Duolingo just delivered its best quarter ever—40% user growth, record profitability, and raised guidance—yet the stock sits 21% below recent highs with every technical indicator flashing red. This disconnect between stellar execution and bearish momentum creates a compelling opportunity for patient investors willing to navigate volatility.

The thesis is straightforward: Duolingo has built a defensive moat around language learning through gamification and AI-powered personalization, expanding successfully into Math, Music, and Chess while generating substantial free cash flow. At $271 per share, the stock trades at a meaningful discount to its $376 analyst target, but technical damage demands staged entries and strict risk management until trend repairs.

What Duolingo Actually Does

Duolingo operates the world’s most popular language-learning platform, serving over 100 million monthly active users through a freemium model that converts engagement into revenue. The company makes money four ways: subscription fees from premium users seeking ad-free experiences, advertising revenue from free users, the Duolingo English Test for academic admissions, and in-app purchases for additional features.

The secret sauce lies in gamification—streaks, achievements, and bite-sized lessons that make learning addictive rather than tedious. This sticky user experience drives daily engagement rates that shame most social media platforms while generating predictable subscription revenue that now exceeds $885 million annually.

The Numbers That Tell The Story

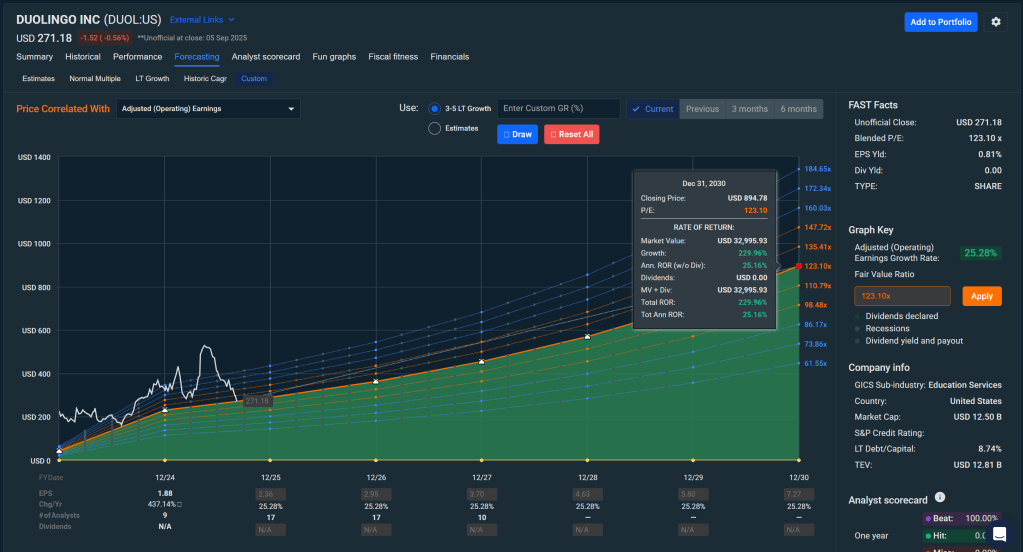

Current Price: $271.18 per share, representing a $12.5 billion market capitalization that values the company at 14.6 times sales and 111 times trailing earnings. Revenue Growth: 39.5% year-over-year expansion driven by both user acquisition and improved monetization per user. Profitability: The company achieved a 13.2% net margin while growing rapidly, generating $321 million in free cash flow over the trailing twelve months. User Metrics: Daily active users grew 40% year-over-year in Q2, maintaining robust engagement despite scale. Financial Strength: The balance sheet holds over $1 billion in cash with minimal debt, providing flexibility for continued investment and expansion.

Why The Opportunity Exists Now

The market is punishing Duolingo for three temporary headwinds while ignoring sustainable competitive advantages. Social media backlash related to AI comments caused a slight U.S. engagement dip, but international markets—particularly China—continue accelerating. The Duolingo English Test faced lower demand due to reduced international student applications, a cyclical issue that should normalize as global mobility returns. Most importantly, some investors fear AI commoditization could undermine the business model, but Duolingo’s gamified approach and habit-forming design create switching costs that pure AI tutors lack.

The expansion beyond languages deserves particular attention. Math, Music, and Chess leverage the same engagement mechanics that made language learning successful, potentially doubling the addressable market without proportional increases in development costs. Early retention data suggests these subjects complement rather than cannibalize core language usage, creating cross-selling opportunities within the existing user base.

International growth provides another underappreciated catalyst. The partnership with Luckin Coffee in China demonstrates how local partnerships can accelerate brand recognition and user acquisition in high-growth markets. China alone represents Duolingo’s fastest-growing region, suggesting meaningful runway for geographic expansion beyond saturated Western markets.

The Risks That Could Derail Progress

AI Disruption represents the primary long-term threat. If Google or Microsoft integrates “good enough” language tutoring into free platforms, Duolingo’s pricing power could erode. Watch for declining conversion rates from free to paid users as an early warning signal. Technical Momentum Risk is immediate and visible. The stock trades below all major moving averages with bearish indicators suggesting further downside if fundamental performance fails to catalyze buying interest. Execution Complexity increases with each new subject area. The company must prove that Math, Music, and Chess enhance rather than distract from core language learning effectiveness.

Social Media Sensitivity became apparent during recent backlash episodes. While international diversification helps, U.S. market sentiment can still impact growth trajectories significantly. Valuation Multiple Compression remains possible if growth rates moderate or if software valuations broadly decline from current premium levels.

Technical Analysis: Timing The Entry

The chart tells a cautionary tale. DUOL trades at $271, well below its 50-day moving average of $353 and 200-day average of $374, indicating established downtrend momentum. The RSI reading of 30.6 suggests oversold conditions but doesn’t guarantee immediate reversal. MACD signals remain mixed with positive momentum diverging from negative price action.

Support levels appear around $250 and more substantially near $240. Resistance clusters around $300 for any bounce attempt, with stronger overhead supply near $327 and $353. A decisive reclaim of the 50-day moving average on strong volume would signal potential trend repair.

The Buy Plan For Different Risk Tolerances

🎯 Strong Buy Zone: ≤ $240 – Maximum opportunity if fundamentals remain intact at these levels 🎯 Primary Buy Range: $240-$285 – Stage entries for long-term holders willing to average down 🎯 Hold/Watch: $285-$355 – Monitor for technical repair signals before adding exposure

🎯 Trim Territory: $355-$395 – Take profits on any momentum-driven overshoots 🚫 Too Expensive: > $395 – Wait for better entry opportunities

Position sizing should reflect the technical damage. Start with 1-2% allocations and cap total exposure at 3-4% until the 50-day moving average is reclaimed. Use $240 as a hard stop for any new positions, representing both technical support and fundamental value inflection point.

Valuation: What Fair Value Looks Like

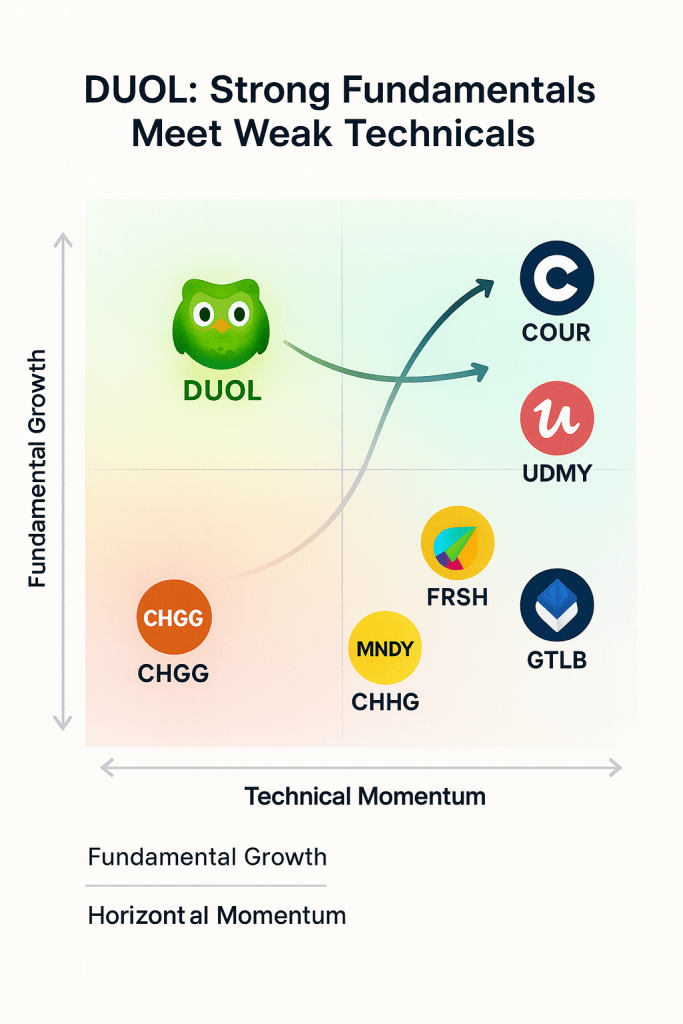

Multiple approaches suggest current pricing offers reasonable risk-adjusted returns. A discounted cash flow model assuming gradual growth deceleration from current 40% rates toward mid-teens long-term expansion yields fair value near $320-$340 per share. Peer comparisons support similar conclusions, with DUOL trading at premium multiples justified by superior growth and profitability metrics.

Scenario analysis provides the clearest framework. Bull Case ($400+) assumes successful category expansion, sustained 30%+ growth, and multiple expansion as execution reduces uncertainty. Base Case ($320-$350) expects gradual growth moderation but margin expansion as scale benefits compound. Bear Case ($200-$240) reflects significant competitive pressure or failed expansion attempts.

What Would Change Our Assessment

We’d become more bullish if new subject areas achieve retention parity with languages while expanding total platform engagement. Sustained conversion rate improvements despite growing free user bases would signal pricing power retention. International partnerships delivering user acquisition at attractive unit costs would validate the global expansion strategy.

Conversely, we’d reassess if conversion rates stagnate while engagement increases, suggesting monetization challenges. Competitive AI tutoring platforms gaining meaningful traction would pressure our growth assumptions. Any guidance resets that break the historical connection between user growth and revenue expansion would require fundamental thesis revision.

Master Metrics Summary

| Metric | Current Value | Context |

|---|---|---|

| Stock Price | $271.18 | 21% below recent highs |

| Market Cap | $12.5B | Mid-cap growth story |

| Revenue Growth | 39.5% YoY | Accelerating from scale |

| User Growth | 40% DAU growth | Sustained engagement |

| Margins | 72% gross, 13% net | Profitable at scale |

| Cash Position | $1.1B | Strong balance sheet |

| P/E Ratio | 111x | Premium but growing into valuation |

| Free Cash Flow | $321M TTM | Strong cash generation |

Bottom Line

Duolingo represents a rare combination of sustainable competitive advantages, expanding market opportunities, and temporary technical weakness creating attractive entry points for patient capital. The stock’s technical damage demands respect through staged entries and clear risk management, but the fundamental opportunity remains compelling for investors with 12-18 month time horizons.

Current pricing around $271 offers reasonable risk-adjusted returns for those willing to navigate near-term volatility while the business executes its expansion strategy. The key catalyst will be proving that new subject areas enhance rather than dilute core engagement metrics while international growth provides meaningful diversification from mature markets.

Leave a comment