While most investors still think of virtual schooling as a pandemic relic, one company has quietly built a $7 billion education empire by turning online learning into serious profits. Stride Inc (LRN) just delivered a blowout Q4 2025 earnings beat with EPS of $2.29 versus expectations of $1.83, crushing forecasts by 30%. Yet the stock trades at just 15.9x forward earnings despite 58% average annual growth over five years.

The investment thesis: Stride offers exceptional growth at a genuinely reasonable price, sitting in our Primary Buy zone at current levels near $159. The company posted full-year revenue of $2.4 billion, up 18% year-over-year, with enrollment growth of 33% in Career Learning and 13% in General Education. With over $1 billion in cash, a fortress balance sheet, and expanding margins, this stock deserves serious consideration for growth investors who can handle education sector volatility.

What Stride Actually Does Beyond Zoom Classrooms

Stride isn’t your typical pandemic-era virtual classroom story. Think of it as the infrastructure company powering America’s shift toward digital education. While Netflix revolutionized entertainment and Amazon transformed retail, Stride is quietly building the backbone for how millions of American students will learn in the coming decades.

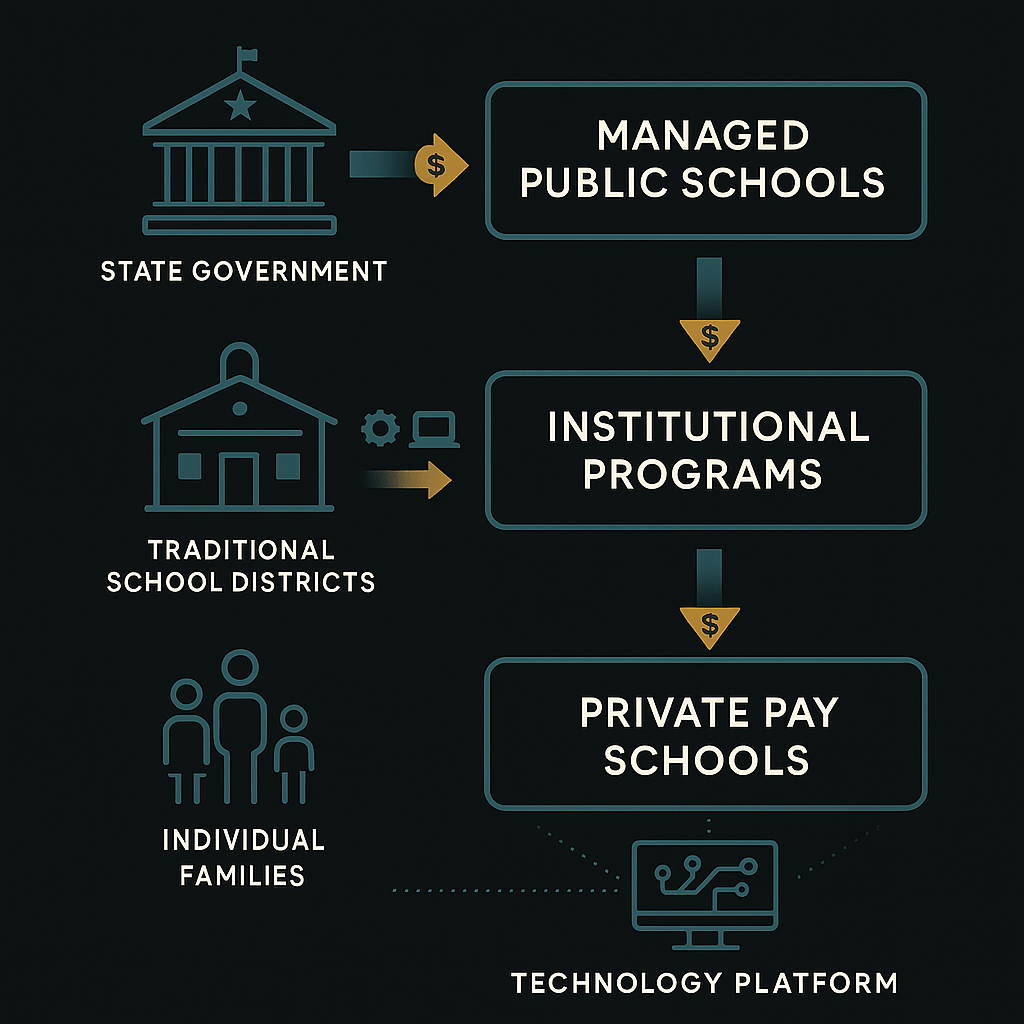

The company operates three distinct but interconnected businesses that create a powerful economic moat. Managed Public School Programs represents the core money-making engine—Stride partners directly with states to operate full virtual charter schools. Parents enroll their children just like any public school, states pay per student through normal funding mechanisms, and Stride handles everything from curriculum development to teacher training to sending laptops home. It’s public education delivered digitally, generating predictable, state-backed revenue streams.

Institutional Programs represents the software-as-a-service opportunity, where Stride sells curriculum and technology platforms to traditional school districts wanting to add online options. This is the scalable growth engine—once you’ve built the platform, adding new districts requires minimal incremental costs. Private Pay Schools rounds out the offering with direct-pay online schooling for families seeking alternatives to their local options.

The business model’s beauty lies in its scalability. Unlike traditional schools that need new buildings, teachers, and facilities for each additional student, Stride’s incremental costs are minimal once the technology infrastructure exists. This creates expanding margins as enrollment grows—exactly what we’re seeing in the recent results.

The Numbers Driving This Investment Case

Current market conditions have created an unusual opportunity to buy quality growth at reasonable prices. Let’s examine the metrics that matter most for long-term wealth building.

Growth that compounds consistently: Revenue reached $2.4 billion in fiscal 2025, representing 18% year-over-year growth, continuing a multi-year trend of double-digit expansion. But earnings growth tells the more compelling story—58% average annual EPS growth over five years as the business scales and operating leverage kicks in. This isn’t artificial growth from accounting tricks or one-time events. It’s fundamental business expansion driven by increasing enrollment and improving margins.

Valuation remains attractive despite performance: Forward P/E of 15.9x looks remarkably cheap when you consider the growth trajectory and competitive position. Compare this to Grand Canyon Education at 20.5x forward earnings, or the broader market trading at 30x. Even within the context of recent strong performance—the stock is up 104% over the past year—the valuation remains reasonable for investors willing to pay for quality growth.

Balance sheet provides fortress-like protection: Current ratio of 5.4x means Stride can pay short-term obligations more than five times over. Debt-to-equity of just 0.4x and interest coverage of 37.5x eliminates bankruptcy risk as a practical concern. The company sits on over $1 billion in cash and securities, providing ample resources to fund growth initiatives without diluting existing shareholders.

Execution track record builds confidence: The Q4 2025 earnings beat marked another quarter where management exceeded expectations, with 10 out of 12 quarters delivering positive surprises. When management provides guidance, they typically deliver results that exceed those projections by meaningful margins. This consistent execution gives investors confidence in forward-looking projections.

Why This Opportunity Exists Right Now

Three significant forces are converging to create unusual value in LRN shares, despite the company’s strong fundamentals and growth trajectory.

Policy tailwinds accelerating nationwide: Sixteen states created new or expanded existing school choice programs in 2025, with virtual and charter options gaining broader political support. States like Texas saw virtual school enrollment climb from 6,793 in 2021-22 to 8,114 in the current academic year, while Massachusetts nearly doubled virtual enrollments since 2018. This isn’t a temporary pandemic response—it represents a structural shift in how America approaches K-12 education delivery.

Market stabilization creating selective opportunity: Virtual school enrollment has stabilized after the initial pandemic surge, with experts noting that families who wanted virtual options have largely found them. This stabilization actually benefits established providers like Stride, as market leadership becomes more entrenched and pricing power improves. The K-12 online learning market is projected to grow at 12.5% annually through 2030, reaching $5.66 trillion, providing a massive addressable market for continued expansion.

Quality mispricing in current environment: With Quality and Growth scores of 93 and 98 respectively (top 7% and 2% of all stocks), LRN should command premium valuations. Instead, recent education sector volatility has created an entry point where investors can buy institutional-quality growth at reasonable prices. The disconnect between business fundamentals and market pricing rarely lasts long for companies with strong execution track records.

Understanding the Investment Risks

Every compelling investment opportunity comes with legitimate risks that prudent investors must understand and weigh against potential returns.

Policy and regulatory risk tops the concern list: State-level changes in virtual school funding, charter regulations, or accountability requirements could materially impact growth prospects. Some states have already tightened oversight requirements, and public perception of virtual schools remains mixed in certain regions. The company recently faced a contract termination with Gallup McKinley School District, though management secured new partnerships to mitigate the impact. This demonstrates that regulatory relationships require constant attention and can affect near-term results.

Operational execution becomes critical at scale: Growing enrollment from current levels toward 800,000+ students requires flawless operational execution. Any major technology failures, curriculum problems, or service disruptions during peak enrollment periods could damage the Stride brand and trigger increased regulatory scrutiny. The company’s reputation for reliability and educational quality represents its most valuable asset—one that requires careful protection.

Valuation has moved significantly: Even at “reasonable” levels relative to growth, LRN has gained 104% over the past year. The easy money may be made, and any disappointment in enrollment growth, margin expansion, or earnings guidance could trigger meaningful selling pressure. Patient investors willing to dollar-cost average during volatility will likely fare better than those expecting immediate gratification.

Broader market sentiment affects education stocks: Education stocks often trade on emotion and policy headlines as much as business fundamentals. Parent satisfaction surveys, standardized test score reports, or media coverage of virtual learning can move the stock independent of underlying business performance. Investors need sufficient conviction in the long-term thesis to withstand short-term noise.

Entry Strategy and Price Targets

Based on our comprehensive analysis incorporating discounted cash flow models, comparable company valuations, and scenario-based projections, we’ve established specific buy zones for position management.

Fair value analysis suggests upside potential: Our internal DCF model, assuming 8.5% WACC, 10% five-year FCFE growth, and 2.5% terminal growth, yields approximately $181 per share. The StockRover fair value of $168.81 provides additional validation, creating a blended fair value estimate around $175. Recent analysis from Simply Wall Street calculated fair value at $163.75, noting the stock appears undervalued. Current levels near $159 provide reasonable entry opportunities for patient investors.

Specific entry zones for position management:

- Strong Buy Zone: ≤ $148 (significant discount to all valuation models)

- Primary Buy Zone: $149-$166 (current trading range—scale in gradually)

- Hold Zone: $167-$192 (fairly valued—maintain existing positions)

- Trim Zone: > $192 (consider reducing position size)

Key catalysts and timeline: The next earnings report on October 28, 2025, will provide crucial back-to-school enrollment numbers and updated guidance for fiscal 2026. Investors should watch for enrollment growth rates versus guidance, margin expansion trends, state policy developments affecting virtual school funding, and technology platform improvements that could attract additional districts.

Competitive Position and Market Context

Understanding Stride’s position within the broader education technology landscape provides important context for long-term investment decisions.

Peer comparison reveals relative value: Among education stocks, LRN trades at a forward P/E of 15.9x with 104% one-year returns and a Quality Score of 93. Grand Canyon Education (LOPE) trades at 20.5x forward P/E with 48.7% returns and similar quality metrics. Adtalem Global Education (ATGE) trades at 15.5x forward P/E with 94.1% returns but lower quality scores. This positioning suggests LRN offers superior risk-adjusted returns within the education sector.

Market leadership advantages compound: Stride’s established relationships with state education departments, proven curriculum development capabilities, and technology infrastructure create significant barriers to entry for competitors. New entrants would need years and hundreds of millions of dollars to replicate Stride’s platform capabilities and regulatory approvals. This moat deepens with each additional state partnership and successful student outcome.

Secular trends support long-term growth: The global e-learning market is expected to reach $740.46 billion by 2032, growing at 14.02% annually, while U.S. online education users will reach 87.6 million by 2029. Virtual reality, augmented reality, and artificial intelligence are enhancing the online learning experience, making digital education more engaging and effective than traditional classroom instruction for many students.

What Could Change the Investment Thesis

Successful investing requires identifying potential scenarios that could materially alter expected returns, both positively and negatively.

Positive scenario drivers: Accelerated state-level adoption of virtual schooling, successful expansion into adjacent markets like corporate training, meaningful margin improvement from operating leverage, or acquisition opportunities that expand the addressable market could drive results significantly above current expectations. Management’s strategic investments in new products like dedicated tutoring for younger grades and career platform enhancements could unlock additional revenue streams.

Negative scenario triggers: Two consecutive quarters of negative earnings revisions, weekly closes below $157 with weakening fundamentals, or state-level regulatory restrictions that materially impact enrollment growth would require portfolio reassessment. Challenges in the adult learning business, particularly in technology areas, have not performed as expected and represent potential headwinds.

Monitoring framework: Track quarterly enrollment data versus guidance, state policy developments affecting virtual school funding, competitive responses from traditional education companies, and management’s ability to maintain service quality while scaling operations rapidly.

Investment Recommendation and Position Sizing

Based on comprehensive analysis of business fundamentals, valuation metrics, competitive positioning, and risk factors, we recommend LRN for growth-oriented portfolios with appropriate risk management.

Position sizing recommendation: Target allocation of 1-3% of total portfolio value, scaling toward the higher end on pullbacks that maintain positive relative strength. This sizing reflects the company’s quality characteristics while acknowledging education sector volatility and single-stock concentration risk.

Implementation strategy: Dollar-cost average into positions over 2-3 months to reduce timing risk. Favor entry opportunities below $166 (Primary Buy zone) while maintaining discipline around the $148 Strong Buy threshold. Consider tactical additions if positive estimate revisions continue ahead of the October earnings report.

Exit discipline: Review positions if two quarters of negative revisions occur, or if the stock closes below the 25th percentile technical level (~$157) while fundamentals weaken. Partial profit-taking above $192 maintains exposure while reducing risk in overheated conditions.

The virtual classroom revolution isn’t replacing traditional schools overnight, but for families seeking educational alternatives and states looking for cost-effective delivery mechanisms, companies like Stride are building the infrastructure that will define the next generation of learning. Sometimes the most compelling investments hide behind seemingly mundane business models that solve real problems profitably.

At current prices, LRN offers reasonable entry into education’s digital transformation with the financial strength to compound returns while the industry evolves. For investors comfortable with education sector dynamics and patient enough to allow the thesis to play out over multiple years, Stride represents compelling value in a quality growth story trading at reasonable prices.

Key Metrics Summary:

- Forward P/E: 15.9x

- 5-Year EPS Growth: 58% annually

- Current Ratio: 5.4x

- Debt/Equity: 0.4x

- Free Cash Flow: $7.70/share

- Quality Score: 93/100 (top 7%)

- Cash Position: >$1.0 billion

Leave a comment