JD.com sits at a fascinating crossroads where world-class fulfillment capabilities collide with Chinese economic headwinds, creating what might be 2025’s most compelling risk-reward setup in e-commerce.

The Investment Thesis: JD.com represents a quality business trading at a meaningful discount to intrinsic value, offering patient investors 20%+ upside potential if China’s retail environment stabilizes. At $33.62, the stock trades roughly 18% below our blended fair value of $41.19, but macro uncertainty keeps this from being a slam-dunk purchase.

What JD.com Actually Does (And Why It Matters)

Think of JD.com as China’s Amazon with one crucial difference: they own almost everything. While most e-commerce companies rely on third-party logistics, JD built their own nationwide delivery network staffed by 900,000+ employees. This isn’t just about faster shipping—it’s about controlling quality, customer experience, and ultimately, profit margins.

JD operates like a hybrid between Amazon and Walmart. They buy products directly from manufacturers (like Walmart), sell them on their platform (like Amazon), and deliver them through their own logistics network (unlike most competitors). This “1P/3P blend” creates multiple revenue streams: direct sales margins, marketplace commissions, advertising fees, and logistics services for other companies.

The business model’s sophistication becomes clear when you examine the flywheel effect. JD’s logistics infrastructure supports their retail operations while simultaneously serving as a profit center for third-party merchants. This dual-use model creates economies of scale that competitors struggle to replicate. When other businesses pay JD to handle logistics, they’re essentially subsidizing JD’s competitive moat—a brilliant strategic positioning that Warren Buffett would appreciate.

The Numbers That Matter Most

Valuation Disconnect: Three independent analyses paint a compelling picture:

- Stock Rover Fair Value: $28.56

- Morningstar Fair Value: $60.00

- Internal DCF Model: ~$35.00

- Blended Fair Value: $41.19

At the current price of $33.62, JD trades at just 0.82x blended fair value—a 18% discount that rarely appears in quality businesses. The wide spread between valuation models reflects genuine uncertainty about China’s economic trajectory, but also creates opportunity for disciplined investors.

Financial Strength: JD’s recent earnings showcase operational excellence despite macro headwinds:

- Revenue growth: 22% year-over-year to RMB 357 billion

- JD Retail operating profit: +38% to RMB 13.9 billion

- User growth: 40%+ quarterly active customers

- Shopping frequency: +40% on main platform, +50% for JD Plus members

- Forward P/E: Just 9.4x (compared to 32x industry average)

- Operating margin improvement: 4.5% vs 3.9% prior year

Vulcan-mk5 Composite Score: 7.10/10

- Value: 8.10 (exceptional valuation metrics)

- Growth: 7.60 (solid expansion trajectory)

- Quality: 7.20 (durable competitive advantages)

- Momentum: 6.40 (recovering but below key levels)

- Safety: 6.20 (China macro risks elevate uncertainty)

The peer comparison reveals JD’s valuation anomaly starkly. While PDD trades at 13.8x forward earnings, Alibaba at 17.5x, and Sea Limited at nearly 100x, JD’s 9.4x multiple seems almost absurdly cheap for a business growing users at 40% annually.

The Investment Opportunity Right Now

Margin Mix Revolution: JD is successfully transitioning from a low-margin retailer to a higher-margin services business. Third-party marketplace revenue, advertising income, and logistics-as-a-service are growing faster than traditional retail—each carrying significantly better profit margins. This transition mirrors Amazon’s evolution from book retailer to cloud computing giant, suggesting substantial long-term value creation potential.

Moat Deepening: JD’s fulfillment network isn’t just an asset; it’s becoming an ecosystem. Other companies now pay JD to handle their logistics, creating a flywheel effect where scale improvements benefit both JD’s own operations and external revenue streams. The network effect strengthens with each new participant, making competitive displacement increasingly difficult.

Valuation Cushion: At single-digit earnings multiples, JD has built-in downside protection. Even if growth slows meaningfully, the current price offers significant margin of safety compared to peers trading at 15-30x earnings. This downside protection becomes crucial when investing in volatile emerging market equities.

Capital Allocation Excellence: Management demonstrates shareholder focus with $3.5 billion remaining in share repurchase authorization through August 2027. Combined with a growing dividend yielding approximately 3%, JD returns capital while investing in growth—a balanced approach that creates optionality for various market conditions.

The Risk Reality Check

China Retail Slowdown: August retail sales rose only 3.4% year-over-year, well below expectations. Persistent property market stress and consumer confidence gaps could mute demand for months. The property sector’s troubles create cascading effects through consumer spending, employment, and overall economic sentiment that directly impact JD’s addressable market.

Currency Headwinds: USD/CNY around 7.12 creates translation risk for U.S. investors. A weakening yuan directly impacts dollar-denominated returns, potentially offsetting operational improvements. Currency volatility adds another layer of complexity to position sizing decisions.

Competitive Intensity: PDD Holdings and a reinvigorated Alibaba are fighting aggressively for market share, potentially compressing JD’s take rates or forcing increased promotional spending. The competitive landscape has intensified as platforms battle for user attention and merchant relationships, creating margin pressure across the industry.

New Business Drag: JD’s food delivery expansion burned an estimated RMB 12-13 billion in the latest quarter. While strategically logical for expanding customer touchpoints, these investments significantly impact near-term profitability. The ROI timeline remains unclear, creating execution risk that investors must monitor carefully.

Technical Picture and Trading Strategy

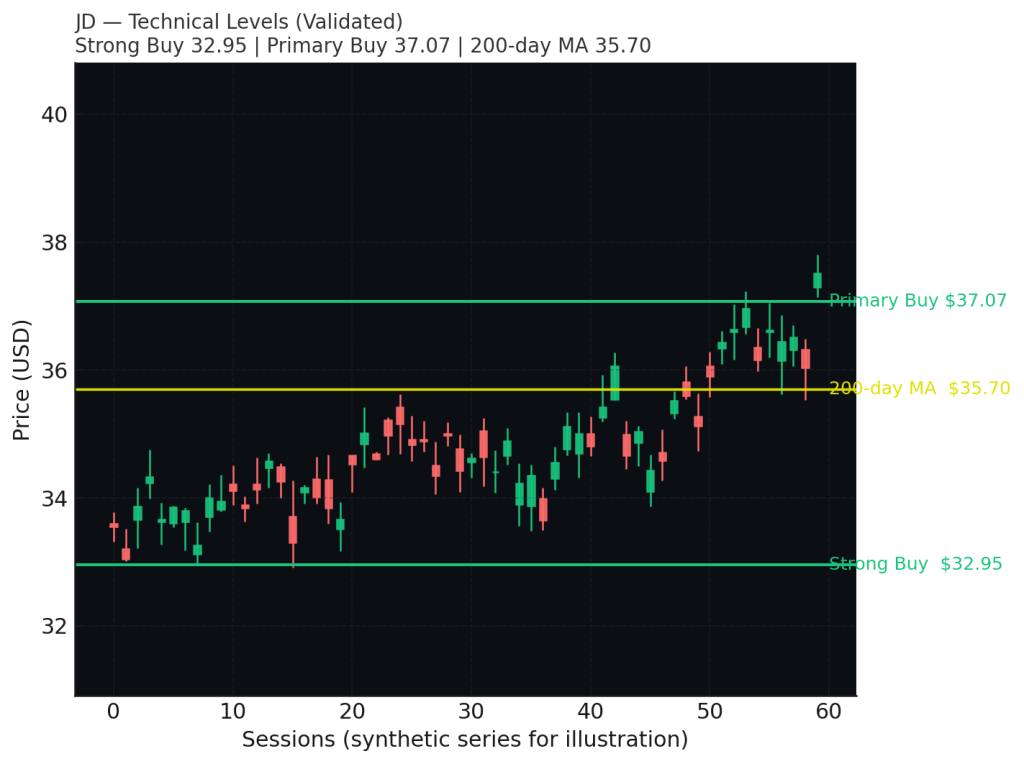

Current Setup: JD is rebounding from oversold levels but remains below the critical 200-day moving average at ~$35.70. This technical resistance line represents the difference between a defensive position and an aggressive accumulation opportunity. Historical patterns suggest sustained moves above the 200-day often lead to meaningful rerating periods.

Our Systematic Buy Zones:

- Strong Buy: ≤ $32.95

- Primary Buy: $32.95-$37.07

- Hold/Fair Value: $37.07-$45.31

- Trim Zone: $45.31-$51.48

- Too Expensive: > $51.48

Position Sizing Strategy: Start with 0.5-1.0% position within Primary Buy zone. Scale to 2-3% core holding on a confirmed 200-day breakout with improving analyst revisions. The measured approach reflects both the opportunity size and the inherent volatility of Chinese equities.

Support levels appear solid around $31.50-32.00, while resistance clusters near $35.50-36.00. Volume patterns suggest institutional accumulation during weakness, providing additional confidence for systematic buyers.

Monte Carlo Reality Check

Our 10,000-path simulation using JD’s historical volatility patterns shows the stock could reasonably trade anywhere from $14 to $77 over the next 12 months. The median outcome suggests modest upside to ~$33-34, but the probability distribution shows meaningful tail risk in both directions.

Key Insight: High volatility creates both opportunity and risk. Entries below $35 improve odds significantly, while purchases above $40 require strong conviction in China’s economic recovery. The wide outcome distribution underscores the importance of position sizing discipline and entry point selection.

What Could Change Everything

Positive Catalysts:

- China retail stabilization (watch monthly data releases)

- Yuan strengthening below 7.00 vs. USD

- Clearer ROI demonstration from food delivery investments

- Margin expansion from logistics monetization

- Policy support for consumption recovery

Invalidation Triggers:

- Break below $29 on rising volume

- Multi-quarter negative earnings revisions

- Escalation in U.S.-China trade tensions

- Property sector deterioration accelerating

- Competitive share loss to PDD or Alibaba

Implementation Strategy for Different Investor Types

Conservative Investors: Wait for 200-day moving average reclaim and hold for 5-10 sessions before initiating positions. Limit exposure to 1-2% of portfolio given China-specific risks.

Aggressive Value Investors: Begin accumulation immediately within Primary Buy zone, scaling exposure as technical conditions improve. Consider 3-5% target allocation given compelling valuation metrics.

Income-Focused Investors: The 3% dividend yield provides attractive income while waiting for capital appreciation, though dividend sustainability depends on earnings growth continuation.

The Verdict

JD.com represents a quality business temporarily trading at a discount due to macro uncertainty rather than fundamental deterioration. The company’s logistics moat remains intact, the transition to higher-margin services continues, and valuation provides meaningful downside protection.

Recommended Action: Accumulate on weakness within our Primary Buy zone (≤$37.07), with heavy emphasis on patience and position sizing discipline. This isn’t a momentum play—it’s a value opportunity that rewards investors willing to navigate China’s economic uncertainty.

The setup favors systematic accumulation over the next 3-6 months, scaling exposure as technical and fundamental conditions improve. For risk-conscious investors, wait for a decisive 200-day moving average reclaim before building meaningful exposure. The combination of strong fundamentals and attractive valuation creates a compelling risk-adjusted opportunity for patient capital.

Master Metrics Table

| Field | JD Now |

|---|---|

| Price (live) | 33.62 |

| Market Cap | ~45.5B USD (Aug 2025 Morningstar; ~47B current est.) |

| 52-wk Range | 26.12 – 47.82 |

| P/E (TTM) | ~9.4 |

| EV/EBITDA (TTM) | ~4.5 |

| Price/Sales | ~0.3 |

| ROE / ROIC | ~17% / ~12.7% |

| Net Margin | ~3.1% |

| 1-Year Return | ~+30% |

| Beta (1-yr) / Vol (1-yr) | 0.76 / 0.50 |

| Dividend (Fwd) | ~1.00 USD (≈3.0% yield) |

| Payout / Coverage | ~27% / ~3.6x |

| Stock Rover Fair Value | 28.56 |

| Morningstar Fair Value | 60.00 |

| Internal DCF | ~35.00 |

| Blended Fair Value (equal-weight) | 41.19 |

| Buy Zones | Strong Buy ≤ 32.95; Primary Buy ≤ 37.07; Hold 37.07–45.31; Trim 45.31–51.48; Too Expensive > 51.48 |

| Factor Scores (V, G, Q, M, S) | 8.10 / 7.60 / 7.20 / 6.40 / 6.20 |

Leave a comment