While Wall Street obsesses over Netflix’s next subscriber number, Disney is quietly assembling the most powerful entertainment fortress in modern history. The company that invented the theme park is now reinventing streaming profitability, sports monetization, and experiential entertainment simultaneously. Trading at $111 with a clear path to $128, the Mouse House offers something rare in today’s market: quality growth at a reasonable price.

Our conviction: Disney sits at the inflection point where three structural trends converge – streaming reaches profitability, sports moves direct-to-consumer, and premium experiences command higher pricing power. The market sees a mature media company; we see a cash-generating machine with multiple expansion levers just beginning to pull. But make no mistake – this transformation demands flawless execution in an industry where content hits are never guaranteed.

The Castle Built on Cash Flows

Think of Disney as the landlord who owns both the apartment building and the furniture factory. While competitors rent distribution or license content, Disney controls the entire value chain from Mickey Mouse’s creation to the hotel room where families sleep after meeting him in person.

The company operates an integrated entertainment ecosystem generating $23.65 billion in quarterly revenue. That’s $94.6 billion annualized, with Parks & Experiences contributing $8.24 billion in quarterly operating income alone – up 22% year-over-year despite concerns about consumer spending.

Here’s why this structure matters: content costs get amortized across theatrical releases, streaming platforms, merchandise, theme parks, and cruise ships. A single Marvel film generates revenue for 5-7 years across multiple channels. The same Frozen character drives box office, Disney+ subscriptions, park attendance, toy sales, and Broadway tickets. This multiplication effect creates margins traditional media companies can’t match.

The Numbers That Build Our Case

Revenue momentum tells Disney’s recovery story. Q3 FY2025 sales hit $23.65 billion (+2% YoY), but that understates the transformation. Streaming revenue grew 6% while entertainment direct-to-consumer finally turned profitable on a GAAP basis. Nine-month revenue of $71.96 billion is up 5% year-over-year, with the critical inflection being margin expansion rather than just top-line growth.

The balance sheet provides safety many growth stories lack. Disney maintains healthy liquidity with moderate leverage at 40% debt-to-capital. Free cash flow is rebuilding strongly at $11.5 billion trailing twelve months, representing a 5.1% FCF yield. That’s enough to cover the $1.00 annual dividend six times over while funding expansion.

Quality metrics confirm this isn’t your grandfather’s media stock. Return on invested capital exceeds the cost of capital, a rarity in entertainment. Operating margins of 19% in entertainment and 16% in sports beat most traditional media peers. Financial health indicators show no distress, while operational fundamentals remain solid.

The Streaming Profit Machine Emerges

Disney’s streaming transformation accelerated throughout 2024-2025, reaching profitability faster than most analysts predicted. The company now boasts 128 million Disney+ subscribers (+1.8 million vs. prior quarter) and 183 million total direct-to-consumer subscribers across all platforms.

The financial opportunity expands rapidly. Disney targets double-digit percentage segment operating income growth in Entertainment for FY2025, with ESPN’s direct-to-consumer bundle launching in 2025-26. Management guides toward $5.85 adjusted EPS (+18% YoY), suggesting the streaming/content transformation is accelerating rather than slowing.

Content advantages remain Disney’s moat. The Marvel Cinematic Universe, Star Wars franchise, Pixar storytelling, and ESPN sports rights create barriers competitors can’t easily replicate. When “Inside Out 2” becomes one of the year’s biggest films, it’s not luck – it’s decades of IP development paying dividends.

The NFL partnership launching with ESPN provides crucial live sports leverage. As linear TV declines, owning premier sports rights in a direct-to-consumer format could be worth $5-10 billion in incremental value by 2027-28.

Parks Still Matter (For Better and Worse)

Don’t mistake Disney for a pure streaming play – Parks & Experiences remains central to both the business model and stock performance. Domestic parks operating income surged 22% year-over-year to $1.7 billion in Q3, demonstrating pricing power even as inflation pressures consumers.

Parks provide crucial advantages. They generate immediate cash flow while streaming profitability takes time to materialize. During strong consumer spending periods, parks become incredibly profitable engines funding innovation. Park expansions in the U.S. and Asia provide multi-year growth visibility.

The challenge? Economic sensitivity flows directly to attendance and spending. The company’s ~1.5 beta means it moves roughly in line with market volatility, but consumer discretionary spending can swing more violently than the overall economy. Any significant recession would pressure both park revenue and content consumption.

Recent consumer strength supports Disney’s parks operations, but any material economic slowdown would weigh on this high-margin division that contributes 35-40% of operating income.

Risk Management: What Keeps Us Honest

Five Specific Concerns That Could Break Our Thesis:

1. Streaming Competition Intensifies

Netflix, Amazon, and Apple outspend Disney on content. If subscriber growth stalls below 135 million Disney+ subs by Q2 FY2026 or churn rises above 4% monthly, the streaming thesis weakens materially. Watch the Q4 earnings call in November 2025 for guidance.

2. Distribution Disputes Accelerate

The YouTube TV carriage fight in late 2025 shows affiliate fee pressure. If Disney loses more than two major distribution partners or suffers 15%+ affiliate revenue decline in FY2026, linear cash flows erode faster than streaming can replace. Monitor quarterly network revenue trends.

3. Content Disappointments Compound

Marvel and Star Wars franchises showing fatigue. If three consecutive major releases underperform expectations (defined as sub-$500M domestic box office for Marvel films or sub-200M opening weekend for Star Wars), IP value deteriorates. Track Rotten Tomatoes scores and opening weekend trends.

4. Recession Crushes Parks

Consumer discretionary spending is cyclical. If U.S. unemployment rises above 4.5% or consumer confidence drops below 95, park attendance could fall 10-15%, cutting operating income by $2-3 billion. Watch monthly attendance data and pricing power.

5. Capital Intensity Strains Cash

Expansion plans require $20-30 billion in capital over 3-5 years. If free cash flow falls below $10 billion annually or debt-to-EBITDA rises above 3.0x, financial flexibility shrinks and dividend/buybacks face pressure. Monitor quarterly FCF and leverage ratios.

Technical Picture: Support Meets Value

Disney’s chart reflects the recovery story with measured progression. The stock trades comfortably above its 200-day moving average at $110, establishing solid technical support. Key resistance appears around $115-118, representing recent highs from 2024.

RSI of 50 suggests neutral momentum – neither overbought nor oversold. MACD shows no clear divergence, indicating trend stability rather than imminent reversals.

Key support levels emerge at $100 (psychological level and prior breakout zone) and $95 (major value threshold). Resistance appears around $115-118 (52-week high area).

The volatility profile demands respect but isn’t extreme. One-year volatility of ~25-30% means daily moves of 1-2% are normal, not exceptional. Five-year beta of 1.54 shows slightly above-market sensitivity, reflecting its consumer discretionary nature.

Investment Strategy: Conviction With Guardrails

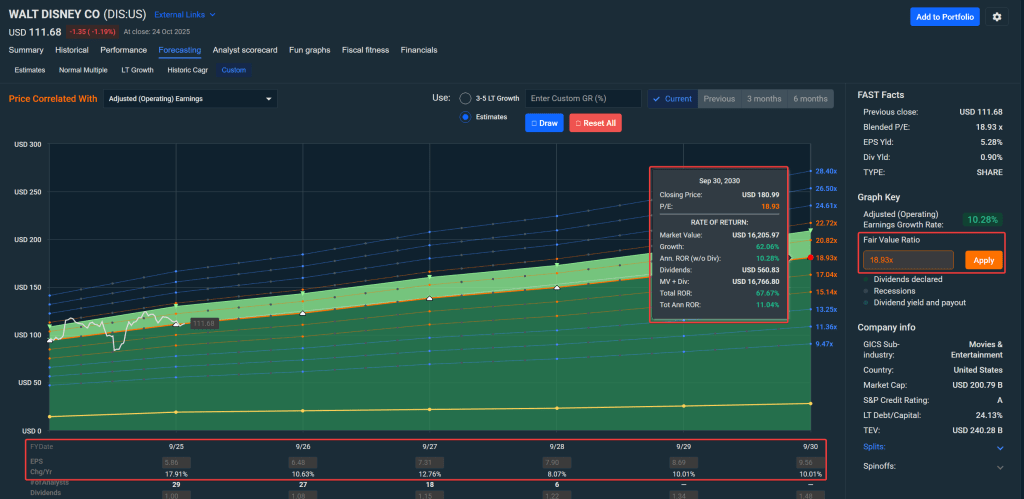

Our blended fair value estimate: $128 per share, weighting DCF analysis ($130) and Morningstar’s independent fair value ($125). Current pricing near $111 reflects 13% undervaluation – not extreme distress but meaningful opportunity.

Buy zones demand discipline:

- Strong Buy below $95 (25% below fair value) – deep value territory where even modest growth assumptions work

- Primary Buy $95-115 (fair value range) – reasonable entry for long-term holders

- Hold $115-140 (fair to modest premium) – maintain positions, don’t add aggressively

- Trim $140-150 (10-17% premium) – take some profits, especially if fundamentals haven’t improved

- Too Expensive above $150 (speculative territory) – reduce positions meaningfully

Position sizing reflects quality, not volatility. Given Disney’s high quality characteristics and moderate growth profile, this fits as a 5-8% core holding in diversified portfolios. Unlike high-volatility names requiring 2-3% caps, Disney’s stability allows larger positions for those comfortable with entertainment industry dynamics.

Entry strategy emphasizes patience:

- Tier 1 (40% of position): Enter immediately at current prices below $115

- Tier 2 (35% of position): Add on any pullback toward $105-108

- Tier 3 (25% of position): Reserve for $95-100 zone if market weakness develops

Stop-loss discipline protects capital:

- Technical stop: Close below $100 for two consecutive weeks suggests trend break

- Fundamental stop: Two consecutive quarters of subscriber losses or margin compression

- Time stop: If streaming doesn’t show 20%+ YoY revenue growth by Q4 FY2026, reassess thesis

- Thesis invalidation: ESPN+ launch fails to reach 10M subscribers by end of 2026

The 12-Month Outlook: Multiple Paths to Value

Base case (50% probability): +15% to $128

Streaming revenue ramps as planned, Parks maintain mid-single digit growth, ESPN+ launch meets expectations. Multiple expands from 18x to 20x forward P/E as investors recognize the transformation is working.

Bull case (20% probability): +30% to $145

Streaming subscriber growth accelerates above 140M Disney+, Parks see double-digit revenue growth from international expansion, ESPN+ exceeds 12M subs in first year, content slate delivers multiple blockbusters. Premium valuation becomes justified by results.

Bear case (30% probability): -15% to $95

Recession pressure weighs on Parks, streaming growth stalls, content disappointments mount, distribution disputes accelerate cord-cutting. Valuation compression occurs as growth concerns resurface.

Probability of positive returns over 12 months: ~58% based on analysis, reflecting moderate confidence despite quality characteristics.

Why This Matters for Your Portfolio

Disney represents a structural shift in how entertainment companies create value. Rather than depending entirely on linear TV distribution, the company built multiple direct-to-consumer revenue streams from the same content investments.

The content fortress provides genuine competitive advantages. Decades of IP development creates barriers new entrants can’t easily replicate, providing pricing power and customer loyalty unusual in commodity media businesses.

Brand strength becomes increasingly valuable. As streaming fragmentation continues, consumers gravitate toward trusted brands with broad content libraries. Disney’s multi-generational appeal provides both retention advantages and family-oriented pricing power.

However, execution risk exists in any transformation. The company must simultaneously manage legacy linear decline, build streaming profitability, expand parks globally, and produce hit content consistently – satisfying both Wall Street growth expectations and Main Street entertainment standards.

Bottom Line Investment Thesis

Disney offers quality exposure to the entertainment streaming transformation without paying growth stock multiples. The streaming business provides margin expansion potential, while Parks offer immediate cash flow and cyclical upside opportunities.

Buy on weakness toward $100-108, accumulate for the multi-year streaming buildout, and hold through volatility. This isn’t a stock requiring daily monitoring, but it rewards patience and proper position sizing.

Current action plan: Begin building positions below $115, target a full position by $105, and hold for the streaming profitability story to fully materialize through 2026. Set review checkpoints at each quarterly earnings call, focusing on Disney+ subscriber trends, Parks margin sustainability, and ESPN+ launch execution.

The transformation from linear-dependent media company to diversified entertainment fortress is real, profitable, and accelerating. Whether the stock price reflects this reality fairly is the bet every investor must make for themselves. We believe the answer is no – and that creates opportunity.

Master Metrics Table

| Metric | Value | Notes |

|---|---|---|

| Current Price | $111 | As of October 26, 2025 |

| Market Cap | $201B | Large-cap entertainment leader |

| Revenue (TTM) | $94.6B | Annualized from Q3 data |

| Gross Margin | ~45% | Varies by segment |

| Net Margin | ~8% | Improving with streaming profitability |

| Current Ratio | ~1.1 | Adequate liquidity |

| Debt/Capital | 40% | Moderate, manageable leverage |

| Interest Coverage | Strong | Comfortable debt service |

| Quality Score | 8.5/10 | Composite score |

| Value Score | 7-8/10 | Modest discount to fair value |

| Growth Score | 6/10 | Mid-single digit top-line |

| Momentum Score | 5-6/10 | Neutral recent performance |

| Safety Score | 8-9/10 | Strong financial foundation |

| 1-Year Beta | 1.54 | Slightly above market |

| Volatility (5Y) | ~25-30% | Moderate for large-cap |

| Forward P/E | 18.2x | Reasonable for quality |

| EV/EBITDA | ~9.0x | In-line with sector |

| FCF Yield | 5.1% | Strong cash generation |

| Revenue Growth | +5% YoY | Accelerating with streaming |

| Disney+ Subscribers | 128M | Core streaming platform |

| Total DTC Subs | 183M | All streaming services |

| Parks OI Growth | +22% | Domestic segment strength |

| Dividend Yield | 0.9% | $1.00 annual payment |

| Dividend Coverage | 6x+ | FCF easily covers payout |

| Blended Fair Value | $128 | DCF + Morningstar weighted |

| Analyst Target | $133 | Wall Street consensus |

| Buy Rating % | 79% | Strong analyst support |

| Upside to FV | +15% | Attractive risk/reward |

Leave a comment