When a telecom giant sheds $100 billion in debt baggage and still trades at a 37% discount to the S&P 500’s P/E ratio, what’s the market really telling us? AT&T’s dramatic transformation from bloated conglomerate to streamlined dividend machine has created one of 2025’s most compelling comeback stories—but is Ma Bell’s renaissance sustainable, or are we witnessing the death throes of a legacy monopoly?

The Transformation That Wall Street Almost Missed

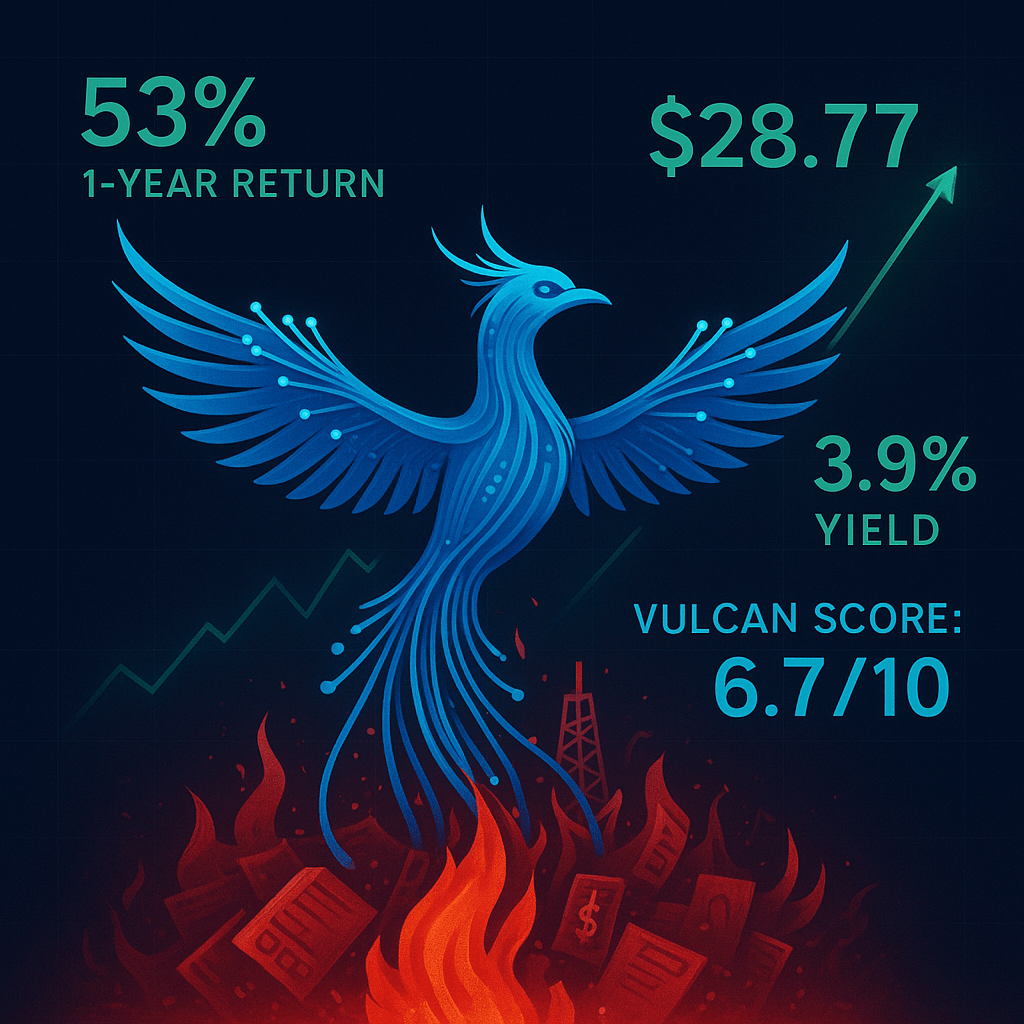

AT&T’s stock has surged 53% over the past year, crushing both the S&P 500’s 15.7% gain and its Communication Services sector peers’ 22.1% advance. Yet at $28.77 per share, T still trades at just 16.4x trailing earnings—a stark contrast to the market’s frothy 30x multiple. This disconnect reveals the market’s lingering skepticism about CEO John Stankey’s radical restructuring gambit.

Wall Street analysts remain cautiously optimistic, with 17 of the 49 covering analysts rating the stock a “Strong Buy” and setting an average price target of $31.34—roughly 9% upside from current levels. The consensus reflects measured enthusiasm: enough conviction to recommend the stock, but not enough to suggest explosive growth ahead.

The Vulcan-mk5 Verdict: Primary Buy with Conviction

Our proprietary Vulcan scoring system rates AT&T at 6.70 out of 10, placing it firmly in “Primary Buy” territory. The breakdown reveals a stock that excels in value and safety metrics while struggling with growth prospects:

- Value Score: 7.80 – Trading at significant discounts across key metrics

- Growth Score: 4.90 – The Achilles’ heel dragging down the composite

- Quality Score: 7.20 – Solid operational efficiency post-restructuring

- Safety Score: 7.40 – Low beta and defensive characteristics

- Momentum Score: 6.20 – Recent outperformance partially priced in

This profile screams “defensive income play” rather than “growth rocket ship”—exactly what disciplined dividend investors should want in an uncertain macro environment.

The Income Investor’s Dream Scenario

AT&T’s 3.9% forward dividend yield might seem pedestrian compared to the 6.1% offered by Verizon, but context matters. The telecom sector has historically delivered some of the market’s highest dividend yields due to predictable cash flows and inelastic demand—people don’t easily give up phone service during economic downturns.

The dividend coverage tells a compelling story of sustainability. With expected 2025 free cash flow of approximately $16 billion and an annual dividend burden of just $8 billion, AT&T maintains a healthy 1.6x coverage ratio. This cushion has allowed the company to prioritize debt reduction while maintaining the dividend that income investors depend on.

Key Dividend Metrics:

- Forward yield: 3.9%

- Payout ratio: 63.4%

- Coverage ratio: 1.6x

- 5-year dividend CAGR: -11.8% (reflecting the 2022 cut during restructuring)

The negative growth rate reflects AT&T’s painful but necessary dividend reduction from $2.08 to $1.11 per share when it spun off WarnerMedia. While dividend aristocrat purists fled, pragmatic income investors recognized this as surgery, not amputation.

The Deleveraging Success Story Wall Street Underestimates

Perhaps the most underappreciated aspect of AT&T’s transformation involves its balance sheet rehabilitation. The company has reduced its net debt-to-EBITDA ratio from crushing post-acquisition highs above 4.0x to a more manageable 2.8x today.

According to Deloitte’s 2025 telecom outlook, the industry globally is experiencing positive financial conditions with EBITDA margins exceeding 38% and contained operating expenses. AT&T’s 19.9% operating margin aligns with these industry dynamics while providing runway for further improvement.

The deleveraging trajectory offers multiple benefits:

- Lower interest expense reducing financial leverage

- Improved credit ratings cutting borrowing costs

- Strategic flexibility for acquisitions or buybacks

- Reduced refinancing risk in a higher-rate environment

Target debt levels of mid-2x EBITDA could unlock share repurchases by 2027, adding another tool for shareholder returns beyond dividends.

Competitive Moats in an Oligopoly Paradise

The wireless industry represents a capital-intensive business with high barriers to entry, where Verizon, AT&T, and T-Mobile dominate with massive subscriber bases that provide the cash flow necessary to maintain nationwide networks.

AT&T’s competitive position benefits from several structural advantages:

Network Infrastructure: Over $100 billion invested in wireless and fiber networks creates substantial switching costs for customers and barriers for competitors.

Customer Stickiness: Postpaid wireless customers exhibit low churn rates, particularly in enterprise segments where AT&T holds strong market positions.

Fiber Expansion: The company’s fiber-to-the-home buildout targets 30 million locations by 2025, creating higher-ARPU service opportunities in an increasingly data-hungry world.

5G Leadership: Early 5G investments position AT&T to monetize emerging use cases in IoT, autonomous vehicles, and edge computing.

The Bear Case: Why Growth Remains Elusive

Every compelling investment thesis demands honest acknowledgment of risks. AT&T’s challenges are real and persistent:

Secular Decline in Wireline: Traditional landline services continue eroding at 6-7% annually, pressuring overall revenue growth despite wireless strength.

Capital Intensity: Network maintenance and upgrades consume substantial free cash flow, limiting financial flexibility compared to asset-light business models.

Competitive Pressure: T-Mobile’s aggressive pricing and Verizon’s premium positioning squeeze AT&T’s pricing power in key market segments.

Earnings Revisions: Recent analyst estimate cuts (11 downward revisions in the past 30 days) suggest near-term earnings headwinds persist.

Position Sizing and Risk Management Strategy

AT&T’s low-beta profile (0.6 over five years) makes it an ideal anchor for defensive portfolios, but position sizing remains critical. Our recommended allocation framework:

Conservative Income Portfolios: 3-5% weighting Balanced Growth/Income: 2-3% weighting

Aggressive Growth: 1-2% weighting or avoid entirely

The dividend portfolio strategy emphasizes established companies with stable cash flows—precisely AT&T’s strength post-restructuring.

Entry and Exit Zones

Strong Buy Zone: Below $27.00 Primary Buy Zone: $27.00-$29.30 (current recommendation) Hold Zone: $29.30-$35.80 Trim Zone: $35.80-$42.40 Exit Zone: Above $42.40

These levels incorporate our DCF-derived fair value estimate of $32.60 with appropriate margin of safety buffers.

The Macro Tailwinds Few Are Discussing

With the Federal Reserve expected to cut rates twice in 2025 (64% odds for September, 80% for October according to CME FedWatch), telecom stocks could benefit from their defensive characteristics and high dividend yields during market uncertainty.

Lower rates provide multiple benefits for AT&T:

- Reduced financing costs on floating-rate debt

- Higher relative yield appeal versus bonds

- Improved valuation multiples for dividend-paying stocks

- Economic stimulus potentially boosting consumer spending on wireless services

The Verdict: Ma Bell’s Measured Resurrection

AT&T represents the antithesis of a meme stock or AI darling—and that’s precisely its appeal. The company has undergone radical surgery, shedding unprofitable assets and refocusing on its core wireless and fiber competencies. The result is a streamlined dividend machine trading at compelling valuations with sustainable competitive advantages.

The investment thesis doesn’t depend on revolutionary growth or multiple expansion. Instead, it relies on predictable cash flows, dividend sustainability, and gradual debt reduction—the boring fundamentals that create lasting wealth.

For investors seeking reliable income with modest capital appreciation potential, AT&T offers a compelling risk-adjusted proposition. The stock may never double in a year, but it could provide steady returns and growing dividends for decades.

In an era of speculative excess and bubble valuations, sometimes the best investment is the one everyone ignores. AT&T’s transformation from debt-laden conglomerate to focused telecom utility deserves recognition—and a place in disciplined dividend portfolios.

Final Rating: Primary Buy Target Price: $32.60 Dividend Yield: 3.9% Risk Level: Low-Moderate Recommended Position Size: 2-5% of portfolio

Risk Disclosure: This analysis is for educational purposes only and does not constitute investment advice. Past performance does not guarantee future results. Consider your risk tolerance and investment objectives before making investment decisions.

Leave a comment