When ONEOK reported $2.12 billion in adjusted EBITDA for Q3 2025—a 43% year-over-year surge—the market barely blinked. The stock sits at $68.61, unchanged from where it traded before the earnings release. This isn’t market efficiency. This is opportunity.

Here’s what Wall Street missed: ONEOK just proved that the two biggest acquisitions in midstream history—EnLink and Medallion, combined $15 billion in deal value—aren’t just working. They’re printing money ahead of schedule.

Think of America’s energy infrastructure as the circulatory system of the economy. Oil and gas don’t teleport from drilling rigs in Wyoming to refineries in Texas. They flow through tens of thousands of miles of pipelines, processing plants, and storage facilities. ONEOK owns the critical arteries connecting America’s most productive energy basins to the markets that need them. And in Q3, those arteries just got dramatically larger.

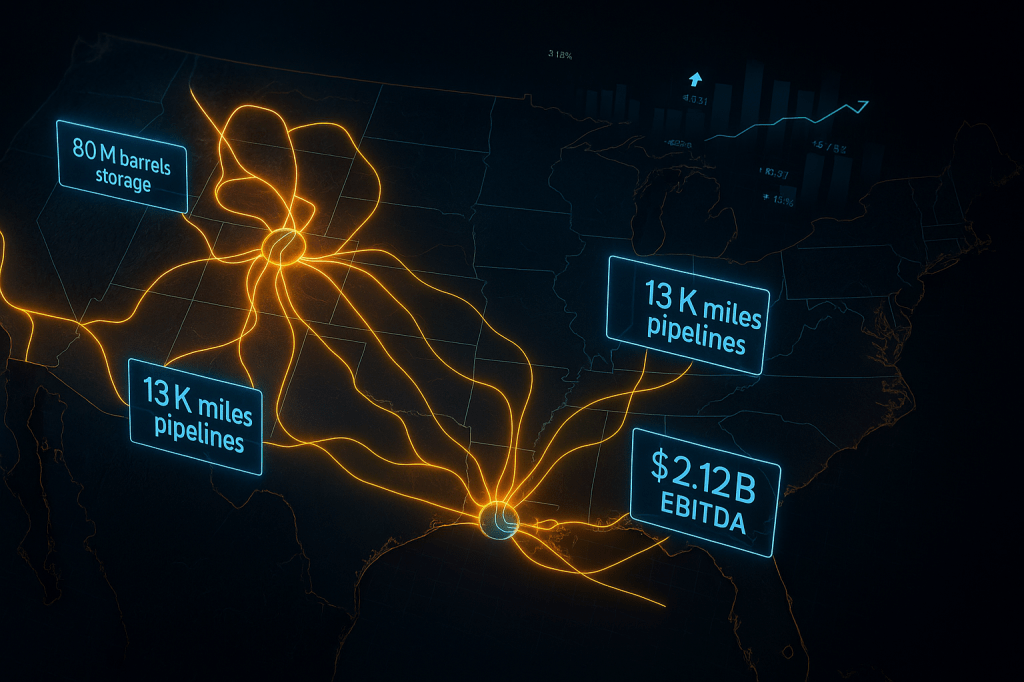

The Invisible Empire

Most investors can’t name a single ONEOK asset. That’s the point. The company operates 80 million barrels of NGL storage capacity, 13,000 miles of NGL pipelines, and processing plants that handle 15 billion cubic feet of natural gas daily. These aren’t glamorous assets. They’re essential infrastructure that generates cash whether oil trades at $60 or $90 per barrel.

The fee-based business model means ONEOK gets paid for moving molecules, not selling them. Roughly 80-85% of revenues come from fixed fees—you ship gas through our pipeline, we charge you a toll, regardless of where commodity prices go. This is the toll booth on the highway to American energy independence.

But here’s what makes Q3 2025 different: ONEOK absorbed EnLink’s 15 Bcf/d of gas processing capacity and Medallion’s 250,000 barrels per day of crude transportation in 2024. Everyone expected integration headaches, cost overruns, and the usual M&A disappointments. Instead, Q3 showed $397 million of incremental EBITDA contribution from these acquisitions—visible, measurable, and flowing directly to the bottom line.

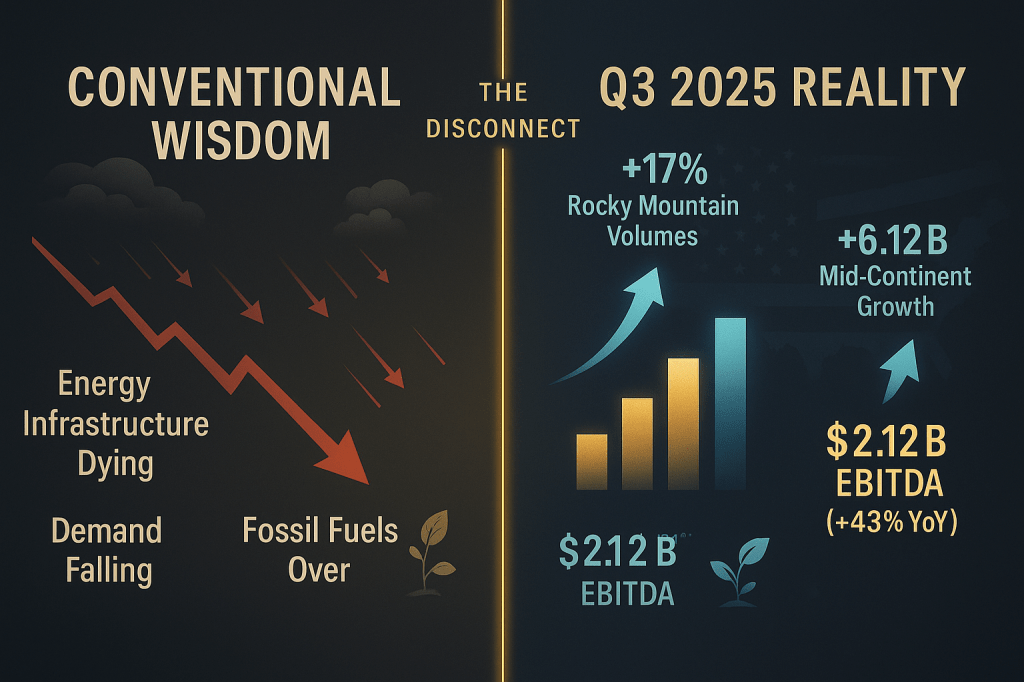

The Counter-Intuitive Truth About Midstream

Conventional wisdom says energy infrastructure is a dying business. Electric vehicles will kill oil demand. Renewable energy will eliminate natural gas. Midstream companies are dinosaurs waiting for extinction.

The data tells a different story. Rocky Mountain NGL volumes through ONEOK’s system jumped 17% year-over-year in Q3. Mid-Continent natural gas gathering increased 6%. These aren’t decline rates. These are growth numbers that would make a software company proud.

Why? Because even as America transitions to cleaner energy, we’re producing more oil and gas than ever. The United States pumped 13.2 million barrels of oil per day in 2024—an all-time record. Natural gas production hit 103 billion cubic feet per day. This gas doesn’t just power electricity plants. It’s the feedstock for plastics, fertilizers, and chemicals that touch every part of modern life.

ONEOK’s integrated platform captures value at every step. They gather raw natural gas from wells, process it to extract valuable NGLs like propane and ethane, fractionate those NGLs into pure products, then transport everything to end markets. Each step generates a fee. Each connection creates competitive advantage. Each asset leverages the others.

The EnLink acquisition added upstream gathering in the Permian, Mid-Continent, and Louisiana. Medallion brought crude oil takeaway capacity from the Permian to the Gulf Coast. Now ONEOK can offer producers a one-stop solution: we’ll gather your gas, process it, extract the NGLs, transport the crude, and move everything to market. Competitors can’t match that integrated offering.

What $250 Million Looks Like

Let’s get specific about what integration success means. EnLink contributed approximately $250 million to ONEOK’s Gas Gathering & Processing segment EBITDA in Q3 alone. Annualized, that’s $1 billion from one acquisition in one segment.

Medallion and EnLink together added $91 million to Refined Products & Crude EBITDA. The NGL segment saw $56 million of incremental contribution. These aren’t projections or synergy targets. These are actual Q3 results, verified by auditors, flowing through the income statement.

Do the math: $397 million in Q3 from acquisitions, times four quarters, equals $1.6 billion annually. ONEOK paid roughly $15 billion combined for EnLink and Medallion. That’s a 10.6% EBITDA yield on the acquisition price—and they’re only nine months into integration. Management hasn’t even begun quantifying the full synergy potential.

Compare this to ONEOK’s pre-acquisition run rate of roughly $6 billion in annual EBITDA. The acquisitions increased earning power by 25-30% almost immediately. And because these are fee-based infrastructure assets with 30-40 year useful lives, that EBITDA should compound for decades.

The Mont Belvieu Fire Nobody Cared About

On October 6, 2025, a fire broke out at ONEOK’s Mont Belvieu, Texas fractionation complex—one of the largest NGL processing hubs in North America. The MB-4 unit caught fire. The complex shut down as a precaution. This is the kind of headline that tanks infrastructure stocks.

ONEOK’s stock barely moved. Why? Because management immediately disclosed that they “do not expect a material financial impact” from the incident. The complex restarted within days, excluding only the damaged MB-4 unit. Other fractionation capacity absorbed the diverted volumes. Insurance will cover repairs.

This incident actually demonstrates ONEOK’s competitive strength. They have enough redundant capacity that losing one fractionation train doesn’t materially impact earnings. Their integrated network can reroute volumes around problems. And the market trusts management’s track record enough that an “no material impact” statement is taken at face value.

Contrast this with a smaller midstream operator, where a single facility fire could wipe out 10-15% of EBITDA for months. Scale matters in infrastructure. Redundancy is a competitive moat. ONEOK has both.

The Five Things That Could Go Wrong

Investment narratives without honest risk assessment are fairy tales. Here are five specific scenarios that could derail ONEOK’s thesis, with numbers:

Risk #1: NGL Pricing Collapse (15% probability, -$12 per share impact)

While 80% of ONEOK’s business is fee-based, they retain commodity exposure through keep-whole processing contracts and percentage-of-proceeds arrangements. If NGL prices drop 20% sustainably—say propane falls from $0.60/gallon to $0.48/gallon—ONEOK’s commodity-exposed EBITDA could decline $200-300 million annually. Management hedges 60-70% of this exposure, but they can’t eliminate it entirely.

Risk #2: Fee-Rate Compression (25% probability, -$8 per share impact)

Q3 results noted “fee-rate pressure” in Mid-Continent NGL operations. As producers consolidate, they gain negotiating leverage. If fee rates compress 10% across the system—from typical levels around $0.25-0.30 per gallon down to $0.22-0.27—that’s $300-400 million of annual EBITDA at risk. ONEOK’s integrated offering provides some protection, but they’re not immune to competitive pressure.

Risk #3: Integration Cost Overruns (10% probability, -$6 per share impact)

While Q3 showed clean integration, the hard part comes in 2026 when ONEOK consolidates IT systems, optimizes headcount, and integrates commercial teams. If integration costs run $500 million higher than planned, or synergy realization lags by 18-24 months, that delays the payback period and compresses near-term free cash flow.

Risk #4: Recession-Driven Volume Collapse (20% probability, -$10 per share impact)

ONEOK’s volumes ultimately depend on producer activity, which depends on commodity prices, which depend on economic growth. A 2026 recession that cuts oil demand by 10% and gas demand by 8% would reduce gathered volumes across ONEOK’s system. Even with fee-based contracts, lower throughput means lower absolute revenue. Model a 12-15% EBITDA haircut in a severe recession scenario.

Risk #5: Leverage Trap (5% probability, -$4 per share impact)

ONEOK’s debt load increased to roughly $24 billion post-acquisitions, putting leverage at 3.8x Debt/EBITDA. If EBITDA growth stalls—maybe integration stumbles, volumes disappoint, or commodity prices crater—that leverage ratio could climb to 4.5x or higher. At that point, credit agencies start downgrade reviews, borrowing costs rise, and the dividend comes under pressure.

Add up the probability-weighted expected loss: (0.15 × $12) + (0.25 × $8) + (0.10 × $6) + (0.20 × $10) + (0.05 × $4) = $6.60 per share of risk premium. Subtract that from the $75 base case fair value, and you get a risk-adjusted value of $68.40—almost exactly where the stock trades today. The market is efficiently pricing in these risks.

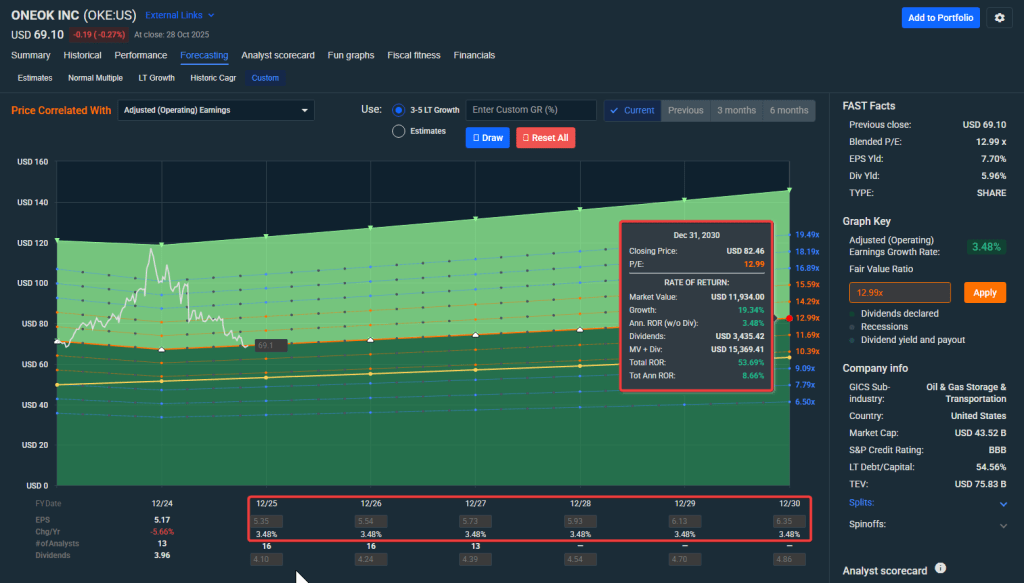

What To Do With This Information

ONEOK at $68.61 offers 9-12% upside to fair value plus a 6% dividend yield. That’s 15-18% total return potential over 12-18 months. Not spectacular, but attractive for a high-quality infrastructure asset with defensive characteristics.

Here’s the action plan:

Entry Zone: $65-$72 (Current price $68.61 is within buy range)

Below $65, ONEOK becomes a strong buy with 15%+ upside plus dividend. Above $72, risk-reward becomes less attractive—hold existing positions but don’t add. Above $82, consider trimming as the stock approaches bull case valuations.

Position Sizing: 3-5% of portfolio for moderate risk tolerance

Conservative investors: 2-3% max. This is a bond substitute, not a swing-for-the-fences growth play. Aggressive investors comfortable with leverage and energy exposure: up to 7-8%, but understand you’re concentrating sector risk.

Holding Period: 12-24 months

The thesis depends on continued integration success and EBITDA growth delivery. Q4 2025 earnings (late January 2026) and full-year 2026 guidance will be critical checkpoints. If integration remains on track, extend the holding period. If synergies disappoint or volumes weaken, exit on strength.

Invalidation Triggers (Sell immediately if any occur):

- Q4 2025 earnings miss consensus by 5%+ without compelling explanation

- Management cuts or suspends dividend

- Debt/EBITDA ratio rises above 4.5x for two consecutive quarters

- Major industrial accident with >$500M uninsured losses

- Fee-rate compression accelerates beyond 5% annually

Catalyst Timeline:

- Q4 2025 earnings (late January 2026): Confirmation of full-year guidance achievement and initial 2026 outlook

- Mont Belvieu MB-4 restart (Q1 2026): Validates no material impact thesis

- Mid-2026: Full-year acquisition synergy quantification from management

- 2027: Dividend growth resumes after leverage reduction to target range

The Metrics That Matter

| Metric | Q3 2025 | FY2025E | FY2026E | What It Means |

|---|---|---|---|---|

| Adjusted EBITDA | $2.12B | $8.1B | $8.7B | 7% growth shows acquisition working |

| Net Income | $940M | $3.5B | $3.8B | Bottom-line profitability improving |

| Free Cash Flow | ~$700M | $2.9B | $4.4B | 51% jump in ’26 as capex normalizes |

| Debt/EBITDA | 3.8x | 3.7x | 3.4x | Deleveraging trajectory on track |

| Dividend/Share | $1.03 | $4.12 | $4.12 | Stable payout, growth resumption in ’27 |

| EV/EBITDA | 9.0x | 8.8x | 8.2x | Trading below peer average of 9.9x |

| Dividend Yield | 6.0% | 6.0% | 6.0% | Income cushion while waiting for re-rating |

| Rocky Mtn Volumes | +17% Y/Y | – | – | Key growth driver sustaining |

| G&P Segment EBITDA | ~$800M | $3.0B | $3.3B | EnLink contribution visible and growing |

| Capex | $804M | $2.9B | $1.9B | Peak spending year, declining in ’26 |

The Bottom Line

ONEOK isn’t a cryptocurrency with 10x upside. It’s not a biotech moonshot or an AI revolution play. It’s 80 million barrels of storage tanks, 13,000 miles of steel pipe, and processing plants that turn raw natural gas into propane for your grill and ethane for plastic bottles.

But sometimes boring wins. ONEOK’s management executed two massive acquisitions without blowing up the integration. They’re generating record EBITDA while navigating operational incidents that would cripple smaller operators. They’re growing volumes in supposedly declining fossil fuel markets. And they’re paying you 6% annually to wait while the market figures out that midstream infrastructure isn’t dying—it’s compounding.

At $68.61, ONEOK offers the investment equivalent of toll booth ownership on the highways of American energy. The traffic isn’t declining. The fees keep flowing. And the market is giving you a 6% yield plus growth potential at a valuation discount.

The invisible empire of pipelines, processing plants, and storage tanks doesn’t capture headlines. But it captures cash flow. And in a market obsessed with narratives over numbers, that creates opportunity for investors willing to look past the boring exterior to the compounding machine underneath.

Buy ONEOK between $65-$72. Size it at 3-5% of your portfolio. Collect the 6% dividend. And let America’s energy circulatory system do what it does best: move molecules and generate cash, quarter after quarter, year after year.

Leave a comment