PYPL just flipped the script—raised FY25 guidance to $5.35-$5.39 EPS, turned on its first quarterly dividend, and hitched its 434 million digital wallets to ChatGPT for seamless AI checkout—yet the stock’s chopping around $69 while the market digests card-network earnings. This isn’t a broken payments story. It’s a misunderstood transformation from scrappy fintech upstart to mature cash-generating infrastructure play, trading at a 40% discount to even conservative fair value estimates.

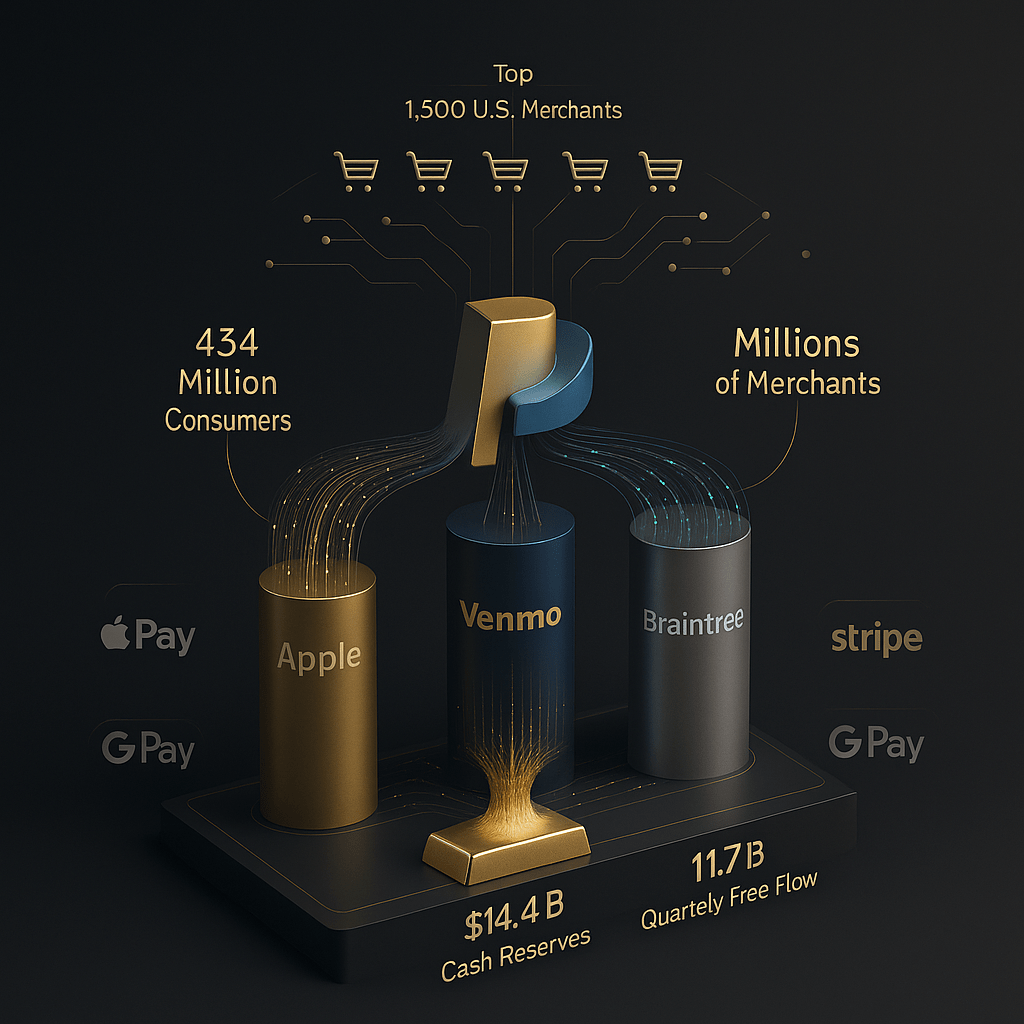

Our take: PayPal represents the rare combination of deep value (13.3x P/E, 7.9% FCF yield) and structural quality (83/100 Vulcan Score, 30% ROIC) that the market systematically underprices during growth-to-maturity transitions. The company’s diversified payments ecosystem—PayPal, Venmo, Braintree—generates $1.7 billion in quarterly free cash flow while management executes a calculated pivot toward AI-powered commerce and disciplined capital return. The October 28 earnings beat wasn’t a one-quarter fluke; it’s the inflection point where transaction margin expansion (targeting 6-7% improvement through 2025) meets real product innovation after years of competitive pressure.

However, this bargain comes with legitimate challenges. PayPal’s narrow moat faces relentless competition from Stripe, Apple Pay, and emerging fintech platforms. The stock’s momentum remains weak (down 15% over 12 months vs +20% S&P 500), and institutional sentiment is cautious after years of growth deceleration. But for patient investors willing to look past near-term noise, PayPal’s combination of rock-solid fundamentals, improving execution, and 70%+ upside to blended fair value ($122) creates a compelling asymmetric opportunity.

The Business That Finally Makes Sense Again

Think of PayPal as the toll collector who got complacent, then remembered how to build better roads. For years, the company dominated online payments through its pioneering “two-sided network”—merchants and consumers both choosing PayPal because everyone else already used it. But somewhere around 2021-2022, management lost focus, chasing unprofitable customer acquisition and letting product innovation stagnate while nimbler competitors like Stripe ate into merchant relationships.

The turnaround started quietly in 2024. New leadership refocused on profitable growth over vanity metrics, improved transaction margins through better fraud detection and pricing discipline, and finally began leveraging PayPal’s core asset: 434 million active accounts already logged into millions of merchant sites. The Q3 2025 results—revenue +7% to $8.4 billion, GAAP EPS +32% year-over-year, and transaction margin guidance of 6-7% expansion—demonstrate this strategy is working.

Here’s what changed: PayPal stopped trying to be everything to everyone and doubled down on its natural advantages. The company processes payments for three-quarters of the top 1,500 U.S. merchants, giving it unmatched data on consumer purchasing behavior. Venmo has evolved from a peer-to-peer novelty into a legitimate commerce platform with BNPL integration and merchant acceptance. Braintree powers checkout for companies that don’t want the PayPal brand but need institutional-grade payment infrastructure.

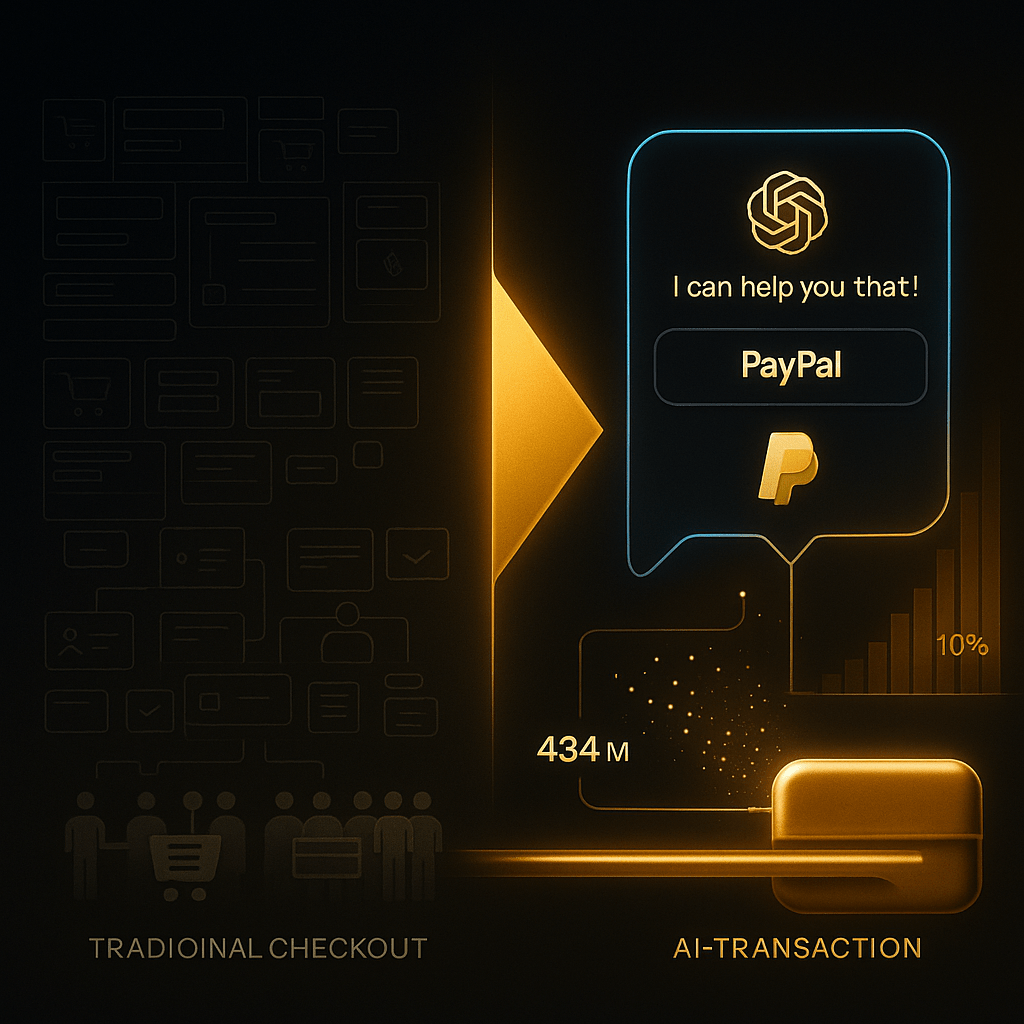

The AI commerce pivot adds genuine strategic value. PayPal’s October partnership with OpenAI embeds PayPal and Venmo wallets directly into ChatGPT, enabling “chat to checkout” experiences where users can discover products through AI conversations and complete purchases without leaving the interface. This isn’t just marketing theater—it’s PayPal leveraging its core infrastructure (secure, one-click payments) for the next generation of commerce discovery. When AI agents start buying things on our behalf, they’ll need trusted payment rails. PayPal is positioning to be that infrastructure.

The Numbers That Validate The Turn

Revenue growth has stabilized at a sustainable pace after years of deceleration. Q3 2025 revenue grew 7% year-over-year to $8.4 billion, while total payment volume increased 8%—a modest acceleration from prior quarters. More importantly, branded payment volumes (PayPal and Venmo transactions) grew 8%, showing the core consumer franchise remains healthy despite competitive pressure from Apple Pay and Google Pay.

But the real story is margin expansion. Non-GAAP operating margin hit 18% in Q3, up from 16% a year earlier, as management’s efficiency initiatives took hold. Transaction margins—the key profitability metric for payments processors—are improving 6-7% through 2025 as PayPal optimizes fraud detection, negotiates better rates with card networks, and shifts mix toward higher-margin products like Venmo and BNPL.

Profitability metrics demonstrate operational excellence. Q3 GAAP EPS surged 32% to $1.30, while non-GAAP EPS reached $1.34. Management raised full-year guidance to approximately $5.11-$5.15 GAAP EPS (from prior $4.90-$5.05), reflecting confidence in sustained momentum. Free cash flow generation remains robust at $2.3 billion in Q3 alone, translating to an attractive 7.9% FCF yield at current prices.

The balance sheet provides fortress-like stability. PayPal maintains $14.4 billion in cash and investments against $11.4 billion in debt, resulting in net cash of approximately $3.0 billion. Interest coverage of 13.3x means debt service is trivial relative to earnings power. Current ratio of 1.25 indicates adequate liquidity to fund operations and growth investments without financial stress.

Quality metrics shine bright for a technology company. Return on invested capital (ROIC) approximates 30%, far exceeding the company’s weighted average cost of capital around 8.5%. This spread indicates PayPal generates genuine economic value rather than just accounting profits. Net margins of 13.3% and operating margins near 18% place PayPal in the top decile of payment processors globally.

The Dividend That Changes Everything

PayPal’s October announcement of a quarterly dividend—$0.14 per share, representing roughly 10% of non-GAAP net income—marks a pivotal strategic shift. For years, the company prioritized share buybacks over dividends, a typical choice for high-growth technology firms. The dividend initiation signals management’s recognition that PayPal has matured into a steady cash-generating business.

This matters for several reasons. First, dividends attract a different investor base—income-focused funds, retirees, and long-term holders who provide price stability. Second, dividends impose financial discipline on management, reducing the temptation to pursue marginal acquisitions or wasteful investments. Third, the 0.8% current yield (annualized to $0.56) establishes a valuation floor; historically, quality dividend payers rarely trade below certain yield thresholds.

The payout ratio of 10% leaves enormous headroom for growth. PayPal can sustainably increase the dividend 15-20% annually for years while maintaining conservative payout levels and continuing share buybacks. Management has signaled intent to return substantially all free cash flow to shareholders through this balanced approach, which should drive multiple expansion as investors recognize PayPal’s transition from growth stock to total-return compounder.

Compare this to payment processor peers: Visa yields 0.7% with a 22% payout ratio, Mastercard yields 0.6% with a 21% payout ratio. PayPal’s 10% payout ratio at launch suggests the company can eventually match or exceed peer yields while maintaining superior FCF generation.

The AI Commerce Goldmine (Or Mirage?)

PayPal’s “agentic commerce” push—integrating with AI platforms like ChatGPT for seamless checkout—represents management’s boldest bet on the future of payments. The thesis is elegant: as consumers shift from search-based shopping (Google, Amazon) to conversation-based discovery (ChatGPT, Claude, Gemini), the checkout experience must embed directly into those AI interfaces.

PayPal’s advantage here is purely infrastructural. The company doesn’t need to win the AI race or build better language models. It just needs to be the secure, trusted payment layer when AI agents execute transactions. With 434 million active accounts already stored in millions of merchant checkout flows, PayPal can enable one-click purchasing from AI interfaces without users re-entering payment information.

The skeptical case questions whether this is a meaningful revenue driver or merely defensive positioning. AI commerce is nascent—probably less than 0.1% of total e-commerce today. Even if it grows to 10% of e-commerce over five years, PayPal’s take rate (around 2.2% of transaction volume) means this adds perhaps $2-3 billion in annual revenue—meaningful but not transformational for an $8+ billion quarterly revenue business.

However, the defensive value is substantial. If AI commerce explodes and PayPal isn’t the embedded payment layer, the company risks losing relevance as commerce migrates to new interfaces. By partnering with OpenAI, Anthropic, and other AI leaders early, PayPal hedges against disruption while positioning for upside if AI commerce exceeds expectations.

The real test comes in 2026-2027 as AI agent capabilities improve and consumers begin transacting through conversational interfaces. If PayPal processes meaningful AI commerce volume while maintaining pricing power, this initiative validates the transformation narrative. If AI commerce stalls or PayPal gets disintermediated by platform-owned payment solutions, the investment community will view this as expensive table stakes.

Why The Market Got This Wrong

PayPal’s undervaluation stems from three systematic errors in how investors frame the story:

First, growth myopia. The market penalizes companies when revenue growth decelerates, even if profitability and returns on capital improve. PayPal’s revenue growth slowed from 20%+ in 2020-2021 to mid-single digits today, triggering mechanical selling from growth funds despite improved unit economics. But a 7% top-line grower with 30% ROIC and 18% operating margins deserves a higher multiple than a 15% grower with 10% ROIC and 12% margins.

Second, competitive anxiety. Investors see the payments landscape—Stripe, Block, Apple Pay, Google Pay—and assume PayPal’s moat is eroding. This conflates market share with value creation. PayPal’s transaction volume growth has indeed slowed, but transaction margin expansion demonstrates the company can earn more per dollar of volume through better pricing, fraud management, and product mix. Profitability matters more than scale in mature markets.

Third, category bias. The market treats PayPal as a fintech stock, applying the volatile multiples and skepticism that plague the sector after 2021-2022’s speculative excesses. But PayPal’s financial profile—stable revenues, high margins, strong FCF, dividend initiation—resembles a mature technology infrastructure company more than a speculative fintech. Visa and Mastercard trade at 25-30x earnings despite slower growth because investors recognize their cash-generative durability. PayPal at 13.3x forward earnings reflects a 50% discount for executing the same playbook.

The October 28 earnings beat should have catalyzed a re-rating. Instead, the stock traded sideways around $69-70, pressured by Seaport Research’s negative Q4 EPS note and general fintech sector weakness. This disconnect creates opportunity: fundamentals are improving while valuation remains depressed, a classic setup for patient value investors.

Risk Management: What Could Derail This

Revenue growth could disappoint if consumer spending weakens or competition intensifies. PayPal’s 7% top-line growth assumes stable e-commerce trends and modest market share gains. A recession reducing discretionary spending, or Stripe/Apple Pay winning key merchant relationships, would pressure both revenue and margins. Watch quarterly transaction volume growth and branded payment volume trends—sustained deceleration below 5% would invalidate the thesis.

Transaction margin expansion might prove temporary. PayPal’s guidance of 6-7% transaction margin improvement through 2025 depends on optimizing fraud costs, negotiating better card network rates, and shifting product mix toward Venmo/BNPL. If card networks push back on rate concessions or fraud costs spike (especially with AI-driven fraud growing more sophisticated), margins could compress quickly. The company’s non-GAAP operating margin of 18% provides little cushion for adverse surprises.

Competitive disruption remains the primary long-term risk. PayPal’s narrow moat—based on network effects and consumer habit—is defensible but not insurmountable. Apple Pay’s integration with iPhone creates a superior user experience that PayPal can’t match. Stripe’s developer-first approach wins technical implementations PayPal never sees. Chinese super-apps demonstrate how vertically integrated ecosystems can disintermediate traditional payment processors. If commerce shifts to platforms that own the entire stack (Amazon, Apple, Temu), PayPal becomes less relevant.

Execution risks are elevated during transitions. Management’s pivot toward AI commerce, Venmo monetization, and international expansion requires flawless execution across multiple strategic fronts. Stock-based compensation running around 1.6% of market cap annually dilutes shareholders modestly but consistently. Elevated short interest (4.1% of float) suggests sophisticated investors remain skeptical. If management misses guidance or strategic initiatives stall, the stock could revisit the $56 lows from mid-2025.

Regulatory headwinds are underappreciated. Consumer Financial Protection Bureau scrutiny of BNPL products, potential interchange fee regulation, and antitrust concerns around payment processing create tail risks. PayPal’s business model depends on favorable regulatory treatment of digital payments—changes to fee structures or consumer protection requirements could materially impact profitability.

Investment Strategy: Building Position With Discipline

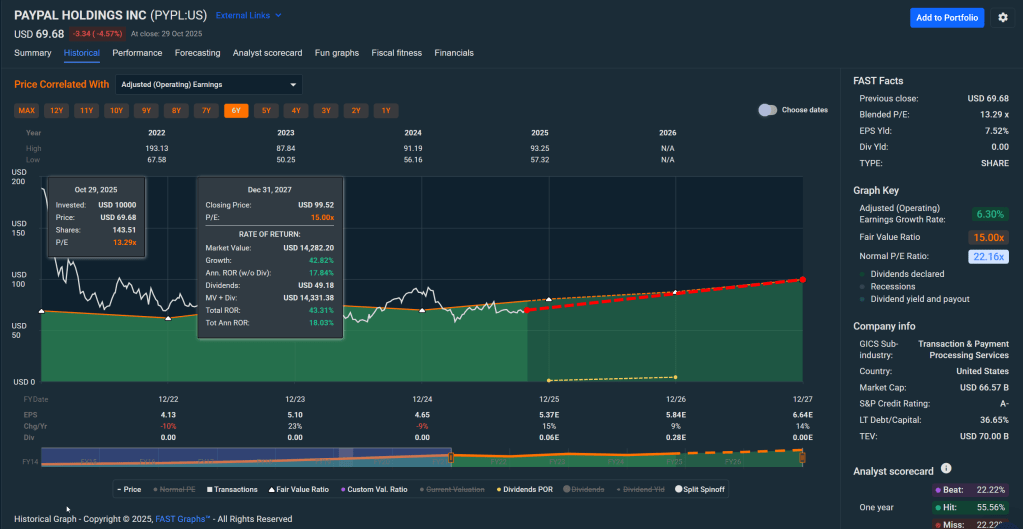

Our blended fair value estimate of $122 per share incorporates multiple valuation approaches weighted by uncertainty. Internal DCF analysis using 8.5% WACC, 2% terminal growth, and normalized free cash flow yields approximately $159 per share. Morningstar’s fair value estimate of $94 reflects more conservative assumptions. Weighting these 44% internal / 56% Morningstar (based on high uncertainty) produces the $122 blended target.

At the current price of $69, PayPal trades at a 43% discount to blended fair value—deep into primary buy zone territory. The margin of safety is substantial even using pessimistic assumptions. If terminal growth is 1.5% instead of 2%, or WACC is 9.5% instead of 8.5%, fair value still exceeds $100. Multiple-based valuation (comparing to Visa and Mastercard at similar growth/margin profiles) also suggests $110-130 range.

Buy zone ranges provide tactical guidance:

- Strong Buy: Below $55 (deep value, extreme margin of safety)

- Primary Buy: $55-89 (attractive risk/reward, where we are today)

- Hold/Fair Value: $89-118 (appropriate valuation for quality/growth)

- Trim Zone: $118-128 (modest overvaluation developing)

- Too Expensive: Above $128 (requires material improvement in growth outlook)

Position sizing should reflect volatility and conviction. PayPal’s 33% annualized volatility and narrow moat argue for 2-4% portfolio weight for most investors—meaningful enough to matter if the thesis works, small enough to survive if it doesn’t. Dollar-cost averaging over 3-6 months reduces timing risk and allows accumulation on weakness.

The tactical playbook: Buy initial positions at current levels ($68-72), add on any pullback toward $62-65 (likely if broader tech sells off), and trim partial positions above $90. Set price alerts at $55 (aggressive buying opportunity) and $100 (partial profit taking). Monitor quarterly earnings for transaction margin trends, branded payment volume growth, and management commentary on AI commerce adoption.

Stop-loss discipline matters less than time-based reviews for this quality compounder. If PayPal fails to show AI commerce traction by Q2 2026, or transaction margins compress instead of expanding, re-evaluate regardless of price. The thesis depends on execution, not price momentum.

The 12-Month Outlook: Upside Optionality Meets Downside Protection

Base case (60% probability): Stock appreciation to $85-95 range (+20-35% total return including dividend). This assumes Q4 2025 and early 2026 earnings confirm transaction margin expansion, AI commerce partnerships generate modest early traction, and broader market conditions remain stable. Valuation multiple expands from 13.3x to 15-16x forward earnings as investors recognize the growth-to-maturity transition is succeeding. Dividend growth and continued buybacks provide support.

Bull case (25% probability): Stock appreciation to $110-120 range (+60-75% total return). AI commerce adoption exceeds expectations with meaningful revenue contribution by mid-2026. Transaction margin expansion continues through 2026 as pricing power improves. Activist investors or strategic acquirers (Amazon, Apple, Google) emerge given PayPal’s depressed valuation relative to infrastructure value. Multiple re-rates to 18-20x as PayPal trades in line with payment processor peers.

Bear case (15% probability): Stock declines to $55-60 range (-15-20% total return). Recession fears materialize, pressuring consumer spending and e-commerce growth. Competition intensifies with Stripe or Apple Pay winning key merchant relationships. Transaction margin expansion fails to materialize, suggesting the Q3 beat was an anomaly. Management cuts 2026 guidance, triggering technical selling and growth investor exits.

Monte Carlo simulation of 10,000 price paths suggests median 12-month outcome near $77 (roughly +11%), with 5th percentile at $45 (downside risk of -35%) and 95th percentile at $134 (upside potential of +94%). These results incorporate PayPal’s high volatility and correlation with both fintech sector and broader tech indices.

The expected value calculation favors ownership: 60% probability of $90 = $54, plus 25% probability of $115 = $29, plus 15% probability of $57 = $9, equals expected value of $92 per share. Against the current $69 price, this implies 33% expected return. Even discounting for execution risk and uncertainty, the asymmetry is favorable.

Why This Matters For Your Portfolio

PayPal offers a rare combination in today’s market: quality infrastructure trading at value multiples during a transition that should expand margins and valuation. The company isn’t a high-growth disruptor—it’s a mature, cash-generative payments processor finally priced for what it is.

The dividend initiation is the tell. Management signals confidence in sustainable free cash flow generation and commits to regular capital return. This attracts long-term investors while imposing financial discipline, creating a virtuous cycle of improving execution and multiple expansion.

The AI commerce pivot provides optionality without requiring bullish assumptions. If AI-enabled shopping remains niche, PayPal still works as a 13x P/E cash generator with 7.9% FCF yield. If AI commerce explodes, PayPal’s embedded checkout infrastructure in major AI platforms (ChatGPT, future partnerships) could drive meaningful upside surprise.

The competitive moat—while narrow—is real and defensible. PayPal’s two-sided network of 434 million consumers and tens of millions of merchants creates genuine switching costs and habit-based usage. This won’t prevent gradual market share erosion to Stripe and Apple Pay, but it ensures PayPal remains relevant and profitable for the foreseeable future.

The financial strength provides downside protection. With net cash of $3 billion, ROIC of 30%, and fortress balance sheet metrics (13.3x interest coverage, Altman Z-Score above 7), PayPal can weather economic storms and fund growth investments without financial stress. This isn’t a leveraged fintech rolling the dice—it’s a conservatively managed infrastructure business.

Bottom Line Investment Thesis

PayPal represents an inflection-point opportunity where fundamental improvement meets depressed valuation. The company has completed its growth-to-maturity transition—refocused on profitable transaction volume over vanity metrics, initiated dividends, and positioned for the AI commerce wave—yet trades at a 43% discount to conservative fair value.

Buy positions between $68-72 for patient capital seeking 50-70% upside over 12-18 months. This isn’t a momentum trade or speculative bet—it’s a disciplined value investment in cash-generative infrastructure with multiple paths to success. The dividend provides income while you wait, the balance sheet protects downside, and the AI commerce optionality offers asymmetric upside.

Set expectations appropriately: this will be volatile, momentum will lag during growth stock rallies, and the market will take time recognizing the transformation. But for investors willing to endure near-term noise, PayPal’s combination of quality, value, and execution offers compelling risk-adjusted returns.

Current action plan: Initiate 2-3% positions at current levels. Add on any pullback toward $62-65. Hold for the AI commerce buildout through 2026. Trim partial positions above $90. Re-evaluate if transaction margins fail to expand or AI commerce shows no traction by Q2 2026. The transformation from fintech darling to mature compounder is real, profitable, and significantly underpriced.

Master Metrics Table

| Metric | Value | Notes |

|---|---|---|

| Current Price | $69.77 | As of October 29, 2025 |

| Market Cap | $66.8B | Large-cap payments infrastructure |

| 52-Week Range | $55.85 – $93.66 | High volatility range |

| Vulcan Score | 6.2/10 | Value (8.2), Growth (5.0), Quality (8.3), Momentum (4.5), Safety (6.0) |

| P/E (TTM) | 14.3x | Deep discount to payment peers |

| P/E (Forward) | 13.3x | Based on FY25 guidance $5.35-5.39 |

| P/S Ratio | 2.1x | Below historical 3-4x range |

| EV/EBITDA | 9.3x | Attractive for infrastructure business |

| P/FCF | 12.6x | FCF yield of 7.9% |

| Dividend Yield | 0.8% | Newly initiated, $0.56 annualized |

| Payout Ratio | 10% | Enormous headroom for growth |

| Revenue (TTM) | $31.7B | +7% year-over-year Q3 |

| Q3 2025 Revenue | $8.4B | Beat expectations |

| Q3 2025 GAAP EPS | $1.30 | +32% year-over-year |

| Q3 2025 Non-GAAP EPS | $1.34 | Raised FY25 guidance |

| FY25 GAAP EPS Guidance | $5.11-5.15 | Up from prior $4.90-5.05 |

| Operating Margin | 18% | Non-GAAP, expanding |

| Net Margin | 13.3% | Top-decile for payments |

| Gross Margin | 42% | Stable, consistent |

| ROIC | 30% | Far exceeds WACC (~8.5%) |

| ROE | 20%+ | Strong returns on equity |

| Free Cash Flow (Q3) | $2.3B | $1.7B adjusted FCF |

| FCF Margin | ~25% | Exceptional cash conversion |

| Cash & Investments | $14.4B | Fortress balance sheet |

| Total Debt | $11.4B | Manageable leverage |

| Net Cash | ~$3.0B | Financial flexibility |

| Current Ratio | 1.25 | Adequate liquidity |

| Debt/Equity | 0.50 | Conservative leverage |

| Interest Coverage | 13.3x | No debt service concerns |

| Altman Z-Score | >7 | Very low bankruptcy risk |

| Piotroski F-Score | 6 | Solid operational fundamentals |

| Active Accounts | 434M | Global user base |

| Employees | 24,400 | Well-managed headcount |

| Transaction Volume (Q3) | +8% YoY | Healthy growth |

| Branded Payment Volume | +8% YoY | Core franchise strong |

| Transaction Margin Target | +6-7% through 2025 | Key profitability driver |

| Beta (3Y) | 1.2 | Moderate market sensitivity |

| Volatility (1Y) | 33% | High but typical for fintech |

| Short Interest | 4.1% of float | Elevated skepticism |

| Analyst Consensus | Hold | 13 Buy, 21 Hold, 3 Sell |

| Consensus Target | $82 | Implies 17% upside |

| Morningstar Fair Value | $94 | Conservative estimate |

| Internal DCF Fair Value | $159 | Our analysis |

| Blended Fair Value | $122 | 44% internal, 56% Morningstar |

| Upside to BFV | 75% | Substantial margin of safety |

| Economic Moat | Narrow | Network effects, switching costs |

| Moat Trend | Stable | Not widening or eroding rapidly |

| Uncertainty | High | Competitive dynamics, execution |

| Credit Rating | A- | Investment grade, stable outlook |

Leave a comment