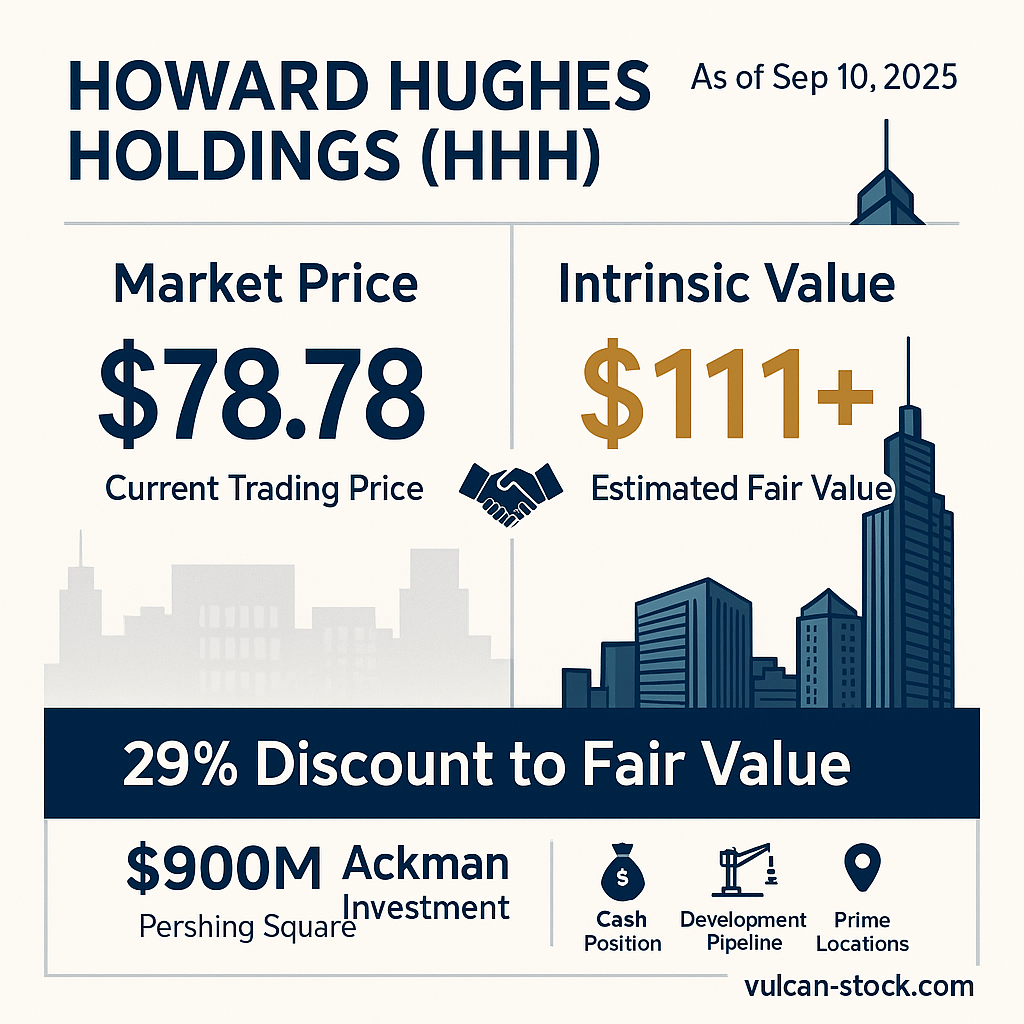

When Bill Ackman writes a $900 million check at $100 per share for a stock trading near $79, something doesn’t add up. Either one of Wall Street’s smartest investors just made a massive mistake, or the market is missing something big with Howard Hughes Holdings (HHH).

Here’s our take: Ackman knows something the market doesn’t. HHH owns irreplaceable land in America’s hottest growth markets, trades 29% below what it’s actually worth, and just got the ultimate stamp of approval from Pershing Square. This isn’t just another real estate play – it’s a rare chance to buy premium assets at a discount with a proven winner calling the shots.

What Does Howard Hughes Holdings Actually Do?

Think of HHH as owning the best neighborhoods in America – before they become the best neighborhoods.

The company owns and develops “master planned communities” in four prime locations: Summerlin (Las Vegas), The Woodlands (Houston), Ward Village (Honolulu), and Columbia (Maryland). These aren’t your typical housing developments. They’re entire cities within cities, complete with shopping centers, office buildings, and thousands of homes.

Here’s how they make money: First, they sell land to homebuilders at premium prices (recently averaging $1.35 million per acre). Second, they keep the commercial rights to build shopping centers and office buildings. Third, they collect rent from the properties they own and operate.

It’s like being the landlord for an entire town that you designed from scratch.

The Numbers That Matter

Let’s cut through the financial jargon and focus on what actually drives HHH’s value:

Cash Position: $1.4 billion – This is HHH’s war chest. In real estate, cash is king during downturns and opportunities.

Debt-to-Equity: 143% – This means HHH owes $1.43 for every dollar of company value. That’s high but manageable given their assets.

2025 Cash Flow Guidance: $410 million – The company expects to generate this much cash this year, up from previous estimates.

Stock Price vs. Estimated Value: $78.78 vs. $111 – Ackman publicly stated HHH’s assets are worth about $118 per share. Our analysis suggests $111. Either way, there’s a big gap.

Why This Opportunity Exists Now

Three things are happening at once that create this rare setup:

Ackman’s Involvement Changes Everything Bill Ackman isn’t just an investor – he’s now Executive Chairman. His track record speaks for itself: he’s made billions by buying undervalued companies and fixing them. When someone with his credentials invests $900 million of his own money, smart investors pay attention.

Land Scarcity in Growth Markets Try buying 1,000 acres in Las Vegas today. You can’t. The best land is already developed or tied up in regulations. HHH owns prime real estate in markets where new supply is nearly impossible to create.

Real Estate Cycle Timing Housing markets move in cycles. Right now, we’re seeing the early signs of a recovery. HHH’s land sales are hitting record prices, and their cash flow guidance keeps improving.

The Vulcan Score Breakdown: 3.23/5.00

Our scoring system rates stocks on five factors. Here’s how HHH stacks up:

Value: 4.20/5 – HHH trades well below what it’s worth. The gap between price ($78.78) and value ($111) is too big to ignore.

Growth: 3.20/5 – Cash flow guidance keeps rising, and land prices are hitting records. Growth is solid but not spectacular.

Quality: 2.60/5 – Great assets, but the debt level keeps this from being a slam dunk on quality.

Momentum: 2.40/5 – The stock has been stuck in a range. It needs to break above $82 to show real momentum.

Safety: 2.80/5 – The $1.4 billion cash cushion helps, but real estate can be volatile.

What Could Go Wrong?

Every investment has risks. Here are the ones that keep us up at night:

Debt Could Become a Problem With debt at 143% of company value, HHH is vulnerable if interest rates spike or the economy turns sour. Real estate companies with high debt can get into trouble fast during downturns.

Condo Development Timing HHH builds luxury condos in Hawaii and other markets. These projects take years to complete and can face delays. If buyers disappear or construction costs explode, profits evaporate.

The Berkshire Hathaway Experiment Ackman wants to turn HHH into a mini-Berkshire Hathaway by buying an insurance company. This strategy worked for Warren Buffett, but it’s risky. Insurance is a different business than real estate.

Housing Market Cycles Real estate goes up and down. If mortgage rates keep rising or the economy enters a recession, land sales could dry up quickly.

Where to Buy, Hold, and Sell

Based on our analysis, here are the price levels that matter:

🎯 Strong Buy: $94 or below – At these levels, you’re getting exceptional value.

🎯 Primary Buy: $95-$106 – Still attractive, but not a steal.

🎯 Hold: $107-$122 – Fair value range. No need to buy or sell.

🎯 Trim: $123 or above – Time to take some profits.

Current Price: $78.78 – This puts HHH in deep value territory.

Technical Picture: What the Charts Tell Us

The stock has been stuck between $72 (support) and $88 (resistance) for months. Here’s what we’re watching:

Bullish Scenario: A weekly close above $82 suggests the stock is breaking out of its range. A move above $88 with real volume would confirm the uptrend.

Bearish Scenario: A close below $70 would signal trouble. That’s our stop-loss level.

Volume Matters: HHH typically trades about 375,000 shares per day. We want to see volume spike above 500,000 shares on any breakout attempt.

Position Sizing: How Much Should You Own?

Real estate stocks can be volatile, so position sizing matters:

Conservative Investor: Start with 2-3% of your portfolio. Maximum 5%.

Aggressive Investor: Start with 3-4% of your portfolio. Maximum 6-8%.

Why the Limits? The debt level and cyclical nature of real estate create more risk than a typical stock. Even great opportunities shouldn’t dominate your portfolio.

Scenario Analysis: What Could Happen

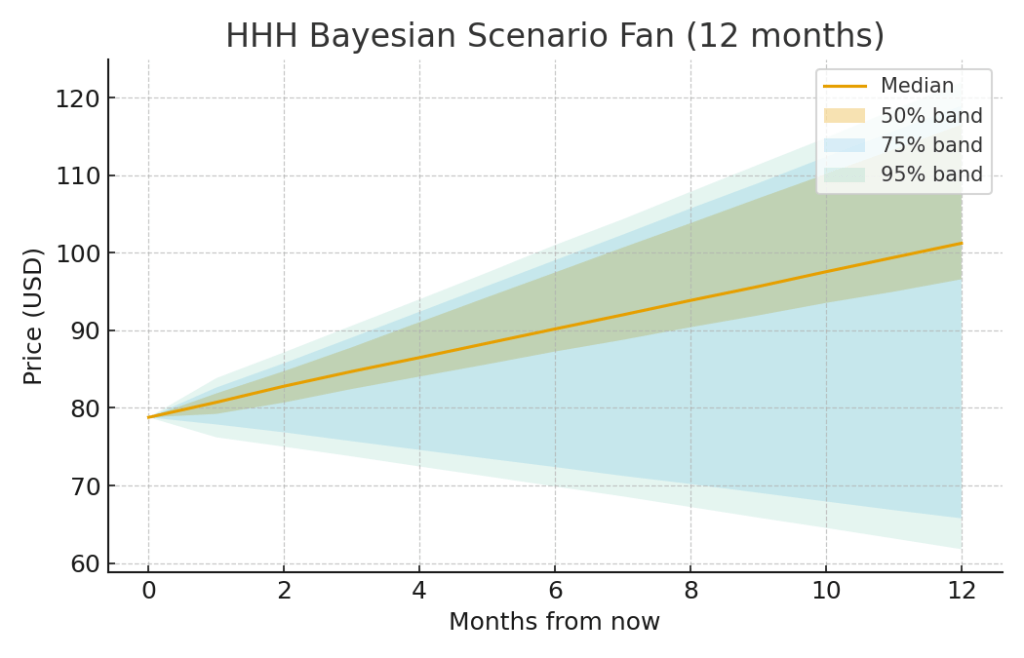

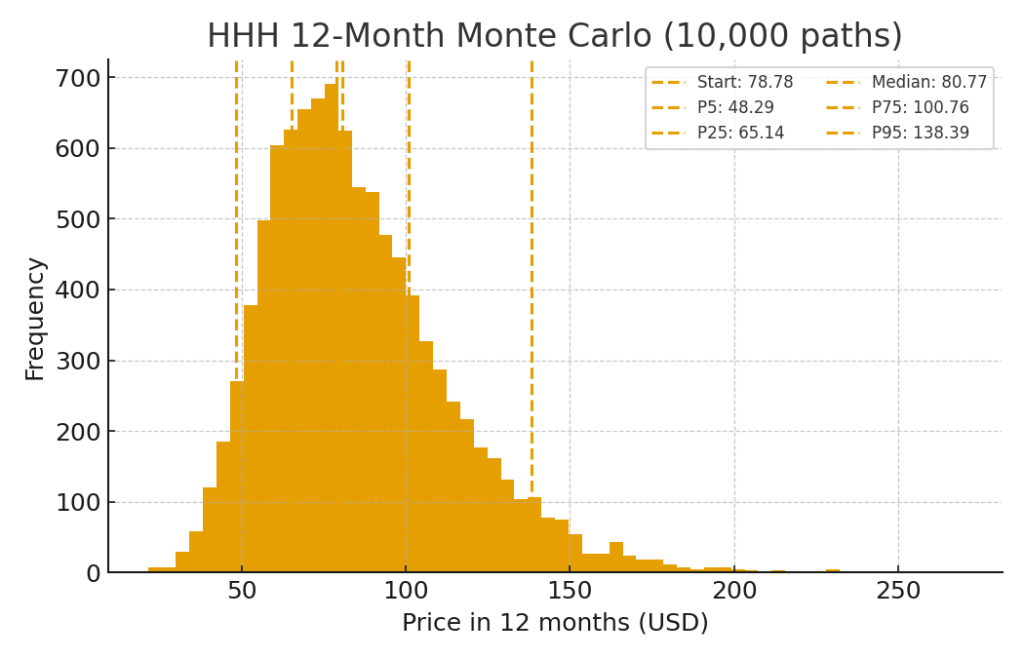

We ran thousands of computer simulations to see what HHH might be worth in 12 months. Here’s what we found:

Bear Case (20% chance): Stock falls to $65 if the economy turns down and real estate markets freeze.

Base Case (45% chance): Stock reaches $100-$106, roughly matching Ackman’s entry price.

Bull Case (35% chance): Stock hits $115-$118, reaching Ackman’s stated asset value.

This chart shows 10,000 different price scenarios over 12 months. The median outcome is around $81, but there’s significant upside potential. The wide distribution reflects real estate volatility, but the clustering around $65-$100 suggests reasonable downside protection.

Our probability analysis weighs three scenarios: Bull case at $118 (35% weight), Base case at $100 (45% weight), and Bear case at $65 (20% weight). The median 12-month target sits around $101, with 50% of outcomes falling between $97-$116.

What Drives These Numbers?

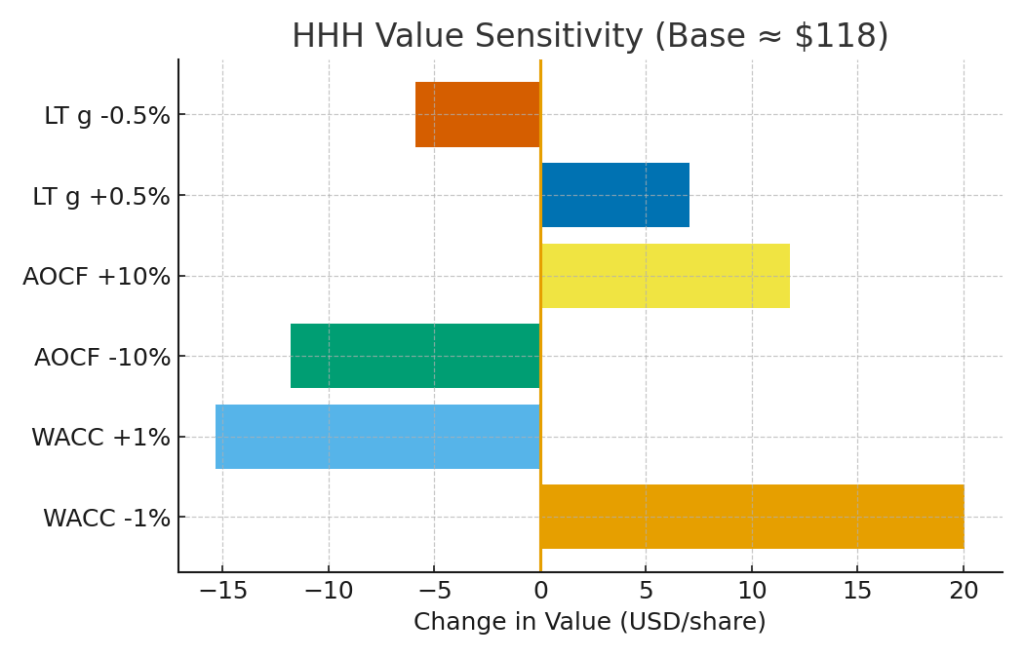

The value sensitivity analysis shows which factors matter most for HHH’s stock price:

Key Insight: The stock is most sensitive to changes in cost of capital (WACC) and cash flow expectations (AOCF). A 1% drop in interest rates could add $20 per share, while strong cash flow execution could add $12 per share.

The math works in your favor. You’re risking about 15% downside for 30-40% upside potential, with multiple scenarios supporting higher prices.

The Ackman Factor: Why This Matters

Bill Ackman’s involvement isn’t just about money – it’s about execution. Here’s his track record:

- Turned around Canadian Pacific Railway for 300%+ gains

- Made billions on his Chipotle investment

- Successfully activated change at multiple companies

When Ackman gets involved, things happen. He doesn’t just buy and hold – he fixes problems and unlocks value.

Catalysts: What Could Drive the Stock Higher

Several events could trigger a re-rating of HHH stock:

Near-term (3-6 months):

- Technical breakout above $88 resistance

- Strong Q3 earnings showing continued cash flow growth

- Details on the insurance acquisition strategy

Medium-term (6-12 months):

- Completion of Ward Village condo towers

- Asset sales or monetizations

- Interest rate cuts boosting real estate sentiment

Long-term (1-2 years):

- Successful transformation into holding company model

- Major land sales or joint ventures

- Dividend initiation once cash flow stabilizes

Peer Comparison: How HHH Stacks Up

Compared to other real estate development companies:

St. Joe Company (JOE): Trades at 4x book value vs. HHH’s 1.3x, but has lower debt

Century Communities (CCS): Homebuilder with stronger balance sheet but less land inventory

Five Point Holdings (FPH): Similar model but smaller scale and higher leverage

HHH offers the best combination of asset quality and valuation discount in the group.

The Bottom Line

Howard Hughes Holdings represents a rare convergence: a quality company trading below intrinsic value with a proven value creator now in charge.

The math is straightforward. You’re buying $118 worth of assets for $79, with Bill Ackman as your partner. The debt level creates some risk, but the cash position and asset quality provide downside protection.

This isn’t a get-rich-quick play. It’s a patient value investment that could deliver 30-40% returns over 12-18 months as the market recognizes what Ackman already sees.

Our Recommendation: Strong Buy below $94, Primary Buy up to $106

Start with a small position and add on weakness. Set a stop-loss at $70. If you can handle some volatility and believe in Ackman’s track record, HHH deserves a place in your portfolio.

The question isn’t whether HHH will eventually trade closer to its asset value. The question is whether you’ll own it when it does.

Master Metrics Table

| Category | Metric | Value | What It Means |

|---|---|---|---|

| Valuation | Current Price | $78.78 | Where you can buy today |

| Fair Value Estimate | $111 | What we think it’s worth | |

| Upside Potential | 41% | Potential gain to fair value | |

| P/E Ratio | 15.2 | Price vs. earnings (reasonable) | |

| Financial Health | Cash on Hand | $1.4B | Safety cushion |

| Debt/Equity | 143% | Leverage level (high but manageable) | |

| 2025 Cash Flow Guide | $410M | Expected cash generation | |

| Technical | 52-Week Range | $61.41-$87.77 | Trading range |

| Support Level | $72 | Where buyers step in | |

| Resistance Level | $88 | Where sellers appear | |

| Position Sizing | Conservative Max | 5% | Risk-conscious allocation |

| Aggressive Max | 8% | Higher conviction limit |

Risk Disclosure: Real estate investments carry cyclical risk. HHH’s leverage increases volatility. Past performance doesn’t guarantee future results. Do your own research and consider your risk tolerance.

Leave a comment