Adobe trades at $350 while analysts see $500+ in value, creating a rare disconnect between artificial intelligence anxiety and fundamental strength. The company just delivered its fifth consecutive quarter of revenue beats, raised guidance again, and already exceeded its $250 million AI revenue target—yet the stock sits 40% below its recent highs as investors worry about AI disruption rather than embracing Adobe’s AI leadership position.

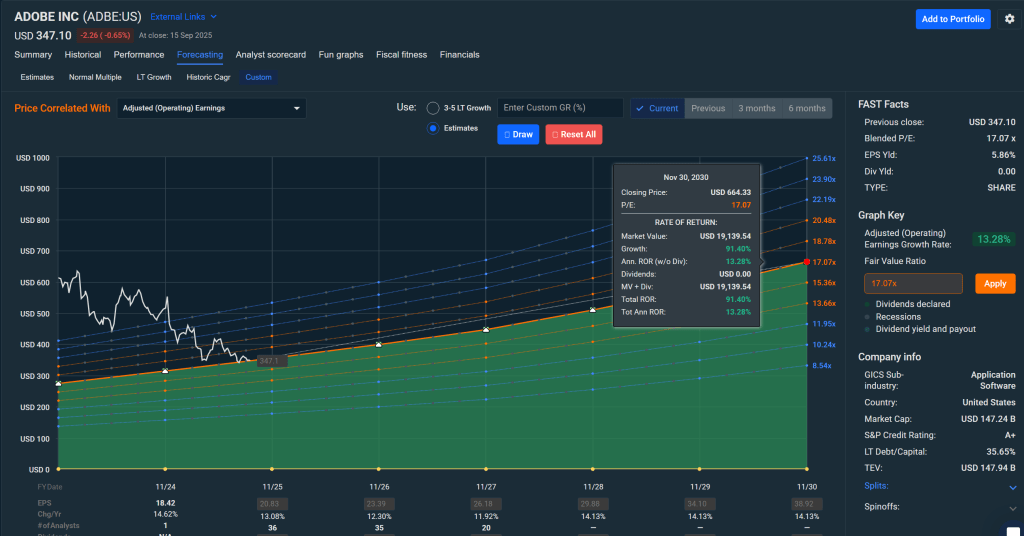

The bottom line: Adobe screens as a high-quality compounder trading at a deep discount after clean execution and accelerating AI monetization. At current prices around $347-350, shares offer 50%+ upside potential if sentiment normalizes, supported by multiple analyst fair value estimates ranging from $425 to $560. The company’s systematic approach to AI integration through Firefly and Creative Cloud positions it as an AI beneficiary, not a victim.

What Adobe Actually Does (And Why It Matters Now)

Adobe dominates content creation software with products like Photoshop and Illustrator that creative professionals consider indispensable. The company’s transition to subscription-based Creative Cloud eliminated piracy while creating predictable recurring revenue streams. Beyond creative tools, Adobe’s Digital Experience segment provides marketing automation and analytics solutions that help businesses manage customer relationships.

The AI integration story centers on Firefly, Adobe’s commercially-safe generative AI platform trained only on licensed content. This addresses the intellectual property concerns that plague other AI tools while providing creative professionals with powerful new capabilities embedded directly into their existing workflows.

The Numbers That Matter: Strong Execution Amid Market Skepticism

Revenue momentum continues accelerating. Q3 fiscal 2025 revenue grew 10% year-over-year to $5.99 billion, beating guidance for the fifth straight quarter. Digital Media revenue reached $4.46 billion with annual recurring revenue (ARR) hitting $18.59 billion, growing 11.7% year-over-year. Management raised full-year revenue guidance to $23.65-23.70 billion.

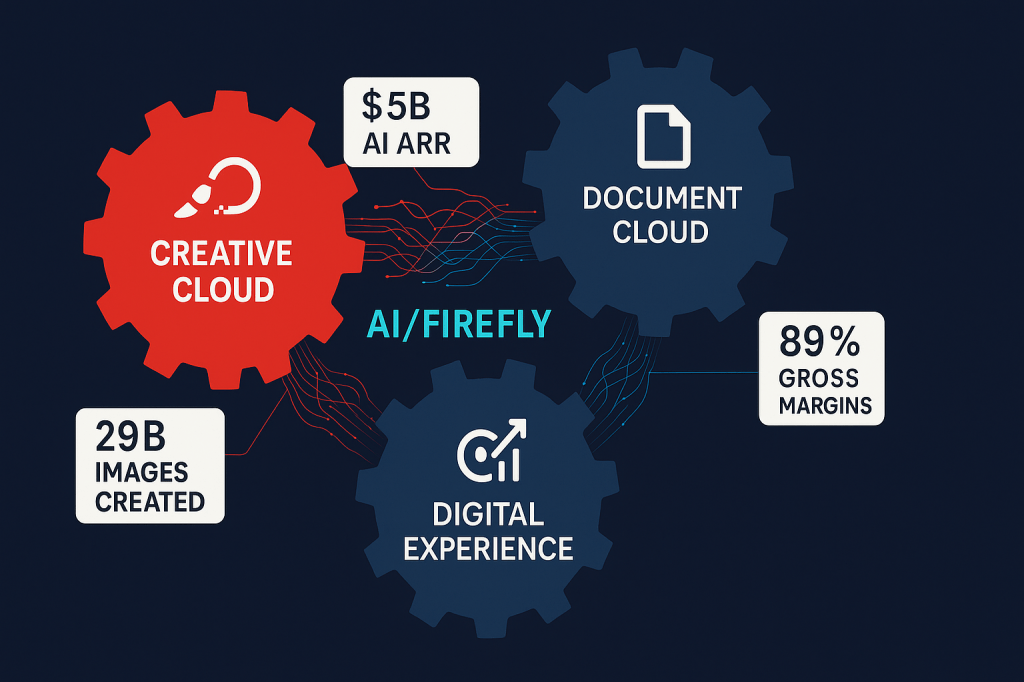

AI monetization exceeds expectations. Adobe’s AI-influenced ARR surpassed $5 billion, while AI-first products already exceeded the company’s $250 million year-end target during Q3—a full quarter ahead of schedule. Users have now created over 29 billion images using Firefly, demonstrating real adoption rather than just trial usage.

Profitability remains exceptional. Gross margins stay above 89%, while non-GAAP operating margins held at 46.3% despite heavy AI investments. Free cash flow generation continues strong, supporting ongoing share repurchases and product development. The company returned $2.06 billion via buybacks in Q3 alone.

Valuation Disconnect: When Fear Creates Opportunity

Multiple professional analyses suggest Adobe trades at a significant discount to intrinsic value. Morningstar maintains a $560 fair value estimate, implying 60%+ upside. CFRA reduced its target to $425 but maintains a Buy rating, noting the stock trades at just 15-17x forward earnings compared to quality software peers at 21-33x multiples.

The Vulcan perspective shows compelling value metrics. Adobe scores 8.02 out of 10 on our composite scoring system, with particularly strong marks for quality (9.40) and growth (6.80). The value score of 8.80 reflects the stock trading at just 15-17x forward P/E versus sector averages of 21-22x, despite wide-moat economics and superior margin profile.

Cross-validation supports the bullish case. StockRover’s quantitative analysis shows Adobe with a 43% margin of safety at current prices, ranking in the 79th percentile for value while scoring 99th percentile for quality metrics. The convergence of multiple analytical approaches pointing to significant undervaluation strengthens the investment thesis.

AI Strategy: Integration, Not Disruption

Rather than being disrupted by AI, Adobe systematically integrates generative capabilities across its entire product portfolio. Firefly’s commercial safety—trained only on Adobe Stock images and licensed content—provides enterprises with legal protection that open-source alternatives cannot match.

The integration approach drives stickiness. Adobe embeds AI features directly into Creative Cloud applications rather than offering standalone products. Photoshop users access generative fill capabilities without leaving their familiar workspace. Acrobat integrates AI Assistant for document processing. This strategy increases switching costs while driving premium subscription tiers.

Enterprise adoption accelerates. GenStudio for Performance Marketing helps large brands automate content creation across campaigns. The platform integrates planning, creation, asset management, and activation into unified workflows. Management highlights growing enterprise pipeline and expanding use cases beyond initial image generation.

Risk Assessment: What Could Go Wrong

Competitive pressure intensifies. Major technology companies integrate generative AI directly into their platforms, potentially reducing demand for Adobe’s specialized tools. Google and Meta’s advertising platforms now include built-in creative generation capabilities that could bypass Adobe entirely for simpler content needs.

AI commoditization concerns persist. As generative AI models become more accessible and capable, some analysts worry about Adobe’s pricing power eroding. The bear case suggests that widespread AI adoption could reduce the value of specialized creative expertise, undermining Adobe’s premium positioning.

Technical momentum remains challenging. The stock trades below both 50-day and 200-day moving averages with RSI indicators in neutral territory. Quantitative strategies may continue selling pressure until clear technical improvement emerges. Market sentiment toward software stocks remains volatile amid concerns about spending slowdowns.

The Systematic Investment Case

Adobe’s Vulcan-mk5 scoring system highlights why this represents a compelling systematic opportunity. The composite score of 8.02 places it firmly in “Ultra Value Buy” territory, supported by:

Quality metrics validate competitive advantages. Return on invested capital of 39.4% demonstrates exceptional capital efficiency. Net margins above 30% and gross margins near 90% reflect pricing power and operational excellence. Interest coverage ratios above 37x indicate minimal financial risk.

Growth sustainability looks intact. Despite recent concerns, Adobe maintains double-digit revenue growth with expanding AI monetization. Forward estimates suggest 9-12% annual growth over the next several years, supported by new product launches and geographic expansion. The shift toward enterprise AI solutions provides additional runway.

Valuation support strengthens conviction. Trading at 15-17x forward earnings while generating superior returns and growth rates creates an asymmetric risk-reward profile. Even conservative assumptions about AI adoption and competitive pressure suggest fair value well above current prices.

Technical Setup and Entry Strategy

Current price action suggests accumulation opportunity for patient investors. Support appears solid near the 52-week low of $330, while resistance sits around $360 (50-day moving average) and $405 (200-day moving average).

Staged entry approach makes sense. Consider initial positions between $330-360 with additional buying above $405 on confirmed uptrend resumption. The wide valuation discount provides cushion against further technical weakness while positioning for eventual sentiment recovery.

Catalyst timeline supports patience. Adobe MAX conference in late October should highlight new AI products and capabilities. Fourth-quarter earnings in December will provide updated fiscal 2026 guidance. Both events offer potential inflection points for improved market perception.

Position Sizing and Risk Management

Given Adobe’s quality metrics and valuation discount, this merits core portfolio allocation of 10-12% for aggressive growth strategies, with maximum exposure of 20% for high-conviction accounts. The combination of wide economic moat, strong balance sheet, and attractive valuation provides downside protection while maintaining significant upside participation.

Stop-loss discipline remains important. Consider protective stops below $324 for swing trading approaches, though long-term investors may prefer averaging down at those levels given the fundamental strength and valuation support.

The Adobe opportunity represents classic systematic investing: high-quality business temporarily out of favor due to macro concerns and competitive fears. For investors willing to look beyond near-term AI anxiety, the combination of execution strength, valuation discount, and improving competitive positioning creates compelling risk-adjusted return potential.

Master Metrics Table

| Metric | ADBE Value | Notes |

| Current Price | $350.55 | Sep 15, 2025 close |

| Vulcan Composite Score | 8.02/10 | Ultra Value Buy territory |

| Fair Value Estimate (Blended) | ~$550 | 50/50 Morningstar/DCF blend |

| Upside Potential | ~58% | Based on blended fair value |

| Margin of Safety | 43% | StockRover calculation |

| Quality Metrics | ||

| Vulcan Quality Score | 9.40/10 | Wide moat validation |

| Gross Margin | 89.3% | Exceptional pricing power |

| Operating Margin | 36.4% | Best-in-class efficiency |

| Net Margin | 30.4% | Superior profitability |

| ROIC | 39.4% | Outstanding capital efficiency |

| ROE | 60.0% | Strong equity returns |

| Interest Coverage | 37.0x | Minimal financial risk |

| Altman Z-Score | 9.2 | Very strong financial health |

| Valuation Metrics | ||

| Vulcan Value Score | 8.80/10 | Deep discount opportunity |

| Forward P/E | 15.2x | vs peers at 21-33x |

| P/E Ratio (TTM) | 22.6x | Historical context |

| Price/Sales | 6.9x | Reasonable for quality |

| EV/EBITDA | 16.0x | Attractive multiple |

| FCF Yield | ~6.2% | Strong cash generation |

| Price/Book | 13.1x | Asset-light model |

| Growth Metrics | ||

| Vulcan Growth Score | 6.80/10 | Solid growth profile |

| Revenue Growth (1Y) | 7.9% | Consistent execution |

| Revenue Growth (3Y Avg) | 9.5% | Sustained momentum |

| Revenue Growth (5Y Avg) | 12.7% | Long-term track record |

| EPS Growth (1Y) | 32.2% | Strong earnings power |

| Sales Growth Next Year | 9.1% | Forward momentum |

| AI Monetization | ||

| AI-Influenced ARR | >$5B | Exceeds expectations |

| AI-First ARR | >$250M | Target exceeded early |

| Firefly Image Generations | 29B+ | Real user adoption |

| Technical/Sentiment | ||

| Vulcan Momentum Score | 5.00/10 | Below moving averages |

| Distance from 52-wk High | -37% | Sentiment opportunity |

| RSI | 44.3 | Neutral territory |

| Short Interest | 2.4% | Low short pressure |

| Analyst Rating | Buy | Strong consensus |

| Financial Strength | ||

| Vulcan Safety Score | 9.00/10 | Exceptional balance sheet |

| Current Ratio | 1.0x | Adequate liquidity |

| Debt/Equity | 0.6x | Conservative leverage |

| Net Cash Position | Positive | Strong cash management |

| Free Cash Flow | $9.6B | Robust cash generation |

| Key Ratios vs Peers | ||

| P/E vs Sector Average | 15.2x vs 21.8x | 30% discount |

| Gross Margin vs Sector | 89.3% vs 63.1% | 26pt advantage |

| ROIC vs Sector | 39.4% vs 13.6% | 26pt advantage |

| Revenue Growth vs Sector | 7.9% vs 4.2% | 3.7pt advantage |

Source: Vulcan-MK5 Analysis System, Morningstar, StockRover, Company Filings

Analysis Date: September 16, 2025

Price Data: Real-time market close

Leave a comment