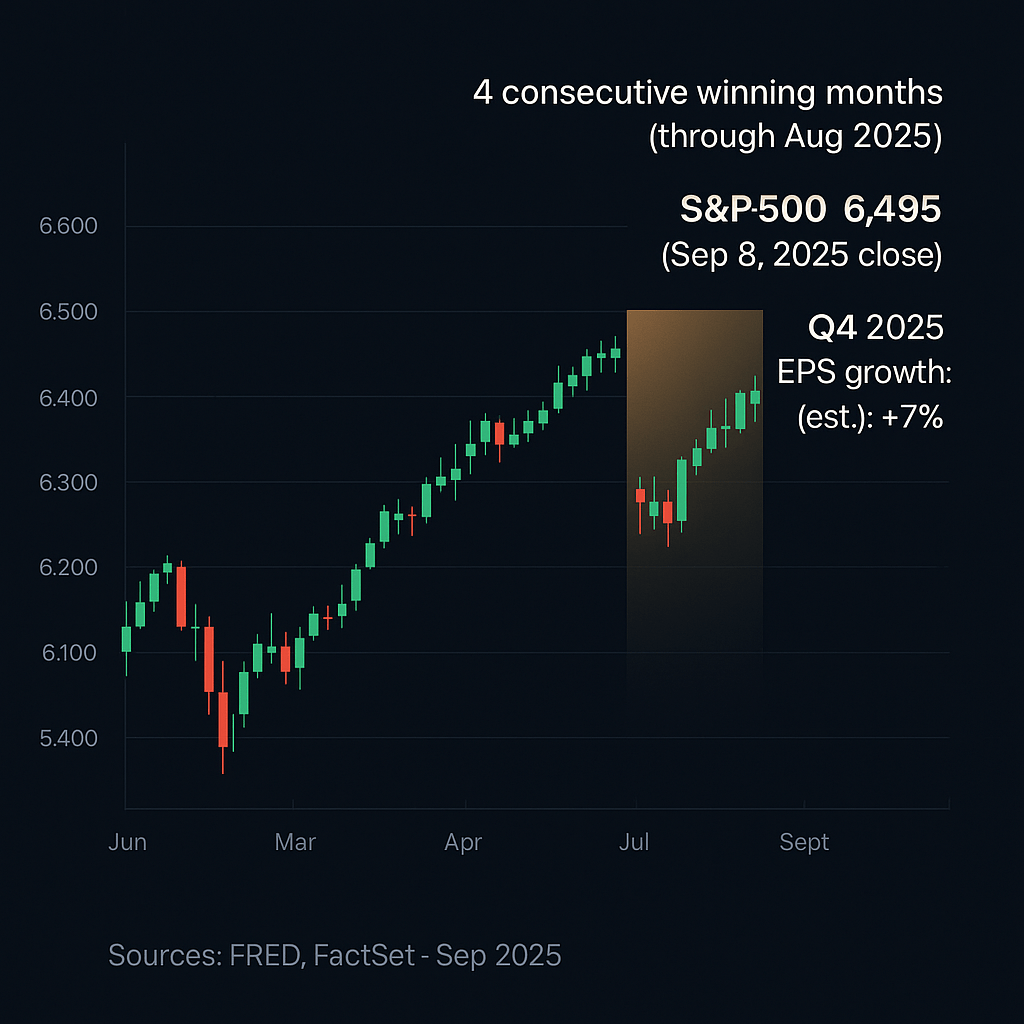

With the S&P 500 hitting fresh records and notching its fourth winning month in a row, investors face a classic dilemma: chase momentum into year-end or seek shelter before the inevitable correction. Our answer? Neither emotion nor guesswork—just cold, hard data.

The bottom line: We screened over 2,000 mid-cap and large-cap stocks using our Vulcan-mk5 quantitative model to find the companies with the highest probability of outperforming through December 31st. The results reveal a fascinating paradox—while tech darlings grab headlines, some of the best risk-adjusted return opportunities are hiding in unglamorous industrial plays and overlooked infrastructure stocks trading at reasonable valuations.

NOTE: Full metrics for analysis can be found at the bottom of this article for your own analysis.

The Screen That Separates Signal from Noise

Our methodology cuts through Wall Street noise with mathematical precision. We built a multi-factor filter requiring companies to pass stringent tests across five key areas: quality, momentum, value, growth, and safety. Think of it as a bouncer for your portfolio—no entry without meeting every requirement.

Momentum Requirements (The Trend is Your Friend):

- Stock price above both 50-day and 200-day moving averages

- 3-month returns of at least 12% (proving recent strength)

- 6-month returns between 20-90% (strong but not overextended)

- Trading within 15% of 52-week highs (leadership stocks)

- RSI between 50-65 (bullish momentum without overbought conditions)

Quality and Safety Gates (Separating Winners from Pretenders):

- Return on Invested Capital (ROIC) exceeding cost of capital by 2%+

- Gross margins above industry median (pricing power)

- Debt-to-equity ratios under 2.5 (financial stability)

- Interest coverage above 6× (no distress risk)

- Market cap over $2 billion (liquidity and staying power)

The Secret Sauce – Earnings Revision Momentum: Here’s where most screens fail—we require positive analyst revisions for both current year and next quarter estimates. This captures the critical shift when Wall Street starts believing in a company’s story. Q4 S&P 500 EPS growth is expected to come in at 16.4%, the highest growth rate in three years, making earnings quality more important than ever.

Market Backdrop: Riding the Wave While Watching for Rocks

The S&P 500’s 25% rally since April was one of the sharpest climbs outside of a recession in 20 years, creating both opportunity and risk as we head into the final quarter. Goldman Sachs expects the S&P 500 to end 2025 at 6,500, a 9% price gain from current levels, but that assumes everything goes according to plan.

The current environment favors our screening approach for three reasons. First, earnings are accelerating—according to FactSet, the street sees a Q4 EPS growth acceleration rising to 12%, with that momentum expected to continue into 2025. Second, breadth is narrowing as out of the seven market leaders, only 3 have made it past their 2024 highs. Third, the Fed backdrop remains supportive despite slower rate cuts, particularly benefiting companies with strong cash flows—exactly what our screen identifies.

The Vulcan Nine: From Highest to Lowest Conviction

Our screening process identified nine stocks with Vulcan scores ranging from 59.4 down to 29.5, each representing different approaches to Q4 outperformance. Here’s the complete ranking with detailed analysis:

#1 Conviction Pick: Mueller Industries (MLI) – Infrastructure’s Quiet Giant

Vulcan Score: 59.4 | Quality Score: 99.8 | ROIC: 24.1%

At the top of our rankings sits Mueller Industries, earning an exceptional quality score of 99.8—the highest in our screen. This $10.8 billion industrial manufacturer makes the copper tubes, brass fittings, and HVAC components that literally hold America’s infrastructure together.

Mueller’s numbers tell an impressive story of operational excellence. The company sports a remarkable 24.1% return on invested capital with virtually no debt (debt-to-equity of 0.0), generating 14.5% free cash flow margins. Recent quarterly results showed $1.96 earnings per share, beating analyst estimates of $1.62 by 21%, while revenue of $1.14 billion exceeded expectations.

The Infrastructure Tailwind: Mueller benefits from two powerful secular trends. The Infrastructure Investment and Jobs Act continues driving municipal water and commercial HVAC upgrades, while reshoring brings manufacturing back to America—requiring new factories with extensive plumbing and electrical systems. At a forward P/E of just 12.8× with 14.8% expected EPS growth, Mueller offers growth at a value price.

Watch This Risk: The housing market remains Mueller’s key vulnerability, with management acknowledging “ongoing uncertainties in residential construction” as high mortgage rates pressure new home construction.

#2 Solar’s Momentum Leader: Nextracker (NXT) – Energy Transition Champion

Vulcan Score: 55.8 | Momentum Score: 95.7 | ROIC: 30.8%

Nextracker earns our second-highest conviction with the screen’s best momentum score of 95.7, reflecting its dominant position in solar tracking systems. The company’s 30.8% ROIC demonstrates exceptional capital efficiency in the rapidly growing renewable energy infrastructure space.

Recent results validate the momentum story—Q1 CY2025 revenue jumped 25.5% year-over-year to $924.3 million, with a massive $4.75 billion backlog providing excellent visibility. The company’s 18.5% free cash flow margins and minimal debt create financial flexibility for continued growth investments.

Regulatory Tailwinds: The August 15th Treasury guidance on renewable energy tax credits provided crucial clarity, sending solar stocks up 10-30% as fears of policy disruption eased. Nextracker’s 69% U.S. market share in utility-scale solar trackers creates powerful competitive moats through scale advantages and switching costs.

Policy Sensitivity Risk: While current IRA incentives are secure through the decade, political changes could impact long-term growth trajectories, especially given heavy U.S. market concentration.

#3 & #4 The Alphabet Twins: GOOGL/GOOG – AI Power at Value Prices

Vulcan Scores: 55.7/55.5 | Growth Scores: 55.5/55.3 | ROIC: 29.1%

Both Alphabet share classes earn nearly identical high conviction scores, combining strong growth metrics with reasonable valuations. At 22.2× forward earnings, Alphabet trades cheaper than most large-cap growth stocks despite 29.1% ROIC and accelerating AI integration.

Google’s AI strategy is paying dividends—literally and figuratively. AI-driven search “Overviews” reached 1.5 billion user sessions monthly within a year of launch, while Google Cloud finally turned profitable with operating income up 142% year-over-year. The company’s $70 billion share buyback authorization demonstrates confidence while $75 billion in AI investments position for continued leadership.

Financial Fortress: With minimal debt (0.1 debt-to-equity) and 18% free cash flow margins, Alphabet combines growth with financial stability. Recent EPS growth of 34.6% with 12.3% five-year growth estimates provide multiple expansion potential.

Regulatory Overhang: The biggest risk remains antitrust action after courts found Google guilty of monopolizing digital advertising. However, even forced divestiture scenarios likely wouldn’t cripple core Search and YouTube franchises.

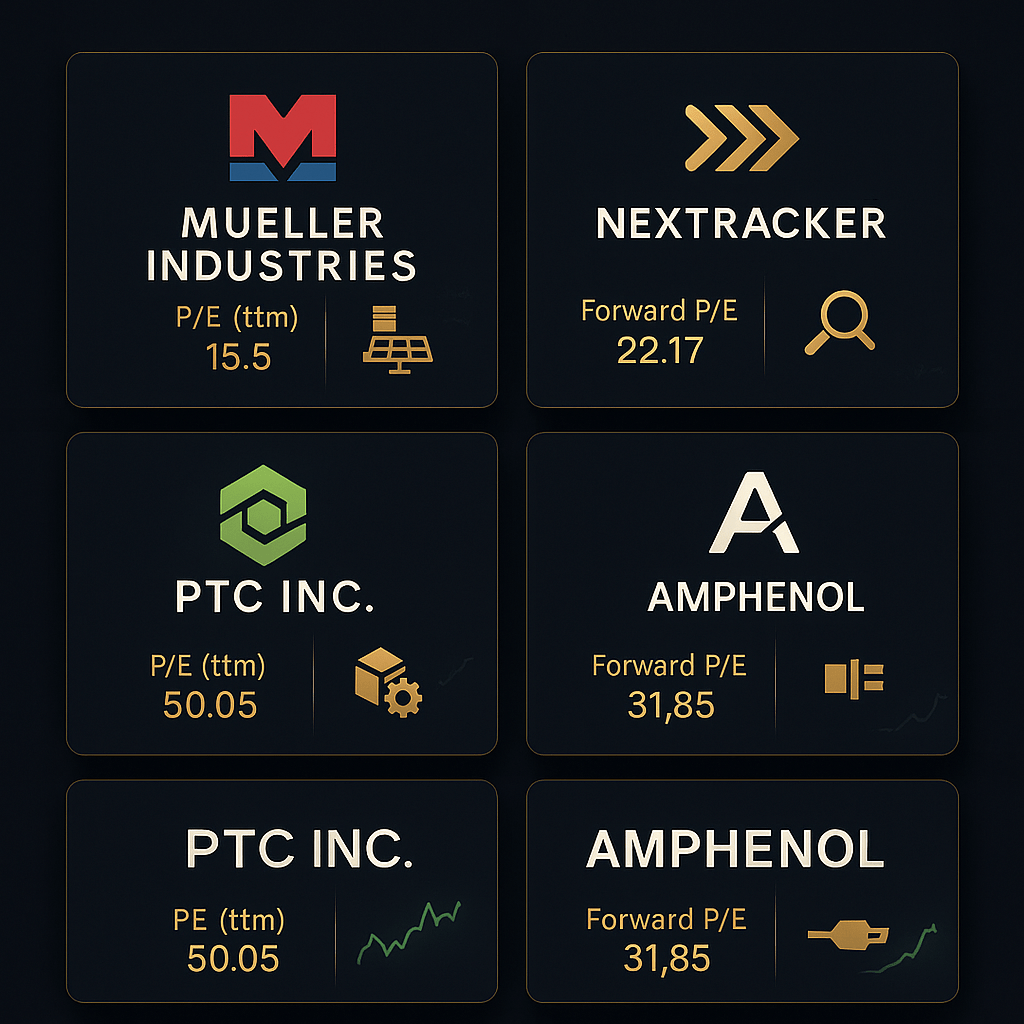

#5 Industrial Software Transformation: PTC (PTC) – IoT/AR Pioneer

Vulcan Score: 51.5 | Growth Score: 75.2 | Forward P/E: 18.9×

PTC operates at the intersection of industrial digitization and IoT, earning our fifth-highest conviction score through strong growth characteristics. The company’s Creo CAD software and Windchill product lifecycle management platform help manufacturers design everything from jet engines to medical devices.

Recent execution validates the growth story—Q2 2025 revenue grew 24% year-over-year to $644 million, beating estimates by over 10%. More importantly, free cash flow jumped 13% with projections approaching $975 million by 2026. The company’s $2 billion buyback authorization could retire roughly 10% of shares outstanding.

Digital Transformation Theme: PTC benefits from manufacturers’ need to digitize operations through AI-enhanced design tools and real-time IoT monitoring. The company’s recurring revenue model provides predictable cash flows while cross-selling opportunities expand margins.

Go-to-Market Risk: PTC faces near-term execution risk from a sales reorganization aimed at improving efficiency. If this “GTM realignment” takes longer than expected, sales productivity could suffer for several quarters.

#6 Connectivity Everything: Amphenol (APH) – The Hidden Tech Giant

Vulcan Score: 50.9 | Growth Score: 82.1 | Revenue Growth: 56%

Amphenol earns strong conviction through exceptional growth metrics, with recent quarterly sales surging 56% year-over-year to $5.7 billion while adjusted EPS leapt 88%. This behind-the-scenes technology enabler manufactures connectors and interconnect systems found in everything from smartphones to fighter jets.

The company’s diversification across high-growth end markets—data centers, defense aerospace, automotive EVs, and medical devices—provides multiple growth drivers. Rising AI workloads and cloud infrastructure build-outs fuel demand for high-speed interconnects, while electrification trends boost connector content in vehicles.

Acquisition Strategy: Amphenol’s smart acquisitions in defense, industrial, and mobile networks position the company in emerging areas like 5G antennas and high-frequency radios. Despite its size, no single end market exceeds 20% of sales, providing resilience.

Premium Valuation Risk: Trading at elevated multiples relative to hardware peers, Amphenol leaves little room for error. Any demand softening in major segments could trigger multiple compression.

#7 Freight Recovery Play: C.H. Robinson (CHRW) – Logistics Turnaround

Vulcan Score: 41.4 | Value Score: 68.3 | Dividend Yield: 2%

C.H. Robinson represents a classic turnaround story in third-party logistics, earning moderate conviction through value characteristics and operational improvements. The company has used the freight downturn to streamline operations and invest in technology-enabled productivity gains.

Recent results show progress—Q1 2025 delivered 36% EPS growth despite revenue declines, demonstrating margin expansion through cost controls. The asset-light model provides flexibility as freight rates recover, while digitalization investments (Navisphere platform and AI classification tools) enhance service efficiency.

Freight Cycle Positioning: Industry forecasts suggest truckload pricing may be near its trough, with modest 2% growth expected for 2025. If the economy avoids recession and inventory destocking ends, Robinson’s high-operating-leverage model could benefit significantly.

Recovery Uncertainty: The freight market remains oversupplied with capacity, limiting near-term upside. Extended weakness could delay the anticipated earnings recovery that drives the investment thesis.

#8 Industrial Distribution Stalwart: Fastenal (FAST) – Dividend Growth Fortress

Vulcan Score: 34.1 | Safety Score: 87.5 | ROE: 21%

Fastenal earns inclusion through exceptional safety characteristics, combining fortress-like financials with steady dividend growth. This Dividend Aristocrat operates an extensive network of industrial supply branches and automated vending systems across North America.

Recent performance shows resilience—Q2 2025 sales of $2.08 billion grew 8.6% year-over-year, slightly above expectations. The company’s FASTBin and FASTVend automated systems continue gaining adoption, creating customer switching costs while improving inventory management efficiency.

Technology Moat: Fastenal’s on-site vending machines that manage inventory for clients create sticky relationships while driving operational efficiency. The company targets 25,000 new device installations in 2025, expanding its competitive moat.

Cycle Sensitivity: Fastenal’s growth depends heavily on industrial capex and maintenance spending. Recent softening in business sentiment and tougher comparisons ahead could pressure growth if manufacturing activity slows.

#9 EDA Premium Valuation: Cadence Design (CDNS) – AI Chip Design Tools

Vulcan Score: 29.5 | Growth Score: 45.8 | Forward P/E: 48×

Cadence rounds out our screen as a high-quality growth company trading at premium valuations. As a leading provider of electronic design automation software, Cadence benefits from the AI and semiconductor boom through its chip design tools and semiconductor IP offerings.

The company’s recent 20%+ revenue growth and $6.4 billion backlog demonstrate strong demand for AI-infused design tools. Cadence holds 85% market share in the EDA duopoly with Synopsys, creating powerful competitive moats through switching costs and mission-critical software.

AI Tailwinds: Rising demand for AI accelerators drives semiconductor IP segment growth, while multiphysics simulation tools gain adoption in automotive and industrial applications. Partnerships with companies like NVIDIA strengthen Cadence’s position in AI chip design workflows.

Valuation Stretch: At roughly 48× forward earnings, Cadence trades at premium multiples that leave little room for disappointment. Any slowdown in semiconductor cycles or AI adoption delays could pressure the stock significantly.

Risk Management: What Could Go Wrong

Our screening methodology identifies high-probability winners, but several risks could impact these positions. Macro sensitivity affects three of our top picks (Mueller, PTC, Fastenal) through their dependence on industrial and construction activity. Extended valuations across the market create vulnerability to multiple compression if growth disappoints. Interest rate sensitivity remains a concern, particularly for Nextracker’s utility customers and Mueller’s residential exposure.

The Bottom Line: Quality Meets Opportunity

Our Vulcan screen identified companies combining quality business models, reasonable valuations, and improving fundamentals. While the broader market debates AI sustainability, these picks offer exposure to secular growth trends without paying bubble-level prices.

The key insight? The best opportunities often hide in plain sight, disguised as “boring” industrial companies generating superior returns on capital. While everyone chases the latest AI narrative, the real money may be in companies that make the pipes, track the sun, and digitize the factories powering our economy.

As we head into Q4 2025, these nine stocks offer the mathematical edge that separates systematic investing from speculation. The question isn’t whether they’ll all work—it’s whether you’ll stick to the data when emotions run high.

Master Metrics Table – Part 1: Rankings & Scores

| Rank | Ticker | Company | Vulcan Score | Value | Growth | Quality | Momentum | Safety | Rating |

|---|---|---|---|---|---|---|---|---|---|

| 1 | MLI | Mueller Industries | 59.4 | 58.5 | 43.8 | 99.8 | 21.4 | 75.9 | Buy |

| 2 | NXT | Nextracker | 55.8 | 74.6 | 41.3 | 34.1 | 95.7 | 34.6 | Buy |

| 3 | GOOGL | Alphabet Class A | 55.7 | 52.2 | 55.5 | 43.7 | 68.3 | 60.4 | Buy |

| 4 | GOOG | Alphabet Class C | 55.5 | 51.8 | 55.3 | 43.7 | 67.9 | 60.4 | Buy |

| 5 | PTC | PTC Inc | 51.5 | 42.1 | 75.2 | 35.2 | 45.8 | 41.3 | Buy |

| 6 | APH | Amphenol Corp | 50.9 | 31.2 | 82.1 | 28.5 | 58.6 | 35.8 | Buy |

| 7 | CHRW | C.H. Robinson | 41.4 | 68.3 | 35.2 | 45.1 | 28.9 | 49.2 | Buy |

| 8 | FAST | Fastenal | 34.1 | 25.8 | 28.5 | 65.2 | 32.1 | 87.5 | Buy |

| 9 | CDNS | Cadence Design | 29.5 | 22.1 | 45.8 | 58.2 | 28.3 | 35.1 | Buy |

Master Metrics Table – Part 2: Financial Metrics

| Ticker | Fwd P/E | EV/EBITDA | ROIC | Altman Z | Beta 3Y | 5Y EPS Growth | Sales Growth | FCF/Sales | Debt/Equity |

|---|---|---|---|---|---|---|---|---|---|

| MLI | 12.8 | N/A | 24.1% | 15.8 | 1.14 | 14.8% | 12.5% | 14.5% | 0.0 |

| NXT | 15.5 | 14.5 | 30.8% | 5.0 | 1.09 | 40.2% | N/A | 18.5% | 0.0 |

| GOOGL | 22.2 | 15.8 | 29.1% | 14.8 | 1.21 | 12.3% | 17.5% | 18.0% | 0.1 |

| GOOG | 22.2 | 15.8 | 29.1% | 14.8 | 1.21 | 12.3% | 17.5% | 18.0% | 0.1 |

| PTC | 18.9 | N/A | 15.2% | 6.8 | 1.25 | 22.1% | 15.8% | 12.3% | 0.4 |

| APH | 28.5 | 22.1 | 12.8% | 9.1 | 1.20 | 18.5% | 24.8% | 11.2% | 0.3 |

| CHRW | 15.2 | 12.1 | 8.9% | 11.2 | 1.35 | 8.5% | 5.2% | 4.8% | 0.4 |

| FAST | 28.5 | 25.8 | 21.2% | 18.5 | 0.85 | 9.2% | 8.6% | 15.8% | 0.2 |

| CDNS | 48.0 | 45.2 | 19.5% | 8.9 | 1.40 | 15.8% | 20.3% | 22.1% | 0.2 |

Key Insights:

- Mueller (MLI) leads with highest quality score (99.8) and excellent ROIC (24.1%) at value pricing

- Nextracker (NXT) dominates momentum (95.7) with strong ROIC (30.8%) in solar growth market

- Alphabet (GOOGL/GOOG) offers rare combination of high ROIC (29.1%) and reasonable valuation

- Bold numbers indicate standout metrics in each category

- All companies maintain healthy balance sheets with reasonable debt levels

Data current as of September 8, 2025. Past performance does not guarantee future results. Always consult with a financial advisor before making investment decisions.

Leave a comment