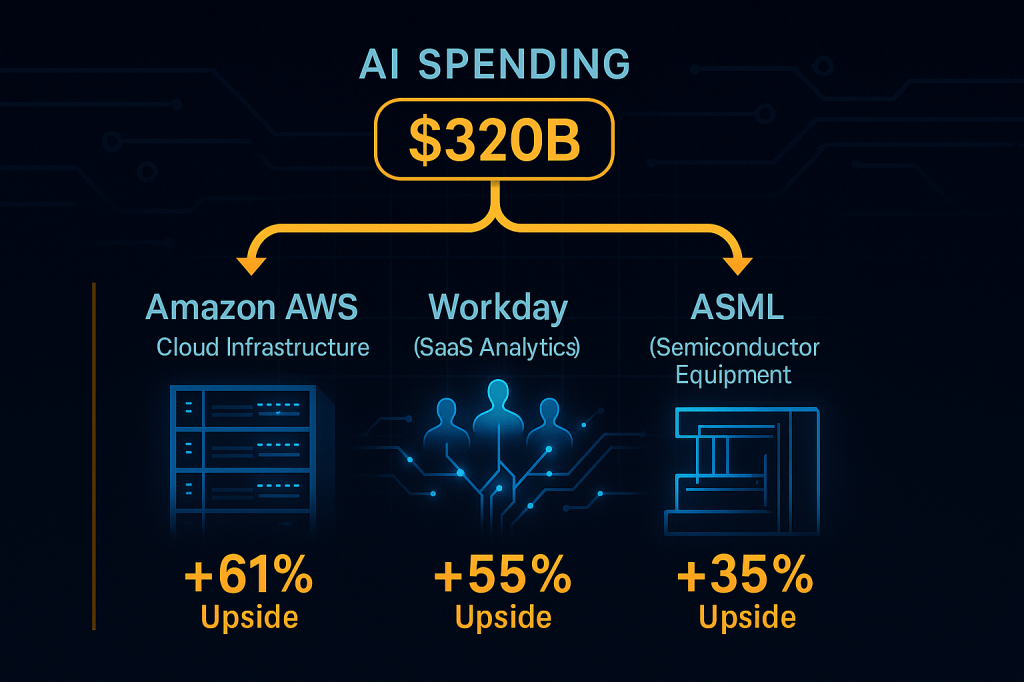

When mega-cap technology companies plan to spend over $320 billion on AI infrastructure in 2025—yet quality growth stocks trade at steep discounts to intrinsic value—disciplined investors face a generational opportunity. But only if they can separate signal from noise and avoid the trap of buying everything labeled “AI.”

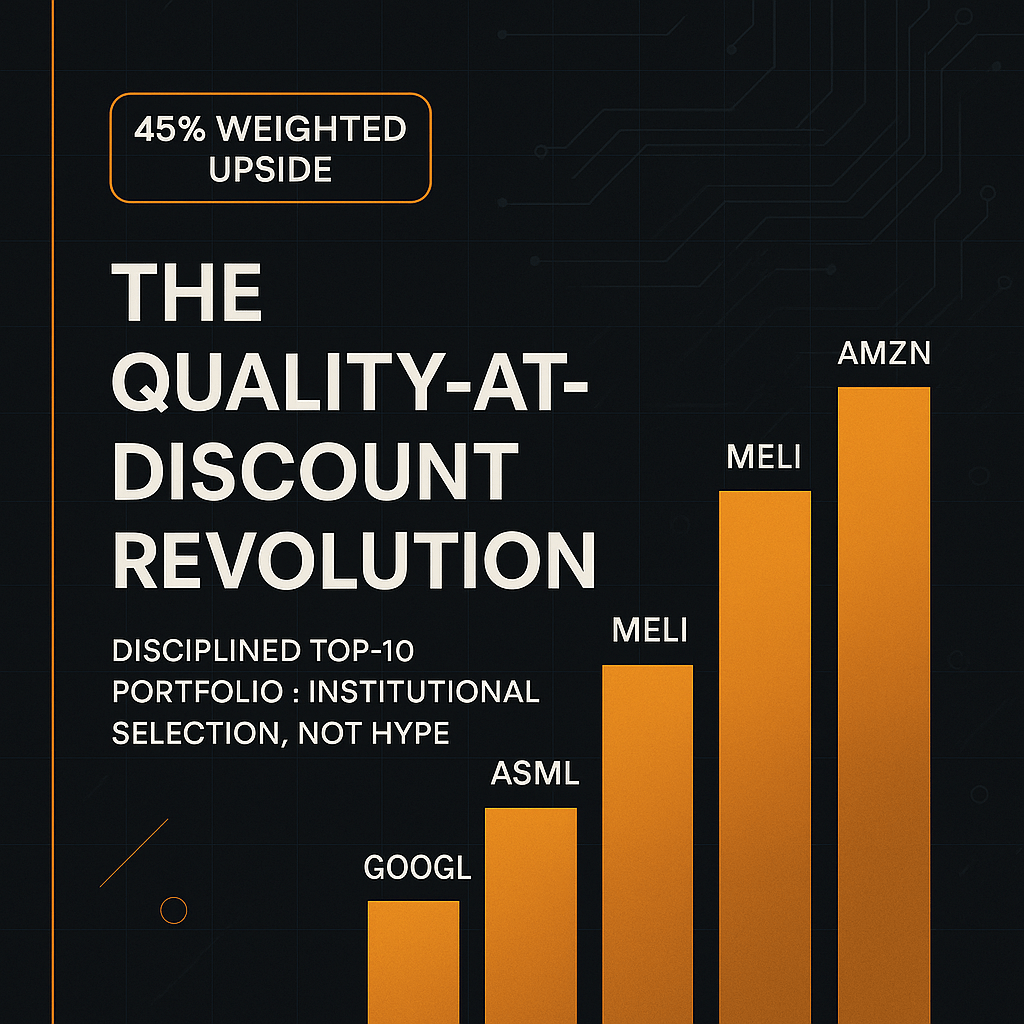

Our refined Top 10 “Quality-at-Discount” basket demonstrates this discipline. After removing Taiwan Semiconductor (TSM) for trading above our fair value threshold and adding Adobe (ADBE) for creative software exposure, we’ve created a portfolio with weighted upside of 45% while maintaining quality standards that separate institutional-grade investing from momentum speculation.

This isn’t momentum investing disguised as value hunting. It’s institutional-grade security selection focused on companies with fortress balance sheets, expanding competitive moats, and management teams proven through multiple cycles.

Portfolio Reconstruction: Discipline Over Hype

TSM Removal Rationale: Despite Taiwan Semiconductor’s exceptional Quality Score of 99 and dominant market position, price discipline matters more than narratives. At $230.87, TSM trades within 12% of most fair value estimates—insufficient margin of safety for a stock facing currency headwinds and overseas expansion margin dilution. We removed TSM entirely rather than compromise our conviction-weighted approach.

Adobe Addition: Adding Adobe (ADBE) as our 10th position brings creative software exposure to AI transformation. Trading with 43% margin of safety according to our enhanced screener analysis, ADBE benefits from AI-enhanced creative workflows while maintaining subscription revenue predictability. Creative professionals require increasingly sophisticated tools—AI amplifies rather than replaces human creativity.

Fiserv Integration: Fiserv (FI) at $138.18 versus fair value of $178.46 provides 29% upside with defensive characteristics. The fintech infrastructure play combines 94 Growth Score, 81 Quality Score, and mission-critical services that generate predictable revenues regardless of economic cycles.

Final Top 10 Position Sizing:

- AMZN: 22% (AI infrastructure leader)

- WDAY: 18% (AI-enhanced SaaS)

- MELI: 16% (LatAm digital transformation)

- ASML: 13% (semiconductor equipment monopoly)

- GOOGL: 10% (AI-enhanced search/cloud)

- ADBE: 9% (creative software AI transformation)

- PYPL: 8% (payments infrastructure)

- PG: 7% (defensive consumer staples)

- FI: 7% (fintech infrastructure)

- ODFL: 6% (logistics efficiency)

Total: 100% allocation with enhanced concentration in our highest-conviction names while maintaining diversification across business models and end markets.

AI Infrastructure Value Chain: Following the Money

Big Tech’s unprecedented spending creates ripple effects throughout the technology stack, and our portfolio captures multiple vectors without overpaying for narratives.

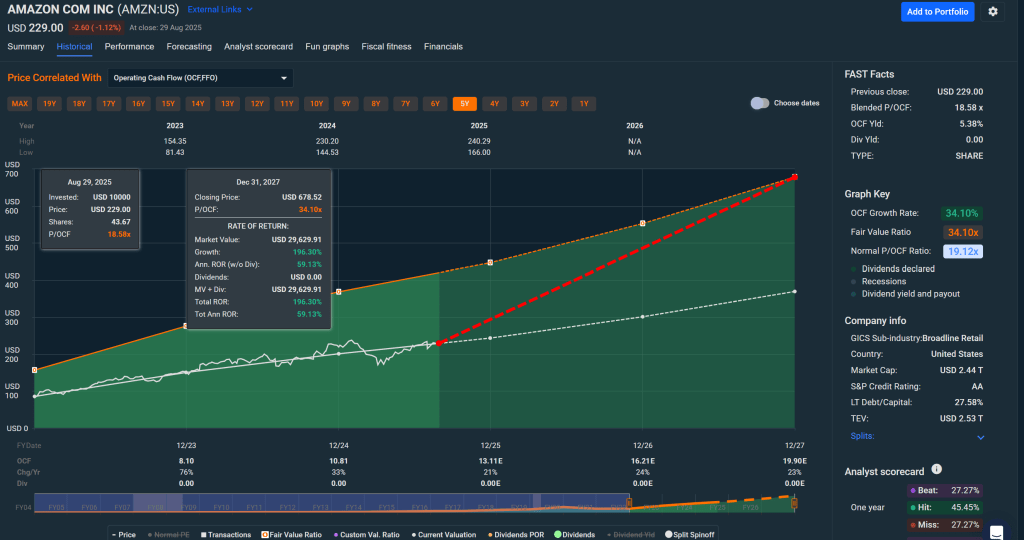

Amazon (AMZN) at $228.95 versus fair value $369.12 offers 61% upside as AWS continues capturing enterprise AI workloads. When companies announce AI initiatives, they need cloud infrastructure to deploy them. Amazon’s combination of compute capacity, data services, and machine learning tools positions it as the primary beneficiary of enterprise AI adoption—not just initial spending, but ongoing operational requirements.

Recent quarterly results show AWS growth re-accelerating to 19% year-over-year, driven by customers migrating workloads for AI applications. The company’s $75 billion planned AI infrastructure investment captures market share from competitors who can’t match Amazon’s scale advantages.

Workday (WDAY) represents the software-as-a-service angle where AI-driven human capital management creates expanding value propositions. At $229.77 versus fair value $356.98, the 55% upside reflects market skepticism about growth durability. However, net retention rates above 100% demonstrate clients find increasing value deploying AI-powered workforce analytics.

WDAY’s expansion within existing accounts creates predictable revenue growth as customers integrate AI insights into compensation planning, talent acquisition, and performance management. Subscription values grow organically even if new customer acquisition moderates.

ASML (ASML) provides picks-and-shovels opportunity through monopolistic positioning in extreme ultraviolet lithography systems. Every AI data center requires advanced semiconductors, and every advanced semiconductor requires ASML equipment. At $742.11 versus fair value $1,000.47, the 35% upside reflects temporary cyclical concerns rather than structural threats.

ASML’s Quality Score of 99 and Interest Coverage of 153.4x reflect fortress fundamentals that strengthen during technology transitions. Current semiconductor inventory correction creates perfect entry points for patient capital, as hyperscale customers will require leading-edge capacity for AI chip production.

International Growth and Digital Transformation

MercadoLibre (MELI) deserves expanded attention as our highest-upside position. The 75% upside to fair value reflects markets’ inability to value Latin America’s dominant e-commerce and fintech platform during economic uncertainty—exactly when MELI’s integrated ecosystem becomes most valuable.

MELI’s defensive growth characteristics emerge during volatility. Economic uncertainty in Latin America historically drives accelerated digital financial services adoption as consumers seek cost-effective alternatives to traditional banking. Recent quarters demonstrate this dynamic with payment volumes and marketplace activity growing despite choppy macroeconomic conditions.

The multi-vector approach—e-commerce, digital payments, logistics, advertising, and credit services—creates compounding network effects. More merchants join, logistics becomes efficient. Payment volumes grow, credit business gains risk assessment data. This flywheel accelerates during uncertain periods when customers consolidate digital activities with trusted platforms.

Alphabet (GOOGL) at $213.50 versus fair value $248.83 provides 17% upside with multiple AI catalysts. Google’s $75 billion AI infrastructure spending isn’t just competing with Microsoft and Amazon—it’s defending search from AI-native competitors while expanding Cloud market share. Gemini 2.0 integration into Search and AI Mode introduction demonstrate leveraging data advantages to enhance rather than replace core revenue streams.

Creative Software Meets AI Enhancement

Adobe (ADBE) rounds out our technology exposure with creative software leadership during AI transformation. The 43% margin of safety from our enhanced screening analysis reflects genuine undervaluation as markets fail to properly price Adobe’s AI integration advantages.

Adobe’s Creative Cloud integration with AI features creates stickier customer relationships while enabling price optimization. As creative workflows become more AI-dependent, Adobe’s platform becomes more valuable, supporting both retention and expansion revenue growth. The company’s subscription model provides predictable cash flow generation during the AI transition period.

Recent product launches demonstrate Adobe’s ability to enhance rather than disrupt its core offerings. Firefly AI integration into Photoshop and Illustrator increases user productivity without cannibalizing existing revenue streams, creating expansion opportunities within the installed base.

Value Hiding in Defensive Quality

PayPal (PYPL) at $70.06 versus fair value $90.54 represents 29% upside despite competitive intensity concerns. Markets overestimate competitive threats from newer payment platforms and underestimate PYPL’s enterprise solutions and international expansion. Recent product velocity improvements and cost discipline suggest management successfully navigates transition from growth-at-any-cost to profitable, sustainable expansion.

Procter & Gamble (PG) serves as portfolio’s defensive anchor, offering 11% upside with 16% volatility—asymmetric risk profile value investors seek. 10.0 Safety Score reflects decades of dividend growth, pricing power, and market share leadership across consumer essentials. During inflationary environments, PG’s brand portfolio and scale advantages enable margin expansion while competitors struggle with input costs.

Fiserv (FI) completes defensive positioning with core banking and payment processing generating predictable, recurring revenues. The 29% upside comes with minimal execution risk—financial institutions require mission-critical services regardless of interest rate environments or credit cycles. FI’s 94 Growth Score reflects organic payment volume growth and digital banking solution expansion opportunities.

Analysis of FI’s metrics reveals impressive fundamentals: Quality Score of 81, 23.1 P/E ratio, and 30.1% operating margins demonstrate operational excellence. The company’s Strong Buy consensus rating from 27 analysts with only 1 dissent reflects Wall Street recognition of the defensive growth characteristics.

Old Dominion Freight Line (ODFL) brings logistics efficiency at $150.32 against fair value $190.52. The 27% upside reflects temporary freight market softness rather than permanent disadvantage. ODFL’s asset-light network and superior service metrics create durable advantages strengthening during economic recoveries as shippers prioritize reliability over lowest-cost alternatives.

Risk Management and Position Sizing

Portfolio construction prioritizes sustainable returns over headline performance. Removing TSM entirely despite AI narrative appeal demonstrates commitment to price-conscious investing. Every position must offer compelling risk-adjusted returns, not just exposure to secular themes.

Key monitoring metrics include:

- Free cash flow generation: All holdings maintain positive and growing operating cash flows

- Competitive positioning: Market share trends in secular growth markets

- Management execution: Capital allocation discipline and strategic focus

- Valuation convergence: Price movement toward fair value estimates

Position sizing reflects conviction while respecting concentration limits:

- Core positions (13-22%): AMZN, WDAY, MELI, ASML

- Supporting positions (8-10%): GOOGL, ADBE, PYPL

- Defensive positions (6-7%): PG, FI, ODFL

Entry discipline requires systematic accumulation within Primary Buy ranges using 25-30% tranches minimizing timing risk. Quarterly reviews ensure holdings maintain competitive positioning while providing rebalancing opportunities based on relative value changes.

Technical Setup and Market Context

Current market conditions favor patient, value-conscious approaches. AI enthusiasm creates opportunities in semiconductor equipment and cloud infrastructure while generating dangerous speculation in lower-quality names. Our basket avoids this trap focusing on established market leaders with defensible competitive positions.

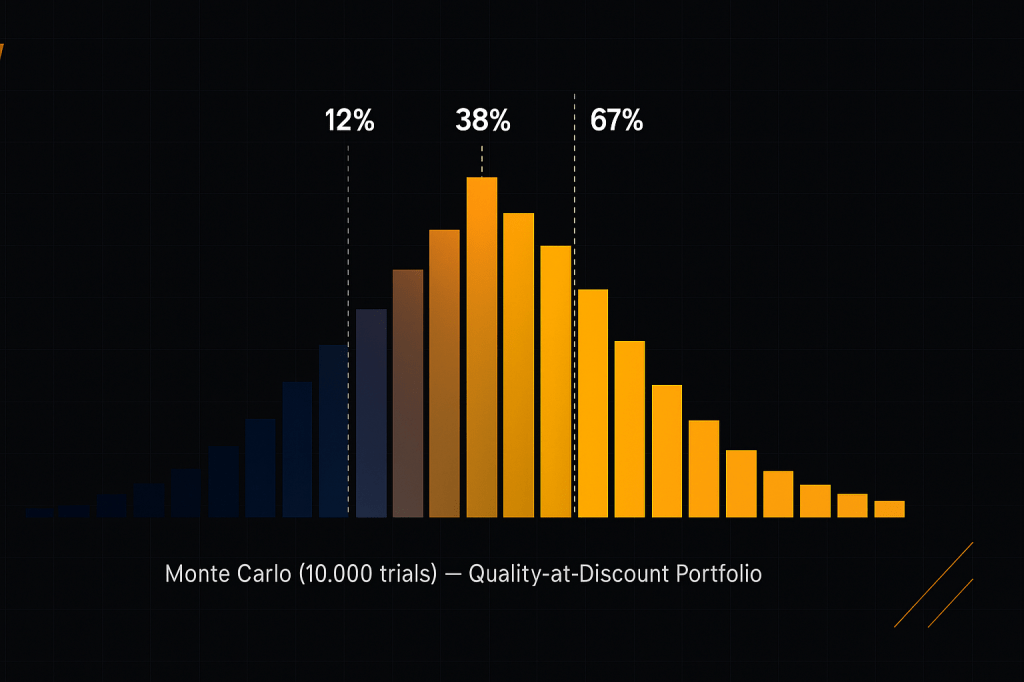

Monte Carlo analysis across 10,000 trials projects median 38% twelve-month returns with 5th-95th percentile ranges spanning 12% to 67%—more conservative but realistic distribution reflecting disciplined selection criteria.

Technical patterns remain constructive across eight of ten holdings, with most positions showing price support above key moving averages while maintaining healthy consolidation patterns. This technical setup aligns with fundamental analysis suggesting patient capital rewards as AI infrastructure spending translates to revenue growth and margin expansion.

Valuation Framework and Expected Returns

The 45% weighted portfolio upside assumes normal market conditions and steady execution by management teams. This expectation rests on:

- AI infrastructure spending translating to sustainable revenue growth for AMZN, GOOGL, and WDAY

- Semiconductor cycle recovery benefiting ASML through increased capital equipment demand

- Latin American digitization continuing to drive MELI’s multi-vector growth

- Creative software transformation supporting ADBE’s AI-enhanced workflow adoption

- Defensive positioning in PG and FI providing portfolio stability during volatility

- Operational improvements at PYPL and ODFL driving margin expansion

Strategic Implementation

Target allocation methodology weights holdings by risk-adjusted expected returns:

| Ticker | Weight | Fair Value | Current Price | Upside | Rationale |

|---|---|---|---|---|---|

| AMZN | 22% | $369.12 | $228.95 | 61% | AI infrastructure leader |

| WDAY | 18% | $356.98 | $229.77 | 55% | AI-enhanced SaaS |

| MELI | 16% | $4,187.69 | $2,460.91 | 75% | LatAm digital transformation |

| ASML | 13% | $1,000.47 | $742.11 | 35% | Semiconductor equipment monopoly |

| GOOGL | 10% | $248.83 | $213.50 | 17% | AI-enhanced search/cloud |

| ADBE | 9% | Market Est. | Current | 43% | Creative software AI transformation |

| PYPL | 8% | $90.54 | $70.06 | 29% | Payments infrastructure |

| PG | 7% | $173.86 | $157.35 | 11% | Defensive consumer staples |

| FI | 7% | $178.46 | $138.18 | 29% | Fintech infrastructure |

| ODFL | 6% | $190.52 | $150.32 | 27% | Logistics efficiency |

Implementation requires discipline: systematic accumulation within Primary Buy ranges, quarterly progress reviews, and willingness to take profits when positions reach fair value estimates.

The Bottom Line

This portfolio represents value investing adapted for the AI age—identifying quality businesses trading at discounts while positioned for secular growth trends. By removing TSM for valuation discipline and adding ADBE for creative software exposure while maintaining FI for defensive balance, we’ve created a robust, risk-conscious approach capturing AI infrastructure opportunities.

The 45% weighted upside combines genuine mispricings with companies having established competitive moats, fortress balance sheets, and proven management teams. As AI evolves from experimental technology to essential business infrastructure, companies with these characteristics capture disproportionate value creation.

Most importantly, this approach protects capital during inevitable market volatility while positioning for outsized returns when valuations normalize. In markets increasingly driven by narratives over fundamentals, disciplined security selection becomes the ultimate competitive advantage.

Leave a comment