When an Insurance Stock Posts Its Second Consecutive Profitable Quarter After Years of Brutal Losses, Wall Street Takes Notice—But Are They Noticing Fast Enough?

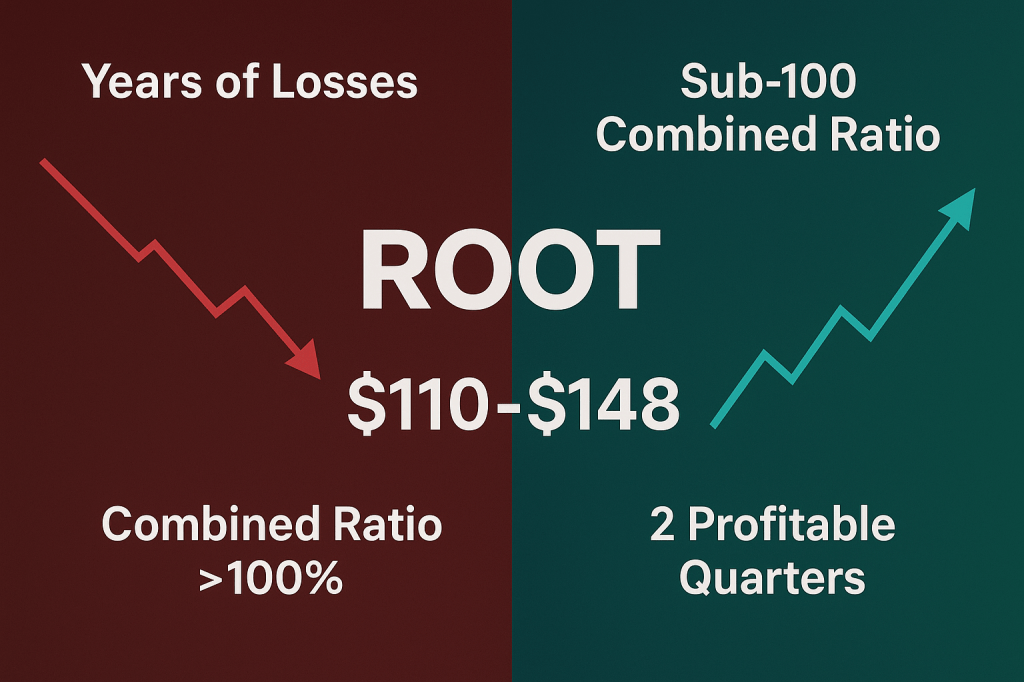

Root Inc (NASDAQ: ROOT) just delivered something the insurance industry rarely witnesses: a complete transformation from catastrophic losses to sustainable profitability. With a second straight profitable quarter and a sub-100 combined ratio, positive operating cash flow, and a materially stronger capital position, ROOT is rewriting the playbook for insurtech success. Yet trading at just $87.99—down over 50% from recent highs—the market seems to be missing the forest for the trees.

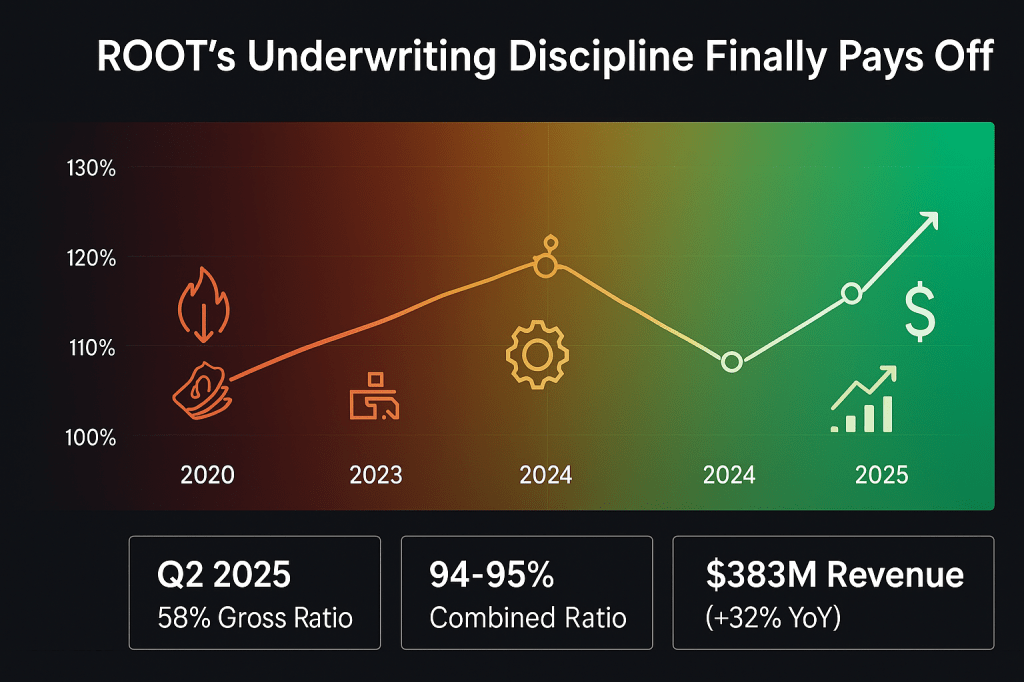

The numbers tell a compelling story of operational discipline finally paying dividends. Q2 revenue hit ~$383M (+32% y/y), with a gross loss ratio near 58% and a net combined ratio around 94-95%—metrics that would make legacy insurance giants envious. But here’s the kicker: ROOT trades at approximately 0.8x EV/TTM sales, a massive discount to both legacy leaders and insurtech peers despite achieving the holy grail of sub-100 combined ratio profitability.

The Vulcan-mk5 Score: A Mixed Signal Worth Decoding

Our comprehensive Vulcan scoring system assigns ROOT a 6.10/10 composite score, breaking down as follows:

- Value: 6.60 — EV/Sales ~0.8x despite newfound profitability

- Growth: 7.40 — Revenue +32% y/y with embedded channel scaling

- Quality: 6.20 — Strong fundamentals but young profit history

- Momentum: 4.00 — Below 200-DMA with RSI in oversold territory

- Safety: 3.80 — High beta and catastrophe sensitivity remain concerns

This mixed scorecard reflects a company in transition—one where fundamental improvements are outpacing market recognition, creating a potential value opportunity for patient investors willing to navigate the volatility.

Three Pillars Supporting the Transformation Thesis

1. Underwriting Discipline Has Finally Stuck

After years of burning cash in pursuit of growth, ROOT has achieved something many thought impossible: sustainable underwriting profitability. The quarter’s ~58% gross loss ratio and ~94-95% combined ratio indicate Root is collecting more than it spends on claims and expenses—a critical inflection point versus the disastrous 2022-23 period.

This isn’t just a lucky quarter. Management’s state-by-state rate cadence appears to be successfully catching up with claims inflation, suggesting the pricing discipline implemented over the past two years is generating lasting results. For context, a combined ratio below 100% means the company makes money on insurance operations before investment income—the gold standard in property and casualty insurance.

2. The Embedded Distribution Channel Is Scaling

Perhaps more intriguing than the underwriting turnaround is ROOT’s evolution in customer acquisition. Nearly half of new writings came via partnerships/embedded channels, which lowers customer acquisition costs, improves selection through credit/behavioral screens at origination, and unlocks step-function access through auto finance, marketplaces, and agents.

This strategic pivot addresses one of insurtech’s biggest challenges: the astronomical cost of direct-to-consumer marketing. By embedding insurance offerings within existing financial transactions, ROOT achieves better unit economics while accessing higher-quality customers who are already engaged in related financial decisions.

3. Capital Position Creates Strategic Runway

ROOT’s balance sheet transformation is equally impressive. Cash and investments (~$641M) and unencumbered capital (~$314M) provide flexibility to keep investing in growth while absorbing volatility in catastrophe seasons. With manageable net debt around $200M, the company has built a fortress balance sheet that can weather both growth investments and potential catastrophe losses.

This financial strength becomes particularly valuable during reinsurance renewal seasons, when carriers with weak balance sheets face punitive pricing or capacity constraints.

The Analyst Consensus: Cautiously Optimistic but Fragmented

Wall Street’s assessment of ROOT reflects the uncertainty inherent in any major business transformation. Current analyst sentiment shows 6% recommending Strong Buy, 18% recommending Buy, 65% suggesting Hold, 12% advising Sell, and 0% predicting Strong Sell. This distribution suggests broad recognition of improvement but lingering questions about sustainability.

The average 12-month price target sits at $148.00 according to four Wall Street analysts, representing potential upside of approximately 68% from current levels—if the transformation thesis proves durable.

However, the wide disparity in analyst opinions reflects genuine uncertainty about ROOT’s ability to maintain underwriting discipline while scaling growth. Insurance is notoriously cyclical, and even the best-managed companies can see margins compressed during hard market cycles or catastrophe-heavy periods.

Risk Factors That Could Derail the Recovery

Catastrophe Volatility Remains the Wild Card

A hotter hurricane/wildfire season could spike catastrophe losses and push the combined ratio >100 in a quarter. ROOT’s exposure to weather-related losses means quarterly results can swing dramatically based on factors entirely outside management’s control.

The company’s reinsurance strategy becomes crucial here. Higher reinsurance rates or tighter capacity could erode the margin capture that’s driving current profitability. Industry-wide reinsurance market dynamics often trump individual company execution in determining short-term profitability.

Competitive Dynamics Could Intensify

ROOT’s improved performance hasn’t gone unnoticed by traditional players. Rate normalization by Progressive and Allstate could compress ROOT’s relative pricing advantage, while legacy players still command massive scale advantages in terms of brand recognition, distribution reach, and capital resources.

The key question: Has ROOT’s technology-driven approach created sustainable competitive advantages, or will traditional players eventually replicate their innovations at lower cost?

Share Volatility Demands Position Size Discipline

ROOT’s high beta and relatively small float create extreme price volatility around earnings and industry headlines. With a 1-year volatility of 0.97 and beta of 1.41, this stock can move 20-30% on quarterly results or even macro insurance industry news.

This volatility profile demands careful position sizing. Even bulls on the ROOT transformation story should limit exposure to 2-3% of portfolio value to avoid outsized impact from inevitable price swings.

Technical Setup: Patience Required for Optimal Entry

ROOT’s current technical position reflects the broader uncertainty surrounding the stock. Trading at $87.99, shares remain below the 200-day moving average around $110-114, with RSI readings in the low 30s suggesting oversold conditions.

Key Technical Levels:

- Support: $75-80 (gap and proximate swing lows)

- Resistance: $100 (psychological level + supply), $110-115 (200-DMA resistance)

The technical setup suggests a range-bound environment until decisive breaks above $100 on volume. For investors convinced of the fundamental transformation, accumulating in tranches within the $75-90 range offers attractive risk/reward, with stops 12-15% below entry points given the high volatility profile.

Valuation Framework: Multiple Paths to Fair Value

Our discounted cash flow analysis anchors ROOT’s fair value around $110 (base case), assuming the company can achieve 5-7% FCF margins over three years as scale and operational leverage accrue. Discounting at 10.5-12% (reflecting small-cap, high-volatility characteristics) yields enterprise value of $1.2-1.4 billion.

The multiple-based approach supports this valuation range. At current levels, ROOT trades at approximately 0.8x EV/Sales—a discount to profitable, sub-100 combined ratio peers and a fraction of high-growth insurtech valuations. If underwriting discipline persists, a 1.0-1.2x EV/Sales multiple appears reasonable, targeting $100-115 per share.

Scenario Analysis:

- Bull Case ($150): Embedded channel accelerates growth while maintaining sub-95% combined ratios

- Base Case ($110): Steady growth with combined ratios in the 94-97% range

- Bear Case ($70): Catastrophe losses or competitive pressure pushes combined ratio above 100%

Investment Recommendation: Risk-Aware Buy with Strategic Entry

Rating: Buy (Risk-Aware)

12-Month Target: $110 (Base Case)

Position Sizing: Maximum 2-3% of portfolio

ROOT represents a compelling turnaround story trading at a material discount to its transformation potential. The company has achieved the critical milestone of sustainable underwriting profitability while building a stronger capital position and evolving its distribution strategy.

However, this opportunity comes with significant execution risk and volatility. The insurance industry’s cyclical nature means even excellent management teams can see margins compressed during challenging periods. ROOT’s high beta and catastrophe exposure demand careful position sizing and entry timing.

Strategic Entry Plan:

- Strong Buy Zone: ≤$75 (exceptional risk/reward)

- Primary Buy Zone: $75-90 (current opportunity)

- Hold Zone: $90-115 (monitor for breakout)

- Trim Zone: $115-145 (take profits on momentum)

Key Catalysts to Watch:

- Additional sub-100 combined ratio quarters

- Embedded channel partnership announcements

- State insurance rate approval progress

- Cash build and capital deployment updates

The Bottom Line: Transformation in Progress

ROOT Inc stands at a critical juncture. After years of painful losses, the company has achieved sustainable underwriting profitability and built a fortress balance sheet. The embedded distribution strategy offers a path to better unit economics, while the technology platform provides potential competitive advantages.

Yet challenges remain significant. Insurance industry cyclicality, catastrophe volatility, and competitive pressure from well-capitalized incumbents create genuine risks to the transformation thesis. The stock’s extreme volatility demands disciplined position sizing and strategic entry timing.

For investors willing to navigate these complexities, ROOT offers an asymmetric opportunity: a potential 25-50% upside if the transformation sustains, versus manageable downside if discipline prevails in position sizing. In a market where true turnaround stories are rare, ROOT’s journey from underwriting disaster to profitable growth deserves serious consideration—just don’t bet the farm on it.

Final Thought: Sometimes the best investments are found not in perfect companies, but in imperfect companies that have learned to perfect their core business. ROOT appears to be writing that exact story.

Leave a comment