Meta description: China just weaponized batteries, threatening America’s $200B AI infrastructure buildout. Here’s what it means for grid, data center, and tech investments—and who wins when supply chains become weapons.

The Weekend That Changed Infrastructure Investing

October 9, 2025 will be remembered as the day China turned off America’s data center lights. Not immediately. Not dramatically. But inevitably, starting November 8.

Picture this: You’re building the most ambitious house in your neighborhood. Foundation poured, walls up, roof ready. Then your only supplier of electrical wiring—who happens to own 96% of the world’s wire production—announces they’re cutting you off in 30 days.

That’s not a metaphor. That’s what happened to America’s AI infrastructure buildout last Wednesday.

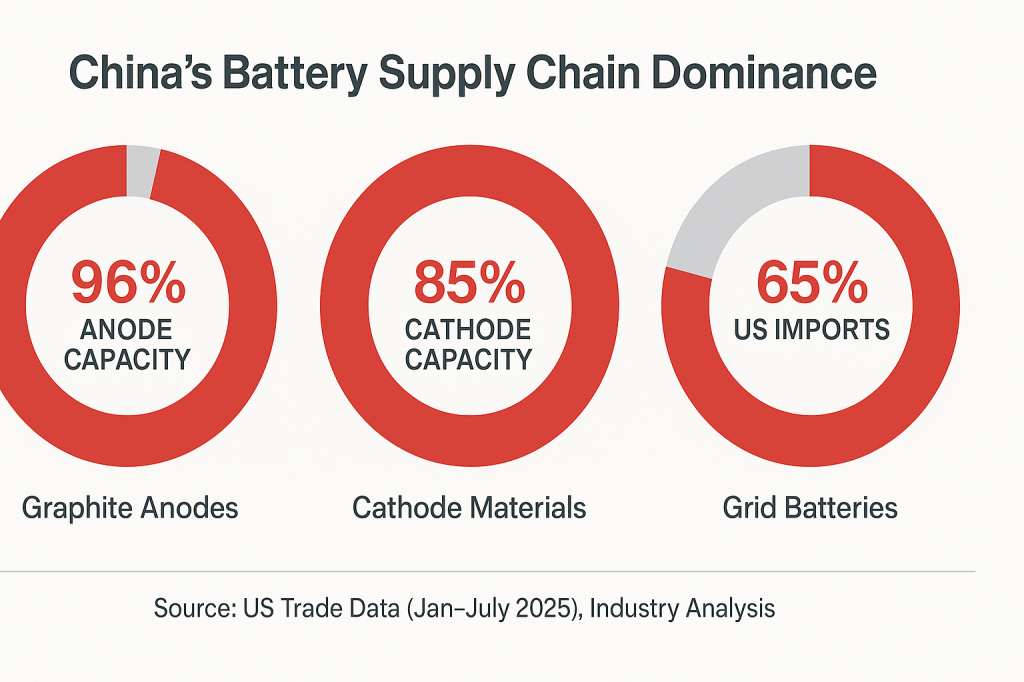

China announced export controls on high-end lithium batteries, the cathode materials inside them, the graphite anodes that make them work, and the equipment to manufacture them. Effective November 8, 2025. The United States imports 65% of its grid-scale lithium batteries from China. China controls 96% of global anode production and 85% of cathode capacity.

Here’s the investment thesis in one sentence: China’s battery export controls create a 5-10 year structural advantage for US grid infrastructure owners while exposing speculative data center plays to execution risk that the market hasn’t priced in yet.

As we analyzed yesterday in “When Supply Chain Weapons Become Market Opportunities,” China’s rare earth controls threatened EV and defense supply chains. Today’s battery controls complete the picture—China is systematically restricting EVERY layer of America’s infrastructure buildout, from the magnets in wind turbines to the batteries powering data centers. This isn’t coincidence. It’s strategy.

Let me show you why this matters to infrastructure investors right now, who wins when China weaponizes supply chains, and what the systematic approach suggests doing about it before the market fully digests what just happened.

The Battery Crisis At-A-Glance

Before diving deep, here’s what you need to know:

| What China Controls | Their Global Share | Controls Take Effect | Impact on US |

|---|---|---|---|

| Graphite Anodes | 96% of capacity | November 8, 2025 | Data center buildout delays |

| Cathode Materials | 85% of capacity | November 8, 2025 | Battery costs surge 20-40% |

| Grid Battery Imports | 65% to US | November 8, 2025 | Supply shortage begins |

| Battery Manufacturing Equipment | Dominant position | November 8, 2025 | Can’t build alternatives quickly |

| US Alternative Capacity | <5% combined | 2027-2030 realistic | Years to achieve independence |

Timeline Reality: Even with massive subsidies (Inflation Reduction Act, CHIPS Act), the US needs 5-7 years minimum to build meaningful domestic battery supply chains. During that transition, infrastructure owners with physical assets win. Speculative operators without locked supply chains lose.

What Actually Happened (And Why It’s Not Just Another Trade War Headline)

On October 9, China’s Ministry of Commerce announced new export controls covering four categories of battery-related items:

High-end lithium batteries with energy density of 300 Wh/kg or greater. This covers most grid-scale storage batteries and advanced EV batteries—the exact batteries that data centers need for backup power and grid stabilization.

Cathode materials. Think of these as the positive terminal in your TV remote battery, except these determine how much energy a massive grid battery can store. China makes 85% of the world’s supply.

Graphite anode materials. The negative terminal. China makes 96% of the world’s supply. There are almost zero non-Chinese alternatives operating at scale today.

Production equipment and technology. The manufacturing know-how to make batteries. Even if someone wanted to build a battery factory in Kansas, they’d need Chinese equipment and expertise to do it.

The controls take effect November 8, 2025. That’s 29 days to secure alternative supply for a buildout that’s supposed to triple US data center electricity consumption by 2028.

The Dependency Numbers That Should Worry Investors

Between January and July 2025, the United States imported 65% of its grid-scale lithium batteries from China. Not consumer electronics batteries. Not EV batteries. Grid-scale batteries that power data centers and stabilize renewable energy sources.

China doesn’t just make batteries. China is the battery supply chain:

- 96% global anode production capacity

- 85% global cathode production capacity

- 70% of rare earth compounds and metals (2020-2023 average)

Large-scale battery storage for US data centers cannot currently be built without Chinese materials, even if batteries are assembled domestically. The cathodes and anodes—the actual functional components—come from China or nowhere.

This is the second punch in a one-two combination. Yesterday’s rare earth controls threatened the magnets powering EV motors and wind turbines. Today’s battery controls threaten the energy storage making AI infrastructure possible. Same strategy, different chokepoint, complete coverage of America’s clean energy and AI ambitions.

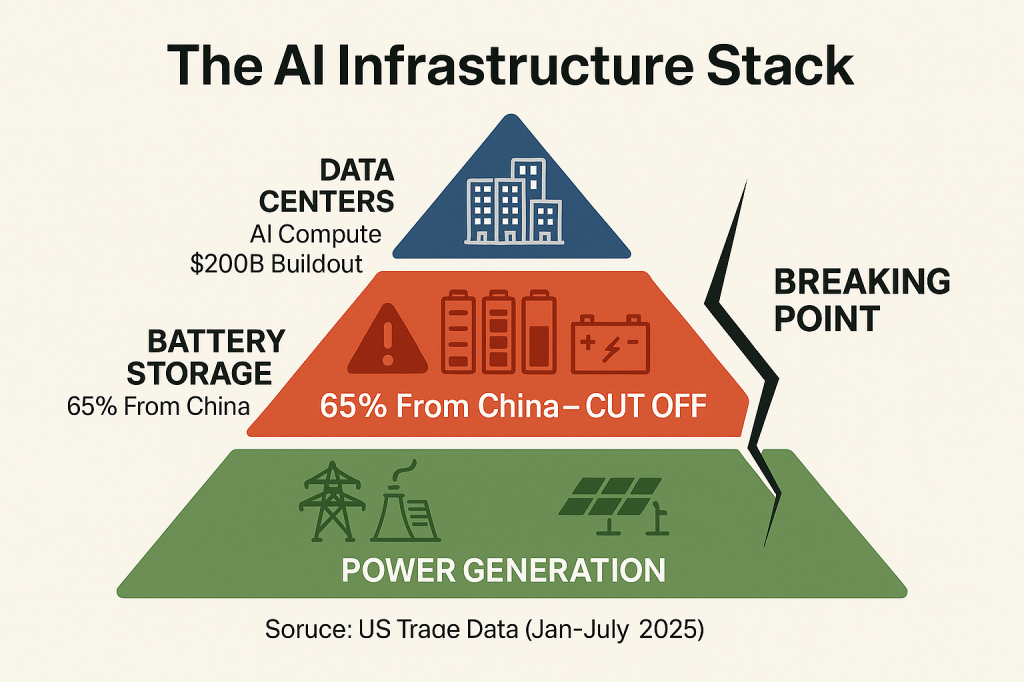

Why This Matters Right Now: The AI Infrastructure Stack Under Siege

Here’s what most investors miss: data centers aren’t just buildings with servers. They’re an infrastructure stack where every layer depends on the one below it. And the foundation of that stack just cracked.

Layer 1: Power Generation (The Foundation)

US data centers doubled their electricity consumption between 2017 and 2023. Lawrence Berkeley National Laboratory projects that consumption will triple by 2028. AI compute runs 24/7—no nights, no weekends, no breaks. That’s continuous baseload demand unlike anything the grid has seen outside of heavy industry.

Data centers now represent 17% of US electricity demand, up from 8% in 2017. By 2028, they’ll consume more electricity than residential homes.

Layer 2: Grid Stabilization (The Weak Link)

Here’s the paradox: AI’s massive power demand is driving renewable energy buildout (wind and solar), but renewables are intermittent. The sun doesn’t shine at night. The wind doesn’t blow on schedule. Data centers can’t go offline when the wind stops.

Battery storage is the bridge. Large-scale lithium batteries store excess renewable energy when the sun is shining and release it when data centers need it at 2 AM. Without battery storage, renewable energy can’t reliably power data centers. Without battery storage, utilities can’t handle the rapid demand spikes from AI compute.

Battery storage isn’t a nice-to-have feature. It’s the critical enabler of the entire AI infrastructure thesis.

Layer 3: Data Center Operations (The Breaking Point)

This is where China’s export controls hit hardest. Data center operators are racing to secure:

- Backup power systems (batteries)

- Grid connection points (requires utility battery storage)

- Power reliability guarantees (depends on grid battery capacity)

Every single piece depends on lithium batteries. And 65% of those batteries came from China.

Small-cap data center operators who’ve run up 500% this year assumed battery availability was a solved problem. It’s not. Mega-cap tech companies (Google, Microsoft, Amazon, Meta) with $50 billion AI infrastructure budgets can outbid anyone for scarce battery supply. Small players can’t.

Those 500% gains were priced for smooth execution. Smooth execution just became impossible for companies without massive capital reserves or locked battery supply contracts.

The October 9 Announcement in Context: This Isn’t China’s First Move

If you zoom out, October 9 wasn’t a surprise—it was the inevitable next step in a pattern that’s been building all year.

April 2025: China announced export controls on rare earth magnets covering seven strategic minerals. These magnets are critical for EV motors, defense systems, and semiconductor manufacturing.

July 2025: China restricted EV battery technology transfers, limiting what Chinese battery companies could share with foreign partners building manufacturing outside China.

October 2025: China expanded rare earth controls to 12 of the 17 most critical minerals, then added battery export controls on the same day.

See the pattern? China is systematically restricting every layer of the clean energy and AI infrastructure stack. First the raw materials (rare earths), then the manufacturing knowledge (battery tech), now the finished products (batteries themselves).

This isn’t trade policy. This is supply chain weaponization.

Trump’s immediate response: threatening 100% additional tariffs on Chinese goods. No meeting with Xi Jinping scheduled (“no reason to attend,” Trump said). Chinese battery stocks fell 6-11% on October 10. CATL dropped 6.82%, EVE Energy fell 11%, BYD declined 2.54%.

The market knows this is serious. The question is whether it’s priced in what this means for infrastructure holdings over the next 12-36 months.

Investment Impact: Winners, Losers, and the Uncertain Middle

Let me walk through how this plays out for different types of infrastructure investments, using the systematic framework that separates smart money from retail panic.

WINNER: NextEra Energy (NEE) – The Landlord Who Owns The Only Road

Think of NextEra Energy as the landlord who owns the only road into town. Data centers can’t bypass them—they MUST connect to NEE’s grid to get power. When batteries become scarce and can’t store power locally, that road just got dramatically more valuable.

Why NEE wins when batteries become scarce: They own the grid infrastructure that data centers must connect to, regardless of battery availability. NEE owns transmission lines, distribution networks, and grid connection points. China can’t export that. Beijing can restrict batteries, but they can’t restrict the physical poles and wires that already exist in Florida and across the US.

What happens when battery imports get constrained:

- Data centers can’t store their own power, so they demand more grid capacity

- Utilities upgrade transmission and distribution to handle spikes

- Regulated utilities like NEE pass costs to customers (rate base growth)

- NEE’s infrastructure moat widens because they own physical assets China can’t replicate

The risk: If battery shortages become so acute that AI data center buildout stalls completely, NEE’s growth thesis moderates. But that’s a 2027+ risk. Near-term (2025-2026), battery constraints strengthen NEE’s position because their grid capacity becomes even more critical.

NEE trades at approximately $80 with fair value estimates in the $90-95 range from composite analyst sources. The quality metrics (Piotroski F-Score, Altman Z-Score) remain strong, and the regulated utility model provides downside protection that speculative plays lack.

Systematic approach: Regulated infrastructure that owns physical grid assets becomes more valuable when other layers face supply constraints. This is the classic “picks and shovels” trade during a gold rush—except this time the gold rush might be delayed, making the picks and shovels even more critical.

Position sizing: Given the defensive nature and regulated moat, systematic investors can allocate 5-8% of portfolio to NEE. This is a core infrastructure holding with China-proof characteristics.

WINNER (WITH CAVEATS): Brookfield Corporation (BN) – The Patient Capital Advantage

Brookfield announced a $200 billion AI factory commitment over five years. Their Q2 shareholder letter explicitly stated they plan to “own or assemble ALL pieces” of the AI infrastructure stack—data center shells, power infrastructure, equipment, everything.

Why BN wins long-term: They own the underlying real estate and power infrastructure regardless of battery source. If battery costs triple, BN passes those costs to tenants through higher rents. If battery delivery delays by 12 months, BN’s existing operational capacity becomes more valuable (scarcity pricing).

Think of Brookfield as the patient landlord with deep pockets. While small operators scramble for batteries and blow up their budgets, BN can simply wait, outbid when necessary, and pass all costs downstream to desperate tenants who need data center space regardless of price.

The execution risk everyone’s missing: That $200 billion buildout assumed battery availability. Brookfield’s capital and relationships can secure battery supply that small operators can’t access, but it will cost more and take longer. Projects scheduled for Q2 2026 might slip to Q4 2026 or Q1 2027.

Near-term watch items:

- Q3 earnings (late October) for any commentary on battery supply chain

- Project timeline updates

- Tenant contract renegotiations (passing battery costs through)

BN trades near fair value estimates around $65-69, with strong quality scores and safety metrics. The premium valuation reflects market confidence in execution, but battery supply constraints add new uncertainty.

Systematic approach: Infrastructure owners with locked supply chains and massive capital win. The thesis is intact, but execution risk just increased for near-term project timelines.

Position sizing: Given execution risk and premium valuation, limit BN to 3-5% of portfolio. This is a growth infrastructure holding with higher risk than defensive utilities.

LOSER: IREN and Small-Cap Data Center Operators – The Capital Disadvantage

IREN represents the poster child for speculative data center plays that assumed smooth infrastructure execution. Bitcoin mining pivoting to AI infrastructure. Massive growth projections. 500% gains pricing in perfect execution.

What battery export controls mean for small-cap operators:

- They lack Brookfield’s capital to outbid for scarce battery supply

- Without battery storage, data centers face reliability issues that customers won’t tolerate

- Projects get delayed, costs increase, ROI projections break

- Valuation compression when the market realizes execution isn’t guaranteed

Picture a poker game where IREN sits with a few thousand dollars while Google, Microsoft, Amazon, and Brookfield sit with billions. The pot is scarce battery supply. Who wins that bidding war? It’s not even close.

That 500% gain assumed all infrastructure components would be available at reasonable cost on reasonable timelines. Battery controls invalidate that assumption for operators without locked supply contracts or massive capital reserves.

Systematic approach: When speculative plays run 500% on perfect execution assumptions, and a major input becomes constrained, the risk-reward flips dramatically. The market priced in smooth sailing. China just created rough waters that small boats can’t navigate.

Position sizing: For speculative data center operators: 0-2% maximum if you must play this theme. Most systematic investors should avoid entirely given execution risk and stretched valuations.

UNCERTAIN: Mega-Cap Tech (GOOGL, MSFT, AMZN, META) – The Deep Pockets Advantage

These companies have $50+ billion AI infrastructure budgets. They’re spending more on data center buildout in 2025 than most countries spend on their entire military.

The bad news: Battery costs just went up, and CapEx efficiency takes a hit. Margins compress slightly when paying premiums for scarce battery capacity or waiting 6-12 months longer for projects to complete.

The good news: Mega-caps can outspend the problem. They can:

- Pre-buy battery capacity at premium prices (lock in multi-year supply)

- Fund alternative battery R&D directly

- Accept lower ROI on infrastructure to maintain competitive position

- Simply wait out the constraint while smaller AI competitors starve for compute

The strategic implication: Battery constraints hurt small AI startups more than they hurt Google and Microsoft. If a startup trying to train large language models can’t get reliable data center access because facilities can’t secure battery storage, they’re dead. Google and Microsoft aren’t.

Think of it this way: when food prices rise 20%, wealthy families adjust their budgets but keep eating well. Poor families go hungry. Mega-cap tech are the wealthy families in this analogy. Small AI startups are the ones who’ll go hungry.

This widens the moat for mega-cap tech vs smaller AI competitors, even as it pressures near-term margins.

Systematic approach: Watch Q4 earnings for CapEx guidance changes and margin pressure. Expect slower AI infrastructure growth in 2026, but recognize this strengthens competitive position against smaller players.

Position sizing: Mega-cap tech can remain 15-25% of portfolio combined, depending on overall portfolio construction. These are quality holdings that can weather supply chain disruptions better than smaller competitors.

UNCERTAIN (HIGH RISK/REWARD): US Battery Manufacturers – The Obvious Trade That’s Too Obvious

Examples: AMPX (Amprius Technologies), ENVX, EOSE, ABAT, ENR, MVST, SLDP, SES

The thesis is obviously correct: US demand surging + China supply restriction + national security imperative = massive opportunity for domestic battery manufacturers.

The execution challenge nobody wants to talk about: Zero of these companies have proven large-scale grid deployment. Most are pre-revenue or barely profitable. All need billions in capital to build manufacturing capacity. And they still need cathode and anode materials… which come from China.

What they need to win:

- Capital to build factories (billions of dollars)

- Supply chain for cathodes/anodes (still China-dependent today)

- Technology licensing (some partnerships with Chinese companies)

- 3-5 years minimum to reach meaningful production volume

- Survival through the cash burn period

AMPX specifically: Their 500+ Wh/kg battery density achievement is real and impressive for defense/aerospace applications. But grid-scale storage needs volume and cost, not just energy density. Can they scale production? Can they get cathode/anode supply? Can they compete on cost with established manufacturers?

The problem with speculation: Without systematic analysis of quality metrics, debt levels, cash burn rates, and dilution risk, picking winners in this group is pure speculation. The thesis is right, but turning the thesis into profitable investments requires fundamental data that separates the survivors from the inevitable bankruptcies.

Systematic approach: Wait for proof of execution, manufacturing scale, and cost competitiveness before deploying capital. Don’t chase the obvious narrative without knowing which companies can actually deliver.

Position sizing: For speculative battery manufacturers: Wait for fundamental validation. If you must speculate, limit to 1-2% total across the entire sector. This is venture capital-level risk.

The Investment Implications: A Systematic Framework

Let me give you specific frameworks across three timeframes with concrete position sizing guidance.

Immediate Actions (Next 30 Days)

1. Validate infrastructure holdings

If utility positions like NEE exist in a portfolio, this thesis just strengthened. Regulated infrastructure that owns the physical grid is more valuable when other layers of the stack face supply constraints. The systematic approach suggests adding on weakness below $75.

For data center operators (especially small-cap), execution risk now exists that didn’t 72 hours ago. Review their battery supply strategy. Most don’t have one.

2. Avoid chasing battery manufacturer speculation

The obvious trade is to buy US battery manufacturers. Everyone sees this. The stocks have likely already moved on the narrative. Without fundamental analysis showing quality metrics and debt levels, this becomes speculation on which companies will execute, not systematic investing based on data.

3. Reassess mega-cap tech assumptions

Large-cap tech positions face near-term margin pressure from higher battery costs but gain long-term competitive moat advantages. The systematic approach suggests holding through the noise rather than panic selling on CapEx efficiency concerns.

Portfolio Construction Example (100% = Total Portfolio):

- Defensive Infrastructure (NEE): 5-8% (increase from 3-5%)

- Growth Infrastructure (BN): 3-5% (hold, don’t add at premium)

- Mega-Cap Tech: 15-25% combined (hold through margin pressure)

- Speculative Data Centers: 0-2% maximum (most should avoid)

- Battery Manufacturers: 0% until fundamental validation

Medium-Term Positioning (3-12 Months)

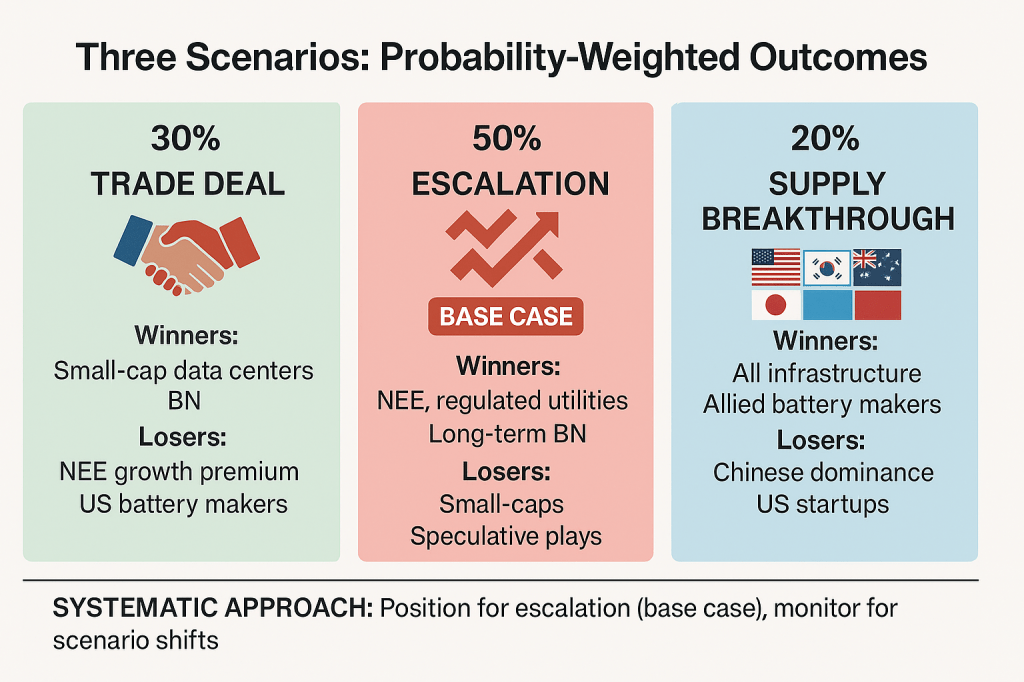

1. Monitor trade negotiations like a hawk

Two scenarios matter:

Bullish scenario (30% probability): Trump and Xi reach a deal by Q1 2026 that includes battery exemptions. Risk-off mood lifts speculative data center plays. Infrastructure buildout accelerates back to plan.

Bearish scenario (50% probability): Trump implements 100% tariffs, China retaliates with additional rare earth controls or solar component restrictions. Infrastructure buildout slows materially. Battery costs stay elevated for years.

Systematic positioning: Overweight defensive infrastructure (NEE-style regulated utilities), underweight speculative infrastructure (IREN-style operators), selective on battery manufacturers only after fundamental analysis confirms execution capability.

2. Watch for US policy responses

Likely government actions:

- Emergency battery reserves (Strategic Battery Reserve like Strategic Petroleum Reserve)

- Enhanced domestic manufacturing subsidies beyond the Inflation Reduction Act

- Defense Production Act invocation for critical battery production

- Allied partnerships (South Korea, Japan, Australia) for integrated supply chains

If the Defense Production Act gets invoked for batteries, US manufacturers get guaranteed government offtake contracts. That validates the investment thesis for successful executors. But systematic investors still need to pick the right companies.

3. Consider allied battery manufacturers

South Korea (LG Energy Solution, Samsung SDI) and Japan (Panasonic) have established battery production without Chinese geopolitical risk. They benefit from US-China supply chain tension without the execution risk of pre-revenue American startups.

These companies deserve systematic analysis for portfolio consideration.

Long-Term Themes (1-3 Years)

1. Technology disruption could obsolete the entire constraint

Solid-state batteries use different materials than lithium-ion (less China-dependent). Sodium-ion batteries use abundant materials. Flow batteries for grid storage have completely different supply chains.

If any of these technologies achieve commercial scale by 2027-2028, China’s cathode/anode dominance becomes irrelevant. Monitor AMPX, QuantumScape, and Solid Power for breakthrough announcements.

2. Geopolitical realignment accelerates

The next 12-24 months will likely see US-Korea-Japan-Australia battery consortium announcements. Allied supply chains reduce Chinese leverage and create investable opportunities in companies tied to those partnerships.

3. Grid storage alternatives emerge

Pumped hydro storage needs no batteries. Compressed air energy storage needs no batteries. Green hydrogen for load shifting needs no batteries.

If battery costs stay elevated for 3-5 years, utilities and data center operators will invest in alternative storage technologies. Good for companies like NEE (owns the infrastructure regardless of storage type), reduces long-term urgency for battery-dependent plays.

Risk Scenarios: Stress Testing Investment Approaches

Let me walk through three scenarios with specific implications.

SCENARIO 1: Trade Deal (30% Probability)

Trigger: Trump and Xi meet in November/December 2025, announce trade framework that exempts batteries from export controls in exchange for US concessions elsewhere

Timeline: Q1 2026 implementation

Winners:

- Speculative data center plays (IREN, small-caps) rally hard on removed execution risk

- BN re-rates higher as $200B buildout timeline returns to plan

- Mega-cap tech CapEx accelerates, margin pressure eases

Losers:

- NEE growth story moderates (less grid urgency without battery constraint)

- US battery manufacturers lose policy tailwind urgency

- Chinese battery manufacturers maintain dominance

Systematic action: Trim quality/defensive positions on strength, reduce defensive bias, consider adding growth/momentum exposure

SCENARIO 2: Escalation (50% Probability – BASE CASE)

Trigger: Trump implements 100% tariffs on Chinese goods by January 2026, China expands export controls to solar panels, wind turbine components, and additional rare earth minerals

Timeline: Throughout 2026, escalating tensions

Winners:

- NEE (grid capacity becomes critical monopoly position)

- BN long-term (owns physical infrastructure, can wait out constraint)

- US battery manufacturers (IF they execute on production)

- Allied battery manufacturers (LG, Samsung, Panasonic benefit from US pivot)

Losers:

- Small-cap data center operators (can’t secure battery supply)

- Mega-cap tech margins (elevated CapEx costs for 2-3 years)

- Clean energy buildout timeline (2030 targets slip to 2035)

- Speculative battery manufacturers that can’t scale production

Systematic action: Overweight NEE and regulated utilities, underweight speculative infrastructure, patient on battery manufacturers (wait for proof of execution), hold mega-cap tech through margin pressure

SCENARIO 3: Supply Chain Breakthrough (20% Probability)

Trigger: US allies (South Korea, Japan, Australia) announce fully integrated battery supply chain initiative with production targets by 2027, including cathode/anode production outside China

Timeline: Announced H1 2026, operational by 2027-2028

Winners:

- All infrastructure plays (constraint removed, buildout accelerates)

- Mega-cap tech (resume AI infrastructure pace without margin pressure)

- Allied battery manufacturers (LG, Samsung, Panasonic)

Losers:

- Chinese battery manufacturers (lose market share)

- US battery startups (face better-funded, established competition from allies)

- NEE growth premium (less urgency returns NEE to normal utility valuation)

Systematic action: Rotate back to growth/AI themes, reduce focus on supply chain defensive plays, evaluate whether allied battery manufacturers offer better risk/reward than speculative US startups

The Systematic Framework: Quality + Safety + Rational Positioning

Here’s what separates systematic analysis from financial media hot takes: not just identifying the narrative, but evaluating which companies can actually execute through the constraint.

Infrastructure Impact Summary with Position Sizing

| Ticker | Type | Quality Thesis | Impact | Systematic Position Size |

|---|---|---|---|---|

| NEE | Defensive Utility | Strong fundamentals, regulated moat | ✅ Positive | 5-8% of portfolio (add below $75) |

| BN | Growth Infrastructure | Excellent quality, premium valuation | ⚠️ Neutral/Risk | 3-5% of portfolio (hold, don’t add) |

| GOOGL | Mega-cap Tech | Highest quality tier | ⚠️ Slight Negative | Part of 15-25% combined (hold) |

| MSFT | Mega-cap Tech | Highest quality tier | ⚠️ Slight Negative | Part of 15-25% combined (hold) |

| AMZN | Mega-cap Tech | High quality | ⚠️ Slight Negative | Part of 15-25% combined (hold) |

| META | Mega-cap Tech | High quality | ⚠️ Slight Negative | Part of 15-25% combined (hold) |

Speculative Plays Risk Assessment with Position Sizing

| Ticker | Category | Thesis | Fundamental Risk | Systematic Position Size |

|---|---|---|---|---|

| IREN | Small-cap Data Center | ❌ Major Negative | High execution risk | 0-2% maximum (most avoid) |

| AMPX | US Battery Manufacturer | ✅ Positive Long-term | Needs fundamental validation | 0% until proof (1-2% max after) |

| ENVX | US Battery Manufacturer | ✅ Positive Long-term | Needs fundamental validation | 0% until proof (1-2% max after) |

| EOSE | US Battery Manufacturer | ✅ Positive Long-term | Needs fundamental validation | 0% until proof (1-2% max after) |

US Battery Dependency Reality Check

| Component | China Global Share | US Alternative Capacity | Timeline to Independence |

|---|---|---|---|

| Anode Materials | 96% | <2% | 5-7 years minimum |

| Cathode Materials | 85% | <5% | 5-7 years minimum |

| Battery Cells | 65% US imports | Growing but insufficient | 3-5 years minimum |

| Rare Earth Processing | 70% | <10% | 7-10 years minimum |

| Manufacturing Equipment | Dominant | Minimal | 5-7 years minimum |

Key insight: Even with massive subsidies from the Inflation Reduction Act and CHIPS Act, the United States cannot quickly replace Chinese battery supply chain dominance. Best case is 5 years to meaningful domestic production. Realistic case is 7-10 years to full independence.

During that transition period, infrastructure owners with physical assets and regulatory moats (like NEE) win. Speculative operators without locked supply chains or massive capital (like IREN) lose.

What To Watch Next: Catalyst Calendar

Within 48 hours (October 12-13):

- Any Trump administration announcements on tariff implementation timeline

- Chinese response to Trump’s 100% tariff threat

- Market reaction Monday morning (watch NEE, BN, data center operators)

Within 2 weeks (by October 25):

- Monitor whether Trump-Xi meeting gets rescheduled or remains canceled

- Track initial market commentary from data center operators on battery supply

- Watch for analyst report downgrades on small-cap data center operators

Within 1 month (by November 11):

- November 8: China export controls officially take effect (watch for any last-minute exemptions)

- Late October: BN Q3 earnings for any battery supply chain commentary

- Early November: Watch for US policy response (Defense Production Act invocation, emergency subsidies, strategic battery reserve announcement)

Within 3 months (by January 2026):

- Q4 mega-cap tech earnings for CapEx guidance changes

- Battery manufacturer Q4 earnings for demand signals and supply chain updates

- Assessment of whether Trump tariffs actually implemented at 100% level

- First data on battery import volumes post-November 8 controls

What I’m Watching Right Now

Immediate actions:

- Adding NEE on any dip below $77 (buying the infrastructure China can’t export)

- Monitoring BN Q3 earnings (Oct 28) for battery supply chain commentary

- Researching South Korean battery manufacturers (LG, Samsung) for systematic framework

- Avoiding speculative US battery stocks until fundamental data confirms execution capability

The 3-5 year positioning:

This isn’t a quarter-to-quarter trade. China didn’t just create a crisis—they created a moat for infrastructure owners who control physical assets that can’t be exported, replaced, or bypassed. NEE’s grid. Brookfield’s real estate. The poles, wires, and land that exist regardless of what Beijing decides about battery exports.

Meanwhile, the speculative plays betting on smooth execution and available inputs just saw their thesis invalidate in real-time. That 500% gain in small-cap data centers? It assumed batteries would be there. They won’t be.

The Bottom Line: When Supply Chains Become Weapons

China has systematically restricted every layer of America’s clean energy and AI infrastructure stack. First rare earths (the raw materials), then EV battery technology (the manufacturing knowledge), now batteries themselves (the finished products). The pattern is clear: supply chains are now weapons, and China is demonstrating they control the critical ammunition.

The investment conclusion is equally clear: Own the infrastructure that China can’t export. Physical assets. Regulated utilities. Grid connection points. Real estate. The tangible, immovable pieces of the stack.

Be extremely selective about speculative plays that depend on smooth supply chain execution. That 500% gain in small-cap data center operators? It assumed batteries would be available. They won’t be, not reliably, not at reasonable cost, not for operators without massive capital.

And be patient on US battery manufacturers. The thesis is obviously correct—domestic production is a national security imperative now. But “correct thesis” doesn’t automatically mean “profitable investment.” Systematic analysis of quality metrics, debt levels, cash burn, and proof of execution matters before deploying capital.

Three frameworks to guide systematic investors:

- Near-term (2025-2026): Battery constraint is real. Winners are defensive infrastructure owners (NEE), losers are speculative operators without locked supply (IREN).

- Medium-term (2026-2028): Transition phase. US domestic production ramps slowly, allied supply chains develop, successful battery manufacturers emerge. Selection matters more than the sector.

- Long-term (2028-2030): Either trade deals normalize supply, or US achieves independence, or technology breakthroughs (solid-state, sodium-ion) make the constraint irrelevant.

Position for all three scenarios by owning quality infrastructure with regulatory moats (NEE 5-8%), maintaining mega-cap tech exposure through margin pressure (15-25% combined), avoiding speculative data center operators (0-2% max), and waiting for systematic analysis before chasing battery manufacturer speculation (0% until fundamental proof).

When supply chains become weapons, own the infrastructure that can’t be exported. Own the monopolies that China can’t replicate. Own the balance sheets that can outspend the constraint.

That’s how systematic investors turn geopolitical risk into portfolio advantage.

For systematic screening tools and fundamental analysis on infrastructure holdings like NEE and BN, visit the Vulcan Stock Screener. Get quality scores, fair value analysis, and safety ratings on thousands of stocks.

Leave a comment