The $8.8 Billion Question That’s Reshaping Crypto

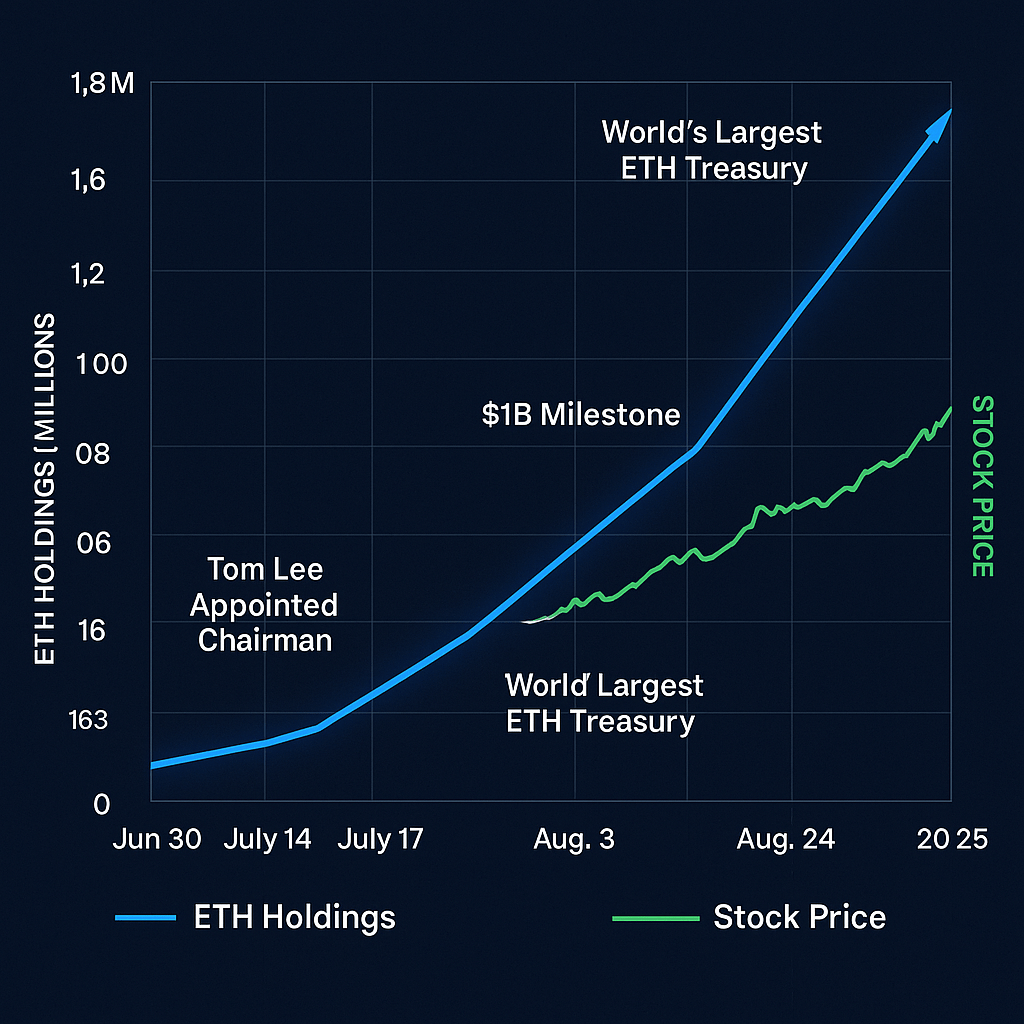

When Tom Lee walked into BitMine Immersion Technologies (BMNR) as Chairman on June 30th, 2025, the company held exactly zero Ethereum tokens. Fifty-seven days later, they control 1.71 million ETH worth $8.82 billion—making them the world’s largest Ethereum treasury and America’s 20th most liquid stock. This isn’t just another crypto pivot story. This is what happens when Wall Street’s most prominent Ethereum evangelist gets $20 billion in authorized firepower to reshape an entire asset class.

The numbers tell a story of unprecedented execution velocity: BMNR now reigns as the #1 Ethereum treasury globally and #2 crypto treasury behind only MicroStrategy. But here’s the tension every investor must grapple with: Is this the birth of the next MicroStrategy-sized winner, or are shareholders about to get diluted into oblivion by the largest equity raise authorization in crypto history?

The Tom Lee Premium: When Credibility Becomes Currency

Since Lee’s appointment, BMNR stock has exploded roughly 1,360%, transforming from a forgotten Bitcoin miner into a $6.33 billion market cap proxy for institutional Ethereum adoption. This isn’t just momentum—it’s the “Tom Lee Premium” in action.

Lee’s track record speaks volumes. As he puts it: “I first invested in MicroStrategy in late 2020, shortly after Michael Saylor pivoted to a Bitcoin Treasury Strategy. Tom Lee and his team have already shown the resolve to grow shareholder value in the manner following Michael’s roadmap.” The difference? Lee is betting on Ethereum’s superior yield profile through staking, while MicroStrategy’s Bitcoin sits static.

The execution metrics are staggering: crypto NAV per share jumped from $22.84 on July 27th to $39.84 by August 24th. At today’s price of $47.07, BMNR trades at approximately an 18% premium to net asset value—a discount to MicroStrategy’s typical 50-100% premium, suggesting room for multiple expansion as the strategy matures.

The Liquidity Machine: Why Trading Volume Matters More Than You Think

Here’s where BMNR’s story gets genuinely fascinating. The company now trades $2.8 billion per day on average, making it the 20th most liquid US stock. This isn’t vanity—it’s strategic weaponry.

High liquidity creates a reflexive advantage: when BMNR needs to raise capital through equity sales, that $2.8 billion daily volume absorbs new shares without catastrophic price impact. This liquidity moat allows for more efficient capital deployment, better execution on ETH purchases, and ultimately superior per-share value creation.

Consider the math: BMNR aims to raise up to $20 billion through stock sales to acquire additional ETH. With current daily volume, they could theoretically execute a $500 million raise over a week without dominating daily flow—impossible for most companies attempting treasury strategies.

The Staking Yield Advantage: Where BMNR Beats Bitcoin Treasuries

While MicroStrategy’s Bitcoin generates zero yield, BMNR’s ETH holdings will soon activate staking rewards. Current Ethereum staking yields run 3-4% annually, but the real prize is optionality. With Ethereum upgrades like Fusaka scheduled for November 2025 and ETH recently hitting new all-time highs near $4,946, BMNR captures both price appreciation and cash generation.

“What is intriguing is BitMine is set to be very profitable once the Company turns on ETH staking,” notes legendary investor Bill Miller III. This transforms BMNR from a pure treasury play into a yield-generating asset—something no Bitcoin treasury can match.

Risk Reality Check: The $20 Billion Dilution Sword of Damocles

Every BMNR investor must confront the elephant in the room: massive dilution potential. With $20 billion in authorized stock sales, the company could theoretically double or triple its share count if raises occur at unfavorable valuations.

The critical metric to monitor: ETH per share trajectory. If BMNR executes raises at premiums to NAV while ETH appreciates, shareholders benefit from leverage to both premium expansion and underlying asset growth. Execute poorly—selling shares below NAV during ETH weakness—and shareholders get crushed by dilution.

Historical precedent matters here. MicroStrategy successfully navigated this balance through disciplined timing and strong Bitcoin appreciation. BMNR’s challenge is executing at 10x the scale in a more volatile underlying asset.

The Competitive Landscape: Why BMNR Leads the ETH Treasury Race

BMNR faces competition from SharpLink Gaming (SBET), which holds approximately 800k ETH, but the gap is widening rapidly. BMNR’s advantages are structural:

Scale Moat: At 1.71 million ETH versus competitors’ hundreds of thousands, BMNR attracts institutional flows seeking significant ETH exposure without direct custody risks.

Execution Speed: The company grew ETH holdings from zero to 833,000 tokens in just 35 days—demonstrating unmatched capital deployment velocity.

Market Position: Ethereum’s chances of reaching $5,000 have increased to 26% on Polymarket, driven partly by institutional accumulation that BMNR leads.

Technical Setup: The Chart Tells a Story

BMNR’s technical picture reflects the fundamental transformation. After exploding from under $5 to a $161 high, shares have consolidated in the $45-$55 range—a healthy digestion of massive gains.

Key levels for position management:

- Aggressive accumulation zone: Below $42

- Primary buying range: $42-$54

- Hold territory: $54-$66

- Profit-taking consideration: Above $75

The current $47.07 price sits in the sweet spot for accumulation, especially given the 18% premium to NAV versus historical crypto treasury premiums of 50-100%.

The Path to $100+: Base Case Scenario Analysis

Our 12-month target range of $75-$106 assumes several key developments:

ETH Price Appreciation: Analyst forecasts cluster around $6,000-$7,500 for ETH by 2025, driven by institutional adoption, staking yields, and upcoming network upgrades.

Holdings Expansion: Disciplined execution of authorized raises could bring holdings to 2.5-3.0 million ETH while maintaining per-share value accretion.

Premium Sustainability: As the ETH treasury strategy matures and staking yields activate, BMNR could command similar premiums to MicroStrategy’s 50-100% range.

Bull Case Math: If ETH hits $8,000 and BMNR holds 3 million tokens at a 30% premium to NAV, target prices exceed $150 per share.

Position Sizing and Risk Management: The Professional Approach

Given BMNR’s volatility profile (beta of 1.35 to a volatile underlying asset), position sizing becomes critical:

Maximum allocation: 2.5% of portfolio for aggressive growth investors Conservative allocation: 1.0-1.5% for balanced portfolios Risk management: Use staged entry over 3-6 months to smooth volatility

Monitor these key metrics religiously:

- ETH holdings per share (target: consistent growth)

- Premium/discount to NAV (warning if consistently above 40%)

- Raise execution quality (accretive vs. dilutive)

- ETH network fundamentals and institutional adoption trends

The Verdict: A Generational Opportunity With Execution Risk

BitMine Immersion Technologies represents the purest institutional play on Ethereum’s transition from speculative asset to digital monetary premium. Tom Lee’s credibility, unmatched liquidity, and first-mover advantage in ETH treasury strategies create a compelling investment thesis.

The risks are real: $20 billion in dilution authorization, crypto volatility, and execution challenges at unprecedented scale. But for investors who believe Ethereum will become the backbone of tokenized finance, BMNR offers leveraged exposure that no other public vehicle can match.

Final Rating: Primary Buy (Vulcan Score: 7.25/10) Target Price Range: $75-$106 (12 months) Position Sizing: 1.5-2.5% maximum allocation

In a world where institutional adoption of crypto treasury strategies is accelerating, BMNR isn’t just riding the wave—they’re creating it. The question isn’t whether this strategy will work, but whether you’re willing to accept the volatility that comes with being first to a generational opportunity.

Leave a comment