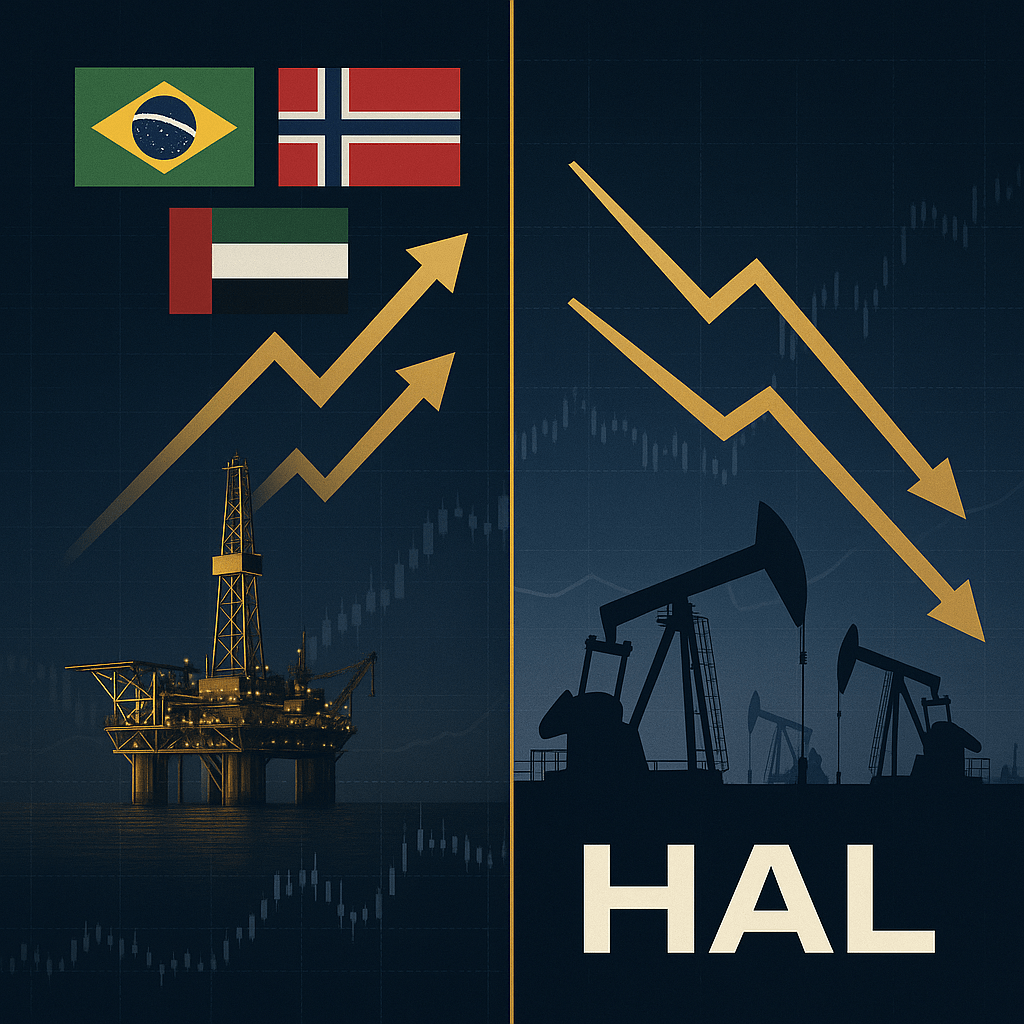

While most investors focus on Halliburton’s struggles in its home market, the oilfield services giant is quietly building momentum in international markets — creating a compelling value opportunity for patient investors willing to look beyond the headline noise.

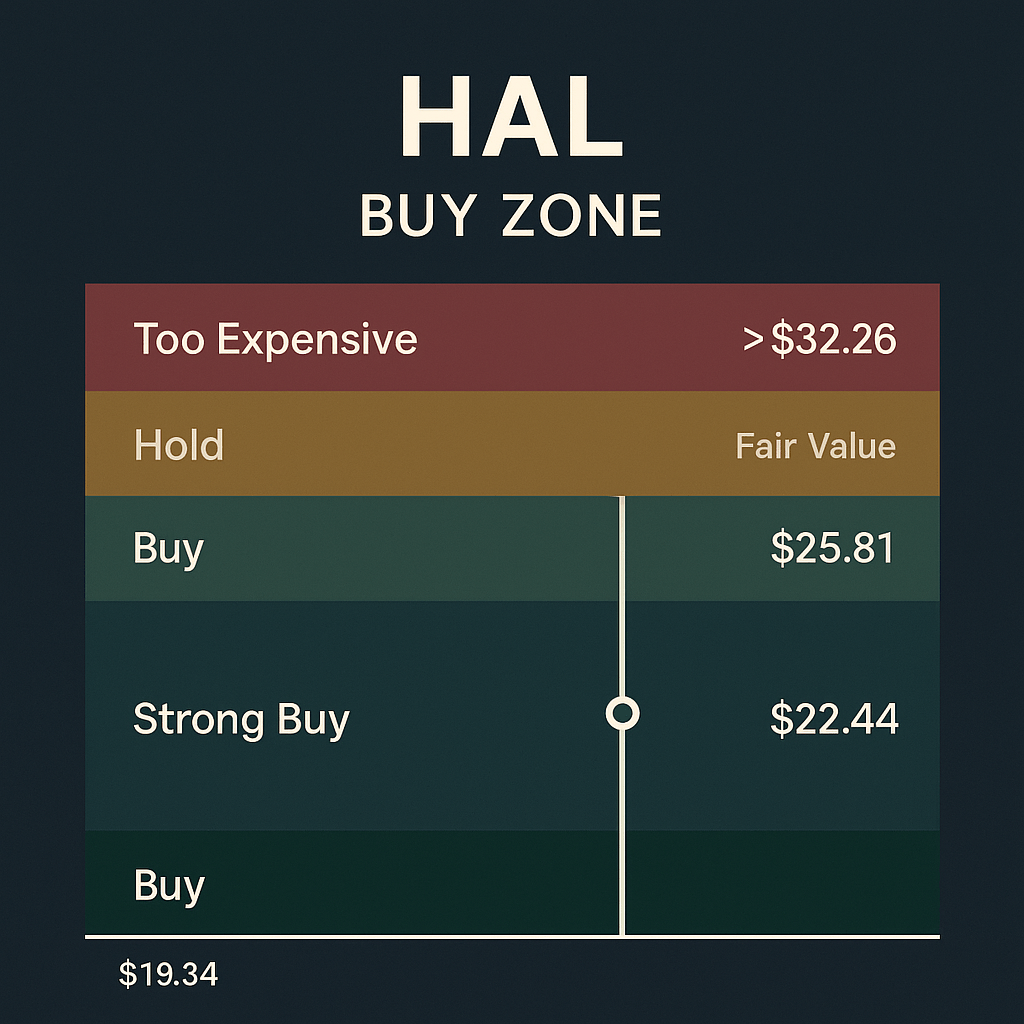

At $22.44, Halliburton trades at roughly 87% of our blended fair value estimate of $25.81, placing it squarely in Primary Buy territory according to Vulcan screening bands. With international operations gaining traction in Brazil, Norway, and offshore projects, plus game-changing electric fracturing technology taking market share, HAL offers approximately 15% upside potential with a solid 3.0% dividend yield while you wait.

What Halliburton Actually Does

Think of Halliburton as the specialized contractor that makes oil drilling possible. When energy companies want to extract oil or gas from underground, they need someone with the technical expertise and equipment to drill the wells, pump the right fluids and chemicals downhole, and complete the complex process of actually getting hydrocarbons flowing to the surface.

Halliburton is the largest oilfield services company in North America and second-largest globally. The company operates in two main segments: Completion & Production (which includes their dominant hydraulic fracturing business) and Drilling & Evaluation (specialized drilling services and downhole tools). Simply put, they’re the experts who turn underground oil deposits into flowing wells.

The Numbers That Tell the Story

Our Vulcan-mk5 analysis reveals a company trading at attractive valuations despite near-term challenges. With a composite score of 3.01 out of 5.00, HAL earns particularly strong marks for value (4.40/5.00) while showing solid quality metrics (3.80/5.00). The forward P/E of 10.6 and EV/EBITDA of 6.5 look compelling compared to both sector peers and the broader market.

The company’s financial foundation remains solid with a debt-to-equity ratio of 0.8, interest coverage of 6.5x, and an Altman Z-score of 3.2 indicating low bankruptcy risk. Free cash flow generation continues with a 3.1x dividend coverage ratio, supporting the current 3.0% yield.

Return metrics tell a story of quality operations: 17.7% return on equity and 12.1% return on invested capital demonstrate management’s ability to generate attractive returns on shareholder capital, even in a challenging environment.

Why This Opportunity Exists Now

The market’s pessimism around HAL stems from legitimate concerns about North American activity levels, where pricing pressure in hydraulic fracturing and reduced drilling activity have weighed on margins. U.S. land rig counts remain well below historical averages, and tariff-related uncertainties add another layer of complexity for domestic operations.

However, this North American focus misses the bigger picture developing internationally. Halliburton’s international revenue showed 2% sequential growth in Q2, driven by activity increases in Latin America and Europe/Africa. The company achieved record quarterly stage count in Argentina and secured its largest international ESP (electric submersible pump) contract to date from a Middle East national oil company.

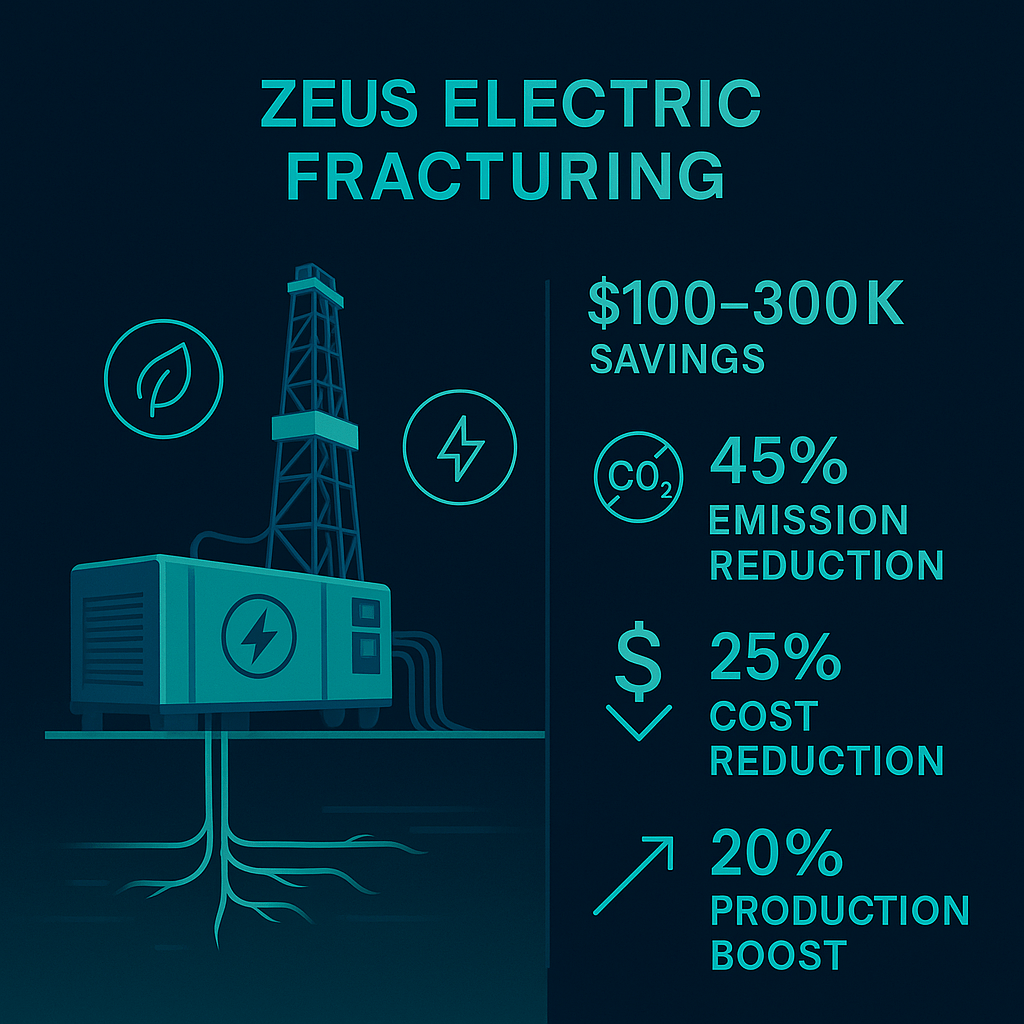

Most significantly, Halliburton’s technological differentiation is gaining traction. By end of 2025, over half of the company’s fracturing fleet will consist of Zeus electric fracturing equipment. This isn’t just an environmental play — Zeus reduces emissions by up to 45% while providing superior operational control, allowing operators to pump at higher rates with better precision and lower total cost of ownership.

The International Growth Engine

While North America represents about 40% of revenues, Halliburton’s international operations offer more stability and growth potential. Offshore projects typically involve longer-term contracts with better margins, and the company’s technological expertise in complex completions creates pricing power in these markets.

The fundamental drivers for international offshore spending remain intact, with industry reports suggesting sanctioned project spend could reach $100 billion annually over the next two to three years. Halliburton’s competitive position in complex offshore completions work positions it well to capture this opportunity.

Brazil and Norway represent particular bright spots, where the company’s advanced completion technologies and operational expertise command premium pricing. These markets value Halliburton’s ability to maximize recovery rates in technically challenging environments.

Technology as a Competitive Moat

Halliburton’s Zeus electric fracturing platform represents more than incremental improvement — it’s a paradigm shift that’s winning market share based on superior economics. Traditional diesel-powered fracturing requires significantly more equipment and fuel, while Zeus can power multiple trailers from a single gas turbine source.

The cost benefits extend beyond fuel savings. Operators report saving between $100,000 and $300,000 in diesel costs per well, with total completion savings of up to 25% while improving hydrocarbon production by up to 20%. Best-in-class Permian producer Diamondback Energy has specifically cited these “unique” benefits on earnings calls.

This technology advantage creates a sustainable competitive moat. Unlike commodity services that compete primarily on price, Zeus offers genuine operational superiority that customers will pay premium pricing to access.

Honest Risk Assessment

The bear case for HAL isn’t hard to construct. North American activity levels could remain depressed longer than anticipated, particularly if oil prices stay weak or economic uncertainty persists. The company’s higher exposure to short-cycle U.S. shale operations (compared to more international-focused peers like Schlumberger) means greater sensitivity to commodity price swings.

Specific risk factors include potential further reductions in Saudi Arabia and Mexico activity, which could pressure international growth rates. Additionally, pricing competition in core North American markets could persist, limiting margin recovery even when activity levels improve.

Tariff-related impacts present another headwind, with management noting $27 million in Q2 impacts and expecting $35 million in Q3. Secondary economic effects from trade tensions could further dampen drilling activity.

The technical setup also shows some caution flags, with MACD turning negative and the stock trading below its 200-day moving average, indicating weak near-term momentum.

Strategic Entry Points and Risk Management

Based on our blended fair value analysis, we establish the following buy zones:

- Strong Buy: ≤$19.34 (75% of fair value)

- Primary Buy: $19.34-$23.23 (current range)

- Hold: $23.23-$28.39

- Trim: $28.39-$32.26

- Too Expensive: >$32.26

At current levels around $22.44, HAL sits in the Primary Buy zone with reasonable risk-adjusted upside. For position sizing, consider starting with 1-2% of portfolio weight, potentially scaling to 4% maximum if the stock reclaims its 200-day moving average with improving fundamentals.

Risk management suggests an initial stop around $19.25 (below the Strong Buy threshold). If the stock rallies above $26, consider trailing stops at 10-12% below the price or 2x the average true range.

Catalyst Timeline and Monitoring Points

Key catalysts to watch include international contract announcements, particularly in Brazil and offshore projects. ESP (electric submersible pump) deployment progress and Zeus electric fracturing market share gains provide fundamental support for the technology-driven thesis.

On the macro side, monitor OPEC+ production discipline and U.S. rig count trends for indications of industry trajectory. Cost reduction progress and margin stabilization in North American operations would signal successful adaptation to current market conditions.

Invalidation triggers include another 10% earnings guidance reduction for fiscal 2025 or persistent North American margin compression extending into Q1 2026.

The Bottom Line

Halliburton presents a classic value opportunity where near-term challenges mask longer-term competitive advantages and international growth prospects. The combination of attractive valuation (trading at 87% of fair value), technological differentiation through Zeus electric fracturing, and international market positioning creates a compelling risk-adjusted opportunity.

The 15% upside to fair value provides reasonable return potential, while the 3.0% dividend yield offers income during the wait. For investors comfortable with cyclical energy exposure and willing to look beyond current North American headwinds, HAL represents quality oilfield services exposure at an attractive entry point.

The key insight: while others focus on what’s broken in North America, patient investors can benefit from Halliburton’s international momentum and technological leadership at a discounted valuation.

Leave a comment