While everyone debates whether Bitcoin miners are dead money, IREN Limited is quietly building one of America’s largest AI data center empires. This Australian company transformed from a pure crypto play into an NVIDIA-partnered infrastructure giant with 23,000 GPUs and 3 gigawatts of contracted power. But trading at $41.86 after a recent pullback, is this transformation worth the premium?

Our take: IREN sits at the profitable intersection of two explosive trends – Bitcoin’s institutional adoption and AI’s insatiable hunger for compute power. The company’s dual-revenue model generates cash from both Bitcoin mining and high-margin AI cloud services, creating multiple paths to growth. However, this premium story comes with premium risk, especially given the stock’s 98% volatility and deep connection to Bitcoin’s wild swings.

The Business That Makes Perfect Sense

Think of IREN as the smart kid who realized owning the power grid matters more than just using it. While other Bitcoin miners focused solely on digging digital gold, IREN built massive data centers with cheap renewable energy – the exact infrastructure needed for AI’s computational explosion.

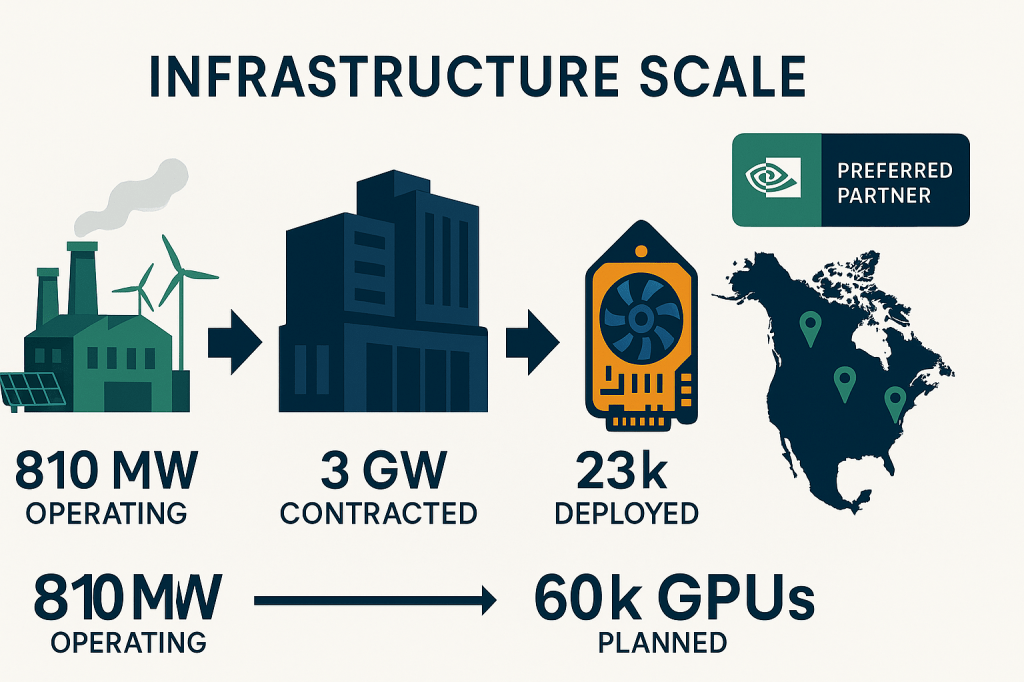

The company operates 810 megawatts of data center capacity across the United States and Canada, all powered by renewable energy sources. That’s enough electricity to power roughly 600,000 homes, instead channeled into Bitcoin mining rigs and AI processors. Even better, they’ve locked in contracts for nearly 3 gigawatts of future capacity – enough to compete with hyperscale cloud providers.

Here’s why this matters: AI workloads pay 5-10x more per unit of compute than Bitcoin mining. While Bitcoin mining generates steady but cyclical returns, AI cloud services command premium pricing with long-term contracts. IREN is essentially monetizing the same power infrastructure twice.

The Numbers That Drive Our Confidence

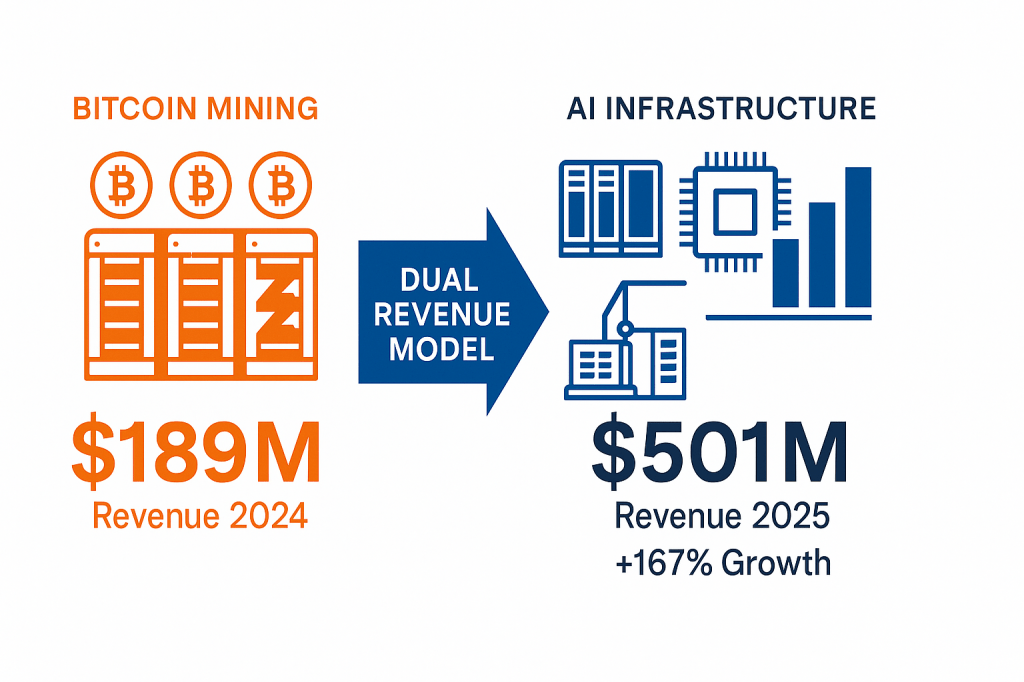

Revenue growth tells the transformation story. IREN’s sales exploded from $189 million to $501 million year-over-year, representing 167% growth. More importantly, gross margins expanded to 68% – remarkably high for an infrastructure business and reflecting the AI premium.

The balance sheet provides stability many crypto stocks lack. IREN maintains a current ratio of 4.3, meaning they can easily pay short-term bills. Interest coverage of 9.5x shows comfortable debt management, while $565 million in cash provides flexibility for expansion.

Quality metrics shine bright. The company scores an impressive Altman Z-Score of 6.2, indicating strong financial health. A Piotroski F-Score of 6 suggests solid operational fundamentals. These aren’t typical crypto metrics – they reflect a maturing infrastructure business.

The AI Cloud Goldmine Emerging

IREN’s AI transformation gained serious momentum throughout 2025. The company doubled its GPU count from 10,900 to 23,000 processors in just months, with plans to deploy 60,000 NVIDIA GB300s in the near future.

NVIDIA Preferred Partner status provides crucial advantages: priority access to cutting-edge chips, better pricing, and direct customer referrals. In today’s GPU-constrained world, this relationship is worth its weight in silicon.

The financial opportunity is massive. IREN targets AI cloud revenue exceeding $500 million annually – nearly matching their entire current revenue from AI services alone. With utilization rates exceeding 90% and multi-year contracts becoming standard, this isn’t speculative revenue but contracted business.

Management guides toward $1.25 billion in annualized revenue from operations, suggesting the transformation is accelerating rather than slowing.

Bitcoin Still Matters (For Better and Worse)

Don’t mistake IREN for a pure AI play – Bitcoin mining remains central to the business model and stock performance. The company operates 50 exahash of Bitcoin mining capacity, making them one of the world’s largest miners.

Bitcoin provides crucial advantages. Mining generates immediate cash flow while AI contracts take time to negotiate and deploy. During Bitcoin bull markets, mining becomes incredibly profitable, funding expansion and innovation. Bitcoin reserves on the balance sheet provide additional upside if cryptocurrency prices rise.

The challenge? Bitcoin’s volatility flows directly to IREN’s stock price. The company’s 2.32 beta means it moves more than twice as much as Bitcoin itself. When crypto crashes, IREN typically falls harder and faster than the underlying asset.

Recent Bitcoin strength near $110,000-$115,000 supports IREN’s mining operations, but any significant crypto selloff would pressure both mining profitability and stock sentiment.

Risk Management: What Keeps Us Cautious

Valuation remains stretched despite recent pullbacks. IREN trades at 18.7x sales and 41x EBITDA – premium multiples requiring near-perfect execution. Forward P/E of 30.7x assumes aggressive profit growth that must materialize.

Capital intensity creates constant funding pressure. The company spent $1.37 billion on expansion recently, generating negative free cash flow of $1.13 billion. While necessary for growth, this cash burn requires either strong operational performance or additional financing.

Analyst revisions trend negative with recent EPS estimates cut by 68% for the current quarter. Seven of the last eight earnings reports missed expectations, suggesting management guidance may be overly optimistic.

Competition intensifies rapidly. Every major tech company is building AI infrastructure, while other Bitcoin miners copy IREN’s dual-model approach. Supply chain constraints for GPUs and power infrastructure could slow expansion plans.

Technical Picture: Momentum Meets Resistance

IREN’s chart reflects the transformation story with violent precision. The stock trades well above its 50-day ($25.20), 100-day ($18.21), and 200-day ($13.73) moving averages, confirming the powerful uptrend.

RSI of 67 suggests momentum remains strong but approaching overbought territory. STOCH reading of 72 indicates similar conditions – bullish but stretched.

Key support levels emerge at $38-40 (prior breakout zone) and $32-34 (major moving average cluster). Resistance appears around $47-49, representing the recent all-time high area.

The volatility profile demands respect. One-year volatility of 99% means daily moves of 5-10% are normal, not exceptional. Maximum drawdowns of 65% over one year show how quickly gains can evaporate.

Investment Strategy: Position Sizing Is Everything

Our blended fair value estimate: $32-40 per share, weighting multiple valuation approaches. Stock Rover’s DCF analysis suggests $40, while multiple-based analysis points toward $32. Current pricing near $42 reflects modest overvaluation but not extreme excess.

Buy zones make tactical sense:

- Strong Buy below $18 (deep value territory)

- Primary Buy $18-29 (reasonable valuation range)

- Hold $29-45 (fair value zone)

- Trim $45-52 (extended valuation)

- Too Expensive above $52 (speculative territory)

Position sizing matters more than timing. Given the 2% portfolio maximum recommendation due to volatility, most investors should treat IREN as a satellite holding rather than core position. The risk-reward profile suits those comfortable with crypto-level volatility.

Scale-in approach works best. Rather than buying full positions at once, accumulate shares during weakness and trim strength. Dollar-cost averaging over 3-6 months reduces timing risk while capturing long-term trends.

The 12-Month Outlook: Multiple Paths Forward

Base case (55% probability): +10% to $46 AI cloud revenue ramps as planned, Bitcoin remains stable, and operational execution meets expectations. Multiple expansion occurs as investors recognize the transformation story.

Bull case (30% probability): +60% to $67

AI cloud adoption exceeds expectations, Bitcoin rallies above $150,000, and NVIDIA partnership delivers major customer wins. Premium valuation becomes justified by results.

Bear case (15% probability): -35% to $27 Bitcoin crashes below $80,000, AI spending slows, or operational execution disappoints. Valuation compression occurs as growth stories lose favor.

Probability of negative returns over 12 months: ~65% based on Monte Carlo analysis, reflecting high volatility despite positive expectations.

Why This Matters for Your Portfolio

IREN represents a structural shift in how Bitcoin miners create value. Rather than depending entirely on cryptocurrency prices, the company built multiple revenue streams from the same infrastructure investments.

The AI infrastructure shortage provides genuine tailwinds. Demand for compute capacity far exceeds supply, creating pricing power and long-term visibility unusual in commodity businesses.

Energy advantage becomes increasingly valuable. As AI workloads grow, access to cheap, reliable power determines profitability. IREN’s renewable energy focus provides both cost advantages and ESG benefits.

However, execution risk remains high. The company must simultaneously manage Bitcoin mining operations, deploy AI infrastructure, and satisfy both crypto and tech investors with different expectations.

Bottom Line Investment Thesis

IREN offers leveraged exposure to two transformative technologies through the same infrastructure investment. The AI cloud business provides growth and multiple expansion potential, while Bitcoin mining offers immediate cash flow and cyclical upside.

Buy the pullbacks, manage the position size, and focus on multi-year trends rather than quarterly volatility. This isn’t a stock for conservative portfolios, but it could be transformational for those willing to accept the risk.

Current action plan: Accumulate shares on weakness toward $32-36, hold for the AI infrastructure buildout, and trim strength above $48. Set stop-losses based on time rather than price – if the AI cloud business fails to materialize by mid-2026, the thesis needs reevaluation.

The transformation from Bitcoin miner to AI infrastructure provider is real, profitable, and accelerating. Whether the stock price reflects this reality fairly is the bet every investor must make for themselves.

Master Metrics Table

| Metric | Value | Notes |

|---|---|---|

| Current Price | $41.86 | As of September 26, 2025 |

| Market Cap | $11.39B | Large-cap infrastructure play |

| Revenue (TTM) | $501M | +167% year-over-year growth |

| Gross Margin | 68.3% | Exceptionally high for infrastructure |

| Net Margin | 17.4% | Strong profitability metrics |

| Current Ratio | 4.3 | Excellent liquidity position |

| Debt/Equity | 0.5 | Moderate, manageable leverage |

| Interest Coverage | 9.5x | Comfortable debt service |

| Altman Z-Score | 6.2 | Strong financial health |

| Piotroski F-Score | 6 | Solid operational fundamentals |

| 1-Year Beta | 2.32 | High correlation to crypto/tech |

| Volatility (1Y) | 99% | Extreme price swings expected |

| Max Drawdown | -65.6% | Historical worst-case scenario |

| Forward P/E | 30.7 | Premium valuation multiple |

| P/S Ratio | 18.7 | High sales multiple |

| EV/EBITDA | 41.2x | Elevated for infrastructure |

| Revenue Growth | 167% | Exceptional expansion rate |

| AI GPUs Deployed | 23,000 | Doubled in recent months |

| Bitcoin Hash Rate | 50 EH/s | Major mining operation |

| Data Center Capacity | 810 MW | Operating infrastructure |

| Contracted Power | 3 GW | Future expansion potential |

| Cash Position | $565M | Strong liquidity buffer |

| Free Cash Flow | -$1.13B | Heavy investment phase |

| NVIDIA Partnership | Preferred | Strategic supplier relationship |

| AI Cloud ARR Target | >$500M | Management guidance |

| Analyst Price Target | $46.44 | Wall Street consensus |

| Buy Rating % | 64% | 8 of 11 analysts bullish |

Leave a comment