Coeur Mining (CDE) has delivered a stunning 185% year-to-date return, transforming from a struggling miner into a silver-heavy cash generator. The company completed its game-changing SilverCrest acquisition in February, added the high-grade Las Chispas mine, and authorized a $75 million buyback program.

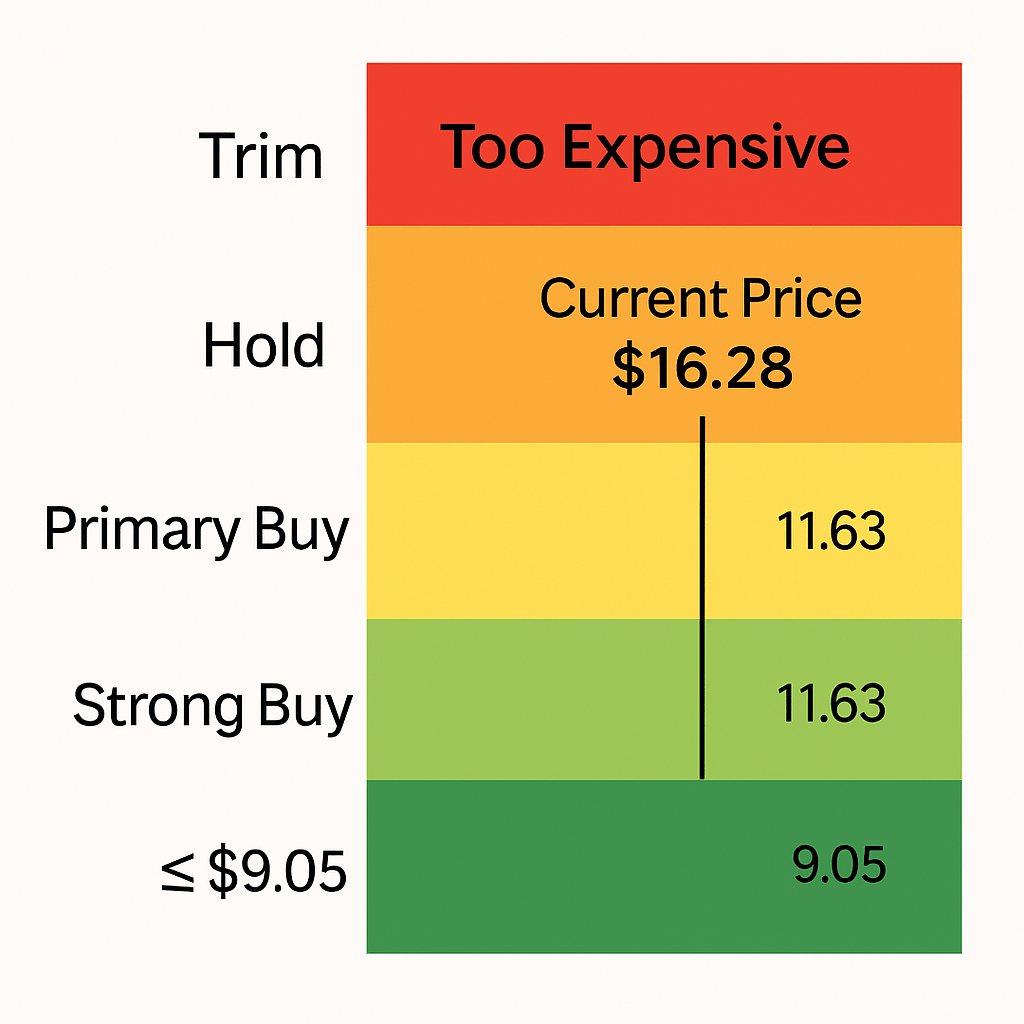

But at $16.28, CDE trades 26% above our blended fair value of $12.92, with momentum indicators flashing overbought signals. Quality business, expensive price. For new money, patience pays—wait for pullbacks into our Primary Buy zone of $9.05-$11.63.

What Coeur Mining Actually Does

Think of Coeur Mining as a treasure hunter that got much better at finding silver and gold. The company operates five mines across the United States, Canada, and Mexico, with silver making up roughly 60% of their revenue.

Here’s how they make money: they dig precious metals out of the ground and sell them at market prices. When silver and gold prices rise—as they have dramatically in 2024-2025—Coeur’s profits multiply because their mining costs stay relatively fixed while their selling prices soar.

The game-changer happened in February 2025 when Coeur acquired SilverCrest and its crown jewel Las Chispas mine in Mexico. This wasn’t just another acquisition—it essentially doubled Coeur’s silver production capacity and added one of the highest-grade silver mines in North America.

The Numbers That Drive This Story

Revenue exploded to $1.46 billion (trailing twelve months) from $1.05 billion last year—that’s 39% growth driven primarily by the Las Chispas addition. More importantly, the quality of earnings improved dramatically with gross margins expanding to 37% from 31%.

Free cash flow tells the transformation story best: $249 million positive versus negative $9 million last year. That’s the difference between a struggling miner and a cash-generating machine. The company used this cash strength to fully repay its revolving credit facility and launch share buybacks.

The balance sheet cleaned up nicely with a debt-to-equity ratio of just 0.11—very healthy for a mining company. Interest coverage of 8.6 times means they can easily handle their debt payments even if operations slow down.

But here’s the valuation reality check: at current prices, CDE trades at 20.2 times EV/EBITDA (enterprise value to earnings before interest, taxes, depreciation, and amortization) compared to an industry average of 11.5 times. That’s a premium that assumes everything goes perfectly.

Why This Opportunity Exists Now

The precious metals rally isn’t just hype—there are real supply and demand fundamentals at work. Industrial demand for silver from solar panels, electronics, and electric vehicles keeps growing while mine supply stays constrained. Coeur positioned itself perfectly as one of the few pure-play silver miners with meaningful scale.

Las Chispas provides the competitive advantage. This mine produces silver at grades of 400-500 ounces per ton—exceptionally rich compared to typical mines producing 3-8 ounces per ton. It’s like comparing a geyser to a garden hose when it comes to metal concentration.

Production momentum continues building with gold production up 25% quarter-over-quarter and silver up 27%. Management also delivered cost control despite inflationary pressures, with all-in sustaining costs decreasing. For context on how we evaluate mining companies’ operational metrics, see our framework on position sizing and risk management for commodity producers.

The $75 million buyback authorization signals management confidence in their cash generation ability. When mining executives return cash to shareholders instead of chasing growth projects, it usually indicates disciplined capital allocation.

What Could Derail This Story

Let’s be honest about what could go wrong, starting with the biggest risk: valuation. At current prices, CDE needs everything to go right just to justify today’s stock price. Any hiccup in execution or metal prices could trigger a significant pullback.

Currency exposure creates ongoing risk since Mexican operations face peso-denominated costs while selling metals in US dollars. An 8% peso appreciation recently hit operating costs—if the peso continues strengthening, it squeezes margins at both Palmarejo and Las Chispas.

The SilverCrest acquisition integration still needs flawless execution. Large mining deals often face unexpected challenges like permitting delays, labor disputes, or geological surprises that weren’t apparent during due diligence. These aren’t deal-breakers but could delay expected synergies.

Technical indicators flash warning signals with RSI (Relative Strength Index) at 75—anything above 70 typically indicates overbought conditions. The last time CDE traded at these momentum extremes, it pulled back 30-40% before finding support.

Your Trading Zones and Entry Strategy

Based on our blended fair value of $12.92 (averaging StockRover’s $12.34 and Street consensus of $13.50), here’s how to approach CDE positions:

Strong Buy zone sits at $9.05 or below—that’s 30% below fair value where the risk-reward strongly favors buyers. Primary Buy zone runs from $9.05 to $11.63, offering 10-30% discounts to fair value. Hold/Fair Value spans $11.63 to $14.21, representing roughly fair pricing.

Current price of $16.28 sits squarely in our Trim zone ($14.21-$16.80), suggesting existing holders should consider taking some profits. Too Expensive territory starts above $16.80.

For position sizing, treat CDE as a tactical satellite holding within a diversified portfolio. Start with 0.5-1.5% allocation and cap core positions at 2-3% maximum given the volatility and premium valuation.

New investors should be patient—wait for pullbacks into the Primary Buy range before establishing positions. For more detailed guidance on how we translate fair value estimates into concrete buy ranges, see our systematic approach to entry zones.

Technical Levels and Price Action

Resistance sits at $17.00-$17.25 near the 52-week high of $17.15. A clean break above this level on volume could target $18-20, but requires continued strength in silver and gold prices.

First support comes at $14.50, representing the prior breakout level where buyers previously stepped in. Key support sits at $12.60 near our fair value estimate—this level should hold if the fundamental story remains intact.

Major support appears at $10.80 based on volume analysis, representing a level where significant buying interest emerged historically.

For the bull case, watch for high-volume hold above $16.80 with metals remaining bid. For the bear case, a weekly close below $14.50 would invite a deeper correction toward fair value in the $11-13 range.

Catalysts and Timeline

Near-term catalysts include third-quarter earnings in November, where investors will focus on production numbers and cost guidance. Las Chispas integration progress and exploration updates could provide positive surprises.

The $75 million buyback execution offers another positive catalyst—management can support the stock price during any weakness while reducing share count. Monitor the pace of repurchases as an indicator of management confidence.

Longer-term, watch for full-year 2026 production guidance and any updates on the Silvertip development timeline. While Silvertip remains years away from production, it adds meaningful optionality to the story.

Macro factors matter enormously for precious metals miners. Federal Reserve policy, dollar strength, and inflation trends all influence gold and silver prices, which directly impact CDE’s profitability.

Risk Management and Invalidation Points

Set clear rules before investing. For traders, a weekly close below $12.50 would invalidate the momentum leg and suggest deeper correction ahead. For investors, two consecutive quarters showing free cash flow deterioration absent metal price weakness would warrant position review.

Consider partial profit-taking in the current Trim zone—harvest 10-25% of positions to lock in gains while maintaining upside exposure. This disciplined approach protects against the inevitable volatility in commodity stocks.

Monitor quarterly results for any signs of integration challenges, cost inflation, or production shortfalls. Mining companies can disappoint quickly when operational issues arise.

The Verdict on CDE

Coeur Mining has genuinely transformed from a debt-laden strugglers into a higher-quality, cash-generative business. The SilverCrest acquisition was strategic and well-timed, positioning the company as a leading silver producer with exceptional asset quality.

But transformation and fair valuation are different concepts. At current levels, most of the good news appears priced in. The stock needs either continued metal price strength or exceptional operational performance to justify today’s premium.

For long-term precious metals investors, CDE remains a quality way to play the silver theme, but entry point determines returns in commodity investing. For value-focused investors, patience will likely reward you with better opportunities in the $11-14 range.

Quality story, premium price—position appropriately and manage risk actively.

Master Metrics Table

| Metric | Value | Context/Comment |

|---|---|---|

| Price (Sept 19, 2025) | $16.28 | Near 52-week high of $17.15 |

| Market Cap | $10.46B | Large-cap precious metals miner |

| 52-Week Range | $4.58 – $17.15 | Currently at premium end |

| VALUATION ANALYSIS | ||

| StockRover Fair Value | $12.34 | DCF-based fundamental analysis |

| Street Consensus Target | $13.50 | Average analyst price target |

| Blended Fair Value | $12.92 | Our weighted average estimate |

| Current Premium | +26% | Above blended fair value |

| Margin of Safety | -24% | Negative (overvalued territory) |

| VULCAN BUY ZONES | ||

| Strong Buy | ≤ $9.05 | 30%+ below fair value |

| Primary Buy | $9.05 – $11.63 | 10-30% below fair value |

| Hold/Fair Value | $11.63 – $14.21 | ±10% of fair value |

| Trim Zone | $14.21 – $16.80 | CURRENT ZONE |

| Too Expensive | > $16.80 | Avoid new positions |

| FINANCIAL PERFORMANCE | ||

| TTM Revenue | $1.46B | +39% year-over-year growth |

| Revenue Growth (1Y) | 63.7% | Driven by Las Chispas acquisition |

| TTM Free Cash Flow | $249M | vs -$9M prior year |

| Gross Margin | 36.7% | Strong for mining industry |

| Net Margin | 13.1% | Healthy profitability |

| Operating Margin | 27.8% | Excellent operational efficiency |

| QUALITY METRICS | ||

| Piotroski F-Score | 7 out of 9 | High financial quality |

| ROIC | 7.2% | Decent capital efficiency |

| ROE | 6.7% | Reasonable equity returns |

| Debt/Equity | 0.11 | Very low leverage |

| Interest Coverage | 8.6× | Excellent debt service ability |

| Current Ratio | 1.6 | Adequate liquidity |

| Altman Z-Score | 4.5 | Very low bankruptcy risk |

| VALUATION RATIOS | ||

| P/E (TTM) | 40.7 | High but improving |

| Forward P/E | 18.7 | More reasonable on forward basis |

| EV/EBITDA | 20.2× | Premium to industry (11.5×) |

| Price/Sales | 5.5× | Above industry average |

| Price/Book | 3.7× | Reasonable for quality miner |

| PEG Ratio | 1.5 | Growth-adjusted valuation |

| MOMENTUM & RISK | ||

| YTD Return | +184.6% | Exceptional momentum |

| 1-Year Return | +141.2% | Strong performance |

| 3-Year Return | +471% | Massive outperformance |

| Volatility (1Y) | 62% | High (typical for miners) |

| Beta (1Y) | 1.17 | Slightly above market |

| RSI | 75.4 | Overbought conditions |

| Short Interest | 2.6% of float | Low short interest |

| OPERATIONAL METRICS | ||

| Q/Q Gold Production | +25% | Strong operational momentum |

| Q/Q Silver Production | +27% | Benefiting from Las Chispas |

| Cost Performance | Improving | AISC declining despite inflation |

| Mine Life | Extending | Successful exploration results |

Leave a comment