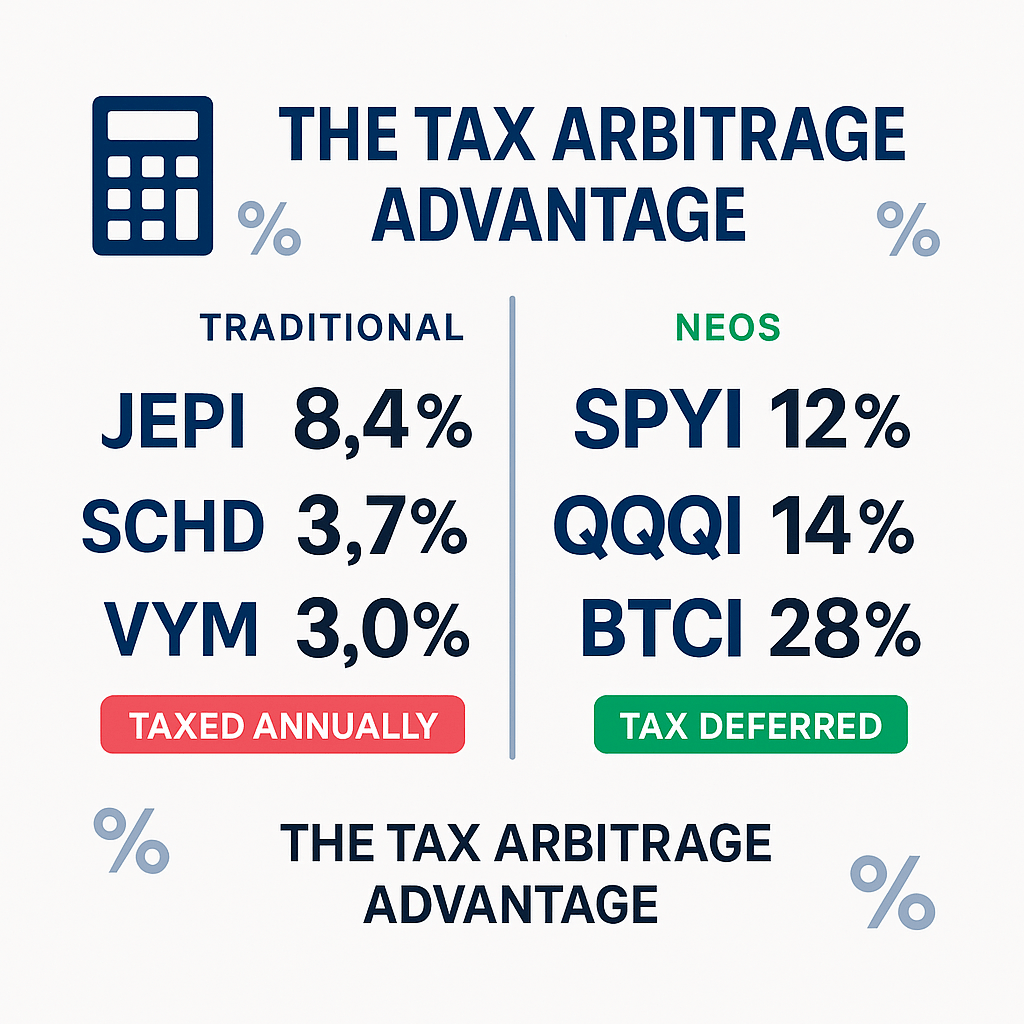

When market volatility becomes your paycheck, traditional dividend math breaks down completely. The NEOS S&P 500 High Income ETF (SPYI), Nasdaq-100 High Income ETF (QQQI), and Bitcoin High Income ETF (BTCI) are rewriting income investing by delivering yields of 12%, 14%, and 28% respectively—with most distributions classified as tax-deferred return of capital. While traditional dividend funds like SCHD yield 3.7% and covered-call veteran JEPI delivers 8.4%, these option-driven strategies are extracting double-digit income from the market’s natural volatility. From our research data, SPYI has maintained NAV growth despite paying massive distributions, proving this isn’t capital destruction disguised as yield. The tax efficiency alone creates a compelling arbitrage: receiving 12% annually with minimal current-year tax liability versus JEPI’s 8% fully-taxable income. I’m positioning this trio as a core income allocation, with specific buy zones that capitalize on the volatility-yield relationship driving these strategies.

Investment Thesis: SPYI, QQQI, and BTCI represent the evolution of income investing—delivering equity-like total returns tilted heavily toward current cash flow. Through sophisticated index options overlays, these funds convert market uncertainty into predictable monthly income streams while preserving capital. The combination of high yields and tax deferral creates compelling after-tax returns that traditional dividend strategies can’t match. Rating: Buy across the trinity, with tactical sizing based on volatility appetite.

How These Funds Mint Income From Market Fear

Understanding SPYI’s mechanics reveals why it’s outperforming traditional covered-call strategies. Rather than writing calls directly against stock positions, SPYI owns the full S&P 500 portfolio while selling index call spreads on SPX options. This structure captures rich option premiums without fully capping upside—explaining how SPYI delivered 14.1% annualized returns since inception versus 15.9% for the S&P 500, while paying 12% distributions.

The call spread approach means when markets rally, SPYI participates until hitting the spread ceiling, then benefits as short calls expire worthless. During sideways markets, the fund harvests pure premium income. In downturns, earned premiums cushion losses. Since August 2022, this strategy generated enough option income to support distributions without eroding the underlying portfolio.

QQQI applies identical mechanics to the Nasdaq-100, capitalizing on tech volatility to push yields toward 14%. The higher option premiums reflect the reality that NDX options trade with elevated implied volatility versus SPX—directly translating to higher income potential. Since launching in January 2024, QQQI captured 19.8% total returns versus the Nasdaq’s 20.5%, proving the strategy works across different equity exposures.

BTCI represents the frontier application: extracting income from Bitcoin’s notorious volatility while limiting direct crypto exposure. The fund holds roughly 24% Bitcoin ETPs, 65% Treasury bills, with the remainder in option positions. This structure means a 50% Bitcoin crash might translate to a 10-15% BTCI decline (offset by bond income and option gains), while a Bitcoin double delivers more modest upside due to call caps. For investors wanting crypto income without crypto risk, BTCI’s 28% yield from a partially-hedged structure offers unprecedented access.

The Tax Arbitrage Nobody’s Talking About

The real alpha lies in tax treatment. Traditional dividend funds create immediate tax liability—SCHD’s 3.7% qualified dividend rate still means annual tax bills. JEPI’s distributions hit investors as ordinary income, potentially halving after-tax yields for high earners.

SPYI and QQQI flipped this equation: 94-96% of distributions qualified as return of capital in 2024, meaning virtually tax-free income in the receipt year. This ROC classification stems from the funds’ ability to realize losses on options positions while maintaining positive cash flow from premiums. The technical mechanism involves using Section 1256 index options, which receive favorable 60/40 tax treatment (60% long-term capital gains, 40% short-term regardless of holding period).

For high-bracket investors, the math is stark: JEPI’s 8.4% yield becomes roughly 5% after taxes, while SPYI’s 12% yield remains largely intact near-term. The ROC simply reduces your cost basis, deferring taxes until you sell—or potentially eliminating them entirely through step-up basis at death.

BTCI achieves similar tax efficiency despite crypto complexity. Recent distributions ran 96% ROC, though the fund’s Cayman subsidiary structure means some future income could face ordinary rates. Even then, the futures-based options likely qualify for 60/40 treatment.

Why These Strategies Work Now

Current market dynamics favor volatility-harvesting strategies. We’re not in the ultra-low-vol environment of 2017-2019 that compressed option premiums. Interest rate uncertainty, inflation concerns, and geopolitical tensions maintain elevated implied volatility—the fuel for these funds’ income engines.

From our analysis of options pricing, the VIX term structure suggests persistent uncertainty ahead. This environment creates rich premiums for systematic sellers, particularly in index options where liquidity is deep. SPYI and QQQI benefit from being volatility agnostic—they profit whether markets go up, down, or sideways, as long as movement occurs.

The macro setup also supports the asset allocation case. With risk-free rates around 5%, income investments face higher competition. Yet these funds clear that hurdle easily, offering equity risk premiums in cash form. SPYI’s 12% yield essentially frontloads the S&P 500’s long-term expected return as current income, with upside bonus potential.

Bitcoin’s maturation adds another layer. BTCI captures crypto volatility during an institutional adoption phase that could reduce BTC’s wildness over time—potentially making the current 28% yield unsustainable at these levels in the future. Early positioning captures maximum premium harvest.

Technical Setup and Buy Zones

SPYI Technical Analysis: Current price around $52.30 represents fair value given the 12% yield. The fund launched at $50 and has maintained NAV stability despite massive distributions—a testament to strategy execution.

🎯 Strong Buy: ≤ $48.50 (yield ≥ 14%)

🎯 Primary Buy: $48.50-$51.50 (yield 12.5-14%)

🎯 Hold: $51.50-$54.00 (current range)

🎯 Trim: > $54.00 (yield drops below 11%)

Entry Strategy: Start with a 3-5% portfolio allocation at current levels. Add on any S&P 500 correction that drives SPYI below $50. The yield-price relationship means market weakness creates better entry points.

Invalidation: Daily close below $46 (suggesting fundamental strategy breakdown) or sustained yield compression below 9% (indicating low-vol regime that hurts option income).

QQQI Technical Analysis: Trading near $54.10 with tech-heavy exposure creating higher volatility than SPYI.

🎯 Strong Buy: ≤ $49.00 (yield ≥ 16%)

🎯 Primary Buy: $49.00-$52.00 (yield 14-16%)

🎯 Hold: $52.00-$56.00 (current range)

🎯 Trim: > $56.00 (yield compression risk)

Technical Note: Watch Nasdaq 100 momentum. QQQI performs best during volatile tech environments. Avoid adding during low-vol momentum runs where call premiums compress.

BTCI Technical Analysis: Most volatile of the trio due to crypto linkage. Current $61.20 reflects recent Bitcoin strength.

🎯 Opportunity Buy: ≤ $55.00 (Bitcoin weakness = higher vol = higher yields)

🎯 Primary Buy: $55.00-$60.00

🎯 Hold: $60.00-$65.00

🎯 Speculative Only: > $65.00

Position Sizing: BTCI should remain a satellite holding (1-3% max) due to crypto risk. Use Bitcoin corrections as entry opportunities.

Risk Reality Check

These aren’t magic money machines. Understanding the trade-offs prevents disappointment:

Opportunity Cost Risk: In sustained bull markets with compressed volatility, these funds will lag pure index exposure. If the S&P 500 rallies 30% in a smooth, low-vol year, SPYI might capture only 15-18% total return. You’re trading some upside for current income.

Distribution Variability: The 12-14% yields aren’t contractual. They fluctuate with volatility levels. A prolonged low-vol environment could compress distributions temporarily. However, the funds maintain monthly payment commitments by adjusting strategy parameters.

Management Execution: Active strategies require skilled execution. While NEOS has demonstrated competence through various market cycles, strategy drift or poor timing could impact performance. The funds’ growing AUM (SPYI over $5B, QQQI near $4.7B) suggests institutional confidence.

BTCI Specific Risks: Crypto regulation, Bitcoin futures market liquidity, and the complex Cayman structure add layers of risk. BTCI works best for investors already comfortable with crypto volatility who want to harvest income from that exposure.

Tax Complexity: ROC distributions require basis tracking. While currently favorable, tax law changes could alter treatment. The funds provide detailed 1099 reporting, but consult tax professionals for personal situations.

Valuation and Fair Value Assessment

Traditional ETF valuation metrics don’t apply cleanly to these option-income hybrids. Instead, I focus on yield-to-risk relationships and sustainable distribution coverage.

Distribution Coverage Analysis: SPYI’s option income plus underlying dividends have consistently covered distributions since inception. The fund actually grew NAV while paying out double-digits—indicating genuine income generation rather than capital return.

Relative Value Framework: Against JEPI’s 8.4% fully-taxable yield, SPYI’s 12% mostly-tax-deferred distribution offers compelling value. The after-tax income advantage widens for higher-bracket investors.

Volatility-Yield Relationship: These strategies profit from volatility risk premiums. Current VIX levels around 20-25 support sustainable yields. If volatility crashes to 2017 levels (VIX consistently below 15), expect yield compression. Conversely, volatility spikes above 30 would boost income significantly.

Fair Value Estimates: SPYI appears fairly valued at current levels yielding 12%. Strong buy triggers activate if yields push toward 14%+ (indicating market stress creating premium buying opportunities).

QQQI’s 14% yield reflects higher Nasdaq volatility. Premium entry occurs during tech selloffs when yields approach 16-18%.

BTCI’s 28% yield seems unsustainably high long-term, but captures current crypto volatility premium. As Bitcoin matures, expect gradual yield normalization toward 15-20% range.

Portfolio Integration Strategy

These funds excel as income-focused allocations within diversified portfolios. They’re not core equity replacements but rather enhanced income vehicles.

Optimal Allocation Framework:

- Conservative Income Focus: SPYI 5-8%, QQQI 2-3%, BTCI 0-1%

- Moderate Yield Tilt: SPYI 8-12%, QQQI 4-6%, BTCI 1-2%

- Aggressive Income: SPYI 10-15%, QQQI 6-8%, BTCI 2-4%

Account Placement: Prioritize taxable accounts to maximize the ROC benefit. In IRAs, the tax advantage disappears, making these funds less differentiated versus alternatives.

Rebalancing Approach: Let distributions accumulate rather than reinvesting automatically. This provides dry powder for opportunities while avoiding the complexity of reinvesting ROC distributions.

For readers interested in systematic income strategies, our analysis of dividend aristocrats during rate cycles provides complementary context. Additionally, our framework for evaluating covered call strategies helps distinguish these innovative approaches from traditional income methods.

The Verdict: Revolutionary Income Engineering

SPYI, QQQI, and BTCI represent genuine innovation in income investing. By converting market volatility into tax-efficient cash flow, they solve the perennial yield investor’s dilemma: accepting low returns or high tax drag.

The strategy mechanics are sound, execution has been strong, and the tax advantages create meaningful alpha. These aren’t yield-chasing gimmicks but sophisticated volatility harvesting strategies with institutional-quality implementation.

Current Action Plan: I’m initiating positions across all three, sized according to risk tolerance. SPYI gets the largest allocation as the most diversified approach. QQQI adds tech-focused income with higher volatility. BTCI remains a small satellite position capturing crypto’s unique risk premium.

Entry Timing: Start building positions now at fair valuations. Add aggressively on any market corrections that spike yields above 14% (SPYI) or 16% (QQQI). BTCI buying opportunities arise during crypto fear cycles.

Long-term Outlook: These strategies should maintain relevance as long as options markets remain liquid and volatility persists. The tax advantages alone justify meaningful allocations for high-bracket investors seeking current income.

The NEOS trinity proves you can engineer higher yields without sacrificing capital preservation. In an environment where traditional income sources offer poor risk-adjusted returns, these funds provide a compelling alternative path.

Rating: Buy across the portfolio, with position sizing reflecting your income needs and volatility tolerance.

Leave a comment