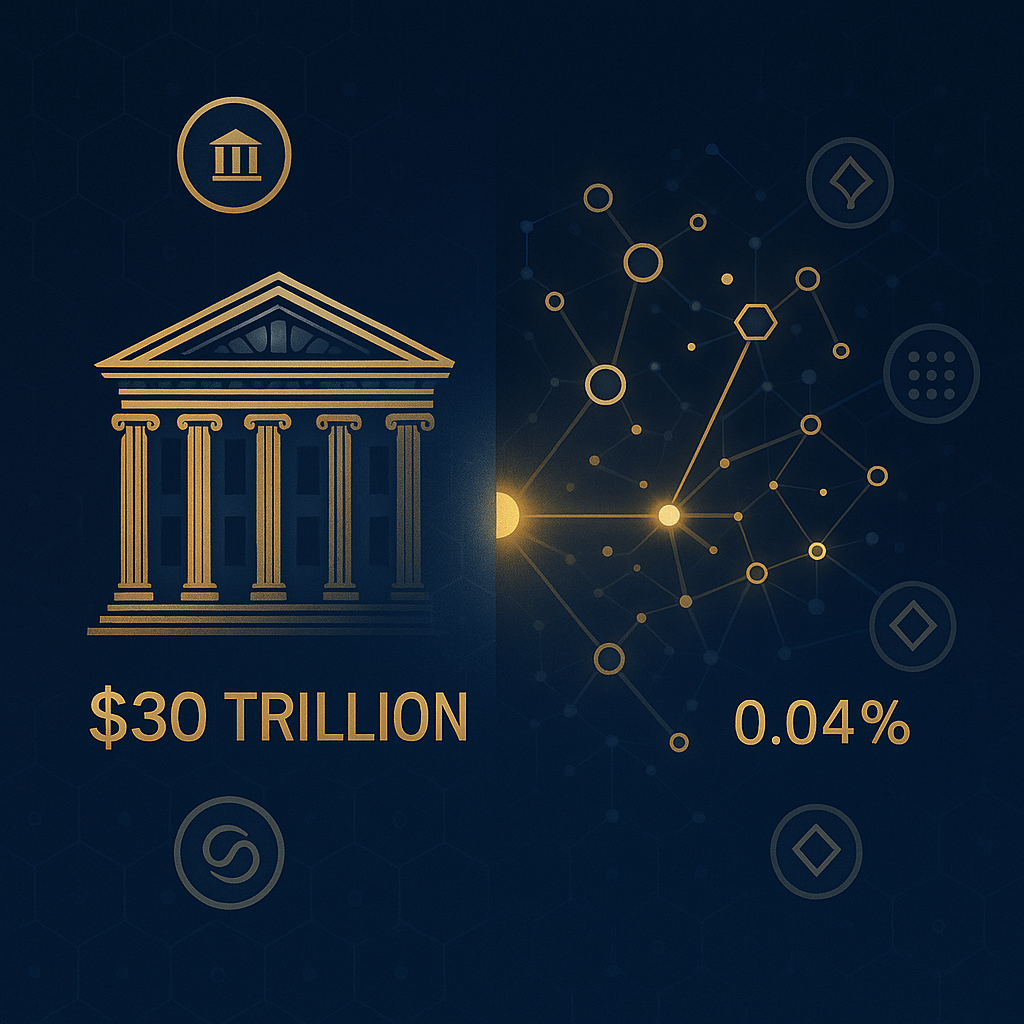

Larry Fink manages $10 trillion and just told shareholders that “every stock, every bond, every fund—every asset—can be tokenized.” Nine months later, the scoreboard reads: $8.3 billion in tokenized treasuries. That’s 0.04% of traditional markets. The gap between Fink’s vision and current reality isn’t a rounding error—it’s a chasm spanning 100-1,000x growth. But here’s what your smart neighbor needs to understand: the race to capture that migration is already underway, the winners are being decided right now, and betting correctly requires abandoning the most dangerous assumption in crypto—that protocol success guarantees token appreciation.

October 2025 delivered genuine breakthroughs. The GENIUS Act became law, creating America’s first federal stablecoin framework. The SEC dismissed Coinbase enforcement and reversed anti-crypto rules. SWIFT announced blockchain integration with 30+ major banks. Visa moved production stablecoin settlements through Worldpay and Nuvei. Tokenized treasuries surged 233% year-over-year with BlackRock’s BUIDL fund capturing 34% market share at $2.8 billion.

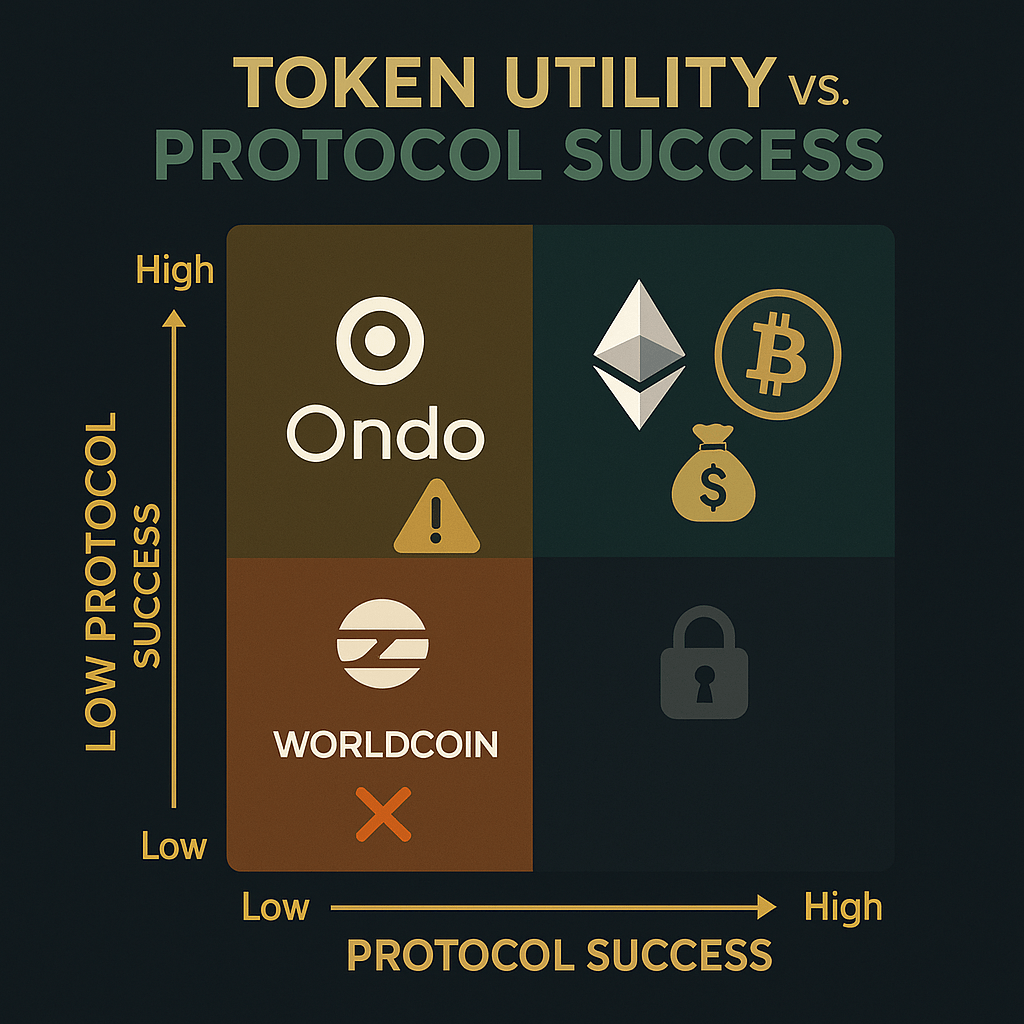

Yet the uncomfortable truth hiding beneath institutional enthusiasm reshapes everything: Ondo Finance operates the second-largest tokenized treasury platform with partnerships including BlackRock, PayPal, and JPMorgan—but you never need to touch the ONDO token to use any of their products. Ethereum commands 85-95% of RWA market share including Layer 2s, but L2s now pay Ethereum just $42,000 quarterly despite generating hundreds of millions themselves. The best protocols may offer the worst token investments.

From our research analyzing five major tokenization candidates—Bitcoin, Ethereum, Chainlink, Solana, Ondo, and Worldcoin—only three merit portfolio allocation. The framework reveals which assets capture institutional capital flows as $306 billion in stablecoins expand toward trillions in tokenized securities, and which impressive-sounding protocols leave token holders with empty promises.

BlackRock Built It, Institutions Came – But Scale Remains Microscopic

Let’s explain what BlackRock actually accomplished in language your intelligent neighbor would understand.

Imagine your local bank announced it’s moving all customer accounts to blockchain. They built the technology, tested it, and 34% of early adopters picked their platform. Sounds impressive—until you learn that only 0.04% of total bank customers have moved. That’s BlackRock’s tokenization story.

The BUIDL fund reached $2.8 billion, becoming the world’s largest tokenized money market fund. Franklin Templeton’s BENJI hit $732 million. Hashnote’s USYC reached $900 million. These aren’t vapors—they’re real institutions processing actual money on blockchain rails. But $8.3 billion across the entire tokenized treasury market represents a grain of sand on a beach when measured against the $20+ trillion traditional Treasury market.

The broader real-world asset sector excluding stablecoins—treasuries, private credit, commodities, real estate—sits at $24-30 billion total. Meanwhile, basic stablecoins dwarf their sophisticated cousins at $306 billion, suggesting markets still prefer simple dollar-equivalents to complex tokenized securities.

Here’s the metaphor that matters: This is Amazon Web Services in 2008. The technology works, early adopters are deploying it, institutional validation is real. But AWS took five years to reach scale and another five to achieve dominance. Projections calling for $2-16 trillion tokenized assets by 2030 require 100-1,000x growth from today’s base. Possible? Absolutely. Probable this decade? That’s the bet.

One data point punctures the hype effectively: BlackRock’s $61 million digital asset revenue represents 0.9% of quarterly revenue despite operating both the $107 billion IBIT Bitcoin ETF and pioneering BUIDL. The infrastructure exists, adoption is real, but scale remains microscopic relative to traditional finance’s gravitational pull.

The Q4 2025 reality check: tokenization works and institutions are deploying it, but we’re in the “proof-of-concept to production” transition, not the exponential growth phase yet.

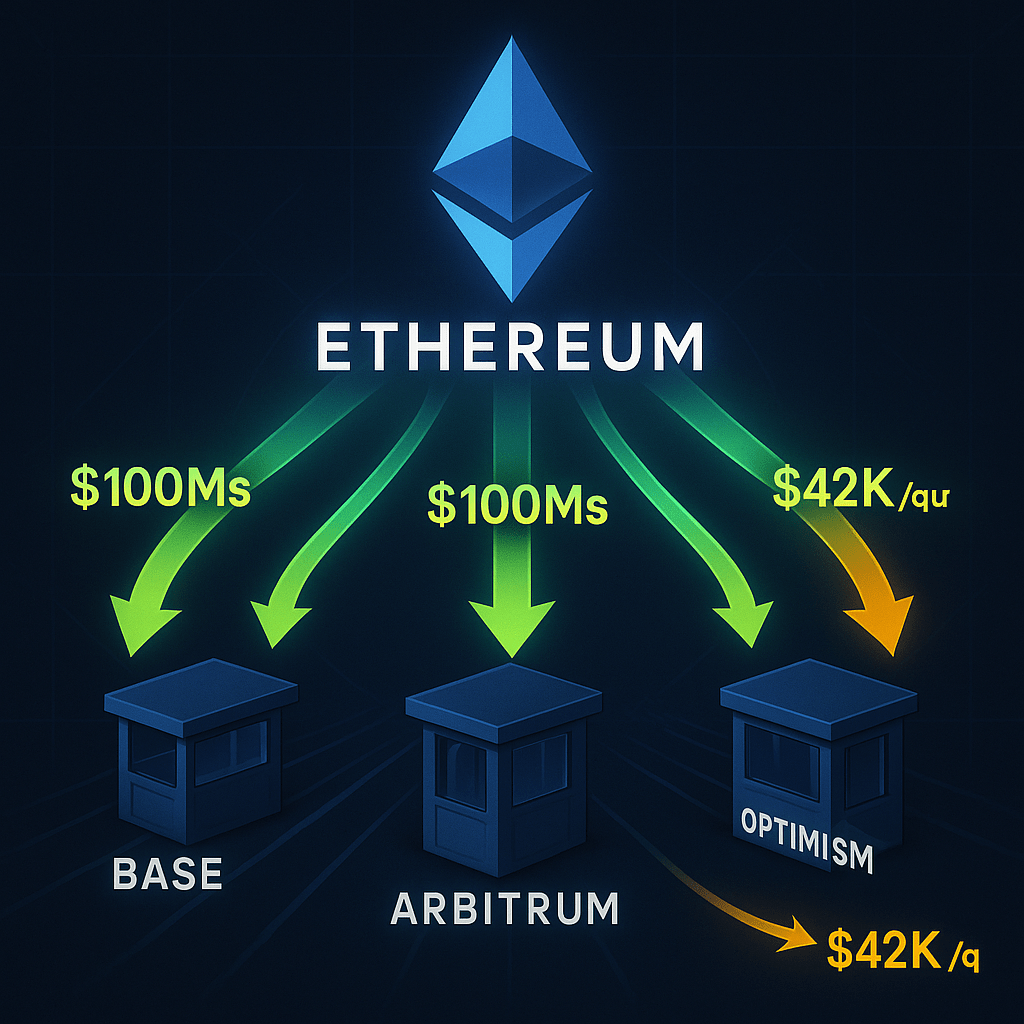

Ethereum Dominates Settlement But L2s Steal the Revenue

Picture a toll highway where 85-95% of all traffic uses your roads, but you installed free express lanes that generate zero toll revenue. That’s Ethereum’s Layer 2 dilemma.

The numbers tell a story of overwhelming market leadership: Ethereum commands 57-72% of the RWA market ($7.5+ billion), rising to 85-95% when including EVM Layer 2s like Base, Arbitrum, and Optimism. Every major tokenized treasury—BlackRock BUIDL, Franklin Templeton BENJI, WisdomTree WTGXX—deploys primarily on Ethereum or its L2s. This isn’t close—Ethereum won the RWA settlement race.

Layer 2 adoption accelerated dramatically in 2025. Base reached $15.96 billion TVL, surpassing Optimism. Arbitrum leads at $18.3 billion. Combined L2 TVL hit $51.5+ billion, up 205% year-over-year. The Pectra upgrade in May doubled blob capacity, enabling L2s to process transactions for literal pennies while maintaining Ethereum’s security.

But here’s where protocol success diverges from token value: Ethereum L1 captures minimal value from this activity. Post-EIP-4844 (Dencun upgrade), L2 data posting costs collapsed 90%+. Base’s quarterly costs to Ethereum dropped from $9.34 million to $42,000—a 99.5% reduction. Blob fees hit 2025 lows of just $5,700 weekly in March. While L2s generate hundreds of millions in fee revenue, Ethereum L1 sees negligible flow-through.

The structural problem: Ethereum designed L2s to succeed, and they’re succeeding at Ethereum’s expense. Over 50% of Ethereum developers now work on L2 infrastructure rather than mainnet. Daily active addresses on L1 sit at just 418,000 while L2s process 60% of ecosystem transactions. ETH shifted from deflationary (burning more than issued) to slightly inflationary post-Dencun at ~0.74% annually.

For ETH token holders, the math is sobering: L2 transaction volumes would need to increase 22,697-fold to replace Ethereum’s peak execution fee revenue with data availability fees. That’s not a typo—twenty-two thousand fold.

Yet the bull case remains intact through institutional momentum. Spot Ethereum ETFs saw $3.87 billion in August inflows (driving ETH up 18.5%). BlackRock’s ETHA dominates with over half the $30.35 billion in total ETF assets, representing nearly 3% of Ethereum’s market cap. At $497-522 billion market capitalization and 29.6% of supply staked (35-36 million ETH), Ethereum retains the deepest institutional liquidity in crypto beyond Bitcoin.

The verdict: Ethereum is decisively winning the RWA settlement race but L2 value fragmentation creates legitimate concerns about whether ETH token holders capture proportional upside. This remains the highest-probability tokenization play despite revenue concerns.

Fair value range: $2,200-2,800 per ETH based on current fundamentals and institutional positioning.

Chainlink’s SWIFT Integration Is Real – Production Remains 2026 Best Case

Your neighbor probably doesn’t care about oracle networks or cross-chain interoperability protocols. But they understand this: when SWIFT—the global banking messaging system connecting 11,500 banks—announces blockchain integration, and Chainlink built the technology making it possible, that matters.

The crypto industry’s enthusiasm for Chainlink’s SWIFT integration stems from genuine technical achievement. Multiple confirmed pilots with UBS Asset Management, ANZ, and 30+ banks demonstrated that Chainlink’s Cross-Chain Interoperability Protocol (CCIP) can bridge SWIFT’s network to blockchain rails. At Sibos 2025 in September, SWIFT announced its Chainlink Runtime Environment enabling ISO 20022 messages to trigger smart contract actions—a genuine infrastructure breakthrough.

But claims of “November 2025 production rollout” circulating in crypto analysis appear nowhere in official SWIFT or Chainlink announcements. The actual status is pre-production readiness with UBS as first adopter of the Digital Transfer Agent standard.

What’s confirmed: CCIP processed $1.66 billion in cumulative cross-chain transfers across 60+ integrated blockchains. Chainlink Proof of Reserve monitors $8.5 billion in tokenized assets including Tether’s USDT, Paxos Gold, and multiple wrapped Bitcoin products. The oracle network dominates with 67% market share—nine times larger than nearest competitor Pyth—and secures $95+ billion across 2,000+ protocol integrations.

Recent partnerships support the bull case. SBI Group (Japan’s $200+ billion financial giant) integrated CCIP, Proof of Reserve, and NAVLink in August 2025. JPMorgan demonstrated cross-chain Delivery versus Payment with Ondo Finance using CCIP. Fidelity International routes $6.9 billion in fund NAV data through Chainlink’s DTCC Smart NAV platform.

The timeline requires realistic probability weighting: 60% chance that by end-2026, SWIFT-Chainlink achieves meaningful production usage defined as 5-10 major banks processing $10-50 billion in tokenized assets. The 40% bear case isn’t technology failure—it’s institutional adoption velocity proving slower than crypto-native observers expect. Banks move with geologic patience through 12-24 month procurement cycles and 18-36 month risk management processes.

The token economics question looms larger. LINK trades at $18-22 with $12.4-14.5 billion market cap—down 60%+ from its $52.88 all-time high. Unlike Ethereum or Solana where tokens are fundamental to network security and gas payments, LINK’s value capture relies on voluntary fee payments and staking mechanisms that remain partially centralized.

Position appropriately: LINK is a medium-probability, medium-timeframe play on institutional tokenization infrastructure scaling in 2026-2027, not a guaranteed 2025 winner.

Target allocation: 10-15% for infrastructure exposure with 60% probability of SWIFT production deployment creating upside.

Ondo Proves Protocol Excellence Doesn’t Guarantee Token Value

Here lies tokenization’s central lesson in its purest form. Ondo Finance operates the second-largest tokenized treasury platform with $1.64 billion TVL (17% market share), boasts partnerships with BlackRock, PayPal, Mastercard, and JPMorgan, and pioneered retail-accessible institutional products. Yet the ONDO token investment case is fundamentally broken.

Let’s explain this to your neighbor: Imagine a company builds an excellent service—let’s say a car-sharing platform that actually works well, grows rapidly, and partners with every major auto manufacturer. Sounds like a great investment. Now imagine using that service requires zero interaction with the company’s stock, shareholders receive zero dividends or revenue share, and the stock exists solely to let holders vote on minor platform rules. Would you buy that stock at 8,200x revenue?

The protocol achievements are legitimate. OUSG (Ondo Short-Term US Government Treasuries) reached $629 million backed primarily by BlackRock’s BUIDL fund, offering 4.07% APY with $5,000 minimums and 24/7 instant settlement. USDY (United States Dollar Yield) hit $690 million providing 4.25-4.65% yields to non-US investors across nine blockchains. Ondo’s September 2025 launch of tokenized equities captured $242 million TVL in two weeks.

Institutional validation runs deep. Ondo holds 38% of BlackRock’s BUIDL supply ($223 million), making it the largest institutional user. PayPal’s $25 million PYUSD liquidity facility enables instant OUSG conversions. Mastercard’s Multi-Token Network integrated OUSG for cross-border payments. These aren’t pilots—they’re production integrations.

So why the harsh assessment? The ONDO token is completely unnecessary for using any Ondo product. Users purchase OUSG and USDY with USDC or PYUSD, receive yields, and redeem—all without ever touching ONDO tokens. The token provides only governance rights over protocol parameters. No revenue share. No staking yields. No required holdings for product access.

The economics are damning. Ondo charges a 0.15% management fee, but it’s currently waived until end of 2025, generating zero revenue. If activated at current TVL, projected annual revenue would be ~$975,000. The token trades at $0.77-0.80 with $2.5 billion market cap and $8 billion fully diluted valuation. That implies an 8,200x FDV-to-revenue multiple if fees were active—a valuation divorced from fundamental value capture.

Only 32% of ONDO’s 10 billion token supply circulates, creating 3.16x overhang. The remaining 68% unlocks through 2028, generating persistent selling pressure. GitHub activity reveals alarm bells: zero commits in recent months despite being a “tech platform,” with just 92 total contributors over the project’s lifetime.

The investment implication is counterintuitive but clear: buy USDY and OUSG directly for 4-5% yield exposure to tokenized treasuries, avoid the ONDO token entirely. The protocol is legitimate and well-positioned. The token is a governance-only instrument with no cash flows trading at speculative valuations.

Allocation recommendation: 0% to ONDO token. Buy the actual OUSG/USDY products for 4-5% yields instead.

Solana Captures Stablecoin Velocity But Faces Governance Risk

Picture two payment networks: one processes 100 transactions at $1 each, another processes 10,000 transactions at $0.001 each. Both generate $100, but one demonstrates genuine payment infrastructure usage. That’s Solana’s value proposition—and its challenge.

Solana’s 2025 performance demolished skeptics. Sixteen months of 100% uptime (as of June 2025) following February 2024’s last outage, combined with 93.5 million daily transactions in Q3 2025 and 22.44 million active addresses in October, demonstrates genuine product-market fit for high-throughput settlement.

Stablecoin metrics tell a nuanced story. Solana hosts $11.7 billion in stablecoin supply with USDC ($9.35 billion) dominating at 70%. But Solana ranks third in stablecoin supply behind Ethereum (~$200+ billion) and Tron, revealing it’s winning on transaction velocity rather than store-of-value dominance.

The key question: Is this sustainable payment adoption or speculation? January 2025’s peak of $59.2 billion in monthly peer-to-peer stablecoin transfers looked impressive until analysis revealed the TRUMP memecoin mania artificially inflated numbers. One Phoenix DEX market maker accounted for ~50% of May 2024 transfer volume; when they changed strategy, volume halved overnight.

Visa’s partnership provides the clearest institutional validation. Production pilots with Worldpay and Nuvei moved “millions of USDC” over Solana for fiat-denominated settlement—real production usage. But Visa explicitly terms these “pilot programs” and expanded to four blockchains (Ethereum, Solana, Avalanche, Stellar), signaling Solana is one option among several.

RWA adoption on Solana reached $418-700 million in non-stablecoin tokenized assets, up 140.6% year-over-year. Major institutional products launched: BlackRock’s BUIDL expanded to Solana, Apollo’s ACRED private credit fund ($127.2 million), Franklin Templeton’s BENJI, VanEck’s VBILL. The R3 Corda integration brings $17 billion in regulated asset connectivity.

The comparison to Ethereum reveals both opportunity and challenge. Solana’s $418-700 million in RWA assets is <10% of Ethereum’s ~$7 billion, showing massive room for growth but also institutional preference for Ethereum’s established infrastructure.

Governance risk lurks beneath surface metrics. Proposal SIMD-0228 aims to slash inflation from 4.78% to 0.87% annually, but it has just 37.8% validator support. If approved, smaller validators may exit, increasing centralization. If rejected, 528,000 SOL weekly issuance ($84 million at $160 SOL) continues diluting holders.

At $196-220 and $107-120 billion market cap, SOL trades at 2x the volatility of BTC (~80% vs ~41%), making it the archetypal high-beta crypto play.

Allocation recommendation: 15-20% for high-beta momentum play with 70-75% probability of continued growth through 2026, requiring active management.

Bitcoin’s Indirect Benefits Through Legitimacy and Reserve Asset Positioning

Bitcoin wasn’t supposed to be a tokenization play, yet Q4 2025 reveals surprising relevance through institutional legitimacy spillover and reserve asset positioning.

Spot ETF flows tell the story. The first week of October 2025 saw $5+ billion in net inflows. BlackRock’s IBIT approached $100 billion AUM just 21 months post-launch. Bitcoin set a new all-time high of $126,500 on October 7, consolidating around $110,000-115,000.

MicroStrategy—now “Strategy”—holds 640,250 BTC (approximately 3% of total supply) with $76+ billion in holdings. This isn’t speculation; it’s a publicly-traded company converting equity into Bitcoin treasury at scale. US businesses control roughly 6.2% of Bitcoin supply across 124+ public companies holding 809,000 BTC collectively.

Nation-state adoption accelerated beyond El Salvador. The United States holds 198,109 BTC (~$19.3 billion) from seizures, with Trump administration policy explicitly retaining rather than selling. Thirteen countries are pursuing Strategic Bitcoin Reserve legislation. Bitcoin is shifting from “digital gold” metaphor to actual reserve asset competing with treasuries.

Bitcoin’s role in tokenization is indirect but foundational. At $2.2-2.3 trillion market cap with 57-58.5% crypto dominance, Bitcoin’s ETF success legitimizes the entire digital asset category for institutions. The 0.83% post-halving inflation and 95% of supply issued makes it the most predictable major crypto asset.

For portfolio construction, Bitcoin functions as the low-risk, high-legitimacy anchor (40-50% allocation) that captures institutional capital flows even when direct tokenization activity occurs on other chains.

Allocation recommendation: 30-40% as foundation with minimal technical, regulatory, or competition risk.

Worldcoin Belongs Nowhere Near This Portfolio

The hypothesis that Worldcoin would provide identity verification infrastructure for tokenized assets requiring KYC compliance is comprehensively invalidated by Q4 2025 reality. There is zero evidence of any tokenized asset platform using World ID for compliance as of October 2025.

Kenya’s High Court ruled Worldcoin operations illegal on May 5, 2025, ordering permanent deletion of all biometric data. The European Union’s data protection authorities demanded biometric data deletion by January 19, 2025 under GDPR enforcement. Worldcoin faces bans, investigations, or restrictions in at least 10 major jurisdictions including Brazil, Hong Kong, South Korea, and Colombia.

The fundamental problem: World ID only proves “humanness,” not identity. RWA platforms requiring KYC need name, address, date of birth, government-issued ID verification, and AML screening. World ID provides none of this.

The token trades at $1.28-1.31 with $2.42-2.76 billion market cap but $9.98 billion fully diluted valuation—only 22% of supply circulates. More damning: the token is completely unnecessary. Worldcoin’s identity verification functions perfectly without WLD tokens.

Allocation recommendation: 0%. Use this capital for actual tokenization plays.

The 2026 Investment Framework

The probability-weighted assessment: 75-85% that 2025-2026 establishes foundational infrastructure through GENIUS Act implementation, MiCA compliance, SWIFT-blockchain integration commitment, and payment network stablecoin settlement. But production deployment at scale achieving billions in daily tokenized asset transactions is 40-60% probable by end-2026, more likely 2027-2028.

Revised allocation framework:

Foundation (50-60%):

- BTC: 30-40% (institutional legitimacy, ETF flows, reserve asset status)

- ETH: 20-25% (RWA settlement dominance despite L2 concerns)

Infrastructure (25-30%):

- LINK: 10-15% (SWIFT integration, 60% probability of 2026 production)

- MATIC/Polygon: 5-10% (fast-growing RWA chain, lower valuation)

- MKR/SKY: 5% (actual DeFi RWA adoption through $680M+ backing DAI)

High-Beta (15-20%):

- SOL: 15-20% (payment rail momentum, requires active management)

Avoid:

- ONDO: 0% (buy OUSG/USDY products directly for 4-5% yields, not the token)

- WLD: 0% (regulatory nightmare, no utility, not used for RWA KYC)

The BlackRock tokenization thesis is correct. The timeline is longer than crypto expects. The winners are more boring than crypto wants. Position accordingly for a 2026 spent building roads, not yet driving on them at scale.

Buy zones updated quarterly as regulatory catalysts materialize and institutional adoption accelerates. Fair values assume 2027-2028 scaling, not 2025-2026 explosive growth.

Leave a comment