanisms, but they’re entrenched with payers and physicians. Arcutis has to fight for every formulary slot, every prior authorization, every prescription pad. If the big players decide ZORYVE is a threat and respond with aggressive pricing or access restrictions, market share gains could slow dramatically.

Reimbursement Complexity: Insurance companies move slowly, especially for novel mechanisms in therapeutic categories where generics and biosimilars already exist. Even if ZORYVE offers superior safety and efficacy, payers may delay formulary placement or impose restrictive step-therapy requirements. That creates friction in the commercialization process and can limit near-term revenue growth even if the clinical profile is outstanding.

Patent and Legal Exposure: Teva filed a patent infringement lawsuit against Arcutis. While management has indicated the exposure is limited, pharmaceutical patent litigation is inherently unpredictable. An adverse ruling could complicate market exclusivity or create licensing obligations that erode profitability.

Volatility and Short Interest: Arcutis trades with a five-year beta around 2.0, meaning it typically moves twice as much as the broader market in both directions. Short interest has run above 10% of float at times, indicating significant skepticism among hedge funds. When momentum turns negative—and in biotech, it always eventually does—the stock can gap down violently. If you’re sized too large or lack clear exit rules, a 20-30% drawdown can happen over a few trading sessions.

How to Actually Play This: Precise Entry Points and Stop-Loss Discipline

This is where most retail investors blow themselves up. They read a bullish thesis, get excited, and throw a market order at the stock without thinking about position sizing, entry zones, or risk management. Don’t be that investor.

Staged Entry Strategy: Start building a position on minor pullbacks toward the $18-$20 range, which represents a consolidation zone from Q3. If the stock dips toward $15—which would require either a significant market correction or company-specific bad news—that’s where you can add more aggressively. The key insight: Volatility works both ways. High-beta names routinely retrace 15-20% even in intact uptrends. Use those dips to accumulate shares at better prices rather than chasing strength above $27.

Stop-Loss Framework: Place mental or hard stops roughly 15-20% below your purchase levels, or just below the 200-day moving average (currently around $18). This protects you if the uptrend breaks and prevents a winning position from morphing into a catastrophic loss. Biotechs don’t always bounce back—if clinical or commercial momentum fractures, the decline can be swift and merciless. Better to take a contained loss and reassess than to hold and hope.

Position Size Discipline: Treat ARQT as a speculative allocation within your equity portfolio. If you’re running a diversified portfolio, limit exposure to 2-5% of total equity value. If this is part of a concentrated biotech sleeve, you can stretch to 7-10%, but only if you’re actively monitoring the position and comfortable with high volatility. This isn’t a set-it-and-forget-it compounder like a quality dividend aristocrat. It requires attention and discipline.

Profit-Taking Zones: If ARQT breaks convincingly above $28-30 without a corresponding fundamental catalyst, that’s a signal to trim partial positions and lock in gains. High-growth biotechs routinely overshoot fair value on momentum—take advantage of that by selling into strength rather than greed-holding through a reversal.

The Catalysts That Could Drive the Next Leg Higher

Several near-term events could re-rate the stock materially higher, which is why maintaining exposure through volatility makes sense if you’ve sized appropriately.

Commercial Milestones: The pediatric atopic dermatitis launch kicked off October 30, 2025, and revenue contribution starts showing up in Q4 results. Watch for prescription data from Symphony Health or IQVIA—if pediatric scripts ramp faster than Street estimates, that will force upward revisions. Similarly, updated formulary wins or expanded prior authorization approvals would signal better insurance access and accelerate revenue growth.

Clinical Data Readouts: Phase 2 results for vitiligo or hidradenitis suppurativa in 2026 represent major binary events. Positive proof-of-concept data could double the stock’s terminal value overnight. These aren’t low-probability lottery tickets—Arcutis has already proven its drug development competence with ZORYVE. If the data shows meaningful efficacy with a clean safety profile, the market will reprice the entire franchise.

Geographic Expansion: European regulatory filings for ZORYVE are in progress, and approval would open a market roughly comparable in size to the United States. That’s not baked into current valuations. Similarly, foam formulations for scalp applications could unlock new patient segments that topical creams don’t serve well.

Patent and Non-Financial Wins: Additional patent grants strengthen the competitive moat and extend exclusivity. Non-financial recognition—like Allure’s “Best of Beauty” award or Fortune’s Best Workplace designation—may seem trivial, but they build brand credibility with consumers and clinicians. In a direct-to-consumer disease category, brand matters more than Wall Street typically acknowledges.

Valuation: Why Fair Value Sits Well Above Today’s Price

Let’s cut through the valuation noise with real math. As of November 1, 2025, ARQT trades around $25 per share. Using conservative assumptions and the company’s own guidance, here’s what the numbers say:

Discounted Cash Flow Analysis: Extrapolating nine-month 2025 results and Q4 expectations, fiscal 2025 sales should land around $390 million. Management guides 2026 toward $460 million at the midpoint. Assume revenue growth moderates to 25-30% in 2026-2027, then slows to 15% by 2030 as the market matures. Apply a 12% weighted-average cost of capital (reflecting biotech risk but acknowledging growing cash generation). Model free cash flow margins rising from near-zero today toward 10% by 2030 as operating leverage kicks in. Use a 3% terminal growth rate. Under these deliberately conservative inputs, the present value of future cash flows implies a fair value in the mid-to-high $20s per share—essentially in line with or slightly above today’s price.

Comparable Multiples Check: Apply an 8x enterprise value-to-sales multiple to 2026 guided revenue of $460 million. That yields an enterprise value around $3.7 billion, or roughly $30 per share (assuming 120 million shares outstanding). This multiple isn’t aggressive—it’s below what the market assigns to many high-growth specialty pharma and biotech companies with similar revenue trajectories and margin profiles. Using a more conservative 6x multiple still gives you $22-$25 per share. Bottom line: The current valuation doesn’t look stretched relative to fundamentals or peer comps.

Analyst Consensus: Wall Street’s average price target sits around $29.40, with a consensus Buy rating. That implies 15-20% upside from current levels before accounting for any positive surprises from pipeline programs or commercial outperformance.

Here’s the key insight: If Arcutis hits its 2026 guidance and maintains momentum into 2027, fair value likely sits 20-30% above today’s price. If clinical programs deliver positive data, that upside expands materially. Conversely, if revenue guidance gets cut or trials disappoint, the downside could be 30-40% from here. That asymmetry—modestly positive base-case upside with significant optionality from catalysts—is what makes ARQT compelling for risk-tolerant growth investors.

Technical Picture: Uptrend Intact, But Respect Key Levels

From a charting perspective, ARQT is in a robust uptrend that started in September 2024 and accelerated through 2025. The stock recently printed a 52-week high at $27.08, well above its 200-day moving average of approximately $18. That 200-day MA represents major support—as long as the stock holds above that level, the technical setup remains bullish. If ARQT breaks below $18 decisively, that would trigger a trend-change signal and warrant either exiting positions or significantly reducing exposure.

Relative Strength Index (RSI) has been elevated but not extreme, suggesting room for further upside without hitting overbought territory. MACD remains in positive territory with bullish crossovers intact. The key risk: At current levels near $27, ARQT is testing prior resistance and potentially entering a short-term overbought zone. If the stock pushes above $28-30 without a consolidation, that would signal potential exhaustion and suggest trimming exposure.

The trading plan: Use $18-$22 as your accumulation zone for new positions or adds. Set stops just below $18 to limit downside. If ARQT breaks above $28 convincingly on heavy volume, that’s a momentum signal—but also a spot to consider taking partial profits if you’re sized large. Volatility will remain elevated given the biotech sector dynamics and the company’s high beta, so expect sharp intraday swings and use limit orders rather than market orders when trading.

The Bottom Line: Speculative Buy with Disciplined Risk Controls

Arcutis Biotherapeutics represents the kind of growth-stock opportunity that emerges rarely: A company with a genuinely differentiated product, accelerating revenue momentum, clear paths to profitability, and a pipeline rich with optionality—all trading at a valuation that isn’t absurdly stretched. The ZORYVE franchise is real, the market opportunity is massive, and management is executing.

But make no mistake—this is a speculative position requiring active risk management. The sector is competitive, clinical trials carry binary risk, and volatility will test your conviction repeatedly. If you can’t handle 20-30% drawdowns or don’t have the discipline to size appropriately and set stops, this isn’t your stock. Stay in index funds and sleep well at night.

For investors who understand the risks and embrace the volatility, ARQT offers legitimate 2-3x upside potential over the next 2-3 years if execution continues. Start small, buy dips rather than strength, maintain strict stop-loss discipline, and let the thesis play out. If all goes well—continued market share gains, positive pipeline data, geographic expansion—you’ll be rewarded handsomely. If setbacks emerge, your position sizing and risk controls will limit the damage to an acceptable level.

The grandmother with the steroid-free cream that actually works? She’s the first wave of millions. Arcutis is capturing that wave systematically, methodically, and profitably. The question isn’t whether ZORYVE will succeed—it already is. The question is whether you have the risk tolerance and discipline to profit from that success. If you do, build your position thoughtfully and buckle up. The ride’s just getting started.

Master Metrics Table

| Metric | ARQT (Est.) | Notes/Source |

|---|---|---|

| Price (11/1/2025) | ~$25 | Current trading level |

| Market Cap | ~$3.1B | 120M shares outstanding |

| LTM Sales (Q3’25 annualized) | ~$400M | Q3 was $99.2M, annualized |

| 9M’25 Product Revenue (YoY growth) | $244.6M (+152%) | Nine months vs. 2024 |

| FY2025E Sales Growth | ~80% | Company filings/estimates |

| FY2026E Sales Guidance | $455-$470M | Company guidance (midpoint ~$462M) |

| Q3’25 GAAP EPS | +$0.06 | vs. –$0.33 in Q3’24 |

| Net Cash (Sep 30, 2025) | $191M | Cash & equivalents, no debt |

| Gross Margin (Q3’25) | ~90% | ($99.2M sales – $8.7M COGS) |

| EV / FY2026E Sales | ~7x | Based on EV ~$3.4B, Sales $460M |

| NTM P/E (2026E) | ~60x | ~$25 price / estimated $0.41 EPS |

| Beta (5-year) | ~2.0 | High volatility vs. market |

| 52-Week Range | $9.60 – $27.08 | Significant appreciation YTD |

| 200-Day Moving Avg | ~$18 | Major support level |

| Analyst Consensus Target | ~$29.40 | Average across covering analysts |

| Analyst Rating Consensus | BUY | Majority bullish recommendation |

Fair Value Estimate: $27-$32 per share (DCF and multiples blend)

Buy Zone: $18-$22 (strong accumulation opportunity)

Reduce Zone: Above $28-$30 (take partial profits on strength)

Stop Loss: Below $17-$18 (200-day MA breakdown signal)

Position Size Recommendation: 2-5% of equity portfolio (speculative allocation)

Risk Rating: HIGH (Volatile biotech with clinical/commercial execution risk)

Time Horizon: 2-3 years (requires patience through volatility)

This analysis is for informational purposes only and should not be construed as investment advice. Conduct your own due diligence and consult with a qualified financial advisor before making investment decisions. Past performance does not guarantee future results.

Leave a comment