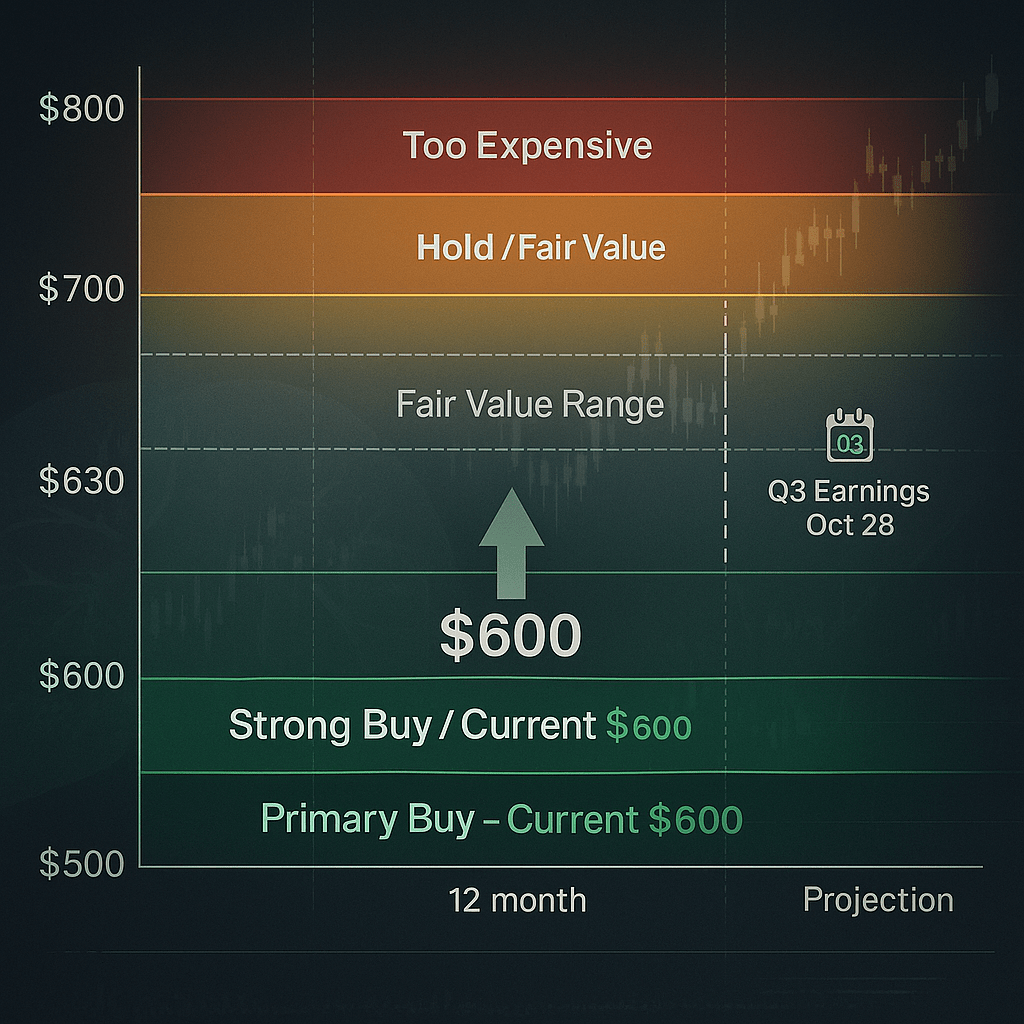

Current Price: $600.00 | Fair Value Range: $690-$720 | Margin of Safety: 18% | Next Catalyst: Q3 Earnings Oct 28, 2025

Regeneron just handed value investors a gift wrapped in bad sentiment. The stock’s down 42% in a year while quality metrics hit 99/100. The market’s punishing Eylea competition but missing the Dupixent expansion story.

The Investment Case: High-quality biotech at reasonable valuation with clear catalysts. Not a falling knife—a temporary disconnect between price and fundamentals.

The Risk: Eylea’s decline accelerates faster than Dupixent growth can offset. At $600, much of that pain is already priced in.

Our Call: Primary Buy zone. Scale in at $600, add on dips toward $560, trim above $700. Q3 earnings October 28 will clarify the path forward.

The Fortress Balance Sheet Nobody’s Talking About

Regeneron isn’t your typical biotech gamble. Think of it as owning a cash-generating machine while the market treats it like a speculative bet.

The numbers that matter:

- Gross margin: 85.6% (keeps 86 cents of every dollar in sales)

- Net margin: 31.4% (converts nearly one-third of revenue to profit)

- Debt-to-equity: 0.09 (essentially debt-free with $7.5B cash vs $2.7B debt)

- Altman Z-Score: 7.0 (bankruptcy risk effectively zero—anything above 3.0 is “safe”)

This is pharmaceutical royalty trading at 15x earnings. When biotechs get cheap, you want the ones that can survive anything—this is that.

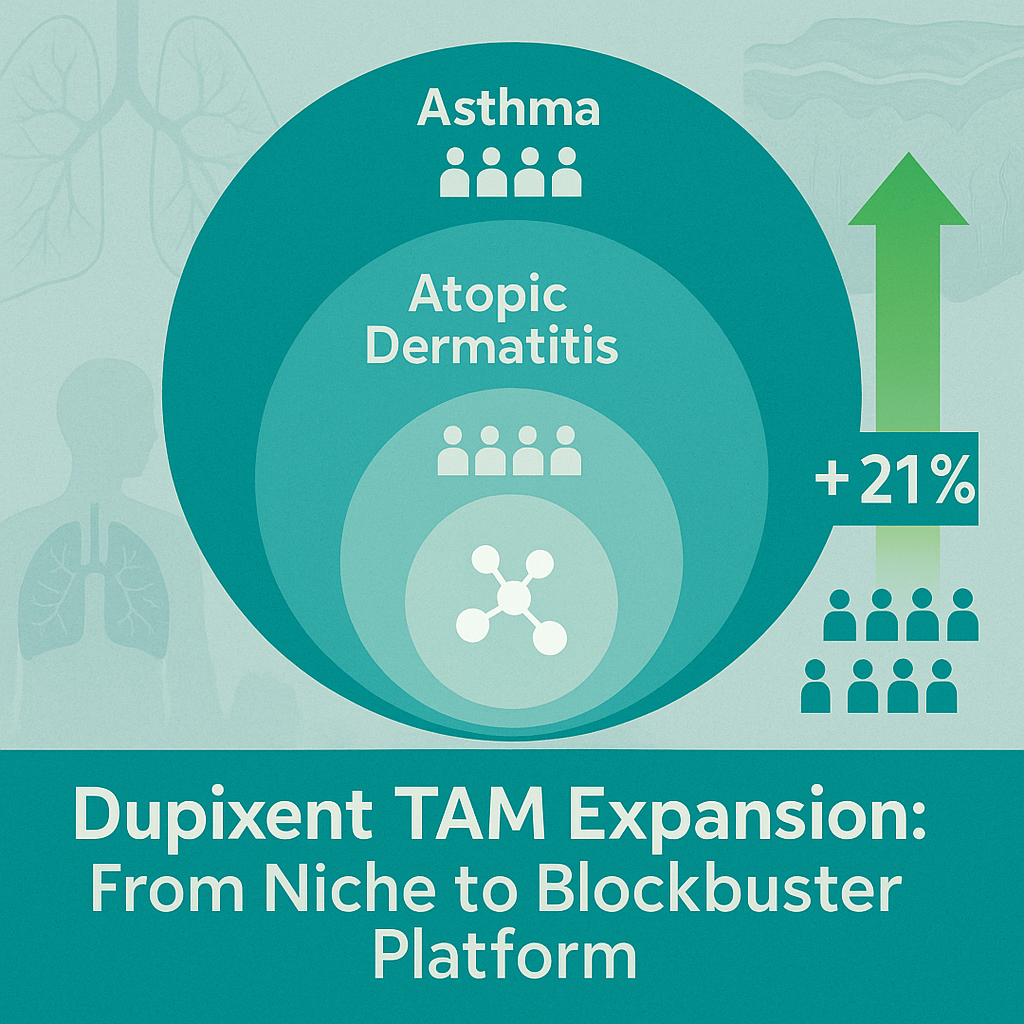

Why We’re Bullish: The Dupixent Expansion Nobody’s Pricing In

The market sees: Eylea losing share to Roche’s competing drug Vabysmo.

The market misses: Dupixent just became the first biologic approved for COPD, opening a 600,000+ patient market that drives decades of recurring revenue.

Dupixent isn’t just growing—it’s conquering adjacent markets. Q2 sales hit $4.3 billion, up 21% year-over-year. Each new disease indication expands the moat. COPD patients need chronic treatment (think decades, not months), and biologics command premium pricing with minimal near-term biosimilar threat.

Why this matters more than Eylea: Dupixent revenue has structural durability. COPD treatment isn’t discretionary and isn’t easily substituted. This growth engine offsets retina headwinds and drives the next decade of earnings. For more on how we evaluate pharmaceutical moats, see our analysis framework on quality metric screening.

The Eylea Reality Check: Bad News Already Priced In

Eylea U.S. sales fell 39% year-over-year to $754 million in Q2 2025. Vabysmo is taking share, and generic Avastin is nibbling at the bottom.

But here’s what’s different now:

- Eylea HD momentum: Up 29% to $393 million (longer dosing intervals = fewer office visits = stickier patients)

- EU regulatory support: European regulators approving extended dosing (reduces patient burden, improves retention)

- Valuation reset: The stock already fell 42%. How much more downside does this known problem justify?

If Eylea stabilizes at current levels (not even recovers), and Dupixent continues mid-teens growth, Regeneron’s earnings power supports $700+ valuation. The market’s pricing in continued collapse that may not materialize.

The Oncology Wildcard: New Revenue Streams in Development

Regeneron’s cancer pipeline has one clear winner and one setback.

Linvoseltamab (Positive): The FDA is reviewing this drug for relapsed/refractory multiple myeloma—a cancer that comes back after treatment. This opens a new revenue stream in a market desperate for better options. Approval likely Q4 2025 or Q1 2026.

Odronextamab (Negative): FDA issued a Complete Response Letter (formal rejection) on July 30, 2025. This delays approval and removes a near-term catalyst.

Net impact: Neutral to slightly positive. The market already discounted odronextamab risk. Linvoseltamab approval would be pure upside.

The Valuation Framework: Three Paths to Fair Value

We’re not relying on one magic calculation. Three approaches all point to $690-$720.

Method 1: Discounted Cash Flow This projects future cash flows and discounts them back to today’s value using the company’s cost of capital (7.1%—low because of minimal debt). Conservative long-term growth assumption of 2.0%. Result: $690

Method 2: Peer Comparison Regeneron trades at 15.1x earnings. Vertex (28.7x), Incyte (20.5x), and similar biotechs average ~22x. Applying a 20x multiple to 2026 earnings estimates: $720

Method 3: Historical Norm Over the past five years, Regeneron averaged an 18x P/E ratio. Current 15.1x is in the bottom third of that range. Mean reversion to 18x: $710

Blended Fair Value: $690-$720

At $600, we’re buying at a 15-18% discount to intrinsic value. Not a screaming bargain, but attractive for this quality level. For more on our valuation methodology across different market environments, see our comprehensive analysis on identifying undervalued quality stocks.

Buy Zones: Where to Scale and When to Trim

We use a banded approach based on fair value, uncertainty, and volatility.

Strong Buy: ≤ $560

Ultra-value territory. Load up if we get here.

Primary Buy: $590-$630

← You are here ($600)

Start building positions. This is the accumulation zone.

Hold (Fair Value): $630-$700

Already own it? Hold. Don’t chase here.

Trim: $700-$760

Take profits, rebalance, or harvest gains for tax purposes.

Too Expensive: > $760

Sell if we get euphoric post-earnings.

Position sizing: Start with 50% of target position at $600. Add remaining 50% on dips below $580 or after Q3 earnings clarity.

Risk Management: What Would Make Us Wrong

Every thesis has a breaking point. Here’s what would invalidate this investment case:

Hard stops:

- Q3 earnings show Eylea declining faster than 50% year-over-year (suggests terminal decline)

- Dupixent growth falls below 10% (signals market saturation earlier than expected)

- FDA rejects linvoseltamab or requires additional trials (removes oncology optionality)

- Price closes below $560 on weekly timeframe (breaks technical support)

What to watch:

- Q3 earnings October 28: Does Eylea stabilize or accelerate decline?

- FDA calendar: Linvoseltamab approval decision (likely Q4 2025)

- Dupixent COPD uptake: Physician adoption metrics from Q4 calls

- Biosimilar timeline: Eylea patent cliff hits 2027-2028 in U.S.

The Technical Picture: Broken Momentum Building Support

Current status:

- Price: $600, above 50-day average ($571), below 200-day average ($607)

- RSI: 59.49 (neutral—not oversold, not overbought)

- Support: $560 (next major level where buyers historically step in)

- Resistance: $615 (near-term), $650 (major supply zone)

The stock isn’t oversold anymore—it’s stabilizing. Higher lows over the past two months (bottomed at $476 in May) suggest accumulation after the washout.

Trading strategy:

- Patient approach: Wait for dip to $580-$590

- Conviction-driven: Scale in at $600, add below $580

- Stop loss: Weekly close below $560 (triggers re-evaluation)

The 12-Month Outlook: Three Realistic Scenarios

Bear Case (25% probability): $540 target (-10% return) Eylea declines accelerate to 60% year-over-year. Dupixent growth slows to 12%. Linvoseltamab approval pushes to late 2026. Stock re-rates to 13x earnings.

Base Case (50% probability): $672 target (+12% return) Eylea stabilizes at current decline rate. Dupixent maintains 18-20% growth as COPD adoption ramps. Linvoseltamab approved Q4 2025. Multiple holds at 15x earnings.

Bull Case (25% probability): $780 target (+30% return) Eylea HD takes share back from Vabysmo. Dupixent exceeds expectations with 25%+ growth. Linvoseltamab launches strong. Multiple expands to 18x earnings (still below historical median).

Risk-adjusted expected return: ~12% over 12 months, plus 0.6% dividend yield.

Q3 Earnings Preview: What to Listen For

Date: Tuesday, October 28, 2025, 8:30am ET (before market open)

Key questions for management:

- Eylea trajectory: Has the decline rate stabilized or accelerated?

- Dupixent COPD: What’s the early uptake signal from prescribers?

- Pricing power: Any changes to net pricing environment?

- Linvoseltamab update: Timeline clarity for approval decision?

- Capital allocation: Buybacks, M&A appetite, or dividend increases?

What would make us more bullish:

- Eylea decline moderating (sub-35% year-over-year)

- Dupixent guidance raise for 2026

- Linvoseltamab approval confirmed for Q4 2025

What would make us cautious:

- Eylea guidance suggests 50%+ declines continue

- Dupixent competition emerging (unlikely but watch for it)

- FDA feedback suggests linvoseltamab delays

Competitive Positioning: How REGN Stacks Up

Against biotechnology peers, Regeneron stands out on quality, lags on momentum.

Peers comparison:

- Vertex (VRTX): Higher quality (94 vs. 90), but trades at 28.7x P/E (REGN at 15.1x)

- Incyte (INCY): Similar valuation, lower quality scores

- Alnylam (ALNY): Higher growth, not yet profitable

- Argenx (ARGX): Premium valuation (40.8x P/E), early stage

Regeneron offers the rare combination: established profitability, fortress balance sheet, reasonable valuation. You’re paying for quality without the growth premium.

Why This Opportunity Exists (Market Psychology)

Markets hate uncertainty, and Regeneron has three sources:

- Eylea decline (known issue, unknown stabilization point)

- Oncology binary events (linvoseltamab approval timing unclear)

- Macro biotech pressure (sector underperformed by 39% in 2024)

This creates the disconnect. Fundamentals say “$690-720 fair value.” Sentiment says “sell the uncertainty.” The gap is your opportunity—but only if you can handle volatility through Q3 earnings.

This isn’t for everyone. If you need smooth upward trajectories, look elsewhere. But if you can stomach 20-30% intra-quarter swings while fundamentals improve, the risk-reward favors buyers at $600.

Conclusion: Quality on Sale, With Defined Catalysts

Regeneron at $600 is a calculated bet on three things:

- Eylea decline moderates (doesn’t have to recover, just stabilize)

- Dupixent growth continues (COPD expansion is real)

- Balance sheet and margins provide downside protection

The margin of safety is 18%. The quality score is 99/100. The downside is defined ($560 support). The upside is clear ($690-720 fair value).

Our recommendation: Primary Buy at current levels ($600). Scale in with 50% position now, 50% below $580 or post-Q3 clarity. Set stop-loss at weekly close below $560. Target $690 over 12 months, trim at $700-720.

This isn’t a home run trade. It’s a solid double with limited strikeout risk. For value-oriented biotech investors, that’s exactly what you want.

Master Metrics Table

| Metric | Value | Context |

|---|---|---|

| Valuation | ||

| Current Price | $600.00 | 52-week range: $476-$1,024 |

| Fair Value (Blended) | $690-$720 | StockRover: $708.49 |

| Margin of Safety | 18% | Attractive for quality |

| Forward P/E | 16.7x | Below peer average 22x |

| P/E (TTM) | 15.1x | Historical range: 7.6-35.5x |

| PEG Ratio | 1.9x | Reasonable vs. growth |

| Price/Sales | 4.7x | Sector: 8.9x |

| EV/EBITDA | 10.9x | Sector: 27.6x |

| Quality Metrics | ||

| Quality Score | 99/100 | Top percentile |

| Gross Margin | 85.6% | Sector: 71.2% |

| Net Margin | 31.4% | Sector: -7.7% |

| Operating Margin | 27.0% | Sector: -11.4% |

| ROIC | 13.8% | Above WACC (7.1%) |

| ROE | 14.9% | Consistent profitability |

| Altman Z-Score | 7.0 | Very safe (>2.99 = safe) |

| Piotroski F-Score | 6/9 | Above average |

| Interest Coverage | 134.2x | Debt service trivial |

| Growth Metrics | ||

| Growth Score | 80/100 | Strong historical growth |

| Revenue Growth (1Y) | 2.7% | Slowing near-term |

| Revenue Growth (5Y avg) | 9.0% | Historical strength |

| EPS Growth (1Y) | -1.9% | Temporary compression |

| EPS Growth (5Y avg) | 7.8% | Solid track record |

| 5Y EPS Growth Est. | 25.6% | Analyst expectations |

| Safety & Risk | ||

| Safety Score | 87/100 | Low volatility for biotech |

| Beta (3Y) | 0.71 | Less volatile than market |

| Volatility (1Y) | 0.40 | Biotech average: 0.19 |

| Max Drawdown (1Y) | -52.3% | Current cycle low |

| Debt/Equity | 0.09 | Minimal leverage |

| Current Ratio | 4.6 | High liquidity |

| Dividend | ||

| Forward Yield | 0.6% | Not a dividend story |

| Payout Ratio | 4.2% | Room to grow |

| Dividend Coverage | 11.3x | Very sustainable |

| Analyst Sentiment | ||

| Consensus Rating | Buy | 18 Strong Buy, 2 Buy, 6 Hold |

| Price Target | $677 | 12.8% upside |

| Recent Revisions | Neutral | 1 up, 1 down (30 days) |

Disclosure: This analysis is for informational purposes only and does not constitute investment advice. Always conduct your own research and consult with a financial advisor before making investment decisions.

Data Sources: StockRover (Oct 5, 2025), TipRanks (Oct 2025), Regeneron Investor Relations, FDA.gov, Reuters

Last Updated: October 5, 2025

Leave a comment