The classic 60% stocks / 40% bonds portfolio (“60/40”) was long seen as a set-it-and-forget-it recipe for steady growth and safety. But in today’s markets, even this old reliable is getting a reality check.

Opportunity: There’s a chance to build a portfolio that’s more resilient than 60/40 by adding a dash of alternative investments that zig when stocks and bonds zag.

Risk: Ignore the changes, and you could face the kind of double losses we saw in 2022 when both stocks and bonds sank together.

Our call: It’s time for the average investor to evolve beyond 60/40 – by replacing a chunk of that portfolio with smart alternatives like managed futures, real assets, or private credit for a smoother ride ahead. We believe a well-diversified portfolio with these elements can boost returns without adding risk, offering a better balance for the long run.

What Made 60/40 a Classic (And Why It’s Shaking Now) 💡

For decades, the 60/40 portfolio has been the “coffee with cream” of investing – a mix of growth (stocks) and safety (bonds) that worked in nearly any weather. The idea was simple: when stocks stumbled, bonds would often hold steady or rise, softening the blow. And when stocks surged, they provided the heavy lifting for returns.

This balanced blend earned its stripes through the disinflation era of the 1980s–2010s, when interest rates fell and bonds enjoyed a bull market alongside equities. In fact, the formula worked so well that many investors came to see 60/40 as an all-weather default.

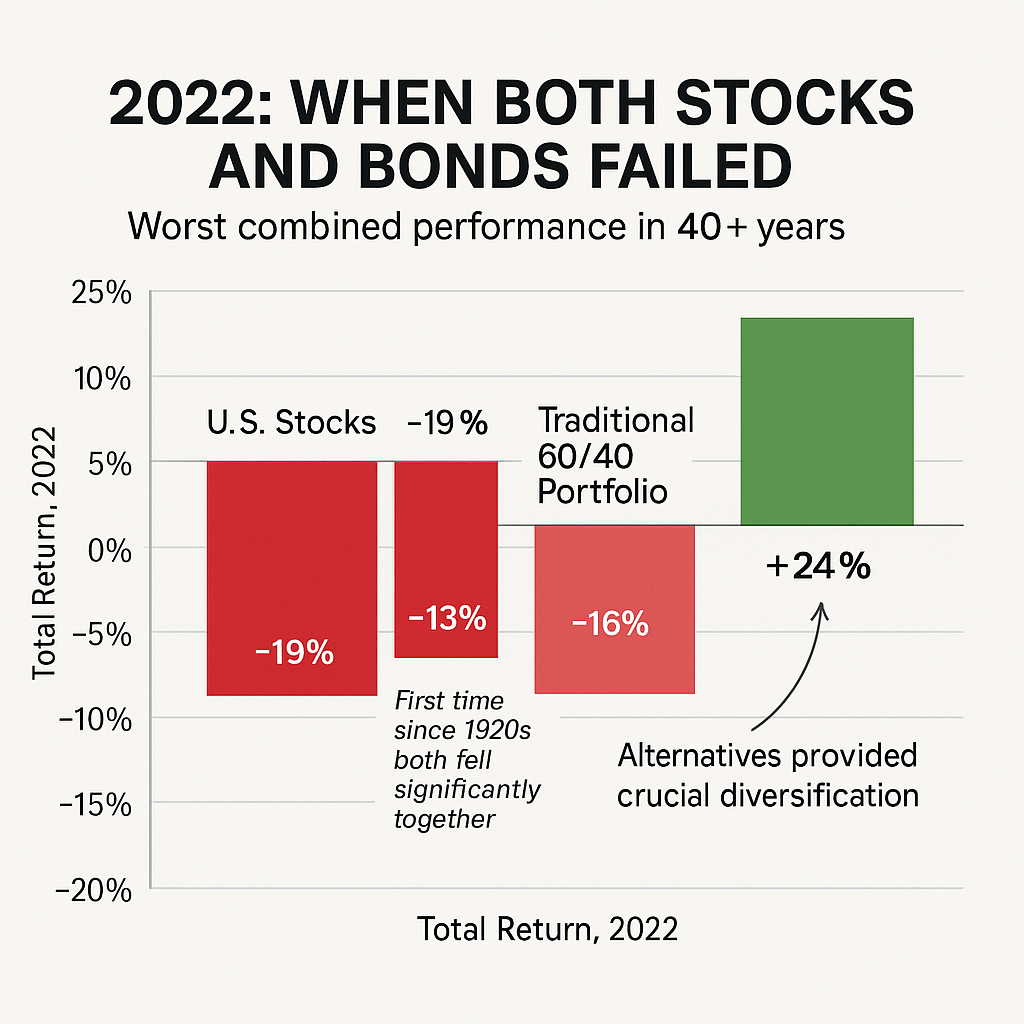

But recent storms have rattled this once-sturdy ship. In 2022, an inflation shock hit both stocks and bonds hard – at the same time. U.S. stocks plunged about 19% and investment-grade bonds lost roughly 13%, marking their worst combined performance in over 40 years. The whole premise of “stocks down, bonds up” failed when rising rates and inflation hurt both sides of the portfolio.

This wasn’t a fluke, either. Over 2022–2023, stocks and bonds started moving in tandem, with bonds often falling alongside stocks. Since the start of 2022, bonds have lost money in 14 of the months when stocks were down, instead of buffering the declines – on average bonds participated in about half of the S&P 500’s downside in those months. In plainer terms: the safety net sprung a leak.

Why the Traditional Approach Broke Down

We’ve entered a new investment “regime” of higher inflation, rising interest rates, and greater macro uncertainty. Bonds aren’t the reliable inverse to stocks they used to be when inflation was low. With today’s volatile rates and policy shifts, traditional bonds have struggled to hedge stock risk like before.

The classic 60/40 was born in a period of falling rates and mild inflation; now it faces a world it wasn’t built for. That’s a scary prospect for a portfolio meant to be boring and dependable.

New Tools in the Toolkit: Alternatives Explained 🧰

So what’s an investor to do? The good news is we’re no longer limited to just stocks and bonds. Alternative investments – once the secret sauce of hedge funds, pensions, and Ivy League endowments – are now widely available to everyday investors (often through simple ETFs or funds).

These are assets or strategies beyond the stock/bond universe that can deliver returns independently of those markets. In other words, they march to a different beat, which is exactly what a portfolio needs when both stocks and bonds are misbehaving.

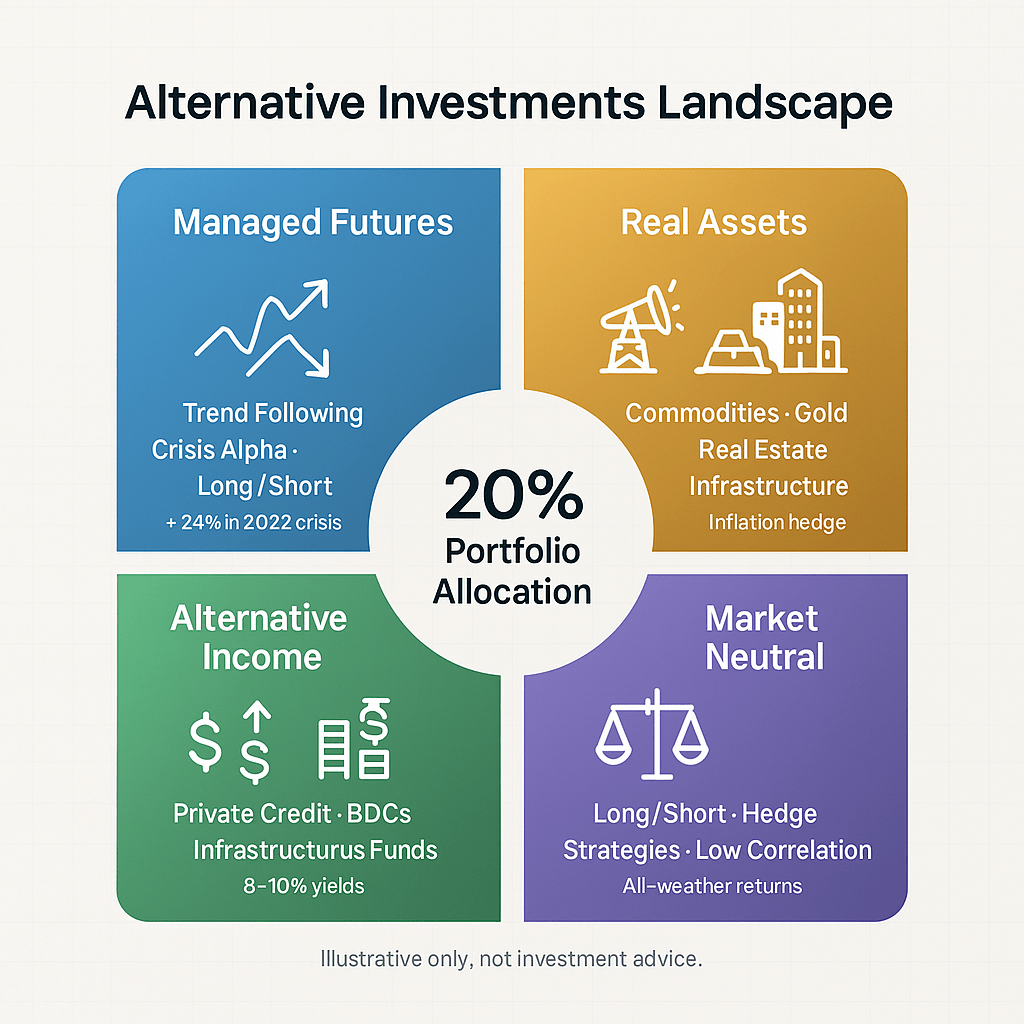

Let’s break down a few key alternatives and how they can help:

Managed Futures (Trend-Following Funds)

These funds can go long or short across commodities, currencies, bonds, and stock indexes – profiting from trends in either direction. Think of them as tactical surfers riding whatever wave comes. They tend to shine in market turmoil.

For example, in 2022 when both stocks and bonds tanked, a broad index of managed futures funds gained roughly 20–30%. From January to October 2022, global stocks fell 17% and bonds fell 11%, but managed futures returned about 24% in that span. That’s crisis alpha in action – making money when almost everything else is losing.

Managed futures helped mitigate losses so much that adding even a 10% slice could have significantly cut a 60/40 portfolio’s 2022 drawdown. The trade-off? In calm or relentlessly rising markets, trend-followers might lag (they do best with big, sustained moves). But as a small portion of a portfolio, they’re a great “airbag” – there if you crash, unobtrusive when you don’t.

Real Assets (Commodities, Gold, Real Estate, Infrastructure)

These are tangible things that often benefit from inflation or supply/demand swings. For instance, commodities (like oil, metals, wheat) and gold tend to rise when inflation is climbing or when geopolitics get messy. Real estate and infrastructure (think pipelines, cell towers, toll roads) produce steady income and have inflation-linked revenues.

In 2022, owning some energy infrastructure was a huge win: pipeline-focused MLPs (Master Limited Partnerships) returned +30.9% for the year, thanks to surging oil/gas prices – all while stocks and traditional bonds were negative. Gold also held its value far better than stocks during that turmoil.

Broad commodities and gold don’t always go up – they can be volatile – but a small allocation (e.g. 5–15% each) can act as an insurance policy when currency values fall or prices spike. They add a different driver of returns not tied to corporate earnings or Fed policy.

Alternative Income (Private Credit, High-Yield Alternatives)

Not all “alts” are about hitting home runs during crises – some are about steady income streams with low correlation to stocks. Private credit (think loans made to mid-sized companies outside the public bond market) is one example. These loans often have floating interest rates and yields currently around 8–10%, giving solid income with relatively low sensitivity to rate swings.

In 2022, as rates jumped, private credit funds actually saw income rise, helping deliver positive returns while public bond funds fell. Private credit has proven resilient through cycles and can be a strategic 5–20% slice of portfolios for yield and diversification.

Similarly, other alternative income ideas include business development companies (BDCs) that lend to small firms, infrastructure funds (often yielding 5%+), or even funds that use option strategies to generate income. The goal is to get paid consistently without depending entirely on stock dividends or low-yield Treasuries.

Important: Many of these carry credit risk (borrowers can default) and may be less liquid, so sizing and selection matter. But a modest allocation here can boost your portfolio’s income and provide stability when stock returns are lean.

Market-Neutral and Hedge Strategies

These are specialized funds aiming for low correlation to markets by design. For example, a market-neutral equity fund might hold long positions in some stocks and shorts in others, targeting gains from the spread (dispersion) rather than overall market direction.

The idea is to make money on idiosyncratic winners vs. losers, not the market’s rise or fall. Such a fund could potentially deliver steady, low-volatility gains in any market – essentially acting like a stable hedge. Some strategies seek to produce “stock-like returns with less volatility and near-zero market correlation.”

These strategies, alongside others like multi-strategy hedge funds or tail-risk funds, can further diversify the diversifiers. They can be complex and often come with higher fees, but the takeaway is that even within alternatives, mixing different types (trend-followers, real assets, market-neutral, etc.) is wise so you’re not betting on just one type of environment.

The Common Theme: True Diversification

The common thread across all these alternatives? They don’t rely on stocks going up or bonds yielding well to make money. They bring new return sources – whether it’s momentum, physical asset value, or credit interest – into the fold.

By doing so, they can lower your overall portfolio volatility and lessen drawdowns, without necessarily sacrificing return. In fact, research consistently finds that judicious allocations to alternatives enhance a portfolio’s risk/return profile. Even 10-20% in diversifiers can make a noticeable difference.

The 60/40 Makeover: Building a Better Balanced Portfolio 🎯

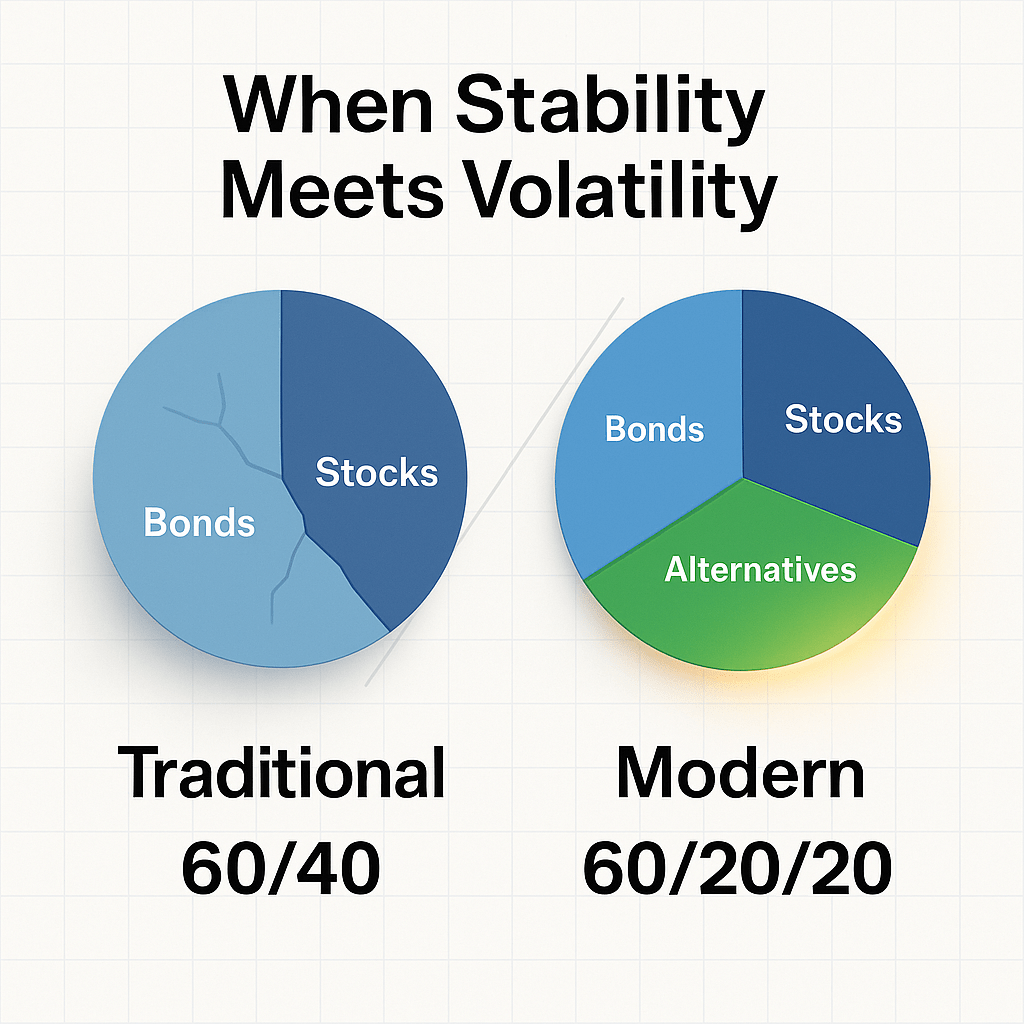

Let’s put it all together. How might an everyday investor revamp the traditional 60/40 allocation? There’s no one-size-fits-all answer (everyone’s risk tolerance and goals differ), but we can outline a framework for a more resilient portfolio. Consider this 60/20/20 mix as a starting point:

🚀 60% in Global Stocks (Growth Engine)

This is your core driver of long-term returns. Diversify broadly – include U.S. large-caps, international stocks, maybe some small-caps or emerging markets. The idea is to capture worldwide economic growth and not put all your eggs in one country’s basket.

The S&P 500 alone is now dominated by a few tech giants, so adding international and smaller stocks provides better balance. This portion gives the portfolio its upside potential. Keep it mostly low-cost index funds or ETFs for broad exposure. You still need stocks for growth – we’re just going to support them with other pillars.

🛡️ 20% in Bonds (Safety Net)

Rather than 40%, we dial bonds down to roughly 20%. Stick with high-quality bonds (Treasuries, investment-grade corporates) for stability, and consider mixing maturities. After the rate rises, bonds finally yield something reasonable again (a 10-year Treasury yields around 4%–5% these days), so they still play a role – providing income and some cushion.

We’re cutting their share because, as discussed, they may not hedge every stock drop, but at 20% they can still dampen day-to-day volatility and be a source of liquidity. You might also include some TIPS (inflation-protected bonds) here, or short-term Treasuries, which held up better when inflation spiked.

🧩 20% in Alternatives (Diversifiers & Opportunistic Plays)

Here’s where the magic of the new approach happens. We allocate roughly 1/5 of the portfolio across the alternative strategies discussed – aiming for a mix that provides true diversification.

For example, one might do: 10% in a broad managed futures fund + 5% in real assets (a commodity index ETF, gold, or a real estate/infrastructure fund) + 5% in an alternative income fund (perhaps a private credit or high-yield diversifier ETF).

This is just an illustration – some may prefer, say, 10% managed futures, 5% gold, 5% market-neutral fund; others might include 5% in a REIT index for real estate exposure, or 5% in an energy pipeline MLP fund for inflation-linked income.

The key is that this 20% is not correlated strongly with your 60% stocks. In fact, if designed well, this sleeve can zig when the stock/bond part zags. Recent data backs this up: a 60/20/20 portfolio (stocks/bonds/alts) has, in backtests, delivered higher returns, lower volatility, shallower drawdowns, and a higher Sharpe ratio than a 60/40.

The Philosophy Behind the New Mix

Crucially, this doesn’t abandon the spirit of 60/40 – it modernizes it. You still have a majority in traditional assets, but the supporting cast is broader. It’s like moving from a basic two-color palette to a full spectrum of colors in your investing toolkit.

You’re preparing for multiple scenarios: inflation spikes, recessions, bull markets, you name it. And because we don’t know exactly what the future holds (will inflation roar back or will growth slow? Will geopolitics shock commodities again?), having this blend makes the portfolio flexible and adaptable.

If stocks and bonds go back to their old uncorrelated dance – great, the alternatives will likely chug along modestly, and you still benefit from the core 60/20. If instead we get more surprise correlations or new crises, that 20% in alts can act as a resilient buffer, potentially even boosting overall returns when the traditional part struggles. It’s a win-win from a preparation standpoint.

How to Implement This Strategy

Thanks to innovation in the fund world, average investors can now access all these alternative exposures easily: managed futures ETFs (several options exist with fees around 0.5–1%), commodity index ETFs, gold ETFs, real estate investment trusts (REITs) or infrastructure ETFs, liquid alternative funds (market-neutral or multi-strategy ETFs), and funds targeting private credit or high-yield.

It’s wise to diversify within the 20% too – don’t bet it all on one alternative strategy. Just as with stocks, a basket of different alts smooths out the bumps. And remember to rebalance periodically: if one part of the alt sleeve soars (say gold doubles or the CTA fund has a great run) and becomes overweight, trim it back to target and refill parts that lagged. This ensures you’re consistently selling high, buying low across the components.

Flexibility for Different Risk Profiles

Flexibility is key. If you’re more risk-averse, you could even go 50% stocks / 30% bonds / 20% alts – a bit less equity exposure. If you’re younger or more risk-tolerant, perhaps 70% stocks / 0% bonds / 30% alts, essentially replacing bonds entirely with a diversified alt basket.

But for many, a direct replacement of half the bonds with alternatives (hence 60/20/20) is a balanced starting point that maintains similar overall risk to 60/40 but with more return drivers in the mix. It acknowledges that bonds alone may not always save the day and recruits some new teammates for the job.

Risks and Caveats: No Free Lunches 🚧

Before we pat ourselves on the back for engineering the perfect portfolio, let’s level with the risks. All investments carry risk, and alternatives are no exception. It’s important to understand what could go wrong and set realistic expectations:

Underperformance in Calm Markets

Many alternative strategies shine when something is going wrong in traditional markets – but that means in strong bull markets for stocks, or periods of stable growth, they might underperform.

For example, if stocks keep climbing steadily year after year and volatility stays low, a managed futures fund might only eke out small gains (or even slight losses) because there are fewer big trends to capture. Likewise, gold tends to do little (or fall) when inflation is low and real interest rates are rising.

So, your portfolio might lag a pure 60/40 in extended benign periods. That’s the cost of insurance. Over a full cycle, we expect the diversification to pay off, but patience is required. Some investors will inevitably question “Why do I own this hedge/alt that isn’t doing much?” during good times – until the tide turns and they’re grateful to have it.

Complexity & Learning Curve

Alternatives can be harder to understand than straightforward stocks or bonds. Their strategies (long/short, futures, leverage, etc.) may confuse some investors, leading to bad timing or misuse if one isn’t educated about them.

It’s easy to get spooked by, say, a managed futures fund that has a sudden loss due to trend reversals, if you don’t realize that’s part of the normal process. Our advice: do a bit of homework on any alternative investment you plan to use. Read plain-English explainers or the fund’s investor education materials. And keep things simple – you don’t need a dozen different alt positions; a few well-chosen, broad funds can cover a lot of ground.

Liquidity and Fees

One reason stocks and bonds are core holdings is they’re highly liquid and cheap to own (index ETFs cost near-zero and trade in seconds). Some alternatives are less liquid or come with higher fees. For instance, private credit or real estate funds might have quarterly liquidity (or lock-ups) and higher expense ratios.

Even “liquid alts” ETFs often charge around 0.5–1% annually – not outrageous, but certainly more than a 0.03% index fund. High fees can eat into returns, especially if the strategy underperforms for a stretch. Mitigate this by choosing established, reputable funds or broad indexes for your alt exposures, and keep an eye on costs.

Correlation Can Surprise

We add alternatives to reduce correlation, but correlations aren’t static. There will be times when an alt that’s usually a great diversifier suddenly moves in sync with stocks. For example, if there’s a liquidity crisis, many assets – even gold or hedge funds – can temporarily sell off together as investors raise cash.

In 2008, for a short period, almost everything fell in value. The point is, don’t expect perfection. Alternatives aim to reduce risk, not eliminate it. A bad quarter or year is still possible in a diversified portfolio – but it likely will be less bad than a traditional portfolio’s worst case.

Execution Risk (Behavioral)

With a more complex portfolio, the human element comes into play. It might be emotionally challenging to stick with a new allocation when parts of it behave unexpectedly. Say your 60/20/20 is flat one year while the plain S&P 500 is up big – you might be tempted to ditch the “boring diversifiers” and chase the hot returns.

Avoid this by reframing success: the goal is the total portfolio doing well over time, not every part winning at once. In fact, if everything in your portfolio is up at the same time, you’re probably less diversified than you think. Successful investors treat the portfolio like a team – the batter, the goalie, the quarterback each have different jobs. Judge them on collective performance and balance, not individually every quarter.

Conclusion: A New Era of “Balanced” Investing 🚀🤝🛡️

The 60/40 portfolio isn’t dead, but it’s no longer the no-brainer it once was. When the financial world changed – higher inflation, rising yields, bigger tail risks – the old 60/40 had its toughest test and stumbled. Rather than throw in the towel on balanced portfolios, smart investors are upgrading the balance.

By introducing alternative diversifiers, we can future-proof our portfolios for whatever comes next. It’s like moving from a two-cylinder engine to a hybrid motor: more sources of power, better efficiency, and insurance against breakdowns.

The Evidence Supporting Change

This is not a hypothetical theory; it’s playing out in real numbers. Portfolios that added commodities, gold, or managed futures fared far better in the recent storms. Financial giants from BlackRock to JPMorgan and WisdomTree are advocating for “beyond 60/40” thinking, and alternative assets are expected to more than double in market size by 2028 as investors embrace them.

Even 5-10% shifts have proven to cut volatility meaningfully and protect capital in drawdowns. And on the flip side, during normal times these allocations have carried their weight without dragging down returns – in some cases even boosting them modestly.

The Democratization of Sophisticated Investing

For the everyday investor, the message is empowering: you are not stuck with the old 60/40 if it doesn’t suit the times. You now have access to the same kind of portfolio design that endowments and ultra-wealthy investors have used for years to weather storms.

It’s about being proactive and flexible. Build a portfolio that makes you comfortable in uncertain times, not just when the sun is shining. In practice, that means diversifying beyond the traditional – maybe it’s 60/20/20, or 50/30/20, or whatever mix fits your needs – and regularly reviewing that mix as conditions evolve.

The Ultimate Goal Remains Unchanged

The goal remains the same as it ever was: grow your wealth over time, and sleep well at night knowing you can handle the bumps along the way. The new balanced portfolio aims to do exactly that, with more tools at its disposal.

It’s a direct replacement for 60/40 that we believe is simply better – more resilient and future-ready. In investing, there are no guarantees, but one thing is clear: relying solely on yesterday’s formula is a risk you don’t have to take. By embracing a richer diversification today, you tilt the odds in your favor for tomorrow.

This is the evolution of the balanced portfolio – and it’s an approach any retail investor can put to work. The 60/40 paradox taught us that even our “safe” mix can falter; the new approach is our answer, ensuring that when stability meets volatility again, our portfolios won’t be caught flat-footed.

Remember: Diversification is the only free lunch in finance, and now the menu just got bigger. Bon appétit to a better balanced portfolio!

Leave a comment