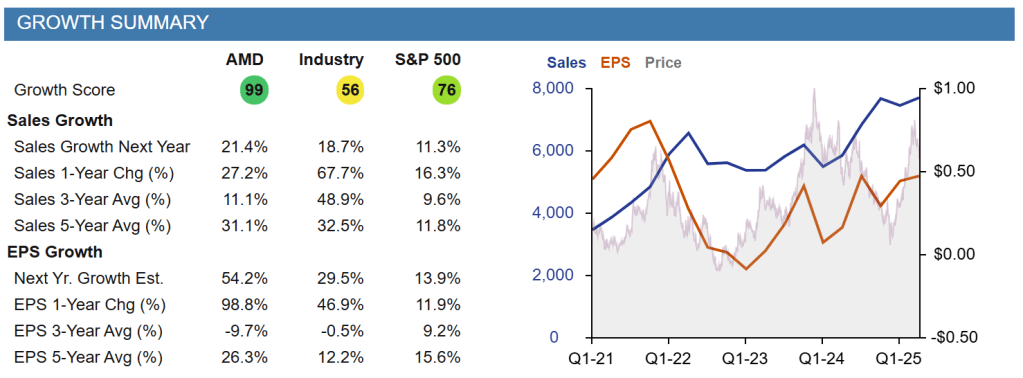

AMD just posted record quarterly revenue of $7.7 billion (up 32% year-over-year) but the stock still tanked. That’s not a contradiction—it’s a wake-up call about what investors actually care about in 2025.

The market wanted aggressive AI acceleration progress. Instead, AMD delivered solid CPU growth while AI GPU revenue declined due to China export restrictions. Now the stock closed Friday (9/5/2025) at $151.14, caught between its proven CPU business and its ambitious AI dreams.

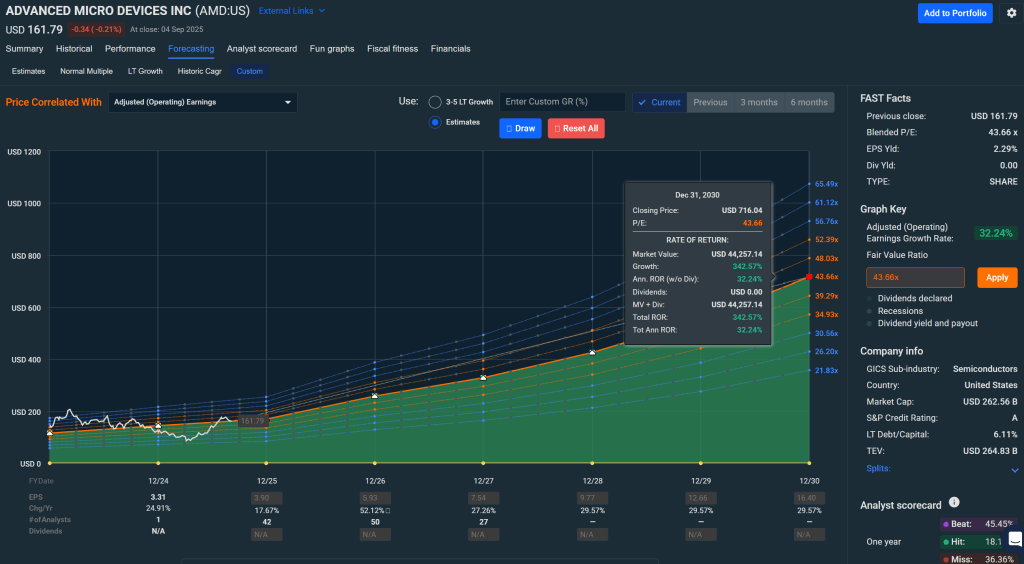

Our take: AMD remains a quality company with genuine AI potential, but the stock isn’t cheap. Primary Buy range is $130-$149. 12-month upside is 32% using a blended P/E from FactSets and historical data of 43.66.

What AMD Actually Does (And Why It Matters Now)

AMD designs the chips that power everything from gaming PCs to massive data centers. They’re best known for two things: processors (CPUs) that compete with Intel, and graphics chips (GPUs) that compete with NVIDIA.

The CPU business is rock-solid. AMD’s EPYC server processors and Ryzen consumer chips have been stealing market share for years. This generates predictable cash flow that funds their bigger bet on AI.

The AI bet centers on their MI350 series accelerators—chips designed to train and run artificial intelligence models. Think of these as specialized engines for AI workloads, competing directly with NVIDIA’s dominant H100 chips.

Here’s what changed: AMD started shipping the MI350 series in late Q2, but China export restrictions killed sales of their older MI300 chips. Revenue from AI accelerators actually declined year-over-year, disappointing investors who expected hockey-stick growth.

The Numbers That Tell the Real Story

Let’s cut through the noise and focus on what matters:

Revenue Growth: $7.7B total (+32% year-over-year) shows the overall business is healthy Data Center Revenue: $3.2B (+14% year-over-year) proves their server business keeps growing

Free Cash Flow: Over $1B generated in Q2 alone provides financial flexibility Forward P/E Ratio: Around 25x forward earnings—not cheap, but not crazy expensive Current Price vs Fair Value: Trading around $152 vs our estimated fair value of $150-160

The key insight: AMD’s traditional businesses (CPUs and gaming) are doing great. The AI business is transitioning between product generations while dealing with export restrictions.

Why Smart Money Sees Opportunity Here

Three factors make AMD’s AI story more compelling than the recent stock price suggests:

Platform Evolution: The new MI355X rack system isn’t just faster chips—it’s a complete deployment solution. Previous generations required customers to do heavy integration work. Now hyperscalers like Microsoft and Google can install AMD racks with minimal custom engineering.

Economic Reality: Large tech companies want alternatives to NVIDIA for two reasons—better pricing and reduced vendor risk. Even if AMD’s chips deliver 85-90% of NVIDIA’s performance, that’s often good enough when you’re buying thousands of units.

Dual Revenue Streams: Unlike pure-play AI companies, AMD’s CPU business provides downside protection. EPYC processors keep gaining server market share regardless of AI adoption speed.

The market is treating this like a binary bet—either AMD wins big in AI or fails completely. Reality suggests they’ll capture 15-20% of incremental AI infrastructure spending over the next few years.

What Could Go Wrong (And Probably Will)

Every investment has risks. Here are AMD’s biggest challenges explained in plain English:

Export Controls Keep Tightening: China restrictions already cost AMD $800 million in write-downs. If controls expand to other countries or get stricter, it directly hits revenue and margins.

NVIDIA Stays Ahead: Every 18 months, NVIDIA releases faster chips that widen their performance lead. AMD needs to hit moving targets while building software tools from scratch—a difficult coordination challenge.

Customer Switching Costs: Companies have invested millions in NVIDIA’s CUDA software platform. Moving to AMD requires rewriting code and retraining engineers. Cost savings alone might not justify that hassle.

Timing Risk: If AI infrastructure spending slows before AMD gains meaningful market share, their window for disrupting NVIDIA could close.

These aren’t theoretical risks—they’re real challenges that could derail the investment thesis.

Where to Buy, Hold, and Sell

Based on our analysis of business fundamentals, peer comparisons, and technical levels, here’s our strategic framework:

🎯 Strong Buy: ≤ $130

🎯 Primary Buy: $130-$145

🎯 Hold Zone: $145-$165

🎯 Trim Zone: $165-$190

🚫 Too Expensive: > $190

Current Assessment: At $152, AMD sits in our Hold Zone—not cheap enough to buy aggressively, but not expensive enough to sell.

Technical Picture: The stock broke below its 50-day moving average around $161 but holds well above the 200-day average near $126. Key support appears around $145-150, while resistance clusters near $160-165.

Strategy for New Money: Wait for pullbacks into the $130-145 range before building positions. Scale in gradually rather than making lump-sum bets.

The 12-Month Outlook: Patience Required

Our base case assumes steady execution on AI products while CPU growth continues. This scenario targets $165-180 over 12 months as fundamental progress offsets current uncertainty.

The bull case requires AMD to prove meaningful AI market share capture and expand gross margins. Success here could drive the stock to $200+ as investors re-rate the company’s long-term potential.

The bear case centers on disappointing AI adoption, extended export restrictions, or broader semiconductor sector weakness. This scenario suggests $125-140 as investors focus purely on CPU business value.

Position Sizing Guidance: Core technology allocation of 3-5% maximum at current levels. Scale higher only during significant weakness. This isn’t a momentum play—it’s a long-term positioning bet.

Why This Matters for Your Portfolio

AMD represents something rare in today’s market: a proven business model (CPUs) funding a legitimate growth opportunity (AI acceleration) at reasonable valuations.

For growth investors, AMD offers AI exposure with downside protection from cash-flowing CPU operations. For value investors, the stock provides quality business exposure without paying venture capital-style multiples.

The investment requires patience. AI infrastructure buildouts happen over years, not quarters. Export restrictions create near-term headwinds. Competition from NVIDIA remains fierce.

But for investors willing to accept semiconductor volatility in exchange for long-term AI positioning, AMD deserves serious consideration at the right price.

The Bottom Line: Great company, reasonable valuation, challenging near-term environment. Wait for better entry points, then build positions gradually. This is a multi-year story that rewards patient capital.

Master Metrics Table

| Metric | Current Value | Analysis |

|---|---|---|

| Stock Price | $152.12 | Hold Zone ($145-165) |

| Market Cap | ~$247B | Large-cap semiconductor |

| Forward P/E | ~25x | Reasonable for growth potential |

| Revenue Growth | 32% YoY | Strong execution across segments |

| Free Cash Flow | $4B+ annually | Healthy cash generation |

| Fair Value Range | $150-160 | Currently trading near fair value |

| Primary Buy Zone | $130-149 | Target accumulation range |

| Maximum Portfolio Weight | 5% | Appropriate for volatility |

| Investment Timeline | 12-24 months | Multi-year story requiring patience |

Leave a comment