Summary

- Vulcan Score: 6.8 / 10.0 (High Quality, Premium Valuation, Above-avg Momentum)

- Our 12-month stance: Quality compounder with rare, mission-critical moats (naval nuclear, special materials, medical isotopes). But at today’s price, BWXT screens expensive versus peers and our intrinsic value work. We prefer adds on pullbacks into our Primary Buy range.

- Base path (12m): backlog conversion keeps revenue/EPS compounding; supply-chain and workforce constraints ease gradually; multiples drift toward the peer pack.

- Position sizing hint: Core exposure 2–4% max at current levels; scale higher only on dips into Buy zones. Covered-call overlays can help manage premium-risk.

- Why not a simple “Buy?” Our DCF and peer-multiple blend suggest fair value materially below spot, even after incorporating the $6B backlog, Navy pricing agreement, and medical growth. Backdrop is supportive, but the price already discounts a lot.

The Nuclear Propulsion Franchise Nobody Can Touch

When the Pentagon needs nuclear reactors for submarines that can stay submerged for months, there’s essentially one phone number to call. BWX Technologies doesn’t just participate in the naval nuclear supply chain—it owns critical segments of it. This isn’t hyperbole; it’s industrial reality carved from decades of specialized expertise that competitors can’t replicate overnight.

The numbers tell a compelling story of franchise durability. BWXT’s record $6B backlog (up ~70% year-over-year) provides multi-year revenue visibility that most defense contractors would envy. The centerpiece is a $2.6B multi-year Navy pricing agreement for naval nuclear reactor components—the kind of long-term, sole-source contract that generates predictable cash flows regardless of broader defense budget noise.

But here’s where the investment thesis gets interesting: the stock has already run hard, gaining over 56% in the past year while the broader Industrials sector managed just 14.6%. At nearly $160 per share, BWXT now trades at a 49.7x P/E ratio that makes even growth stock investors pause. The question isn’t whether this is a quality business—it clearly is. The question is whether paying nearly 50x earnings for that quality makes sense when peer defense contractors trade at 15-23x forward earnings.

The Moat Analysis: Why BWXT Commands Premium Multiples

BWXT’s competitive advantages run deeper than typical defense contractors. The company operates at the intersection of nuclear propulsion, special materials, and medical isotopes—three areas where expertise barriers are measured in decades, not quarters.

The naval nuclear business represents the core fortress. With submarine construction ramping for both Virginia-class attack subs and Columbia-class ballistic missile submarines, BWXT sits at a chokepoint in America’s nuclear deterrent. The AUKUS alliance with Australia and the UK creates additional long-term demand vectors that weren’t fully visible just two years ago.

Recent operational metrics reinforce this positioning. Q2 2025 delivered revenue of $764M (+12%), adjusted EBITDA of $146M (+16%), and management raised full-year guidance to revenue of ~$3.1B with EBITDA margins expanding to $565–575M. The book-to-bill ratio of ~2.2x suggests demand continues outpacing current production capacity.

Beyond naval nuclear, the medical isotopes segment offers optionality that most investors undervalue. BWXT’s work in technetium-99m production and medical device components taps into healthcare’s growing reliance on nuclear medicine. While commercialization timelines extend into 2026, the addressable market for medical isotopes continues expanding as diagnostic procedures become more sophisticated.

Where the Premium Valuation Becomes Problematic

Quality businesses deserve quality multiples—but BWXT’s current valuation stretches even generous quality premiums to their limits. Our DCF analysis, starting from the FY25 free cash flow guidance midpoint of $280M and applying conservative assumptions (5-year FCF growth glide of 10/8/7/6/5%, WACC of 8.5%, terminal growth of 2.5%), yields a fair value range of $66–89 per share.

Even generous steady-state assumptions—applying a 22x FCF multiple consistent with durable, moat-heavy aerospace and defense names—point toward fair value in the $95–125 range. Our blended fair value of ~$94 per share suggests BWXT currently trades at approximately 40% above intrinsic value.

The peer comparison amplifies these concerns. General Dynamics trades at ~20x forward earnings, Lockheed Martin at ~17-21x, Huntington Ingalls at ~15-18x, and Northrop Grumman at ~20-23x. BWXT’s 39.6x forward P/E demands execution perfection and material upside catalysts to justify the premium.

StockRover’s quantitative scores capture this valuation tension perfectly: while BWXT earns an impressive 78 Quality Score and 87 Growth Score, its 60 Value Score reflects the premium pricing. The -24% Margin of Safety versus StockRover’s $120.77 fair value estimate confirms our thesis that current prices embed optimistic assumptions about future performance.

Risk Management in a Premium-Priced Position

The primary risk isn’t business execution—BWXT’s operational metrics suggest steady progress across key programs. The risk is multiple compression as investors recalibrate expectations or defense sector sentiment shifts. At nearly 50x earnings, even modest disappointments could trigger meaningful price adjustments.

Supply-chain constraints represent the most tangible near-term risk. Defense contractors across the board face workforce shortages and material bottlenecks that could extend project timelines. BWXT’s specialized manufacturing requirements make these constraints potentially more acute than for peers producing less complex systems.

The Commercial Operations segment also bears watching. Recent margin softness due to field services mix shifts and initial dilution from the Kinectrics acquisition suggests integration challenges could persist. While management eyes margin improvement, execution risk remains elevated during the integration period.

Policy risks deserve mention but shouldn’t be overstated. Continuing resolutions and budget debates create headline volatility, but naval nuclear programs enjoy bipartisan support driven by strategic necessity rather than political preference. The bigger policy risk might be unrealistic investor expectations about defense spending growth rates.

Entry Strategy: Patience Over Urgency

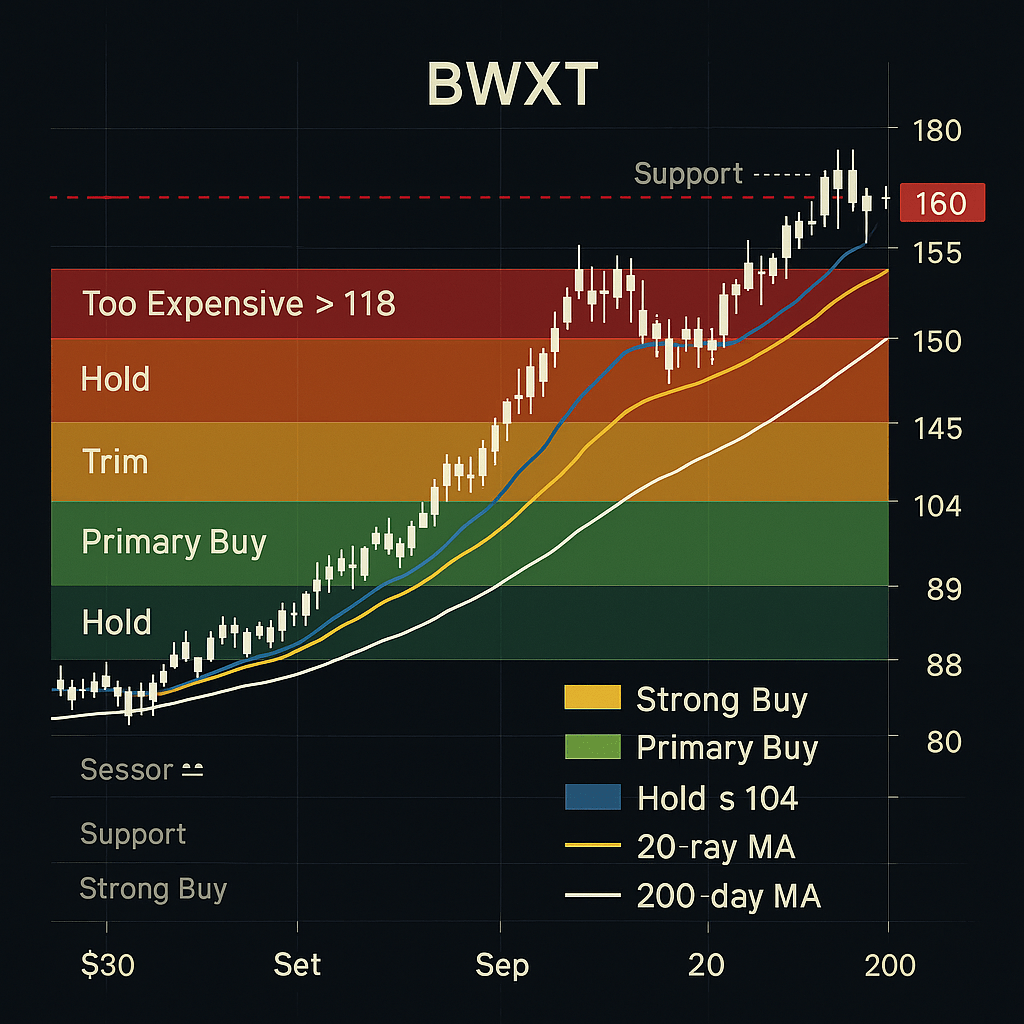

For investors seeking BWXT exposure, the optimal strategy prioritizes patience over momentum chasing. Our buy zones reflect valuation discipline rather than business pessimism:

- Strong Buy: ≤ $80

- Primary Buy: $80–$89

- Hold / Fair Value: $89–$104

- Trim: $104–$118

- Too Expensive: > $118

Current technical levels support this patient approach. BWXT trades below its 20-day moving average (~$170) but above the 50-day (~$154) and well above the 200-day (~$123). RSI sits neutral at ~49, suggesting neither oversold nor overbought conditions. Key support emerges around $152-155, while resistance clusters near $170-175.

For existing holders, the strategy shifts toward risk management. Consider trimming positions above $160 and deploying covered calls with 0.15-0.25 delta strikes 30-60 days out to harvest premium while maintaining core exposure. Position sizing should reflect the premium valuation—core exposure of 2-4% maximum at current levels, scaling higher only on meaningful pullbacks.

The Scenario Framework: Base, Bull, and Bear Cases

Our base case (50% probability) envisions steady backlog conversion, gradual supply-chain normalization, and multiple compression toward peer averages. This scenario targets $155-175 over 12 months as fundamental progress offset valuation normalization.

The bull case (30% probability) requires multiple positive catalysts: accelerated submarine production, breakthrough medical isotope commercialization, and meaningful space-nuclear contract wins. NASA’s lunar surface power initiative represents genuine optionality, though timeline uncertainty makes this more 2026-2027 catalyst than near-term driver. Bull scenario implies $180-205 targets.

The bear case (20% probability) centers on execution disappointments, extended supply-chain disruptions, or broader defense sector multiple compression. Budget optics around defense spending, while unlikely to affect core naval nuclear programs, could trigger sector-wide selling. Bear case suggests $130-150 downside.

Why This Isn’t a Simple Hold

BWXT presents the classic high-quality, high-price dilemma that separates disciplined investors from momentum chasers. The business quality is undeniable—few companies enjoy such durable competitive moats in mission-critical applications. Management execution appears solid, with consistent guidance raises and operational improvements across key segments.

But investment success requires buying great businesses at reasonable prices, not just buying great businesses. At current valuations, BWXT prices in considerable optimism about execution, program timing, and multiple sustainability. Even minor disappointments could trigger meaningful corrections.

The covered call overlay strategy offers a compromise for existing holders reluctant to sell quality franchises. Writing calls against core positions generates income while capping upside participation—appropriate for premium-valued positions where downside protection matters more than upside capture.

The Bottom Line

BWXT represents one of the highest-quality ways to access the naval nuclear and medical isotopes themes. The competitive moats are real, the backlog provides multi-year visibility, and the strategic importance ensures continued government support. These attributes justify premium valuations—but not infinite premiums.

Our recommendation reflects valuation discipline rather than business skepticism: hold existing positions with covered call overlays, trim on strength above $160, and prepare to add aggressively if pullbacks create entry opportunities in the $80s. Great businesses at great prices beat great businesses at any price, and BWXT currently falls in the latter category.

The nuclear renaissance remains intact, submarine construction schedules support multi-year growth, and medical isotope applications continue expanding. When BWXT’s valuation better reflects these realities rather than pricing them to perfection, the risk-reward equation will improve meaningfully. Until then, patience beats urgency.

Vulcan-mk5 Score Block

- Composite: 6.80 / 10.00

- Pillars: Value 2.30, Growth 6.20, Quality 9.10, Momentum 8.00, Safety 8.20

- Rating: Hold / Trim on strength

- Position sizing: 2–4% at current price; up to 5–6% only inside Primary Buy zone with covered-call overlay

Master Metrics Table

| Metric | BWXT |

|---|---|

| Ticker | BWXT |

| Price | 160.03 |

| Blended Fair Value | 94 |

| Discount to FV | -41% |

| Vulcan Score | 6.80 |

| Value | 2.30 |

| Growth | 6.20 |

| Quality | 9.10 |

| Momentum | 8.00 |

| Safety | 8.20 |

| Strong Buy ≤ | 80 |

| Primary Buy | 80–89 |

| Hold Zone | 89–104 |

| Trim Zone | 104–118 |

| Too Expensive > | 118 |

| Exp. 12m Total Return | ~-40% |

Leave a comment