Wall Street obsesses over Biogen’s shrinking multiple sclerosis franchise. Meanwhile, a quiet revolution launched October 6th that could redefine how 6.9 million Americans access Alzheimer’s treatment—and most investors missed it entirely.

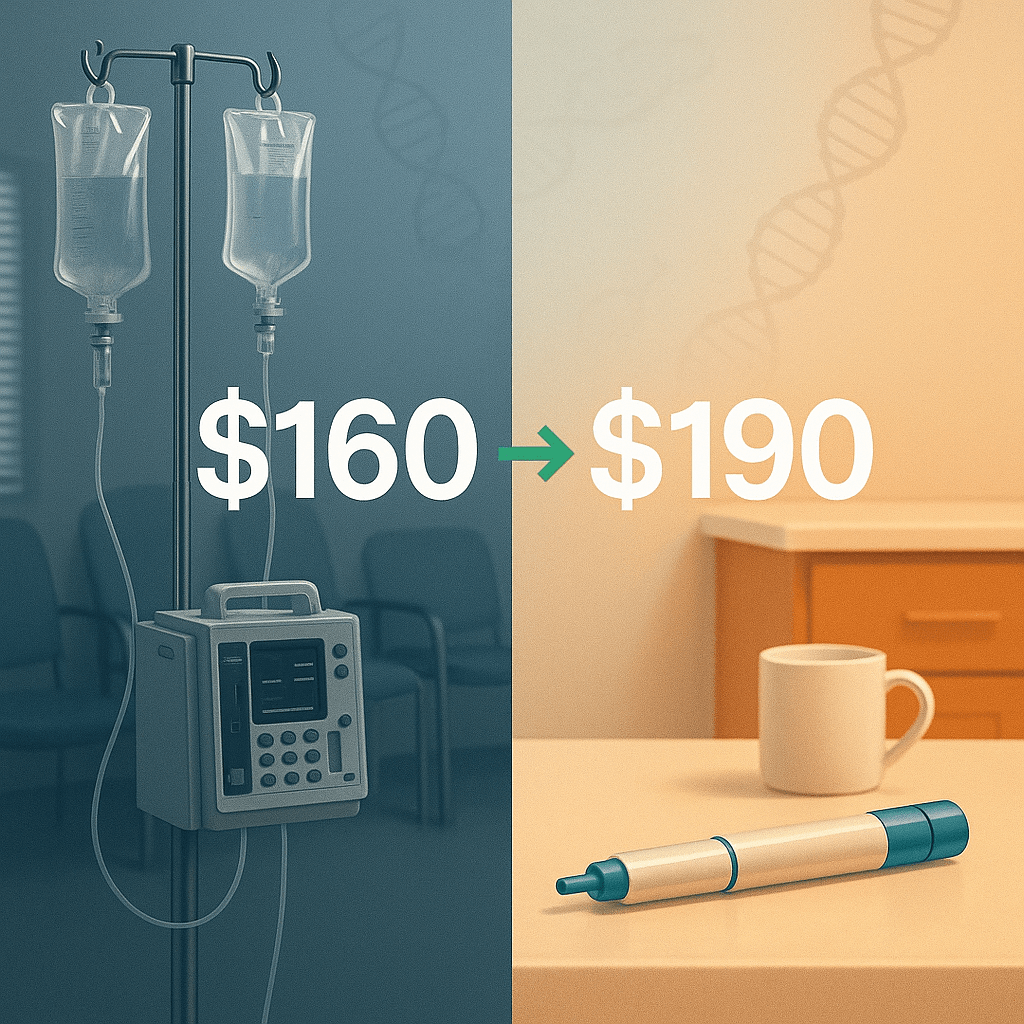

The bottom line: Quality large-cap biotech trading at $160 with 19% margin of safety to fair value, powered by a live catalyst that transforms theoretical Alzheimer’s therapy into practical home care. Legacy headwinds are real, but the transformation math favors patient accumulation for those who understand what just changed.

Our take: Buy on dips below $155. Core position sizing 3-5% with adds on validation. Invalidate on close below $148 or if Q3 earnings (Oct 30) undercut guidance.

The Business Nobody Understands Anymore

Here’s what makes Biogen fascinating: Everyone knows what they were—the MS drug giant with Tecfidera printing billions. Few grasp what they’re becoming—the infrastructure play on Alzheimer’s treatment delivery.

Think of it like watching Netflix in 2007. Wall Street saw declining DVD revenue and worried about Blockbuster competition. Visionaries saw streaming infrastructure being built while everyone watched the wrong metrics.

Biogen’s generating $10 billion in sales with 75% gross margins and throwing off serious cash. That’s not a company in trouble—that’s a company in transition. The MS portfolio funds the transformation. The question isn’t whether they’ll survive the shift; it’s whether investors recognize the opportunity before the market reprices it.

What Actually Makes Money Today

The revenue split tells you everything about why the stock trades cheap:

Legacy MS business: Still generates $4+ billion annually, but declining 5-8% per year as generics and biosimilars take share in Europe. This is the weight dragging sentiment—predictable erosion that analysts model perfectly and price in pessimistically.

New product ramp: Four launch products (Leqembi, Skyclarys, Zurzuvae, Qalsody) delivered $252 million in Q2 alone—up 91% year-over-year. That’s early-stage exponential growth hidden inside a mature company’s P&L.

Partnership economics: Roche collaboration on Ocrevus and other biologics provides steady royalty stream with zero commercial investment. High-margin cash that funds R&D without dilution.

The business model works: 15% net margins, $1.8 billion free cash flow annually, manageable debt at 0.4x equity. They’re not broken—they’re repositioning with a fortress balance sheet.

The Catalyst Nobody’s Pricing Correctly

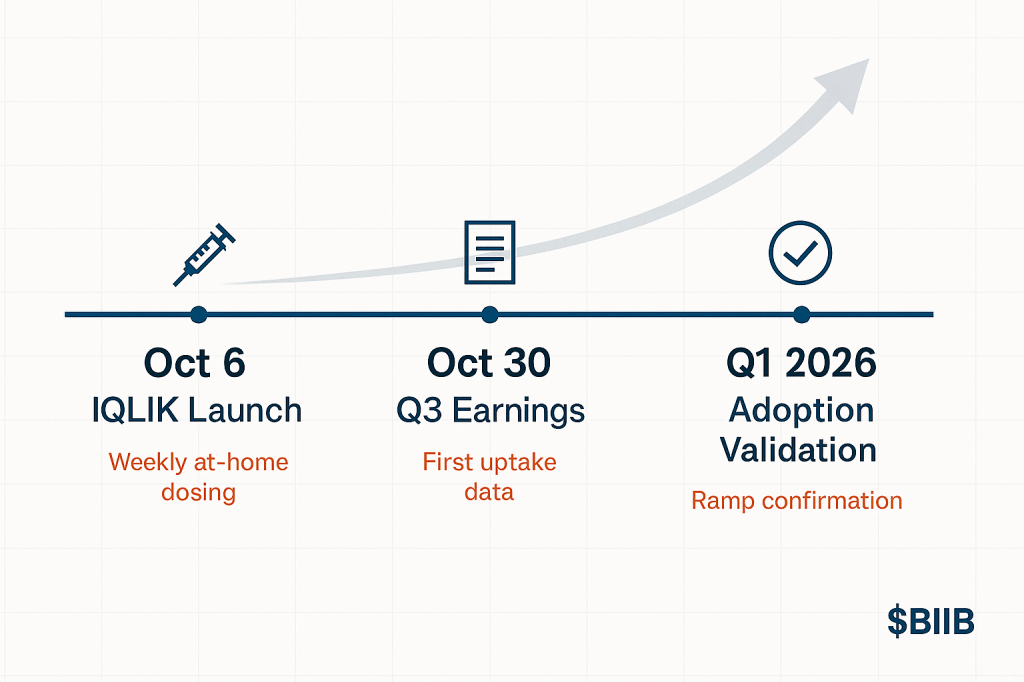

October 6, 2025 wasn’t just another FDA approval. It was an infrastructure unlock.

Leqembi IQLIK (the weekly subcutaneous maintenance formulation) eliminates the single biggest barrier to Alzheimer’s treatment adoption: infusion center dependence. Before this week, every patient needed twice-monthly IV infusions requiring specialized monitoring. The math on that is brutal—limited infusion slots, geographic access barriers, caregiver coordination nightmares.

Now: Weekly at-home injection for maintenance dosing after initial ramp. A nurse visit replaces hospital trips. The eligible patient pool just expanded dramatically.

Here’s the part most analysts miss: This isn’t about better efficacy (the drug works the same). It’s about conversion friction. Imagine Amazon in 2000 requiring customers to visit a warehouse for delivery. The product worked, but adoption was capped by logistics. That’s what just changed for Biogen.

Early indicators suggest the market doesn’t fully grasp this yet:

- Stock up only 13% in past month despite catalyst

- Consensus still models conservative adoption curves

- Q2 earnings beat by 41% barely moved the needle

- Forward P/E of 10.1x while growth assets ramp

The disconnect between business momentum and valuation creates the opportunity.

Why This Works at $160

Let’s talk about what you’re actually paying for at current levels.

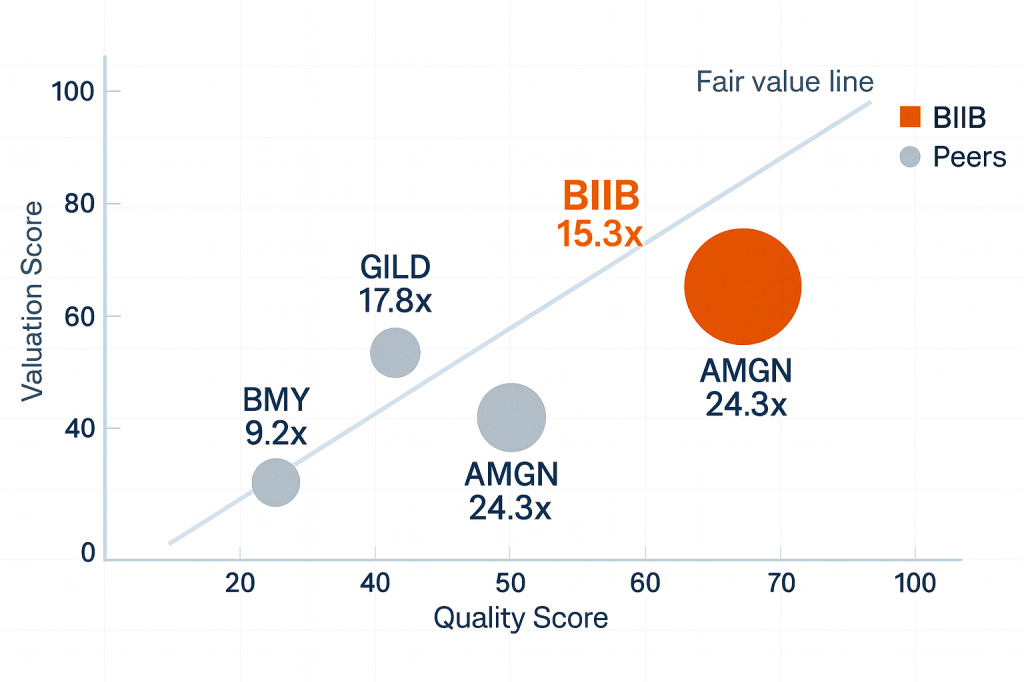

Valuation reality: Forward P/E of 10.1x with the S&P at 30.9x. You’re getting biotech innovation at value-stock pricing because the market sees legacy decline and discounts the future. EV/EBITDA of 9.8x versus peer average of 19.5x tells the same story—this is priced for contraction, not transformation.

Quality foundation:

- Gross margins: 75.4% (fortress economics)

- Operating margins: 24.1% (best-in-class execution)

- ROIC: 7.4% (below cost of capital but improving with mix shift)

- Free cash flow: $1.85 billion annually (funds everything without strain)

- Altman Z-Score: 3.2 (financially healthy, zero distress risk)

The margin of safety math: Fair value around $190-195 based on blended DCF and peer multiples (conservative assumptions on Leqembi ramp). Current price of $160 gives you 19% cushion. That’s meaningful downside protection with asymmetric upside if adoption inflects.

What changes the story: Three scenarios to watch—

Bull case (25% probability): Smooth transition to at-home maintenance, strong patient adherence, positive Q3 results. Stock reaches $205-210 (32% upside) as market reprices growth trajectory.

Base case (50% probability): Steady adoption with typical early hurdles, guidance intact, modest uptake improvements. Target $175-180 (12% upside) on derisked execution.

Bear case (25% probability): Adoption slower than modeled, payer friction, capacity constraints persist. Downside to $145-150 (8% decline) if thesis breaks.

The risk/reward setup favors accumulation: 12-32% upside in positive scenarios versus 8% downside if we’re wrong. That 3:1 ratio justifies position sizing.

The Risks That Keep Us Honest

Nothing’s guaranteed in biotech, and Biogen’s transformation faces real obstacles:

Adoption isn’t automatic: Weekly subcutaneous dosing is better than biweekly infusions, but patient initiation still requires complex diagnosis and monitoring. If blood-based biomarker testing doesn’t accelerate or if PCPs remain hesitant to prescribe, the addressable market stays constrained. Early uptake data over the next two quarters will be critical.

Payer dynamics are messy: Medicare Part D versus Part B coverage creates out-of-pocket variability. Some patients could face meaningful costs despite insurance. If reimbursement friction slows adoption, the bull case crumbles. Watch for any negative payer policy changes.

Legacy erosion might accelerate: The MS business is declining, but at a manageable pace. If generic competition intensifies or if new competitors take unexpected share, the base business could shrink faster than new products ramp. That would pressure cash flow and investor sentiment.

Partnership instability: The Eisai arbitration over European commercialization allocations isn’t resolved. If that relationship deteriorates or if collaboration economics shift unfavorably, it could disrupt the Alzheimer’s strategy. Biogen needs strong partners to execute globally.

Monitoring and safety concerns: ARIA (brain swelling) remains a known side effect requiring vigilant monitoring. If real-world safety events increase or if monitoring protocols prove too burdensome, adoption could stall. One high-profile adverse event would crater the stock.

These aren’t hypothetical worries—they’re legitimate hurdles. The difference between opportunity and value trap is whether management executes through them. Track these risk factors closely.

What to Watch Over the Next Six Months

Three catalysts will tell us if the thesis is working:

1. Q3 Earnings (October 30, 2025)

This is the first full quarter with IQLIK availability plus the first read on post-launch momentum. Look for:

- Leqembi revenue acceleration: Anything above $150 million globally (up from ~$100 million in Q2) signals strong uptake

- Guidance maintenance or raise: If they hold or increase the $15.50-16.00 EPS range, confidence is justified

- Patient initiation commentary: Management discussing funnel dynamics, prescription trends, and monitoring workflow improvements

- Payer feedback: Any color on reimbursement decisions or coverage policies

Positive surprise here could push the stock toward $170-175 quickly. Disappointment risks retreat to $145-150 support.

2. Real-World Adoption Metrics (November-December)

Between earnings calls, watch for:

- Blood-based biomarker testing growth: Claims data showing increased diagnostic testing by PCPs and neurologists

- Prescription data leaks: Third-party sources (IQVIA, Symphony) on weekly prescription trends

- Competitive response: Eli Lilly’s donanemab launch timeline and positioning

- Conference presentations: Any real-world data at neurology conferences (American Academy of Neurology, CTAD)

These leading indicators will front-run official financial results and provide early confidence or warning signals.

3. International Progress (Q4 2025/Q1 2026)

Alzheimer’s is a global market, and ex-US approvals matter:

- European label expansion: Any EMA decisions on maintenance dosing or broader indications

- China market development: Regulatory progress and commercial infrastructure building

- Partnership updates: Clarity on the Eisai arbitration and collaboration health

International revenue could eventually exceed U.S. given population demographics. Early wins validate the global opportunity.

Position Sizing and Risk Management

Here’s how to structure this intelligently:

Initial position: 2-3% of portfolio at current levels ($155-160). This is starter sizing that won’t hurt if we’re early but positions you for the opportunity.

Add triggers:

- Dip to $150-153 (technical support zone) = add another 1-2%

- Strong Q3 results with raised guidance = add 1% on strength

- Positive adoption data between earnings = scale another 1%

- Maximum position size: 5% (concentrated enough to matter, small enough to survive being wrong)

Sell/trim discipline:

- Close below $148 on weekly chart = invalidation, cut to 1-2%

- Q3 earnings miss or guide down = reduce by half immediately

- Negative safety event or payer policy shift = reassess entire thesis

- Target hit ($190-195) = trim half, let rest run with trailing stop

Options overlay (for those who use them):

- Sell $180 covered calls against half the position (collect premium during wait)

- Consider $150 protective puts if you’re nervous (costs ~2-3% but defines risk)

- Bull call spreads ($160/$180) for March 2026 if you prefer defined risk

The key is staying patient. This isn’t a momentum trade—it’s a value repositioning that needs time to develop. The margin of safety protects you during the wait.

The Technical Picture

Charts don’t tell the fundamental story, but they reveal where supply and demand shifted:

Current state: Repair phase after multi-year downtrend. Made higher low at $150 in August, broke above 50-day MA in September, now consolidating near $160. Not screaming “buy me,” but not broken either.

Key levels:

- Support: $150-155 zone (August low and 50-day MA convergence)

- Resistance: $170 (March 2025 high), then $190-195 (gap fill and fair value)

- Breakdown level: $148 (weekly close below this changes the game)

What the chart tells us: Stock is building a base after years of destruction. Needs a catalyst to break $170, but the foundation is firming. Not oversold enough to be a “falling knife,” not overbought enough to chase. That’s actually ideal for patient accumulation.

Use technical levels for entry optimization, not thesis validation. The fundamentals drive this one.

Competitive Reality Check

Biogen isn’t alone in Alzheimer’s treatment, and that matters:

Eli Lilly’s donanemab: Expected approval creates a duopoly. Lilly has stronger commercial infrastructure and deeper pockets. That’s real competition. But: duopolies often expand markets rather than split them. If both companies drive awareness and diagnosis, total patients treated grows. Biogen doesn’t need to “win”—they just need their fair share of a massively underpenetrated market.

Roche partnership dynamics: Biogen’s collaboration with Roche on Ocrevus (MS) and other biologics remains strong. This generates high-margin royalty income and validates their science. The relationship matters for credibility and cash flow stability.

Pipeline depth: Three Phase III programs (salanersen for SMA, dapirolizumab for lupus, plus others) provide additional shots on goal. These aren’t priced into the stock yet but could provide upside surprises in 2026-2027.

The competitive landscape is rational, not existential. Biogen has the assets and partnerships to compete effectively.

Why This Isn’t a Value Trap

Value traps look cheap for good reason—they’re dying. Biogen doesn’t fit that profile:

They’re growing where it counts: New product revenue up 91% year-over-year. Yes, legacy MS is declining, but the new franchises are ramping fast enough to offset. That’s transformation, not deterioration.

They’re profitable and cash-generative: $1.8 billion in annual free cash flow funds R&D, reduces debt, and provides strategic flexibility. Companies burning cash are traps. Companies printing cash while repositioning are opportunities.

Management is executing: Q2 earnings beat by 41%, full-year guidance raised, pipeline advancing. These aren’t the actions of a distressed management team—they’re signs of operational competence.

The catalyst is real and near-term: IQLIK launch just happened. Q3 results arrive October 30th. You won’t wait years for thesis validation—you’ll know within months if this works.

Value traps lack catalysts, bleed cash, and guide down repeatedly. Biogen has the opposite profile. The market is pricing in worst-case scenarios while the business delivers better-than-expected results. That gap closes over time.

The Bottom Line

Biogen at $160 offers rare biotech value: fortress balance sheet, 75% gross margins, meaningful margin of safety to fair value, and a live catalyst that could unlock sustained growth.

The thesis is straightforward: Legacy MS business declines predictably. New Alzheimer’s infrastructure ramps faster than the market models. Crossover happens in 2026-2027, and the stock reprices higher as investors recognize the transformation.

The risk is real but bounded: Adoption could disappoint, payer dynamics could worsen, safety concerns could resurface. But with 19% downside cushion to fair value and strong financial position, you’re not betting the company’s survival—you’re betting on execution quality.

The timeline is patient but defined: Q3 results (Oct 30) provide first inflection signal. Q4 and Q1 2026 confirm or deny adoption momentum. By mid-2026, you’ll know if this thesis works. That’s short enough to stay engaged, long enough to accumulate intelligently.

Position it correctly: This isn’t a 20% portfolio bet. It’s a 3-5% core holding that offers asymmetric risk/reward. If it works, you’ll make meaningful returns. If it doesn’t, you’ll lose a manageable amount. That’s proper risk management for a transformation story with live catalysts.

The setup favors patient accumulation below $160, especially on dips toward $150. Let the October 30th earnings print validate execution. Size positions for the opportunity without risking the portfolio on binary outcomes.

Biogen Master Metrics Table

| Category | Metric | Value | Context |

|---|---|---|---|

| Valuation | Current Price | $159.88 | As of Oct 3, 2025 |

| Fair Value | $190.17 | Stock Rover estimate | |

| Margin of Safety | 19% | Meaningful cushion | |

| Forward P/E | 10.1x | vs. Market 30.9x | |

| P/E Ratio | 15.3x | vs. Peers 25.5x | |

| EV/EBITDA | 9.8x | vs. Peers 19.5x | |

| Price/Sales | 2.3x | vs. Peers 4.3x | |

| Price/Book | 1.3x | Asset-backed value | |

| PEG Ratio | N/A | Growth inflecting | |

| Quality | Gross Margin | 75.4% | Best-in-class |

| Operating Margin | 24.1% | Excellent execution | |

| Net Margin | 15.3% | Healthy profitability | |

| Return on Equity | 8.7% | Below peer 33.7% | |

| ROIC | 7.4% | Improving with mix shift | |

| Interest Coverage | 8.1x | Strong debt service | |

| Debt/Equity | 0.4x | Conservative leverage | |

| Current Ratio | 2.5x | Strong liquidity | |

| Altman Z-Score | 3.2 | Financially healthy | |

| Piotroski F-Score | 5 | Moderate quality | |

| Growth | TTM Sales | $10.0B | Slight decline |

| Sales Growth (1Y) | 4.1% | Positive turn | |

| Sales Growth (3Y Avg) | -1.2% | Legacy erosion | |

| EPS (TTM) | $10.45 | Recovering | |

| EPS Growth (1Y) | -5.5% | Tough comp | |

| Q2 2025 EPS | $5.47 | Beat $3.88 est (41%) | |

| FY 2025 EPS Guide | $15.50-$16.00 | Raised from $14.50-$15.50 | |

| Forward EPS | $15.82 | Next year estimate | |

| New Product Revenue | $252M Q2 | +91% YoY | |

| Momentum | 1-Month Return | 12.9% | Recent strength |

| YTD Return | 4.6% | Lagging market | |

| 1-Year Return | -13.5% | Underperformance | |

| 52-Week Range | $110.03-$194.13 | High volatility | |

| Beta (1Y) | 0.63 | Less volatile than market | |

| Volatility (1Y) | 31% | Moderate for biotech | |

| Dividend | Current Yield | 0.0% | No dividend |

| Payout Ratio | N/A | Reinvesting in growth | |

| Balance Sheet | Cash & Equivalents | $2.76B | Strong liquidity |

| Total Debt | $6.59B | Manageable | |

| Stockholders’ Equity | $17.6B | Solid base | |

| Free Cash Flow (TTM) | $1.85B | Cash generative | |

| FCF/Net Income | 88% | High conversion | |

| Sentiment | Analyst Rating | Buy | 14 Strong Buy, 1 Buy, 19 Hold |

| Price Target | $175-$190 | Consensus upside | |

| Short Interest | 4.5% | Moderate skepticism | |

| Insider Ownership | N/A | Not disclosed | |

| Institutional Ownership | High | Major holder confidence | |

| Catalysts | Q3 Earnings | Oct 30, 2025 | Key inflection |

| Leqembi IQLIK Launch | Oct 6, 2025 | Just happened | |

| Phase III Initiations | Q2 2025 | 3 programs started |

Data sources: Company SEC Filings, Vulcan proprietary analysis. All metrics as of October 3-5, 2025 unless otherwise noted.

Leave a comment