Wall Street loves a good narrative. A flashy tech IPO. A bold acquisition. A charismatic CEO promising disruption. What Wall Street often misses? The quiet compounders hiding in plain sight, executing systematic transformations while everyone’s looking elsewhere.

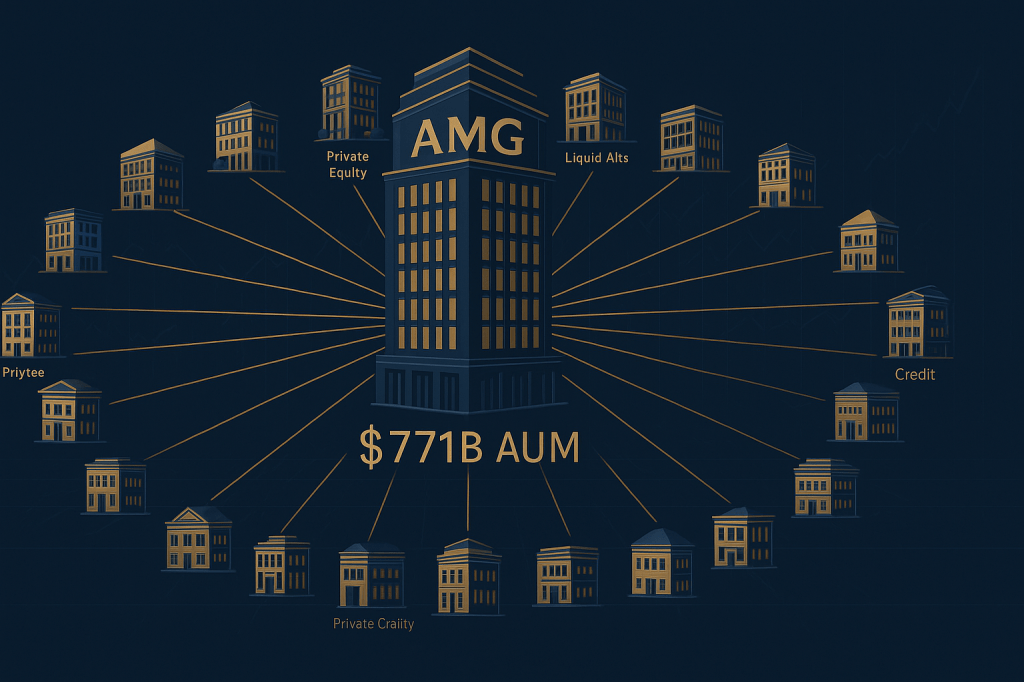

Enter Affiliated Managers Group (AMG), trading at $244 with a story that sounds almost too boring to work. They don’t manage money directly. They don’t have a recognizable consumer brand. They own minority stakes in about 40 independent investment firms. Think of it as the Berkshire Hathaway model applied to asset management – collect fees from great operators while they run their businesses.

Here’s what makes this interesting now: AMG is executing one of the most significant business model transformations in asset management, and the market is pricing it like nothing’s changed. The company just posted its strongest organic growth quarter in 12 years – over $8 billion in net inflows during Q2 2025. More importantly, the mix of what they’re gathering has fundamentally shifted. Private markets assets under management hit roughly $150 billion, up 50% since 2022. That’s not incremental improvement. That’s structural change.

The opportunity? You’re buying a capital-light compounding machine at roughly 10x forward earnings, during a transformation from low-fee equity products to high-fee alternative investments. The risk? This business model only works if the underlying affiliates keep performing, and you’re betting on management’s ability to pick and scale winners.

What You’re Actually Buying

Most asset managers are in the business of managing other people’s money directly. AMG took a different path. They identified high-quality boutique investment firms – the kind that institutions and wealthy families trust with billions – and bought minority economic stakes. The deal: AMG provides capital and infrastructure support, while the affiliate partners maintain autonomy and keep running their strategies.

This creates a fascinating dynamic. When a pension fund or endowment allocates $500 million to an AMG affiliate’s private equity fund, AMG participates in the management fees without having to build that capability from scratch. It’s a capital-light revenue model that scales beautifully when the assets grow.

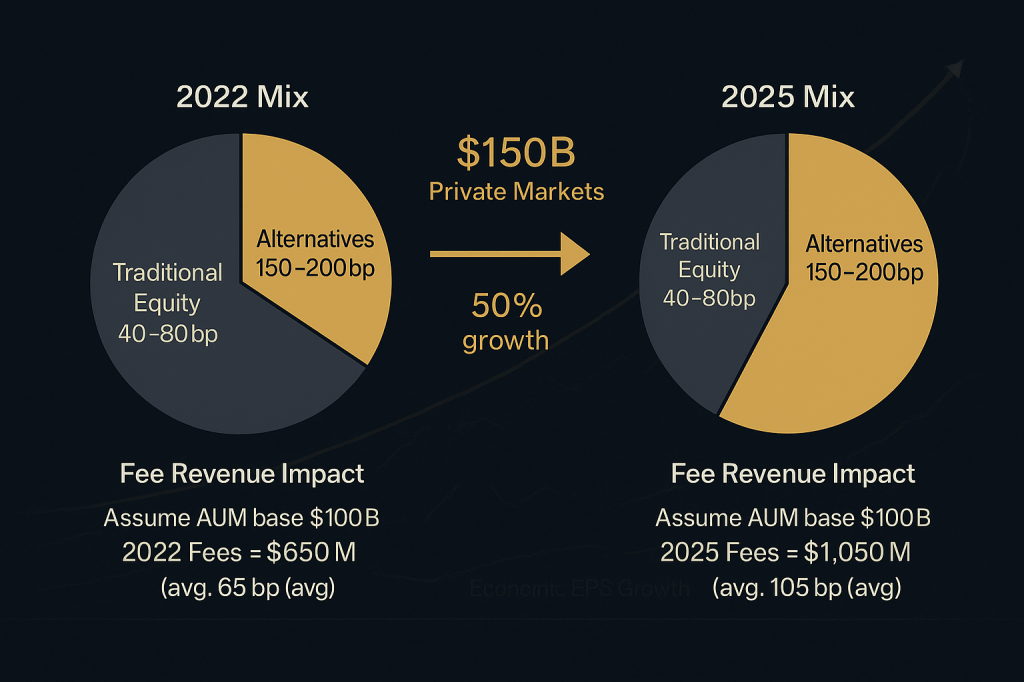

As of June 30, 2025, those 40-ish affiliates collectively managed approximately $771 billion. That number alone is impressive, but the composition matters more. Traditional long-only equity strategies – think mutual funds and separate accounts – generate management fees typically between 40 to 80 basis points. Private equity and private credit strategies? Fees run 150 to 200 basis points, often with 20% performance fees on top.

AMG’s transformation centers on shifting that mix toward alternatives. The private markets segment hit roughly $150 billion in the most recent quarter, representing nearly 20% of total AUM. That’s the highest-margin piece of the business, and it’s growing faster than everything else.

The Transformation Everyone’s Missing

Q2 2025 marks an inflection point. The company reported over $8 billion in net client inflows – the strongest organic growth quarter in twelve years. That’s not a typo. In an industry where most traditional managers are bleeding assets, AMG posted net inflows equivalent to about 4% annualized organic growth.

Breaking down where that money went reveals the story. Private markets strategies dominated the inflows, with private credit and secondaries leading the way. Liquid alternatives – strategies that bring hedge fund-like approaches to mutual fund structures – saw strong demand from wealth management channels. Traditional long-only equity? Still generating fees, but growing much slower.

This matters because fee rates compound. If you’re managing $100 billion at 50 basis points, you’re generating $500 million annually. Move that same $100 billion to strategies earning 150 basis points with performance fees, and you’re potentially looking at $2-3 billion over a market cycle. AMG isn’t starting from scratch – they’re upgrading the revenue quality of an already substantial base.

The numbers back this up. Economic earnings per share hit $5.39 in Q2 2025, and management reiterated their expectation for double-digit percentage growth in Economic EPS for the full year. That’s not guidance for a mature, low-growth business. That’s acceleration.

Why The Multiple Stays Compressed

So if the business is transforming and earnings are growing, why is AMG trading at roughly 10x forward earnings when comparable alternative asset managers command 15-20x? Three reasons, and they’re all addressable.

First, the model is complex. Explaining “we own stakes in firms that manage other people’s money” requires more than an elevator pitch. Investors who don’t want to dig into affiliate-level performance often pass entirely. This creates persistent inefficiency.

Second, the results are lumpy. Performance fees can swing 30-50% year-over-year based on market conditions and realization cycles in private markets. In strong years when portfolio companies exit at premium valuations, performance fees surge. In choppy markets, they dry up. Analysts modeling smooth linear growth struggle with this volatility.

Third, there’s key-person risk at the affiliate level. If a star portfolio manager leaves one of AMG’s larger affiliates, that can materially impact flows and valuation. The decentralized model that creates operational advantages also means AMG doesn’t control day-to-day talent retention the way a traditional manager would.

None of these are new issues. What’s changed is the offset. The private markets build-out provides more durable revenue streams with longer lock-up periods. A private equity fund raised today generates fees for 10+ years regardless of short-term market volatility. That stability wasn’t present five years ago when 80% of the business came from liquid strategies.

The Capital Allocation Angle

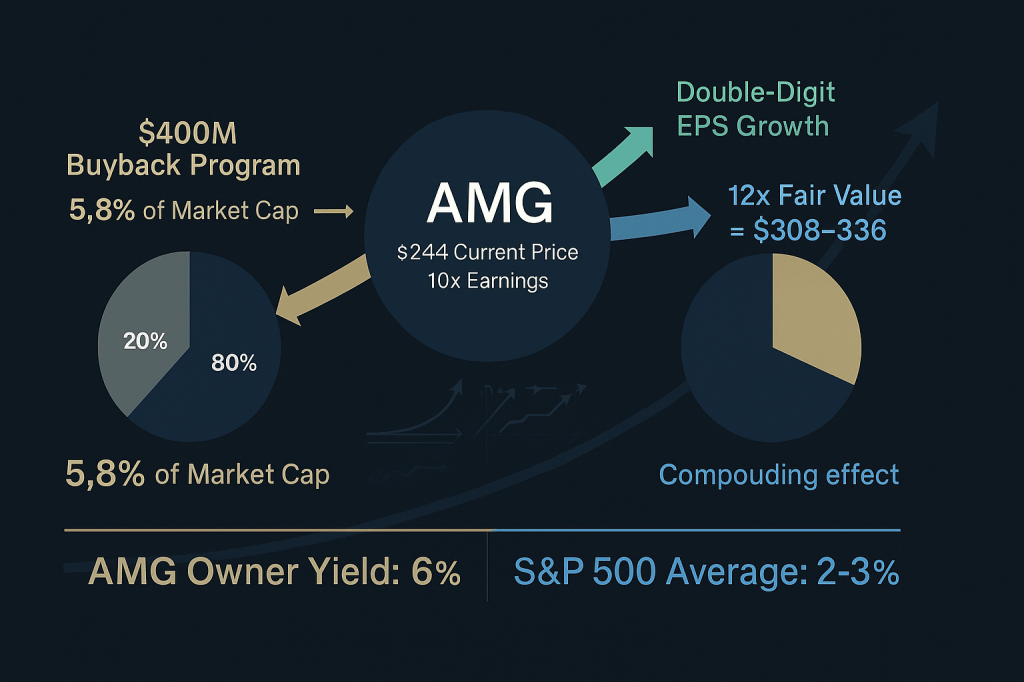

AMG’s management understands their stock is cheap. They’re responding with aggressive capital return. The company repurchased approximately $273 million in shares during the first half of 2025, and management has committed to at least $400 million in buybacks for the full year.

At current prices around $244, that $400 million represents roughly 5.8% of the market cap. Combined with a token dividend (currently $0.01 quarterly, basically nothing), the effective owner yield sits near 6% before any organic earnings growth. For a business compounding Economic EPS at double-digit rates, that’s attractive math.

The buyback strategy makes sense given the valuation disconnect. Every dollar spent repurchasing shares at 10x earnings has a 10% earnings yield, materially better than funding most new affiliate investments at prevailing private market valuations. Management is essentially betting that their own stock is the best investment opportunity they can find.

This creates a self-reinforcing cycle. Buybacks reduce share count. Earnings per share grow faster than absolute earnings. The market slowly recognizes the transformation. Multiple expands. Rinse and repeat.

What Could Go Wrong

No investment thesis survives contact with reality without acknowledging where it breaks. For AMG, three scenarios matter.

Scenario One: Private Markets Fundraising Slows. The entire thesis depends on sustained demand for alternative strategies. If institutional allocators pull back on private equity commitments or private credit spreads compress to the point where new funds can’t clear return hurdles, net flows could turn negative quickly. AMG added roughly $55 billion in alternative assets during the first half of 2025. If that pace drops to $10-15 billion, the growth narrative stalls.

Scenario Two: Affiliate Performance Deteriorates. The model only works when underlying managers deliver results. If several key affiliates underperform their benchmarks for extended periods, clients redeem and new business dries up. AMG has diversification across 40 firms, but the top 10 affiliates drive the majority of earnings. One or two blow-ups could materially impact consolidated results.

Scenario Three: Market Drawdown Hits Fee Base and Performance. AMG’s revenue is directly tied to asset values and realized gains. A sustained 30-40% correction in public and private markets would compress both management fees and performance fees simultaneously. The company’s balance sheet shows net debt-to-EBITDA around 3.6x on some estimates – manageable in normal conditions, but could become constraining if earnings fall 20-30% in a severe downturn.

The invalidation trigger: If net flows turn negative for two consecutive quarters while the company simultaneously slows buyback activity, the thesis is broken. That combination would signal both a business problem (clients leaving) and a management problem (loss of confidence in capital allocation).

Valuation In Context

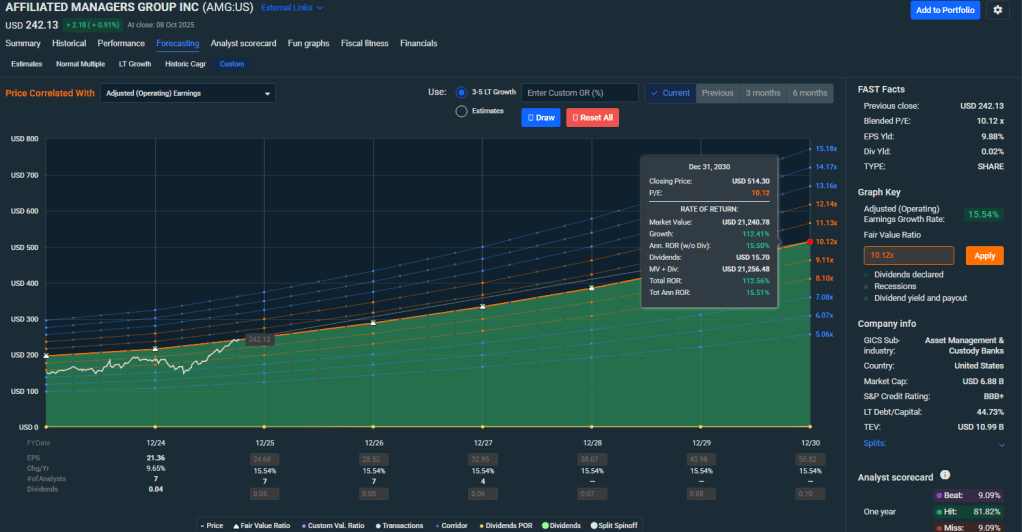

Consensus estimates project 2025 EPS around $24.20, rising to roughly $28+ in 2026. At $244, that implies a forward P/E near 10x for 2025 and approximately 8.7x for 2026.

Compare that to alternative asset managers. Ares Management trades around 18-20x earnings. Apollo Global Management sits near 15-17x. KKR hovers around 14-16x. These firms have cleaner structures as pure-play alternatives platforms, but AMG’s discount feels excessive given the transformation underway.

Applying a 11-12x multiple to 2026 earnings of $28 produces a fair value range of roughly $308-336 before factoring in buyback accretion. That implies 26-38% upside from current levels. The 11-12x multiple assumes AMG gets partial credit for its alternative exposure but maintains a holding company discount.

Running a simplified DCF using consensus earnings as a proxy for free cash flow, a 70% payout ratio through buybacks and dividends, 8% five-year growth, 10% discount rate, and 3% terminal growth yields a base case value around $333 per share. More aggressive assumptions (80% payout, 12% growth) push that to nearly $500. More conservative inputs (60% payout, 4% growth) drop it to roughly $201.

The key insight: Fair value likely sits 25-40% above current prices across most reasonable scenarios. The asymmetry tilts positive.

The Buy Zone Strategy

Given the volatility in financial services and the lumpiness of AMG’s earnings, buying requires discipline:

- Strong Buy zone: ≤$230 – This is “back up the truck” territory. At these levels, you’re paying under 9.5x forward earnings for a transforming business with 6%+ owner yield.

- Primary Buy zone: $230-260 – Current price of $244 sits here. Attractive entry for building a position with reasonable upside to fair value.

- Hold zone: $260-295 – Fair value range where the risk/reward balances. Let winners run but don’t add new money.

- Trim zone: $295-330 – Take profits if the stock sprints into this range without corresponding fundamental improvement.

- Too Expensive: >$330 – At these levels, you’re paying full value. Better opportunities exist elsewhere.

The optimal strategy: Initiate at 1% portfolio weight in the Primary Buy zone, with flexibility to scale to 2-3% on any dips toward $230. This recognizes both the opportunity (structural transformation) and the risk (lumpy earnings, key-person exposure).

Time Horizon and Catalysts

This is a 12-24 month thesis, not a trade. The catalysts that drive revaluation include:

Q3 and Q4 2025 earnings (November 2025 and February 2026): Continued confirmation of net inflows and alternative asset growth would validate the transformation thesis. Management’s guidance for double-digit Economic EPS growth needs to materialize in actual results.

New affiliate announcements: AMG regularly evaluates new partnerships and seeding opportunities. Adding a marquee name in private credit or infrastructure could materially move sentiment.

Interval fund traction: Liquid alternative strategies packaged in interval fund structures are gaining adoption in wealth management channels. AMG has exposure here, and meaningful flows would demonstrate the stickiness of the alternative shift.

Buyback execution: The $400 million repurchase target needs to get done. If management delivers while the stock stays cheap, the accretion shows up in 2026 EPS beats.

Multiple expansion: As the alternative mix crosses 25-30% of total AUM and fee margins continue expanding, analysts will eventually re-rate the stock toward peer multiples. That’s a 3-5 point multiple expansion worth 30-50% to the stock.

The Bottom Line

AMG is boring by design. The holding company structure. The lack of direct client relationships. The dependence on affiliate performance. These aren’t bugs – they’re features that create persistent market inefficiency.

What you’re buying at $244: A capital-light compounding machine transitioning from low-margin traditional strategies to high-margin alternatives, trading at 10x earnings with 6% owner yield and double-digit EPS growth. The market is pricing AMG like a mature asset manager declining slowly. The reality looks more like a transformation in the middle innings.

The risk sits in execution. Affiliate performance must hold. Private markets fundraising needs to continue. Management has to allocate capital intelligently. Miss on any of those, and the discount to peers could be justified.

But if the next 2-3 quarters confirm sustained net inflows and margin expansion, this setup offers institutional quality at a retail price. Sometimes the best investments are the ones nobody’s talking about.

Master Metrics Table – AMG (Affiliated Managers Group)

| Metric | Value | Commentary |

|---|---|---|

| Current Price | $244.12 | As of Oct 8, 2025 |

| Market Cap | ~$6.9B | ~28.4M shares outstanding |

| AUM | $771B | Across ~40 affiliate firms |

| Private Markets AUM | ~$150B | ~20% of total, up 50% since 2022 |

| Q2 2025 Economic EPS | $5.39 | Strongest organic growth in 12 years |

| Q2 2025 Net Inflows | >$8B | Driven by alternatives demand |

| 2025 EPS Consensus | $24.20 | Double-digit growth expected |

| 2026 EPS Consensus | $28+ | Continued acceleration |

| Forward P/E (2025) | 10.1x | Below alt manager peers at 15-20x |

| Forward P/E (2026) | 8.7x | Significant discount to fair value |

| Net Debt/EBITDA | ~3.6x | Manageable leverage for the sector |

| EV/EBITDA (LTM) | ~10.4x | In line with diversified managers |

| 2025 Buyback Plan | ≥$400M | ~5.8% of market cap at current price |

| H1 2025 Buybacks | $273M | On pace to exceed full-year target |

| Dividend | $0.01/qtr | Token payout, focus on buybacks |

| Owner Yield | ~6% | Buyback yield primary component |

| Fair Value Range | $308-336 | Using 11-12x 2026 EPS |

| Upside to Fair Value | 26-38% | Before buyback accretion |

Vulcan Score Breakdown (Based on Transformation Thesis):

- Value: 8.5/10 (Trading at meaningful discount to intrinsic value)

- Growth: 7.5/10 (Double-digit EPS growth, best organic flows in 12 years)

- Quality: 8.0/10 (Capital-light model, diversified affiliates, improving mix)

- Safety: 6.5/10 (Moderate leverage, key-person risk, market beta exposure)

- Momentum: 7.0/10 (Strong recent flows, analyst upgrades, buyback support)

Composite Vulcan Score: 7.5/10 – Strong Buy in Primary Zone

Disclaimer: This analysis is for informational purposes only and should not be considered financial advice. Always conduct your own research and consult with a financial advisor before making investment decisions.

Leave a comment