When Wall Street Says “Strong Buy” But Your Stock Falls 38% in a Month

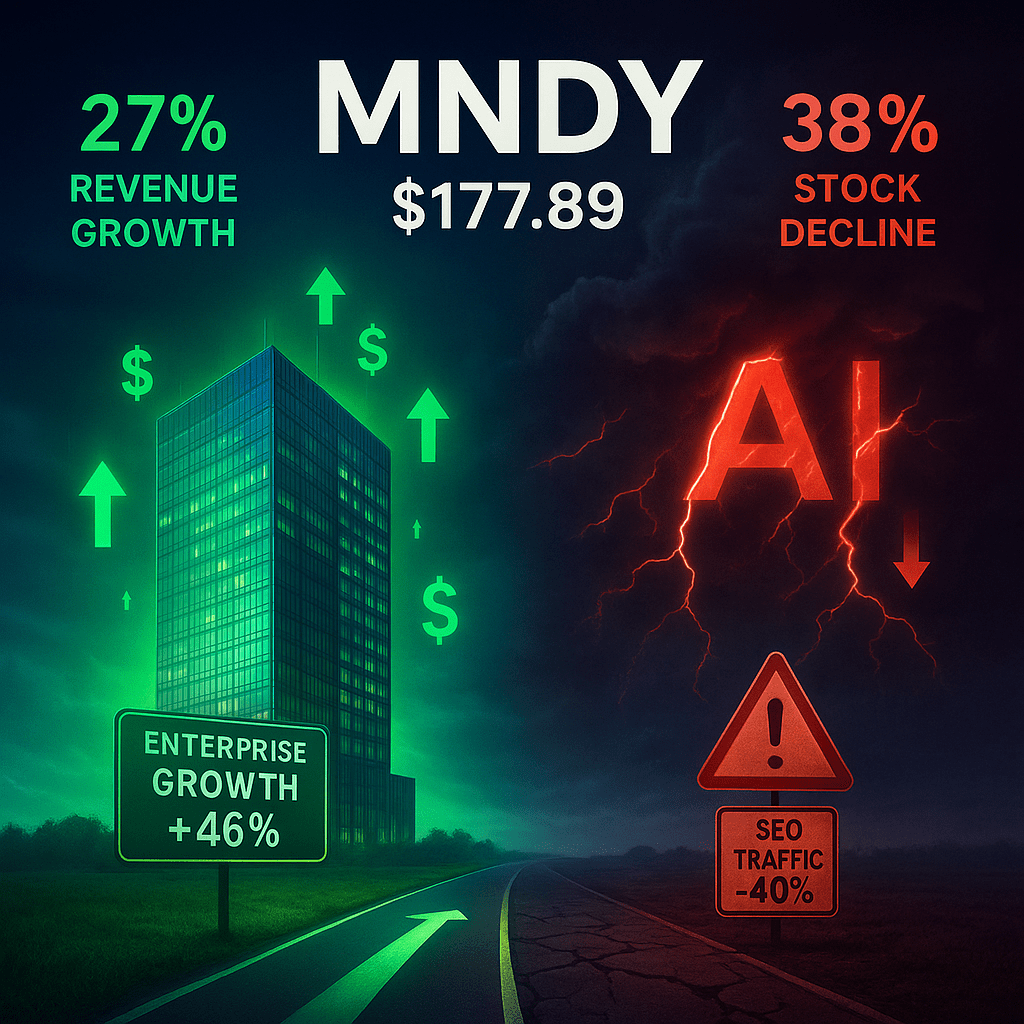

Picture this: You’re crushing earnings, your CRM product just hit $100 million in annual recurring revenue, and 24 Wall Street analysts are screaming “Strong Buy” with an average price target of $310. Yet your stock plummets 38% in a single month, erasing nearly $3 billion in market value. Welcome to the paradox that is Monday.com (MNDY) in August 2025—a cautionary tale of how even the strongest SaaS fundamentals can’t shield you from the seismic shifts reshaping digital marketing.

This isn’t just another earnings disappointment story. This is about a company caught in the crossfire of Google’s AI revolution, where algorithm changes and AI Overviews are causing 40-60% drops in organic traffic for many sites, fundamentally altering how growth-stage SaaS companies acquire customers. But here’s what makes MNDY fascinating: while the market panicked, the underlying business accelerated.

The Great Disconnect: Fundamentals vs. Market Reality

Let’s cut through the noise with hard numbers. MNDY just delivered Q2 results that would make most SaaS CFOs weep with joy:

- Revenue surged 27% year-over-year to $299 million, maintaining robust top-line momentum

- Non-GAAP operating margin hit 15%, showcasing expanding profitability in a disciplined spending environment

- Enterprise customers spending >$100K ARR jumped 46% year-over-year, validating their upmarket strategy

- CRM product crossed the critical $100M ARR milestone, proving multi-product traction beyond their core workflow platform

- Net cash position of approximately $1.5 billion, providing a fortress balance sheet in uncertain times

Yet the stock sits at $177.89, down from highs near $343 just months ago. Despite 24 analysts maintaining a “Strong Buy” consensus with a 12-month price target of $310.17, representing 74% upside from current levels, the market remains skeptical.

The SEO Apocalypse: When Google’s AI Turns Against You

The culprit behind MNDY’s selloff isn’t financial performance—it’s algorithmic warfare. Monday.com built its customer acquisition engine on search engine optimization, a strategy that worked brilliantly until Google decided to revolutionize search with AI.

Google’s AI Overviews now appear in over 50% of queries, doubling since August 2024, fundamentally altering the search landscape. For SaaS companies like Monday.com that relied heavily on organic search traffic, this represents an existential threat to their growth engine. Some sites are already seeing 20-60% traffic declines as AI provides direct answers without requiring clicks.

Management didn’t sugar-coat the reality during their Q2 earnings call, citing “down-market SEO headwinds” tied to Google’s algorithm changes and AI Overviews. This transparency, while refreshing, spooked investors who suddenly realized that MNDY’s customer acquisition playbook needed a complete rewrite.

The timing couldn’t be worse. While enterprise customers are embracing Monday’s platform at record rates, the SMB segment that drove early growth faces headwinds as organic traffic dries up and customer acquisition costs spike. It’s a tale of two markets: enterprise acceleration meets SMB deceleration.

The Vulcan Verdict: Quality Hiding Behind Momentum Noise

Our proprietary Vulcan-mk5 scoring system cuts through the emotional market reaction to reveal the underlying investment reality:

Composite Score: 5.86/10

- Value: 4.30 (Premium valuation leaves little room for error)

- Growth: 8.10 (Exceptional top-line momentum and market expansion)

- Quality: 7.20 (Strong margins, net cash position, sticky business model)

- Momentum: 3.20 (Technical damage from recent selloff)

- Safety: 6.50 (Fortress balance sheet offsets execution risks)

The score tells the story: This is a high-quality growth compounder temporarily impaired by momentum headwinds and valuation compression. The fundamentals remain intact, but the market has lost patience with the SEO transition story.

Enterprise Acceleration: The Hidden Growth Driver

While headlines focus on SEO challenges, the real story is Monday’s enterprise transformation. Large customers aren’t just choosing Monday—they’re expanding their usage at accelerating rates:

- 46% year-over-year growth in customers spending >$100K ARR signals sticky, expanding relationships

- Net Dollar Retention of 111% demonstrates healthy expansion within existing accounts

- CRM reaching $100M ARR validates their multi-product strategy beyond core workflow tools

This enterprise momentum matters because large customers don’t discover Monday through Google searches—they find it through sales teams, referrals, and strategic partnerships. The SEO headwinds that hurt SMB acquisition barely touch enterprise deals, creating a natural buffer for the business.

Valuation Reality Check: Premium Price for Premium Growth

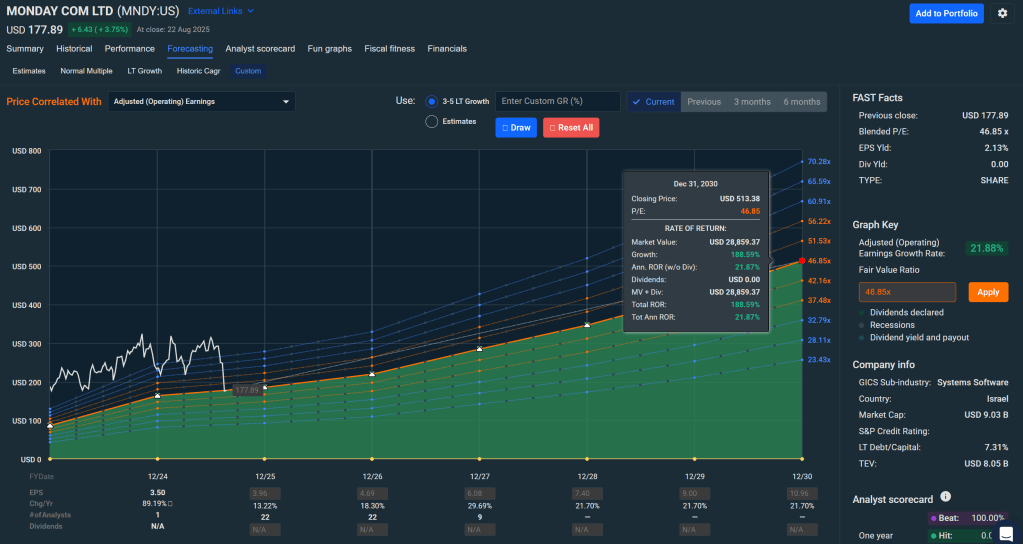

At $177.89, MNDY trades at:

- 232.6x trailing P/E (inflated by investment spending)

- 8.6x price-to-sales (premium to peers but justified by growth quality)

- 29.2x price-to-free cash flow (reasonable for a 27% growth SaaS leader)

Our discounted cash flow analysis yields a base fair value of approximately $170 per share, while blending with peer multiples suggests $221. The current price of $177.89 sits right at the intersection—fairly valued if you believe the growth story, expensive if you think SEO headwinds persist.

Risk Management: The Bayesian Approach

Smart position sizing requires acknowledging MNDY’s inherent volatility. With realized volatility near 66% annually, this isn’t a stock for the faint of heart. Our scenario analysis suggests:

Bull Case (35% probability): $260 target

- Enterprise acceleration continues

- Marketing pivots beyond SEO succeed

- CRM cross-selling drives expansion

Base Case (45% probability): $221 target

- Steady execution with modest margin improvement

- SEO headwinds gradually normalize

- Enterprise growth offsets SMB challenges

Bear Case (20% probability): $140 target

- Prolonged SEO impact on customer acquisition

- Enterprise momentum slows

- Valuation compression continues

The expected value-weighted target of $218 suggests 22% upside, but the wide distribution demands careful position sizing.

The Technical Setup: Oversold But Broken

From a technical perspective, MNDY presents a classic oversold bounce opportunity with significant structural damage:

- Trading below all major moving averages (50, 100, 200-day)

- RSI in mid-20s territory, suggesting oversold conditions

- Support near $166-171 (recent lows and 52-week floor)

- Resistance at $205-210, then $240-260 if momentum returns

The chart suggests accumulation opportunities near current levels, but any position should be sized for continued volatility as the market digests the SEO transition story.

Strategic Recommendation: Cautious Accumulation

Rating: Cautious Buy on Weakness

MNDY represents a rare opportunity to buy a quality SaaS compounder at temporarily depressed prices. The SEO headwinds are real but manageable for a company with $1.5 billion in net

Leave a comment