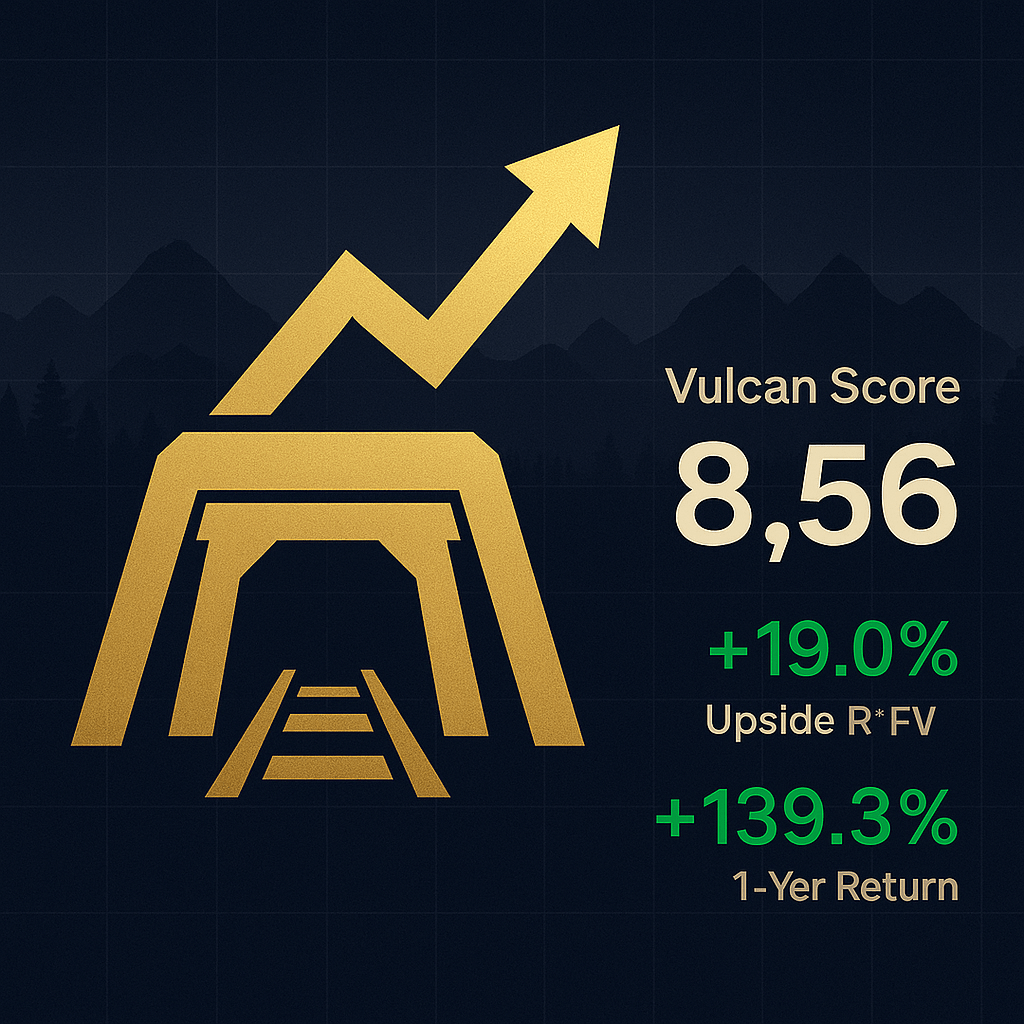

When gold miners surge 139% in a year while maintaining a beta of just 0.48, something extraordinary is happening beneath the surface. Kinross Gold Corporation has transformed from a geographically scattered operation into a disciplined, cash-generating machine at precisely the moment when macro conditions have aligned for a sustained precious metals bull run.

Related analysis we’ve done for Gold:

A four pillar strategy

Royal Gold (RGC)

Newmon Gold Miner (NEM)

SSR Mining (SSRM)

The numbers tell a compelling story: gold recently pierced $3,500 per ounce for the first time in history, the dollar index has softened to around 98, and real yields hover near 1.8% – creating what veteran gold strategists call a “perfect storm” for quality miners. But here’s what separates Kinross from the pack: while most gold stocks are momentum plays riding the bullion wave, KGC has engineered a structural transformation that positions it to compound wealth even if gold pulls back.

The Great Bear Transformation

The investment thesis centers on execution excellence meeting unprecedented opportunity. Kinross spent the better part of a decade cleaning house – divesting problematic Russian operations, streamlining its geographic footprint, and most importantly, acquiring the Great Bear project in Canada. This isn’t just another mine acquisition; it’s a generational asset that could redefine the company’s cost structure for the next decade.

Great Bear’s preliminary economic assessment outlines production of approximately 500,000 ounces annually at all-in sustaining costs around $800 per ounce. With gold trading north of $3,500, that translates to operating margins exceeding $2,700 per ounce – the kind of cash generation that transforms balance sheets and rewards patient shareholders. More critically, those unit costs place Great Bear in the first quartile of the global cost curve, providing sustainable competitive advantage regardless of gold’s direction.

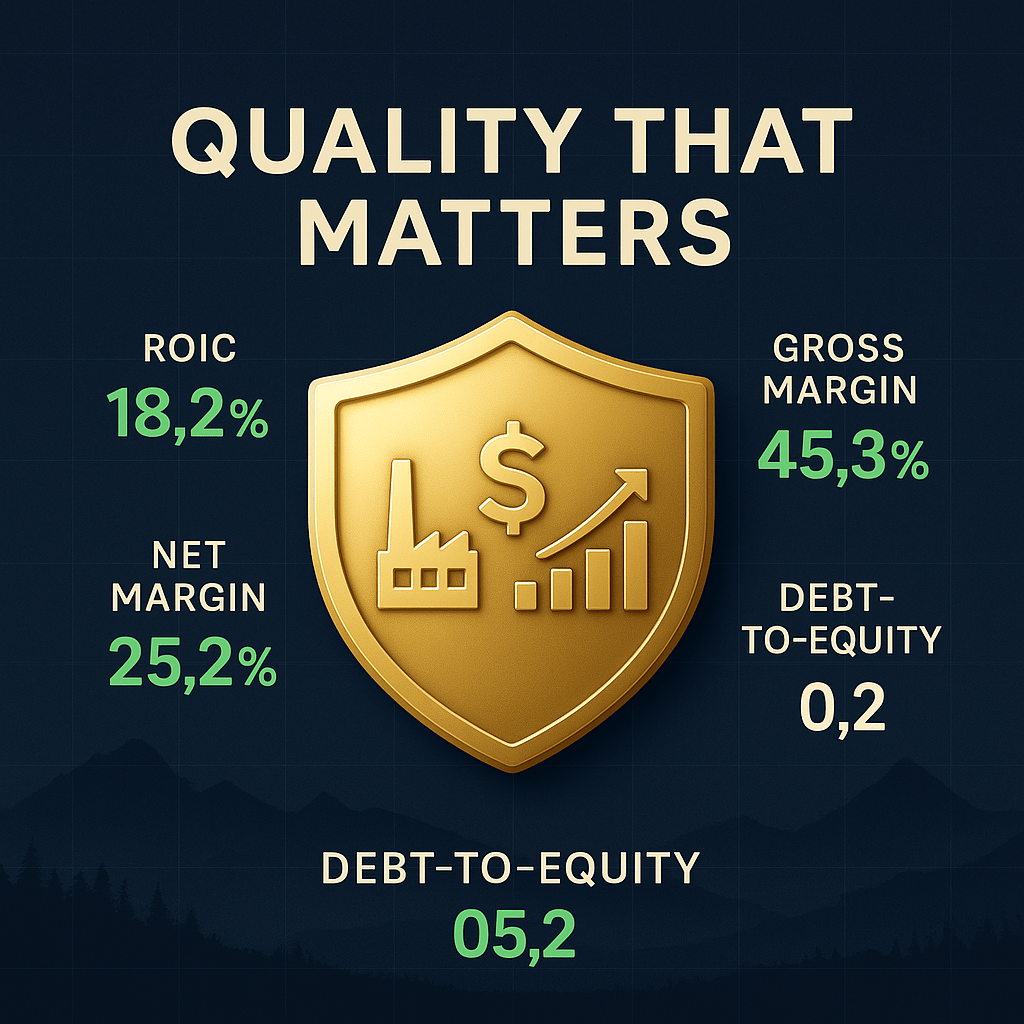

The timing couldn’t be more fortuitous. While the broader materials sector has struggled with inflationary pressures and supply chain disruptions, Kinross has emerged with a cleaned-up asset base, minimal debt leverage (debt-to-equity ratio of just 0.2), and interest coverage exceeding 33 times. This financial fortress provides optionality that most miners simply don’t possess.

Quality Metrics That Matter

Beyond the Great Bear narrative lies a company that has quietly achieved operational excellence. Kinross now generates gross margins of 45.3% compared to the industry average of 38.3%, while maintaining net margins of 25.2% versus peers at 18.3%. Return on invested capital has climbed to 18.2%, more than double the sector median.

Perhaps most telling is the earnings momentum: Kinross has beaten consensus estimates in four of the last five quarters, with the most recent surprise coming in at 33.3% above expectations. This isn’t luck – it’s systematic operational improvement showing up in measurable results. The market has taken notice, pushing analyst revisions higher across current quarter, next quarter, and full-year estimates.

The Altman Z-Score of 4.6 indicates robust financial health, while the company’s beta of 0.48 suggests it captures gold’s upside while providing relative downside protection. For context, this gives investors exposure to a sector that has historically been highly volatile, but with roughly half the volatility of the broader market.

Macro Tailwinds Accelerating

The precious metals complex is experiencing its strongest fundamental backdrop in over a decade. Central bank purchases continue at near-record levels, geopolitical tensions support safe-haven demand, and the Federal Reserve’s dovish pivot has weakened the dollar while keeping real yields contained. These aren’t temporary factors – they represent structural shifts that could support higher gold prices for years.

Currency debasement concerns have moved from the financial fringes to mainstream institutional portfolios. When sovereign wealth funds and pension plans begin allocating to gold as an inflation hedge and portfolio diversifier, it creates sustained demand that overwhelms short-term trading volatility. Kinross benefits disproportionately from this institutional shift because its operational improvements have coincided with the sector’s re-rating.

The technical setup reinforces the fundamental story. KGC has established a clear uptrend well above its 50-day ($17.90) and 150-day ($15.21) moving averages. The 200-day moving average at approximately $18.33 provides meaningful support, suggesting any pullbacks toward $20-$21 would likely find buyers ahead of that longer-term trend line.

Risk Assessment and Position Management

No investment thesis is complete without honest risk assessment. Gold’s recent parabolic move creates vulnerability to mean reversion, particularly if the dollar rebounds sharply or real yields spike higher. A DXY move above 103 combined with 10-year real yields exceeding 2.2% for several weeks would likely pressure both bullion and mining equities.

Project execution risk around Great Bear represents another consideration. While the preliminary economic assessment looks compelling, actual development could encounter permitting delays, capital cost overruns, or geological surprises. Mining is inherently risky, and even high-quality deposits don’t always translate to expected returns.

Geopolitical exposure through West African operations adds another layer of complexity. While Kinross has reduced this exposure significantly, any political instability or resource nationalism in key operating jurisdictions could impact production or increase operating costs.

Cost inflation remains an industry-wide challenge. Energy prices, labor costs, and equipment expenses have pressured all-in sustaining costs across the sector. Kinross has managed this better than peers, but continued inflationary pressure could compress margins if gold prices plateau.

Technical Levels and Entry Strategy

From a technical perspective, KGC has established a strong foundation for continued advancement. The stock recently tested and broke above its previous 52-week high around $20.97, suggesting reduced overhead resistance into the $23-$26 range.

Support levels stack up favorably: initial support around $20.00 (psychological level), followed by the 200-day moving average at $18.33. Any pullback to this zone would likely attract institutional buying, particularly given the strong fundamental backdrop.

The momentum structure remains healthy despite the significant year-to-date advance. Unlike many momentum stocks that show exhaustion signals after major runs, KGC continues to demonstrate relative strength with manageable volatility. The 42% annualized volatility provides opportunity for skilled traders while remaining acceptable for longer-term investors.

Valuation Framework and Price Targets

Using a discounted cash flow approach anchored to the current P/FCF multiple of 13.3x, we derive a blended fair value around $25.50 per share. This assumes steady free cash flow generation of approximately $1.60 per share annually, growing at mid-single digits as Great Bear comes online and gold prices remain constructive.

Scenario analysis suggests a range of outcomes: Bull case scenarios with sustained gold above $3,300 and flawless Great Bear execution could support valuations in the $29-$31 range. Base case assumptions around $3,000-$3,300 gold with steady operational progress justify the $25-$26 target. Bear case scenarios with gold below $2,800 and execution challenges could compress valuations toward $19-$20.

The current price around $21.43 provides roughly 19% upside to fair value with asymmetric risk/reward characteristics. Position sizing should reflect both the opportunity and the inherent volatility of the mining sector.

Implementation Strategy

For investors seeking precious metals exposure through a quality operator, Kinross represents a compelling risk-adjusted opportunity. The combination of operational excellence, balance sheet strength, and embedded growth optionality creates multiple ways to win.

Recommended approach involves staged accumulation on any weakness toward $20-$21, with core positions sized at 2-4% of portfolio depending on risk tolerance. The strong technical structure suggests limited downside risk to the 200-day moving average, providing a reasonable stop-loss level for risk management.

Monitor quarterly guidance language around West African operations and Great Bear development milestones. Management credibility remains high, but any execution stumbles could temporarily pressure the multiple while the fundamental story develops.

The Bottom Line

Kinross Gold offers institutional-quality exposure to the precious metals theme through a disciplined operator with embedded growth catalysts. The macro environment provides sustained tailwinds, while operational improvements and balance sheet strength offer downside protection.

At current levels, the risk/reward profile favors patient accumulation with 12-month price targets around $25-$26. The Great Bear development timeline creates medium-term catalysts, while gold’s structural bull market provides the backdrop for sustained outperformance.

This isn’t a speculative momentum play – it’s a calculated bet on operational excellence meeting generational opportunity in the world’s most enduring store of value. For investors seeking to participate in gold’s advance while minimizing single-stock risk, Kinross represents one of the sector’s most compelling combinations of quality and growth potential.

Buy Range Guidance:

- Strong Buy Zone: ≤ $17.85

- Primary Buy Range: ≤ $21.68

- Hold / Fair Value: $21.68–$29.33

- Trim: $29.33–$34.43

- Too Expensive: > $34.43

Leave a comment