Picture this: You’re running a contact center with 5,000 agents fielding millions of customer calls every year. Every second of wait time costs money. Every misrouted call burns customer goodwill. Every compliance miss invites regulatory hell.

Now imagine software that routes calls perfectly, predicts customer needs before they speak, records everything for compliance, and uses AI to analyze sentiment in real-time. That’s not science fiction—that’s what NICE Ltd does for thousands of enterprises worldwide. And right now, Wall Street is pricing this market leader like it’s on the verge of obsolescence.

The Disconnect That Creates Opportunity

Here’s what makes zero sense: NICE generates $2.8 billion in revenue with 19% net margins—higher than most software companies dream of achieving. The business throws off $660 million in free cash flow annually. Cloud revenue is growing 12% year-over-year as the company smoothly transitions from legacy on-premise to subscription models. Customer retention sits at 98%.

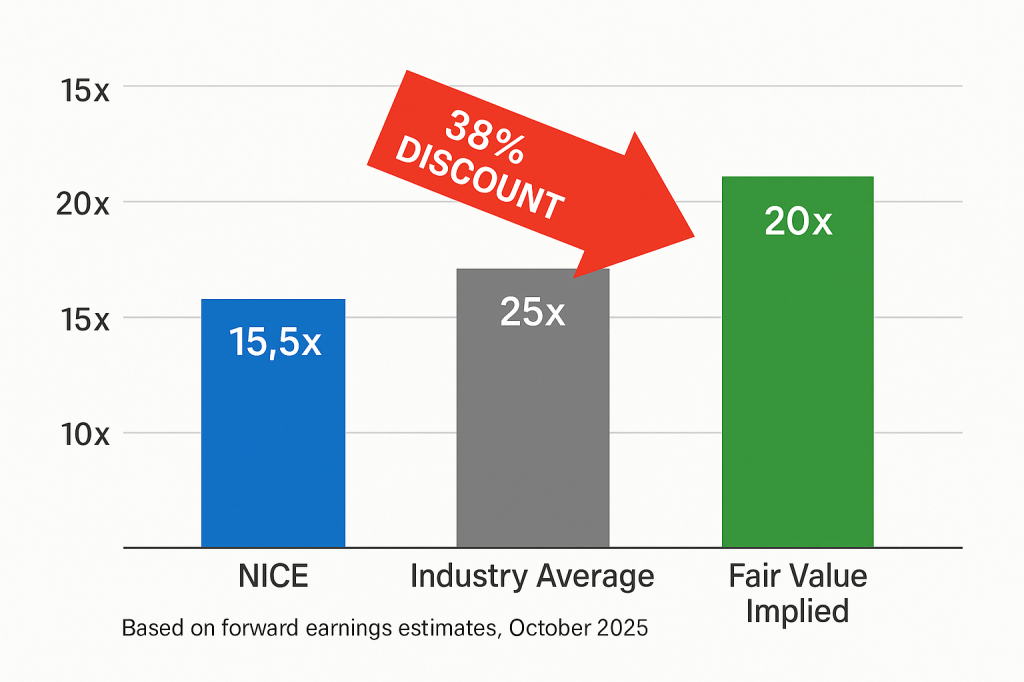

Yet the stock trades at 15.5 times earnings.

Let me put that in perspective. The average software company trades at 25 times earnings. NICE’s direct competitors—smaller, less profitable firms—command similar or higher multiples despite inferior fundamentals. Five9 trades at 7x forward earnings but only because analysts expect EPS to explode from near-zero today. Verint trades at 6x forward for the same reason—they’re barely profitable now.

NICE is already profitable. Massively so. And the market is giving it a distressed valuation.

The shares have dropped 27% in the past year while the business has actually improved. Management just raised full-year guidance after beating Q2 estimates. This isn’t a company in trouble—this is a cash-compounding machine that Wall Street temporarily forgot how to value.

What NICE Actually Does (And Why It Matters)

Think of NICE as the invisible backbone of customer service. When you call your bank, your insurance company, or your cell phone provider, there’s a good chance NICE software is orchestrating that entire interaction.

Their CXone platform—the industry-leading cloud contact center solution—does everything: routes your call to the right agent based on need and availability, provides that agent with your full history in real-time, records the conversation for compliance and training, analyzes the emotional tone of the exchange using AI, and generates performance metrics that help companies optimize their operations.

This isn’t commodity software. Contact centers are mission-critical infrastructure for enterprises. When your contact center goes down, revenue stops. When compliance fails, regulators show up with fines. NICE has spent 30 years building integrated capabilities that point-solution competitors can’t match: omnichannel routing, workforce optimization, real-time analytics, robotic process automation, fraud detection.

The moat is scale and integration. Once a company with 10,000+ agents runs on NICE’s platform, ripping it out and replacing it with a competitor is like replacing the engine in a car while it’s driving down the highway. Possible? Technically. Smart? Rarely.

The Numbers That Tell the Real Story

Profitability: 67% gross margins. 21% operating margins. 19% net margins. These aren’t “fake” SaaS metrics—this is real GAAP profitability that flows through to actual cash.

Cash Generation: $660 million in free cash flow on $2.8 billion in revenue equals a 23% FCF margin. The company converts profits to cash efficiently with no debt on the balance sheet—actually net cash of $1.1 billion.

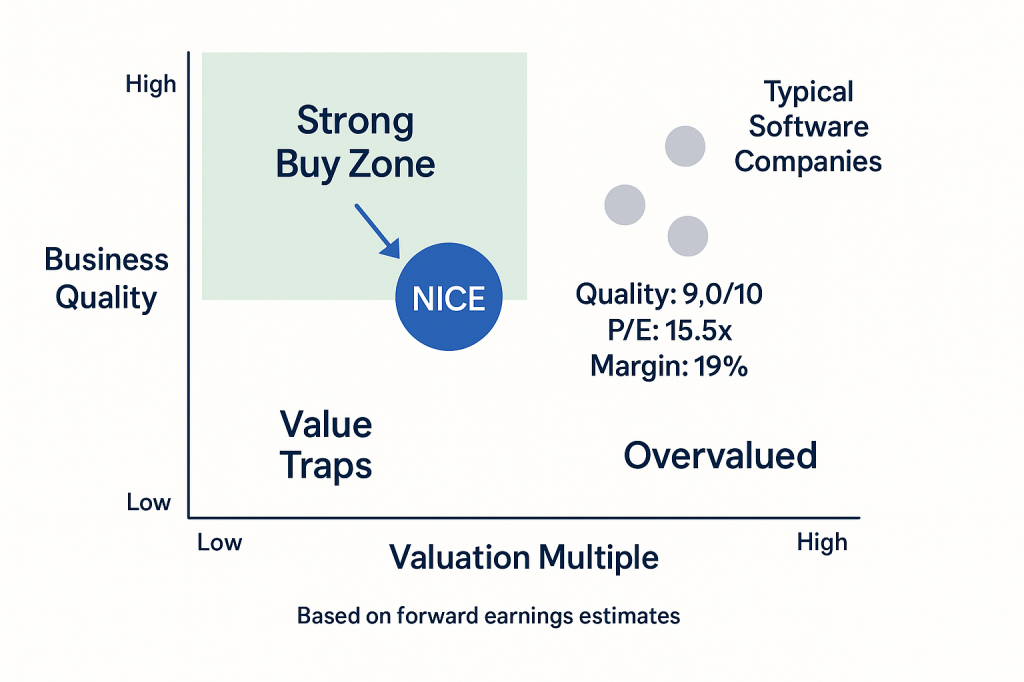

Quality: Return on invested capital of 12.6%. Altman Z-score solidly in the safe zone. Piotroski F-score of 9 out of 9—the highest quality rating possible. This is a fundamentally sound business by every metric.

Growth: Not explosive, but steady and sustainable. 8-10% revenue growth with cloud segment leading at 12%. Long-term EPS growth forecast around 9% annually, aided by operating leverage as the cloud mix rises.

Valuation: Trading at 15.5x trailing earnings and just 9.5x forward earnings. Compare that to the software industry average of 25x. Price-to-sales of 2.9x versus industry 5x+. EV/EBITDA of 8.2x versus industry 15x+.

Every traditional valuation metric screams undervalued.

Why Now? The Catalyst Path

The market isn’t irrational forever—eventually, cash-generating businesses get re-rated. Here’s what could close the valuation gap over the next 12-18 months:

Continued Execution: NICE just raised guidance after a strong Q2 beat. If the company keeps delivering 8-10% revenue growth with expanding margins, the narrative shifts from “struggling SaaS” to “steady compounder.” The next earnings report (November 13) will be critical—another beat and raise would reinforce that management has visibility and confidence.

Cloud Momentum: As cloud revenue approaches 85%+ of total revenue (currently 50-60%), the business model becomes more predictable with higher lifetime value per customer. Higher recurring revenue typically commands higher multiples. We’re watching for cloud ARR growth to maintain double-digits through 2026.

AI Integration Pays Off: NICE has embedded generative AI into its analytics—real-time transcription, sentiment analysis, intelligent routing. These aren’t gimmicks; they’re features enterprises will pay for. Any major customer wins or product announcements showcasing AI capabilities could spark renewed investor interest (remember how AI narrative drove other software stocks in 2023-2024).

Macro Relief: Tech valuations compressed in 2024 due to higher interest rates. If rates stabilize or decline through 2025—which seems likely given economic data—growth-adjacent software names could see multiple expansion. NICE would benefit disproportionately given how depressed its valuation is today.

Capital Deployment: The company has $1.1 billion in net cash and board authorization for buybacks. Management could accelerate share repurchases at these levels, reducing share count 1-2% annually and boosting EPS growth. Even a small dividend initiation would attract income-focused investors.

The base case isn’t heroic—it simply requires NICE to keep doing what it’s been doing: growing steadily, maintaining margins, generating cash. If that happens, the stock should trade at 16-18x earnings (still below peers), implying a price around $160 within 12 months—roughly 23% upside from current $130.

The bull case assumes sentiment fully normalizes and NICE gets valued like the quality business it is: 20x earnings on $180+ stock price, representing 38% upside.

The Honest Risk Assessment

Nothing’s perfect, and NICE has risks worth monitoring:

Competition: Cloud-native competitors like Five9, Genesys, and even Zoom/Twilio are fighting for contact center market share. If NICE were to lose a major customer or see cloud ARR growth drop below 5%, the growth thesis weakens. Track this metric every quarter.

Macro Sensitivity: In a recession, enterprise software budgets tighten. NICE’s exposure to financial services and telecom means economic downturns could stall sales cycles. A material GDP contraction would pressure near-term estimates.

Geopolitical Overhang: NICE is an Israeli company. Regional conflict or political instability could disrupt operations or talent retention in Israel. So far, the company’s business continuity plans have held up, but this remains a tail risk.

Execution on Acquisitions: NICE has a history of acquisitions (inContact in 2016, MindTouch recently). Integration risks are real—cost overruns, technical issues, or customer churn from acquired products could hurt margins or reputation. Watch for any signs of elevated churn rates.

Valuation Risk: Paradoxically, the cheap valuation is a double-edged sword. If tech sector sentiment stays very weak—rates staying higher for longer—multiples could compress further. If NICE traded under 10x forward earnings without fundamental deterioration, it might signal market perception we’ve missed.

Thesis Invalidation Triggers: If cloud revenue growth falls below 5% for 2-3 consecutive quarters, or if there’s material margin erosion (suggesting pricing pressure), we’d reassess. Likewise, any accounting irregularity or unexpected debt surge would break the quality/safety thesis entirely.

The bear case—macro recession plus execution stumbles—could see the stock at $115 (about 12% downside from here). But even that scenario isn’t catastrophic given the low starting multiple and strong balance sheet.

Where to Buy, Where to Sell

From a technical perspective, NICE has been in a corrective phase but shows signs of bottoming. The stock trades below its 200-day moving average (~$142), indicating intermediate-term weakness. However, momentum indicators are improving: RSI recently climbed from oversold territory (<30) to around 45, and MACD is curling upward.

Support levels: Strong support around $120—the 52-week low and a level where shares found buyers during the mid-2023 sell-off. Further support at $110 (our bear-case fundamental floor, roughly 12x forward earnings).

Resistance levels: Expect resistance around $145-150, which includes the 200-day MA and prior support from earlier this year. A break above $150 on volume would be a bullish technical signal, potentially clearing the runway to our $160+ target.

Entry Strategy: Consider a staged approach to manage volatility:

- Primary buy: Current levels around $130 (15.5x earnings, 47% margin of safety vs. fair value)

- Strong buy: Add aggressively in the low-$120s if the stock pulls back (10-11x forward earnings)

- Momentum add: Final tranche if the stock breaks above $145 with volume (confirms trend reversal)

Exit/Trim Guidance:

- Hold: Up to fair value around $175 (where risk/reward becomes neutral)

- Trim: Above $200 (20%+ above fair value; valuation would be ~25x forward earnings without fundamental justification)

- Stop loss: Weekly close below $120 would be concerning, but given our long-term conviction, a “mental stop” focused on fundamentals may be more appropriate than a hard technical stop

Position Sizing: For a moderate-risk portfolio, 4-5% allocation makes sense. This is a quality business with low fundamental risk trading at a discount—worthy of core holding status, not a speculative lottery ticket.

Buy Zone Presentation

Strong Buy: ≤ $125 (compelling deep value)

Primary Buy: $125-$140 (attractive entry)

Hold: $140-$175 (fair value range)

Trim: $175-$200 (reduced upside)

Too Expensive: > $200 (stretched valuation)

The Bottom Line

Wall Street occasionally makes mistakes. Right now, it’s pricing NICE Ltd—a profitable, cash-generating, market-leading software company—like a distressed turnaround or unprofitable growth story. Neither characterization fits the facts.

This is a 30-year-old business with 98% customer retention, 19% net margins, zero debt, and $1 billion+ in net cash. The company grows revenue at high-single digits, converts earnings to cash efficiently, and operates in a mission-critical category (contact centers) with secular tailwinds (digital customer experience, AI analytics).

Yet it trades at a 40%+ discount to software industry multiples and a 35%+ discount to our fair value estimate.

The opportunity is simple: buy a quality business at a bargain price, wait for the market to recognize its mistake, and collect steady compounding in the meantime. The base case offers 20-25% upside over 12-18 months. The bull case offers 40%+. The downside appears limited to mid-teens percentage at most, given the strong fundamentals and low starting valuation.

This isn’t a bet on explosive growth or a revolutionary product. It’s a bet on arithmetic—that eventually, a company earning $8+ per share won’t trade at 15x earnings forever when peers trade at 25x.

Our Vulcan framework rates NICE a Strong Buy with a composite score of 8.7/10, reflecting exceptional marks in Value (9.2/10) and Quality (9.0/10). For patient investors seeking high-quality tech at distressed prices, NICE checks every box.

The market’s mistake is your opportunity. Act accordingly.

Master Metrics Table

| Metric | Value | Note |

|---|---|---|

| Current Price | $129.88 | As of October 18, 2025 |

| Market Cap | $8.1 Billion | ~62M shares outstanding |

| Vulcan Score | 8.7/10 | Strong Buy rating |

| Valuation | ||

| Fair Value (Blended) | $175 | 35% upside to fair value |

| Margin of Safety | 47% | Per Stock Rover DCF |

| Trailing P/E | 15.5x | vs industry 25x+ |

| Forward P/E | 9.5x | Based on FY25 estimates |

| Price/Sales | 2.9x | vs industry 5x+ |

| EV/EBITDA | 8.2x | vs industry 15x+ |

| FCF Yield | 7.5% | Strong cash generation |

| Quality Metrics | ||

| Gross Margin | 67.0% | Best-in-class profitability |

| Operating Margin | 21.3% | Expanding with cloud mix |

| Net Margin | 18.9% | Actual GAAP profitability |

| ROIC | 12.6% | Efficient capital deployment |

| ROE | 14.4% | Strong returns on equity |

| Piotroski F-Score | 9 | Highest quality rating |

| Altman Z-Score | 4.3 | Safe zone (>2.6) |

| Interest Coverage | 50x+ | Zero debt burden |

| Debt/Equity | 0.1 | Essentially debt-free |

| Net Cash | $1.1 Billion | $16.84 per share |

| Growth Metrics | ||

| Revenue (TTM) | $2.84 Billion | Trailing 12 months |

| Revenue Growth (1Y) | 7.6% | Q2 beat estimates |

| Revenue Growth (3Y Avg) | 10.1% | Consistent growth |

| Revenue Growth (5Y Avg) | 11.5% | Track record |

| Cloud Revenue Growth | 12% | Accelerating transition |

| EPS Growth (1Y) | 29.4% | Operating leverage |

| EPS Growth (3Y Avg) | 31.4% | Strong expansion |

| Forward Growth Est. | 9-10% | Sustainable pace |

| Cash Flow | ||

| Free Cash Flow (TTM) | $660 Million | 23% FCF margin |

| FCF Per Share | $10.27 | Strong per-share basis |

| Operating Cash Flow | $755 Million | Solid conversion |

| CapEx | $95 Million | Light capital needs |

| Dividend & Returns | ||

| Dividend Yield | 0.0% | No current dividend |

| Share Buyback Yield | ~1% | Ongoing authorization |

| Customer Retention | 98% | Industry-leading |

| Risk Metrics | ||

| Beta (1-Year) | 0.87 | Lower volatility than market |

| Volatility (1-Year) | 0.41 | Moderate |

| Max Drawdown (1Y) | -35.8% | Recent correction |

| Short Interest | 3.5% | Low short pressure |

| Analyst Consensus | ||

| Rating | Buy | 10 Strong Buy, 1 Buy, 6 Hold |

| Mean Price Target | $180 | Street consensus |

| Next Earnings | Nov 13, 2025 | Q3 report date |

| Scenario Analysis | ||

| Bull Case (35% prob) | $180 | 38% upside; AI traction |

| Base Case (50% prob) | $160 | 23% upside; steady execution |

| Bear Case (15% prob) | $115 | 12% downside; macro/execution |

| Expected Return (12M) | ~20-25% | Risk-adjusted |

Key Catalysts (Timeline)

- Q3 Earnings (Nov 13): Look for revenue beat, cloud ARR growth >10%, guidance raise

- H1 2026: Potential buyback announcement or dividend initiation; macro rate relief

- Mid-2026: AI product case studies; industry conference announcements (NICE Interactions)

- 2026-2027: Cloud mix approaching 85%+; margin expansion to 30-35% operating margin

Investment Recommendation

Rating: Strong Buy

Target Price (12M): $160 (base), $180 (bull)

Position Size: 4-5% of portfolio (core holding)

Entry Strategy: Staged – primary at $130, add on dips to $120s, momentum add above $145

Hold Period: 12-18 months minimum (long-term compounder)

Risk Level: Moderate (quality business, low fundamental risk despite stock volatility)

Data sources: Vulcan Database (October 18, 2025), Vulcan-mk5 Analysis Framework, company filings. All forward-looking statements represent estimates and projections subject to change. This analysis is for informational purposes and does not constitute investment advice. Past performance does not guarantee future results.

Leave a comment