The Telehealth Titan Trading at a Premium That Would Make Silicon Valley VCs Blush

The numbers don’t lie, but they don’t always tell the whole story either. Hims & Hers Health (HIMS) presents one of the most fascinating paradoxes in today’s market: a company executing flawlessly on every operational metric while trading at valuations that would make even the most optimistic growth investor pause. At $42.35, HIMS sits in that uncomfortable middle ground where fundamental excellence meets market physics—and the tension is palpable.

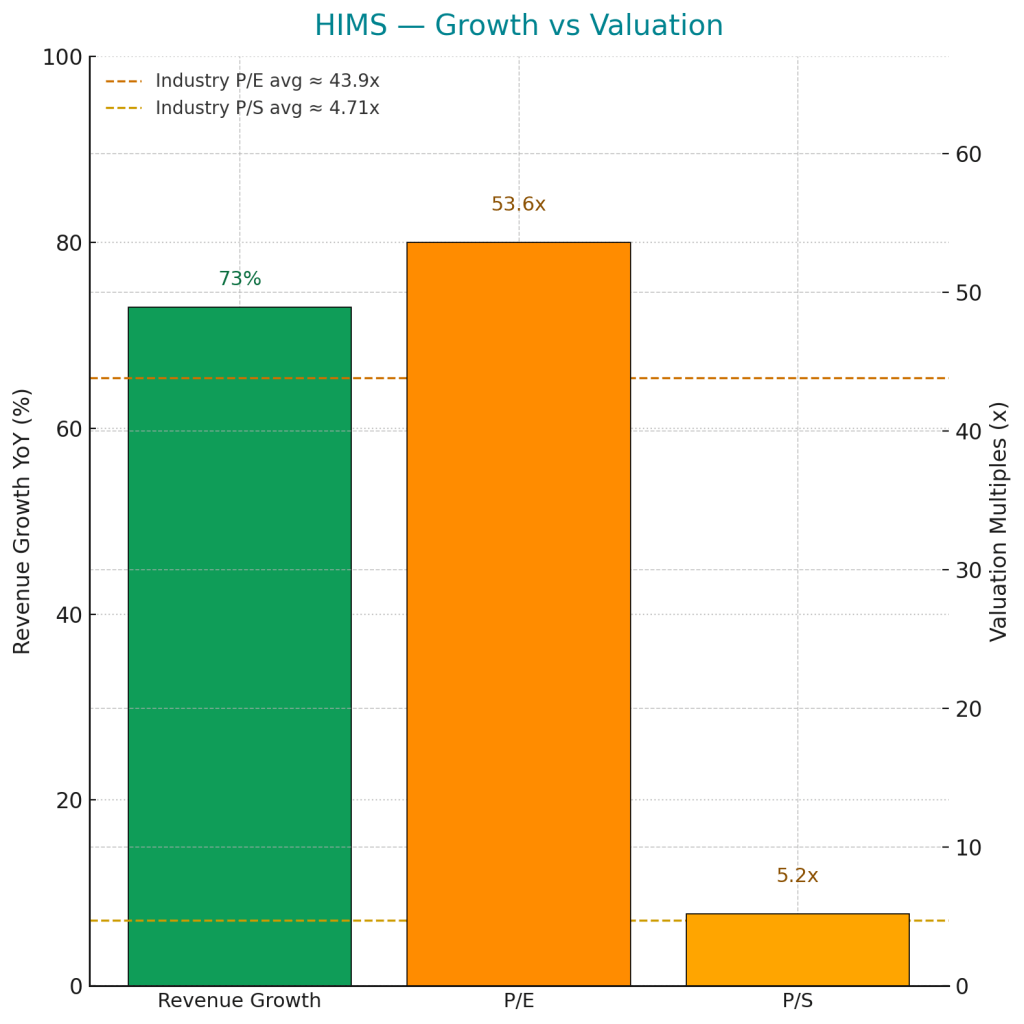

When a stock rockets 189% in twelve months only to shed 30% in the last month alone, you’re witnessing more than simple volatility. You’re seeing the market’s schizophrenic relationship with growth at any price, particularly when that growth comes with a 53.6 P/E ratio and 38.5% short interest. The bears aren’t betting against the business model; they’re betting against the mathematics of maintaining premium multiples in an increasingly value-conscious environment.

The Execution Engine That’s Actually Working

Strip away the market noise, and HIMS reveals itself as a telehealth juggernaut firing on all cylinders. Q2 2025 delivered the kind of numbers that growth investors dream about: 73% year-over-year revenue growth to $545 million, subscriber count expanding to 2.4 million (+31% YoY), and actual GAAP profitability of $42-43 million. This isn’t growth-at-all-costs speculation—this is a company that has cracked the code on profitable expansion in a notoriously difficult healthcare vertical.

The platform’s evolution from male-focused sexual health to a comprehensive wellness ecosystem spanning mental health, dermatology, and emerging GLP-1 treatments represents textbook category expansion done right. Cross-selling opportunities are expanding lifetime value per customer while the subscription model provides the kind of predictable revenue that Wall Street typically rewards with premium multiples.

Yet here’s where the story gets interesting: gross margins actually contracted from 81% to 76% year-over-year as the company invested in scale and diversification. This isn’t operational deterioration—it’s the natural evolution of a platform business transitioning from niche specialist to category leader. The margin compression reflects strategic choices about market expansion rather than competitive pressure or execution failures.

The Valuation Tightrope That’s Making Everyone Nervous

The math is brutally simple: at current levels, HIMS trades at valuations that assume perfect execution for years to come. Our DCF analysis suggests fair value around $38, putting the current price at a modest 11% premium to intrinsic value. That might seem reasonable for a high-growth healthcare platform, until you factor in the execution risk and multiple compression threats that come with such elevated expectations.

The technical picture tells the story of a stock caught between two narratives. After touching a 52-week high of $72.98, HIMS has given back roughly 42% of its gains, settling into a trading range that reflects genuine uncertainty about sustainable valuation levels. Key resistance sits at $48-52 (the breakdown zone from earlier highs), while support has emerged around $40 with deeper technical support in the low-$30s.

This isn’t random noise—it’s the market’s attempt to reconcile exceptional fundamentals with stretched valuations in an environment where growth premiums are under constant scrutiny. The 38.5% short interest isn’t just bearish positioning; it’s a massive coiled spring that could drive explosive moves in either direction depending on execution and sentiment shifts.

The Risk-Reward Equation That Smart Money Is Calculating

The bull case for HIMS remains compelling: network effects are strengthening, customer acquisition costs are improving, and the total addressable market in digital health continues expanding. Platform businesses that achieve critical mass often experience accelerating returns to scale, and HIMS appears to be approaching that inflection point.

However, the bear case isn’t rooted in business model skepticism—it’s anchored in valuation reality. At 53.6x trailing earnings and 5.2x sales, HIMS is priced for perfection in a market that increasingly punishes disappointments with violent re-ratings. The margin compression trend, while strategically logical, creates additional pressure on profitability metrics that support these premium multiples.

Our scenario modeling suggests a wide range of probable outcomes over the next 12 months. Base case assumptions around 18% annual price appreciation with 60% volatility yield a median target near current levels, but with probability bands stretching from $16 to $112. This isn’t a normal distribution—it’s the signature of a high-conviction, high-volatility growth story where outcomes cluster at extremes.

The Strategic Positioning Framework for Different Investor Types

For growth-oriented portfolios, HIMS represents a rare combination of proven execution and significant runway, but position sizing becomes critical given the volatility profile. Our recommendation caps exposure at 3% of equity allocation, with staged entries preferred over single-point purchases.

Value investors face a more complex decision matrix. While current pricing exceeds our fair value estimate, the discount to peak valuations and strong fundamental trajectory create an interesting setup for patient capital. The key insight: this isn’t traditional value territory, but it’s not momentum chasing either.

The technical setup favors staged accumulation in the $33-36 range, where risk-reward ratios improve meaningfully. Above $44-50, profit-taking becomes more attractive than additional accumulation, particularly given the heavy short interest that could trigger rapid moves in either direction.

The Catalyst Timeline That Could Drive Next Moves

Near-term catalysts center on Q3 earnings (expected November 3rd) and any updates on GLP-1 market penetration, which represents a significant growth driver that the market hasn’t fully valued. Management’s ability to demonstrate margin recovery while maintaining growth rates will largely determine whether the current valuation premium expands or contracts.

Medium-term opportunities include potential geographic expansion and deeper healthcare vertical integration. The platform’s data advantages and established customer relationships create natural expansion paths that could support continued premium valuations if executed effectively.

Long-term value creation depends on HIMS’s evolution from telehealth platform to comprehensive wellness ecosystem. Success would justify current valuations and potentially drive multiple expansion; failure would likely trigger meaningful multiple compression regardless of absolute growth rates.

The Bottom Line for Rational Investors

HIMS sits at an inflection point where excellent execution meets stretched valuations in a market environment that’s increasingly skeptical of growth premiums. The company deserves credit for building a genuinely differentiated platform with strong unit economics and expanding market opportunity.

However, investment success requires honest assessment of valuation risk alongside fundamental strengths. At current levels, HIMS offers compelling long-term potential for investors willing to accept significant volatility and execution risk. The stock isn’t cheap, but it’s not obviously expensive either—it’s fairly valued for a business that needs to continue exceeding expectations.

Our recommendation reflects this reality: Hold current positions but avoid aggressive accumulation above $40. Use any weakness toward the low-$30s as opportunities for patient capital, and consider profit-taking on strength above $45. This isn’t a momentum play or a value opportunity—it’s a quality growth story trading near fair value in a market that’s still learning how to price platform businesses with genuine competitive moats.

The next twelve months will determine whether HIMS joins the ranks of sustainably profitable growth companies that command premium valuations, or becomes another cautionary tale about the dangers of paying up for execution risk. The fundamentals support optimism; the valuation demands prudence.

References

Yahoo Finance — HIMS quote, market data, valuation measures, 52-week range. Hims & Hers Investor Relations — Q2’25 press release & shareholder letter. Finviz — screening snapshot incl. EV/EBITDA and short-interest series. MarketBeat — short interest (% of float, days to cover). StockRover — comprehensive financial analysis and peer comparison data.

Leave a comment