Manulife Financial (NYSE: MFC) presents an intriguing proposition for income-focused investors: a Big Three Canadian life insurer trading near fair value while capitalizing on Asia’s insurance penetration boom. At $31.80 per share, MFC offers a compelling blend of 4% dividend yield and systematic expansion into higher-growth markets, though recent U.S. headwinds demand careful position sizing.

Our take: Quality dividend play with geographic diversification upside, best suited for income portfolios willing to accept insurance sector volatility.

What Manulife Actually Does

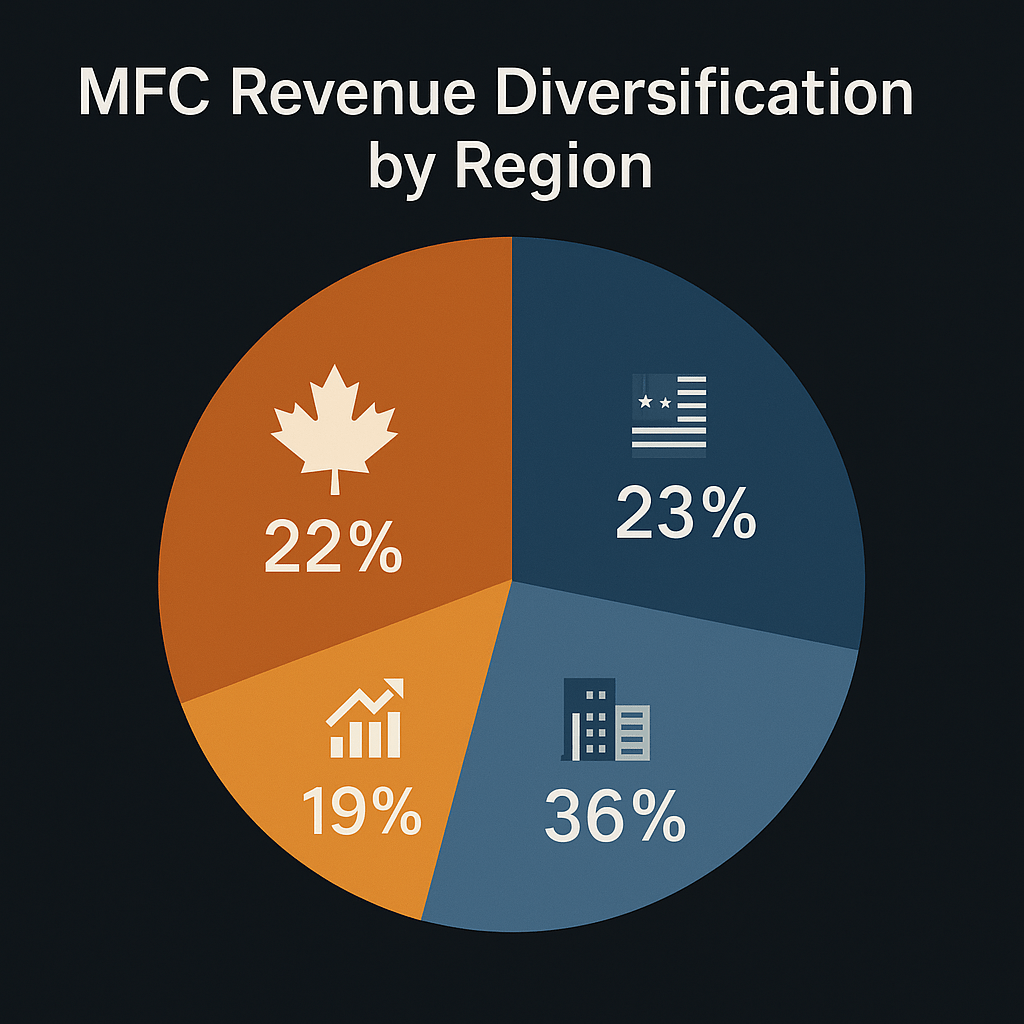

Think of Manulife as North America’s international insurance company. While competitors like MetLife focus primarily on domestic markets, MFC operates across three distinct regions: Canada (22% of earnings), Asia (36% of earnings), and the United States (23% of earnings). The remaining 20% comes from their Global Wealth and Asset Management business, which oversees CAD $1.03 trillion in assets.

This geographic spread isn’t just diversification for diversification’s sake. Asia represents the growth engine – markets like Hong Kong and Singapore where insurance penetration remains low compared to developed Western standards. Meanwhile, Canada provides stable, regulated cash flows, and the U.S. (operating under the John Hancock brand) delivers scale in the world’s largest insurance market.

The Comvest Private Credit Catalyst

MFC’s most significant near-term catalyst involves their agreement to acquire 75% of Comvest Credit Partners, expected to close in Q4 2025. This move expands their presence in private credit markets – a higher-fee business that’s become increasingly attractive as traditional lending faces pressure.

Why this matters: Private credit typically generates higher management fees than traditional asset management, potentially boosting MFC’s wealth management margins while diversifying revenue streams beyond traditional insurance products.

The Numbers That Matter

Our Vulcan-mk5 analysis gives MFC a composite score of 8.12/10, with particularly strong marks in value (9.80) and growth (8.10). Here’s what drives these scores:

Valuation Metrics:

- Forward P/E: 7.3x (attractive for a quality insurer)

- Price-to-Book: 1.7x (reasonable for sector)

- Dividend Yield: 4.0% forward (sustainable coverage)

Quality Indicators:

- Return on Equity: 10.9% (solid for insurance sector)

- Interest Coverage: 5.7x (comfortable debt servicing)

- Debt-to-Equity: 0.3x (conservative leverage)

Growth Catalysts:

- Asia segment growth outpacing mature markets

- 10+ years of consecutive dividend increases

- EPS growth estimate: 9.1% next year

Why Asia Changes Everything

The investment thesis centers on Asia’s insurance penetration opportunity. While North American and European markets show high insurance adoption rates, countries across MFC’s Asian footprint – including Hong Kong, Singapore, and mainland China – still have significant room for growth.

The demographic tailwind is powerful: Rising middle classes in these markets increasingly seek life insurance and retirement planning products. MFC’s established presence positions them to capture this growth without the startup costs competitors would face entering these markets fresh.

Recent quarterly results support this thesis. Asia new business growth has consistently outpaced the company’s North American operations, even as the U.S. segment faced headwinds from higher-than-expected mortality and credit losses.

The U.S. Headwind Reality Check

MFC’s Q2 2025 earnings miss stemmed primarily from U.S. segment weakness – specifically higher credit losses and mortality claims than modeled. Management characterized these as “noise” rather than systemic issues, but investors should monitor whether this pattern persists into the second half.

What this means practically: If you’re considering MFC, position sizing becomes crucial. The insurance sector can experience quarterly volatility from items like natural disasters, mortality fluctuations, or credit cycle changes. These don’t necessarily impact long-term business quality but can create near-term price swings.

Technical Levels and Entry Strategy

Current technical picture looks constructive. MFC trades at $31.80, above both 50-day and 200-day moving averages around $30.70, suggesting trend repair after earlier-year weakness.

Our buy-zone framework based on Stock Rover’s $32.38 fair value:

🎯 Strong Buy: ≤ $22.67 🎯 Primary Buy: $22.67-$27.52

🎯 Hold: $27.52-$30.76 🎯 Current Zone (Hold): $30.76-$35.62 🎯 Trim: $35.62-$38.86 🚫 Too Expensive: > $38.86

At current levels near $31.80, MFC sits in the Hold zone – not a screaming bargain, but reasonable value for quality dividend income with geographic diversification upside.

Entry strategy: Consider starter positions at current levels for income-focused portfolios, with plans to add on any dips toward the $27.50-$30.00 range. Use a soft stop below $29.00 on a decisive weekly close.

Dividend Sustainability Deep Dive

MFC’s dividend coverage appears solid for a life insurance company. The current 74.6% payout ratio provides reasonable cushion, while 10+ years of consecutive increases demonstrates management’s commitment to shareholder income.

Key dividend metrics:

- Forward yield: 4.0%

- 5-year dividend growth rate: 9.5%

- Dividend coverage ratio: 1.8x

For income investors: This yield sits in the “sweet spot” – high enough to provide meaningful income, not so high as to signal unsustainability. The geographic diversification also helps smooth earnings volatility that could threaten dividend consistency.

Risk Management Considerations

Primary risks to monitor:

Interest Rate Sensitivity: Life insurers benefit from higher rates (better investment spreads) but face headwinds if rates fall too quickly. Current rate environment appears supportive, but watch for sudden policy shifts.

Credit Cycle Exposure: MFC’s investment portfolio includes corporate bonds and mortgages. Economic downturns can pressure credit quality, as seen in Q2’s U.S. results.

Foreign Exchange Impact: With significant Asian operations, CAD and USD strength vs. Asian currencies can impact translated earnings.

Regulatory Changes: Insurance remains heavily regulated globally. Changes in capital requirements or product regulations could affect profitability.

Position Sizing and Portfolio Fit

For income-focused portfolios: MFC works as a core 3-5% position, providing geographic diversification within the financial sector while maintaining reasonable dividend coverage.

For growth-oriented portfolios: Consider 2-3% starter positions, acknowledging that insurance sector volatility may not suit all risk tolerances.

Maximum suggested exposure: 6-8% for income-tilted strategies that can handle insurance sector cyclicality in exchange for higher yield and Asia growth exposure.

Competitive Positioning

MFC differentiates itself from pure-play North American insurers like MetLife (MET) or Prudential Financial (PRU) through established Asian market presence. This geographic diversification provides:

- Access to higher growth markets without startup costs

- Currency diversification beyond North American exposure

- Different economic cycle timing across regions

Compared to Asian-focused competitors, MFC offers North American regulatory stability and dividend consistency that pure-play Asian insurers may lack.

The Verdict: Quality Income with Geographic Upside

MFC screens as a solid income play for investors seeking dividend growth with international diversification. The combination of 4% yield, Asia growth exposure, and conservative balance sheet creates an attractive risk-adjusted proposition for income portfolios.

The current price near $31.80 offers fair value rather than deep value, making this more suitable for systematic accumulation rather than aggressive buying. Wait for dips toward $27.50-$30.00 for more compelling entry points, or build positions gradually at current levels.

Bottom line: MFC works best for dividend-focused investors who understand insurance sector volatility but want exposure to Asia’s growth potential without sacrificing North American dividend reliability. Position size accordingly – this is a marathon play, not a sprint.

Master Metrics Summary

| Metric | Value | Assessment |

| Current Price | $31.80 | Hold zone vs. $32.38 fair value |

| Vulcan Score | 8.12/10 | High quality composite |

| Forward P/E | 7.3x | Attractive for sector |

| Dividend Yield | 4.0% | Sustainable income level |

| ROE | 10.9% | Solid profitability |

| Debt/Equity | 0.3x | Conservative leverage |

| Payout Ratio | 74.6% | Reasonable coverage |

| Beta | 1.10 | Moderate market sensitivity |

Risk Rating: Medium (insurance sector volatility, FX exposure, credit cycle sensitivity) Income Rating: High (4% yield with 10+ year growth streak) Growth Rating: Medium-High (Asia expansion opportunity)

Leave a comment